Edward Jones Bundle

What Drives Edward Jones' Success?

Understanding a company's core principles is crucial for investors and strategists alike. Edward Jones, a financial powerhouse with a vast client base, offers a compelling case study in how mission, vision, and values shape business strategy.

Delving into the Edward Jones SWOT Analysis can further illuminate their strategic positioning. This exploration of Edward Jones' mission, vision, and core values provides a valuable framework for assessing their commitment to clients and long-term investment philosophy. Discover how these financial services values influence their operations and drive their success in a competitive market. Learn about the Edward Jones mission statement explained and how it aligns with their vision for the future.

Key Takeaways

- Edward Jones prioritizes individual investors and personalized relationships.

- Their long-term investment philosophy and focus on client needs drive success.

- Edward Jones managed $2.2 trillion in client assets by the end of 2024.

- Adapting to technology and evolving client expectations is key for future growth.

- Strong values and purpose are essential for long-term prosperity in financial services.

Mission: What is Edward Jones Mission Statement?

Edward Jones' mission is 'To partner for positive impact to improve the lives of our clients and colleagues, and together, better our communities and society.'

Let's delve into the Edward Jones mission statement and unpack its significance for investors, financial professionals, and anyone interested in understanding the firm's core principles. The Target Market of Edward Jones is primarily individual investors seeking personalized financial guidance.

The Edward Jones mission statement goes beyond simply providing financial products. It emphasizes a commitment to positive impact, encompassing clients, colleagues, communities, and society. This holistic approach is central to the firm's identity.

At the heart of the Edward Jones mission is the client. The firm aims to improve their lives through personalized financial advice and long-term planning. This is achieved through a network of financial advisors.

The mission also includes a commitment to supporting colleagues. This suggests a focus on employee development, a positive work environment, and a culture that values its people. This is key to the Edward Jones company culture.

Edward Jones is dedicated to improving communities and society. This is demonstrated through various initiatives, including financial literacy programs and community involvement. This reflects the financial services values.

Edward Jones primarily operates in the U.S. and Canada. They maintain a strong local presence with a vast network of branch offices. As of late 2024, Edward Jones had over 14,000 financial advisors serving clients from nearly 15,000 branch offices.

Edward Jones' unique value proposition lies in its human-centric model. They emphasize trusted personal relationships and tailored financial advice. This differentiates them from competitors who may rely more on technology or impersonal service. This is a core component of the Edward Jones mission.

The Edward Jones mission is not just a statement; it's a guiding principle that shapes the firm's actions and interactions. It influences their investment philosophy, client service approach, and commitment to the communities they serve. This commitment is evident in their long-term investment philosophy and focus on building lasting relationships. Understanding the Edward Jones mission statement is crucial for anyone seeking to align their financial goals with a firm that prioritizes both financial success and positive impact. The Edward Jones vision for the future is clearly rooted in these core values.

