Block Bundle

Who Really Owns Block Company?

Understanding the Block SWOT Analysis is crucial, but have you ever wondered who truly steers the ship at Block Inc? The ownership structure of this fintech giant, formerly known as Square, is a complex web that dictates its strategic moves and future trajectory. From its humble beginnings with Jack Dorsey to its current status as a major player, Block's ownership has evolved significantly.

This deep dive into Block Company ownership will uncover the key players influencing its direction. We'll explore the evolution of Block Inc shareholders, from early investors to the current major stakeholders, and analyze how these shifts have shaped the company's governance and strategic decisions. Discover the answers to questions like: Who is the CEO of Block Company, and who controls Block Company? Unravel the intricacies of Block Company's stock ownership breakdown and gain insights into how to find Block Company ownership information.

Who Founded Block?

The story of Block, Inc. (formerly Square, Inc.) began in February 2009, when Jack Dorsey and Jim McKelvey co-founded the company. Initially based in St. Louis, Missouri, their vision was to simplify financial transactions, particularly for small businesses, by enabling them to accept credit card payments easily.

The founders aimed to democratize financial tools, making them accessible to a broader audience. This mission drove the company's early development and shaped its approach to product innovation. The initial focus was on providing simple, user-friendly solutions for payment processing.

The company's early success was fueled by a $10 million seed funding round led by Khosla Ventures. This investment was critical in the early stages, providing the necessary capital to develop and launch its payment processing solutions. This early financial backing was a key factor in Block's initial growth and market entry.

Jack Dorsey and Jim McKelvey co-founded Block, Inc. in February 2009.

The seed funding round raised $10 million, led by Khosla Ventures.

The founders aimed to make financial tools accessible to small businesses and individuals.

Jack Dorsey held a significant ownership stake.

The company was initially based in St. Louis, Missouri.

The initial focus was on payment processing solutions.

As of February 9, 2023, Jack Dorsey held 8.3% of the company's shares, which amounted to 48.84 million shares. This represents a decrease from the 10.80% he reported owning in February 2022. Jim McKelvey also remains involved as a co-founder and director. The early ownership structure and agreements, such as vesting schedules, are not publicly detailed in available information. Understanding the target market of Block is crucial for analyzing the company's strategy.

- Jack Dorsey's ownership decreased from 2022 to 2023.

- Jim McKelvey continues to be a key figure in the company.

- Early ownership details are not extensively available in public records.

- The company's focus remains on accessible financial tools.

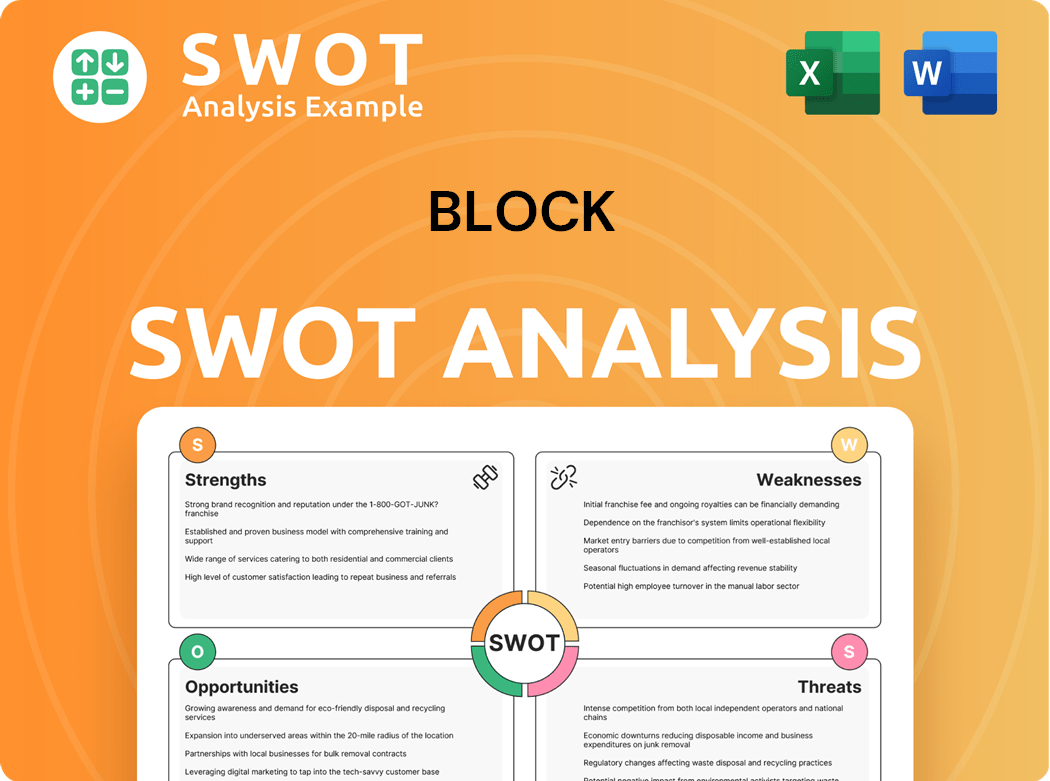

Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Block’s Ownership Changed Over Time?

