Bendigo Bank Bundle

How Does Bendigo Bank Thrive in Australia's Banking Battleground?

The Australian banking sector is a complex arena, dominated by giants yet constantly reshaped by innovative regional players. Bendigo and Adelaide Bank, a prominent regional institution, has cultivated a unique community-focused model. This approach sets it apart from larger competitors. As of 2024, the bank navigates a rapidly changing landscape influenced by technology, evolving consumer needs, and increasing regulatory scrutiny.

Bendigo and Adelaide Bank's journey, originating in 1858, reflects a commitment to community-centric banking, fostering economic growth. Today, it's a major regional player offering diverse financial services. This introduction sets the stage for a detailed Bendigo Bank SWOT Analysis, identifying its key rivals and differentiating factors in the Australian financial market. We'll delve into the Bendigo Bank competitive landscape and perform a thorough Bendigo Bank market analysis to understand its Bendigo Bank market share Australia and Bendigo Bank competitive advantages.

Where Does Bendigo Bank’ Stand in the Current Market?

The core operations of Bendigo and Adelaide Bank revolve around providing comprehensive financial services to a diverse customer base. These services span retail banking, business banking, wealth management, and insurance products. The bank's primary focus is on delivering these services across Australia, with a significant emphasis on regional and rural areas. As of the first half of the 2024 financial year, the bank's financial health was evident with a cash earnings increase of 2.1% to $283.4 million, showcasing its resilience in a competitive market.

Bendigo and Adelaide Bank's value proposition centers on community banking, customer relationships, and tailored financial solutions. This approach sets it apart from the larger banks. The bank leverages its extensive network of branches, including community bank branches, to foster strong ties within local economies. This community-centric model allows for personalized service and deep engagement with customers, which is a key differentiator in the competitive landscape.

Bendigo and Adelaide Bank holds a significant market position in the Australian banking sector, particularly as a leading regional bank. While it doesn't match the market share of the 'Big Four' banks, it has carved out a strong niche. The bank's total lending reached $77.8 billion, with residential lending at $73.3 billion, demonstrating a solid presence in the home loan market. Looking into the Brief History of Bendigo Bank can give more insights into its evolution.

The financial performance of Bendigo and Adelaide Bank highlights its stability and growth. In the first half of FY24, the bank reported a net interest margin of 1.70%, which is a key indicator of its profitability. The bank's focus on cost management and strategic investments in digital platforms contributed to its financial success. This financial health supports its competitive position and ability to invest in future growth.

Bendigo and Adelaide Bank's competitive advantages stem from its community-focused business model and strong customer relationships. Its extensive branch network, particularly in regional areas, allows it to offer personalized services and build trust. The bank's investment in digital transformation enhances customer experience. These factors contribute to its ability to compete effectively in the Australian banking industry.

The main rivals of Bendigo and Adelaide Bank include the 'Big Four' Australian banks (Commonwealth Bank, Westpac, ANZ, and National Australia Bank). Additionally, other regional banks and financial institutions compete for market share. Understanding the competitive landscape requires analyzing the strengths and weaknesses of these key players, as well as their market strategies and financial performance.

A comprehensive market analysis of Bendigo and Adelaide Bank reveals its strategic positioning and growth opportunities. The bank's business strategy focuses on balancing community banking with digital innovation. This approach allows it to maintain customer loyalty and expand its reach. The bank's commitment to its core values and customer-centric approach contributes to its sustained success.

- Focus on regional and rural markets.

- Investment in digital platforms and services.

- Maintaining strong customer relationships.

- Offering tailored financial solutions.

