Block Bundle

Can Block Inc. Maintain Its Fintech Dominance?

The fintech revolution has created a battlefield where companies constantly battle for supremacy, and Block, Inc. (formerly Square) is a key player. From its roots in simplifying payments for small businesses, Block has expanded its reach to encompass a wide array of financial services. Understanding the Block SWOT Analysis is crucial for investors and strategists alike.

This exploration of the Block company competitive landscape will delve into its core offerings, examining its market share and the competitive pressures it faces. We'll dissect Block's business strategy, identify its key players and market positions, and analyze its financial performance comparison within the industry. This Block company market analysis report offers insights into the company’s growth opportunities and challenges, providing a comprehensive Block company industry overview.

Where Does Block’ Stand in the Current Market?

Block, Inc. has established a significant market position within the global financial technology sector, primarily through its Square and Cash App platforms. The company's core operations revolve around providing financial tools and services to both businesses and consumers. Square focuses on payment processing and business solutions for small and medium-sized businesses (SMBs), while Cash App offers a range of consumer-focused financial services, including peer-to-peer payments and investment options.

The value proposition of Block lies in its ability to offer integrated and user-friendly financial solutions. Square simplifies payment acceptance and business management for merchants, while Cash App provides consumers with a convenient platform for managing their finances. This dual approach allows Block to capture a broad spectrum of financial activity, from point-of-sale transactions to personal investments. The company's focus on innovation and customer experience has been key to its success in a competitive market, as highlighted in the Growth Strategy of Block.

Block's market position is further strengthened by its diverse product offerings and strategic expansion into new markets. The company's ability to adapt to evolving consumer and business needs has enabled it to maintain a competitive edge in the rapidly changing fintech landscape.

Square is a leading provider of payment processing solutions for SMBs, generating $7.4 billion in gross profit in 2023. It serves diverse industries, offering a comprehensive suite of tools including point-of-sale hardware, software, payroll services, and business financing. Square's strong foothold is primarily in North America, with expanding international presence.

Cash App has become one of the most popular mobile payment apps in the U.S. In Q4 2023, Cash App reported a gross profit of $1.18 billion, demonstrating strong user engagement. It offers peer-to-peer payments, debit cards, direct deposit, stock investing, and Bitcoin trading. In March 2024, Cash App had 56 million monthly active users.

Block's overall financial health remains strong, with a reported gross profit of $7.59 billion for the full year 2023. The company's financial performance reflects its ability to generate revenue from multiple sources. The company continues to face intense competition and seeks to expand its reach.

Block has strategically shifted from solely payment processing to a broader financial services provider. This diversification helps capture a larger share of both business and consumer financial activity. The company focuses on expanding its reach in emerging markets and integrating its diverse product offerings.

Block's market position is characterized by strong performance in its core markets, particularly in the U.S., and strategic expansion into international markets. The company's focus on innovation and user-friendly financial solutions has allowed it to maintain a competitive edge.

- Square's leading position in payment processing for SMBs.

- Cash App's popularity in mobile payments and financial services.

- Diversification into broader financial services to capture more market share.

- Ongoing expansion into new markets and product integration.