The ownership structure of Block, Inc. has seen significant changes since its initial public offering (IPO). The company, initially valued at $2.9 billion, went public on November 19, 2015, trading under the ticker symbol 'SQ'. This marked a pivotal moment, transitioning from private to public ownership and opening up investment opportunities to a broader audience. Effective January 21, 2025, the ticker symbol changed to 'XYZ'.

A major shift in Block's ownership occurred with the acquisition of Afterpay in January 2022, valued at $29 billion in stock. This strategic move not only expanded Block's business operations but also introduced new shareholders into the company's ownership structure. This acquisition is a prime example of how Block has evolved, integrating new entities and stakeholders into its corporate framework. For more insights, you can read a Brief History of Block.

| Event | Date | Impact on Ownership |

|---|---|---|

| IPO | November 19, 2015 | Transitioned from private to public ownership; shares offered to the public. |

| Afterpay Acquisition | January 2022 | Introduced new shareholders through stock-based acquisition. |

| Ticker Symbol Change | January 21, 2025 | Reflects corporate evolution and potential strategic shifts. |

As of February 18, 2025, Block had approximately 559.43 million Class A common shares and 60.05 million Class B common shares outstanding. Class B shares hold ten times the voting power of Class A shares, giving co-founders Jack Dorsey and Jim McKelvey considerable influence, even with less than 11% of total shares as of June 2022. Major institutional investors held a substantial portion of the shares, totaling 449.94 million as of January 17, 2025. Key shareholders include Vanguard Group Inc. (10.04%), BlackRock, Inc. (5.23%), and T. Rowe Price Group, Inc. (4.38%).

Understanding the ownership of Block, Inc. is crucial for investors and stakeholders. The company’s ownership structure is a dynamic landscape shaped by its IPO, acquisitions, and the influence of key shareholders.

- The company went public on November 19, 2015, under the ticker symbol 'SQ'.

- Jack Dorsey and Jim McKelvey, the co-founders, hold significant voting power.

- Major institutional investors hold a substantial portion of the shares.

- The acquisition of Afterpay brought new stakeholders to Block.

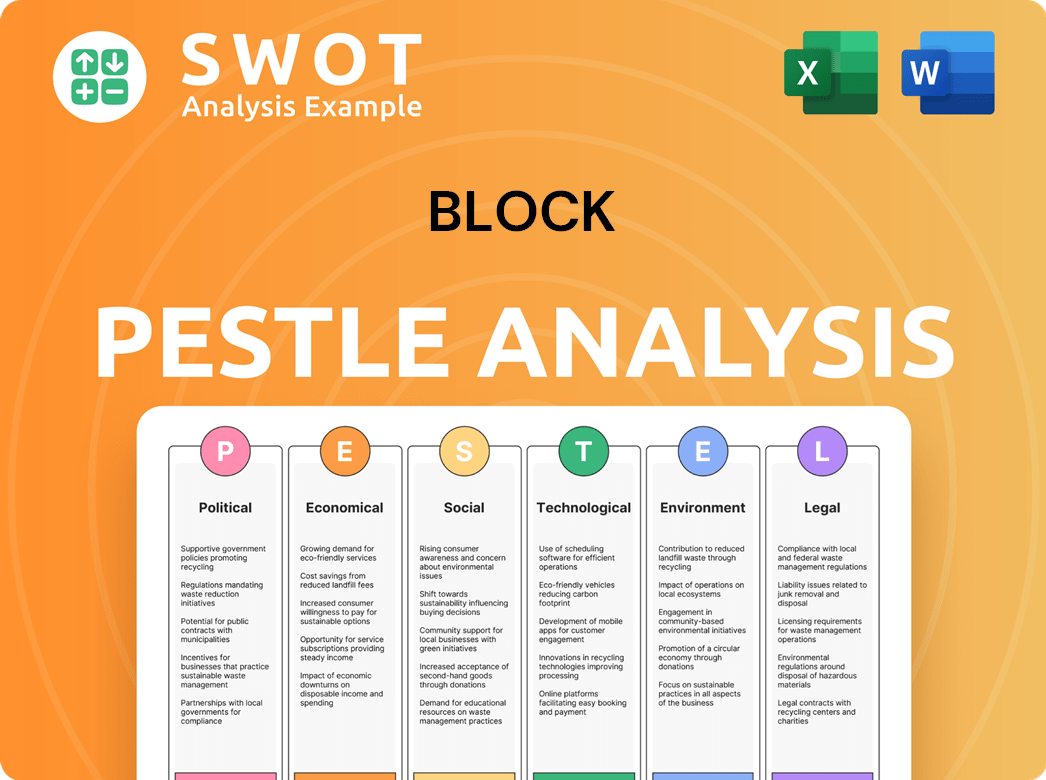

Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Block’s Board?

