Bendigo Bank Bundle

What Drives Bendigo Bank's Success?

Understanding a company's mission, vision, and core values is key to grasping its strategic direction and long-term potential. For Bendigo Bank, these foundational elements are particularly critical, shaping its identity and guiding its operations within the Australian banking landscape. Delving into these principles reveals the heart of Bendigo Bank's commitment to its customers and community.

Bendigo Bank's Bendigo Bank SWOT Analysis provides a comprehensive view of the company's strategic positioning, but understanding its core principles is essential. Examining the Bendigo Bank Mission, Bendigo Bank Vision, and Bendigo Bank Core Values offers insights into how the Bank Strategy is implemented. This exploration helps in understanding Bendigo Bank's purpose and values and its commitment to Company Values.

Key Takeaways

- Bendigo Bank prioritizes customers and communities, distinguishing them in Australian banking.

- Their Community Bank model fosters local prosperity and high customer trust.

- Digital transformation and tech investments are key for future growth and customer experience.

- Alignment with values is crucial for navigating industry challenges and maintaining trust.

- Bendigo Bank offers a compelling vision for corporate purpose in finance.

Mission: What is Bendigo Bank Mission Statement?

Bendigo Bank's mission is to provide their customers with high-quality banking products and personalised service, to improve their local community's prosperity, to develop long-term relationships with their local community, to continuously develop the leadership and professional skills of their staff, and to reward their shareholders for their investment.

Let's delve into the core of Bendigo Bank's operations and understand its mission.

The Bendigo Bank Mission encapsulates a multi-faceted approach to banking. It's a commitment to customers, communities, employees, and shareholders. This comprehensive mission statement underlines the bank's dedication to creating value across multiple dimensions.

At the heart of the Bendigo Bank's purpose and values lies a strong customer focus. The mission emphasizes high-quality banking products and personalized service. This approach aims to build lasting relationships and meet the diverse financial needs of its customers.

A key aspect of the Bendigo Bank Mission is improving local community prosperity. This is achieved through financial support, community initiatives, and the Community Bank model. This focus differentiates Bendigo Bank from many other financial institutions.

Bendigo Bank prioritizes long-term relationships within local communities. This commitment goes beyond transactional banking, fostering a sense of partnership and shared growth. This is a critical element of the Bank Strategy.

The mission also includes continuous staff development and rewarding shareholders. This reflects a balanced approach, investing in employees and ensuring financial returns. This is a core part of the Company Values.

The Community Bank model is a direct reflection of Bendigo Bank's mission. It allows banking services and revenue to stay within local communities, creating a positive impact. In the 2024 financial year, over $40 million was invested back into communities through the Community Bank network, demonstrating their commitment.

The Bendigo Bank Mission is clearly demonstrated in their operations, particularly through the Community Bank model. For example, in the 2024-2025 financial year, the bank partnered with the Livingstone Shire Council, providing over $133,000 in funding for community projects. This commitment to local communities is a cornerstone of their identity. To further understand how Bendigo Bank achieves its goals, explore the Growth Strategy of Bendigo Bank. This focus on community investment and customer service sets Bendigo Bank apart in the financial sector.