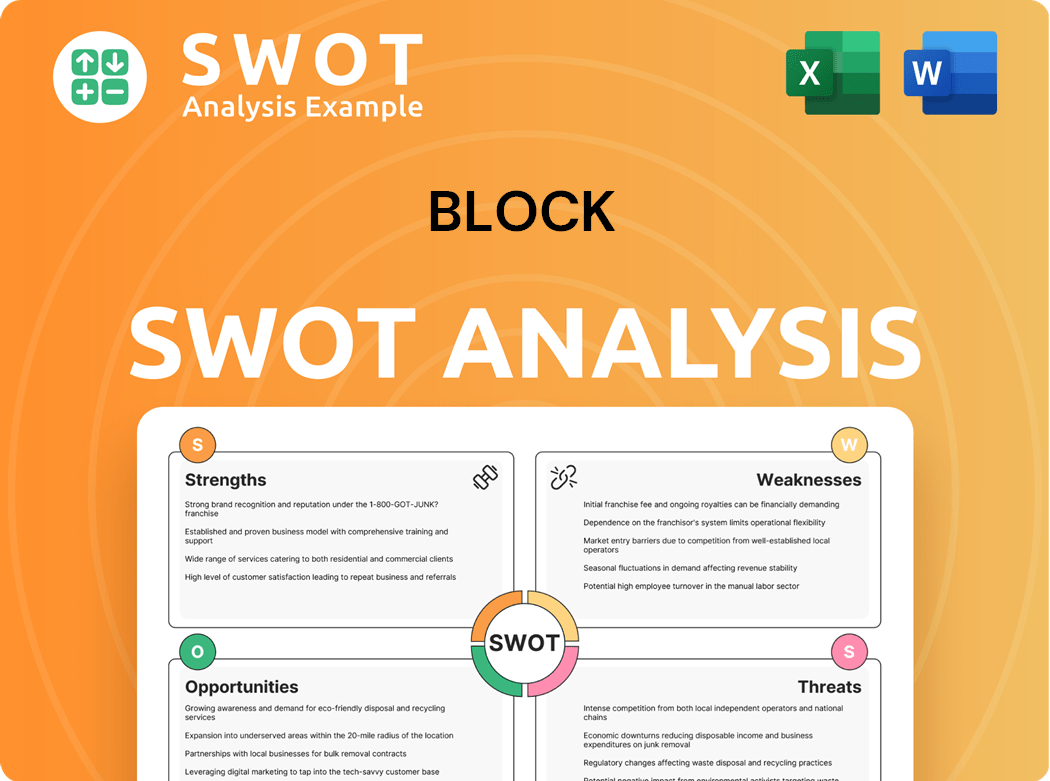

Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Block?

The competitive landscape for Block is multifaceted, encompassing a wide array of rivals across its diverse business segments. This dynamic environment requires Block to continually innovate and refine its strategies to maintain and grow its market share. Understanding these competitors and their respective strengths is crucial for Block's strategic planning and future growth initiatives. A detailed Revenue Streams & Business Model of Block can shed further light on how Block generates its income and navigates this competitive arena.

Block faces competition in the seller ecosystem, particularly from established payment processors and specialized point-of-sale (POS) providers. In the consumer-focused Cash App segment, the competition is intense, involving both direct competitors like Venmo and indirect rivals such as traditional banks and tech giants. The company's success hinges on its ability to differentiate its offerings, attract and retain users, and adapt to the evolving demands of the financial technology market.

The competitive landscape of Block is constantly evolving, influenced by technological advancements, shifting consumer preferences, and the entry of new players. This necessitates a proactive approach to market analysis and strategic adaptation to maintain a competitive edge. The company's ability to navigate these challenges will be critical to its long-term success.

In the seller ecosystem, Block's Square competes with traditional payment processors and specialized POS providers. These competitors offer similar solutions, challenging Block's market position through competitive pricing and industry-specific innovations. The competition is fierce, with each player vying for market share by offering attractive features and services to attract businesses.

Fiserv's Clover system provides hardware and software solutions tailored for small and medium-sized businesses. Clover offers a comprehensive suite of tools, directly competing with Square's integrated offerings. Fiserv's focus on providing a complete business management solution makes it a significant competitor in the seller ecosystem. In recent financial reports, Fiserv has shown steady growth in its merchant services segment, highlighting its strong market presence.

PayPal, through Zettle, offers point-of-sale solutions that compete directly with Square. PayPal's established brand and extensive user base give it a competitive advantage. Zettle's integration with PayPal's broader ecosystem enhances its appeal to merchants. PayPal's merchant services revenue continues to be a significant portion of its overall revenue, reflecting its strong position in the market.

Lightspeed Commerce provides POS and management platforms, particularly in the retail and restaurant sectors. Lightspeed's specialized features and industry-specific focus make it a strong competitor. The company's growth strategy often involves acquisitions to expand its market reach and product offerings. Recent financial results indicate Lightspeed's continued expansion in the global market.

Toast is a significant competitor in the restaurant industry, offering specialized POS and management platforms. Toast's focus on the restaurant sector allows it to provide tailored solutions. The company's ability to cater to the specific needs of restaurants makes it a formidable competitor. Toast's revenue growth has been driven by its expansion in the restaurant technology market.

