CNO Financial Group Bundle

How is CNO Financial Group Redefining Sales and Marketing in the Insurance Industry?

CNO Financial Group, a major player in the financial services sector, has dramatically reshaped its approach to reach middle-income Americans. This transformation, particularly since 2020, has led to remarkable growth, including record sales in 2024. This shift reflects a deep understanding of evolving consumer needs and market dynamics.

This analysis delves into the core of CNO Financial Group SWOT Analysis, exploring its evolving sales and marketing strategies. We'll examine how CNO Financial Group leverages both exclusive agents and digital channels to drive CNO Financial Group Sales and enhance its market presence. Understanding the company's CNO Financial Group Marketing tactics and overall CNO Financial Group Strategy is key to grasping its success in a competitive landscape, including its Insurance Sales Strategy and overall Financial Services Marketing approach.

How Does CNO Financial Group Reach Its Customers?

The sales and marketing strategy of CNO Financial Group, a financial services company, relies on a diverse approach to reach its target market. Their strategy includes a mix of both online and offline sales channels. This multi-channel strategy is a key component of how they connect with their customers.

CNO Financial Group's sales channels are designed to cater to the needs of middle-income Americans. They have adapted to include digital capabilities, which is reflected in their sales. The company's approach combines virtual interactions with the established in-person agent force.

The company's sales channels include a network of approximately 4,900 exclusive agents, over 5,500 independent partner agents, and direct marketing efforts. This diversified distribution model is a key differentiator in the insurance industry. The evolution of these channels reflects strategic shifts, particularly the significant adoption of digital capabilities. For example, web and digital channels now account for over 36% of sales generated by D2C leads, a 28% increase year-over-year.

The Consumer Division of CNO Financial Group serves individual consumers through various channels. These include phone, virtual interactions, online platforms, and face-to-face engagements with agents. This division saw its Medicare Supplement New Annualized Premiums (NAP) increase by 24% and overall Consumer Division NAP up 5% in 2024.

The Worksite Division focuses on selling voluntary benefit life and health insurance products in the workplace. They interact with customers at their place of employment and virtually. This division achieved record full-year insurance sales in 2024, up 16%, and saw a 23% increase in fourth-quarter insurance sales.

CNO Financial Group has demonstrated consistent growth across its sales channels. Producing agent counts in both the Consumer and Worksite Divisions were up 8% in Q4 2024, marking consistent growth. CNO also reported an 11th consecutive quarter of strong sales momentum and a ninth consecutive quarter of growth in producing agent count in Q1 2025.

- Annuity collected premiums were up 12% in Q1 2025, representing its seventh consecutive quarter of growth.

- Client assets in brokerage and advisory reached a record $4.1 billion in 2024, an increase of 28%.

- To further understand the company's customer focus, consider reading about the Target Market of CNO Financial Group.

- The company's strategic focus on digital channels has contributed to its customer acquisition and sales.

