Block Bundle

Who Are Block Company's Customers?

Understanding the Block SWOT Analysis is crucial for any investor or strategist. Block Company, a leader in financial technology, has experienced a remarkable evolution in its customer base. From its origins serving small businesses, Block now caters to a diverse audience, making understanding its customer demographics and target market essential. This analysis dives deep into who uses Block's products and services.

This exploration of Block Company delves into the specifics of its Block Company customers, examining their geographic locations, income levels, and purchasing behaviors. We'll uncover the answers to "What are the demographics of Block Company users?" and "Who is the target audience for Block Company products?" Analyzing this data provides invaluable insights for anyone seeking to understand the company's strategic direction and potential for future growth through effective market segmentation.

Who Are Block’s Main Customers?

Understanding the Owners & Shareholders of Block requires a look at its primary customer segments. The company, formerly known as Square, has cultivated a diverse customer base. This includes both businesses and individual consumers, each with distinct needs and characteristics. Analyzing the customer demographics and target market is crucial for understanding the company's strategic direction and growth potential.

Block, Inc. operates with a dual customer focus. This approach allows the company to address a wide range of financial needs. The company's success is closely tied to its ability to serve these two primary groups effectively. The evolution of its products and services reflects the company's commitment to meeting the changing demands of its diverse customer base.

The company's strategy involves continuous adaptation to market trends. It is achieved through product innovation and strategic diversification. This ensures that Block remains relevant and competitive in the rapidly evolving financial technology landscape. The company's ability to cater to both business and consumer needs is a key factor in its sustained growth.

The B2B segment primarily includes small and medium-sized businesses (SMBs). These businesses span various industries, such as retail, food and beverage, and professional services. They typically seek solutions for payment processing, point-of-sale (POS) systems, payroll, and overall business management. The company's focus on SMBs has been a foundational element of its revenue generation.

The owners and operators within this segment are diverse. They often share a need for intuitive, affordable, and integrated financial tools to streamline operations. This includes sole proprietors and businesses with multiple employees. The company provides tools to help these businesses manage their finances efficiently. The Block Company customers in this segment are crucial for the company's revenue stream.

The B2C segment, primarily served by Cash App, targets individual consumers. This segment has expanded Block's market reach significantly. Cash App has become a key driver of revenue diversification. The company's focus on individual consumers has increased over time.

The B2C segment includes a broad demographic range. A significant portion includes younger, digitally-native individuals, often in urban and suburban areas. These users are comfortable with mobile-first financial services. Reports from 2024 indicate a strong presence among Gen Z and Millennials. The Block Company audience includes a wide range of consumers.

The company's success is built on serving two primary customer segments: B2B and B2C. The B2B segment focuses on SMBs, providing essential financial tools. The B2C segment, driven by Cash App, targets individual consumers, particularly younger demographics.

- The B2B segment provides payment processing and business management solutions.

- The B2C segment offers peer-to-peer payments and investment opportunities.

- Cash App has expanded the company's market reach and revenue streams.

- The company's strategy involves continuous adaptation to market trends.