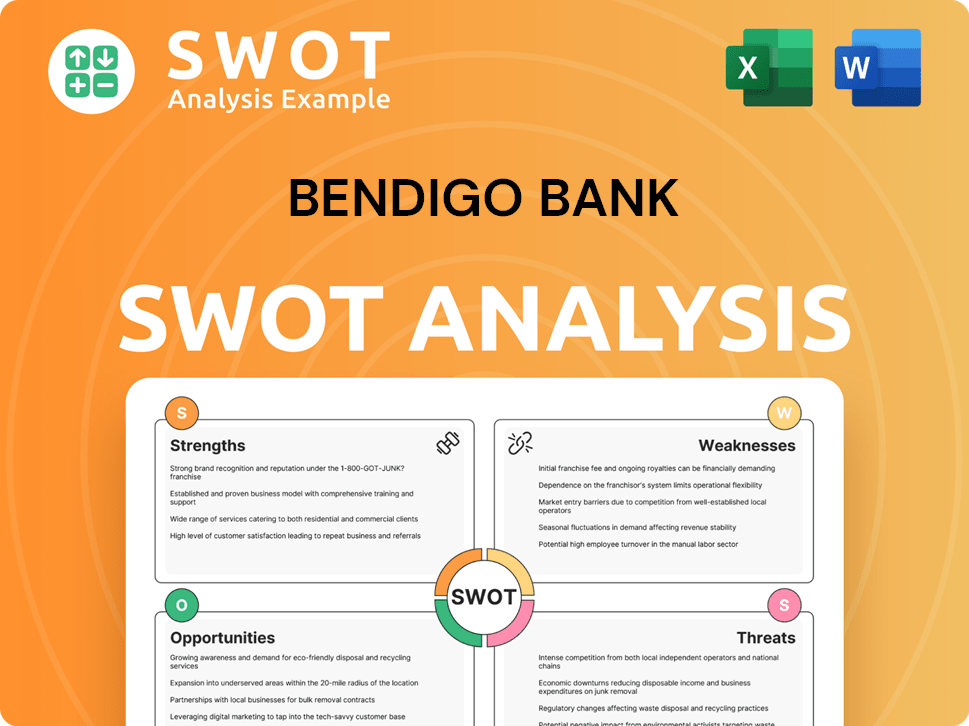

Bendigo Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bendigo Bank?

The Bendigo Bank competitive landscape in Australia is shaped by a diverse array of financial institutions. Understanding the key players and their strategies is crucial for assessing the bank's market position and future prospects. This analysis delves into the main competitors challenging Bendigo and Adelaide Bank, providing insights into the competitive dynamics within the Australian banking sector.

The bank faces competition from both direct and indirect sources, each with its own strengths and strategies. Analyzing these competitors helps to understand the challenges and opportunities facing Bendigo and Adelaide Bank in maintaining and growing its market share. This Bendigo Bank market analysis examines the competitive environment and the strategies employed by key players.

The 'Big Four' banks, including Commonwealth Bank of Australia (CBA), Westpac Banking Corporation, Australia and New Zealand Banking Group (ANZ), and National Australia Bank (NAB), are Bendigo and Adelaide Bank's primary direct competitors. These banks have a significant advantage due to their size, extensive branch networks, and substantial marketing budgets. They compete aggressively across all banking segments.

Other regional banks, such as Bank of Queensland and Suncorp Bank, also compete with Bendigo and Adelaide Bank. These institutions often focus on specific geographic areas or customer segments, competing on personalized service and local expertise. This can be a key differentiator in attracting and retaining customers.

Non-bank lenders, particularly in the mortgage sector, pose a competitive threat. Companies like Aussie Home Loans and Mortgage Choice offer alternative lending solutions, acting as brokers and providing customers with a wider range of options. This increases competition in key areas like home loans.

The rise of neobanks and fintech companies presents an increasing indirect competitive threat. These players, such as Judo Bank, and various smaller fintechs, disrupt traditional banking models by offering specialized services, streamlined digital experiences, and often lower fees. They challenge Bendigo and Adelaide Bank on innovation and convenience, particularly among tech-savvy customer segments.

Mergers and acquisitions, like NAB's acquisition of 86 400, reshape the competitive landscape. These transactions consolidate market power and introduce new competitive dynamics. Bendigo and Adelaide Bank must continually adapt to these evolving market conditions.

Bendigo and Adelaide Bank must leverage its community model while investing in digital capabilities to remain relevant. This involves focusing on customer service, local expertise, and innovative digital solutions to compete effectively. The bank's ability to adapt and innovate will be critical.

Several factors influence the competitive environment for Bendigo and Adelaide Bank. These include pricing strategies, digital capabilities, customer service, and brand reputation. Understanding these factors is crucial for developing effective strategies.

- Pricing: Competitive pricing on products like home loans and deposits is essential to attract and retain customers.

- Digital Capabilities: Investing in advanced digital platforms and services is crucial to compete with neobanks and fintechs.

- Customer Service: Providing excellent customer service and maintaining a strong brand reputation are key differentiators.

- Market Share: Maintaining and growing market share in a competitive environment requires strategic initiatives.