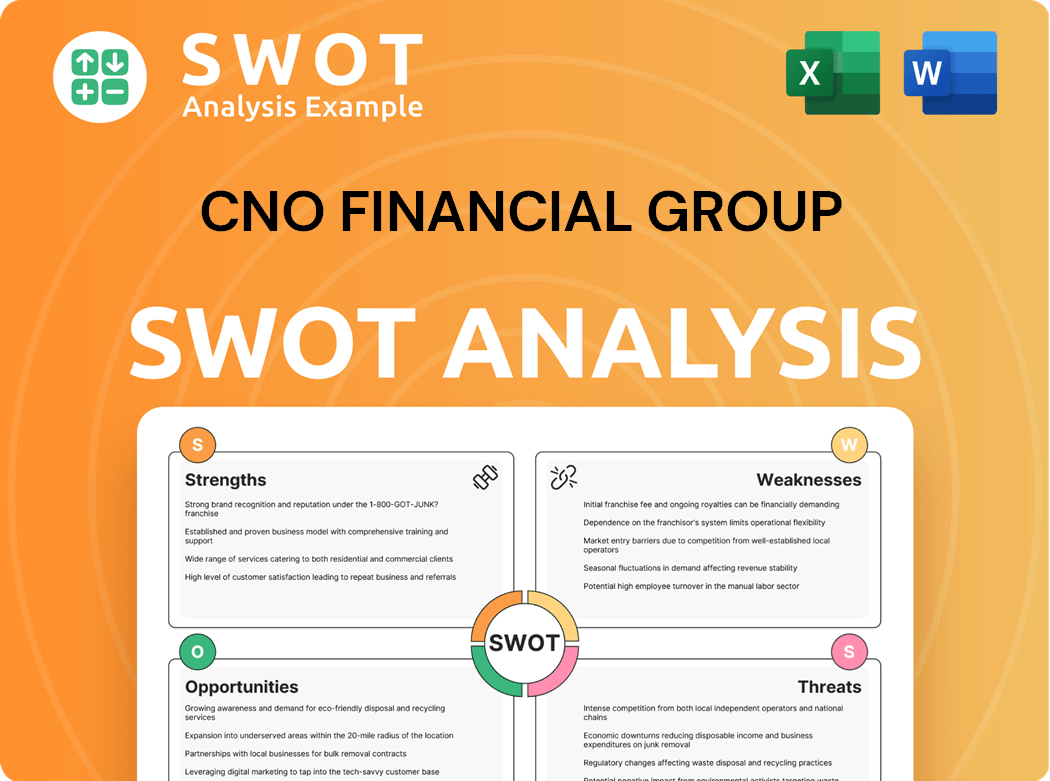

CNO Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does CNO Financial Group Use?

The marketing tactics of CNO Financial Group (CNO) are designed to reach middle-income Americans through a blend of digital and traditional channels. The company's strategy focuses on building brand awareness, generating leads, and driving sales. A key shift involves diversifying direct marketing efforts beyond traditional television advertising to include web and digital platforms.

CNO's digital marketing efforts have become increasingly important. These efforts have resulted in a significant portion of sales, with web and digital platforms generating over 36% of sales from direct-to-consumer leads. This represents a 28% year-over-year increase, highlighting the effectiveness of digital channels in reaching and engaging customers. The company continues to invest in technology to improve customer experience and operational efficiency.

CNO's approach to marketing integrates various channels, recognizing that customers often seek technology to complement human interaction. The company's marketing strategy is data-driven, supported by technology transformation initiatives that enable shared data across different user populations and business applications. These initiatives include the integration of AI to support real-time end-user recommendations and automate activities with integrated robotics solutions.

CNO has invested in technology to improve customer experience and operational efficiency. This includes accelerating underwriting for simplified life products.

The company utilizes its online health insurance marketplace, Myhealthpolicy.com. It processed almost 90% of all Medicare Advantage (MA) policies sold during the Annual Enrollment Period in 2024.

CNO has partnerships, such as the continued strategic collaboration with Cognizant announced in February 2024. This aims to optimize and enhance technology-based services and solutions with cloud and digital technologies and artificial intelligence (AI).

The company has integrated AI to support end-user recommendations in real time and automated activities with integrated robotics solutions.

Colonial Penn, one of CNO's brands, markets primarily through television advertising, direct mail, the Internet, and telemarketing.

CNO's approach to data-driven marketing and customer segmentation is supported by its efforts to enable shared data across diverse user populations and multiple business applications.

CNO's marketing strategy combines digital and traditional methods to reach its target market effectively. The company focuses on leveraging technology to enhance customer experience and streamline operations. The integration of AI and data-driven insights supports personalized customer interactions and efficient sales processes. For more details on CNO's strategic approach, you can read this article about CNO Financial Group sales.

- Digital Channels: Web and digital platforms generate a significant portion of sales.

- Technology Investments: Focus on improving customer experience and operational efficiency.

- Partnerships: Collaborations like the one with Cognizant to optimize technology-based services.

- Traditional Media: Continued use of television, direct mail, and telemarketing.

- Data-Driven Approach: Utilizing data to support customer segmentation and personalized marketing.

