CNO Financial Group Bundle

How Does CNO Financial Group Stack Up in Today's Market?

In the ever-changing financial services sector, understanding the CNO Financial Group SWOT Analysis is crucial for investors and strategists alike. This analysis delves into the competitive landscape, revealing key players and strategies. We'll explore how CNO Financial Group navigates the complexities of the insurance industry and financial services, focusing on its market position and financial performance.

This examination of CNO Financial Group's competitive landscape will uncover its key competitors and strategic initiatives. We'll analyze CNO Financial Group's strengths and weaknesses, providing insights into its competitive advantages and growth strategies. Furthermore, we'll assess the company's challenges and industry outlook, offering a comprehensive view of its position within the financial services market, including its market share.

Where Does CNO Financial Group’ Stand in the Current Market?

CNO Financial Group's market position is firmly established within the U.S. insurance industry, particularly targeting middle-income Americans. The company offers a suite of financial products, including life and health insurance, annuities, and supplemental health plans, tailored to meet the specific needs of its customer base. CNO operates through well-known brands such as Bankers Life and Casualty Company, Colonial Penn Life Insurance Company, and Washington National Insurance Company, each contributing to its comprehensive service offerings.

The company's focus on the middle-income market allows it to concentrate its resources and expertise on a specific demographic. CNO's strategic acquisitions and consistent profitability underscore its significant presence in this niche. Its multi-channel distribution network, which includes career agents, direct marketing, and independent distributors, ensures broad reach across the United States.

CNO Financial Group's financial performance in 2023 reflects its stability and market strength. The company reported a net income of $197.8 million for the full year, demonstrating a solid financial health. Furthermore, total assets reached $33.0 billion as of December 31, 2023, which highlights its substantial scale within the insurance and financial services sector.

CNO Financial Group's core operations revolve around providing insurance and financial services to middle-income Americans. This includes a variety of products such as life insurance, health insurance, and annuities. The company distributes these products through multiple channels, including a dedicated sales force and direct marketing efforts.

CNO Financial Group offers value by providing financial security and peace of mind to its target demographic. It focuses on serving the needs of middle-income individuals and families. The company's diverse product offerings and multi-channel distribution strategy enhance accessibility and cater to a wide range of financial needs.

CNO Financial Group maintains a strong national presence across the United States. Its operations span the entire country, ensuring that its products and services are accessible to a wide range of customers. The company's extensive distribution network supports its ability to effectively serve diverse customer segments.

CNO Financial Group's customer base primarily consists of middle-income Americans. The company tailors its products and services to meet the specific financial needs of this demographic. This focus allows CNO to build strong relationships with its customers and provide relevant solutions.

CNO Financial Group's market position is strengthened by its focus on the middle-income market and its multi-channel distribution strategy. The company's financial performance, including its net income of $197.8 million in 2023 and total assets of $33.0 billion, demonstrates its stability and significant presence in the insurance industry. Strategic initiatives and acquisitions have further solidified its position.

- Strong presence in the middle-income market.

- Multi-channel distribution network.

- Consistent financial performance.

- Strategic focus on profitable growth.