These competitors challenge Block through competitive pricing, industry-specific innovations, and established distribution networks. The seller ecosystem is highly competitive, with each company striving to offer the best value proposition to attract and retain merchants. The ongoing competition drives innovation and forces companies to continually improve their offerings to maintain their market share.

In the consumer-focused Cash App segment, Block faces intense competition from various players. These competitors include established fintech companies and tech giants, all vying for dominance in the digital wallet and personal finance market. Competition is fierce, with each company aiming to attract users through innovative features and strategic partnerships.

- Venmo (PayPal): A direct competitor in the peer-to-peer payment space, Venmo boasts a large user base and strong brand recognition. Venmo's ease of use and social features have made it a popular choice for consumers. PayPal's financial reports consistently highlight Venmo's significant transaction volume and user engagement.

- Traditional Banks: Traditional banks offer digital payment services, competing with Cash App's broader financial offerings. Banks leverage their existing customer base and infrastructure to provide digital payment solutions. Many banks are investing heavily in their digital platforms to remain competitive in the fintech landscape.

- Apple Pay and Google Pay: These tech giants leverage their vast user ecosystems and device integration to facilitate mobile payments. Apple Pay and Google Pay benefit from their widespread device adoption and seamless user experience. Both companies continue to expand their payment services and partnerships to increase their market share.

- Fintech Startups: Fintech startups focusing on specific financial services, such as investing apps like Robinhood or Chime in mobile banking, indirectly compete with Cash App's broader financial offerings. These startups often target specific niches within the financial services market. Their growth is fueled by innovative features and targeted marketing campaigns.

- Emerging Threats: The entry of new players focusing on blockchain and cryptocurrency services also presents an emerging competitive threat, as Block expands its focus in these areas. The cryptocurrency market's volatility and regulatory environment add complexity to this segment. New entrants are constantly innovating, and the competitive landscape is rapidly changing.