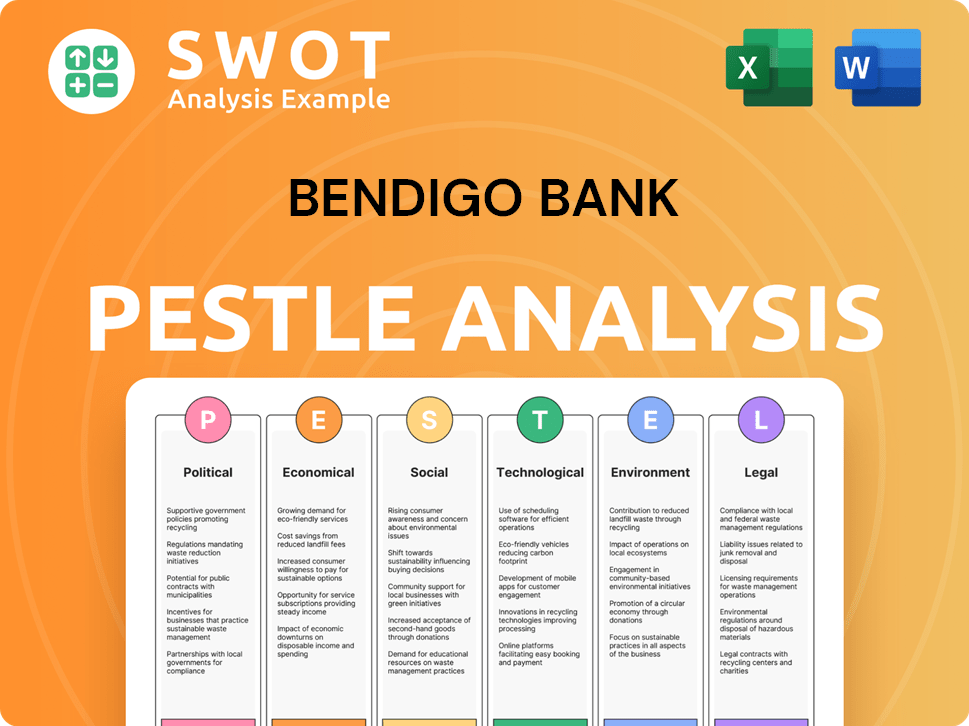

Bendigo Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bendigo Bank a Competitive Edge Over Its Rivals?

Understanding the Bendigo Bank competitive landscape requires a deep dive into its core strengths. The bank distinguishes itself through its unique 'Community Bank' model, fostering strong local relationships and tailoring services to specific community needs. This decentralized approach allows for a strong brand image associated with community support and trust, setting it apart from larger, more centralized banks in Australia.

Another key aspect of Bendigo Bank's business strategy is its focus on personalized customer service. This approach appeals to customer segments that value personalized advice and support, particularly in regional areas where the bank has a strong presence. The bank's diverse product portfolio, which includes retail, business, wealth, and insurance offerings, provides a comprehensive suite of services that caters to a broad customer base, fostering cross-selling opportunities and increasing customer loyalty.

Bendigo Bank's financial performance and market position are significantly influenced by these competitive advantages. While it doesn't have the same scale as the 'Big Four' banks, it leverages its size to be more agile and responsive to market changes and customer feedback. This allows for quicker implementation of new initiatives and adaptation to evolving customer preferences, which is crucial in the dynamic Bendigo Bank competitive environment.

The 'Community Bank' model allows for tailored services and strong local relationships, fostering customer loyalty. This decentralized approach gives the bank a competitive edge by understanding and meeting the specific needs of local communities. This model contributes to a strong brand image associated with community support and trust, which is a key element in the Bendigo Bank competitive advantages.

Bendigo Bank emphasizes human interaction and relationship banking, which appeals to customers valuing personalized advice. This focus is particularly strong in regional areas, where the bank has a significant presence. This approach contrasts with the trend towards fully digital or automated services, offering a differentiating factor in the Bendigo Bank industry analysis.

Being smaller than the 'Big Four' banks allows Bendigo Bank to be more agile and responsive to market changes. This enables quicker implementation of new initiatives and adaptation to evolving customer preferences. This agility is crucial in maintaining a competitive edge and responding effectively to the Bendigo Bank competitors.

