Sony Bundle

How Does the Sony Company Thrive in Today's Market?

Sony, a titan in the global market, seamlessly blends technology, entertainment, and financial services, leaving an indelible mark on how we experience the world. From the immersive gaming experience of the PlayStation 5 to its innovative imaging solutions, Sony's influence is undeniable. Understanding the Sony SWOT Analysis is key to grasping its multifaceted business model.

This deep dive into Sony's operations will uncover the strategies behind its enduring success. We'll explore the intricacies of the Sony business model, examining how the Sony corporation generates revenue and maintains its competitive edge across diverse sectors. Discover how Sony's products and services, from cutting-edge electronics to captivating entertainment, shape its global presence and adapt to market changes.

What Are the Key Operations Driving Sony’s Success?

The Sony company operates through a diverse range of businesses, creating and delivering value across multiple sectors. Its core offerings include gaming, music, pictures, electronics, imaging & sensing solutions, and financial services. Each segment caters to distinct customer needs, from entertainment experiences to advanced technology for various industries.

Its operational processes are highly integrated and sophisticated, involving advanced manufacturing, global sourcing, and continuous research and development. The company's approach is unique due to its synergistic approach across segments, leading to compelling customer benefits and strong market differentiation. For example, its imaging technology is integrated into its electronics products, and its entertainment content is distributed through its gaming platforms.

The Sony business model relies on a complex, global supply chain and strategic partnerships. Distribution networks utilize both physical retail and digital platforms. This cross-pollination of technologies and content translates into compelling customer benefits, such as a seamless entertainment ecosystem, and strong market differentiation due to its comprehensive and integrated offerings. To learn more about its origins, you can read the Brief History of Sony.

The gaming segment, driven by the PlayStation, is a major revenue driver. The Pictures and Music divisions contribute significantly to the entertainment sector. In the fiscal year 2023, the Game & Network Services segment generated approximately ¥3.9 trillion in revenue. The Music segment brought in around ¥1.4 trillion, and the Pictures segment reached about ¥1.3 trillion.

Electronics products, including TVs and audio equipment, are key components of the business. Imaging & Sensing Solutions provide critical components for various devices. In fiscal year 2023, the Electronics Products & Solutions segment reported revenues of approximately ¥2.7 trillion. The Imaging & Sensing Solutions segment generated roughly ¥1.6 trillion.

Financial Services, including life insurance and banking, contribute to the company's diversified portfolio. This segment provides financial stability and supports the overall business strategy. In fiscal year 2023, the Financial Services segment generated approximately ¥1.7 trillion in revenue.

The integration of technologies and content across segments creates a unique value proposition. This approach allows for a seamless entertainment ecosystem and strong market differentiation. The company's ability to leverage its diverse portfolio is a key aspect of its success. The company's consolidated sales for fiscal year 2023 reached approximately ¥12.388 trillion.

The Sony operations are characterized by a global supply chain, strategic partnerships, and extensive distribution networks. These elements are critical for the company's ability to compete and innovate. The company's commitment to research and development is a cornerstone of its strategy, with significant investments in areas such as display technology and image sensors.

- Global Supply Chain: A vast network of suppliers, manufacturers, and logistics partners.

- Strategic Partnerships: Collaborations with game developers, content creators, and technology providers.

- Distribution Networks: Utilizing both physical retail and digital platforms like the PlayStation Store.

- Research and Development: Continuous investment in innovation across all segments.

Sony SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Sony Make Money?

The Sony company operates with a highly diversified revenue model, reflecting its presence across various sectors. This approach allows the Sony corporation to generate income from multiple sources, which include gaming, music, pictures, electronics, imaging, and financial services. Understanding these revenue streams is crucial for grasping the Sony business model and its overall financial health.

Monetization strategies at Sony are tailored to each segment, ensuring they capture value across different markets. These strategies range from direct product sales to subscription services and licensing agreements. The company's ability to adapt and innovate in its monetization approaches is key to its continued success and ability to compete in a dynamic global market.

In the fiscal year ending March 31, 2024, the gaming and network services segment was a significant contributor to revenue, driven by strong PlayStation 5 sales and increased network services revenue. This segment's performance underscores the importance of gaming within Sony's operations.

This segment generates revenue from PlayStation consoles, game software, add-on content, and PlayStation Plus subscriptions. In 2024, this segment showed robust financial performance, driven by strong sales of the PlayStation 5 and increased network services revenue. The company uses tiered pricing for consoles and games, along with subscription models and microtransactions to maximize revenue.