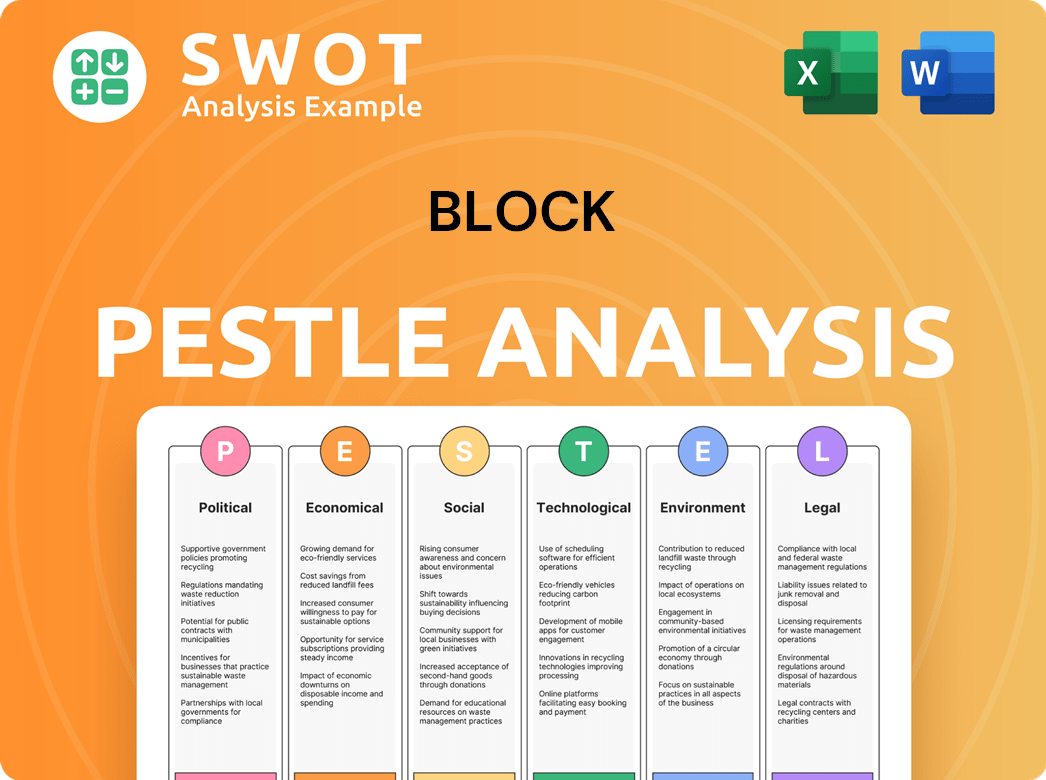

Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Block a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of the Block company requires a deep dive into its key advantages. Block, Inc. has carved a significant niche in the fintech sector. Its strategic moves and competitive edge are crucial for investors and analysts. The company's integrated approach, encompassing both seller and consumer services, sets it apart from many competitors.

The company's success is built on a foundation of innovation and a keen understanding of market dynamics. Block's ability to adapt and integrate new technologies, such as blockchain, positions it well for future growth. The company's focus on user experience and ease of use has been pivotal in attracting and retaining customers. By examining these elements, stakeholders can better assess Block's market position and growth potential.

A comprehensive Block company market analysis reveals several key strengths. The company's diverse product offerings and strategic partnerships contribute to its robust market presence. Analyzing these aspects provides a clearer picture of Block's competitive advantages and potential challenges. This analysis is essential for anyone looking to understand the dynamics of the fintech industry and the position of Block within it.

Square's integrated ecosystem offers a 'one-stop-shop' solution for sellers. This includes point-of-sale systems, payment processing, payroll, and business loans. This approach simplifies operations for small and medium-sized businesses, fostering customer loyalty. This integrated model is a key differentiator in the Block company competitive landscape.

Cash App has a strong brand and a user-friendly interface. It has cultivated a highly engaged user base. The network effect is crucial, as more users adopt Cash App, its utility grows. This has helped drive significant growth in peer-to-peer payments.

Cash App's early adoption of Bitcoin trading and stock investing features has been a key advantage. It positions Cash App as a leader in offering diverse financial services within a single mobile application. This appeals to a younger, digitally native demographic, driving user acquisition and engagement.

Block's continuous innovation in blockchain technology and decentralized finance through its Spiral and TBD divisions provides a long-term competitive edge. This positions the company at the forefront of emerging financial paradigms. These initiatives are crucial for future growth and market leadership.

Block's competitive advantages are multifaceted, spanning its integrated seller ecosystem, strong brand equity with Cash App, early adoption of innovative financial services, and continuous innovation in blockchain technology. However, the company faces challenges, including imitation by well-funded competitors and the rapid pace of technological change. For a deeper understanding of Block's target audience, consider reading about the Target Market of Block.

Block's competitive advantages include its integrated ecosystem, strong brand recognition, and early adoption of new technologies. These factors contribute to its market position. The company's ability to innovate and adapt is crucial for sustained success.

- Integrated Seller Ecosystem: Square's comprehensive solutions simplify operations for businesses.

- Strong Brand and User Experience: Cash App's user-friendly interface fosters high user engagement.

- Early Adoption of Bitcoin: Positions Cash App as a leader in diverse financial services.

- Innovation in Blockchain: Spiral and TBD divisions drive long-term competitive edge.

