Bendigo Bank Bundle

How Does Bendigo Bank Win in Australia's Banking Battleground?

Bendigo Bank, celebrated as the 'Bank of the Year' for customer satisfaction in 2023, offers a compelling case study in community-focused banking. Its unique approach, rooted in local engagement and customer relationships, sets it apart in Australia's competitive financial landscape. This article explores how Bendigo Bank's strategic initiatives drive its success.

From its gold rush era origins, Bendigo Bank has cultivated a loyal customer base by prioritizing community and customer-first values, differentiating itself from larger institutions. Understanding the Bendigo Bank SWOT Analysis is key to grasping its business strategy. This analysis will dissect Bendigo Bank's sales strategy and marketing strategy, examining how it acquires new customers and maintains its market position through effective campaigns and community engagement, providing valuable insights for financial professionals and business strategists alike. We'll also look at its digital marketing initiatives and customer relationship management practices.

How Does Bendigo Bank Reach Its Customers?

The sales channels of Bendigo Bank are a blend of traditional and digital platforms, designed to reach a wide customer base effectively. This approach is a key component of its overall Bendigo Bank business strategy, ensuring accessibility and convenience for its customers. The bank's strategy focuses on leveraging both physical and online channels to meet evolving customer needs and maintain a competitive edge in the financial services sector.

The company's strategy includes a significant investment in digital channels. The company's website and mobile banking applications are crucial for customer acquisition and service. These digital platforms enable account opening, loan applications, and everyday banking transactions. This digital transformation reflects the changing preferences of consumers who seek convenience and self-service options.

Bendigo Bank's sales strategy heavily relies on its extensive network of physical branches and agencies. These branches are a cornerstone of the bank's distribution strategy, especially for retail and small business banking. The Community Bank model, where local communities share in the profits, fosters strong local relationships and is central to the bank's operations. This model differentiates it from competitors and strengthens its market position.

The physical branches and agencies offer personalized service, complex product discussions, and community engagement. These branches serve as key touchpoints for customers needing face-to-face interactions. This approach is particularly important for building trust and providing tailored financial solutions.

The company’s website and mobile banking applications are crucial e-commerce platforms. These digital channels enable account opening, loan applications, and everyday banking transactions. Digital channels are essential for customer acquisition and service, catering to the growing demand for convenience.

Bendigo Bank has strategically integrated digital capabilities to offer an omnichannel experience. This ensures seamless transitions between online and offline interactions. The bank aims to provide a consistent and convenient experience across all touchpoints.

The Community Bank model fosters strong local relationships and is central to the bank's distribution strategy. This model allows local communities to share in the profits. This approach enhances customer loyalty and brand reputation.

The bank's sales strategy involves a balanced approach, blending traditional and digital channels. The Community Bank model is central to its distribution strategy, fostering strong local relationships. Digital channels provide convenience and self-service options, essential for customer acquisition.

- Branch Network: Physical branches and agencies provide personalized service.

- Digital Platforms: Website and mobile apps facilitate online transactions.

- Community Focus: The Community Bank model enhances local engagement.

- Omnichannel Integration: Seamless transitions between online and offline interactions.

