Bendigo Bank Bundle

How Does Bendigo Bank Australia Thrive?

Explore the inner workings of Bendigo Bank, a unique Bendigo Bank SWOT Analysis reveals the strengths of this prominent Australian financial institution. Discover how this community bank model fosters strong customer relationships and local economic development. Uncover the key strategies behind its consistent performance and deep-rooted community engagement.

From its comprehensive banking services to its innovative community-focused approach, understanding How Bendigo Bank works is crucial. As a leading financial institution, Bendigo Bank's adaptability and strategic agility in a rapidly evolving financial landscape are noteworthy. This analysis will delve into its core value propositions, diverse revenue streams, and competitive advantages to provide a comprehensive view of its operational mechanics.

What Are the Key Operations Driving Bendigo Bank’s Success?

The core operations of Bendigo and Adelaide Bank center around providing a comprehensive suite of financial services. This includes retail banking, business banking, wealth management, and insurance products, all designed to serve a diverse customer base. The bank distinguishes itself through its community banking model, emphasizing accessibility, personalized service, and strong local engagement.

The value proposition of Bendigo and Adelaide Bank lies in its ability to offer tailored financial solutions while fostering a sense of community. By focusing on customer relationships and local partnerships, the bank creates a unique banking experience. This approach translates into tangible benefits such as accessible banking services, tailored financial advice, and shared prosperity within the community.

The bank's operational model is supported by rigorous credit assessment, advanced analytics, and ongoing investments in digital platforms. Its distribution network includes traditional branches, community bank branches, and a growing digital presence. This multi-faceted approach ensures that the bank can meet the diverse financial needs of its customers while maintaining a strong focus on community involvement. A deeper understanding of Competitors Landscape of Bendigo Bank can provide additional insights into its market position.

Bendigo Bank offers a wide array of banking services, including home loans, personal loans, and deposit accounts. Business banking services encompass commercial lending and merchant facilities. Wealth management solutions include financial planning and investment options.

The community banking model is a key differentiator, with profits shared with local communities. This fosters trust and local engagement, contributing to customer loyalty. The bank's focus is on customer relationships rather than purely transactional interactions.

Lending operations involve rigorous credit assessment and risk management. Deposit-taking is facilitated through a branch and agency network, complemented by digital platforms. Technology development focuses on enhancing customer experience and operational efficiency.

The distribution network comprises traditional branches, community bank branches, and a growing digital presence. Partnerships with local communities are integral to the operational model. This collaborative approach builds a strong customer base.

Customers benefit from tailored financial advice and accessible banking services, particularly in regional areas. The community banking model fosters a sense of shared prosperity. The bank's focus on customer relationships enhances the overall banking experience.

- Tailored financial advice.

- Accessible banking services in regional areas.

- Sense of shared prosperity within the community.

- Strong customer relationships.

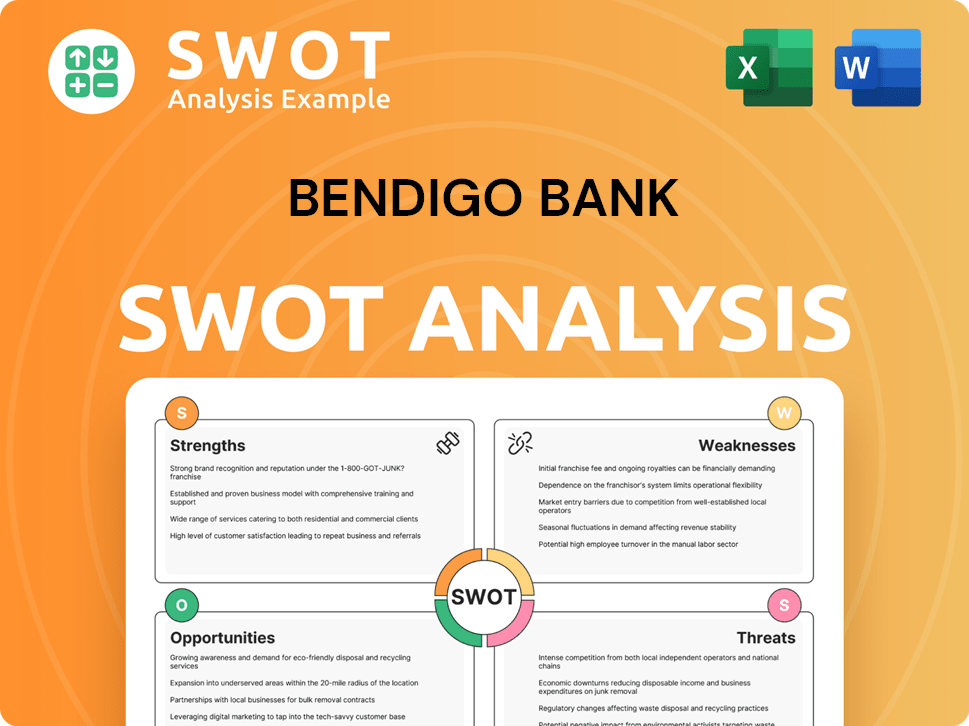

Bendigo Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bendigo Bank Make Money?

