CNO Financial Group Bundle

What's the Story Behind CNO Financial Group?

Ever wondered about the journey of a leading CNO Financial Group SWOT Analysis? From its humble beginnings in 1979, this American financial services powerhouse has steadily grown, adapting to the ever-changing landscape of the insurance and financial services industry. This brief history of CNO Financial Group will uncover the key milestones, strategic shifts, and the vision that shaped this company.

CNO Financial Group's history reflects a commitment to serving middle-income Americans with essential financial products. The company's evolution, marked by strategic acquisitions and a focus on customer needs, has solidified its position in the market. Understanding the CNO history, including its early days as Security National of Indiana Corp., is crucial for investors and anyone interested in the trajectory of this prominent insurance company.

What is the CNO Financial Group Founding Story?

The story of CNO Financial Group, a prominent player in the financial services sector, began in 1979. Founded as Security National of Indiana Corp., the company has evolved significantly over the years. This evolution has seen it grow into a major provider of insurance and financial products.

The company's headquarters are located in Carmel, Indiana. The early focus was on providing essential financial products to a specific demographic. The initial vision laid the groundwork for the company's future growth and expansion.

The company's co-founder, Stephen Hilbert, played a key role in its establishment. David Deeds is also credited as a co-founder, though specific details about his background are not extensively detailed in the provided information. The founders recognized a need for accessible financial products.

The primary goal was to offer life and health insurance, annuities, and supplemental health insurance to middle-income Americans.

- The distribution strategy involved independent agents, career agents, and direct-to-customer channels.

- Acquisitions were a crucial part of the company's growth strategy, starting with the purchase of Consolidated National Life Insurance Co. in 1983.

- The company, then known as Conseco, expanded its portfolio through acquisitions, including Lincoln Income Life Insurance Company and Bankers National Life Insurance Company in 1986.

- CNO Financial Group went public in 1985.

The original business model centered on distributing insurance products through various channels. This multifaceted approach was designed to reach a broad customer base. The company's early strategies set the stage for its future expansion and market presence.

An aggressive acquisition strategy was a hallmark of the company's early years. This approach allowed the company to expand its offerings and market reach. The acquisition of companies like Lincoln Income Life Insurance Company and Bankers National Life Insurance Company significantly bolstered its position in the insurance market. For more insights into the target market of CNO Financial Group, explore this article: Target Market of CNO Financial Group.

The company's initial public offering in 1985 marked a significant milestone. This event provided capital for further growth and expansion. These early strategic decisions and financial moves shaped the trajectory of CNO Financial Group.

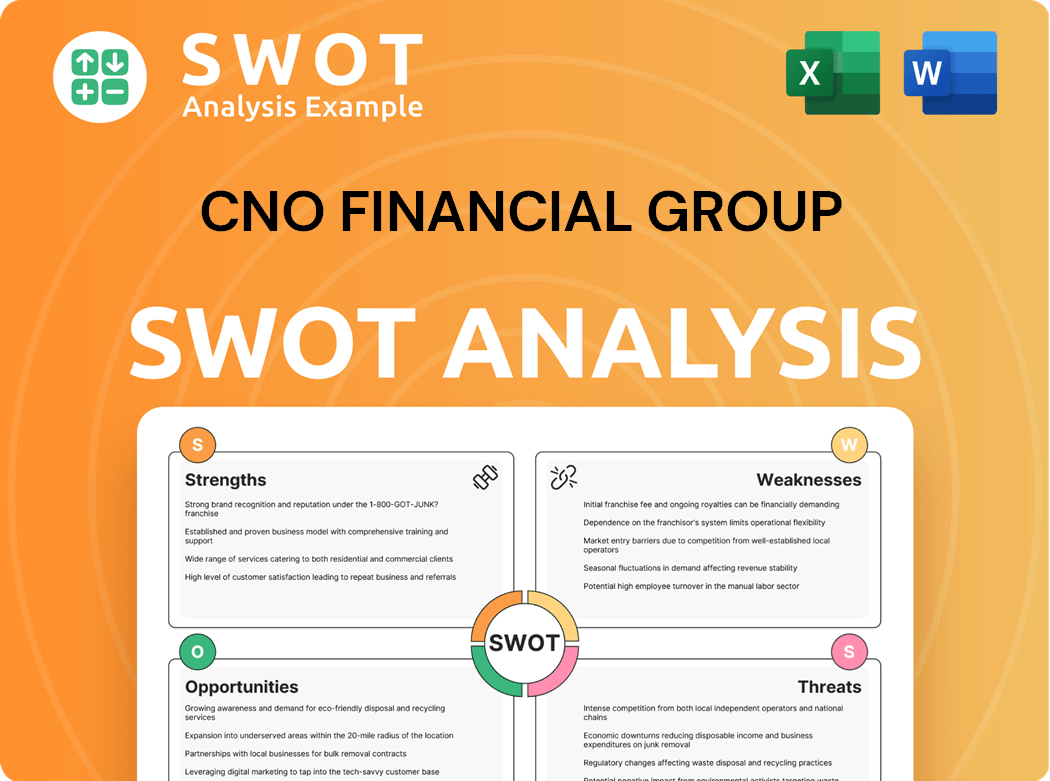

CNO Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of CNO Financial Group?