The bank's comprehensive suite of services, including retail, business, wealth, and insurance, fosters cross-selling opportunities. This diverse portfolio caters to a broad customer base, increasing customer stickiness and providing a competitive advantage. This broad offering supports Bendigo Bank's growth strategy.

Bendigo Bank's competitive advantages include its Community Bank model, personalized customer service, agility, and diverse product offerings. These strengths contribute to its market position and differentiate it from larger competitors. For more details, explore the Revenue Streams & Business Model of Bendigo Bank.

- Strong Community Focus: Tailored services and local relationships.

- Personalized Service: Emphasis on human interaction and advice.

- Agility: Quick adaptation to market changes.

- Comprehensive Products: Retail, business, wealth, and insurance.

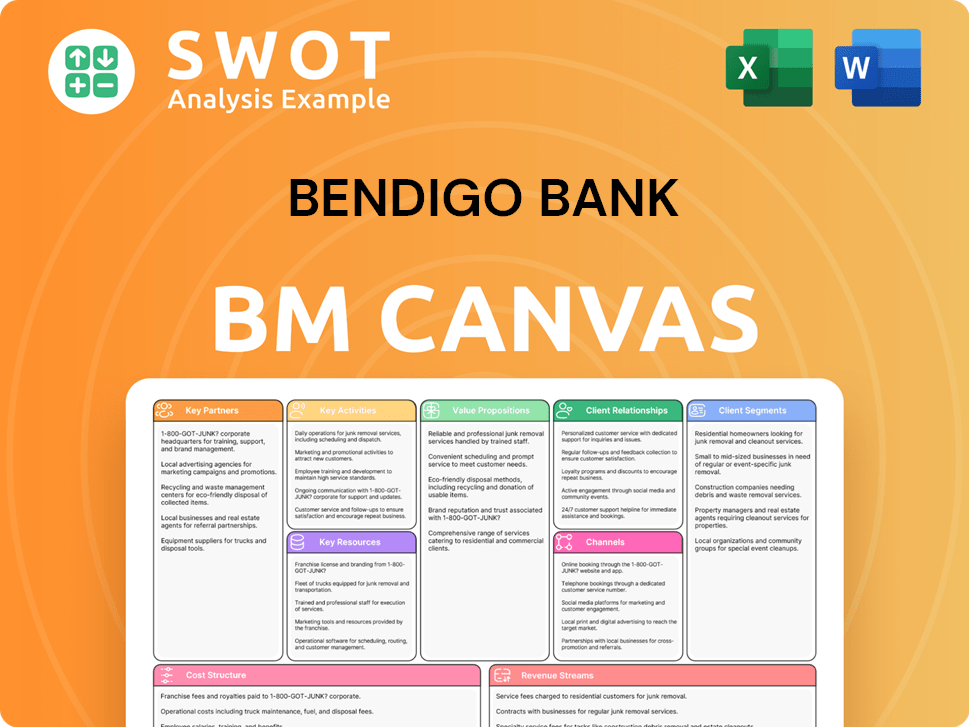

Bendigo Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bendigo Bank’s Competitive Landscape?

The Australian banking sector is undergoing significant transformation, creating both challenges and opportunities for financial institutions like Bendigo and Adelaide Bank. The Growth Strategy of Bendigo Bank must navigate these shifts to maintain its competitive position. Understanding the current industry trends, anticipating future challenges, and capitalizing on emerging opportunities are crucial for sustained success in this dynamic environment. A thorough Bendigo Bank market analysis is essential to guide strategic decisions.

The competitive landscape for Bendigo and Adelaide Bank is shaped by technological advancements, evolving customer preferences, and regulatory changes. The rise of digital banking, increasing competition from fintechs and the 'Big Four' banks, and the impact of global economic factors such as inflation and interest rate fluctuations are key drivers. The bank's ability to adapt to these forces will determine its financial performance and market share in the coming years. A detailed Bendigo Bank competitive landscape assessment is vital.

The Australian banking industry is experiencing rapid digitalization, with a growing emphasis on mobile and online banking. Open banking initiatives are fostering greater collaboration between banks and fintechs, leading to innovative products and services. Regulatory scrutiny of responsible lending and data privacy is increasing operational costs. Inflation and interest rate changes impact lending margins and customer affordability, requiring strategic financial planning.

