Bendigo Bank Bundle

Who Does Bendigo Bank Serve?

In today's evolving Bendigo Bank SWOT Analysis, understanding customer demographics and target market is paramount for success in the competitive banking industry. With the rise of digital banking, knowing who Bendigo Bank's customers are and what they need is more critical than ever. This analysis delves into Bendigo Bank's customer profile, exploring how it adapts to changing financial landscapes.

From its community-focused roots, Bendigo Bank has broadened its reach, making market segmentation a key aspect of its strategy. This exploration examines the bank's approach to financial services, including its customer base size, customer satisfaction levels, and how it tailors products to meet diverse needs. Analyzing the customer demographics and target market reveals how Bendigo Bank maintains its competitive advantage.

Who Are Bendigo Bank’s Main Customers?

Understanding the Growth Strategy of Bendigo Bank involves a close look at its customer base. Its target market is segmented into both consumer (B2C) and business (B2B) sectors. The bank's community banking model significantly influences its customer demographics, particularly in regional and rural areas of Australia.

On the B2C side, the bank serves a diverse range of customers. This includes young adults, families, and retirees. While specific data on age, income, or education is not publicly available for 2024-2025, the bank's focus on community suggests a strong presence in regional and rural populations. These customers often value personalized service and local accessibility.

For B2B customers, Bendigo Bank caters to small and medium-sized enterprises (SMEs), agricultural businesses, and not-for-profit organizations. These segments require tailored financial solutions. The community branch model fosters strong relationships with local businesses. The agricultural sector is a significant B2B segment.

The B2C segment includes a broad range of individual customers. This includes young adults seeking their first accounts to retirees managing their wealth. The bank's focus on community banking suggests a strong presence among regional and rural populations across Australia. Digital offerings are increasingly targeting younger demographics.

The B2B segment includes SMEs, agricultural businesses, and not-for-profit organizations. These segments often require tailored financial solutions. The bank's community branch model fosters strong relationships with local businesses. The agricultural sector represents a significant B2B segment.

Bendigo Bank's customer segmentation strategies focus on both individual consumers and business clients. The bank's target market is influenced by its commitment to community banking. It has likely seen shifts in its target segments driven by economic changes and the demand for digital banking services.

- Customer Base Size: The bank serves a substantial customer base across Australia.

- Customer Satisfaction: The bank aims for high customer satisfaction levels through its community-focused approach.

- Digital Banking: Investments in digital infrastructure are ongoing to meet evolving customer preferences.

- Geographic Focus: A strong presence in regional and rural areas is a key characteristic of its target market.

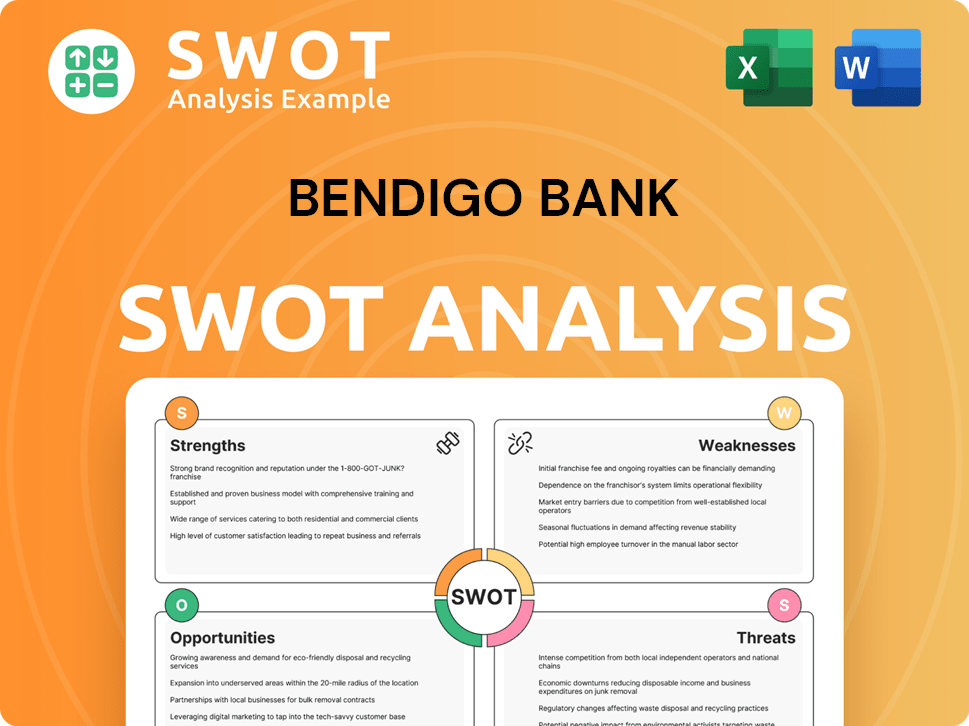

Bendigo Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Bendigo Bank’s Customers Want?

