Block Bundle

How Does the Block Company Revolutionize Finance?

Block, Inc. (formerly Square) is transforming the financial landscape, moving beyond simple card readers to a global fintech powerhouse. Its innovative products, like the Square Point of Sale system and the popular Cash App, have driven significant revenue growth and widespread adoption. Understanding Block SWOT Analysis is crucial for anyone seeking to navigate the evolving world of finance.

This exploration of "How Block Company Works" is essential for investors seeking to understand investment opportunities and the company's growth potential. We'll dissect Block company operations, examining its business model, diverse revenue streams, and strategic maneuvers to provide a comprehensive understanding. Whether you're interested in Block company structure, services, or the broader industry trends, this analysis offers valuable insights into a key player in the digital economy.

What Are the Key Operations Driving Block’s Success?

The core of the business, formerly known as Square, revolves around two main ecosystems: Square for sellers and Cash App for individuals. Square equips businesses with tools for payments, financing, and operations, while Cash App provides a platform for sending, spending, and investing money. These platforms are designed to be user-friendly, offering accessible financial services to a wide range of users.

Operational processes involve continuous technological development, robust payment processing infrastructure, and a strong sales and support network. The company's value proposition lies in simplifying complex business operations and making financial tools accessible, particularly for small and medium-sized businesses. The company also focuses on user experience and accessibility, especially for those who may be unbanked or underbanked.

The company's integrated approach allows it to offer a seamless experience across its various products. It continually introduces new features, translating its core capabilities into tangible customer benefits and strong market differentiation. This strategy has allowed the company to maintain a competitive edge in the rapidly evolving financial technology landscape.

Square provides a suite of tools for businesses, including hardware like card readers and software for point-of-sale management. It also offers online store creation, payroll services, and business banking solutions. The focus is on streamlining operations and providing financial tools for small and medium-sized businesses.

Cash App allows users to send, spend, and invest money. It includes peer-to-peer payments, direct deposit, a linked debit card (Cash Card), and the ability to buy and sell Bitcoin and stocks. The platform prioritizes ease of use and integrated financial services.

The company's operations include continuous technology development, robust payment processing, and a strong sales and support network. Supply chains for hardware products involve manufacturing and logistics, while digital platforms rely on cloud infrastructure and cybersecurity. Strategic partnerships with financial institutions and payment networks are crucial.

The company simplifies business operations and makes financial tools accessible. Cash App offers ease of use and integrated services, appealing to a broad demographic. The integrated approach and rapid innovation translate into customer benefits and market differentiation. This is how the Owners & Shareholders of Block benefit.

In Q1 2024, the company's gross profit increased by 22% year over year, reaching $2.08 billion. Cash App generated $1.26 billion of gross profit, up 25% year over year. The company's focus on innovation and user experience has contributed to its strong financial performance.

- Square's gross payment volume (GPV) was $58.4 billion in Q1 2024, up 15% year over year.

- Cash App had 57 million monthly transacting active customers in March 2024.

- The company continues to invest in its ecosystems to drive growth and expand its services.

- The company's adjusted EBITDA for Q1 2024 was $501 million, up from $363 million in the same period last year.