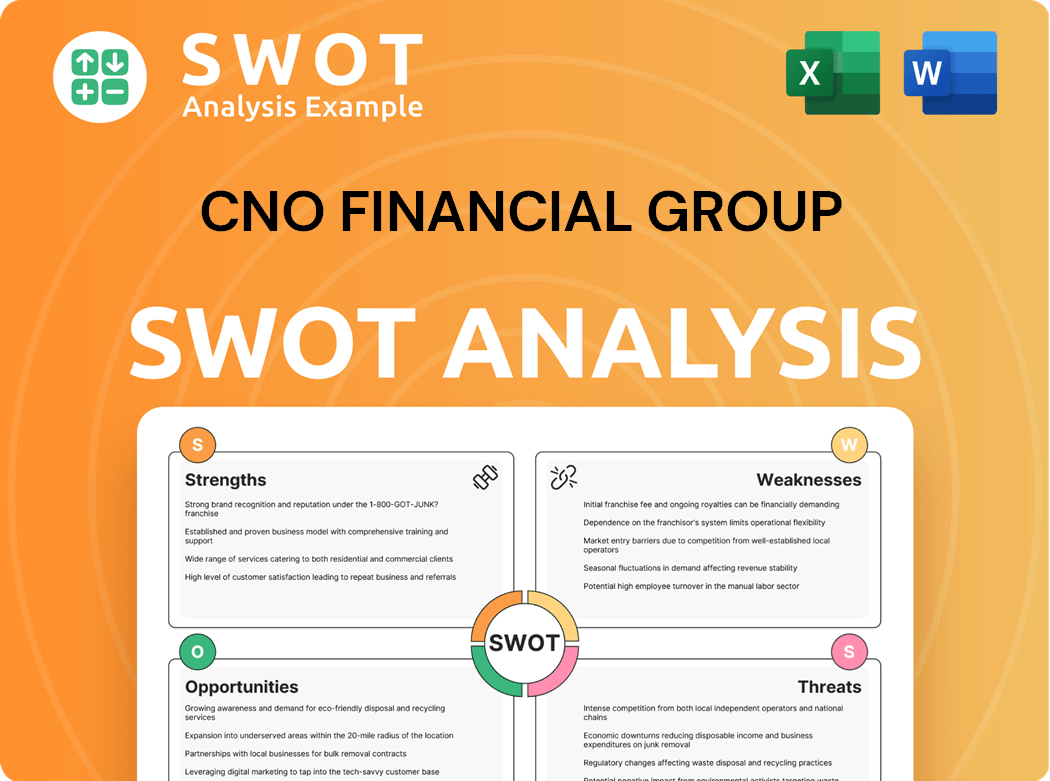

CNO Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging CNO Financial Group?

The CNO Financial Group operates within a dynamic competitive landscape, facing both direct and indirect competition in the insurance industry and broader financial services sectors. Understanding the key players and their strategies is crucial for assessing CNO Financial Group's market position and future prospects. This analysis considers both established competitors and emerging trends influencing the company's performance.

CNO Financial analysis reveals a focus on the middle-income market in the United States, with a product portfolio including life and health insurance, annuities, and supplemental health benefits. The competitive environment is shaped by the offerings of other insurance providers, as well as financial institutions that provide alternative financial products. The company's strategic initiatives and recent acquisitions, such as the 2023 acquisition of DirectPath, are designed to strengthen its competitive position.

Direct competitors to CNO Financial Group include insurance companies that offer similar products. These companies compete for market share by focusing on specific niches or distribution channels, like large sales forces or direct-to-consumer models. Indirect competition comes from financial service providers offering retirement planning, savings vehicles, and other financial products.

Direct competitors offer similar insurance products, including life, health, and supplemental insurance. These companies often target the same middle-income demographic as CNO Financial Group.

Primerica is a significant direct competitor, known for its term life insurance and financial services distributed through a large sales force. They focus on providing financial solutions to middle-income families.

Aflac specializes in supplemental insurance, offering products that complement traditional health insurance. They are a major player in the supplemental insurance market.

Various regional and niche-focused insurers also compete by targeting specific health or life insurance products. These companies often focus on specialized products or distribution strategies.

Indirect competitors include broader financial service providers that offer alternative financial products. These companies may compete for the same customer base by providing retirement planning or investment services.

These large, diversified financial institutions offer a wide range of products, including insurance and annuities. They often target a broader or higher-income demographic but can still compete for certain segments of CNO Financial Group's customer base.

The competitive dynamics are also influenced by Insurtech companies. These companies use technology to offer streamlined or personalized insurance solutions. The industry has seen some consolidation, with mergers and acquisitions impacting the competitive balance. For instance, CNO Financial Group’s acquisition of DirectPath in 2023 aimed to enhance its worksite health and benefits capabilities. For more insights into how CNO Financial Group is navigating the market, consider reading about the Growth Strategy of CNO Financial Group.

Several factors influence the competitive landscape for CNO Financial Group and its peers. These include product offerings, distribution channels, brand recognition, and pricing strategies.

- Product Innovation: The ability to develop and offer competitive insurance and financial products.

- Distribution Channels: Effective sales and marketing strategies, including agency networks, direct sales, and digital platforms.

- Customer Service: Providing excellent customer service to retain and attract customers.

- Technology Adoption: Utilizing technology to streamline operations, improve customer experience, and offer innovative solutions.

- Financial Strength: Maintaining a strong financial position to ensure stability and attract customers.

