Sony Bundle

Who Really Calls the Shots at Sony?

Ever wondered who truly steers the ship at one of the world's most iconic brands? The question of Sony SWOT Analysis unveils a fascinating story of corporate evolution and strategic influence. From its humble beginnings in post-war Japan to its current status as a global entertainment and technology powerhouse, understanding Sony's ownership is key. This deep dive explores the forces that shape this multinational conglomerate.

Unraveling the Sony ownership structure provides crucial insights for investors and analysts. Knowing the Sony parent company and its key players illuminates how decisions are made and how the company navigates the complex landscape of profitability, innovation, and social responsibility. This analysis will cover the Sony corporation's history, from its founding to the present day, detailing the roles of Sony shareholders, major institutional investors, and the impact of public shareholding. We'll also explore where Sony's headquarters is located and how to invest in Sony stock.

Who Founded Sony?

The story of Sony, a global technology and entertainment giant, begins with its founders, Masaru Ibuka and Akio Morita. Their vision and leadership were instrumental in shaping the company's early ownership and direction. Understanding the initial ownership structure provides valuable insight into the company's foundational values and its approach to innovation and expansion.

Masaru Ibuka, an engineer, initiated the company in May 1946, initially named Tokyo Tsushin Kogyo K.K. (Tokyo Telecommunications Engineering Corporation). Akio Morita, a physicist, joined soon after, bringing his business acumen. The early ownership was primarily held by Ibuka and Morita, reflecting their central roles in both the technical and business aspects of the company. Their direct control allowed for a long-term focus on product development and market penetration.

The early financial backing came mainly from Ibuka's personal funds and contributions from a few associates. The initial capital was ¥190,000. The focus was on establishing a solid operational framework and developing innovative products, particularly in audio and electronics. The founding team's commitment to pioneering technology was closely tied to their ownership, which enabled them to pursue long-term goals without immediate pressure from external shareholders.

The early ownership of the Sony corporation was characterized by the strong influence of its founders, Masaru Ibuka and Akio Morita. Their direct control was crucial for the company's early strategic decisions and focus on technological innovation. The initial financial backing was primarily internal, with a reliance on personal funds and contributions from close associates, rather than external investors.

- Founders: Masaru Ibuka and Akio Morita.

- Initial Capital: ¥190,000.

- Early Focus: Product development in audio and electronics.

- Ownership Structure: Primarily controlled by Ibuka and Morita.

- Strategic Advantage: Direct control allowed for long-term vision.

The early ownership structure of Sony, with its founders at the helm, set the stage for its future success. This structure allowed for a strong focus on innovation and long-term strategic planning. For a deeper understanding of the competitive environment, you can explore the Competitors Landscape of Sony.