The primary revenue streams and monetization strategies of Bendigo and Adelaide Bank are centered around traditional banking activities, with a strong emphasis on interest income and fees. The bank's financial model is designed to generate revenue through a variety of services, ensuring a diversified income base.

Net interest income is the cornerstone of its financial performance, representing the difference between interest earned on assets and interest paid on liabilities. Additionally, the bank leverages fees and commissions from various banking services, wealth management, and insurance products to bolster its revenue streams.

The bank's community bank model also plays a crucial role in its monetization strategy. This approach fosters customer loyalty and market penetration, indirectly leading to higher deposit volumes and loan originations.

The main revenue streams for Bendigo and Adelaide Bank include net interest income, fees, and commissions. The bank's financial performance is heavily influenced by these sources, which are managed strategically to ensure profitability and growth. For the first half of the 2024 financial year, the bank reported a net interest margin of 1.76%, showcasing its efficiency in core lending and deposit-taking activities.

- Net Interest Income: This is the primary revenue source, derived from the difference between interest earned on loans and interest paid on deposits.

- Fees and Commissions: These are generated from banking services, wealth management, and insurance products.

- Community Bank Model: This model indirectly boosts revenue by increasing customer loyalty and market penetration.

- Wealth Management: Advisory fees and commissions on investment products.

The bank employs several strategies to monetize its services effectively. These strategies focus on optimizing revenue streams and expanding market reach. A key element is the community bank model, which enhances customer relationships and supports local economies. To learn more about the strategic initiatives, consider reading about the Growth Strategy of Bendigo Bank.

- Digital Enhancements: Streamlining service delivery and reducing operational costs through digital offerings.

- New Product Lines: Catering to evolving customer needs and expanding market reach.

- Community Bank Model: Fostering customer loyalty and market penetration through shared profit models.

- Fee Optimization: Reviewing and adjusting fees on banking services to maximize revenue.

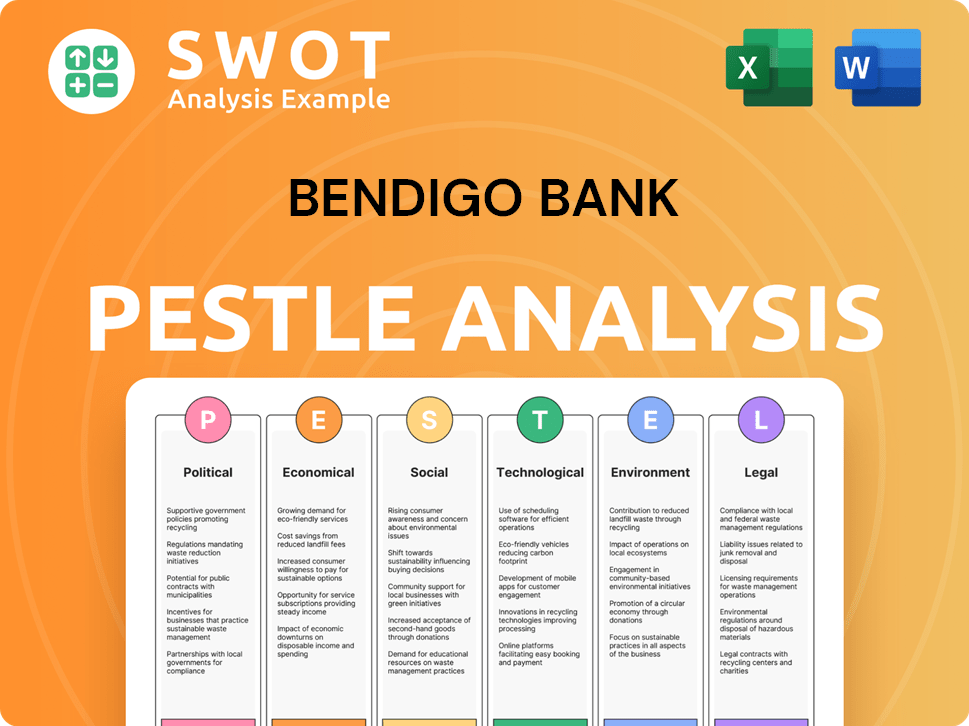

Bendigo Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bendigo Bank’s Business Model?