Understanding the customer needs and preferences is crucial for any financial institution, and for the financial services provider, it's a cornerstone of its community-focused approach. The bank's customers are driven by a combination of practical, psychological, and aspirational needs, influencing their choices and loyalty within the banking industry.

Practical needs often involve reliable and accessible banking services, including competitive interest rates and convenient branch locations, especially in regional areas. Psychological drivers include the desire for trust, security, and personalized service, which align with the bank's community-centric model. Aspirational drivers might include achieving financial goals such as homeownership or business growth, for which customers seek relevant financial products and expert advice.

Purchasing behaviors are influenced by fees, interest rates, and ease of account management. The bank's reputation for ethical practices and community involvement plays a significant role in customer decisions. Digital banking adoption is growing, while complex needs may still involve in-person consultations. Addressing pain points like accessible banking in underserved areas and understanding local economic conditions is key. Market trends, such as demand for sustainable investments, shape product development.

Customers require accessible and reliable banking services. This includes competitive interest rates and convenient branch locations, especially in regional areas.

Customers seek trust, security, and personalized service. The bank's community-centric model aligns with these needs.

Customers aim to achieve financial goals like homeownership or business growth. They seek relevant financial products and expert advice.

Customers consider fees, interest rates, and ease of account management. The bank's ethical reputation influences decisions.

Digital banking is growing for everyday transactions. Complex needs, such as home loans, may involve in-person consultations.

The bank addresses the need for accessible banking in underserved areas. It aims to understand local economic conditions.

The bank's customer base size is substantial, with over 2.1 million customers as of the latest reports. Customer satisfaction levels are generally high, reflecting the bank's focus on community and personalized service. Market segmentation strategies are employed to tailor products and services to different customer groups. For example, the bank's target market for home loans includes first-home buyers and those seeking to refinance, while business banking services cater to small and medium-sized enterprises (SMEs) in regional areas. The bank's competitive advantage lies in its strong community ties and personalized service, differentiating it from larger institutions. The bank's marketing strategies highlight its community contributions and personalized service. To learn more about the bank's customer profile, you can read more about it in an article about the bank's customer demographics.

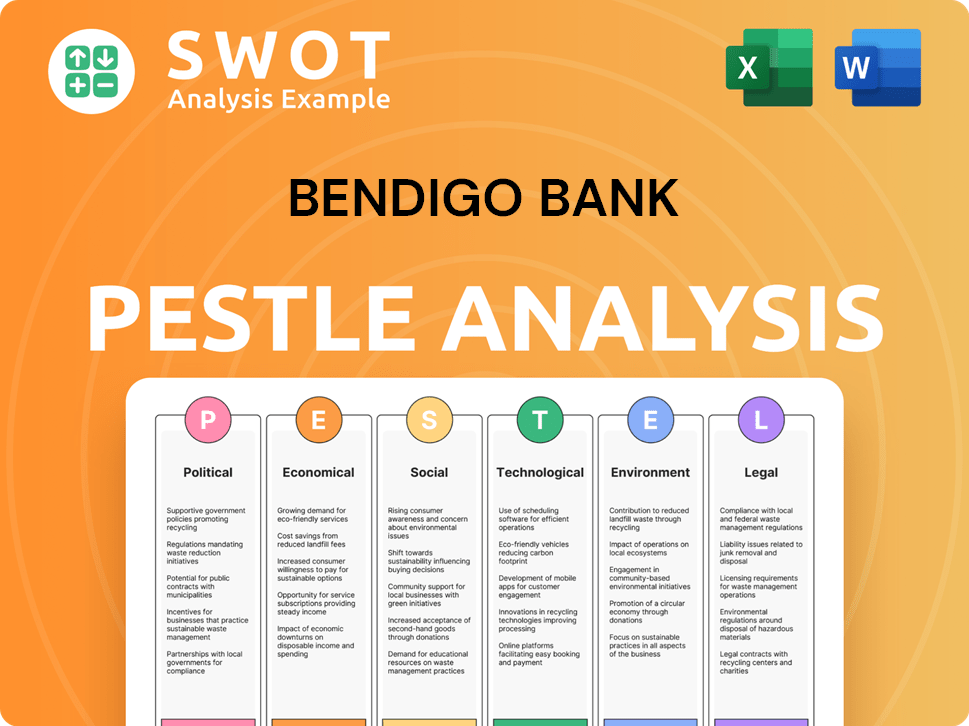

Bendigo Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Bendigo Bank operate?

The geographical market presence of the bank is predominantly focused on Australia. Its operations are spread across various states and territories, with a strong emphasis on regional and rural areas. The bank's Community Bank model has historically facilitated deep community connections, establishing a robust presence in these locales.