The early years of CNO Financial Group, then known as Conseco Inc., were marked by significant expansion through strategic acquisitions. This CNO history shows the company's aggressive growth strategy. Starting as Security National of Indiana Corp. in 1979, it went public in 1985 and quickly began acquiring other companies to broaden its portfolio.

In 1986, Conseco acquired Lincoln Income Life Insurance Company for $32.3 million and Bankers National Life Insurance Company for $118 million. These acquisitions were key steps in building its presence in the

Despite its rapid growth, Conseco faced major challenges. The company underwent a Chapter 11 reorganization in 2002, emerging in 2003, which was one of the largest bankruptcy filings in U.S. history at the time. Following the bankruptcy, Conseco divested Greentree and refocused on the insurance sector.

A pivotal moment occurred on May 11, 2010, when Conseco Inc. officially became CNO Financial Group, Inc. This change was intended to distinguish the holding company from its operating insurance subsidiaries. This strategic move aimed to clarify the

In January 2020, CNO Financial Group realigned its operating model, moving from three business segments to two divisions: Consumer and Worksite. This restructuring aimed to streamline operations and create a more customer-focused approach. The company anticipated a reduction of approximately 230 positions across its corporate offices, while also adding about 20 new roles in key areas.

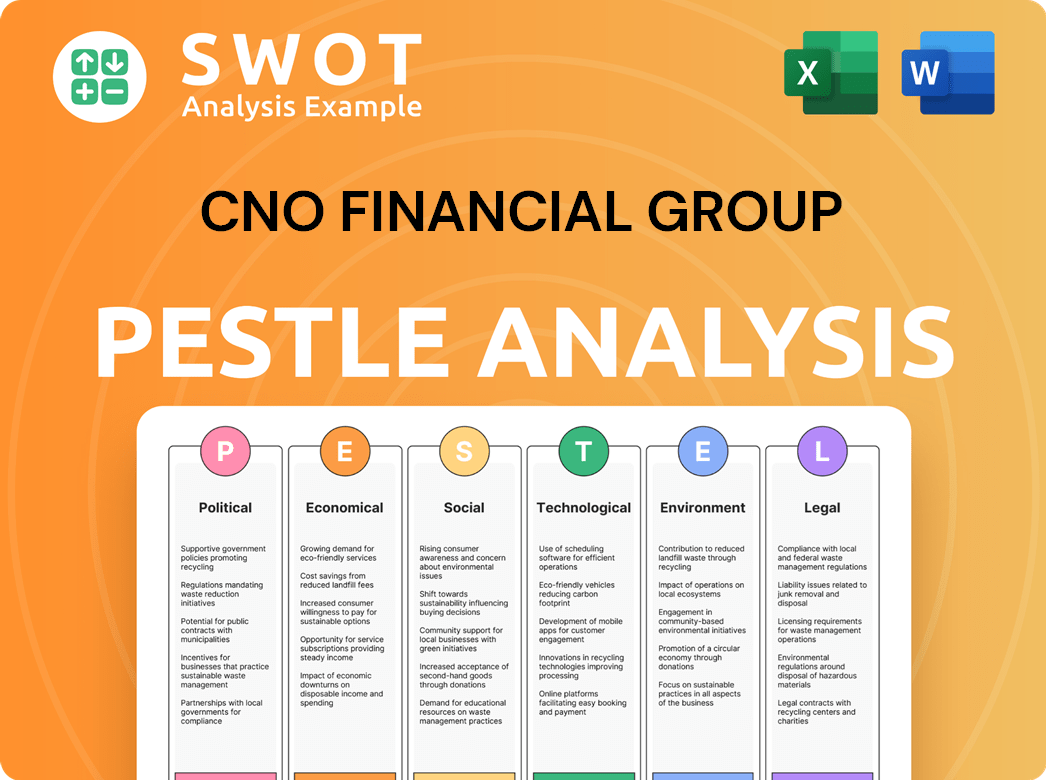

CNO Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in CNO Financial Group history?