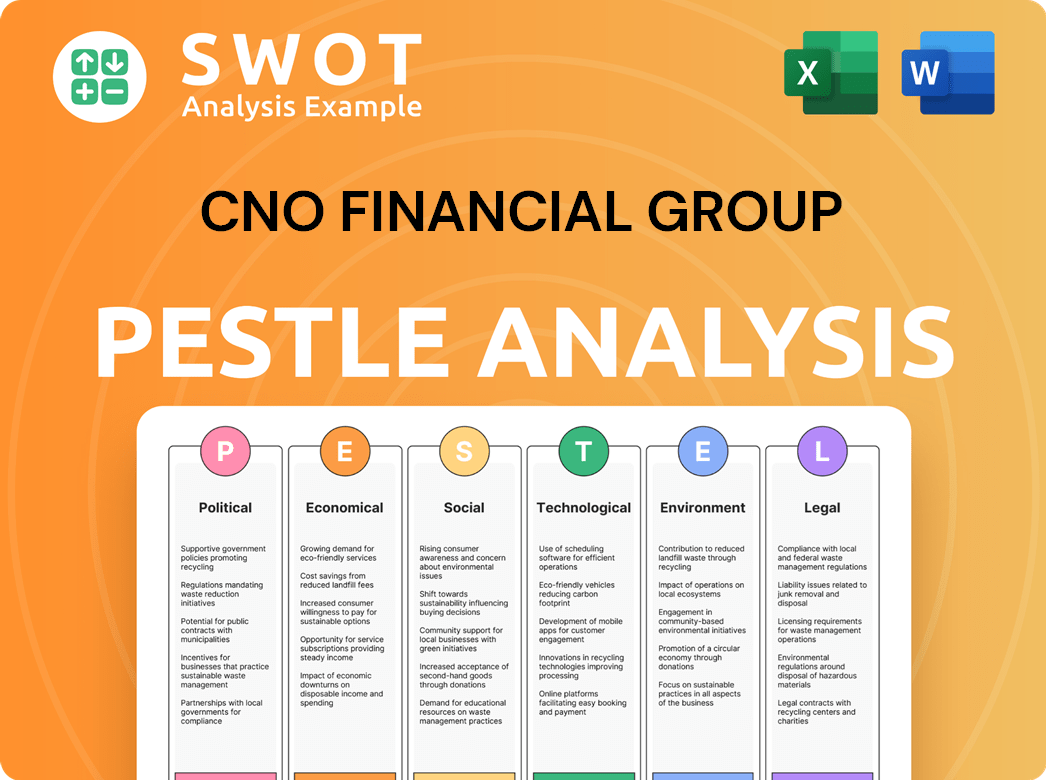

CNO Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is CNO Financial Group Positioned in the Market?

CNO Financial Group positions itself as a trusted provider of insurance and financial services, focusing on securing the future of middle-income Americans. This strategic brand positioning emphasizes health, income, and retirement protection. By targeting this specific demographic, CNO differentiates itself in the market, aiming to provide professional guidance and essential insurance and retirement products to a segment often overlooked by other financial institutions.

The company's brand identity is conveyed through its family of brands, including Bankers Life, Colonial Penn, Optavise, and Washington National, each catering to specific needs within the middle-income segment. For example, Bankers Life serves those near or in retirement with life and health insurance, annuities, and investments. Colonial Penn offers easy-to-understand, affordable products, primarily through direct marketing. This multi-brand approach allows CNO to address a wide range of financial needs within its target market.

CNO's approach focuses on value, accessibility, and a holistic view of financial security. The company's diversified distribution model, which combines exclusive agents, independent partners, and direct marketing, is a key element of its brand promise. This strategy ensures broad reach and the ability to build lasting relationships with its target demographic. CNO's commitment to maintaining brand consistency across all channels, while also investing in technology to enhance customer experience, further strengthens its market position.

CNO Financial Group's primary focus is on middle-income Americans, a demographic often underserved by traditional financial institutions. This targeted approach allows for tailored products and services. Understanding the specific needs of this group is central to CNO's Growth Strategy of CNO Financial Group.

CNO utilizes a multi-brand strategy, including Bankers Life, Colonial Penn, Optavise, and Washington National, each designed to meet specific needs within the target market. This allows for a segmented approach to CNO Financial Products and services. Each brand has a distinct identity, yet they collectively represent CNO's commitment to financial security.

CNO employs a diversified distribution model, including exclusive agents, independent partners, and direct marketing channels. This multi-channel approach ensures broad market reach and accessibility. This strategy is crucial for effective CNO Financial Group Sales.

The company emphasizes value, accessibility, and a holistic approach to financial security. This includes providing easy-to-understand products and professional guidance. This value proposition is central to CNO's Financial Services Marketing.

In 2024, CNO Financial Group demonstrated strong performance, reflecting the effectiveness of its brand positioning and CNO Financial Group Strategy.

- Operating earnings per diluted share grew by 28% to $3.97 in 2024, indicating strong financial health.

- The company was recognized as one of America's Best Insurance Companies by Forbes in 2024, highlighting positive brand perception.

- CNO was also named one of America's Most Responsible Companies by Newsweek in 2024, reflecting its commitment to its mission.

- Record sales were achieved in both the Consumer and Worksite Divisions in 2024, showing successful Insurance Sales Strategy.