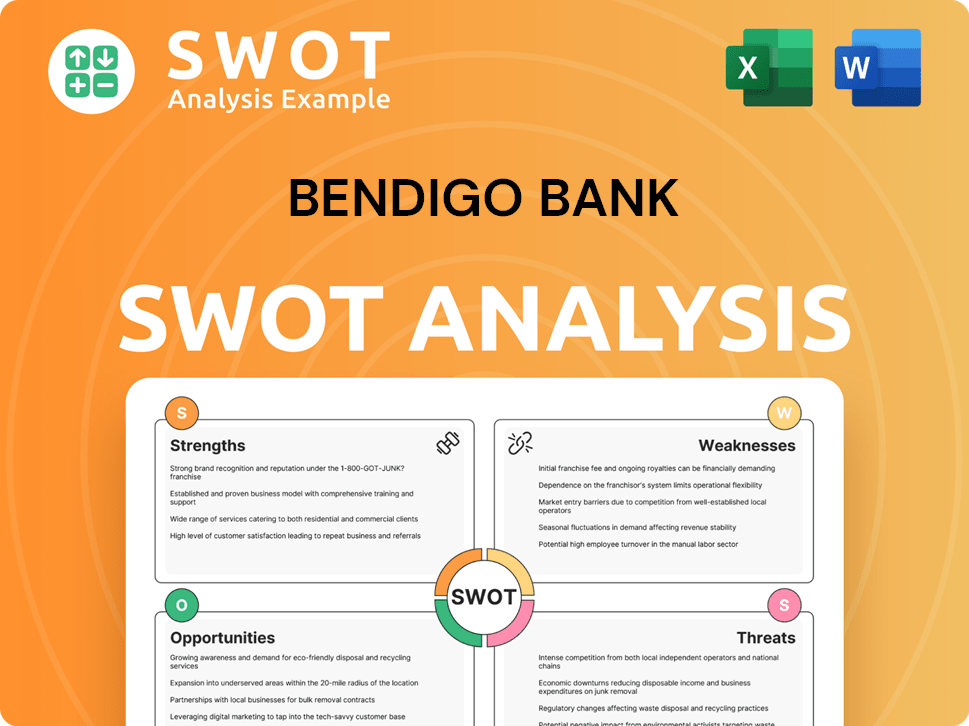

Bendigo Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is Bendigo Bank Vision Statement?

Bendigo and Adelaide Bank's vision is 'to be Australia's bank of choice, by feeding into the prosperity of customers and their communities.'

Let's delve into the Bendigo Bank Vision and unpack its significance.

The Bendigo Bank Vision is decidedly forward-looking, aiming for a position of leadership within the Australian banking sector. This aspiration sets a clear direction for the company's future endeavors and strategic planning.

The vision's scope is national, targeting the entire country. Bendigo Bank doesn't limit its ambitions to a specific region but strives to be the preferred financial institution across Australia. This broad scope indicates a commitment to widespread impact.

The vision directly links the bank's success with the prosperity of its customers and the communities they operate within. This highlights a commitment that goes beyond traditional financial metrics, emphasizing a broader societal impact. This is a key component of understanding the Bendigo Bank's purpose and values.

Considering Bendigo Bank's current trajectory and market position, the vision appears both realistic and aspirational. The bank's strong reputation and customer loyalty provide a solid foundation for achieving its goals.

Bendigo Bank has consistently been recognized as Australia's most trusted bank. This high level of trust provides a significant competitive advantage and supports the bank's vision of becoming the bank of choice. Their Net Promoter Score (NPS) is significantly above the industry average, indicating high customer satisfaction.

With over 2.5 million customers, Bendigo Bank aims to double this number. Their ongoing digital transformation and investments in key growth areas demonstrate a commitment to enhancing service offerings and reaching a wider customer base, aligning with their vision. For more insights, consider reading about Owners & Shareholders of Bendigo Bank.

Understanding the Bendigo Bank Vision provides a crucial insight into the company's long-term goals and strategic direction. It underscores the bank's commitment to not only financial success but also to the well-being of its customers and the communities it serves. This vision is a cornerstone of Bendigo Bank's overall Bank Strategy.