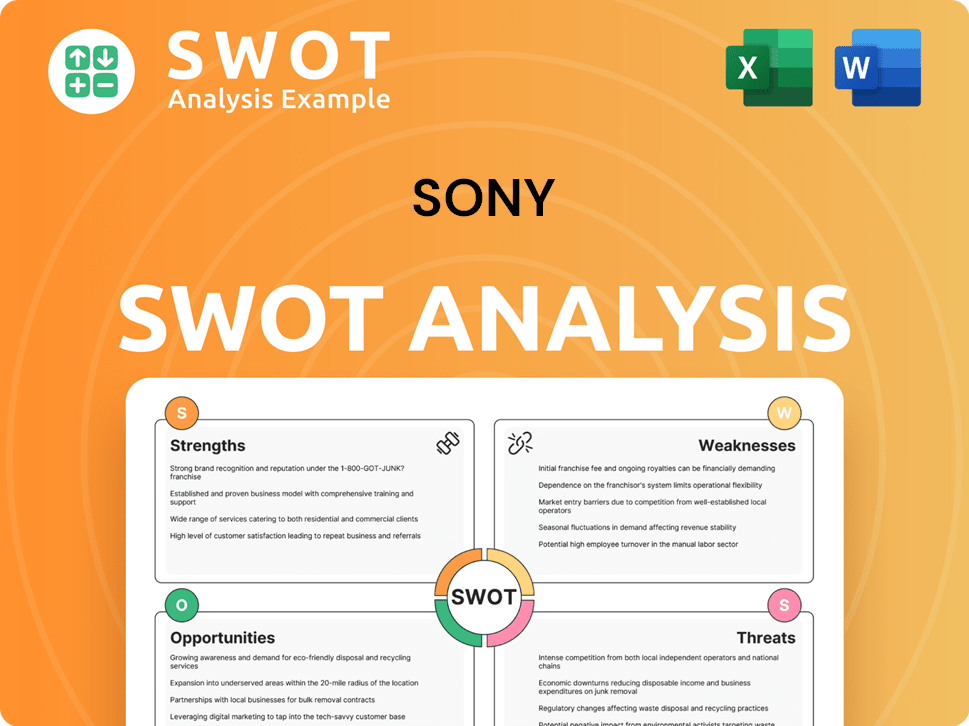

Sony SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Sony’s Ownership Changed Over Time?

The evolution of the Sony corporation's ownership began with its founding and has been significantly shaped by key events. The initial public offering (IPO) in 1958 on the Tokyo Stock Exchange was a pivotal moment, allowing for broader investment and a shift away from direct founder control. While the precise initial market capitalization details from 1958 are not readily available, this move was a significant step in democratizing ownership.

Over the years, the Sony parent company has seen its ownership structure change. The shift towards a publicly traded model has been a defining factor in its ownership journey. This transition has influenced the company's strategic direction and its relationship with shareholders, reflecting the dynamics of a large multinational corporation.

| Event | Impact on Ownership | Year |

|---|---|---|

| Initial Public Offering (IPO) | Broadened investor base, diluted founder control | 1958 |

| Growth and Expansion | Increased institutional ownership, dispersed shareholding | Ongoing |

| Market Fluctuations | Changes in major shareholder holdings, impact on stock price | Ongoing |

Today, Sony ownership is characterized by a widely dispersed structure, typical of a large public corporation. The largest segment of ownership is held by institutional investors. As of December 31, 2023, The Vanguard Group, Inc. held 3.03% of Sony's shares, and BlackRock, Inc. held 2.76%. These percentages reflect passive investments by index and mutual funds. Individual insiders hold a very small percentage. This structure promotes a focus on financial performance and shareholder value.

Sony is a publicly traded company with a dispersed ownership structure, primarily held by institutional investors.

- The IPO in 1958 was a key event in the evolution of Sony's ownership.

- Major institutional shareholders include firms such as BlackRock and Vanguard.

- Individual insiders hold a small percentage of the company's shares.

- The shift towards institutional ownership emphasizes financial performance.

