CNO Financial Group Bundle

Decoding CNO Financial Group's Customer Base: Who Are They?

In the ever-evolving financial landscape, understanding the CNO Financial Group SWOT Analysis is crucial for investors and strategists alike. The aging of the baby boomer generation and their increasing need for financial planning services is a key factor. This analysis will delve into the customer demographics and target market of CNO Financial Group, a leading provider of insurance and financial services. We'll explore how the company strategically positions itself to meet the needs of its core customer segments.

This exploration of CNO Financial Group's target market will provide valuable insights into the customer demographics of insurance customers and the company's approach to market segmentation. We'll examine the specific financial needs CNO Financial Group addresses, including CNO Financial Group customer age demographics, CNO Financial Group customer income levels, and CNO Financial Group's target market geographic location. By analyzing these factors, we can better understand the company's strategic focus and its ability to serve its ideal customers.

Who Are CNO Financial Group’s Main Customers?

The primary focus of CNO Financial Group is on the middle-income pre-retiree and retired American demographic. This Customer demographics is considered an attractive and underserved market with significant growth potential. The company strategically targets this group, offering a range of financial products and services designed to meet their specific needs. This focus allows for tailored marketing and product development, enhancing customer engagement and loyalty.

CNO Financial Group serves its target market through two main divisions: the Consumer Division and the Worksite Division. The Consumer Division, which includes brands like Bankers Life and Colonial Penn, directly serves individual consumers. The Worksite Division, operating under the Optavise brand, provides employee benefits programs to businesses, further extending CNO's reach within its Target market.

The company's strategic approach includes a diversified product portfolio tailored to the needs of its Insurance customers. This includes life and health insurance, annuities, and investment products. By offering a comprehensive suite of financial solutions, CNO aims to be a one-stop shop for its target demographic's financial needs, particularly as they approach and enter retirement. This strategy supports long-term customer relationships and revenue growth.

In 2024, annuity products were a significant part of CNO's portfolio, accounting for 41% of total premiums collected. Fixed indexed annuities represented 35% of total premium collections. This highlights the company's strong focus on providing retirement planning solutions, catering to the needs of its pre-retiree and retiree customer base.

Health insurance products, including supplemental health, Medicare supplement, and long-term care, comprised 37% of total premiums collected in 2024. Life insurance products accounted for 22%. The strong performance of Medicare Supplement insurance, with $372 million in direct written premiums and a 7.2% market share as of Q4 2023, demonstrates the company's success in this sector.

The Worksite Division, through its Optavise brand, provides employee benefits programs, extending CNO's reach within its target market. This division focuses on voluntary benefit life and health insurance products offered in the workplace, catering to the needs of employees and businesses. This segment broadens CNO's customer base and revenue streams.

The long-term care insurance segment is another key area, generating $845 million in annual revenue. This segment shows stable cash flow, approximately $215 million in 2023. This demonstrates the company's ability to provide financial security for its customers. It also contributes to the overall financial health of CNO Financial Group.

CNO Financial Group is confident in its growth strategies heading into 2025, driven by favorable macroeconomic and demographic trends, particularly the increasing demand for retirement income solutions. The company's focus on its target demographic, combined with its diversified product portfolio, has contributed to strong financial performance. Operating earnings per diluted share increased by 52% in Q1 2025 compared to the previous year.

- Market Segmentation allows CNO to tailor products and services.

- The company's focus on pre-retirees and retirees drives its product development.

- CNO's diversified product portfolio supports long-term customer relationships.

- The company's financial performance reflects its strategic focus.