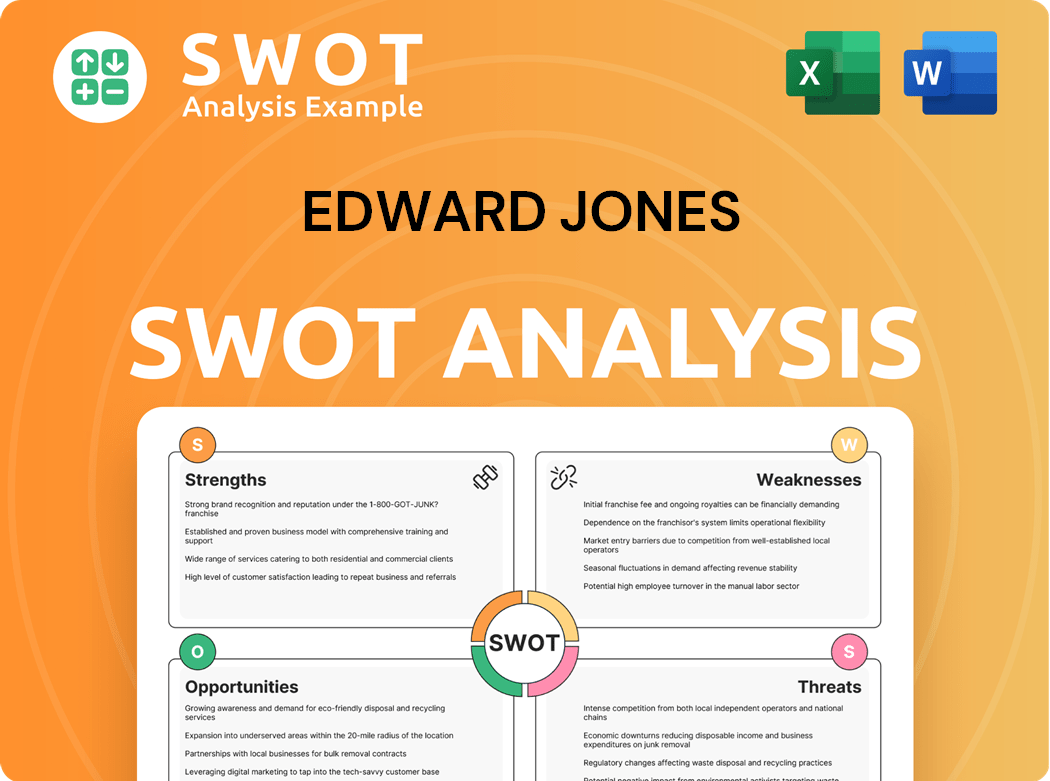

Edward Jones SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Edward Jones Vision Statement?

Edward Jones' vision is 'to be the first choice of serious, long-term individual investors for trusted financial advice.'

The Edward Jones vision statement serves as a guiding star for the Edward Jones company, outlining its aspirations for the future. This vision is not merely a statement; it's a commitment to a specific market segment and a particular approach to financial services values. The focus is clear: to be the premier provider of financial advice for individuals seeking a long-term investment strategy. Understanding this vision is crucial for anyone looking to understand the Edward Jones mission and how it operates.

The vision statement is explicitly future-oriented, setting a goal for market leadership. It aims for a position of preeminence within the financial advisory space, specifically targeting serious, long-term individual investors.

The vision statement is laser-focused on a specific target audience: "serious, long-term individual investors." This targeted approach allows Edward Jones to tailor its services and build strong relationships with a defined client base.

The vision highlights the importance of "trusted financial advice." This underscores Edward Jones' commitment to building relationships based on trust, transparency, and a deep understanding of client needs. This is a key aspect of the Edward Jones statement.

Given Edward Jones' history and current market position, the vision appears both realistic and aspirational. They have a proven track record of success and a strong foundation to build upon.

While not explicitly stated, the vision implies a desire for significant market share within their chosen niche. Being the "first choice" suggests a goal of capturing a substantial portion of the market for long-term individual investor financial advice.

Edward Jones continues to invest in its advisor network and technology, which supports its vision. These investments enhance personalized service and strengthen the firm's ability to meet the needs of its target market. As of December 31, 2024, Edward Jones managed approximately $2.2 trillion in assets.

The vision statement's emphasis on being the "first choice" suggests a commitment to continuous improvement and adaptation to meet the evolving needs of its clients. This is a long-term strategy, focusing on building enduring relationships rather than pursuing short-term gains. This is reflected in their core values and the way they operate, as highlighted in the article about Owners & Shareholders of Edward Jones.

