CNO Financial Group Bundle

Can CNO Financial Group Continue Its impressive Growth Trajectory?

CNO Financial Group, a key player in providing financial services to middle-income Americans, has undergone a significant transformation. This CNO Financial Group SWOT Analysis reveals the core of its growth strategy, particularly since 2020, driving impressive sales growth. With a solid foundation and a market capitalization of $3.76 billion USD as of June 2025, CNO is poised for further expansion.

This analysis delves into CNO Financial Group's growth initiatives, exploring how this insurance company plans to capitalize on its strengths. We'll examine CNO Financial Group's strategic planning, including its digital transformation and recent acquisitions, to understand its future prospects. Furthermore, a thorough market analysis will shed light on the competitive landscape and potential investment opportunities for CNO Financial Group, offering insights into its long-term strategy and profitability forecast within the insurance sector.

How Is CNO Financial Group Expanding Its Reach?

CNO Financial Group is actively pursuing several expansion initiatives to broaden its customer base and revenue streams. These initiatives are crucial for the company's Growth Strategy and future success in the Financial Services industry. The company focuses on entering new markets and introducing new products, particularly within its Worksite and Consumer divisions, to drive growth.

A key aspect of CNO's strategy involves geographic expansion, targeting areas with strategic opportunities to increase market share. Furthermore, the integration of virtual connections with its established in-person agent force is a significant differentiator. This approach supports sustained sales and agent force growth, ensuring the company remains competitive and adaptable to changing market dynamics.

The company's expansion efforts are designed to capitalize on emerging opportunities and solidify its position in the market. By focusing on new markets and product categories, CNO Financial Group aims to enhance its financial performance and create long-term value for its stakeholders. This strategic approach is essential for realizing the Future Prospects of the business.

The Worksite division saw record full-year insurance sales, up 16% in 2024, with fourth-quarter sales up 23%. This marks its 11th consecutive quarter of insurance growth. New products significantly contributed, with critical illness sales up 24%, accident up 13%, and hospital indemnity up 20% in 2024.

Geographic expansion is a crucial element, contributing 35% of the total Worksite new annualized premium (NAP) growth for the year and 38% in the fourth quarter of 2024. NAP from new group clients in the Worksite division was up 78%. This initiative targets areas identified for strategic opportunities to increase market share.

In the Consumer division, Medicare Supplement NAP rose by 44% in 2024, and submitted Medicare Advantage applications increased by 39%. The integration of virtual connections with its in-person agent force is a differentiator for sales and service delivery. This supports sustained sales and agent force growth in 2025.

Annuity collected premiums were up 12% in Q1 2025, marking its seventh consecutive quarter of growth, with account values up 7% and premium per policy up 19%. Client assets in brokerage and advisory increased by 28% in 2024, and 16% for the quarter in Q1 2025.

CNO Financial Group's expansion plans are supported by a strong emphasis on innovation and customer-centric solutions. The company's ability to adapt to market changes and leverage its distribution channels is key to its success. For further insights, you can read about the Revenue Streams & Business Model of CNO Financial Group.

- Entering new markets and product categories.

- Focusing on geographic expansion to increase market share.

- Leveraging virtual connections for sales and service delivery.

- Driving growth in both Worksite and Consumer divisions.