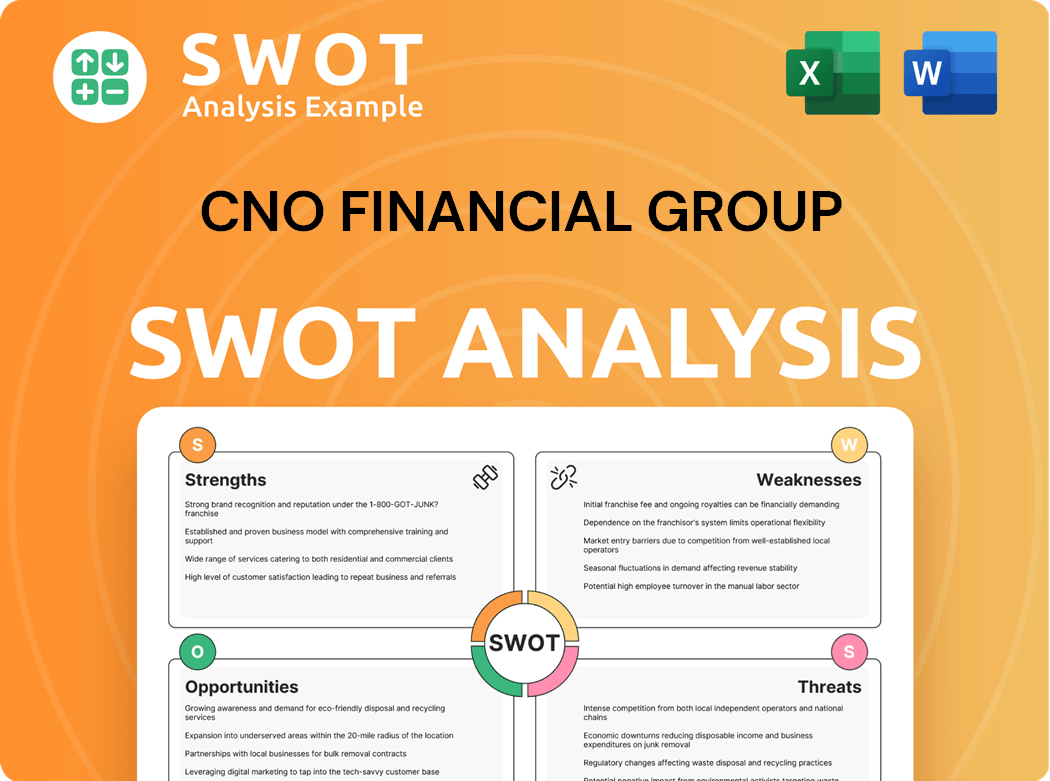

CNO Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do CNO Financial Group’s Customers Want?

Understanding the customer needs and preferences is crucial for companies like CNO Financial Group. The company's success hinges on its ability to meet the financial security needs of its target market. This involves offering products and services that resonate with their customers' desire for protection and peace of mind.

CNO Financial Group's approach focuses on providing accessible and easy-to-understand insurance and financial solutions. This customer-centric strategy is designed to build lasting relationships and ensure customer satisfaction. By addressing the specific needs of its target market, CNO Financial Group aims to foster loyalty and drive sustainable growth.

The primary focus of CNO Financial Group centers on addressing the financial needs of middle-income Americans, particularly those nearing or in retirement. Their core offerings include life and health insurance, annuities, and financial services. These products are designed to provide financial protection and retirement security, core needs for their target market.

Customers are driven by the desire for financial protection. This is especially true for those in the pre-retirement and retirement phases of life. The peace of mind that comes from securing their future and protecting loved ones is a key motivator.

Reliable retirement income is a critical need, particularly for those nearing or in retirement. CNO Financial Group aims to address this through its annuity products and brokerage/advisory services. These solutions are designed to provide a steady stream of income during retirement.

Customers value insurance products that are easy to understand and affordable. This is a key focus, especially with products like those offered by Colonial Penn. Simple, clear communication helps build trust and encourages purchasing decisions.

Providing professional guidance is essential, especially for middle-income customers. CNO Financial Group recognizes that accessible retirement products and expert advice are crucial. This support helps customers navigate complex financial decisions.