The board of directors at Block, Inc. is pivotal in guiding the company's direction and overseeing its strategies. As of April 2025, the board consists of 10 members, operating under a staggered system where directors serve three-year terms. Independent directors include Roelof Botha, Amy Brooks, Paul Deighton, Randy Garutti, Mary Meeker, and Neha Narula. Jack Dorsey, the co-founder, holds the positions of Head and Chairman, while Jim McKelvey, also a co-founder, is a director. Shawn 'JAY-Z' Carter and Anthony Eisen also contribute to the board, representing significant acquisitions and strategic alliances.

The structure of the board and the distribution of voting power are key elements in understanding who owns Block Company. The annual meeting of stockholders in 2024 took place virtually on June 18, where elections for Class III directors were held, with terms extending until the 2027 annual meeting. The upcoming 2025 annual meeting is scheduled for June 17, where elections for Class I directors will occur, with terms lasting until 2028.

| Director | Title | Affiliation |

|---|---|---|

| Jack Dorsey | Head, Chairman, Co-founder | Block, Inc. |

| Jim McKelvey | Director, Co-founder | Block, Inc. |

| Roelof Botha | Independent Director | |

| Amy Brooks | Independent Director | |

| Paul Deighton | Independent Director | |

| Randy Garutti | Independent Director | |

| Mary Meeker | Independent Director | |

| Neha Narula | Independent Director | |

| Shawn 'JAY-Z' Carter | Director | Roc Nation |

| Anthony Eisen | Director | Afterpay |

Block, Inc. operates with a dual-class share structure, which significantly influences Block Company ownership and voting rights. Class B shares offer ten times the voting power of Class A shares. This structure gives substantial control to co-founders Jack Dorsey and Jim McKelvey. As of June 2022, they held nearly all Class B shares, which allowed them to control over 48% of the shareholder vote, even though they owned less than 11% of the total shares. A shareholder proposal in June 2022 aimed to eliminate this dual-class structure, but it was unsuccessful. For more insights into the competitive landscape, consider exploring the Competitors Landscape of Block.

Understanding Block Inc shareholders and the voting structure is crucial for investors.

- The dual-class share structure gives significant voting power to the co-founders.

- Independent directors bring diverse expertise to the board.

- The annual meetings are important for shareholder decisions.

- The board's composition reflects strategic partnerships and acquisitions.