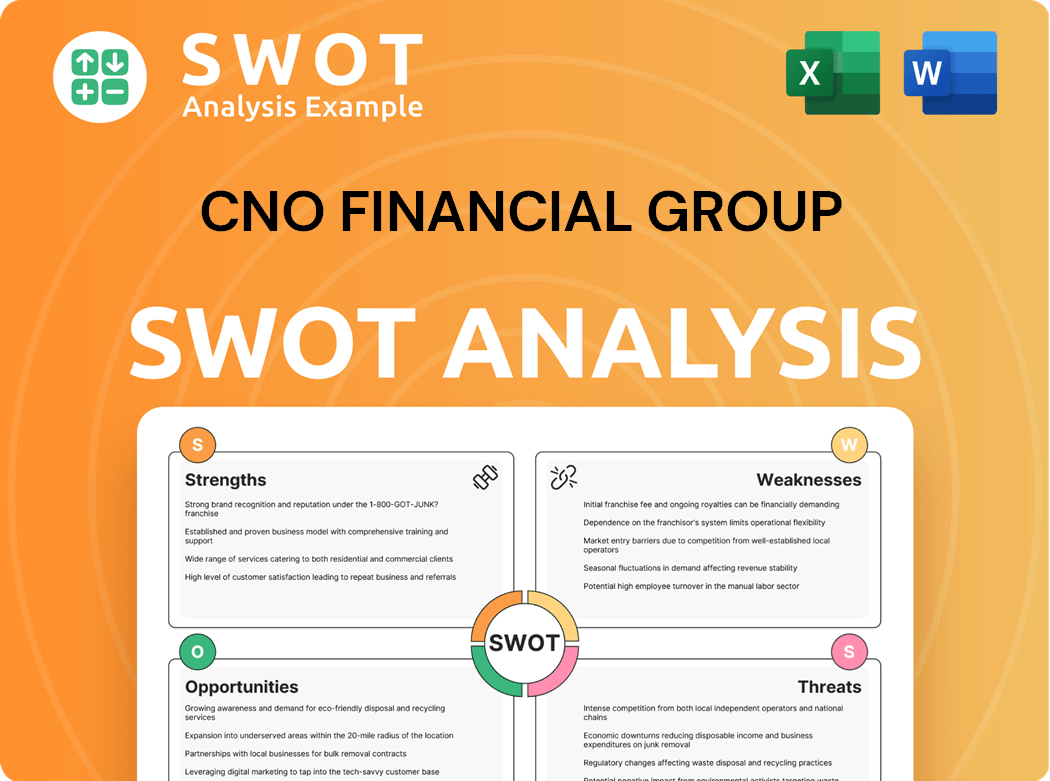

CNO Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CNO Financial Group Invest in Innovation?

CNO Financial Group is heavily investing in technology and innovation to ensure its sustained growth. The company's strategic focus on digital transformation and new product development is central to its long-term strategy. This approach is designed to enhance its competitiveness within the evolving financial services and insurance sectors.

The company's commitment to innovation is reflected in its diversified product portfolio and the expansion of services. CNO is leveraging technology to improve efficiency and customer experience. These advancements are crucial for achieving its growth objectives and adapting to the changing demands of the market.

CNO Financial Group's growth strategy includes a significant investment in technology. This is part of a broader initiative to modernize its operations and improve its market position. The company is focused on using technology to drive efficiency, enhance customer service, and create new revenue streams.

CNO Financial Group launched a three-year technology modernization initiative starting in Q2 2025. The company plans to invest a total of $170 million in this program. This includes an investment of $60 million in 2025 to upgrade its technological infrastructure.

The modernization program emphasizes the use of AI and cloud solutions. These technologies are crucial for strengthening CNO's long-term growth capabilities. The integration of AI and cloud services aims to improve operational efficiency and enhance customer service.

CNO's digital transformation is evident in its Medicare health insurance platform, Myhealthpolicy.com. This platform processed nearly 90% of all Medicare Advantage policies sold during the Annual Enrollment Period. The success highlights the effectiveness of its digital initiatives.

The company's accelerated underwriting for simplified life products achieved a nearly 80% instant decision rate. This demonstrates the efficiency gains from technological advancements. This rapid processing capability enhances the customer experience and streamlines operations.

CNO continues to diversify its product portfolio with new offerings like 'Optimize Clear'. The expansion of Medicare-related services and products has contributed to strong performance in early 2025. These new products support CNO's growth objectives.

In February 2025, Optavise introduced 'Optavise Clear,' a new solution in employee benefits management. This new offering expands the company's capabilities in the benefits market. This launch is part of CNO's broader strategy to enhance its service offerings.

These technological capabilities and new product developments are critical to CNO Financial Group's growth and its ability to compete in the insurance landscape. The company's focus on innovation and technology is a key driver of its growth strategy.

CNO Financial Group's innovation and technology strategy is multifaceted, focusing on modernization, digital transformation, and new product development. These strategies aim to improve efficiency, enhance customer experience, and drive revenue growth. The company's investments in AI and cloud solutions are central to its efforts to strengthen its long-term growth capabilities.

- Technology Modernization: A three-year initiative starting in Q2 2025, with a $170 million investment, including $60 million in 2025, to update its technological infrastructure.

- Digital Transformation: Utilizing platforms like Myhealthpolicy.com to process a significant portion of Medicare Advantage policies.

- Accelerated Underwriting: Achieving nearly 80% instant decision rates for simplified life products.

- New Product Development: Launching new products like 'Optimize Clear' and expanding Medicare-related services.

- AI and Cloud Solutions: Integrating AI and cloud technologies to improve operational efficiency and customer service.