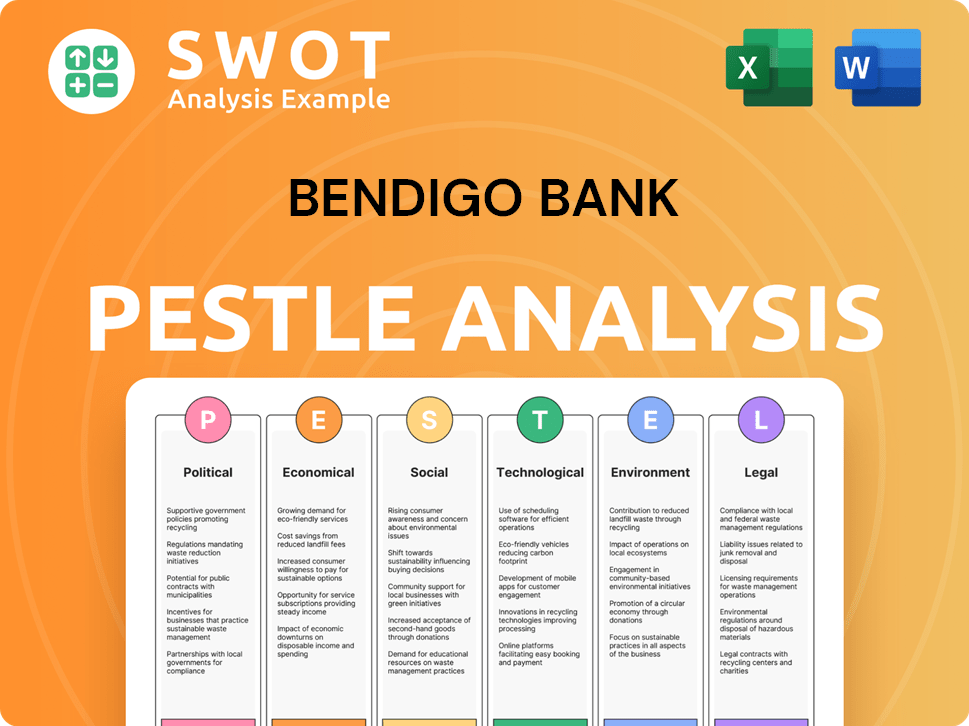

Bendigo Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is Bendigo Bank Core Values Statement?

Understanding the core values of Bendigo Bank is crucial to grasping its unique approach to banking and its commitment to community impact. These values guide the bank's operations and shape its interactions with customers and stakeholders, differentiating it from many of its competitors.

Community is a cornerstone of Bendigo Bank's identity, deeply embedded in its Community Bank model. A portion of the profits generated by Community Bank branches is returned to local communities, supporting local projects and initiatives. This commitment has resulted in over $280 million being returned to communities since the inception of the Community Bank model, directly impacting community well-being and resilience.

Bendigo Bank places a strong emphasis on customer service, aiming to provide a seamless, multi-channel experience. This customer-centric approach is reflected in high customer satisfaction ratings, particularly in home loans, with recent surveys consistently placing Bendigo Bank among the top banks for customer experience. The bank is also investing heavily in digital capabilities to enhance customer interactions and offer personalized service, recognizing the evolving needs of its customer base.

Bendigo Bank's consistent recognition as Australia's most trusted bank highlights the importance of trust in its corporate identity. This trust is built through its community involvement, customer-centric approach, and ethical business practices. Maintaining this trust is paramount, especially in the financial sector, and Bendigo Bank actively works to uphold its reputation through transparency and responsible banking practices.

The value of 'feeding into the prosperity of customers and communities' is central to Bendigo Bank's mission and vision. This value drives the bank's efforts to provide accessible financial services, support financial literacy programs, and invest in initiatives that create positive outcomes for individuals and communities. This commitment is further demonstrated through its support of various financial literacy programs, helping empower individuals to make informed financial decisions.

These Bendigo Bank Core Values collectively define the bank's unique position in the market, emphasizing its commitment to social responsibility and shared value. Understanding these core values provides a foundation for appreciating how the bank approaches its strategic decisions and its impact on the communities it serves. The next chapter will delve into how the mission and vision influence the company's strategic decisions.

How Mission & Vision Influence Bendigo Bank Business?

The Bendigo Bank Mission, Bendigo Bank Vision, and Bendigo Bank Core Values are not just aspirational statements; they are the driving force behind the company's strategic decisions. These foundational elements shape how Bendigo Bank operates, influencing everything from product development to community engagement.

Bendigo Bank's commitment to its mission of 'feeding into the prosperity of our customers and communities' is vividly demonstrated through its Community Bank model. This unique approach allows local communities to own and operate their own branches, with a portion of profits reinvested back into the community.

- In 2024, over $40 million was invested back into communities through the Community Bank model.

- This investment supports local projects, fostering economic growth and social well-being.