Revenue comes from recorded music sales (physical and digital), music publishing, and visual media. Monetization strategies include licensing agreements, streaming royalties, and physical sales. Sony leverages its extensive music catalog and relationships with artists to generate income.

The pictures segment earns revenue from motion picture production and distribution, television production, and media networks. Monetization involves theatrical releases, home entertainment sales, licensing to streaming platforms, and television broadcasting rights. This segment benefits from the global demand for entertainment content.

Revenue comes from sales of televisions, audio equipment, mobile phones, and digital cameras. The monetization strategy relies on direct product sales and value-added services. Sony focuses on innovation and quality to maintain a competitive edge in the electronics market.

This segment generates revenue from the sale of image sensors to various industries. The monetization strategy is based on high-volume sales and technological advancements. Sony is a major player in the image sensor market, supplying to smartphone manufacturers and other clients.

Revenue is derived from life insurance premiums and investment income, as well as banking services. The monetization model is premium-based for insurance and interest-based for banking. This segment provides a stable source of revenue through financial products.

In addition to these, Sony explores bundled services and cross-selling opportunities across its entertainment divisions to enhance customer lifetime value. For more insights into Sony's marketing strategies for products, you can read the Marketing Strategy of Sony article.

Sony PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Sony’s Business Model?

The Sony company has navigated a complex landscape, marked by pivotal moments and strategic shifts. Its journey includes groundbreaking innovations in gaming, entertainment, and technology. Understanding these developments is key to grasping the company's current position and future prospects. The Sony business model has evolved, adapting to market changes and technological advancements to maintain a competitive edge.

Key milestones, such as the launch of the PlayStation in 1994, reshaped the gaming industry. The acquisition of Columbia Pictures in 1989 significantly expanded its entertainment portfolio. More recently, the company has focused on content IP, expanding the PlayStation Network, and investing in new technologies like virtual reality. These moves are crucial for maintaining its relevance in a rapidly changing market.

The Sony corporation faces various operational and market challenges. Supply chain disruptions, especially during the COVID-19 pandemic, impacted console production and electronics sales. Regulatory hurdles and shifts in consumer preferences, such as the move from physical media to streaming, have required continuous adaptation. The company has responded by investing in digital distribution and expanding its streaming services.

The original PlayStation launch in 1994 revolutionized the gaming industry, followed by the successful PlayStation 2 and PlayStation 5. The acquisition of Columbia Pictures in 1989 expanded its entertainment holdings. Establishment of Sony Financial Holdings in 2004 diversified revenue streams.

Focus on strengthening content IP to enhance its entertainment offerings. Expansion of the PlayStation Network to increase user engagement and revenue. Investments in new technologies like virtual reality to stay ahead of market trends. Strategic partnerships to broaden market reach and technological capabilities.

Strong brand recognition and customer loyalty across diverse product categories. Technological leadership in imaging sensors and display technologies. Economies of scale in manufacturing and global distribution networks. A robust ecosystem of hardware, software, and content to create a network effect.

Supply chain disruptions, especially during the COVID-19 pandemic, impacted production. Regulatory hurdles and antitrust scrutiny in various markets. Market shifts, such as the move from physical media to streaming, require continuous adaptation. Competition from other tech giants in various sectors.

Sony's competitive advantages include brand strength, technological leadership, economies of scale, and a strong ecosystem. The company continuously adapts to new trends, such as the increasing demand for high-resolution imaging and the growth of subscription-based entertainment. This is achieved through R&D and strategic partnerships.

- Strong brand reputation and customer loyalty.

- Technological leadership in imaging and display technologies.

- Robust ecosystem across gaming, music, and pictures.

- Adaptation to market changes through innovation and strategic moves.

Sony's financial performance is influenced by its diverse operations. For the fiscal year 2023, the Game & Network Services segment generated the highest revenue, followed by Music and Pictures. The company's ability to adapt to market dynamics is crucial. To learn more about the specific consumer groups, check out the Target Market of Sony.

Sony Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Sony Positioning Itself for Continued Success?

The Sony company maintains a robust position across several key industries. Its PlayStation brand is a global leader in gaming, consistently competing with major players for market share. The music and pictures segments rank among the top entertainment companies worldwide, and it holds a strong presence in premium electronics. Its imaging and sensing solutions division is a dominant force in the global image sensor market, supplying critical components to major smartphone manufacturers.

Despite its strong industry position, Sony corporation faces several risks, including regulatory changes, new competitors, and technological disruptions. Changing consumer preferences and geopolitical tensions also pose ongoing challenges. However, Sony's business model is designed to adapt to these challenges through innovation and strategic investments.