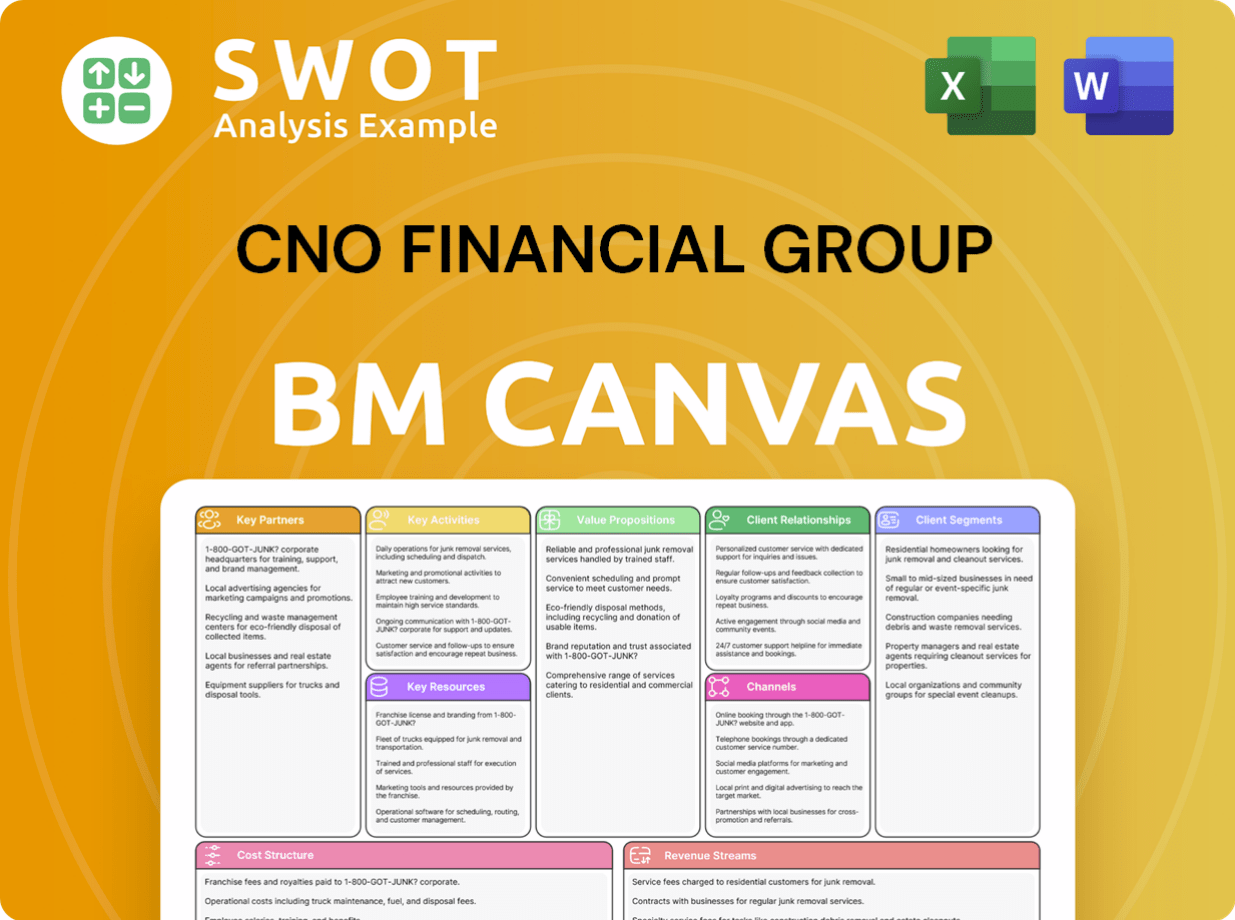

CNO Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are CNO Financial Group’s Most Notable Campaigns?

The sales and marketing strategy of the CNO Financial Group has been centered around key campaigns that have driven significant growth. These campaigns, though not always explicitly labeled as such, represent strategic initiatives aimed at adapting to market changes and enhancing customer engagement. The focus on digital transformation, product innovation, and geographic expansion has been pivotal in achieving impressive sales results and strengthening the company's market position.

A significant driver of success has been the transformation of business units, specifically the creation of the Consumer and Worksite Divisions. This strategic shift aimed to align the company's operations with evolving consumer behaviors. The success of these divisions is evident in the record sales figures reported in 2024, demonstrating the effectiveness of this strategic realignment.