- This strategy differentiates Bendigo Bank from competitors, building strong customer loyalty.

- The Community Bank model exemplifies Bendigo Bank's core values by prioritizing community prosperity.

The Bendigo Bank Vision of being the bank of choice is driving a significant digital transformation program. This initiative aims to enhance customer experience and provide accessible services through innovative digital platforms.

Bendigo Bank is working towards a single core banking system, expected to be completed by 2025. This modernization will streamline operations and improve service delivery.

The development of digital platforms like Up, which has acquired a significant customer base through referrals, demonstrates Bendigo Bank's focus on innovation. This platform caters to evolving customer needs, providing a modern banking experience.

Bendigo Bank's 2024-2025 Financial Inclusion Action Plan demonstrates its commitment to supporting customer prosperity. This plan includes initiatives to build financial capabilities and improve accessibility for vulnerable groups.

Bendigo Bank's success is reflected in its high customer satisfaction ratings and consistent ranking as Australia's most trusted bank. These metrics confirm that their mission and vision are actively shaping positive outcomes.

The growth in customer numbers, reaching over 2.5 million, indicates the positive reception of their approach. This growth highlights the effectiveness of aligning Company Values with customer needs and community well-being.

The Bank Strategy at Bendigo Bank is deeply intertwined with its mission and vision. From its commitment to community banking to its digital transformation efforts, the company consistently demonstrates its dedication to its core purpose. Understanding the influence of these guiding principles provides valuable insights into Bendigo Bank's operations and its impact on the financial landscape. To learn more about the origins of this influential institution, read our Brief History of Bendigo Bank. Next, we will delve into the necessary Core Improvements to Company's Mission and Vision.

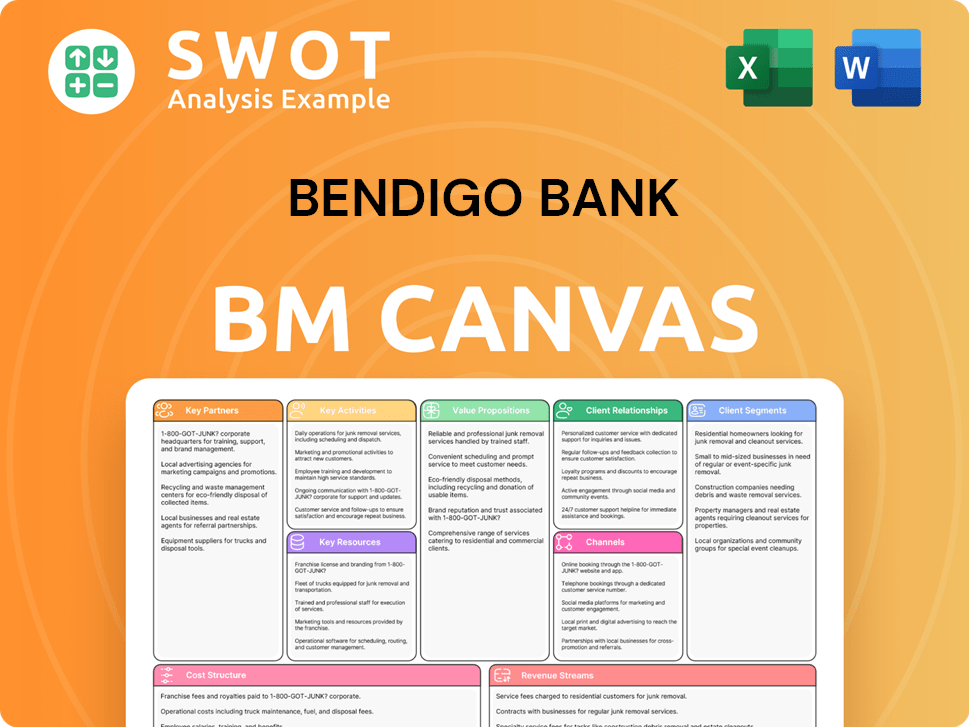

Bendigo Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While Bendigo Bank's foundational statements are strong, strategic enhancements can further solidify its position in a dynamic market. These improvements focus on aligning with evolving stakeholder expectations and future-proofing the bank's strategic direction, ensuring sustained success.