While specific market share percentages for 2024-2025 by region are not readily available, the bank's extensive network of branches and agencies spans the country. There's a notable concentration in Victoria, New South Wales, and Queensland. The bank benefits from strong brand recognition within these regional communities, often being perceived as a local institution.

The bank strategically adapts its services to meet the diverse needs of its customer base across different regions. For example, agricultural regions may require specialized agribusiness financing, while growing regional centers might prioritize home loans and small business banking. The bank's Community Bank branches are empowered to address local needs and reinvest profits back into their communities, fostering tailored services and partnerships.

The bank's primary focus is the Australian market, particularly regional and rural areas. This strategic focus allows for a deep understanding of local needs and preferences. This geographic focus is a key element of its market segmentation.

The Community Bank model is central to the bank's geographic strategy. This model allows branches to operate with a degree of autonomy, responding to local market demands and reinvesting profits within the community. This approach helps the bank tailor its services effectively.

The bank has also expanded its digital presence to serve customers across all geographic areas, including metropolitan centers. This digital expansion complements its physical branch network and broadens its reach. This strategy is crucial for reaching a wider target market.

Decisions regarding expansions or strategic withdrawals are typically driven by community demand and economic viability. The Community Bank model provides flexibility in market entry and exit strategies. This responsiveness is important for maintaining a strong presence in the banking industry.

The bank recognizes and caters to the differences in customer demographics, preferences, and buying power across various regions. This localized approach allows for tailored services and partnerships that resonate with the specific economic and social fabric of each area. Understanding customer demographics is key.

The bank's customer base is diverse, with a significant presence in regional and rural areas. This customer base includes individuals, families, and businesses, with services tailored to meet their specific needs. For more insights into the bank's structure, you can explore Owners & Shareholders of Bendigo Bank.

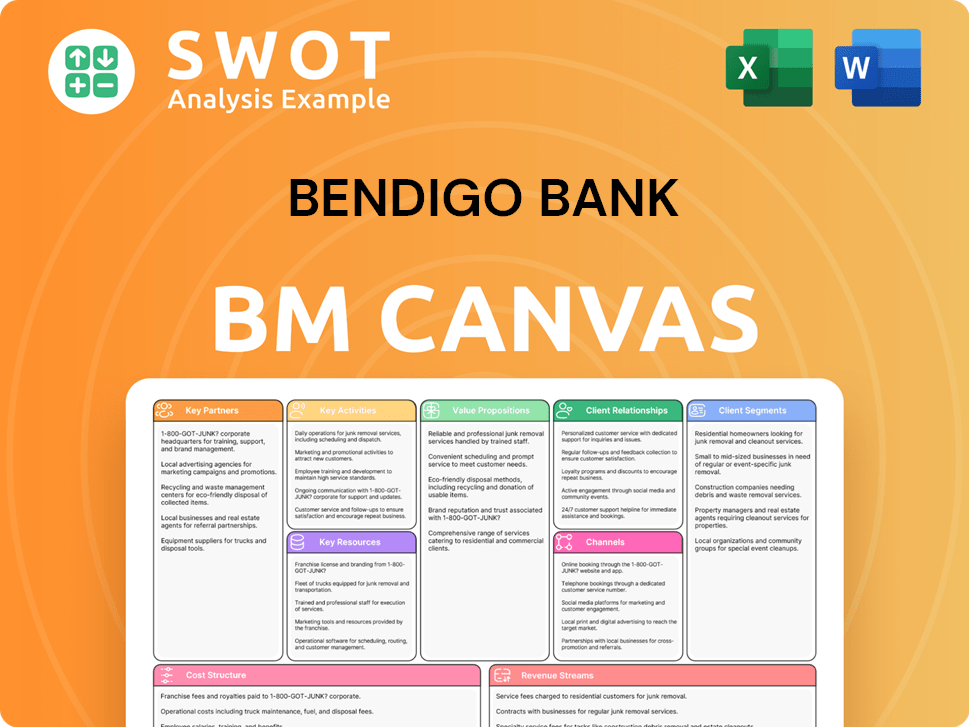

Bendigo Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Bendigo Bank Win & Keep Customers?

The acquisition and retention strategies of the bank are deeply rooted in its community banking model, which emphasizes local engagement and personalized service. This approach enables the bank to build strong relationships with its customers, fostering loyalty and driving positive word-of-mouth referrals. The bank's marketing efforts are tailored to resonate with its target market, focusing on ethical banking practices and community development.

The bank employs a multi-channel approach to reach its target market, combining traditional methods with digital strategies. This includes local sponsorships, digital marketing campaigns, and referral programs to attract new customers. Simultaneously, the bank prioritizes customer retention through personalized experiences, loyalty programs, and robust after-sales service, enhancing customer lifetime value.