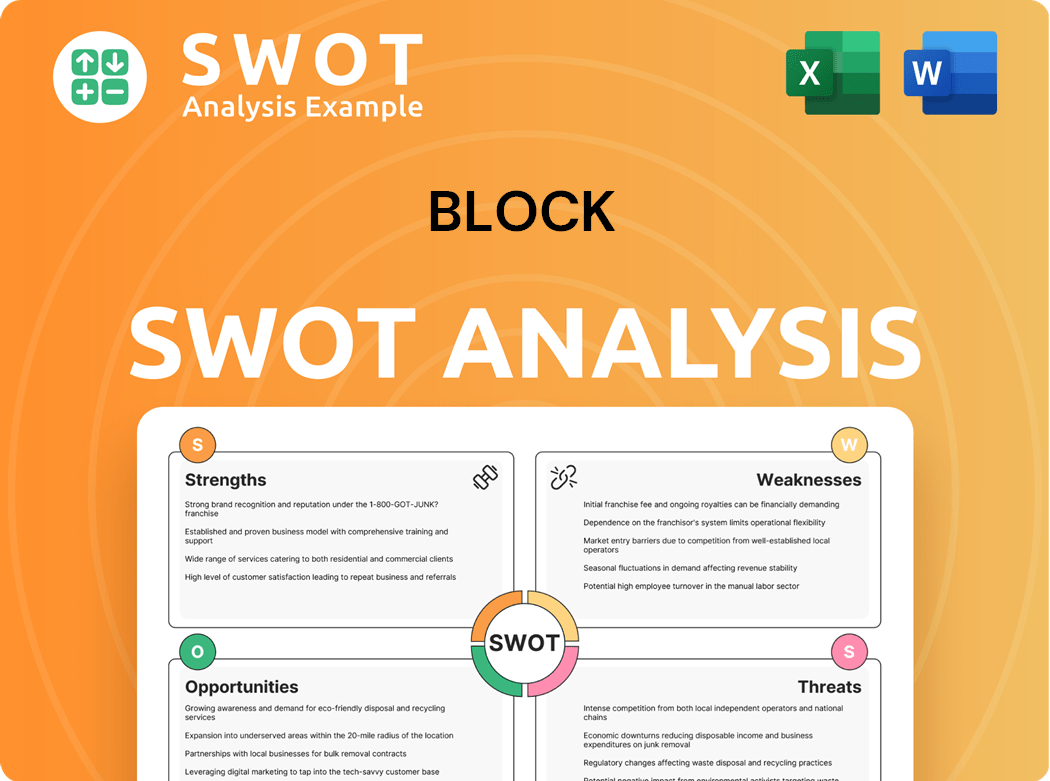

Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Block Make Money?

The Marketing Strategy of Block focuses on diverse revenue streams and monetization strategies. This approach allows the company to maintain a robust financial position. The company's financial success is evident in its gross profit figures.

For the fiscal year 2023, the company reported a gross profit of $7.50 billion, demonstrating the effectiveness of its monetization strategies. The company leverages its Square and Cash App ecosystems to generate revenue. These ecosystems are central to its financial operations.

The Square ecosystem is a primary revenue generator for the company. It primarily earns revenue through transaction fees from its seller ecosystem. The Cash App also contributes significantly to the company's revenue streams.

Square's main revenue comes from transaction-based fees, especially from processing card payments. Square also generates revenue from subscriptions and services. These include offerings like Square Online and Square Payroll.

Cash App's revenue is primarily from transaction fees for instant deposits and transfers. Interchange fees from the Cash Card and Bitcoin transactions are also significant. In Q4 2023, Cash App's gross profit was $1.18 billion.

The company uses tiered pricing for some Square services. Cross-selling between products like Square Payroll and Point of Sale (POS) systems is also a strategy. The company introduces new features to increase engagement and revenue.

Bitcoin transactions also contribute to the company's revenue. In Q4 2023, Bitcoin gross profit was $66 million. This shows the growing importance of digital currency in their financial model.

The company is expanding into new areas like Tidal, its music streaming service. The TBD platform, focused on Bitcoin development, also represents a potential future revenue stream. This diversification supports a more resilient business model.

The company's revenue mix shows growth in subscription and service-based revenue. This indicates a move towards a more diversified and stable business model. This shift enhances the company's financial predictability.

The company's revenue model is built on transaction fees, subscriptions, and services. The Square seller ecosystem is a major source of revenue. In Q4 2023, Square's gross profit from transaction-based fees was $2.16 billion. The Cash App ecosystem also generates substantial revenue through various fees. The company's approach to monetization includes tiered pricing and cross-selling. These strategies help to increase revenue and customer engagement.

The company's revenue streams are diverse and include transaction fees, subscriptions, and services.