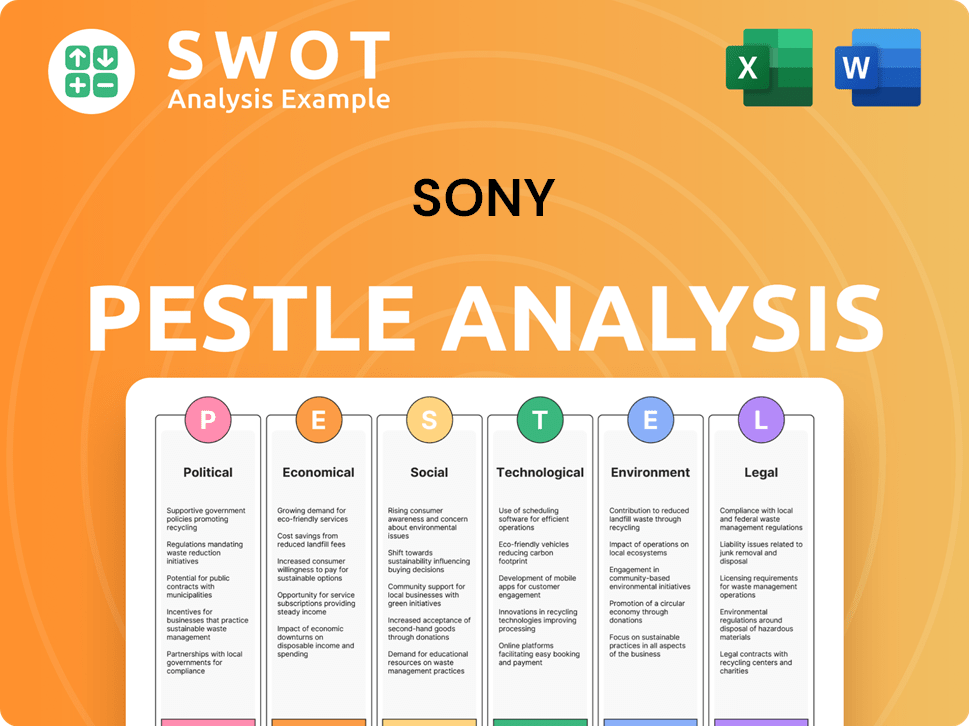

Sony PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Sony’s Board?

The current board of directors of the Sony Group Corporation includes a mix of internal executives, industry experts, and independent directors. As of early 2025, the board typically consists of executive directors, who also hold management positions within the company, and non-executive directors, with a significant number being independent. For instance, Kenichiro Yoshida serves as Chairman and CEO, representing a key executive position on the board. While specific board members do not directly represent major institutional shareholders like BlackRock or Vanguard, these institutional investors influence decisions through their voting power on resolutions and director elections. Understanding the Sony ownership structure is key to assessing the company's governance.

The board's composition and decisions are regularly reviewed by investors, focusing on strategic direction, executive compensation, and overall corporate performance. The Sony corporation operates with a focus on long-term value creation. The board is responsible for overseeing the company's strategic direction and ensuring that management is acting in the best interests of the shareholders. The board's structure is designed to promote effective corporate governance and accountability, which is crucial for maintaining investor confidence and driving sustainable growth. To learn more about the company's strategic goals, explore the Growth Strategy of Sony.

| Board Member | Title | Notes |

|---|---|---|

| Kenichiro Yoshida | Chairman and CEO | Executive Director |

| Hiroki Totoki | President, COO, and CFO | Executive Director |

| Toshiko Kinoshita | Independent Director |

Sony's parent company operates under a one-share-one-vote structure, meaning each ordinary share has equal voting rights. There are no known dual-class shares, special voting rights, or golden shares that would give outsized control to any specific individual or entity. This structure generally promotes corporate governance aligned with the interests of all shareholders. The company's Sony shareholders have a significant voice in the company's direction. The company's market capitalization as of May 2024 was approximately $130 billion.

The board of directors at Sony comprises a mix of executives and independent members, ensuring diverse perspectives. The company operates under a one-share-one-vote system, promoting shareholder equality.

- The board includes both executive and non-executive directors.

- Institutional investors influence decisions through voting power.

- The company's governance structure supports shareholder interests.

- The company's headquarters is located in Tokyo, Japan.

