Edward Jones Bundle

Who Exactly Does Edward Jones Serve?

In the ever-changing world of finance, understanding your customer is key to success. For Edward Jones, a firm built on personal relationships, knowing its Edward Jones SWOT Analysis is crucial. This exploration delves into the core of Edward Jones' strategy, examining who their clients are and how they adapt to the evolving financial landscape. Discover the essence of their client base.

This deep dive into the Edward Jones target market will reveal the customer demographics that define their success. We'll explore the Edward Jones clients, their financial goals, and how Edward Jones tailors its services. Learn about Edward Jones customer profile, including who are Edward Jones' typical clients, their Edward Jones client age range, and Edward Jones income demographics. Get insights into Edward Jones target audience analysis and understand Edward Jones ideal customer profile for informed investment decisions.

Who Are Edward Jones’s Main Customers?

Understanding the Owners & Shareholders of Edward Jones is key to grasping its customer base. The firm primarily focuses on individual investors and business owners, operating on a business-to-consumer (B2C) model. This means the company directly serves the end-users of its financial services.

As of the end of 2024, Edward Jones serves over 9 million clients across North America. These clients have assets under care totaling approximately $2.2 trillion. This vast client base highlights the firm's significant presence in the investment landscape.

The typical Edward Jones customer falls within the 35-65 age range, seeking to grow their wealth and plan for retirement. These individuals generally belong to the upper-middle to high-income brackets, indicating a focus on clients with substantial financial resources.

Edward Jones' target market centers on individual investors and business owners. The firm is known for its focus on clients in the 35-65 age range, who are looking to grow their wealth. These clients typically have upper-middle to high incomes.

The firm caters to a diverse group of investors. This includes a significant number of clients with at least $10 million in investable assets. The firm's advisors increased by 5% in 2024, showing its commitment to serving more clients.

Edward Jones is adapting to evolving investor needs. The firm launched 'Edward Jones Generations' in March 2025, targeting wealthier clients. This includes offering alternative investments like private equity.

- Focus on high-net-worth individuals.

- Expansion of services to include alternative investments.

- Continued growth in advisor headcount.

- Enhancement of competitiveness.

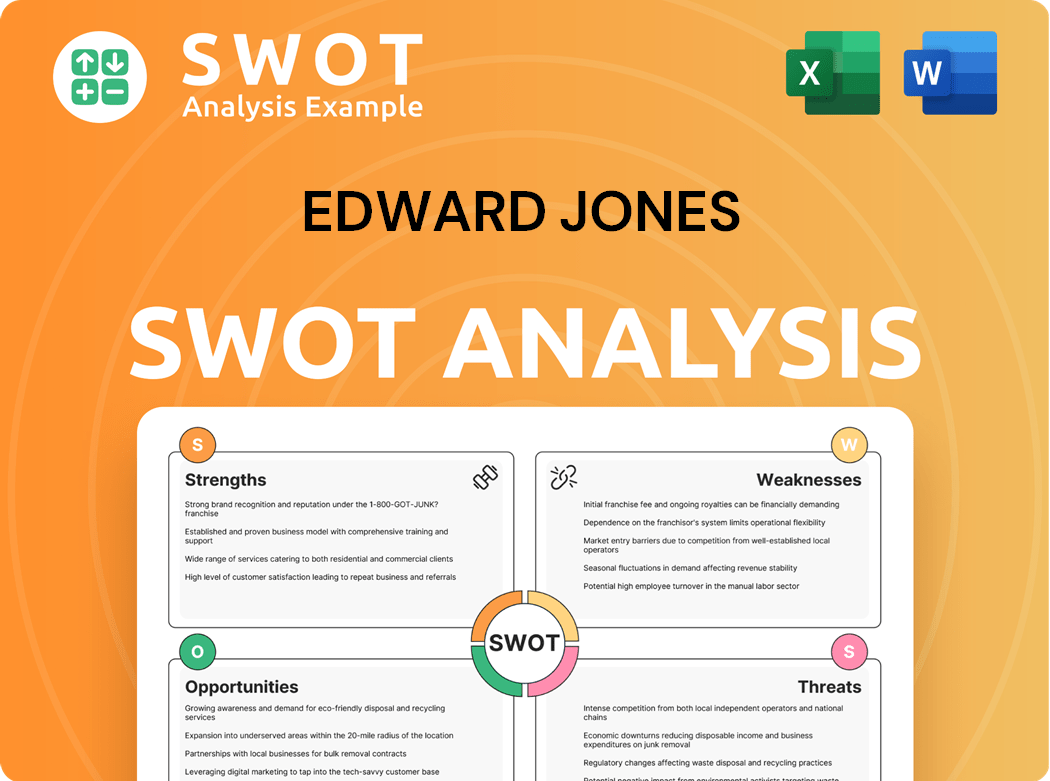

Edward Jones SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Edward Jones’s Customers Want?