CNO Financial Group ensures its products are accessible to its target market. This includes offering a range of solutions that cater to different needs and budgets. Accessibility is a key factor in attracting and retaining customers.

Leveraging technology to enhance customer service is a priority. Web and digital channels generate a significant portion of new premiums. This focus improves customer experience and streamlines interactions.

CNO Financial Group's performance reflects the growing demand for its products. In Q1 2025, annuity collected premiums increased by 12%, marking the seventh consecutive quarter of growth. Client assets in brokerage and advisory services were up 16%, demonstrating strong customer demand.

- Annuity collected premiums have shown consistent growth, reflecting the effectiveness of retirement income solutions.

- The increase in client assets underscores the trust customers place in CNO Financial Group's financial services.

- The company's ability to introduce and refresh product offerings, like new insurance products in 2024, has led to double-digit sales growth. For example, critical illness (up 24%), accident (up 13%), and hospital indemnity (up 20%).

- The blended approach of virtual connections combined with a local, in-person agent force has proven successful in building lasting customer relationships.

- Web and digital channels contributed to 30% of the full-year direct-to-consumer new annualized premiums in 2024, highlighting the importance of technological investments.

The company's success is also driven by its ability to adapt to market trends and customer feedback. For more insights, you can read about the Growth Strategy of CNO Financial Group.

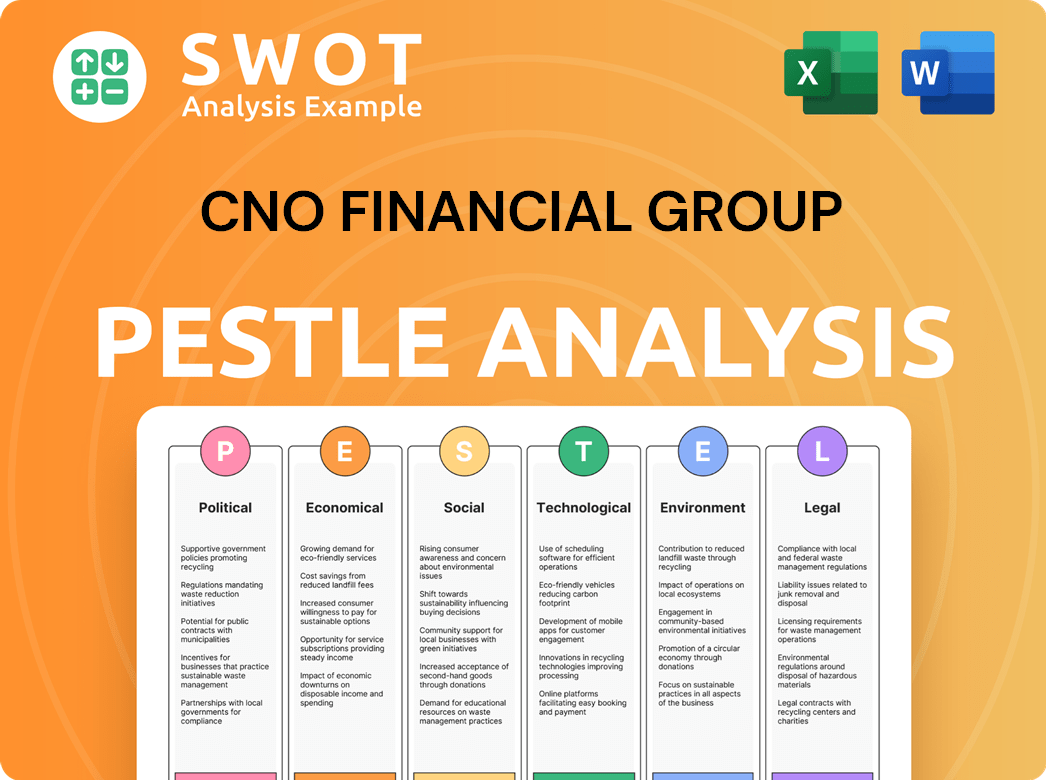

CNO Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does CNO Financial Group operate?

