Bendigo Bank Bundle

What's the Story Behind Bendigo Bank?

Journey back in time to discover the fascinating Bendigo Bank SWOT Analysis, a financial institution with deep roots in Australia. From its origins during the Victorian gold rush, Bendigo Bank has carved a unique path in the world of finance. Explore how this Australian bank transformed from a building society into a major player in the banking industry.

The brief history of Bendigo Bank reveals a compelling narrative of community banking and adaptability. Founded in 1858, Bendigo Bank's early days were marked by a commitment to fostering home ownership and stability. This unwavering focus on community has been a cornerstone of its success, influencing its evolution and shaping its enduring presence in the Australian banking landscape. Understanding the Bendigo Bank company's journey is crucial for anyone interested in the banking history.

What is the Bendigo Bank Founding Story?

The Bendigo Bank, a cornerstone of Australian banking, has a rich history rooted in the Victorian goldfields. Its founding in 1858 marked the beginning of a journey from a building society to a prominent Australian bank, deeply committed to community values. Understanding the Bendigo Bank history provides valuable insights into the evolution of community banking in Australia.

The establishment of Bendigo Bank was a direct response to the socio-economic changes brought about by the gold rush. The founders aimed to create a stable, home-owning community from the transient population. This initiative highlights the bank's early focus on community development, a characteristic that has remained central to its operations.

The Bendigo Bank company began its journey on July 9, 1858, in Bendigo, Victoria, initially known as the Bendigo Land and Building Society. This marked the start of a financial institution designed to meet the specific needs of the local community. The aim was to transition the transient population into a more stable, home-owning community.

The initial business model was a fixed-term building society, with approximately 150 individuals subscribing £5 each to establish the society. The primary service was financing miners' cottages to improve living conditions and encourage permanent settlement.

- The society’s cooperative approach, inspired by the building society movement in Britain, enabled individuals to save and borrow for home ownership.

- The cultural and economic context of the gold rush, with rapid population growth and demand for infrastructure, heavily influenced the company's creation.

- The financial mechanisms directly supported local development, emphasizing community focus.

- The early days of Bendigo Bank underscore its commitment to supporting local communities.

The early days of Bendigo Bank saw the company focusing on financing miners' cottages. This initiative was a direct response to the needs of the growing population in the goldfields. The bank's commitment to community development is a key aspect of its banking history.

The early success of the Bendigo Bank can be attributed to its focus on community needs. This approach set the stage for its future growth and its role in Australian banking. For more information, consider reading about the Target Market of Bendigo Bank.