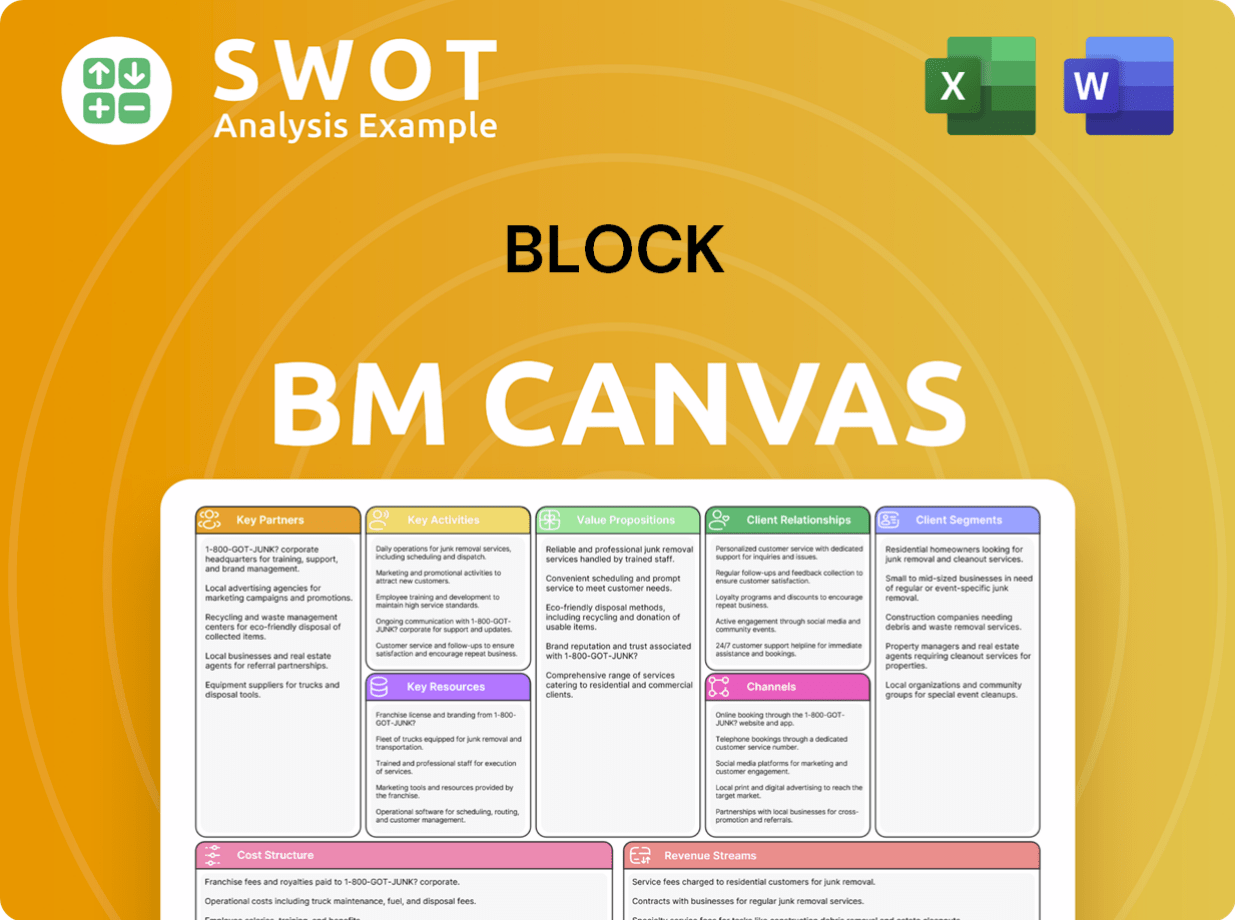

Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Block’s Competitive Landscape?

The financial technology sector is experiencing a period of significant transformation, driven by technological advancements, evolving consumer behaviors, and regulatory changes. This dynamic environment presents both challenges and opportunities for companies like Block. Understanding the Block company competitive landscape requires a close examination of these trends and their impact on the company's strategic positioning and future prospects.

The Block company market analysis reveals an industry characterized by intense competition and rapid innovation. Established financial institutions, fintech startups, and tech giants are all vying for market share, creating pricing pressures and increasing customer acquisition costs. Navigating this landscape requires a robust Block company business strategy that focuses on innovation, customer experience, and strategic partnerships.

Technological advancements, including AI, machine learning, and blockchain, are reshaping financial services. Consumer preferences are shifting towards seamless, mobile-first financial experiences. Regulatory changes globally are also significantly impacting the industry, with increasing scrutiny on data privacy and consumer protection.

Intense competition from established financial institutions and fintech startups. Regulatory hurdles can slow down growth and increase operational complexities. Cybersecurity risks and protecting sensitive financial data remain a paramount challenge. Potential disruptions could arise from declining demand for specific services.

The increasing adoption of digital payments globally, particularly in emerging markets. Continued innovation in its Cash App and Square ecosystems. Strategic partnerships with other technology companies or financial institutions. Block’s continued investment in blockchain and cryptocurrency.