Understanding the needs and preferences of its clients is crucial for any financial services firm, and this is especially true for Edward Jones. The firm's success is deeply rooted in its ability to cater to the specific desires of its target market, which primarily seeks personalized financial guidance and long-term planning.

Edward Jones' approach centers around building strong, personal relationships. This is achieved through its network of one-advisor branch offices, which fosters a high level of trust and intimacy. This model resonates well with clients, particularly in smaller communities, who often value a close, personal connection with their financial advisor.

The firm's clients are looking for more than just investment management; they desire comprehensive financial guidance. Edward Jones has responded by expanding its services to include more holistic financial planning, such as estate and tax planning strategies, which are being rolled out across thousands of U.S. branch teams in 2024 and 2025.

Clients value tailored investment strategies aligned with their unique goals, risk tolerance, and financial situations. This personalized approach is a key differentiator for Edward Jones, setting it apart from firms offering a more standardized service.

Edward Jones provides comprehensive financial guidance that extends beyond investment management, including estate planning and tax planning. This holistic approach addresses a broader range of client needs.

To meet unmet needs, Edward Jones is expanding its offerings to include banking services. An application to establish Edward Jones Bank was submitted in April 2025, demonstrating the firm's commitment to providing a full suite of financial solutions.

Responding to market trends, such as the increasing interest in ESG (Environmental, Social, and Governance) investing, Edward Jones is exploring opportunities to offer ESG investment options. This demonstrates the firm's responsiveness to evolving client preferences.

Edward Jones leverages technology, such as the MoneyGuide planning platform and Salesforce, to enhance the client experience and provide AI-driven insights. This integration aims to improve service while maintaining the human element of advice.

Product development is influenced by customer feedback and market trends, such as the increasing interest in ESG (Environmental, Social, and Governance) investing. This ensures that Edward Jones remains relevant and responsive to its clients' evolving needs.

The purchasing behaviors of Edward Jones' clients are heavily influenced by the desire for comprehensive financial guidance. The firm's approach to meeting these needs is further detailed in the Revenue Streams & Business Model of Edward Jones article, which highlights the firm's commitment to providing a full suite of financial services. Edward Jones' focus on personalized service and comprehensive financial planning is designed to meet the specific needs of its target audience, driving client satisfaction and loyalty.

Edward Jones' clients are primarily looking for personalized investment advice and long-term financial planning. The firm's emphasis on building deep, personal relationships through its network of one-advisor branch offices resonates strongly with clients, particularly those in smaller communities, who seek a high level of intimacy and trust in their advisor relationships. This personalized approach is a key differentiator, as clients often look for tailored investment strategies that align with their unique goals, risk tolerance, and financial situations.

- Personalized Investment Strategies: Clients seek tailored investment plans.

- Comprehensive Financial Guidance: Clients desire services beyond investment management, including estate and tax planning.

- Trust and Intimacy: Clients value close, personal relationships with their advisors.

- Holistic Approach: Edward Jones offers a full suite of financial solutions to meet diverse client needs.