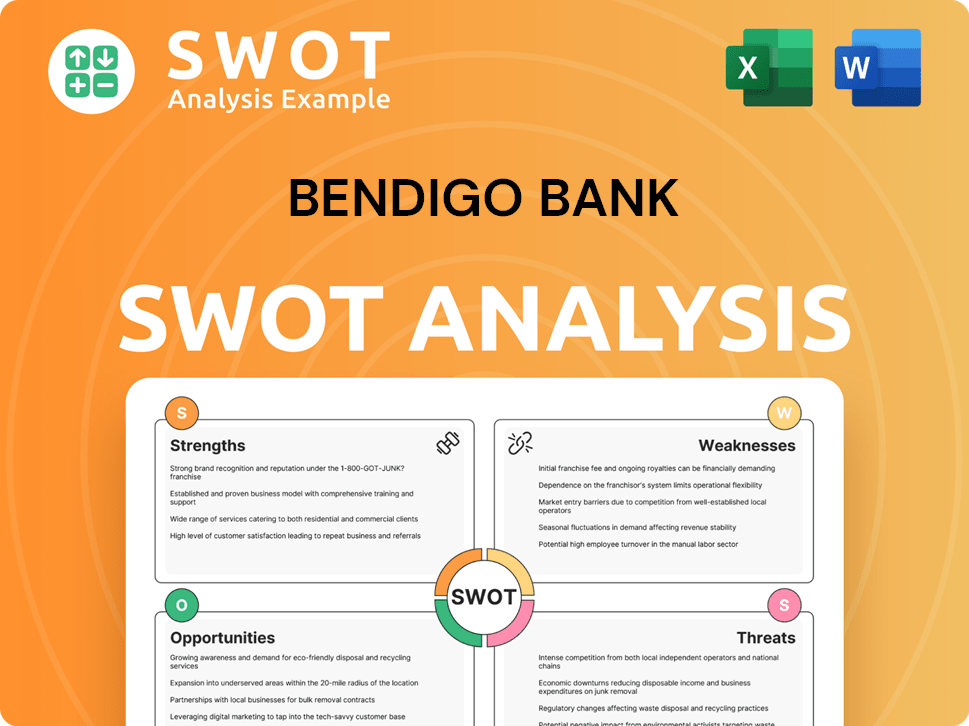

Bendigo Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Bendigo Bank?

The early years of the Bendigo Bank focused on expanding its local footprint and services. This Australian bank began as the Bendigo Land and Building Society. The company's strategy involved mergers and acquisitions to grow its reach and offerings, marking a significant chapter in its banking history.

In 1865, seven years after its start, the company restructured and became the Bendigo Mutual Permanent Land and Building Society. It was formally incorporated in Victoria in 1876. This restructuring was a crucial step in its evolution, setting the stage for future growth and expansion.

The Bendigo Bank company expanded through mergers and acquisitions. Key mergers included Bendigo and Eaglehawk Star in 1978, Sandhurst in 1983, and Sunraysia in 1985. The acquisition of Capital and Compass building societies also contributed to its growth.

On July 1, 1995, the Bendigo Land and Building Society converted to a bank, becoming 'Bendigo Bank Limited.' This transformation marked its evolution into a full-fledged financial institution. At this point, it was recognized as Australia's oldest and Victoria's largest building society.

In 1999, the bank formed an alliance with IOOF, involving mutual shareholding. In 2000, it received an operating license, leading to the absorption of the First Australian Building Society and the establishment of a regional headquarters in Ipswich. The bank invested a substantial A$75 million in expanding its head office in Bendigo.

By November 2007, Bendigo Bank merged with Adelaide Bank, resulting in the entity known today as Bendigo and Adelaide Bank. Before the merger, Bendigo Bank operated nearly 900 outlets across Australia. The merger created a larger entity with over 400 branches.

Throughout its growth, Bendigo Bank maintained a focus on community and regional needs, which distinguished it in the competitive Australian banking landscape. This commitment is a key part of its identity, as discussed in Growth Strategy of Bendigo Bank. This focus helped it to build strong relationships with the communities it served.