- Square: Transaction fees, subscriptions, and services.

- Cash App: Transaction fees, interchange fees, and Bitcoin transactions.

- Other: Tidal and TBD, representing future revenue streams.

- Growth: Increasing subscription and service-based revenue.

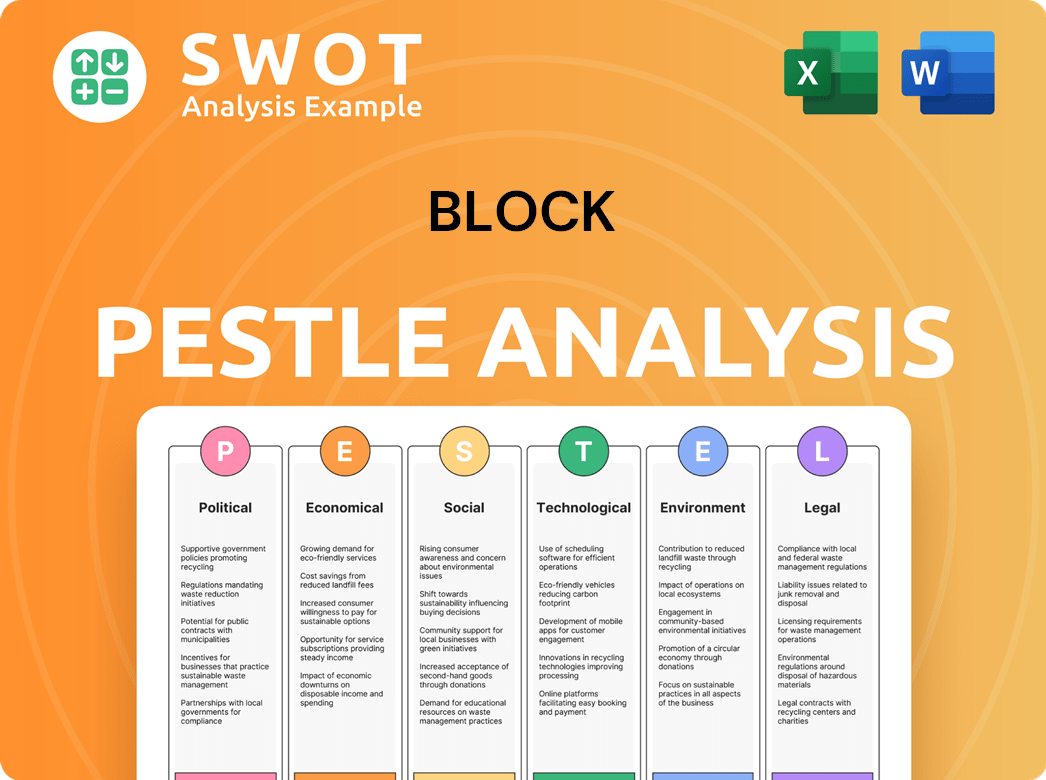

Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Block’s Business Model?

The evolution of the Block company has been marked by significant milestones and strategic shifts. Initially, the launch of the Square Point of Sale system was a game-changer, simplifying payment processing for small businesses. This move established a strong market presence. Later, the introduction of Cash App expanded its reach into consumer financial services, significantly broadening its user base and service offerings.

Strategic moves, such as partnerships with banks for Square Banking services, have been critical for expanding products and market reach. The acquisition of Afterpay in 2022 for approximately $13.1 billion was a major strategic step. It integrated buy now, pay later (BNPL) capabilities into both Square and Cash App, aiming to enhance user engagement and provide new financing options. These actions showcase the company's adaptability and forward-thinking approach in the fintech sector.

Block's operational challenges have included adapting to the evolving regulatory landscapes in fintech and managing supply chain disruptions for its hardware products. The company's responses have often involved agile product development and strategic investments in infrastructure. These efforts are crucial for maintaining competitiveness and ensuring long-term growth in a dynamic market. The company continues to adapt to new trends, such as the increasing adoption of cryptocurrencies, by integrating Bitcoin services into Cash App.

