Block Bundle

How did a simple payment problem launch a financial revolution for Block Company?

Imagine a world where a single missed sale could inspire a financial technology giant. That's precisely what happened in 2009, igniting the Block SWOT Analysis journey. This article delves into the Block Company history, tracing its roots from a glassblower's dilemma to its current status as a global fintech leader. Discover the Block Company origin story and the driving force behind its innovative spirit.

From its humble beginnings, Block Company has experienced a remarkable Block Company evolution, marked by crucial Block Company milestones and strategic expansions. Understanding the Block Company timeline reveals how Jack Dorsey and Jim McKelvey, the Block Company founders, transformed a simple idea into a multifaceted financial ecosystem. Explore the Block Company's impact on the industry and its significant achievements.

What is the Block Founding Story?

The story of Block, Inc. (formerly Square, Inc.) begins in February 2009. The company's origin is rooted in a practical problem faced by co-founder Jim McKelvey. This led to the creation of a simple solution that would revolutionize how small businesses handle payments.

The company's early days were marked by a focus on solving a specific challenge. This initial problem led to the development of a product that would eventually transform the financial technology landscape. The company's early success was fueled by a clear understanding of market needs and a commitment to innovation.

The Marketing Strategy of Block has been instrumental in its growth and evolution.

Block Company history began in February 2009. Jack Dorsey, also co-founder of Twitter, and Jim McKelvey founded the company. The initial idea stemmed from McKelvey's inability to process a $2,000 sale due to the lack of credit card payment options.

- The company's origin was in St. Louis, Missouri.

- The first product, the Square Reader, launched in 2010.

- The Square Reader was a small, square-shaped card reader.

- The initial seed funding round raised $10 million, led by Khosla Ventures.

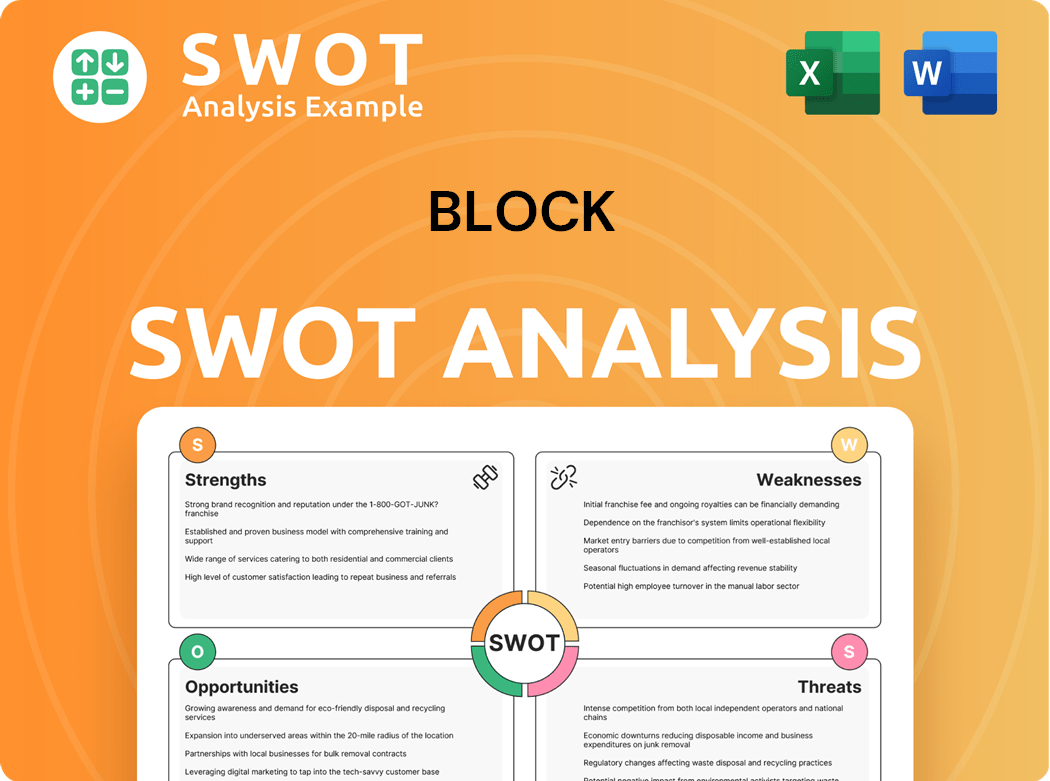

Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Block?