The geographical market presence of CNO Financial Group is predominantly within the United States. The company focuses on serving middle-income pre-retiree and retired Americans across the nation. CNO Financial Group has a well-established distribution network and operates in 38 states, ensuring a broad reach to its target market.

CNO Financial Group's strategic initiatives include geographical expansion, which has significantly contributed to its growth. This expansion strategy targets areas where the company sees opportunities to increase its market share. As of December 2024, CNO Financial Group has a strong presence across the country, with offices, associates, and agents in over 220 communities.

The company addresses the differences in customer demographics and preferences across regions through its diverse distribution channels and product portfolio. CNO Financial Group localizes its offerings by leveraging its exclusive agent force, direct marketing, and independent distributors to reach various segments within its target market. For example, Bankers Life focuses on Americans near or in retirement, while Colonial Penn targets middle-income retirees. The Worksite Division, through Optavise, provides employee benefits to businesses, further diversifying its reach. For more insights into the competitive landscape, consider reading about the Competitors Landscape of CNO Financial Group.

CNO Financial Group's geographic expansion initiative has been a consistent driver of growth. This strategy has contributed significantly to the growth of the Worksite Division's new annualized premium (NAP).

The Worksite Division saw record full-year insurance sales, up 16% in 2024, partly due to geographic expansion. This division's growth highlights the company's ability to adapt its distribution channels.