The CNO Financial Group has a rich CNO history marked by significant milestones. The insurance company has evolved significantly over time, adapting to market changes and expanding its financial services offerings. This company timeline reflects its resilience and strategic growth.

| Year | Milestone |

|---|---|

| 2002-2003 | Successfully emerged from Chapter 11 reorganization, showcasing its ability to restructure and refocus on its core insurance business. |

| 2010 | Rebranded to CNO Financial Group, signaling a new chapter and a strategic shift from past challenges. |

| 2024 | Washington National, a CNO subsidiary, launched a new Hospital Indemnity Insurance product, expanding its product offerings. |

CNO Financial Group consistently focuses on innovation to better serve its customers. In February 2024, CNO Financial Group partnered with Cognizant to enhance its technology services, using industry-leading delivery frameworks.

CNO Financial Group offers a diverse portfolio of life and health insurance, annuities, and financial services to meet the needs of middle-income Americans. This diversification helps the company manage risk and cater to a broad customer base.

The partnership with Cognizant in 2024 demonstrates CNO Financial Group's commitment to leveraging technology. This collaboration aims to improve operational efficiency and enhance customer service through advanced delivery frameworks.

CNO Financial Group has invested in employee well-being and corporate social responsibility. The company has been recognized as a 'Great Place to Work' and a 'Healthiest Workplace in America' for its wellness programs.

CNO Financial Group has faced challenges, including adapting to market volatility and evolving consumer preferences. The 2020 restructuring, which involved workforce reductions, aimed to create a leaner, more customer-centric organization.

The company must navigate fluctuations in the financial markets and adapt to changing economic conditions. This requires strategic planning and risk management to maintain financial stability.

Evolving consumer demands and preferences require CNO Financial Group to continuously innovate its products and services. This includes offering digital solutions and personalized customer experiences.

The 2020 restructuring, which involved workforce reductions of approximately 230 positions, aimed to streamline operations. The expected annual savings of $22 million, with half reinvested in technology and growth, demonstrates the company's commitment to efficiency.

Despite these challenges, CNO Financial Group has maintained strong financial performance. The 16.4% return on equity in 2024, up from 14.0% in 2023, highlights its strategic adaptability and resilience. For more insights, explore the Revenue Streams & Business Model of CNO Financial Group.