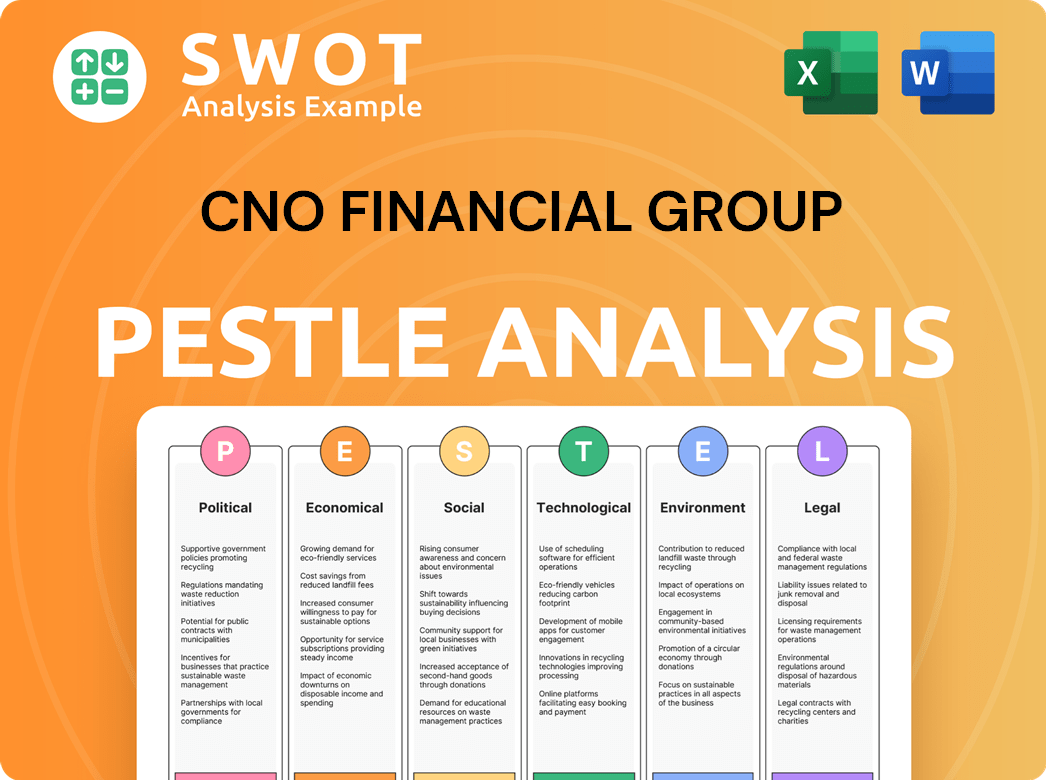

CNO Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CNO Financial Group’s Growth Forecast?

The financial outlook for CNO Financial Group (CNO) appears promising, reflecting a strong performance in 2024 and ambitious targets for the coming years. The company's strategic focus on profitable growth and improved financial metrics indicates a positive trajectory. Investors and stakeholders are likely to find the company's financial health and future plans compelling.

CNO's commitment to enhancing its operational efficiency and shareholder value is evident in its financial goals. The company's strategic planning includes significant investments in technology, which are expected to support long-term growth. The company's ability to generate substantial free cash flow and return capital to shareholders further underscores its financial strength and commitment to creating value.

CNO Financial Group's Target Market of CNO Financial Group is focused on the middle-income market, providing insurance and financial services. This targeted approach, combined with a focus on digital transformation, positions CNO for continued expansion and market share growth. The company's strategic initiatives are designed to capitalize on opportunities within the financial services sector.

In 2024, CNO achieved a net income of $404.0 million, translating to $3.74 per diluted share. This represents a significant increase compared to the $276.5 million, or $2.40 per diluted share, reported in 2023. Operating earnings per diluted share (excluding significant items) rose by 40% for the full year 2024, demonstrating strong growth.

The company's operating ROE, excluding significant items, was 11.4% in 2024, up from 8.6% in 2023. CNO aims to improve its run-rate operating ROE by 150 basis points over the next three years. The target is approximately 10.5% in 2025 and 11.5% by 2027, even with substantial technology investments.

CNO has a strong capital position and generates robust free cash flow. In 2024, the company generated $284 million in excess cash flow to the holding company. As of December 31, 2024, unrestricted cash and investments held by the holding company were $372.5 million.

CNO returned $349.3 million to shareholders in 2024, a 50% increase from 2023. The consolidated statutory risk-based capital ratio was estimated at 383% at the end of 2024, indicating a strong capital base. These returns reflect the company's commitment to shareholder value.

CNO Financial Group anticipates continued profitable growth and improved financial performance. The company reaffirmed its full-year 2025 guidance, expecting operating earnings per share between $3.70 and $3.90. This outlook is supported by strong financial results and strategic initiatives.

- CNO's strategic planning includes a focus on digital transformation.

- The company is committed to enhancing its operational efficiency.