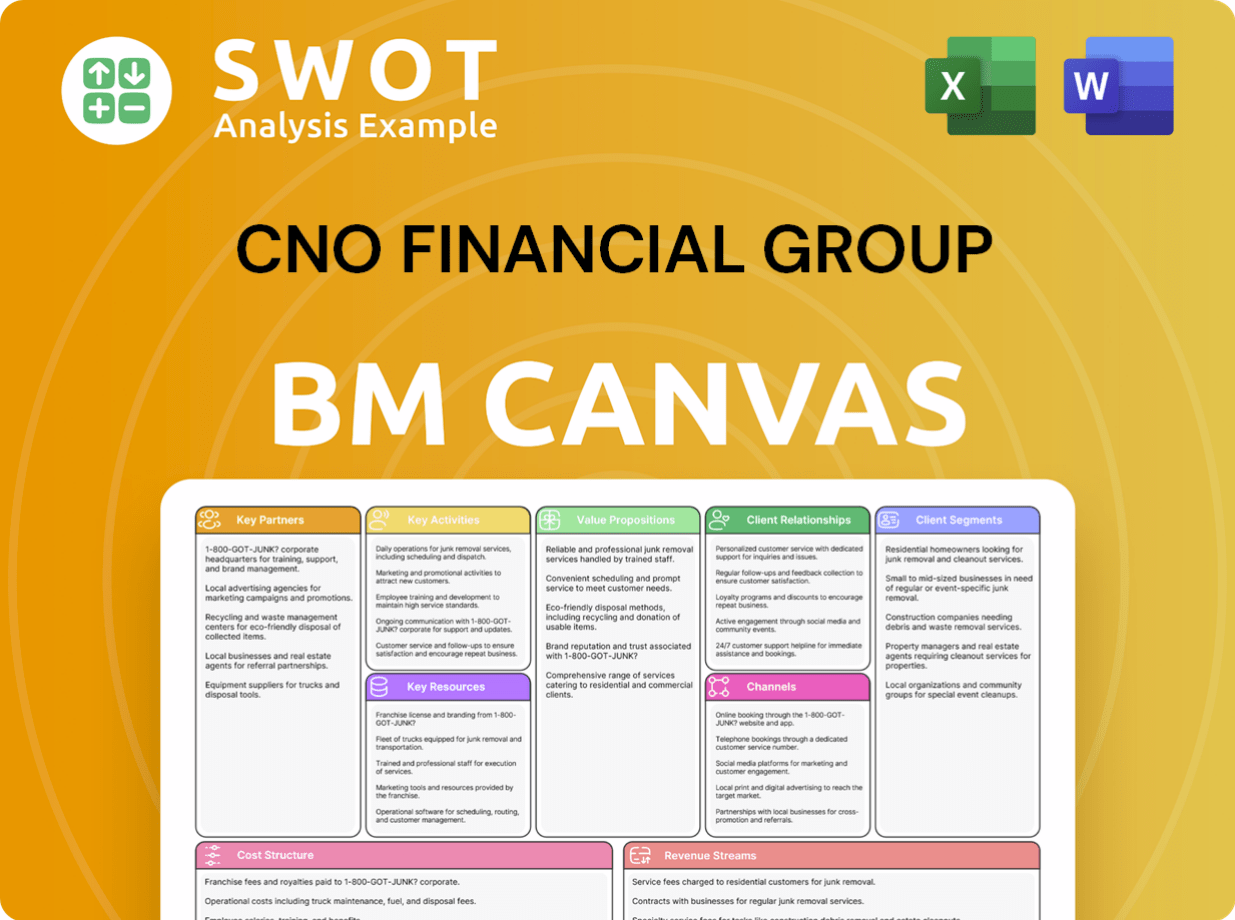

CNO Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does CNO Financial Group Win & Keep Customers?

CNO Financial Group employs a multi-faceted strategy for acquiring and retaining customers, focusing on both digital and traditional channels. The company's approach is tailored to serve a diverse customer base through its Consumer and Worksite divisions. Understanding the customer demographics and tailoring services to meet their needs is central to its business model.

The company leverages a combination of exclusive agents, independent partners, and digital platforms to reach its target market. This integrated approach allows for both personalized service and broad market coverage. Key strategies include digital innovation, customer data analysis, and a commitment to enhancing the overall customer experience. CNO Financial Group's focus is on the underserved middle-income market.

CNO's customer acquisition efforts are supported by a robust distribution network and digital capabilities. The company's commitment to leveraging technology and data-driven insights further enhances its ability to attract and serve its customers effectively. This includes utilizing accelerated underwriting processes and a dedicated platform for Medicare Advantage policies.

Digital channels are a significant component of CNO's customer acquisition strategy. In 2024, web and digital platforms generated 30% of the company's full-year direct-to-consumer new annualized premiums. The company's technology platform processed almost 90% of all Medicare Advantage policies sold during the annual enrollment period in 2024.

CNO utilizes a strong agent network, including approximately 4,500 producing agents and financial representatives as of December 31, 2024. The Worksite Division has around 370 exclusive producing agents. CNO also contracts with over 10,000 agents and independent partners, which expands its reach to potential insurance customers.

CNO employs accelerated underwriting for some of its simplified life products. This process achieves a nearly 80% instant decision rate on submitted policies, improving the customer experience. These efforts contribute to the company's ability to build long-term relationships with its clients.

Customer data and market segmentation are crucial for targeting campaigns. CNO focuses on the underserved middle-income market for its consumer business, combining virtual connections with local agents. This approach allows CNO to better understand the needs of its target market.

Retention strategies at CNO focus on building long-term relationships and delivering value. The company emphasizes strong policyholder persistency. For instance, the customer retention rate for its long-term care insurance segment was 89% in 2023. CNO's commitment to returning value to shareholders, with $349 million returned in 2024, also contributes to customer confidence. To further understand the financial aspects, you can read more in the Revenue Streams & Business Model of CNO Financial Group article.

CNO Financial Group concentrates on the middle-income market, which helps define its target market. This strategic choice allows the company to tailor its products and services to meet the specific needs of this demographic. This targeted approach supports effective customer demographics analysis.