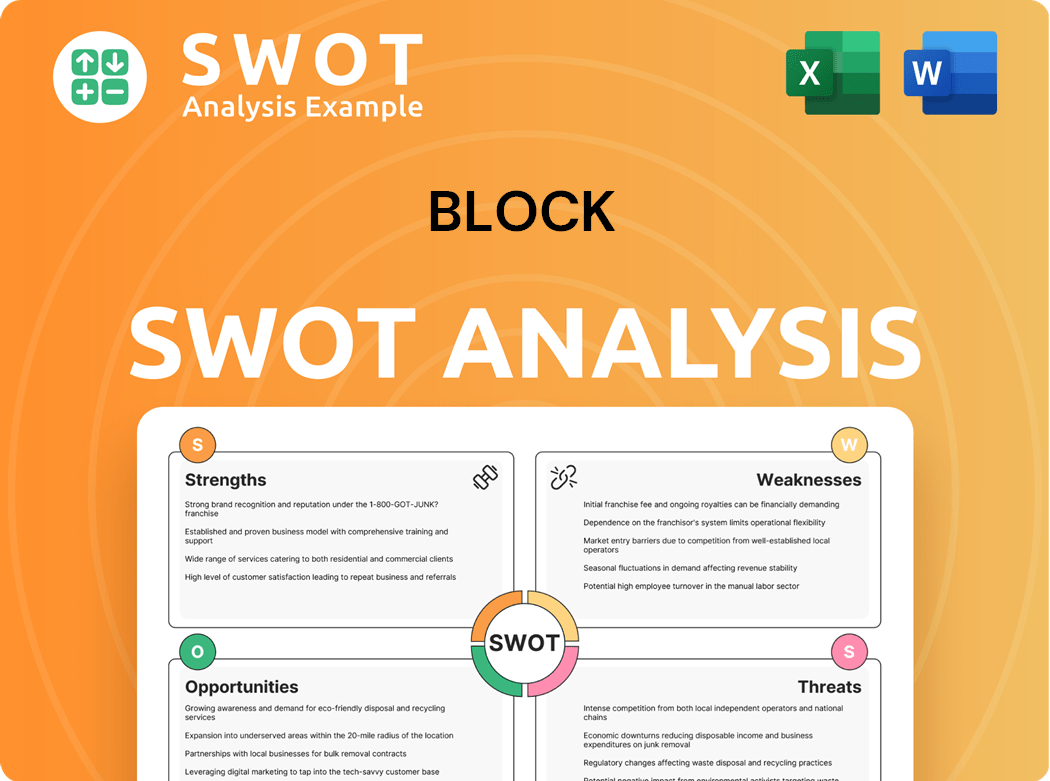

Block SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Block’s Customers Want?

Understanding the needs and preferences of its diverse customer base is crucial for the success of Block Company. The company's approach involves tailoring its products and marketing strategies to resonate with distinct customer segments, ensuring relevance and driving engagement. This customer-centric focus allows Block to maintain a competitive edge in the rapidly evolving financial technology landscape.

For its B2B and B2C customers, Block Company employs different strategies to meet their needs. By understanding the motivations and behaviors of each group, the company can optimize its offerings and communication to maximize customer satisfaction and loyalty. This targeted approach is essential for achieving sustainable growth and market leadership.

The company's success hinges on its ability to provide solutions that address the unique challenges and aspirations of its customers. This involves a deep understanding of their needs, preferences, and behaviors. By continuously adapting and innovating, Block Company aims to remain at the forefront of the fintech industry, delivering value and driving financial empowerment for all its users.

Square's B2B customers, primarily small business owners, are driven by the need for operational efficiency and simplified payment acceptance. They seek integrated solutions that manage sales, inventory, and payroll seamlessly. The psychological driver often involves a desire for control and business growth, with Square enabling them to professionalize operations.

Cash App's B2C users prioritize convenience, accessibility, and financial autonomy. They are motivated by the ability to send and receive money instantly, manage spending, and access investment opportunities. The aspirational driver often includes achieving financial independence and participating in emerging financial trends.

Customer feedback has consistently influenced product development, leading to features like enhanced analytics and more flexible hardware options. Block Company adapts its offerings to address customer preferences, illustrating how product features and marketing are customized to meet distinct demands. This iterative approach ensures that products remain relevant and user-friendly.

Block tailors its marketing for Cash App by highlighting its simplicity and speed, often leveraging social media trends and influencer partnerships. Both segments value security and transparent fee structures. The company's marketing efforts are designed to resonate with the target audience, driving user acquisition and engagement.

Product development is heavily influenced by customer feedback. Square's features, such as enhanced analytics, address specific pain points across various industries. Cash App's user-friendly interface and transaction speed are key to its appeal. This customer-centric approach ensures that products meet evolving market demands.

Both Square and Cash App prioritize security and transparent fee structures. This focus builds trust and encourages long-term customer loyalty. Clear and understandable fee structures are essential for maintaining customer satisfaction and confidence in the services offered.

The needs of Block Company's target market vary depending on the product. Square customers value efficiency, ease of use, and financial tools. Cash App users prioritize convenience, accessibility, and financial autonomy. Understanding these needs is crucial for product development and marketing strategies.

- Operational Efficiency: Square's B2B customers seek tools to streamline operations.

- Financial Autonomy: Cash App users desire control over their finances.

- Ease of Use: Both segments appreciate user-friendly interfaces and simple processes.

- Security: Customers prioritize secure transactions and data protection.

- Transparent Fees: Clear and understandable fee structures build trust.