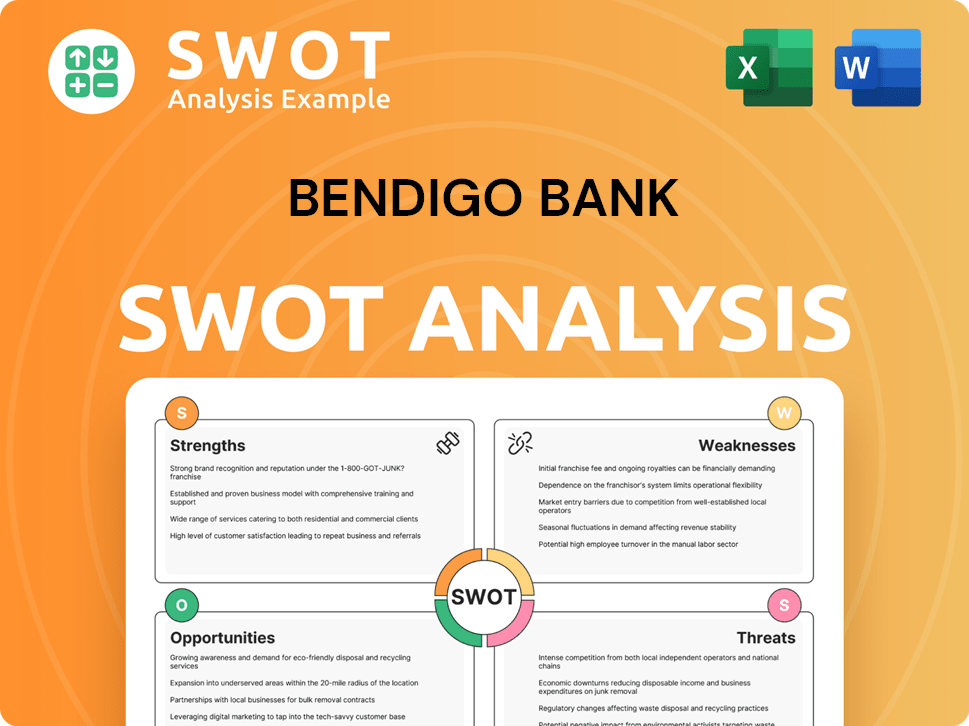

Bendigo Bank SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Bendigo Bank Use?

The marketing tactics employed by the bank are designed to boost brand awareness, generate leads, and drive sales, combining digital and traditional methods. The bank's approach to digital marketing includes content marketing, SEO, paid advertising, and email campaigns. The bank's commitment to community engagement and data-driven marketing further enhances its strategy.

The bank leverages a variety of digital strategies. These include content marketing, SEO, paid advertising, and email marketing. The bank also uses social media platforms to engage with customers and share community-focused content. Traditional methods such as TV, radio, and print media are also used to reach a broader audience, particularly for brand awareness campaigns and major product launches.

The bank's community focus often leads to collaborations with local community leaders and organizations. Data-driven marketing allows for targeted communications, and the bank utilizes analytics tools to track campaign performance. The marketing mix has evolved to increasingly prioritize digital channels in response to changing consumer behavior, while traditional media and community engagement remain vital components of its overall strategy.

The bank uses content marketing to provide financial education resources. Search Engine Optimization (SEO) is used to improve online visibility. Paid advertising, including search engine marketing (SEM) and display advertising, targets specific customer segments. Email marketing campaigns are deployed for customer relationship management.

Social media platforms like Facebook, LinkedIn, and X (formerly Twitter) are used for brand engagement. The bank actively shares community-focused content. Collaborations with local community leaders and organizations are common.

TV, radio, and print media are used for brand awareness and product launches. The bank participates in and sponsors community events. This reinforces its local commitment and provides direct engagement opportunities.

Customer data is leveraged for segmentation and personalization. This allows for more targeted and relevant communications. Analytics tools are used to track campaign performance and optimize marketing spend.

Digital channels are increasingly prioritized in response to changing consumer behavior. Traditional media and community engagement remain vital. This reflects its unique brand positioning.

The bank's marketing efforts are geared towards customer acquisition. They utilize a variety of channels to attract new customers. The goal is to expand the customer base and increase market share.

The bank's marketing strategy is multifaceted, focusing on digital and traditional methods. The bank uses content marketing to provide financial education. The bank also leverages SEO and paid advertising. The bank's community focus is a key differentiator, as highlighted in this analysis of the bank's strategies Bendigo Bank's marketing approach.

- Digital Marketing: Content marketing, SEO, paid advertising, and email campaigns.

- Social Media: Active use of platforms like Facebook, LinkedIn, and X (formerly Twitter).

- Traditional Media: TV, radio, and print for brand awareness.

- Community Engagement: Sponsorship of events and collaborations with local leaders.