The bank faces challenges from the sophisticated digital platforms of larger banks and agile fintechs, necessitating continuous technological investment. Cybersecurity threats and data protection are critical concerns in the digital landscape. Intense competition from major banks and neobanks puts pressure on margins and market share. The potential decline in traditional banking service demand and increased regulatory burdens also pose significant risks. Aggressive new competitors capturing niche markets could also affect Bendigo Bank's market position.

Bendigo and Adelaide Bank can leverage its community ties and trusted brand for personalized digital services. Expanding digital offerings can attract younger demographics. The open banking regime presents opportunities for collaboration with fintechs. There are growth opportunities in emerging markets within Australia, especially in regional areas. Strategic partnerships with technology providers can enhance capabilities. This creates a chance to improve Bendigo Bank's competitive advantages.

Bendigo and Adelaide Bank's competitive position will likely evolve towards a hybrid model, balancing its community focus with digital capabilities. The bank's strategy must prioritize technology investment, strong customer relationships, and adaptation to regulatory changes. This approach will help the bank remain resilient and capitalize on future growth opportunities. Key competitors in 2024 include the 'Big Four' banks and emerging neobanks.

To thrive, Bendigo and Adelaide Bank must prioritize digital transformation and enhance its technology infrastructure. It is essential to foster strong customer relationships through personalized services and community engagement. The bank needs to proactively manage cybersecurity risks and comply with evolving regulatory requirements. Strategic partnerships and collaborations with fintechs can drive innovation and expand market reach. These actions will help Bendigo Bank navigate the competitive environment.

- Investment in digital platforms and cybersecurity measures.

- Strengthening customer relationships and community engagement.

- Strategic partnerships to enhance service offerings.

- Adaptation to regulatory changes and market dynamics.

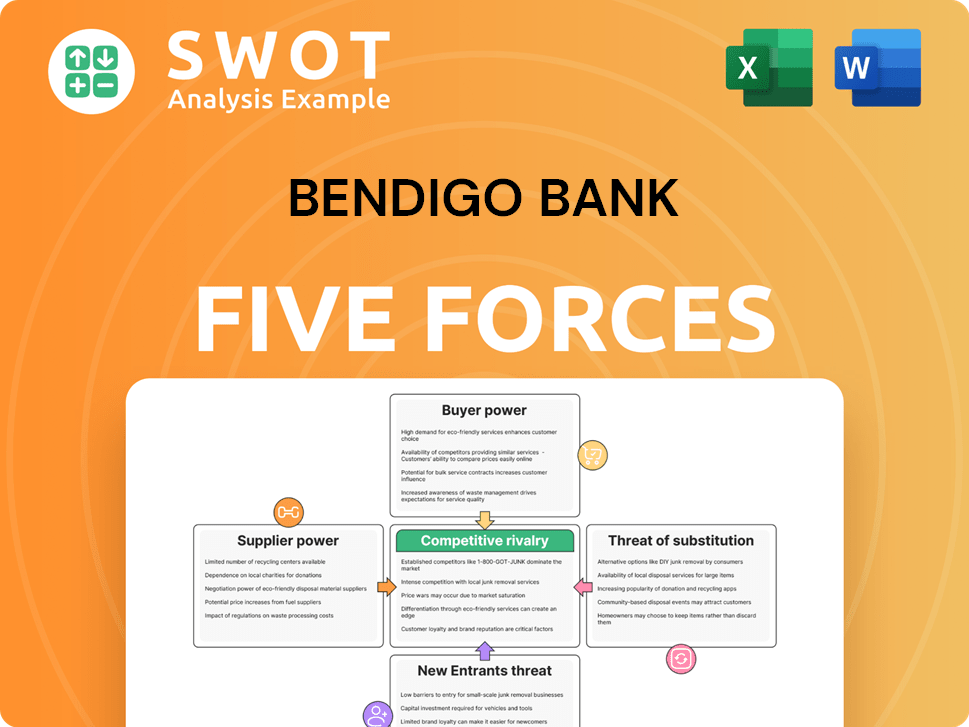

Bendigo Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bendigo Bank Company?

- What is Growth Strategy and Future Prospects of Bendigo Bank Company?

- How Does Bendigo Bank Company Work?

- What is Sales and Marketing Strategy of Bendigo Bank Company?

- What is Brief History of Bendigo Bank Company?

- Who Owns Bendigo Bank Company?

- What is Customer Demographics and Target Market of Bendigo Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.