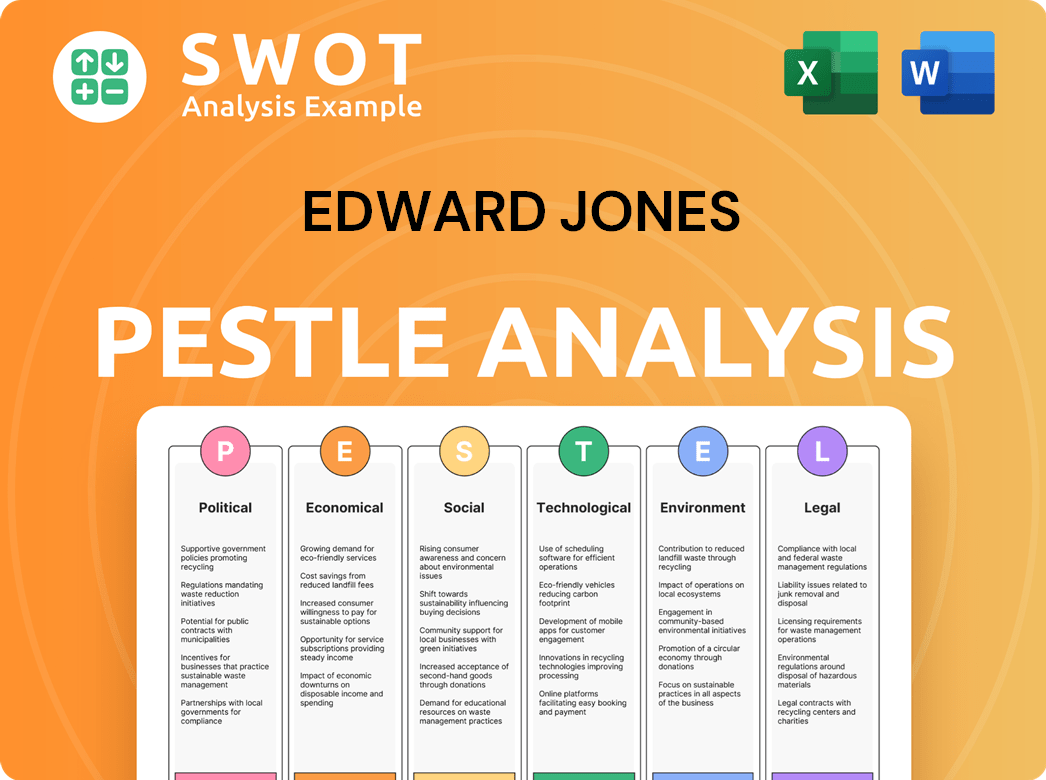

Edward Jones PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Edward Jones Core Values Statement?

Understanding the core values of Edward Jones is crucial to grasping its operational philosophy and its approach to serving clients. These values are the bedrock of the company's culture and guide its interactions within the financial services industry.

This is a foundational value for Edward Jones, reflected in its personalized service model. Financial advisors are trained to understand individual client needs and develop tailored financial strategies. This commitment is evident in their high client retention rates, with an average client relationship lasting over 15 years, showcasing a dedication to long-term client well-being over short-term gains. Edward Jones’s commitment to clients is further demonstrated by its focus on building trust and providing transparent advice.

Edward Jones emphasizes a conservative investment approach, focusing on long-term strategies rather than speculative trading. This value influences the types of products and services offered and the guidance provided by financial advisors. This long-term philosophy is supported by their investment in research and analysis, ensuring advisors have the resources to make informed decisions. According to recent data, approximately 80% of Edward Jones’s client assets are invested in long-term investments, reflecting this core value.

This value underscores the importance of collaboration, both between advisors and clients and within the company culture. Edward Jones encourages collaboration among its advisors, fostering a supportive environment. The emphasis on the client-advisor relationship is a cornerstone of their approach, with advisors acting as partners in their clients' financial journeys. This partnership approach has contributed to the firm's high Net Promoter Score (NPS), a measure of client loyalty and satisfaction, consistently above the industry average.

This core value speaks to Edward Jones's corporate culture, aiming to create an inclusive environment where employees feel valued and empowered. This is supported by their investment in training and development programs for their associates, fostering a culture of continuous learning and growth. The company's commitment to its employees is reflected in its high employee retention rates and numerous awards for workplace excellence. This focus on people is a key differentiator for the Edward Jones company.

These four core values—client-first approach, long-term investment philosophy, partnership, and respect for individuals—collectively define the Edward Jones company and its commitment to providing personalized financial services. Understanding these values is key to appreciating the firm's unique position within the financial services industry. To further explore how these values translate into strategic decisions, read the next chapter on how the Edward Jones mission and vision influence the company's strategic decisions.

How Mission & Vision Influence Edward Jones Business?

Edward Jones's mission and vision statements are not merely aspirational; they are the bedrock upon which the firm constructs its strategic decisions. These statements profoundly shape the firm's approach to client service, expansion, and overall business strategy.

The Edward Jones mission to "partner for positive impact" is directly reflected in its strategic initiatives. This commitment is evident in the firm's continued investment in its financial advisor network, which grew by 5% in 2024, exceeding 20,000 advisors.

- This expansion supports the firm's mission by ensuring a widespread presence to deliver personalized service.

- The launch of Edward Jones Generations, a service tailored for high-net-worth clients, showcases an evolution of service models while maintaining the relationship-focused approach.

- Edward Jones's commitment to clients is a core tenet of its mission.

The Edward Jones vision of being the first choice for trusted financial advice drives innovation in client service. The integration of financial planning software, like MoneyGuide, in 2024, is a prime example.

The firm's robust financial performance underscores the effectiveness of its mission- and vision-guided strategy. In 2024, Edward Jones reported over $16 billion in revenue and managed $2.2 trillion in client assets.