Sony's PlayStation brand consistently ranks among the top gaming consoles globally, competing with Microsoft's Xbox and Nintendo's Switch. The music and pictures segments are major players in the entertainment industry, with extensive content libraries. In electronics, Sony maintains a presence in premium segments such as televisions, cameras, and audio equipment. Its imaging and sensing solutions division is a leading supplier of image sensors.

Regulatory changes, especially concerning data privacy and antitrust, pose risks. New competitors in emerging technologies could disrupt market dynamics. Rapid advancements in display technology and AI-driven content creation necessitate continuous adaptation. Changing consumer preferences and geopolitical tensions also present ongoing challenges.

Sony is investing in expanding its PlayStation ecosystem, including PC and mobile gaming. It aims to leverage its intellectual property across its entertainment divisions. In imaging and sensing solutions, Sony is focused on developing next-generation sensors. Leadership emphasizes a commitment to innovation and content creation to drive sustained growth.

Sony plans to sustain and expand its ability to make money by continuing to innovate in its core businesses. The company is strategically investing in high-growth areas. It is also fostering greater synergy across its entertainment and technology segments. This helps Sony maintain its competitive edge and adapt to evolving market demands.

In fiscal year 2023, Sony's consolidated sales reached approximately ¥12.388 trillion, with operating income of ¥1.208 trillion. The Games & Network Services segment, a key part of Sony products, saw significant revenue, driven by PlayStation 5 sales and digital content. The company's strategy focuses on growth in gaming, music, and pictures, while also expanding in imaging and sensing solutions. Sony is also investing in new technologies to stay competitive.

- Continued investment in the PlayStation ecosystem, including PC and mobile gaming.

- Leveraging intellectual property across entertainment divisions for synergistic content.

- Developing next-generation sensors for automotive and industrial applications.

- Focus on innovation and content creation to drive sustained growth and adapt to market changes.

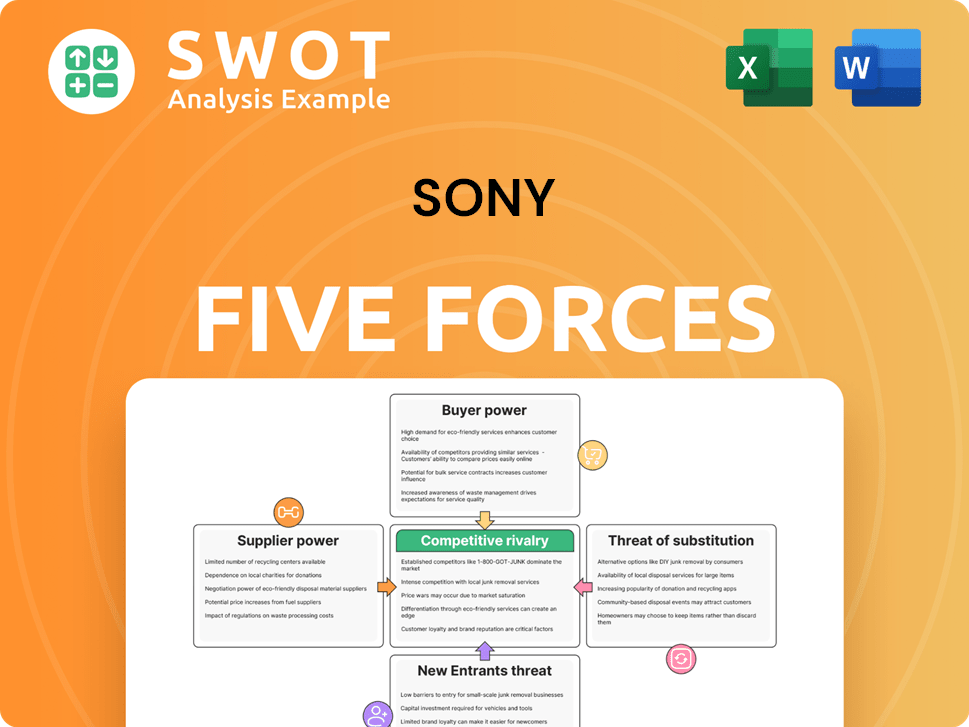

Sony Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sony Company?

- What is Competitive Landscape of Sony Company?

- What is Growth Strategy and Future Prospects of Sony Company?

- What is Sales and Marketing Strategy of Sony Company?

- What is Brief History of Sony Company?

- Who Owns Sony Company?

- What is Customer Demographics and Target Market of Sony Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.