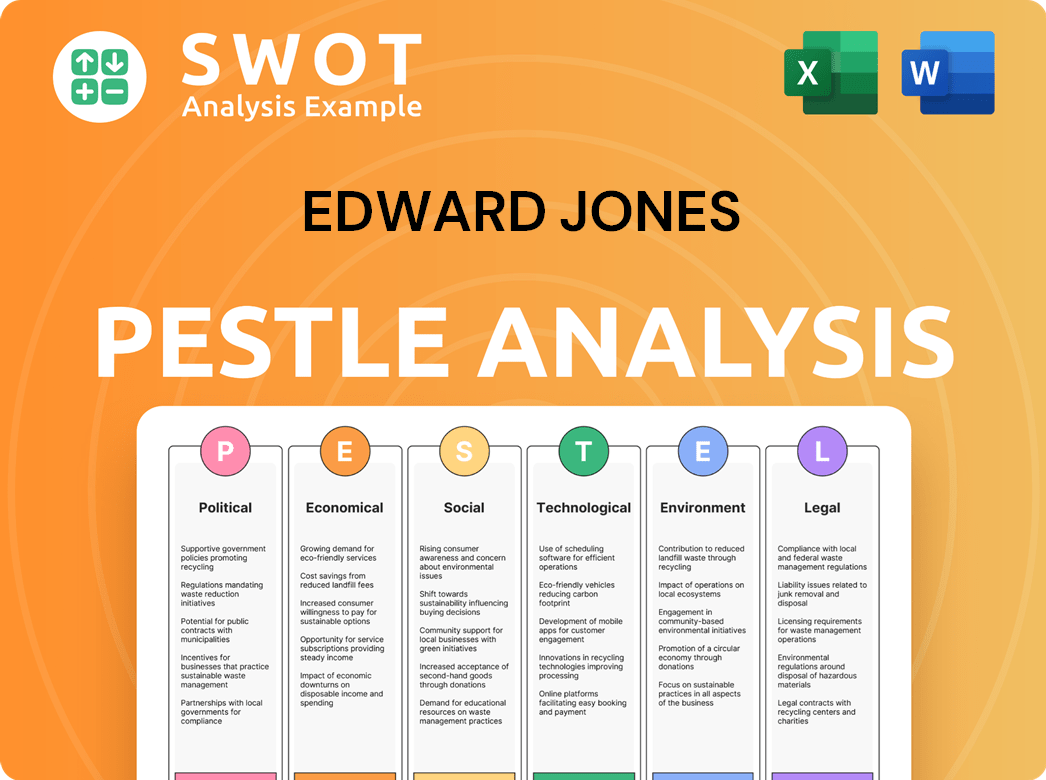

Edward Jones PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Edward Jones operate?

The geographical market presence of Edward Jones is substantial, primarily concentrated in North America. The firm's extensive network includes over 15,000 branch locations, providing a widespread reach across the United States and Canada. This expansive footprint allows the company to serve a diverse clientele, including those in underserved areas.

Edward Jones strategically positions its branches to be accessible to a broad range of potential clients. This approach allows the company to cater to a wide array of customer demographics. The company's community-based approach is a key factor in its ability to attract and retain clients, especially in areas where larger financial institutions may have a limited presence.

This localized strategy is further enhanced by the firm's decentralized model, which enables financial advisors to tailor their services to the specific needs of their local communities. This adaptability is crucial for addressing the varied preferences and financial goals of Edward Jones clients across different regions. For more insights, consider reading a Brief History of Edward Jones.

Edward Jones operates through a vast network of over 15,000 branch locations, ensuring widespread accessibility. This extensive network allows the firm to serve clients in many communities, including those in 68% of U.S. counties. This widespread presence is a core component of their customer acquisition methods.

The firm's decentralized model empowers local advisors to customize their services to meet the specific needs of their communities. This approach is vital for understanding the unique characteristics of Edward Jones clients. This localized strategy enhances the customer service experience.

Edward Jones strategically focuses on both smaller communities and major metropolitan areas. The firm is expanding its presence in major cities like New York City. This dual approach allows the company to serve a diverse range of Edward Jones clients.

The firm is actively building capacity in its Canadian branches to manage intergenerational wealth transfers. They also address specific demographic trends in the Canadian market. This focus demonstrates Edward Jones' commitment to serving its clients effectively.