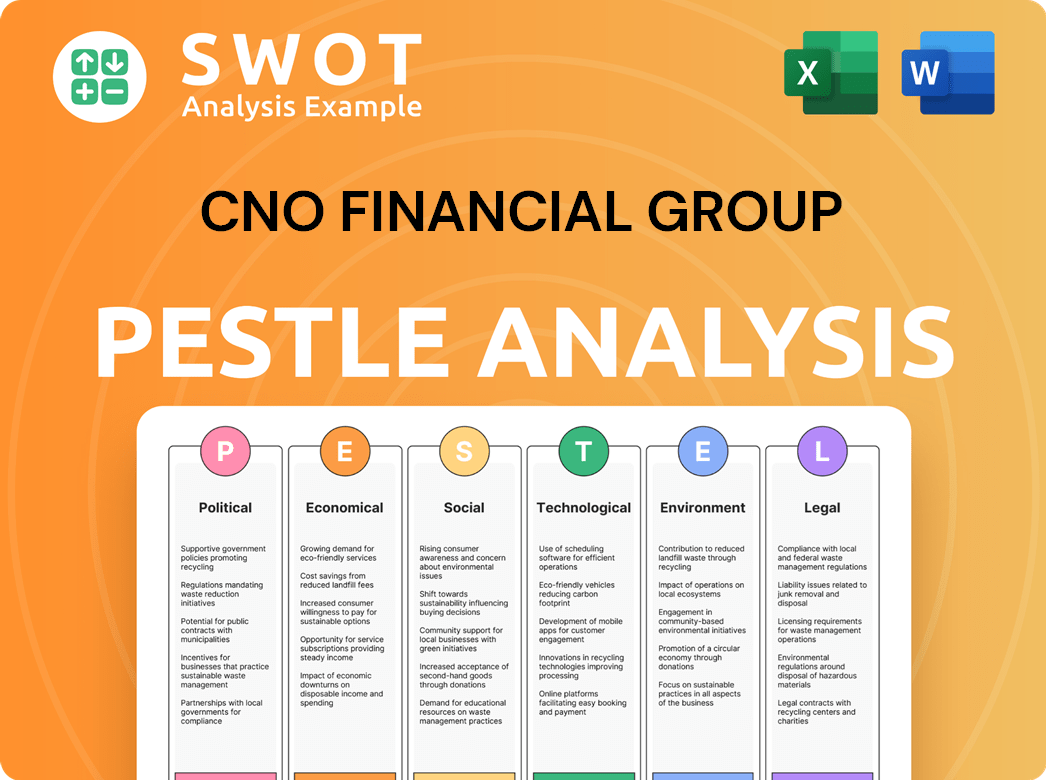

CNO Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives CNO Financial Group a Competitive Edge Over Its Rivals?

When examining the CNO Financial Group, understanding its competitive advantages is crucial for any CNO Financial analysis. The company has carved a niche within the insurance industry and financial services sector by focusing on the middle-income American demographic. This strategic focus, coupled with a multi-channel distribution network, allows it to maintain a strong market share.

CNO Financial Group's approach to the market is centered around understanding and serving the financial needs of a specific customer segment. This specialization allows for the tailoring of products and services, enhancing customer engagement and loyalty. The company's long-standing presence and established brands provide a solid foundation for sustained growth.

A deeper dive into the CNO Financial Group's operational strategies and financial performance reveals key strengths that set it apart in the competitive landscape. For a look at the company's origins, you can check out the Brief History of CNO Financial Group.

CNO Financial Group specializes in serving the middle-income American demographic, allowing for tailored product offerings and services. This focus enables the company to understand and meet the specific financial needs of this customer segment. This targeted approach helps in building stronger customer relationships and loyalty.

The company utilizes a multi-channel distribution network, including a career agency force, direct-to-consumer marketing, and independent agents. This diversified approach enhances its reach and flexibility in engaging with customers. It allows CNO Financial Group to offer a variety of options for customer interaction, whether in-person or online.

Brands like Bankers Life and Colonial Penn have strong brand equity and recognition within their target markets. This long-standing presence and established brand recognition foster customer trust and loyalty. The brands' reputation contributes to a competitive edge in the insurance and financial services market.

CNO Financial Group demonstrates financial stability through prudent financial management and disciplined underwriting practices. The company's consistent profitability and strong capital position, as seen in its 2023 results, provide a solid foundation. This financial strength supports growth and innovation in product development.

CNO Financial Group maintains a competitive edge through its focused customer base, multi-channel distribution, strong brand recognition, and financial stability. These advantages contribute to its sustainable growth and market position. The company's commitment to adapting to evolving customer preferences further strengthens its competitive standing.

- Specialization in the middle-income market.

- Diversified distribution channels.

- Established brand recognition.

- Prudent financial management.