The evolution of Bendigo and Adelaide Bank, a prominent financial institution, showcases a journey marked by strategic decisions and significant milestones. A key element of its success has been the consistent development of its Community Bank model, which began in 1998. This approach, where local communities collaborate with the bank to establish and manage branches, sharing in the profits, has been crucial to its expansion and a key differentiator in the market.

Throughout its history, the bank has faced various operational and market challenges, including economic downturns, regulatory changes, and intense competition. Its response has often involved a dual strategy of maintaining its community focus while simultaneously investing in digital transformation. The bank has consistently enhanced its digital banking platforms to meet evolving customer expectations and improve operational efficiency, aiming to balance its traditional branch network with modern digital capabilities.

Its competitive advantages stem primarily from its strong brand reputation built on trust and community engagement, its unique community bank network which fosters unparalleled local relationships, and its agility compared to the larger Australian banks. The bank continues to adapt to new trends, such as the increasing demand for digital financial services and the evolving regulatory landscape, by strategically investing in technology and talent to sustain its business model and maintain its competitive edge.

The launch of the Community Bank model in 1998 was a pivotal moment, driving significant growth. Strategic acquisitions and mergers have expanded its footprint and service offerings. Continuous investment in digital banking platforms has been essential to meet customer expectations and improve efficiency.

Focus on community banking has fostered strong local relationships and trust. Digital transformation initiatives have improved customer experience and operational efficiency. Strategic partnerships and acquisitions have expanded market reach and service capabilities.

The Community Bank model provides a unique advantage in terms of local engagement. A strong brand reputation built on trust and community involvement sets it apart. Agility and adaptability allow for quicker responses to market changes compared to larger competitors.

In 2024, the bank reported a statutory net profit after tax of $478.7 million. Digital banking continues to be a focus, with ongoing enhancements to mobile and online platforms. The bank is actively involved in community programs, investing in local initiatives.

The bank's financial performance reflects its strategic initiatives and market position. Key metrics include net profit, customer deposits, and loan growth, showing the bank's ability to navigate market challenges and maintain its competitive edge. The bank's focus on community banking and digital innovation has contributed to its financial stability and growth.

- In 2024, the bank's total customer deposits reached $84.7 billion.

- The bank's lending portfolio grew, reflecting its commitment to supporting customers.

- The Community Bank network continues to contribute significantly to the bank's overall performance.

- The bank's digital banking platforms experienced increased customer engagement.

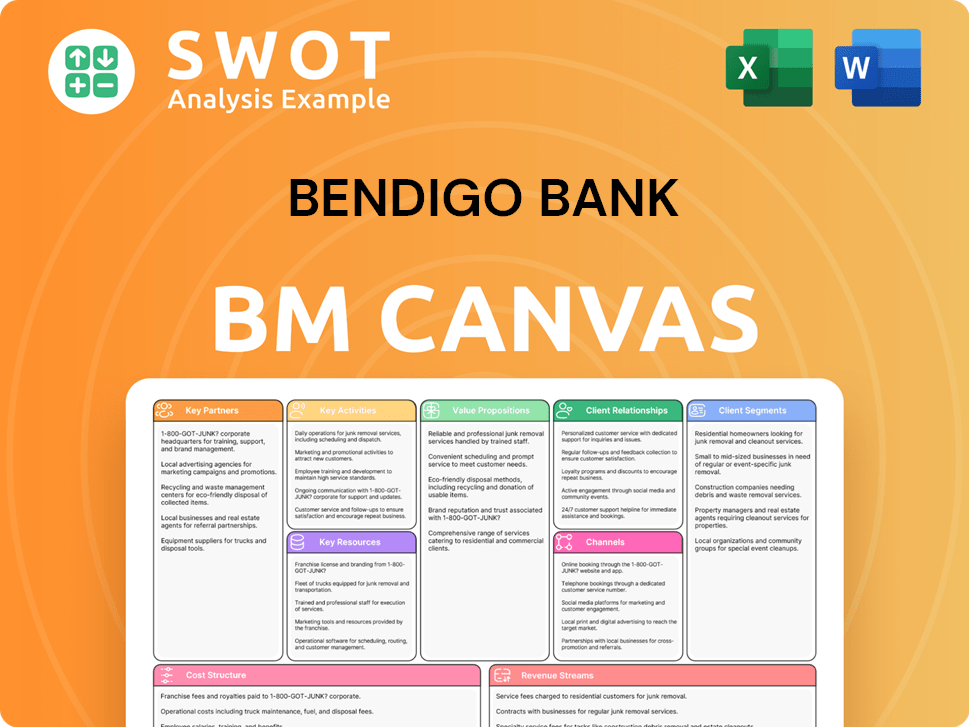

Bendigo Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bendigo Bank Positioning Itself for Continued Success?