- Data-Driven Marketing: Customer data for segmentation and personalization.

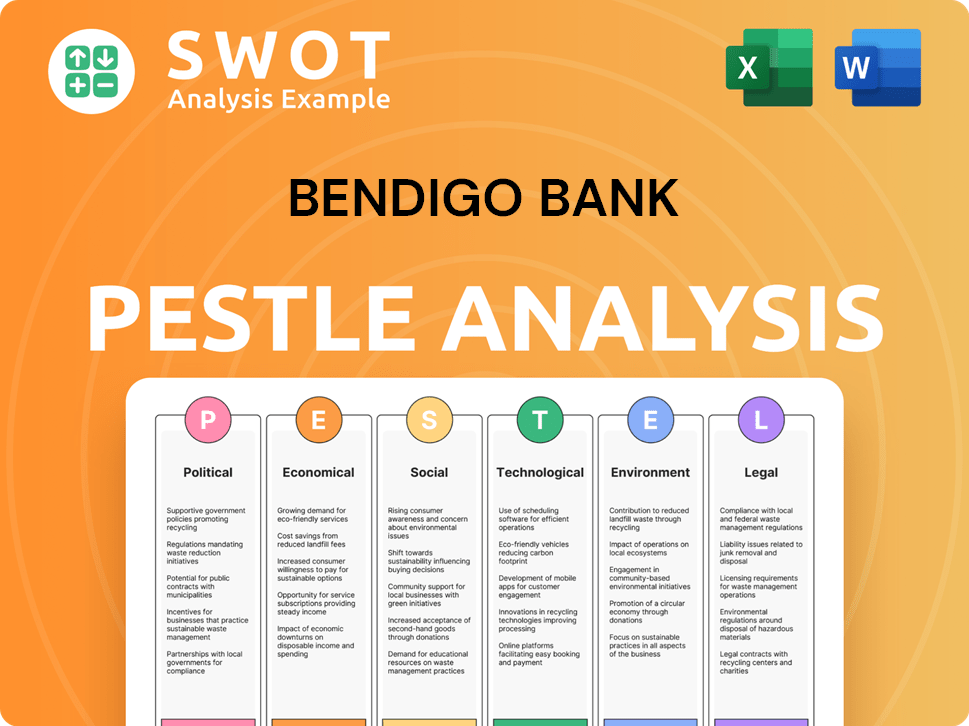

Bendigo Bank PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Bendigo Bank Positioned in the Market?

The brand positioning of the financial institution centers on community, trust, and strong customer relationships, setting it apart from larger financial institutions. The core message emphasizes 'banking that's bigger than money,' highlighting the positive impact on local communities through its unique Community Bank model. This model reinvests a portion of profits into local projects, fostering shared value and loyalty among customers.

The visual identity often incorporates elements that convey stability, approachability, and a connection to Australian landscapes and communities. The tone of voice is supportive, collaborative, and empathetic, reflecting a focus on understanding and meeting customer needs. This approach supports its Bendigo Bank sales strategy by building trust and loyalty.

The financial institution primarily appeals to its target audience—individuals, families, and small to medium-sized businesses—through its unique selling proposition of community investment and personalized service. Its differentiation lies not just in price or innovation, but in the tangible benefits its banking model brings to local areas. This approach is key to its Bendigo Bank marketing strategy.

The financial institution consistently receives high accolades for customer satisfaction. In 2023, it was named 'Bank of the Year' for customer satisfaction by Roy Morgan, a testament to its customer-centric approach. This recognition underscores the effectiveness of its brand positioning and its Bendigo Bank customer acquisition strategies.

The financial institution strives for brand consistency across all channels and touchpoints, from physical branches to digital platforms. This ensures that the community-focused message and customer-centric experience are delivered uniformly. This is a critical element of its Bendigo Bank business strategy.

The financial institution actively monitors shifts in consumer sentiment, particularly regarding ethical banking and social responsibility. It adapts its messaging to reinforce its values and maintain relevance in a dynamic competitive landscape. This ensures its Bendigo Bank financial services remain appealing.