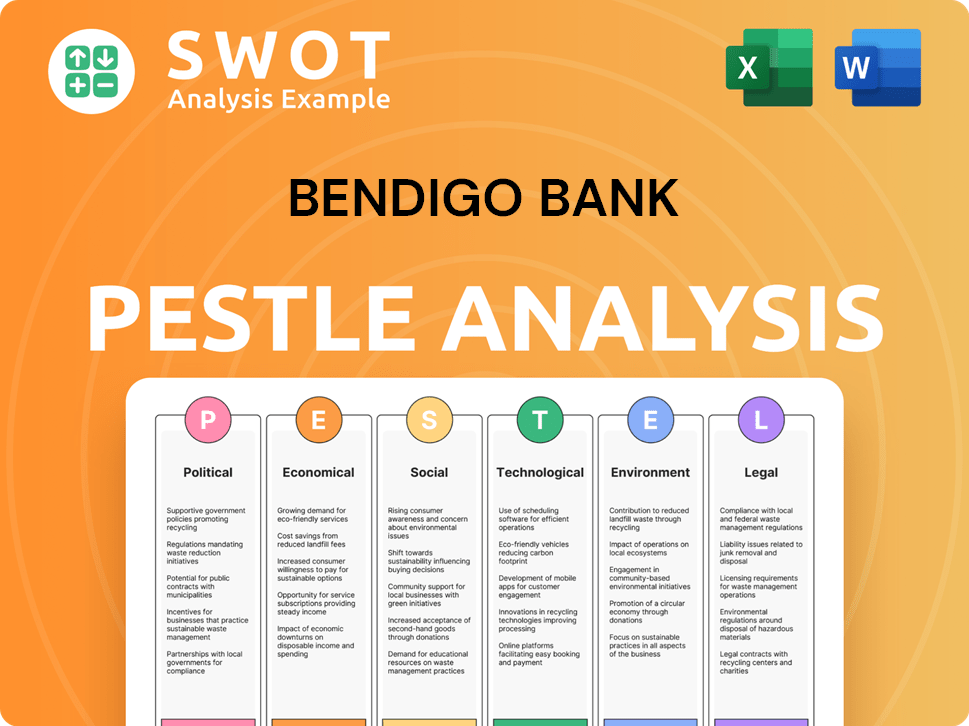

Bendigo Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Bendigo Bank history?

The Bendigo Bank's history is marked by significant milestones, including pioneering financial products and community-focused initiatives. From its early days as a building society to its current status as a leading Australian bank, the company has consistently adapted to the changing financial landscape.

| Year | Milestone |

|---|---|

| 1998 | Launched the 'Community Bank' program, empowering local communities to operate their own bank branches. |

| 2002 | Pioneered 'Green Loans' in Australia, demonstrating a commitment to environmental sustainability. |

| 2007 | Merged with Adelaide Bank, a pivotal move in its merger history. |

| 2023 | The Community Bank model grew to over 300 branches, with $20 billion in loans and $31.3 billion in deposits. |

| 2024 | Aimed to migrate 50% of its applications to the cloud as part of its digital transformation. |

Bendigo Bank has been at the forefront of innovation in the banking history. A notable innovation was the introduction of the first mortgage offset account in Australia. This product is now standard across the industry. The bank also launched the Community Bank program, a unique 'profit-with-purpose' model. This model allows communities to operate their own branches, reinvesting profits locally, which is a key aspect of Bendigo Bank's community focus.

The Community Bank program, launched in 1998, is a significant innovation. It allows local communities to own and operate bank branches, with profits reinvested locally.

Bendigo Bank introduced the first mortgage offset account in Australia. This product has since become a standard offering across the industry.

In 2002, Bendigo Bank pioneered 'Green Loans' in Australia. This initiative demonstrated the bank's commitment to environmental sustainability.

The bank is undergoing a digital transformation to consolidate its core banking systems and migrate applications to the cloud. This includes the successful rollout of the Bendigo Lending Platform.

The digital-only bank, Up, has surpassed 1 million customers after six years of operation, showcasing the bank's digital innovation.

Bendigo Bank has faced several challenges throughout its Bendigo Bank history. These include navigating market downturns and competitive pressures. In the half-year ended December 31, 2024, the bank reported a 1.1% decrease in cash earnings compared to the prior period. Operating expenses also rose by 5% due to investments in its transformation program and inflationary pressures.

The bank has had to navigate market downturns, impacting its financial performance. These downturns have required strategic adjustments to maintain profitability.

The Australian bank sector is highly competitive, requiring Bendigo Bank to constantly innovate. This competition affects profit margins and market share.

Higher funding costs have led to margin pressures, impacting earnings. This is evident in the reported decrease in cash earnings for the half-year ended December 31, 2024.

Operating expenses have increased due to investments in digital transformation and inflationary pressures. This impacts the bank's profitability.

In 2007, Bendigo Bank rejected a merger proposal from Bank of Queensland. This decision shaped its future trajectory.

The ongoing digital transformation program requires significant investment. These costs have contributed to the increase in operating expenses.

For more insights into the Bendigo Bank company, you can explore Revenue Streams & Business Model of Bendigo Bank.