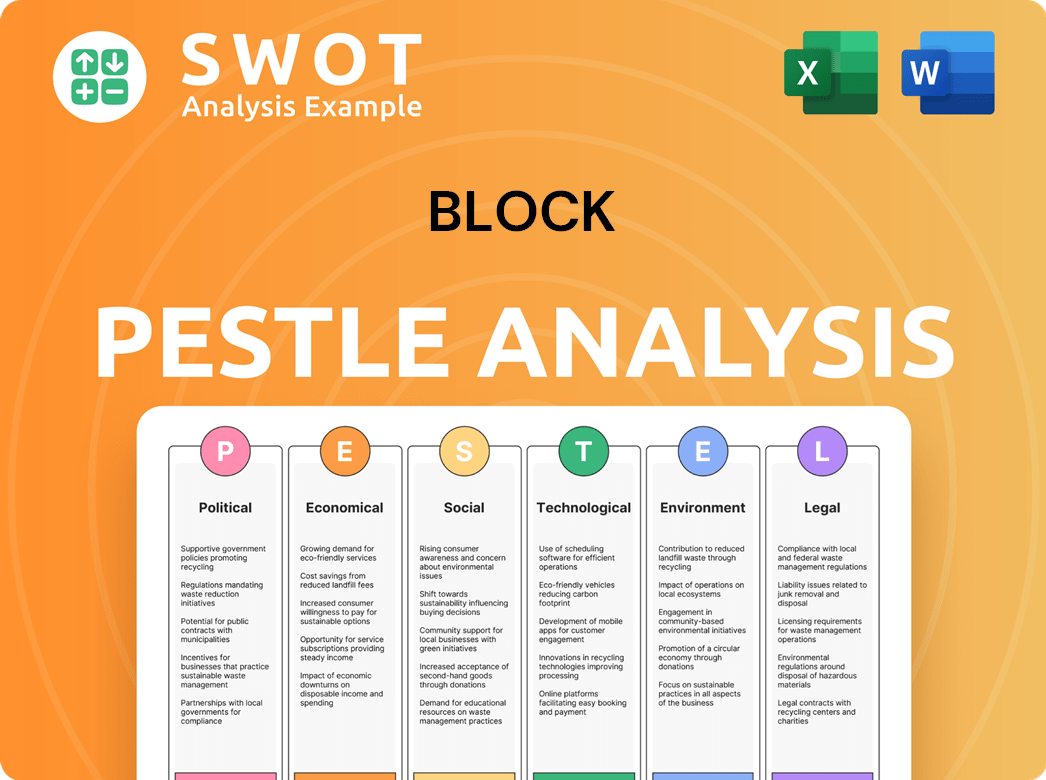

Block PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Block operate?

The geographical market presence of Block, Inc. is primarily concentrated in North America, with a strong foothold in the United States. The company has expanded its operations internationally, targeting key markets to broaden its reach. Block's strategy involves adapting its offerings to suit local regulations and consumer preferences in various regions.

The United States serves as Block's largest market, where both Square and Cash App have achieved significant adoption. This widespread use is seen across all states, with a higher concentration in major metropolitan areas. Square's market share is particularly robust among small businesses in urban and suburban settings, while Cash App has a broad user base across diverse demographics nationwide.

Beyond the U.S., Block has strategically expanded into countries like Canada, Australia, Japan, and several European nations, including the UK. These expansions are part of Block's strategy to diversify its revenue streams and capitalize on the growing demand for digital payments and financial technology globally. This expansion is crucial for Block's future growth, as it continuously analyzes market opportunities and potential for further penetration.

Block's success in the U.S. market is evident through the widespread adoption of Square and Cash App. Square's point-of-sale (POS) systems are prevalent in small businesses, while Cash App has a large user base. This strong presence in the U.S. provides a solid foundation for Block's overall financial performance.

Block's international expansion strategy focuses on adapting its services to local markets. This includes customizing payment methods, currency options, and business management tools to meet regional demands. The company's approach ensures that its products resonate with local audiences.

Block uses market segmentation to target different customer groups effectively. Square focuses on small businesses, while Cash App appeals to a broader consumer base. This segmentation allows Block to tailor its products and marketing efforts to meet specific customer needs.

International expansion is a key area for Block's future revenue diversification. The company continuously analyzes market opportunities to increase its global presence. This strategic approach supports Block's long-term growth and market leadership.

Analyzing the geographical market presence of Block Company reveals a strategic focus on both domestic and international markets. The company's success in the U.S. is a cornerstone, with expansion efforts designed to capitalize on the global trend toward digital financial services. For more insights into the company's broader strategy, consider reading about the Marketing Strategy of Block.