The Community Bank model is central to the financial institution's brand. This model allows branches to be owned and operated by local communities. A portion of the profits are reinvested back into the community. This model supports its Bendigo Bank market analysis and helps to identify local needs.

For a detailed look at the financial institution's revenue streams and business model, explore the insights provided in Revenue Streams & Business Model of Bendigo Bank.

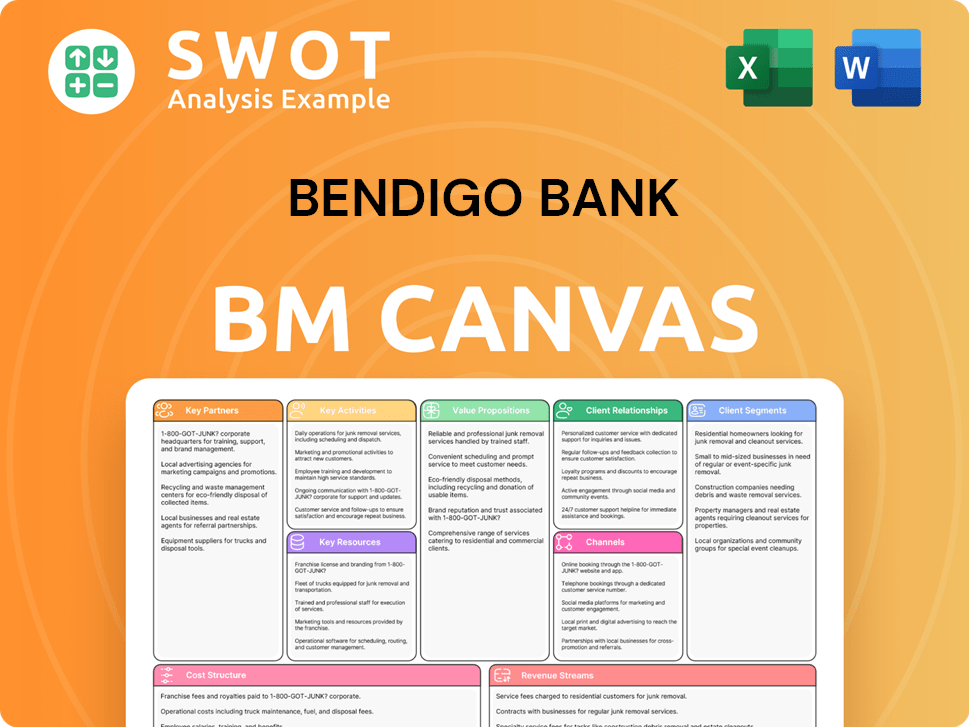

Bendigo Bank Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Bendigo Bank’s Most Notable Campaigns?

The Bendigo Bank sales strategy and Bendigo Bank marketing strategy are heavily influenced by its commitment to community banking. This approach is a core element of its brand identity and is consistently highlighted in its marketing campaigns. These campaigns are often less about traditional advertising and more about fostering local loyalty and driving customer acquisition through demonstrated community benefit. The bank's focus on community engagement is a key differentiator in the Bendigo Bank competitive advantage analysis.

A significant part of Bendigo Bank's business strategy involves continuous promotion of its Community Bank branches. These branches are central to the bank's operations and are a key factor in attracting customers. The bank supports local initiatives, sponsorships, and events to underscore the positive impact of banking with them on local communities. This sustained community engagement helps in building strong customer relationships, which is a crucial aspect of Bendigo Bank customer relationship management.

Another important area for the bank is its digital transformation efforts. Ongoing communication about enhanced digital banking services and mobile app features is aimed at attracting digitally-savvy customers and improving the overall customer experience. These initiatives often leverage online advertising and social media to showcase new features and benefits. For a detailed look at the bank's target audience, check out Target Market of Bendigo Bank.

The bank consistently promotes its Community Bank model, which is integral to its brand. This involves local sponsorships and events. These efforts aim to build local loyalty and drive customer acquisition. The bank's 2023 financial report highlighted the continued success of this model.