The early years of the company, initially known as Square, Inc., were marked by rapid growth and strategic expansion. The company quickly established itself by providing accessible payment processing solutions. This period saw the launch of key products and services, as well as pivotal acquisitions and leadership changes that shaped its trajectory. Understanding the Target Market of Block helps to understand the company's growth.

In its early years, the company, then operating as Square, Inc., gained significant traction by addressing the need for accessible payment processing. By 2011, it was processing approximately $2 billion worth of payments annually. The company's valuation at this time was around $240 million, demonstrating early success. The company's origin story is one of solving a real-world problem.

A pivotal moment in the company's history was the launch of Cash App in 2013. This peer-to-peer payment service was designed to compete with platforms like Venmo. This move marked a strategic shift beyond merchant services, expanding into consumer-focused financial tools. This diversification was key to the company's evolution.

In 2014, the company integrated a payroll feature into its payment processing system. This was followed by the introduction of a merchant cash advance offering, a customer feedback product, and an invoicing service. These additions broadened the suite of services offered to merchants. These early products helped to solidify the company's position.

The company went public on November 19, 2015, with an initial valuation of $2.9 billion. This initial public offering (IPO) was a crucial step, raising significant capital for further expansion. The IPO allowed the company to accelerate its growth strategy.

By 2018, Cash App's downloads reportedly surpassed those of Venmo and PayPal on the Apple Store. This indicated strong market reception and user adoption. This milestone highlighted the success of the company's consumer-focused strategy. This was a significant achievement in the company's history.

The company's growth strategy during this period also involved key acquisitions. In 2018, it acquired Weebly for $365 million, integrating website building and e-commerce capabilities. This acquisition, along with others, diversified the company's product line. These acquisitions expanded the company's reach.

Leadership transitions also occurred, with Jack Dorsey taking on the additional role of 'Square Head' in October 2023, alongside his existing roles as 'Block Head' and Chairperson. These strategic moves and continuous product evolution shaped the company's trajectory. These changes reflect the company's ongoing evolution.

These strategic moves and continuous product evolution transformed the company from a simple card reader company into a multifaceted financial technology provider. The company's early products and expansion strategy were key to its success. This transformation is a key part of the company's legacy.