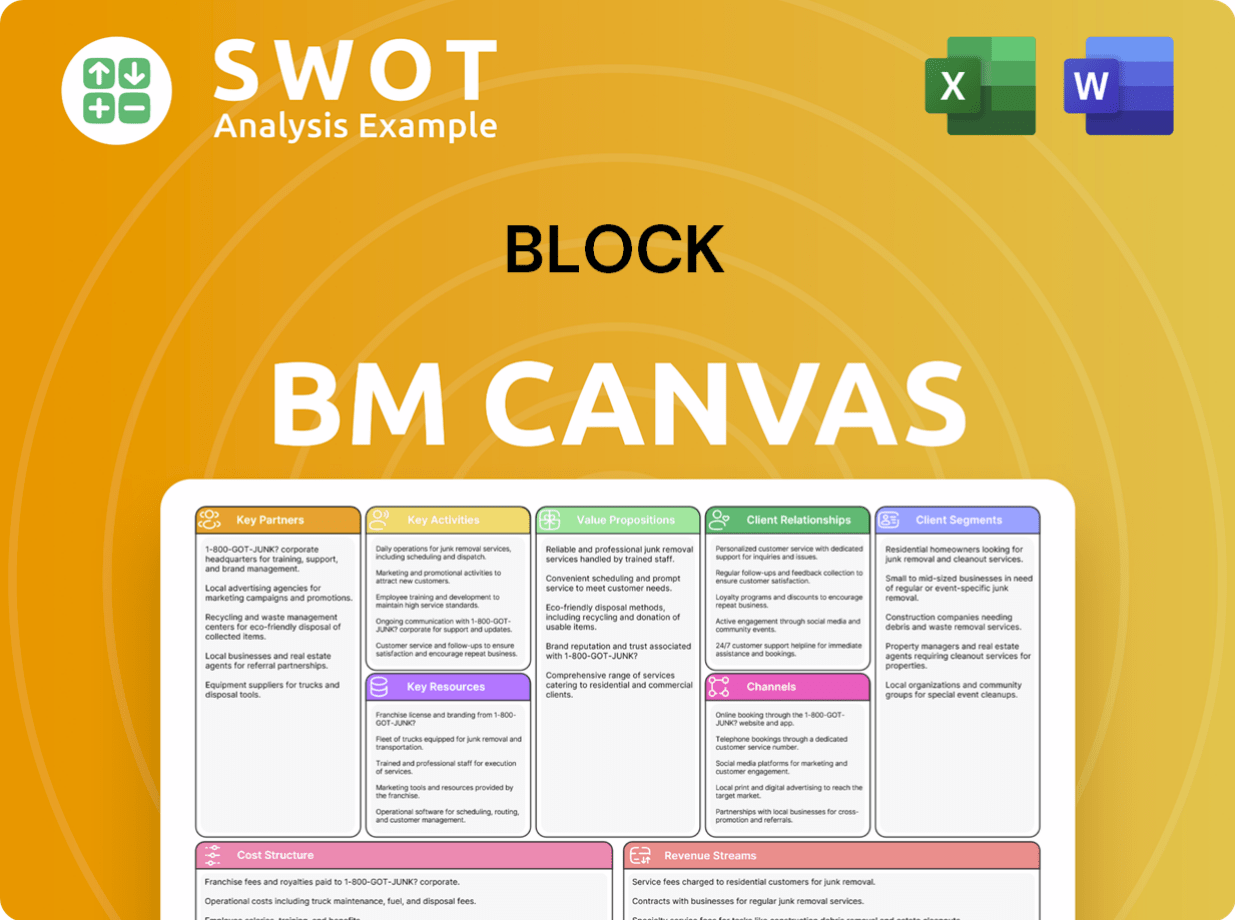

Block Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Block Win & Keep Customers?

The customer acquisition and retention strategies employed by the company, often referred to as the company, are multifaceted, utilizing both digital and traditional methods to reach its diverse customer base. These strategies are tailored for its two primary platforms, Square and Cash App, each targeting distinct segments within the broader market. Understanding the demographics and target market is crucial for the company's success.

For Square, the focus is on attracting small to medium-sized businesses (SMBs) with integrated business solutions. Cash App, on the other hand, targets a younger demographic, emphasizing peer-to-peer payments and financial services. These distinct approaches reflect the company's strategy to cater to a wide range of financial needs, from business management to personal finance.

The company invests heavily in customer data analytics and CRM systems to segment its users and target campaigns effectively. This data-driven approach allows for personalized marketing messages and the suggestion of relevant features, enhancing customer engagement and loyalty. The company's strategic focus on customer acquisition and retention is crucial for its long-term growth and market position. To learn more about the company's overall strategy, you can read about the Growth Strategy of Block.

Square primarily uses online advertising, search engine marketing (SEM), and content marketing. These efforts showcase the benefits of its integrated business solutions. Word-of-mouth referrals and strategic partnerships with industry associations also play a significant role in attracting new customers. Sales tactics include freemium models and introductory offers.