Ongoing communication about enhanced digital banking services is a key focus. This includes the promotion of mobile app functionalities to attract digitally-savvy customers. Online advertising and social media are used to showcase new features. This helps in the Bendigo Bank digital marketing initiatives.

The bank emphasizes its involvement in local communities through sponsorships and events. This approach aims to reinforce the bank's commitment to community support. It helps in demonstrating the positive impact of banking with the bank on local areas. This engagement is a key element of the Bendigo Bank sales and marketing plan example.

The bank's reputation for community involvement serves as a strong buffer during challenges. Consistent messaging around trust and community support is a defining factor. Positive media coverage related to community contributions reinforces its brand. This approach helps with Bendigo Bank brand awareness strategies.

The bank's focus on community banking and digital innovation has positioned it well in the market. The Bendigo Bank sales performance indicators are often tied to customer satisfaction and community impact. The bank's approach to Bendigo Bank financial services is designed to meet the needs of a diverse customer base. The bank's marketing efforts are strategically aligned to build brand loyalty and attract new customers. The bank's commitment to local communities and digital innovation is crucial for its continued success and growth in the competitive financial services sector. The bank's Bendigo Bank market analysis shows the importance of community engagement.

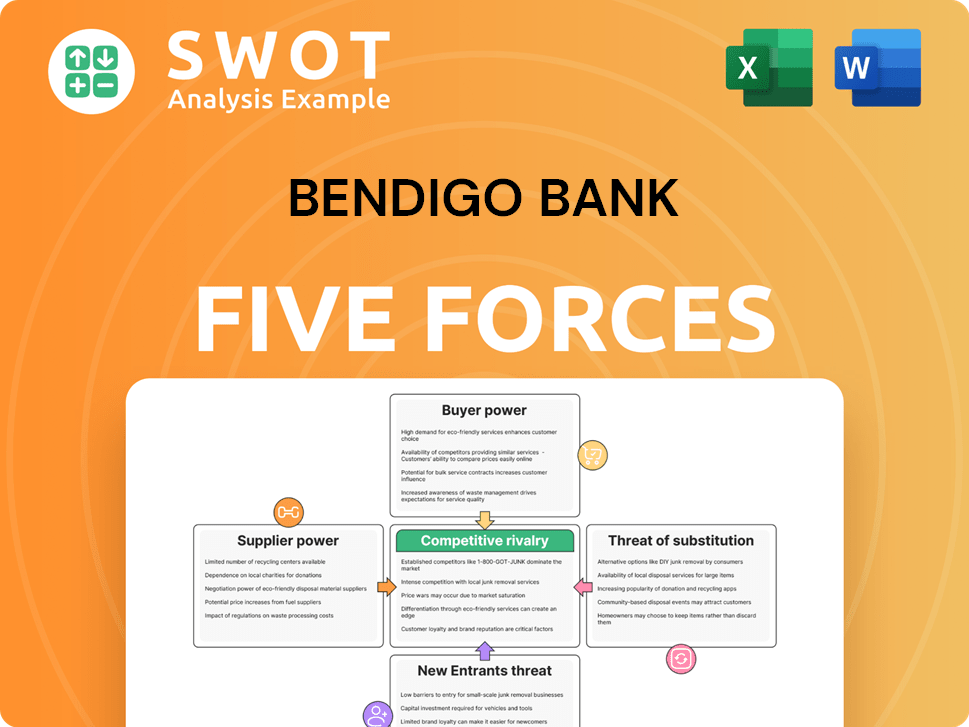

Bendigo Bank Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bendigo Bank Company?

- What is Competitive Landscape of Bendigo Bank Company?

- What is Growth Strategy and Future Prospects of Bendigo Bank Company?

- How Does Bendigo Bank Company Work?

- What is Brief History of Bendigo Bank Company?

- Who Owns Bendigo Bank Company?

- What is Customer Demographics and Target Market of Bendigo Bank Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.