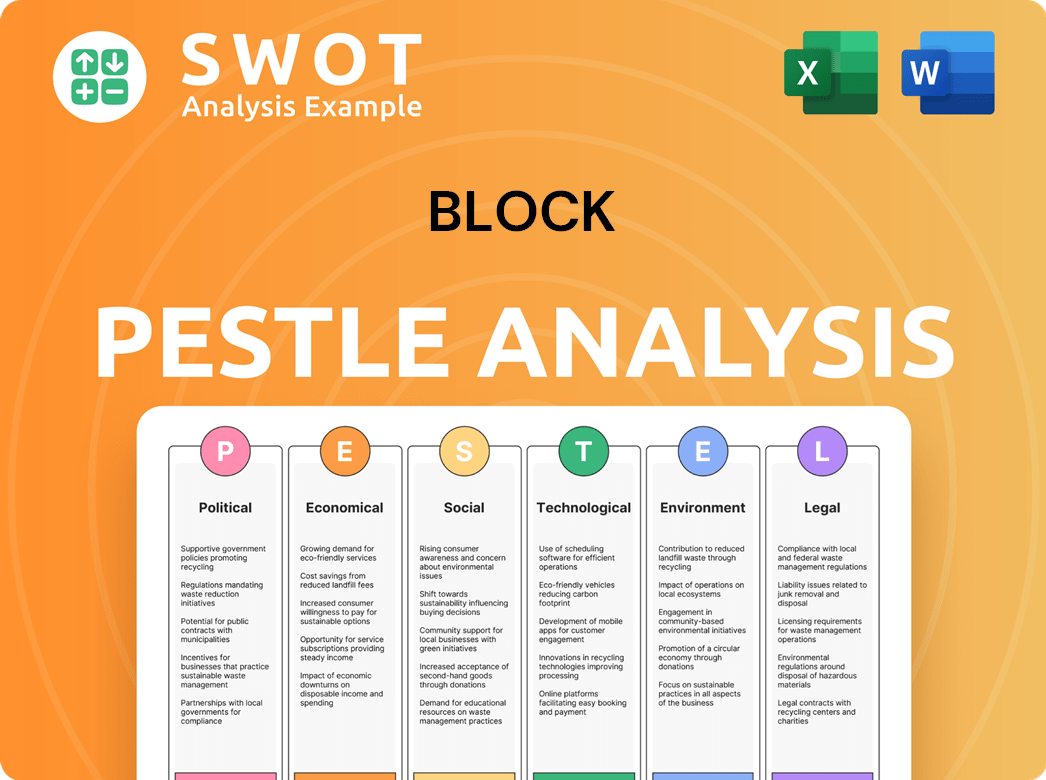

Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Block history?

The history of Block, Inc. is marked by significant milestones that have shaped its trajectory from a payment processing startup to a diversified financial services and technology company. The Growth Strategy of Block has been instrumental in its evolution, driving its expansion and influence in the industry. The company's origin and evolution reflect a commitment to innovation and a proactive approach to market opportunities.

| Year | Milestone |

|---|---|

| 2010 | Introduced the Square Reader, revolutionizing mobile payments for small businesses. |

| 2013 | Launched Cash App, expanding into peer-to-peer payments and consumer financial services. |

| 2017 | Cash App began allowing users to invest in stocks and Bitcoin. |

| 2021 | Square, Inc. rebranded to Block, Inc., reflecting a broader scope beyond payment processing. |

| 2021 | Acquired Tidal, a music streaming service, for $297 million. |

| 2022 | Acquired Afterpay, an Australian buy now, pay later (BNPL) service, for US$29 billion in stock. |

| 2023 | Launched Bitkey, a self-custody Bitcoin hardware wallet, in 95 countries. |

| 2024 | Finished developing its own standalone three-nanometer bitcoin mining chip. |

Block has consistently introduced innovative products and services to meet evolving market demands. These innovations have not only expanded its service offerings but also strengthened its position in the financial technology sector. The company's focus on technological advancements has been pivotal in its continued growth and market leadership.

The Square Reader, launched in 2010, transformed mobile payments for small businesses, making it easier for them to accept card payments. This innovation provided a simple, accessible, and affordable solution, significantly impacting how small businesses operate.

Cash App, introduced in 2013, expanded Block's reach into peer-to-peer payments and consumer financial services. It evolved to include features like stock and Bitcoin investments, providing users with comprehensive financial tools.

Block's integration of Bitcoin into its services, starting with Cash App in 2017, allowed users to buy, sell, and hold Bitcoin. This strategic move positioned the company at the forefront of the cryptocurrency movement.

The acquisition of Afterpay in January 2022 for US$29 billion expanded Block's financial services portfolio, entering the buy now, pay later (BNPL) market. As of 2023, Afterpay serves 24 million users and 348,000 merchants, processing US$27.3 billion in payments annually.

In December 2023, Block launched Bitkey, a self-custody Bitcoin hardware wallet, in 95 countries. This move underscored Block's commitment to decentralization and secure Bitcoin storage, providing users with greater control over their digital assets.

In April 2024, Block announced the completion of its own standalone three-nanometer bitcoin mining chip. This advancement aims to decentralize bitcoin mining hardware, furthering the company's involvement in the cryptocurrency ecosystem.

Block has faced several challenges throughout its history, including regulatory scrutiny and market volatility. These experiences have tested the company's resilience, prompting it to adapt and innovate to maintain its competitive edge. The company's ability to navigate these challenges has been crucial to its long-term success.

In March 2023, Hindenburg Research alleged that Block facilitated fraud and avoided regulation, claims the company refuted. These allegations led to increased scrutiny and the need for enhanced compliance measures across its platforms.