CNO is investing in a three-year, $170 million technology modernization initiative starting in Q2 2025. This investment aims to enhance product development, agent experience, and customer service. The use of AI and cloud solutions will be key to improving these areas.

The company's captive distribution network and agents contribute to the stability of its business. This distribution model supports long-term customer relationships. The captive distribution model is a key factor in retaining insurance customers.

Returning value to shareholders, with $349 million returned in 2024, reflects financial strength and stability. This financial stability can indirectly boost customer confidence and assist in retention. The company's strong financial performance signals stability to its customers.

Enhancing the customer experience is a key strategic objective for CNO. The company aims to provide excellent service through its various distribution channels. This focus on customer experience is central to CNO's retention efforts.

CNO leverages diverse and integrated distribution channels to reach its target market. This includes a combination of virtual and in-person interactions. This integrated approach helps in acquiring and retaining customers by offering flexibility.

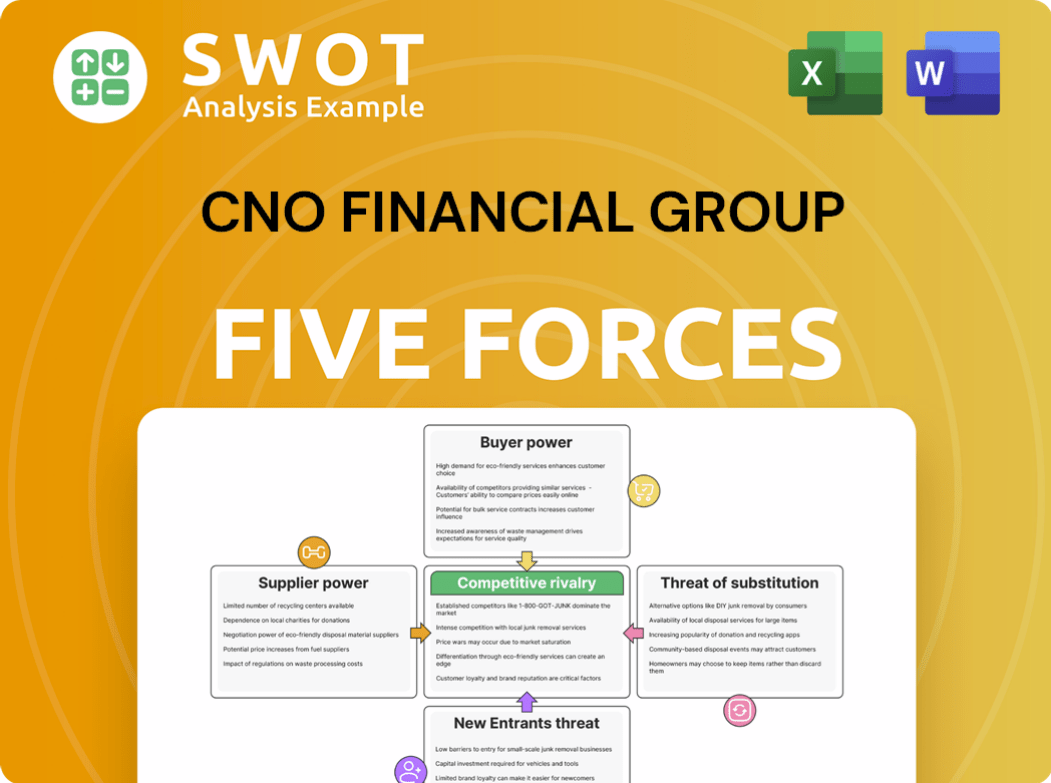

CNO Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CNO Financial Group Company?

- What is Competitive Landscape of CNO Financial Group Company?

- What is Growth Strategy and Future Prospects of CNO Financial Group Company?

- How Does CNO Financial Group Company Work?

- What is Sales and Marketing Strategy of CNO Financial Group Company?

- What is Brief History of CNO Financial Group Company?

- Who Owns CNO Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.