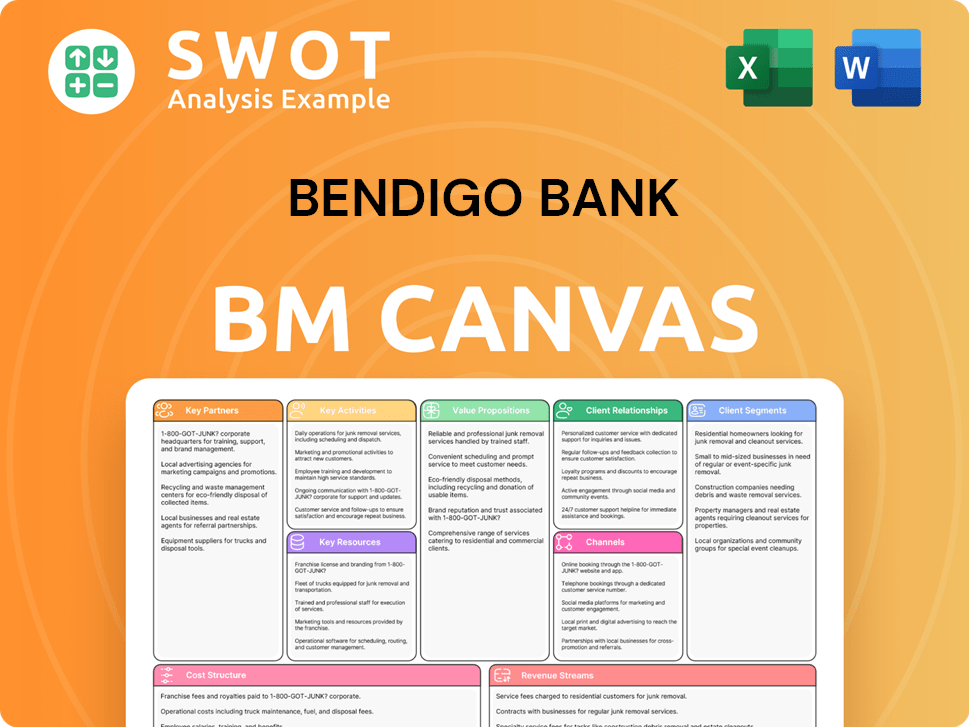

Bendigo Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Bendigo Bank?

The Bendigo Bank's journey is marked by significant milestones, evolving from a building society to a major Australian bank. Its history reflects a commitment to community and innovation, shaping its identity and strategic direction.

| Year | Key Event |

|---|---|

| July 9, 1858 | Founded as the Bendigo Land and Building Society in Bendigo, Victoria. |

| 1865 | Restructured and renamed Bendigo Mutual Permanent Land and Building Society. |

| 1978 | Merged with Bendigo and Eaglehawk Star. |

| 1983 | Acquired Sandhurst building society. |

| 1985 | Acquired Sunraysia building society. |

| July 1, 1995 | Converted to a bank, becoming Bendigo Bank Limited. |

| 1998 | Launched the 'Community Bank' program, with the first branches opening in Minyip and Rupanyup. |

| 2000 | Received an operating license and absorbed First Australian Building Society, with a A$75 million head office expansion. |

| 2002 | Introduced 'Green Loans' and formed 'Community Sector Banking.' |

| November 2007 | Merged with Adelaide Bank, forming Bendigo and Adelaide Bank. |

| 2019 | Began efforts to reduce the number of applications from 650 to 325 by 2024. |

| May 22, 2024 | Held its 2024 Investor Day, outlining future plans. |

| August 26, 2024 | Full-year results and final dividend announcement for FY24. |

| November 1, 2024 | Chief Transformation Officer Ryan Brosnahan discusses the bank's digital transformation journey. |

| February 17, 2025 | Released its interim financial results for the half-year ended December 31, 2024, reporting cash earnings of $265.2 million. |

| May 23, 2025 | Announced its FY25 third quarter update, with residential lending growing at an annualised rate of 9.4% to $66.7 billion. |

The bank is focused on simplifying its operations and modernizing its technology infrastructure. A key goal is to operate on a single core banking system by the end of 2025, consolidating from eight different systems. This includes transitioning to cloud services and leveraging AI to rewrite legacy applications, enhancing efficiency and customer experience.