The departure of key executives, such as Cash App CEO Brian Grassadonia, who was appointed as the company's new 'ecosystem lead' in September 2024, has required Block to adapt its leadership structure. These changes have aimed to streamline operations and enhance coordination across business segments.

Block has navigated market downturns and competitive pressures by continuously innovating and expanding its offerings. These challenges have prompted the company to diversify its revenue streams and strengthen its market position.

Facing competition from established financial institutions and other fintech companies, Block has focused on differentiating its services. This has involved strategic acquisitions, like Afterpay, and developing new technologies, such as the Bitcoin mining chip.

Block operates in a highly regulated financial environment, and it has faced increased scrutiny from regulatory bodies. The company has had to adapt its compliance measures and invest in risk management to maintain its operational integrity.

The company's reliance on technology exposes it to risks such as cyberattacks, data breaches, and system failures. Block has had to invest in cybersecurity measures and infrastructure to protect its customers' data and ensure the reliability of its services.

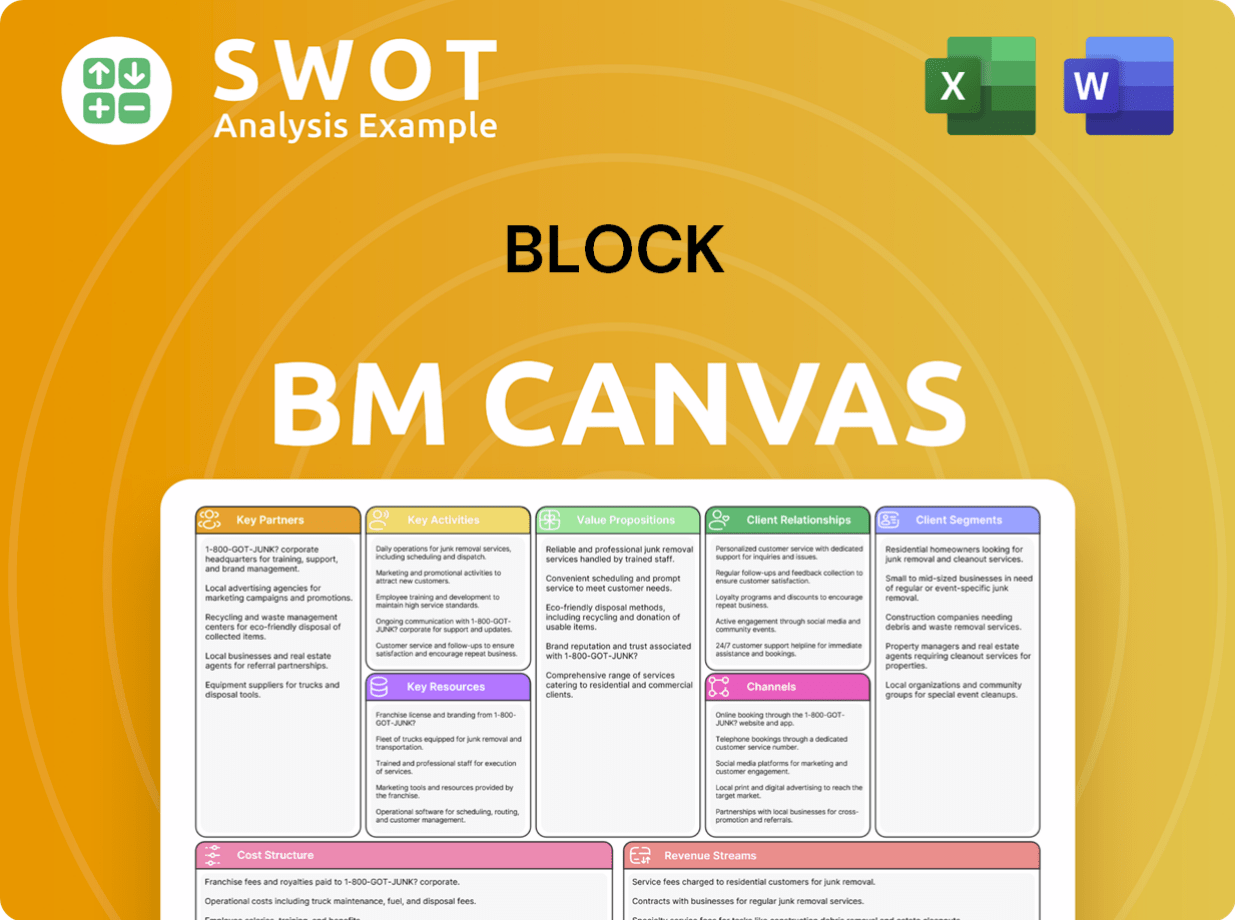

Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Block?

The Block Company history is marked by significant milestones, evolving from a payment processing startup to a multifaceted financial services and technology company. This journey, which began with its founders and their vision, showcases the company's adaptability and its commitment to innovation in the financial sector. The Block Company timeline reflects its strategic moves, including acquisitions and technological advancements.

| Year | Key Event |

|---|---|

| 2009 | Square, Inc. is founded by Jack Dorsey and Jim McKelvey in St. Louis, Missouri. |

| 2010 | The Square Reader, the company's first product, is launched, enabling small businesses to accept credit card payments via smartphones. |

| 2013 | Cash App, a peer-to-peer payment service, is introduced. |

| 2014 | Square Capital is launched, providing access to funding for merchants. |

| 2015 | Square, Inc. goes public on the New York Stock Exchange with an initial valuation of $2.9 billion. |

| 2017 | Cash App begins allowing users to use Bitcoin. |

| 2018 | Square acquires Weebly for $365 million, integrating website building and e-commerce capabilities. |

| March 2021 | Square acquires majority ownership in Tidal, a music streaming service, for $297 million. |