Cash App heavily relies on viral marketing, social media campaigns, and peer-to-peer referrals, often incentivized with bonuses for new sign-ups. Influencer marketing is particularly effective in reaching younger demographics. The app's user-friendly interface and the network effect are crucial for acquisition.

Retention strategies for Square customers focus on continuous product innovation, robust customer support, and providing tools that enhance business growth. Analytics and payroll services are key, increasing reliance on the Square ecosystem. The company's aim is to increase customer lifetime value.

Retention for Cash App users is driven by expanding functionalities beyond peer-to-peer payments, including direct deposit, stock and Bitcoin investing, and debit card services. Personalization, based on customer data and usage patterns, is crucial for tailoring marketing messages and suggesting relevant features.

The company's strategy includes cross-selling between Square and Cash App, aiming to increase customer lifetime value. As of Q1 2024, Cash App had over 80 million monthly active users. Square processed $57.9 billion in gross payment volume (GPV) in Q1 2024. These figures demonstrate the scale of the company's customer base and the effectiveness of its acquisition and retention strategies. The company continues to evolve its strategies, with a greater emphasis on integrating its services to provide a comprehensive financial ecosystem.

- Customer Demographics: The company's customer base is diverse, with Square catering to SMBs and Cash App attracting a younger demographic.

- Market Segmentation: The company segments its market based on business needs (Square) and personal finance preferences (Cash App).

- Customer Behavior Analysis: The company uses customer data to understand purchase patterns and tailor its services.

- Reaching Target Audience: The company uses online advertising, social media, and influencer marketing to reach its target audience.

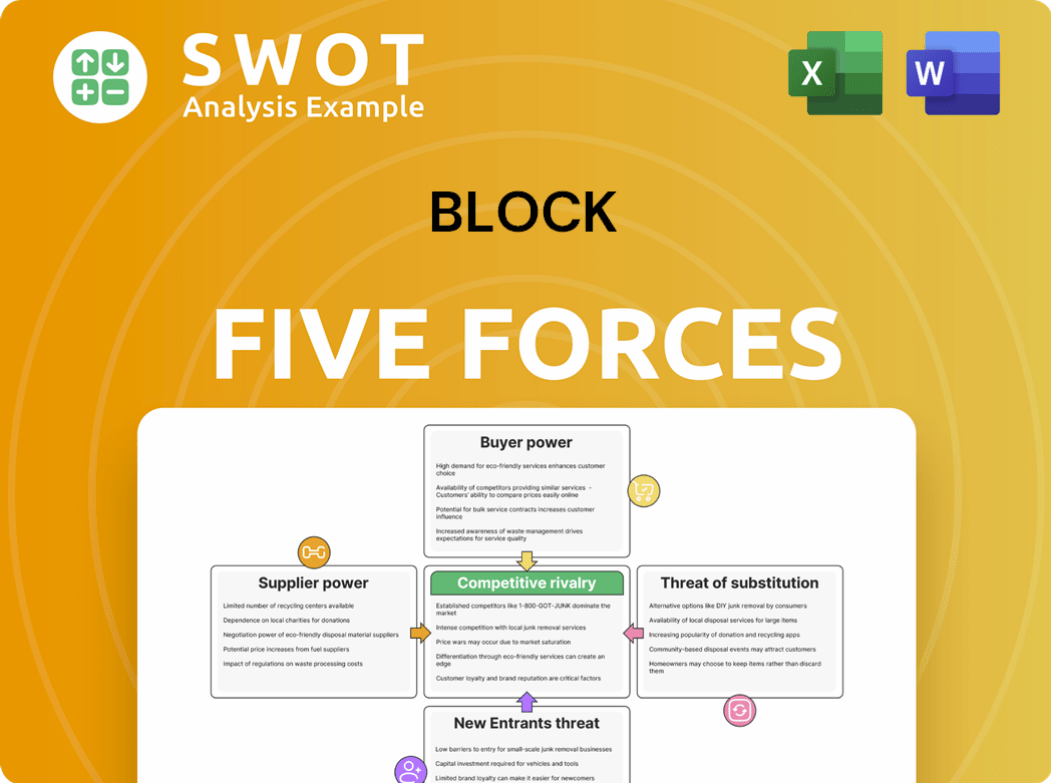

Block Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Block Company?

- What is Competitive Landscape of Block Company?

- What is Growth Strategy and Future Prospects of Block Company?

- How Does Block Company Work?

- What is Sales and Marketing Strategy of Block Company?

- What is Brief History of Block Company?

- Who Owns Block Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.