- CNO aims to improve its run-rate operating ROE by 150 basis points over the next three years.

- The company's strong capital position and robust free cash flow generation are key financial strengths.

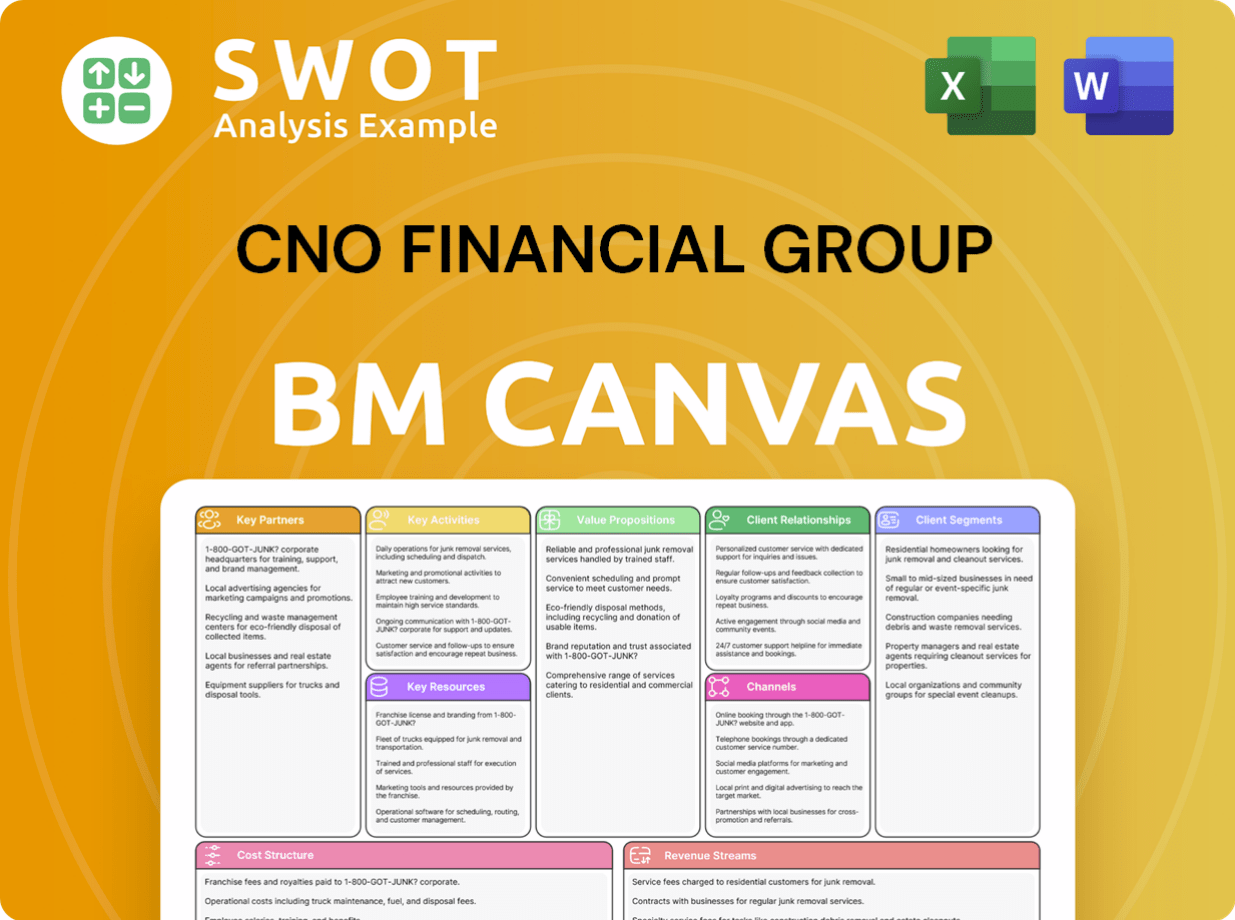

CNO Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CNO Financial Group’s Growth?

The CNO Financial Group, a key player in the financial services sector, faces several potential risks that could influence its Growth Strategy and Future Prospects. Understanding these challenges is crucial for investors and stakeholders assessing the company's long-term viability. These risks range from intense competition to regulatory changes and economic uncertainties.

The insurance company operates in a highly competitive market, with rivals such as Unum Group, Primerica, and others vying for market share. Additionally, the company must navigate evolving regulatory landscapes, particularly those impacting Medicare and retirement products. Economic fluctuations and technological disruptions further complicate its operational environment.