To enhance its Bendigo Bank Mission, explicitly incorporating environmental sustainability is crucial, going beyond the existing Climate & Nature Action Plan. This could involve a clearer commitment to sustainable finance and responsible investment practices, resonating with environmentally conscious customers and investors, and potentially attracting new customer segments. According to a 2024 report by the UN Environment Programme, sustainable finance is experiencing significant growth, with assets under management in sustainable funds reaching over $40 trillion globally.

The Bendigo Bank Vision should explicitly highlight innovation and technology as central to its future. This will underscore the importance of digital transformation and customer experience, helping Bendigo Bank stay competitive in the rapidly evolving financial landscape. By doing so, Bendigo Bank can improve its Bank Strategy and attract talent and investment focused on future-oriented banking solutions. The global fintech market is projected to reach $698 billion by 2028, highlighting the importance of technological advancement.

To further align with industry best practices, Bendigo Bank Core Values could be updated to explicitly include Environmental, Social, and Governance (ESG) targets. This would demonstrate a stronger commitment to ethical and responsible business practices, which is increasingly important to stakeholders. Companies with strong ESG performance often experience improved financial performance and reduced risk, according to research by Harvard Business Review. If you want to know more about Bendigo Bank's competitors, you can read about it here: Competitors Landscape of Bendigo Bank

The bank must continually adapt its Bendigo Bank Mission and Bendigo Bank Vision to address emerging technologies like AI and changing consumer behaviors. This proactive approach will ensure that their statements remain relevant and forward-looking, enabling Bendigo Bank to meet the evolving needs of its customers. The rise of AI in banking is transforming customer service, fraud detection, and risk management, with market projections indicating substantial growth in AI-driven financial solutions by 2027.

How Does Bendigo Bank Implement Corporate Strategy?

The true measure of any company's mission, vision, and core values lies in their practical implementation. This chapter examines how Bendigo Bank translates its aspirational statements into tangible actions and outcomes, demonstrating its commitment to its stated principles.

The Community Bank model is a prime example of how Bendigo Bank operationalizes its mission to improve local prosperity. This unique structure allows local branches to make investment decisions that directly benefit their communities.

- Community Bank branches contribute a portion of their profits back into the local community.

- This reinvestment supports local projects, initiatives, and organizations.

- The model fosters a strong sense of community ownership and engagement.

- It creates a virtuous cycle of economic growth and social impact.

Leadership plays a crucial role in embedding the Bendigo Bank Mission and Bendigo Bank Vision throughout the organization. CEO and Managing Director, Richard Fennell, consistently emphasizes the importance of digital innovation and sustainable growth.

Bendigo Bank communicates its Bendigo Bank Core Values and strategic direction through various channels. These include annual reports, sustainability reports, and investor presentations, ensuring transparency and accountability.

The bank actively highlights its community investments and customer satisfaction ratings in its public communications. This demonstrates a commitment to transparency and building trust with stakeholders.

Concrete examples of alignment between stated values and actual business practices are evident. High home loan customer satisfaction, reflecting a strong focus on customer service, is a key indicator.

Bendigo Bank's Financial Inclusion Action Plan outlines specific actions to support vulnerable customers and improve financial literacy. This directly reflects their commitment to customer and community prosperity, a key tenet of their Bank Strategy.

- The plan includes initiatives to improve access to banking services for underserved communities.

- It focuses on providing financial education and resources to promote financial well-being.

- The bank partners with community organizations to deliver these programs.

- This initiative aligns with the bank's ethical values and commitment to social responsibility.

Bendigo Bank has formal programs and systems to ensure alignment between its values and actions. These include refreshed values, behaviors, and a code of conduct, along with a consequence framework.

Their ESG and Sustainability Business Plan demonstrates a commitment to driving action toward a resilient and sustainable future. This plan outlines specific goals and targets for environmental and social impact.

Bendigo Bank's commitment to community is reflected in its significant investment in local initiatives. In 2023, Community Bank branches contributed over $25 million to local communities.