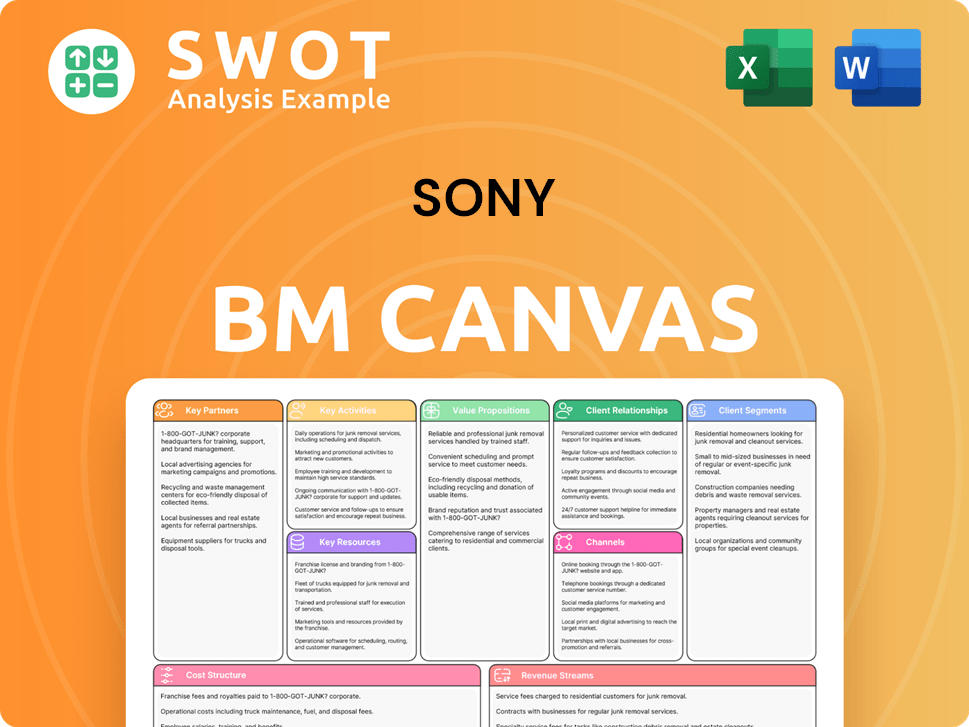

Sony Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Sony’s Ownership Landscape?

Over the past few years, the ownership structure of the Sony corporation has seen gradual changes. These shifts are largely due to broader market dynamics and strategic actions. For example, in May 2024, a share repurchase program of approximately ¥200 billion ($1.3 billion USD) was announced. This can consolidate ownership among remaining Sony shareholders and boost earnings per share.

Industry trends also influence Sony's ownership profile. There's a rise in institutional ownership across major global corporations, driven by the growth of index funds and passive investing. This often leads to increased focus on environmental, social, and governance (ESG) factors. Additionally, the founders' direct stakes have become negligible over time. The company consistently communicates its financial performance and strategic outlook, which influences analyst perspectives on its future valuation and Sony stock.

| Aspect | Details | Impact |

|---|---|---|

| Share Buybacks | ¥200 billion ($1.3 billion USD) share repurchase program announced in May 2024 | Consolidates ownership, boosts earnings per share. |

| Institutional Ownership | Increase due to index funds and passive investing. | Greater scrutiny on ESG factors. |

| Founder Dilution | Founders' direct stakes have become negligible. | Reflects the company's growth and public listing. |

Understanding Sony ownership involves looking at its publicly traded status, with no single entity holding controlling shares. The company's financial performance and strategic moves, like share buybacks, influence the perspectives of analysts and investors. For a deeper dive into how Sony approaches the market, you can explore the Marketing Strategy of Sony.

The majority of Sony's shares are held by institutional investors. These include investment firms, pension funds, and asset management companies. Details on specific major shareholders are available through public filings.

Institutional investors often exert influence through voting on corporate governance matters. They also engage with the company on ESG issues. This shapes Sony's strategic direction.

Market trends, like the growth of passive investing, influence Sony's ownership structure. These trends lead to a greater emphasis on financial performance and sustainability practices.

Sony uses share buybacks to manage its capital and potentially increase shareholder value. These actions can impact the distribution of ownership over time.

Sony Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Sony Company?

- What is Competitive Landscape of Sony Company?

- What is Growth Strategy and Future Prospects of Sony Company?

- How Does Sony Company Work?

- What is Sales and Marketing Strategy of Sony Company?

- What is Brief History of Sony Company?

- What is Customer Demographics and Target Market of Sony Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.