The Bendigo and Adelaide Bank holds a distinctive position within the Australian banking industry, differentiating itself from the major banks through its community-centric model. Its strength lies in deep customer loyalty, particularly in regional and rural communities where its community bank branches are prevalent. This localized approach fosters strong relationships and often translates into higher customer retention rates. The bank serves a diverse customer base across Australia through its network of branches, agencies, and digital channels.

However, the bank faces risks and headwinds that could impact its operations and revenue. Regulatory changes, intense competition from major banks and fintech companies, and technological disruption pose challenges. Economic downturns or shifts in consumer preferences could also influence its operational model and revenue streams.

The bank carves a niche as a community bank, competing against larger financial institutions. It emphasizes customer relationships and local presence. Its focus on regional and rural areas provides a competitive advantage.

Regulatory changes, particularly regarding capital requirements and consumer protection, pose challenges. Competition from major banks and fintechs impacts market share. Technological advancements require ongoing investment.

The bank focuses on digital transformation, new product offerings, and reinforcing its community banking model. It aims to balance technological innovation with its core values. It plans to leverage its community ties for growth.

Continued investment in digital transformation to improve customer experience. Exploration of new product offerings to meet market demands. Strengthening the community banking model to leverage its competitive advantage.

The bank's financial performance and community involvement are key indicators of its success. It emphasizes its commitment to local communities through its community bank branches. Recent data shows a focus on sustainable growth and community support.

- The bank's financial results reflect its strategic focus on customer service and community engagement.

- It has been investing in digital platforms to enhance customer experience and operational efficiency.

- The community banking model allows it to build strong relationships with customers.

- The bank continues to explore new ways to support local communities.

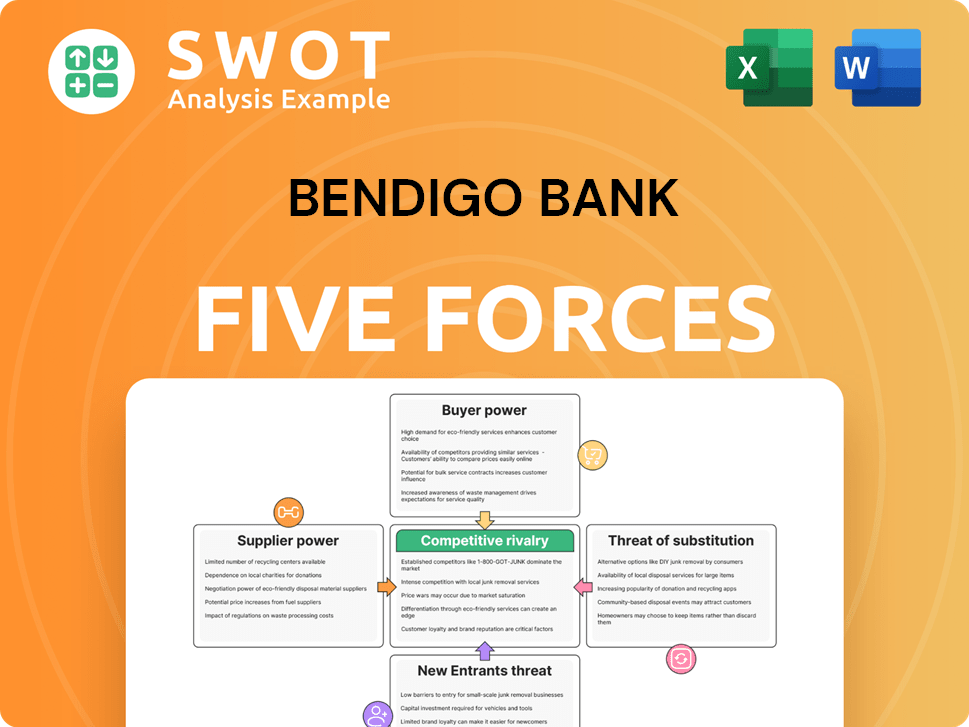

Bendigo Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bendigo Bank Company?

- What is Competitive Landscape of Bendigo Bank Company?

- What is Growth Strategy and Future Prospects of Bendigo Bank Company?

- What is Sales and Marketing Strategy of Bendigo Bank Company?

- What is Brief History of Bendigo Bank Company?

- Who Owns Bendigo Bank Company?

- What is Customer Demographics and Target Market of Bendigo Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.