Bendigo Bank consistently achieves high customer satisfaction ratings, demonstrating the effectiveness of its customer-centric approach. This focus on customer service aligns with their core values.

Bendigo Bank continuously evaluates and refines its implementation strategies to ensure they remain relevant and effective. This includes adapting to changing market dynamics and stakeholder expectations.

- Regular reviews of its values and code of conduct.

- Feedback mechanisms from customers and employees.

- Integration of new technologies and sustainable practices.

- Proactive responses to regulatory changes and emerging risks.

Bendigo Bank is investing heavily in digital innovation to enhance customer experience and improve operational efficiency. This supports its vision for the future by providing accessible and convenient services.

The bank is committed to sustainable practices, including reducing its environmental footprint and supporting environmentally friendly initiatives. This aligns with its long-term vision for a sustainable future.

Bendigo Bank fosters a positive and inclusive work environment, where employees are empowered to contribute to the bank's mission. This strong culture supports the Company Values.

The bank collaborates with various partners to achieve its goals, including community organizations, government agencies, and other businesses. These partnerships amplify its impact and reach.

By consistently aligning its actions with its stated mission, vision, and core values, Bendigo Bank demonstrates a commitment to creating long-term value for all its stakeholders. For a deeper understanding of the bank's strategic approach, further insights can be found in our analysis of the Target Market of Bendigo Bank.

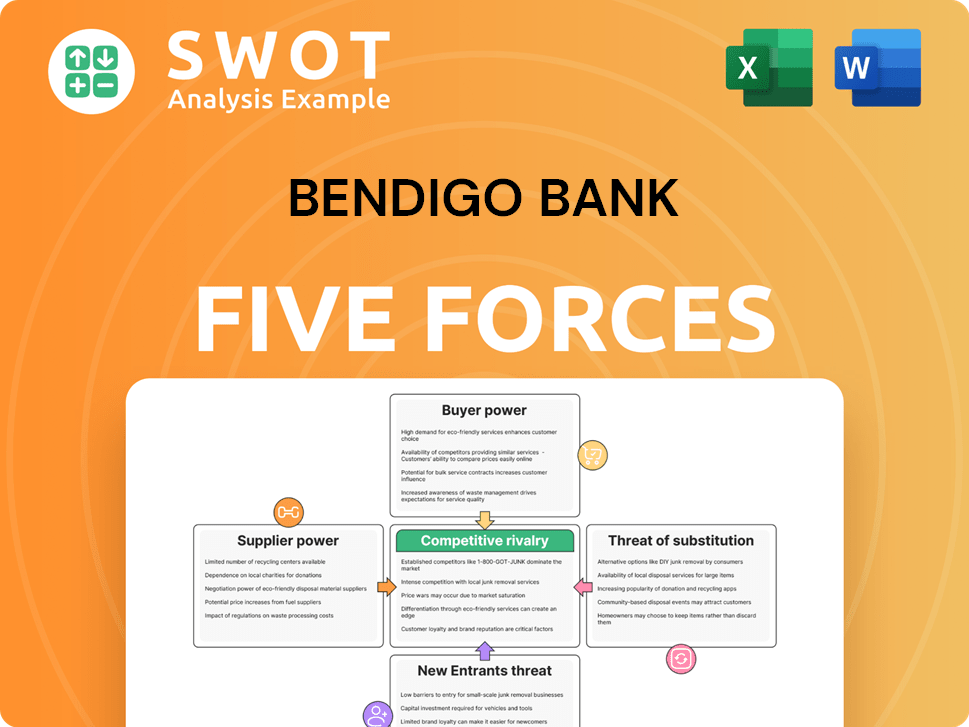

Bendigo Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bendigo Bank Company?

- What is Competitive Landscape of Bendigo Bank Company?

- What is Growth Strategy and Future Prospects of Bendigo Bank Company?

- How Does Bendigo Bank Company Work?

- What is Sales and Marketing Strategy of Bendigo Bank Company?

- Who Owns Bendigo Bank Company?

- What is Customer Demographics and Target Market of Bendigo Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.