| December 2021 | Square, Inc. changes its name to Block, Inc. to reflect its broader focus beyond just payment processing. |

| January 2022 | Block completes the acquisition of Afterpay for US$29 billion, expanding into the buy now, pay later market. |

| December 2023 | Block launches Bitkey, a self-custody Bitcoin hardware wallet, in 95 countries. |

| April 2024 | Block announces the development of its own three-nanometer bitcoin mining chip. |

| September 2024 | Leadership reshuffle, with Brian Grassadonia appointed as 'ecosystem lead'. |

| October 2024 | Bitkey is named one of TIME's 'best inventions of 2024'. |

| February 2025 | Block states it is manufacturing bitcoin mining chips with roll-out plans later in the year. |

| March 2025 | Block becomes the first company in North America to deploy the NVIDIA DGX SuperPOD with DGX GB200 systems for AI model research and training. |

| May 2025 | Block announces the launch of 'Bitcoin For Businesses' on Square, enabling merchants to accept bitcoin payments via the Lightning Network, starting in late 2025. |

Block is positioned for continued growth, aiming to integrate its ecosystem of brands. This integration includes Square, Cash App, Afterpay, Tidal, Bitkey, and Proto. The company's focus on Bitcoin and decentralized technologies remains a core strategy.

Block's commitment to Bitcoin is evident, holding 8,480 BTC as of Q1 2025, making it the second-largest corporate Bitcoin holder globally. The company plans to make Bitcoin more accessible and usable in everyday commerce. The launch of 'Bitcoin For Businesses' on Square is a key initiative.

Analyst predictions highlight Cash App's growing user base as a key driver for Block's stock. The company's focus on operational continuity and strategic Bitcoin initiatives positions it as a compelling long-term investment. Net margins improved to 12% in late 2024, up from 0.04% the prior year.

Block's consistent introduction of new features and services, coupled with its emphasis on underserved markets and mobile-first technology, suggests a future where Block continues to increase access to the global economy for more people. The company's expansion strategy includes strategic acquisitions and partnerships.

Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Block Company?

- What is Growth Strategy and Future Prospects of Block Company?

- How Does Block Company Work?

- What is Sales and Marketing Strategy of Block Company?

- What is Brief History of Block Company?

- Who Owns Block Company?

- What is Customer Demographics and Target Market of Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.