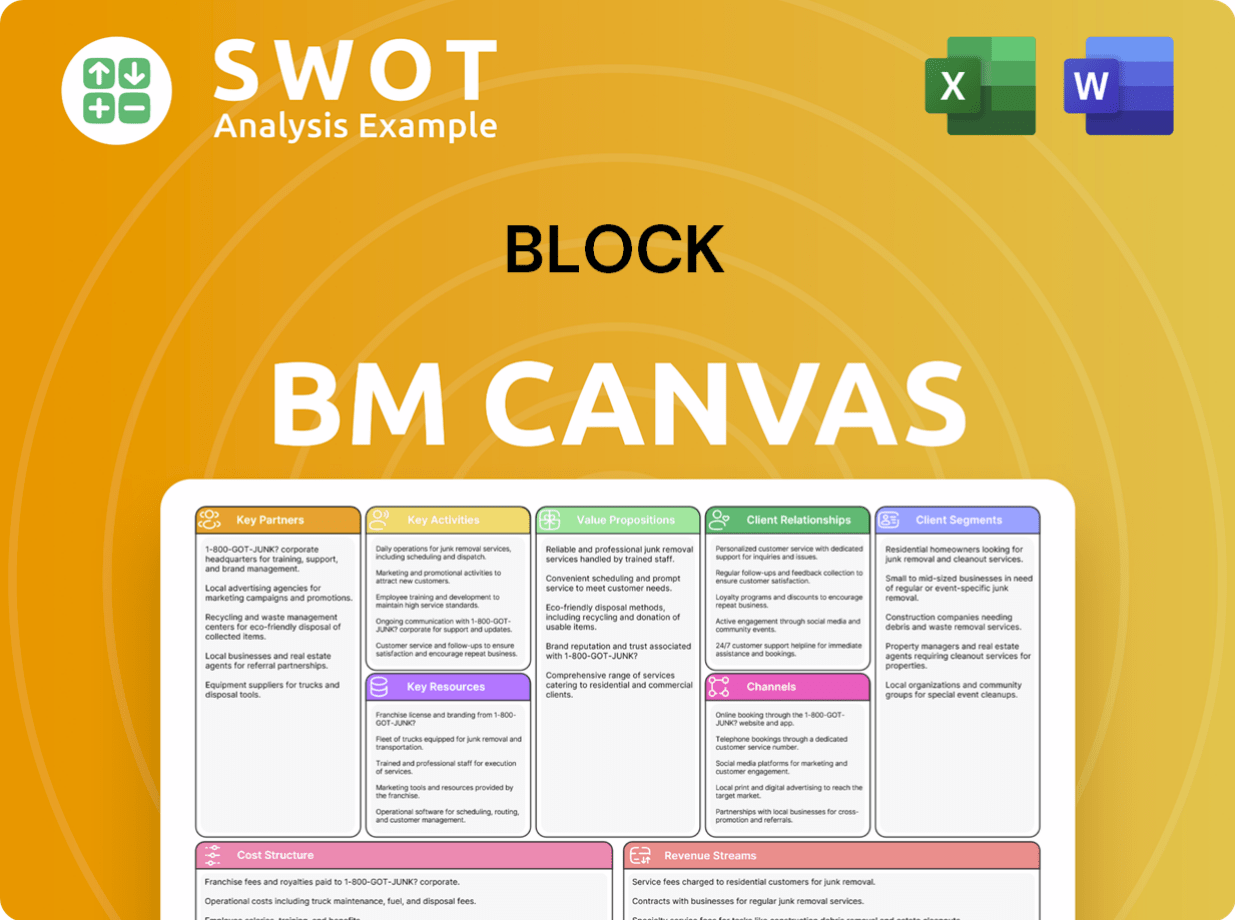

Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Block’s Ownership Landscape?

Recent developments have significantly reshaped the ownership profile of Block, Inc. The company, formerly known as Square, Inc., underwent a name change in December 2021, signaling its expansion beyond its original seller-focused business. This rebranding coincided with Jack Dorsey's resignation as CEO of Twitter. A major strategic move was the acquisition of Afterpay in January 2022 for $29 billion in stock, which brought new shareholders into the fold and integrated Afterpay's buy-now-pay-later services.

As of early 2025, institutional ownership remains a key feature of Block, Inc. Major institutional investors such as Vanguard, BlackRock, and T. Rowe Price hold significant stakes. While the ownership percentage of founder Jack Dorsey has seen some fluctuations, he continues to maintain a considerable position. As of February 2023, his stake was reported at 8.3%.

| Metric | Q1 2024 | Year-over-Year Growth |

|---|---|---|

| Total Net Revenue | $5.96 billion | 19% |

| Gross Profit | $2.09 billion | 22% |

| Cash App Gross Profit | $1.26 billion | 25% |

Financially, Block demonstrated strong performance in Q1 2024, with total net revenue reaching $5.96 billion, reflecting a 19% year-over-year increase. Gross profit also saw a substantial rise, reaching $2.09 billion, up 22% year-over-year. Cash App's gross profit alone was $1.26 billion, a 25% increase year-over-year. For the full year 2024, the company anticipates at least $8.78 billion in gross profit, indicating 17% year-over-year growth, and adjusted operating income of at least $1.30 billion. Block is also strategically investing in bitcoin, planning to allocate 10% of its gross profit from bitcoin products into bitcoin purchases throughout 2024. The company is on track to achieve a 'Rule of 40' run rate by the end of 2025, ahead of its 2026 goal.

Understanding Block Company ownership involves looking at institutional investors, the founder Jack Dorsey, and the impact of acquisitions like Afterpay. Marketing Strategy of Block provides insights into the company's broader business approach.

Major shareholders include institutional investors like Vanguard and BlackRock. Jack Dorsey remains a significant individual shareholder. The ownership structure is dynamic, reflecting the company's growth and strategic initiatives.

Block's Q1 2024 results showed strong revenue and profit growth. The company's guidance for 2024 indicates continued financial strength, with a focus on achieving key growth targets.

Block is investing in bitcoin and aiming to achieve a 'Rule of 40' run rate. These strategic moves highlight the company's commitment to innovation and sustainable growth, shaping its future ownership landscape.

Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Block Company?

- What is Competitive Landscape of Block Company?

- What is Growth Strategy and Future Prospects of Block Company?

- How Does Block Company Work?

- What is Sales and Marketing Strategy of Block Company?

- What is Brief History of Block Company?

- What is Customer Demographics and Target Market of Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.