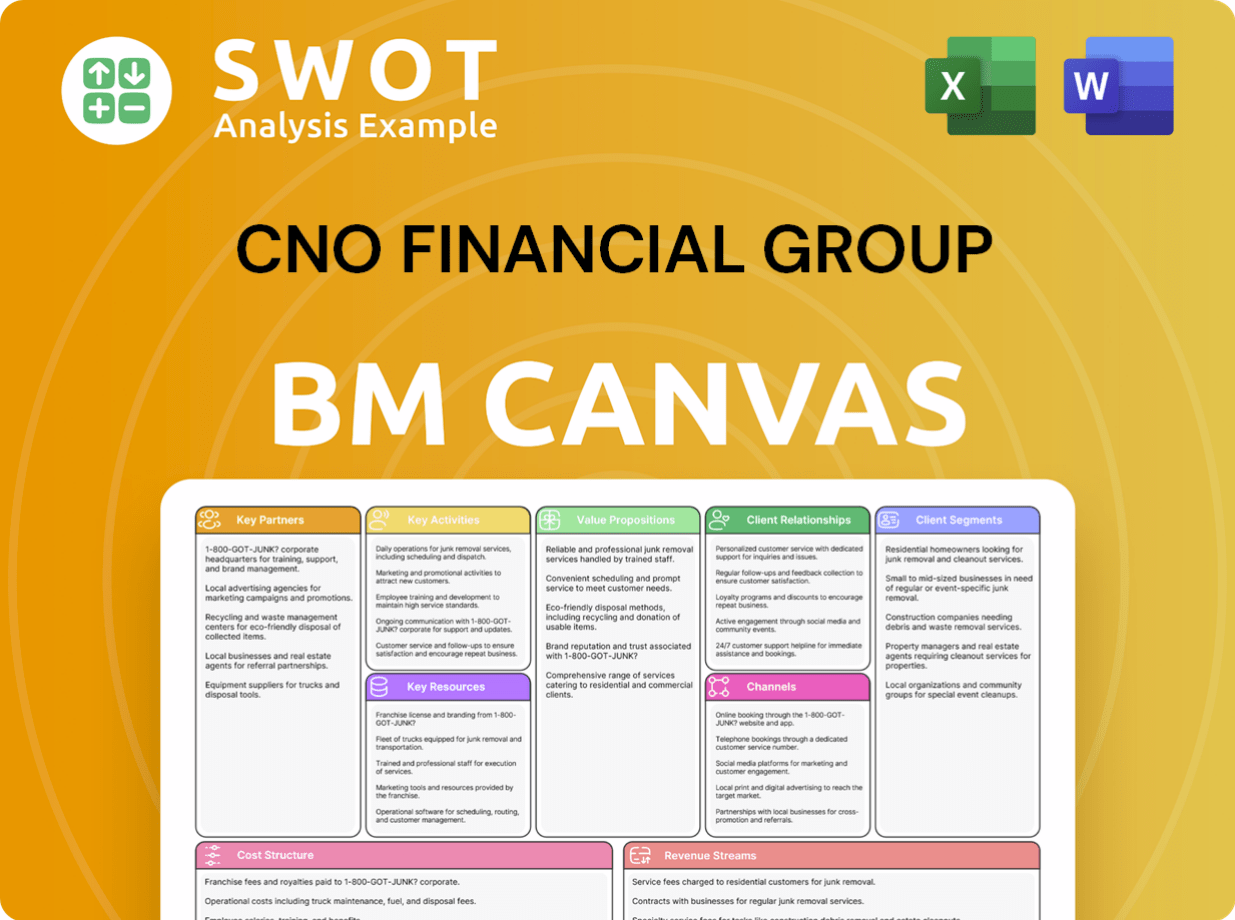

CNO Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for CNO Financial Group?

The CNO Financial Group has a rich history characterized by strategic acquisitions, financial restructuring, and a consistent focus on its core business. Here is a brief overview of the company's evolution, highlighting key milestones and transformations over the years.

| Year | Key Event |

|---|---|

| 1979 | Incorporated as Security National of Indiana Corp. by Stephen Hilbert. |

| 1983 | Acquired Consolidated National Life Insurance Co. |

| 1985 | Became a public company. |

| 1986 | Acquired Lincoln Income Life Insurance Company and Bankers National Life Insurance Company. |

| 1998 | Purchased Greentree Financial and Colonial Penn Life Insurance Company. |

| 2002-2003 | Underwent Chapter 11 reorganization, emerging after nine months. |

| 2010 | Officially changed holding company name from Conseco Inc. to CNO Financial Group, Inc. |

| 2015 | Sold its Hyderabad-based India operations to Cognizant. |

| January 2020 | Announced a corporate restructuring, realigning into Consumer and Worksite divisions and reducing workforce by approximately 230 positions. |

| February 2024 | Partnered with Cognizant for technology services. |

| September 2024 | Washington National launched the Hospital Indemnity Insurance product. |

| December 2024 | ESG Risk Rating updated to 17.31 (Low Risk). |

| February 2025 | Reported full-year 2024 net income of $404.0 million, a 46% increase from 2023, and returned $349.3 million to shareholders, a 50% increase from 2023. |

| March 2025 | Ex-dividend date for common stock. |

| April 2025 | Reported Q1 2025 net operating income of $81.1 million, or $0.79 per diluted share, up from $57.5 million, or $0.52 per diluted share in Q1 2024. Annuity collected premiums up 12% and client assets in brokerage and advisory up 9.4%. |

CNO Financial Group is poised for continued growth, driven by its strategic initiatives and strong financial performance. The company's leadership is confident in its ability to navigate market conditions and capitalize on favorable demographic trends. CNO's focus on ROE expansion and sustained sales growth is expected to build on its successful 2024 results.

The company's commitment to financial stability and shareholder returns is evident in its recent results. Full-year 2024 saw a 46% increase in net income to $404.0 million and a 50% increase in returns to shareholders, reaching $349.3 million. In Q1 2025, net operating income rose to $81.1 million, or $0.79 per diluted share, surpassing the $57.5 million, or $0.52 per diluted share from Q1 2024.

CNO Financial Group is investing in technology and growth to enhance its customer-centric approach across its consumer and worksite divisions. The company's focus on expanding its agent count, which grew by 3% in Q1 2025 compared to Q1 2024, and its new money rates exceeding 6% for nine consecutive quarters, are key drivers of its strategic plans.

CNO Financial Group aims to maintain its strong position in the financial services sector by focusing on core areas. These include production, agent force metrics, policyholder persistency, underwriting margin, capital management, and investment management. The company's commitment to protecting middle-income Americans and helping them plan for their financial futures underscores its mission.

CNO Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of CNO Financial Group Company?

- What is Growth Strategy and Future Prospects of CNO Financial Group Company?

- How Does CNO Financial Group Company Work?

- What is Sales and Marketing Strategy of CNO Financial Group Company?

- What is Brief History of CNO Financial Group Company?

- Who Owns CNO Financial Group Company?

- What is Customer Demographics and Target Market of CNO Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.