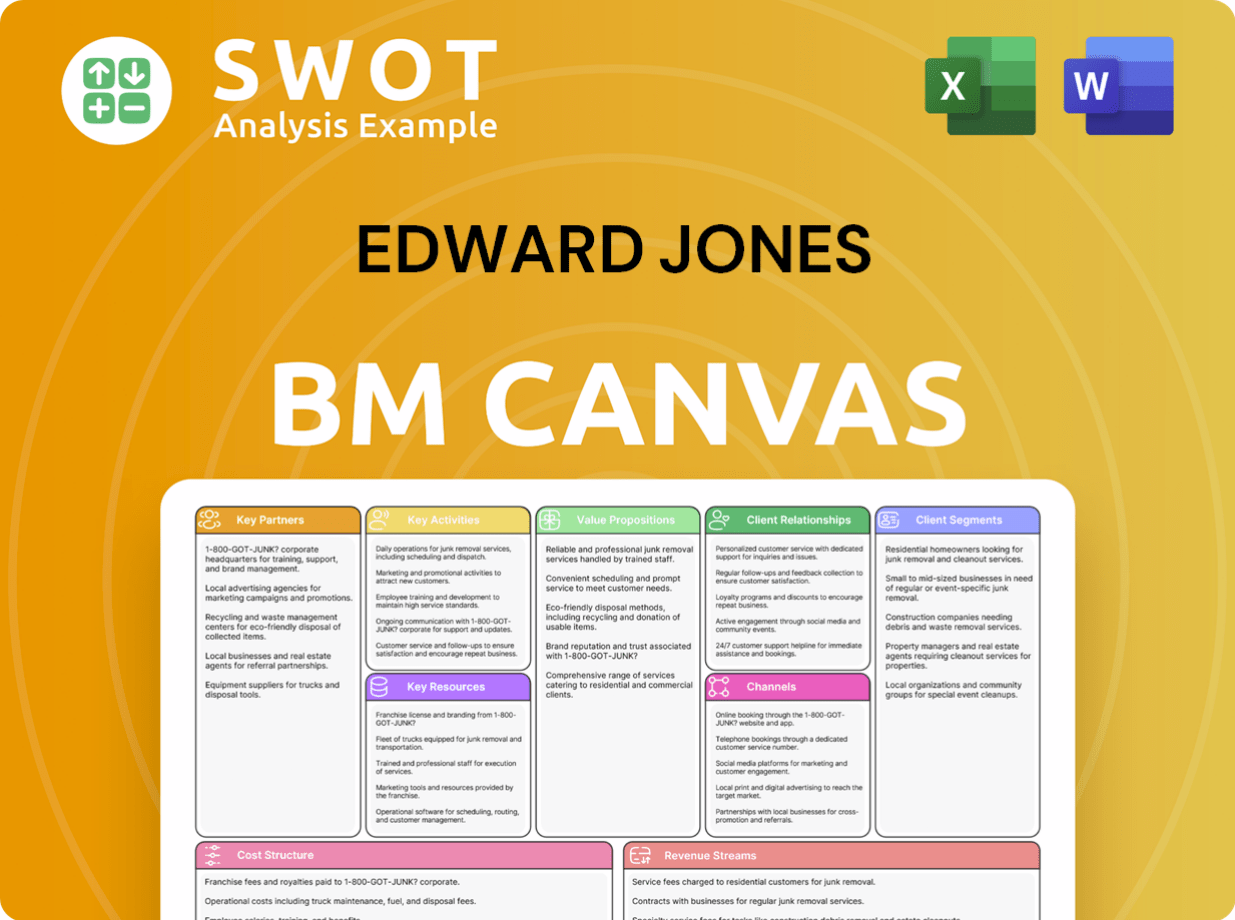

Edward Jones Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Edward Jones Win & Keep Customers?

The customer acquisition and retention strategies of Edward Jones are deeply intertwined with its commitment to personalized service and its extensive network of financial advisors. The firm focuses on building strong, long-term relationships with its clients, differentiating itself through face-to-face advice and a human-centric approach. This strategy is supported by significant investments in technology and advisor development, aiming to provide a comprehensive and tailored experience for each client.

A critical aspect of Edward Jones' strategy involves expanding its advisor network. The firm actively recruits experienced financial advisors and implements programs to retain them, such as profit-sharing bonuses. This expansion is crucial for reaching more clients and communities, ensuring that personalized financial advice is accessible. The strategy supports the firm's mission to serve its clients and communities effectively.

Retention efforts at Edward Jones are centered around deepening client relationships and providing holistic wealth management services. The firm is rolling out financial planning services across its branch teams, supported by technology that enhances the client experience. By offering comprehensive financial planning, banking, and intergenerational advice, Edward Jones aims to solidify its client relationships and provide long-term value.

Edward Jones focuses on growing its network of financial advisors to acquire new customers. In 2024, the firm's advisor count grew by 5%. Attracting and retaining experienced advisors is a key priority, supported by profit-sharing bonuses and team-based working environments.

The firm enhances client retention by offering comprehensive wealth management services. This involves financial planning, banking, and intergenerational advice. Over 1.3 million client households were served by the MoneyGuide planning platform as of September 2024.

Technology plays a crucial role in supporting both acquisition and retention strategies. Edward Jones utilizes Salesforce to create a 360-degree view of clients. Advisors gather actionable insights from over 500,000 client interactions weekly.

AI is used to provide 'nudges' or recommendations to advisors, improving client interactions. This technology supports the quality of real-time customer conversations. Edward Jones is committed to leveraging technology to enhance the client experience.

Edward Jones' approach to customer acquisition and retention is built on several key strategies. The firm focuses on a human-centric model with personalized service, leveraging its extensive network of financial advisors. These strategies are designed to attract and retain clients by providing comprehensive and tailored financial advice.

- Expanding the advisor network to serve more clients effectively.

- Deepening client relationships by offering holistic wealth management services.

- Leveraging technology, such as Salesforce and AI, to enhance client interactions and advisor support.

- Encouraging advisors to work in teams to improve both recruiting and retention.

Edward Jones Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Edward Jones Company?

- What is Competitive Landscape of Edward Jones Company?

- What is Growth Strategy and Future Prospects of Edward Jones Company?

- How Does Edward Jones Company Work?

- What is Sales and Marketing Strategy of Edward Jones Company?

- What is Brief History of Edward Jones Company?

- Who Owns Edward Jones Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.