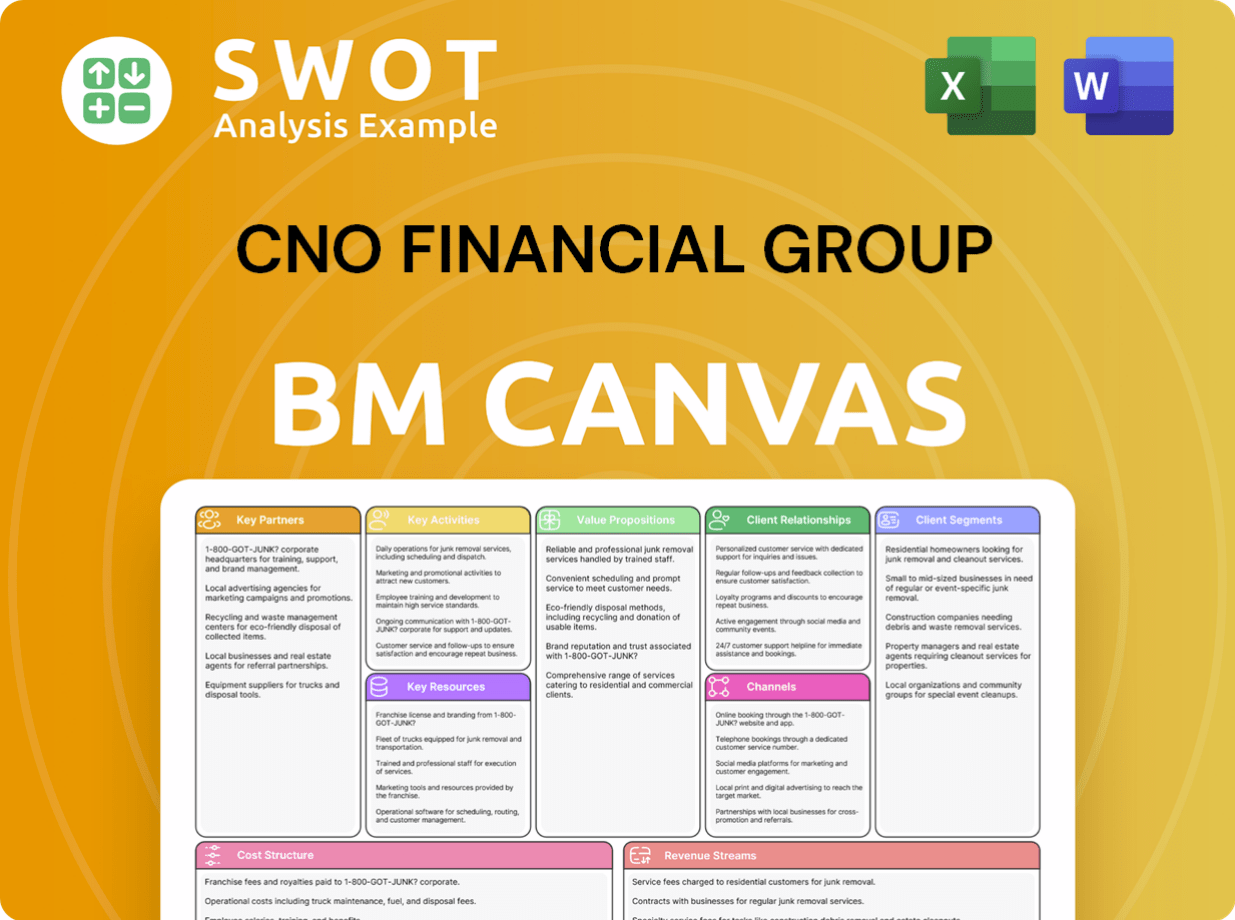

CNO Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping CNO Financial Group’s Competitive Landscape?

The insurance and financial services sector is experiencing significant shifts that impact companies like CNO Financial Group. These changes are driven by technological advancements, evolving consumer preferences, and regulatory pressures. Understanding these dynamics is crucial for assessing CNO Financial Group's competitive landscape and future prospects. The company's success hinges on its ability to adapt to these trends while navigating the inherent risks of the industry.

Analyzing CNO Financial Group's position requires considering its market share, financial performance, and strategic initiatives. The competitive environment includes both traditional insurance providers and emerging Insurtech companies. CNO Financial analysis involves evaluating its strengths, weaknesses, opportunities, and threats to determine its long-term sustainability and growth potential.

Technological advancements, including AI and data analytics, are reshaping the insurance industry. Consumer preferences are shifting towards digital solutions, demanding transparency and accessibility. Regulatory changes, particularly in data privacy and consumer protection, are also influencing the market.

Managing interest rate fluctuations and navigating an increasingly competitive landscape are key challenges. Economic downturns could impact the disposable income of CNO's target demographic. Adapting to Insurtech disruptors and maintaining profitability in a dynamic market are also crucial.

Expanding into underserved segments within the middle-income market presents a significant opportunity. Developing new products, such as those addressing long-term care and cybersecurity, can drive growth. Strategic partnerships and acquisitions can broaden capabilities and market reach.