The global digital payments market is projected to reach $18.8 trillion by 2028, according to a report by Research and Markets. The fintech industry saw $19.7 billion in funding in Q1 2024, indicating continued investor interest. The shift towards mobile payments is evident, with mobile payment users expected to reach 1.5 billion by 2025.

To maintain a competitive edge, Block must focus on several key areas. These include expanding its international footprint to tap into the growth potential in emerging markets. Further innovation in its product offerings, such as integrating AI-driven analytics or expanding investment products. Strengthening cybersecurity measures and ensuring regulatory compliance.

- Competitive Pressure: The rise of digital wallets like Apple Pay and Google Pay intensifies competition, as these platforms are already integrated into millions of devices.

- Regulatory Scrutiny: Increased regulatory oversight globally, particularly around cryptocurrency and data privacy, demands significant investment in compliance.

- Technological Disruption: The rapid advancement of blockchain and decentralized finance presents both opportunities and risks, requiring continuous adaptation.

- Market Expansion: Expanding into new markets, especially in regions with high mobile payment adoption rates, is crucial for growth.

For a deeper understanding of Block's financial performance and ownership structure, further details can be found in the article about Owners & Shareholders of Block.

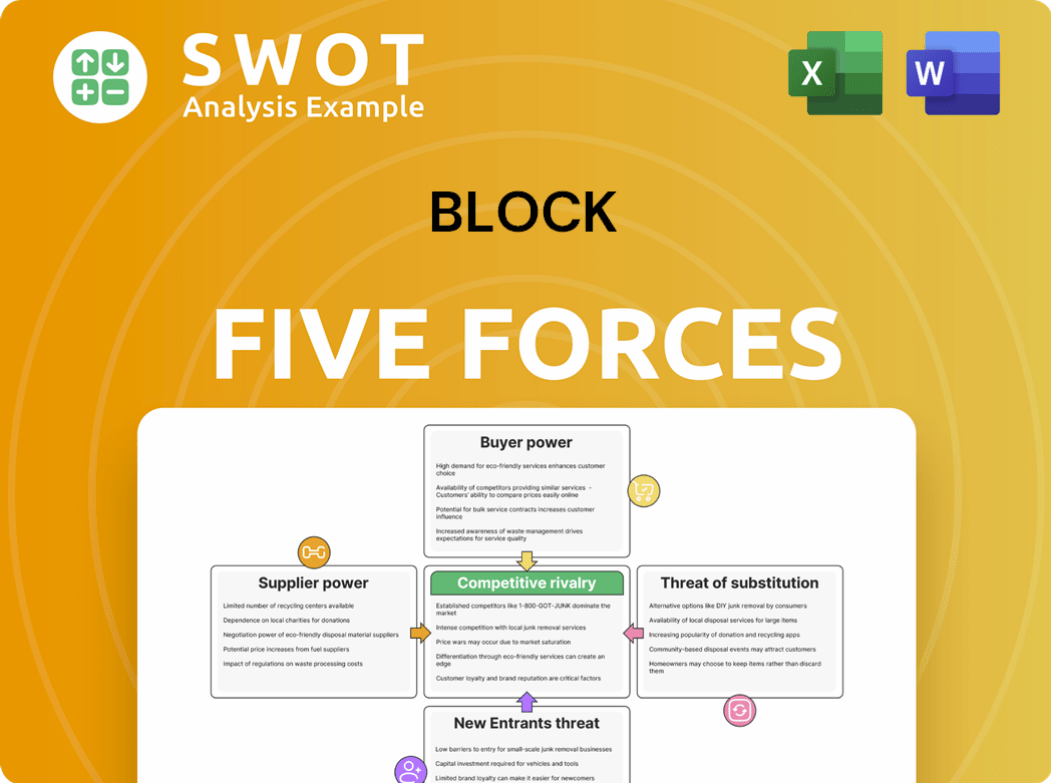

Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Block Company?

- What is Growth Strategy and Future Prospects of Block Company?

- How Does Block Company Work?

- What is Sales and Marketing Strategy of Block Company?

- What is Brief History of Block Company?

- Who Owns Block Company?

- What is Customer Demographics and Target Market of Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.