Managing Partner Penny Pennington's statement highlights the firm's momentum. Her words reflect the company's commitment to serving clients, colleagues, and communities, aligning with the Edward Jones core values.

Edward Jones's long-term investment philosophy is a direct result of its mission and vision. The firm's focus on building lasting relationships with clients is a key component of its strategy.

The Edward Jones company culture values are deeply intertwined with its mission and vision. These values guide the firm's interactions with both clients and employees.

The Edward Jones statement of purpose provides a solid foundation for its strategic decisions. This is a key element of the firm's success in the financial services industry.

The influence of the Edward Jones mission, vision, and Edward Jones core values is undeniable, shaping the firm's strategic direction and contributing to its sustained success. To understand how Edward Jones continues to adapt and refine its core principles, let's explore the next chapter: Core Improvements to Company's Mission and Vision, and to understand more about the company's foundation, you can read a Brief History of Edward Jones.

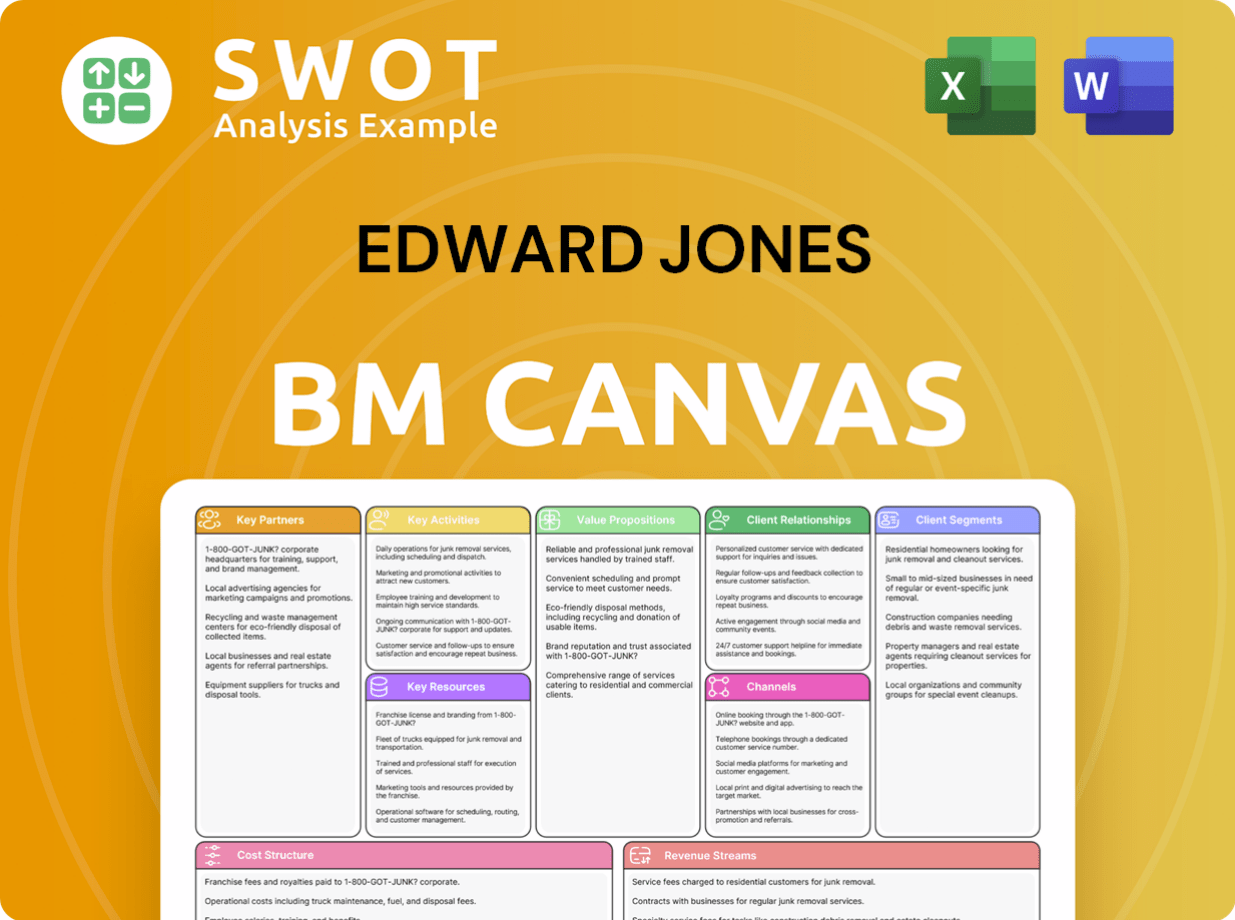

Edward Jones Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Edward Jones's mission, vision, and core values have proven successful, ongoing refinement is crucial for sustained relevance and growth in the dynamic financial services landscape. This section explores potential improvements to their core statements, focusing on adapting to evolving market trends and client expectations.