CNO Financial Group is focusing on digital transformation to enhance customer experience and operational efficiency. The company is also investing in product innovation to meet evolving consumer needs. Strategic partnerships and acquisitions are being explored to expand market reach and capabilities.

CNO Financial Group's competitive advantages include its focus on the middle-income market and its established distribution network. However, the company faces challenges from competitors and economic uncertainties. For a deeper dive into the ownership structure and financial performance, see Owners & Shareholders of CNO Financial Group. Recent data indicates the insurance industry is experiencing a shift towards digital platforms, with Insurtech companies gaining market share. CNO Financial Group's ability to adapt to these changes will determine its future success. The company's revenue breakdown reveals a reliance on specific product lines, making diversification and innovation critical for sustained growth. The geographic presence of CNO Financial Group is primarily in the United States, creating both opportunities and risks tied to the U.S. economic outlook. The company's stock performance reflects investor confidence, which is influenced by its financial performance and strategic initiatives. The customer base of CNO Financial Group is primarily middle-income individuals and families, whose financial decisions are sensitive to economic conditions.

CNO Financial Group must strategically address several key areas to ensure its long-term success. This includes adapting to technological advancements and evolving consumer preferences. The company needs to manage risks associated with interest rate fluctuations and economic downturns.

- Digital Transformation: Investing in digital platforms and AI to improve customer experience and operational efficiency.

- Product Innovation: Developing new insurance products to meet the changing needs of the target demographic.

- Strategic Partnerships: Exploring partnerships and acquisitions to expand market reach and capabilities.

- Risk Management: Effectively managing interest rate risk and economic downturn impacts.

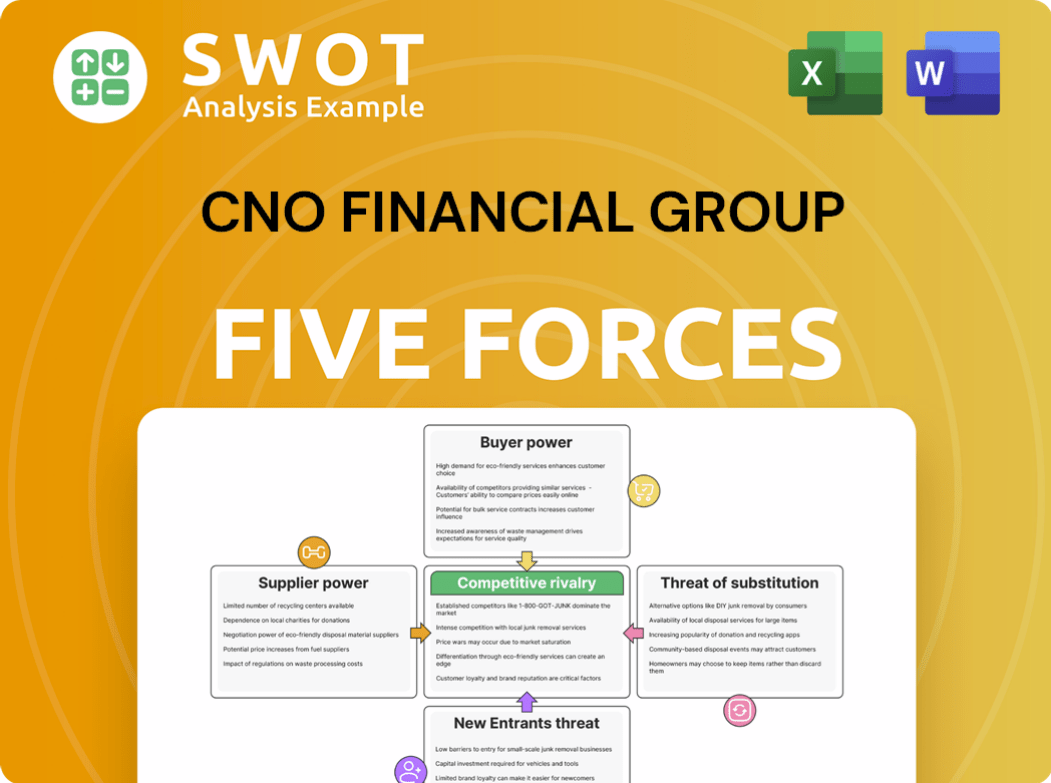

CNO Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CNO Financial Group Company?

- What is Growth Strategy and Future Prospects of CNO Financial Group Company?

- How Does CNO Financial Group Company Work?

- What is Sales and Marketing Strategy of CNO Financial Group Company?

- What is Brief History of CNO Financial Group Company?

- Who Owns CNO Financial Group Company?

- What is Customer Demographics and Target Market of CNO Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.