The Square Point of Sale system launch was a key milestone, democratizing payment processing for small businesses. Cash App's introduction expanded the company into consumer financial services. Strategic partnerships and acquisitions, like Afterpay, have further shaped its trajectory.

Block has focused on expanding its product offerings and reach through strategic partnerships. The acquisition of Afterpay in 2022 was a significant move to integrate BNPL capabilities. These actions highlight the company's commitment to adapting to shifts in consumer payment preferences.

Block benefits from strong brand recognition and customer loyalty, particularly with Square and Cash App. Its user-friendly interfaces and robust payment processing capabilities provide technological leadership. Economies of scale allow for competitive pricing, especially for small businesses.

Block continually adapts to new trends, such as the increasing adoption of cryptocurrencies, by integrating Bitcoin services into Cash App. The acquisition of Afterpay also demonstrates its commitment to adapting to shifts in consumer payment preferences. This approach helps maintain a competitive edge.

Block's competitive advantages include strong brand recognition, technology leadership, and economies of scale. The network effects within its seller and consumer ecosystems create a virtuous cycle. The company's ability to adapt to new trends, such as the increasing adoption of cryptocurrencies, is crucial.

- Strong brand recognition and customer loyalty, particularly with Square and Cash App.

- Technology leadership through user-friendly interfaces and robust payment processing.

- Economies of scale enabling competitive pricing.

- The network effects within both its seller and consumer ecosystems.

- Adaptation to new trends, such as cryptocurrency integration.