To reflect its investments in digital tools and platforms, Edward Jones could explicitly integrate a commitment to technological innovation within its vision or core values. This would signal adaptation to a digitally-driven financial landscape, enhancing the firm's appeal to tech-savvy clients and potential employees. According to a 2024 report by Accenture, firms that embrace technology see a 20% increase in client engagement.

Given the growing importance of ESG investing, Edward Jones could strengthen its appeal by including a more explicit statement about sustainability or responsible investing. This would resonate with a growing segment of investors who prioritize these concerns, potentially attracting assets. Data from Morningstar shows that sustainable funds experienced inflows of $23.5 billion in Q1 2024.

The current Edward Jones vision statement could be updated to better articulate its aspirations for the future of financial services. This could involve emphasizing its commitment to client-centricity, incorporating elements of innovation, or highlighting its role in helping clients achieve their financial goals in a changing world. A forward-looking vision statement helps attract and retain top talent, which is critical in the competitive Competitors Landscape of Edward Jones.

While the current Edward Jones core values are strong, they could be enhanced to reflect the evolving needs of modern clients. This might include adding a value related to transparency, or perhaps, a value centered on continuous learning and adaptation. This demonstrates a commitment to providing relevant and up-to-date advice.

How Does Edward Jones Implement Corporate Strategy?

The successful implementation of a company's mission and vision is crucial for its long-term success, shaping its culture, strategy, and stakeholder relationships. Edward Jones demonstrates this implementation through various strategic initiatives designed to reinforce its core values and achieve its stated goals.

Edward Jones invests heavily in its financial advisors through comprehensive training and development programs. This commitment was recognized with a 2025 Training APEX Award, highlighting the firm's dedication to equipping its colleagues with the skills and knowledge necessary to serve clients effectively. This directly supports the Edward Jones mission of improving the lives of its employees and providing exceptional client service.

- The firm’s training programs are designed to foster a deep understanding of the company's values and client-centric approach.

- Continuous professional development is encouraged, ensuring advisors stay current with market trends and regulatory changes.

- These programs contribute to high advisor retention rates, fostering long-term client relationships.

- Data indicates that advisors who complete advanced training programs experience higher client satisfaction scores.

Leadership plays a vital role in reinforcing the Edward Jones mission and Edward Jones vision through consistent communication and by embodying the firm's financial services values. Managing Partner Penny Pennington's statements consistently emphasize the firm's purpose and commitment to its stakeholders, including clients, associates, and communities. This top-down approach ensures that the values are integrated into the firm's culture.

The Edward Jones mission and values are communicated to stakeholders through various channels, including the company website, annual reports, and direct advisor interactions. Transparency in communication builds trust and reinforces the firm's commitment to its clients and employees. This helps in building a strong brand reputation.

Edward Jones ties its compensation structure and performance metrics for financial advisors to the 'ideal client experience,' which is closely linked to the firm's values. This ensures that advisors are incentivized to prioritize client needs and build long-term relationships. This approach is a key element of the firm’s long-term investment philosophy.

Concrete examples of alignment between stated values and practices include community involvement initiatives and philanthropic efforts. Edward Jones demonstrates its commitment to bettering communities through various programs and partnerships. This commitment supports the Edward Jones company's values of integrity and service.

Edward Jones has formal programs and systems, such as its Code of Ethical Conduct, to ensure that associates adhere to the highest ethical standards, reinforcing the value of integrity. This commitment to ethical behavior builds trust with clients and maintains the firm's reputation. For a deeper dive into how Edward Jones approaches the market, consider reading about the Marketing Strategy of Edward Jones.

Edward Jones Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Edward Jones Company?

- What is Competitive Landscape of Edward Jones Company?

- What is Growth Strategy and Future Prospects of Edward Jones Company?

- How Does Edward Jones Company Work?

- What is Sales and Marketing Strategy of Edward Jones Company?

- Who Owns Edward Jones Company?

- What is Customer Demographics and Target Market of Edward Jones Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.