The bank's commitment to both acquisition and retention is reflected in its customer base size and satisfaction levels. By understanding its customer demographics and target market, the bank has been able to refine its strategies and maintain a competitive edge within the financial services sector. The bank's success is also influenced by the Competitors Landscape of Bendigo Bank and its ability to differentiate itself in a crowded market.

The bank utilizes a blend of traditional and digital channels to acquire customers. Local community sponsorships and events are key, reflecting its community-focused model. Digital marketing, including social media and SEO, is increasingly important for reaching a broader audience.

Sales strategies emphasize personalized service and relationship building. Branch staff, with their local knowledge, play a crucial role in this. Referral programs also contribute, leveraging positive word-of-mouth within strong community networks.

Retention focuses on fostering customer loyalty through personalized experiences and robust after-sales service. The Community Bank model itself is a significant retention tool, as customers are invested in the success of their local branch.

Customer data and CRM systems are vital for targeted campaigns and personalized communications. This enables the bank to offer relevant products and services at the right times, enhancing customer engagement and retention.

The Community Bank model is central to both acquisition and retention. Customers are often invested in the success of their local branch and the community benefits it generates, fostering a strong sense of loyalty.

Loyalty programs are likely used to reward long-term relationships and product bundling. While specific details may vary, the focus is on incentivizing customer retention and engagement.

Successful acquisition campaigns often highlight the bank's ethical stance and commitment to community development. This differentiation helps the bank stand out from larger competitors and attract customers aligned with these values.

Changes in strategy over time have included a greater emphasis on digital channels. This shift caters to evolving customer preferences and expands reach beyond traditional regional strongholds, impacting customer lifetime value and churn rates.

Customer data and CRM systems are becoming increasingly vital for targeting campaigns and personalizing communications. This allows the bank to offer relevant products and services at appropriate times, enhancing customer experience.

The bank likely employs market segmentation strategies to target specific customer groups effectively. This could involve segmenting by age range, income levels, geographic location, or specific financial needs, such as home loans or business banking.

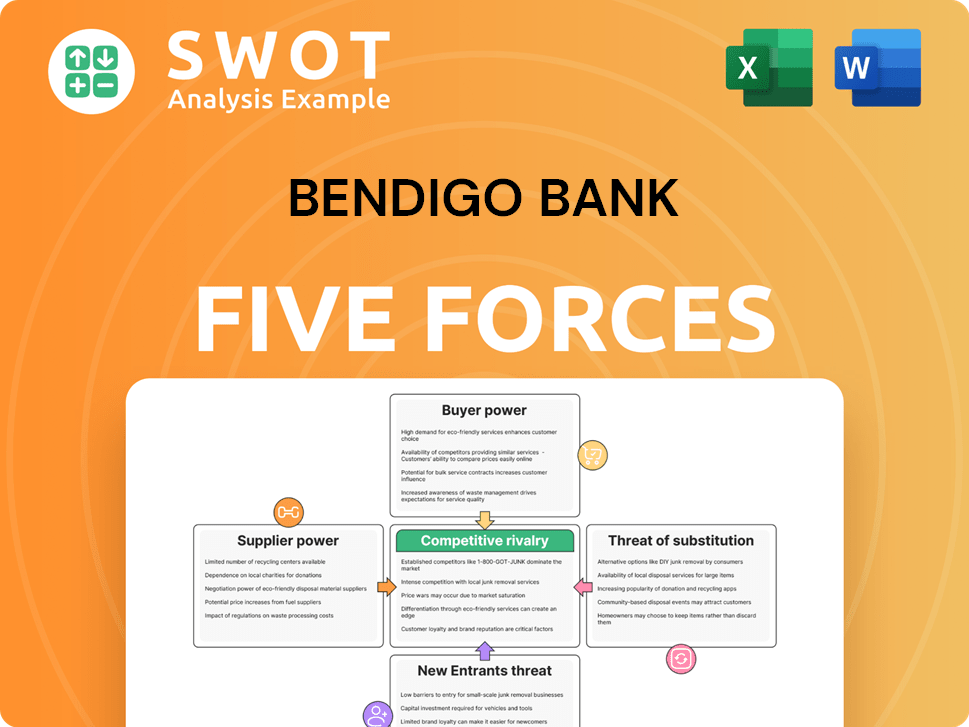

Bendigo Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bendigo Bank Company?

- What is Competitive Landscape of Bendigo Bank Company?

- What is Growth Strategy and Future Prospects of Bendigo Bank Company?

- How Does Bendigo Bank Company Work?

- What is Sales and Marketing Strategy of Bendigo Bank Company?

- What is Brief History of Bendigo Bank Company?

- Who Owns Bendigo Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.