Bendigo Bank continues to emphasize its community banking model, which has been a cornerstone of its strategy. Since 1998, over $366 million has been reinvested back into local communities. This commitment to community prosperity remains a key differentiator and a driver of sustainable growth for the Australian bank.

The digital-only brand, Up, with over 1 million customers, is a key component of Bendigo Bank's future growth strategy. The bank aims to be Australia's bank of choice, driven by its purpose to 'feed into the prosperity of our customers and communities, not off it.' The residential lending grew at an annualised rate of 9.4% to $66.7 billion in the third quarter of FY25.

In the half-year ended December 31, 2024, the bank reported cash earnings of $265.2 million. The full-year results and final dividend announcement for FY24 were made on August 26, 2024. The bank's financial performance is a key indicator of its overall health and ability to invest in future initiatives.

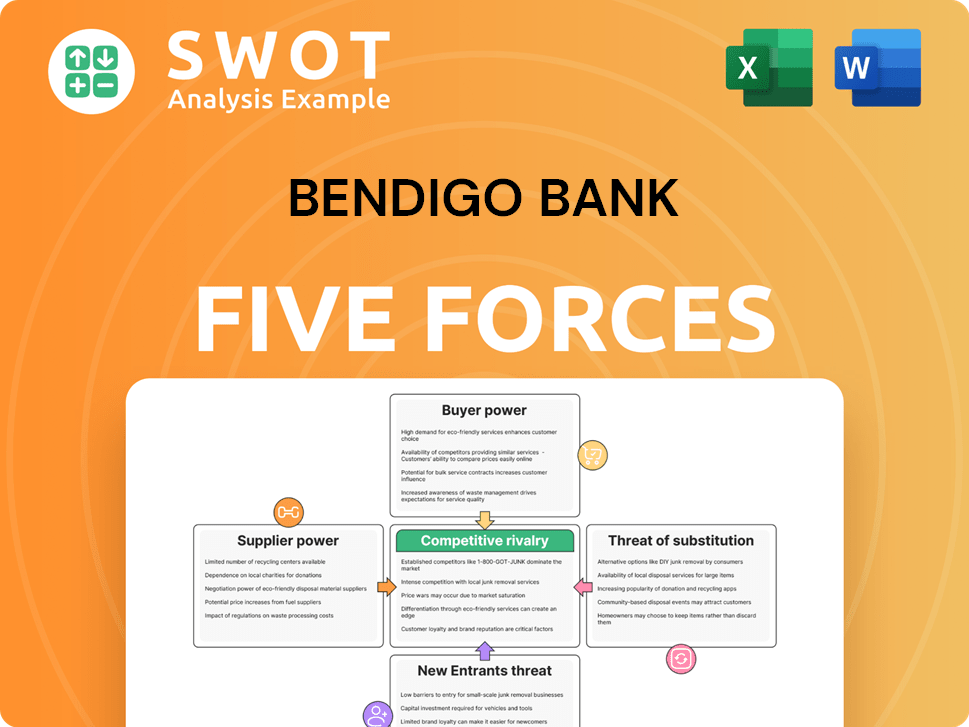

Bendigo Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Bendigo Bank Company?

- What is Growth Strategy and Future Prospects of Bendigo Bank Company?

- How Does Bendigo Bank Company Work?

- What is Sales and Marketing Strategy of Bendigo Bank Company?

- What is Brief History of Bendigo Bank Company?

- Who Owns Bendigo Bank Company?

- What is Customer Demographics and Target Market of Bendigo Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.