Despite these challenges, CNO Financial Group employs various strategies to mitigate risks and pursue its growth objectives. These include a diversified product portfolio, a strong capital position, and disciplined financial management. The company's ability to adapt and innovate will be critical to its success in the years ahead. For a deeper dive into the company's ownership structure and financial performance, you can refer to Owners & Shareholders of CNO Financial Group.

The Insurance Company faces stiff competition from major players in the financial services industry. Competitors such as Unum Group, Primerica, and others constantly innovate to capture market share. This competitive landscape requires CNO Financial Group to continuously differentiate its products and services to maintain a competitive edge.

Regulatory changes pose a significant risk, especially those affecting Medicare and retirement products. The company must adapt to evolving regulations, which can increase compliance costs. For instance, New York domestic insurers are expected to incorporate climate risk into their financial risk management, which can impact operations.

Economic downturns and inflationary pressures can affect consumer spending and insurance uptake. These economic uncertainties can also impact operational costs. While CNO Financial Group's management expressed optimism for 2025, projecting improved operating earnings and ROE, economic conditions could affect these targets.

Technological advancements require continuous investment and adaptation to stay ahead. The rapid pace of technological change in the insurance industry necessitates ongoing modernization efforts. Dependence on investment income also presents a risk, as fluctuations in market interest rates can affect profitability.

Fluctuations in market interest rates and equity markets can significantly impact net investment income. This dependence on investment income introduces volatility in the company's financial performance. Managing investment portfolios to mitigate these risks is crucial for CNO Financial Group.

CNO Financial Group addresses these risks through a diversified product portfolio and a strong capital position. Disciplined expense and capital management are also key strategies. The strategic use of reinsurance further helps in managing risk. These strategies aim to ensure long-term financial stability and growth.

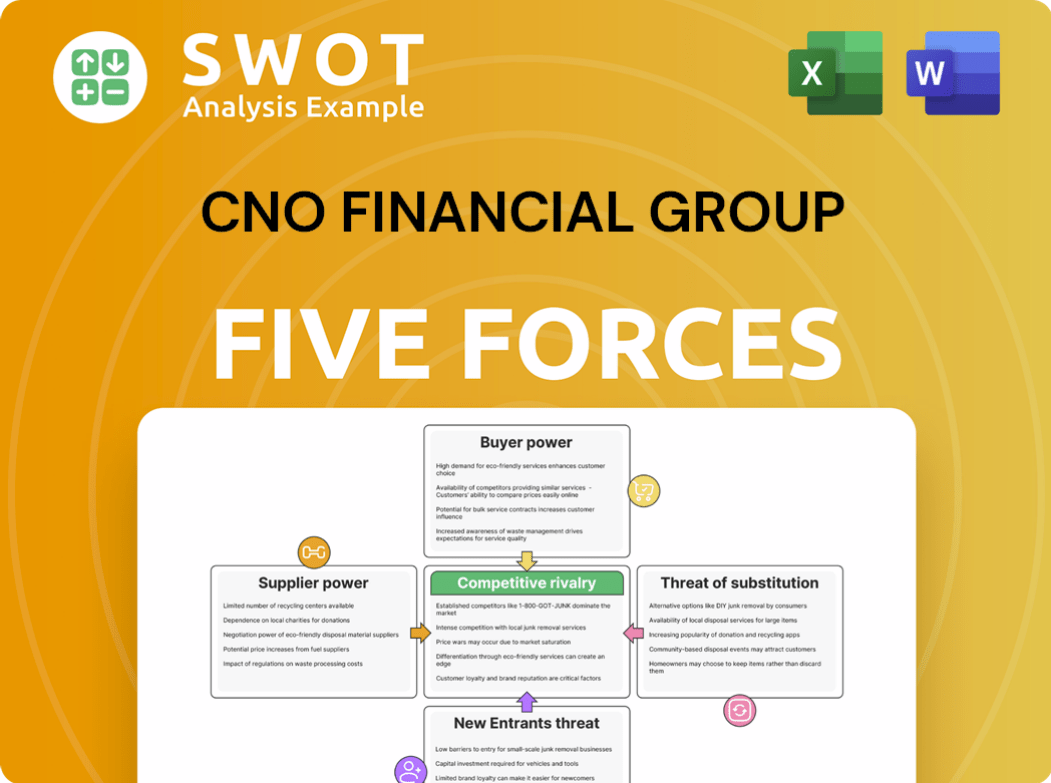

CNO Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CNO Financial Group Company?

- What is Competitive Landscape of CNO Financial Group Company?

- How Does CNO Financial Group Company Work?

- What is Sales and Marketing Strategy of CNO Financial Group Company?

- What is Brief History of CNO Financial Group Company?

- Who Owns CNO Financial Group Company?

- What is Customer Demographics and Target Market of CNO Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.