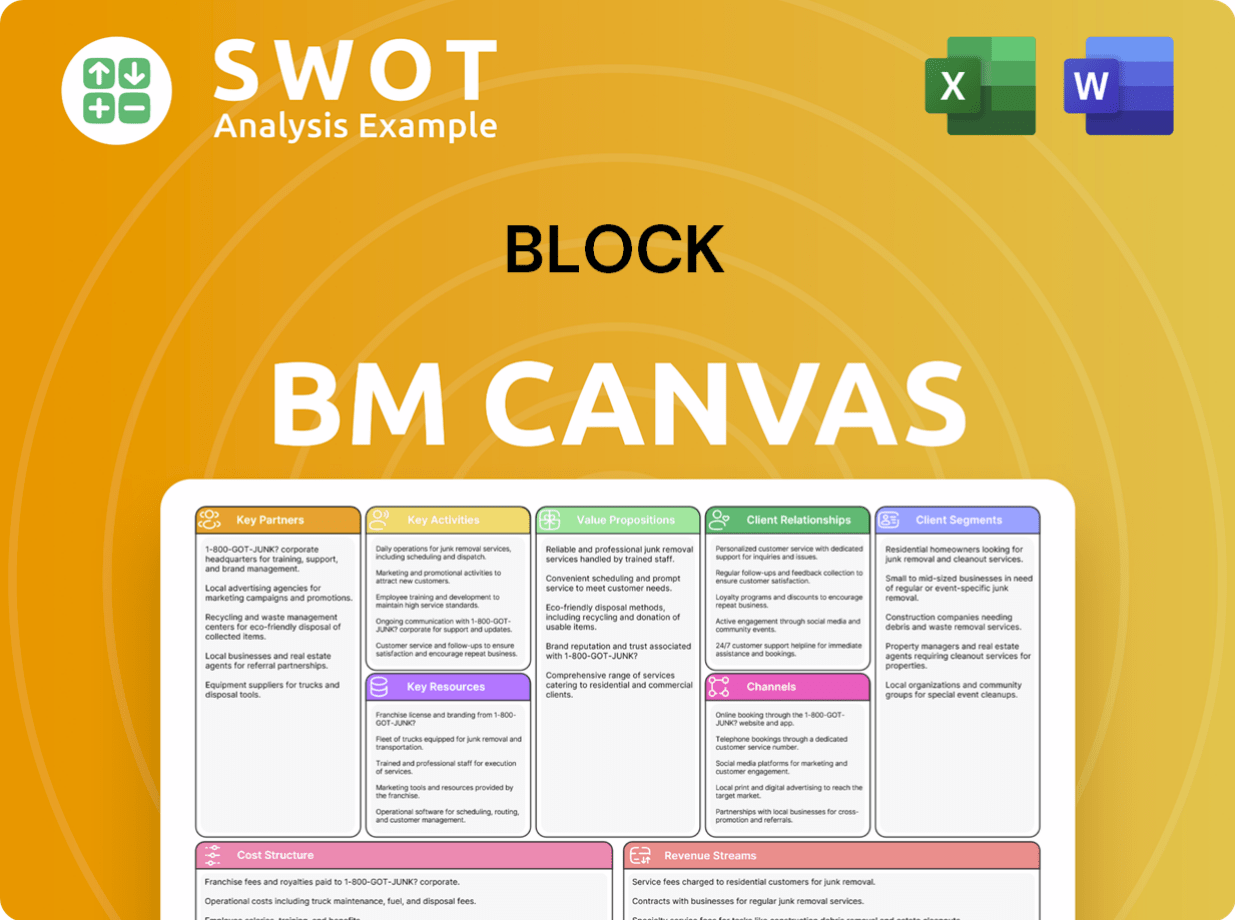

Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Block Positioning Itself for Continued Success?

The financial technology industry sees Block, Inc. as a significant player, especially with its strong presence in small business payment processing and peer-to-peer consumer payments. Competitors include traditional financial institutions, fintech firms like PayPal (including Venmo), and new entrants in embedded finance. Block's competitive advantage comes from its brand loyalty, particularly with Cash App's younger users, and its comprehensive service offerings. Operations extend globally, reaching beyond North America to places like Australia, Japan, and the UK.

Despite its robust position, Block faces risks that could affect its operations and income. Regulatory changes in finance and cryptocurrency pose a significant threat, as stricter rules could impact its business model and profitability. Competition from established and new businesses constantly pressures pricing and innovation. Technological disruption, while offering opportunities, could also pose a risk if new technologies change the payment or financial services landscape. Consumer preferences, like a shift away from digital payments or a decline in cryptocurrency interest, could also affect its growth. Understanding the target market of Block is crucial for navigating these challenges.

Block's position is strong in fintech, particularly in small business payments and peer-to-peer transactions. Its brand strength, especially with Cash App, and its comprehensive services give it an edge. Global expansion is a key strategy, with operations in several international markets.

Regulatory changes in finance and cryptocurrency pose risks to Block's business model. Increased competition and technological disruption also threaten its operations. Shifts in consumer preferences, such as reduced interest in digital payments or cryptocurrencies, could impact growth.

Block plans to integrate Afterpay, expand internationally, and innovate in blockchain and cryptocurrency through its TBD platform. The company aims to deepen relationships with current users, attract new customers, and explore new revenue streams in emerging technologies. Success depends on executing these strategies and adapting to market changes.

Key strategies include integrating Afterpay, expanding globally, and continuing innovation in blockchain and cryptocurrency. Leadership focuses on promoting economic inclusion and building an open financial system. The emphasis is on deepening user relationships and exploring decentralized finance.

Block's future hinges on its ability to execute strategic initiatives and adapt to the rapidly evolving fintech industry. The company must effectively manage risks and capitalize on emerging opportunities.

- Continued innovation in payment solutions and financial services.

- Expansion into new markets and strengthening global presence.

- Adaptation to changing regulatory environments and consumer preferences.

- Strategic partnerships and acquisitions to enhance service offerings.

Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Block Company?

- What is Competitive Landscape of Block Company?

- What is Growth Strategy and Future Prospects of Block Company?

- What is Sales and Marketing Strategy of Block Company?

- What is Brief History of Block Company?

- Who Owns Block Company?

- What is Customer Demographics and Target Market of Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.