CNO Financial Group's approach to CNO Financial Group's sales and marketing strategy includes a multifaceted approach, from digital initiatives to product launches. The company's commitment to technology modernization and customer-centric strategies further reinforces its position in the financial services market.

The Consumer Division has focused on Medicare Supplement and Medicare Advantage policies. Medicare Supplement New Annualized Premiums (NAP) were up by 24% in Q1 2025. The success of the Myhealthpolicy.com platform, processing nearly 90% of MA policies during the 2024 Annual Enrollment Period, highlights digital adoption.

The Worksite Division saw record full-year insurance sales, up 16% in 2024, with a 23% increase in Q4 insurance sales. New product launches, such as a critical illness product, and geographic expansion initiatives have significantly contributed to NAP growth. Life insurance sales in this division increased by 17% in Q1 2025.

CNO Financial Group is investing in technology modernization, including a $170 million program starting in Q2 2025. This initiative leverages AI and cloud solutions to strengthen growth, improve service, and enhance customer experience. The instant decision rate for simplified life products was 87% in Q1 2025.

The company's integrated sales and marketing efforts have led to 10 consecutive quarters of sales growth and 8 consecutive quarters of producing agent count growth by the end of 2024. CNO has returned $349 million to shareholders in 2024, a 50% increase from 2023, and $116.8 million in Q1 2025.

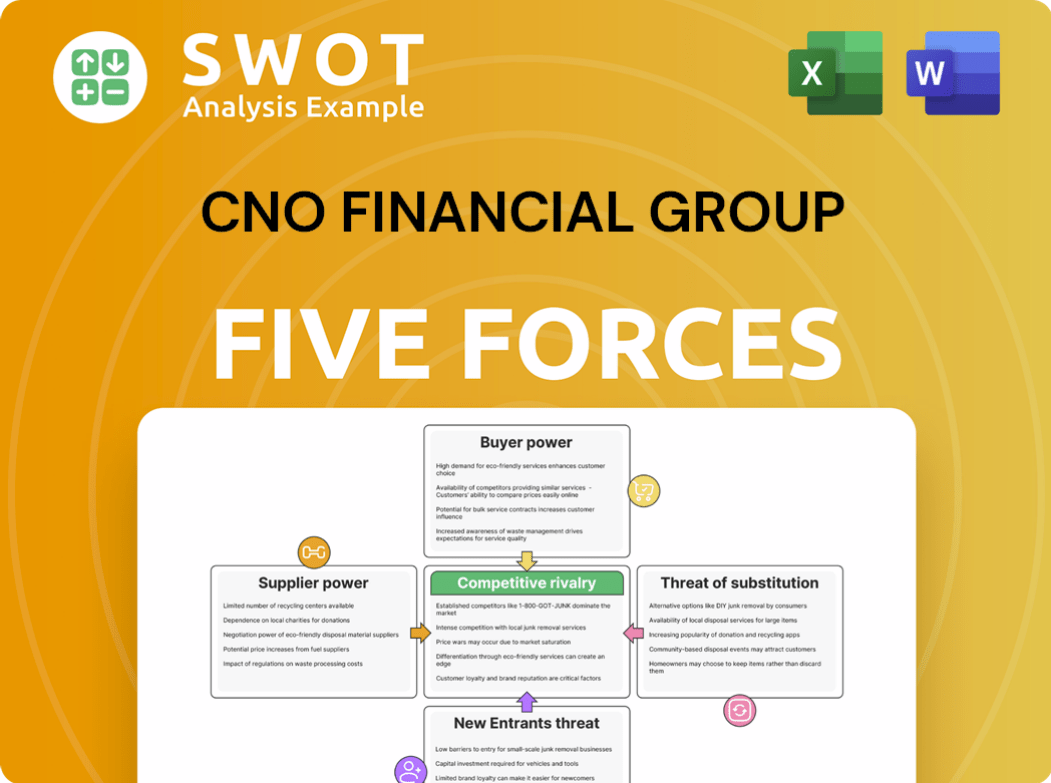

CNO Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CNO Financial Group Company?

- What is Competitive Landscape of CNO Financial Group Company?

- What is Growth Strategy and Future Prospects of CNO Financial Group Company?

- How Does CNO Financial Group Company Work?

- What is Brief History of CNO Financial Group Company?

- Who Owns CNO Financial Group Company?

- What is Customer Demographics and Target Market of CNO Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.