CNO Financial Group Bundle

Who Really Controls CNO Financial Group?

Understanding the ownership of a financial powerhouse like CNO Financial Group is key to grasping its future. From its roots as Security National of Indiana Corp. to its current status, CNO's journey has been marked by significant shifts in ownership. This report peels back the layers to reveal who shapes the strategic direction of this major CNO Financial Group SWOT Analysis company.

Tracing the ownership of CNO Financial Group, a publicly traded insurance company, reveals a story of transformation and influence. Knowing who owns Bankers Life, a CNO Financial subsidiary, and other key entities provides insights into the company's operations and strategic decisions. This analysis will explore the major shareholders, the impact of institutional investors, and how the company's ownership has evolved over time, including details on the CNO Financial Group stock.

Who Founded CNO Financial Group?

The story of CNO Financial Group (CNO) began in 1979 as Security National of Indiana Corp., founded by Stephen Hilbert. While specific details about the initial ownership structure aren't readily available in public records, the early years were marked by significant acquisitions that shaped the company's direction. These strategic moves set the stage for CNO's growth in the insurance sector.

Early on, CNO focused on expanding through acquisitions. Security National of Indiana Corp. acquired Consolidated National Life Insurance Co. in 1983. The company's insurance operations commenced in 1982. It then went public in 1985. In 1986, the company made two key acquisitions: Lincoln Income Life Insurance Company and Bankers National Life Insurance Company, further solidifying its presence.

The transition to a public company in 1985 broadened the shareholder base, which diluted the initial founder ownership over time. The company's early strategy, driven by Hilbert, was clearly geared towards rapid expansion through acquisitions. While specific founder agreements and early ownership details are not widely publicized, the swift growth through these deals suggests a concentrated effort to build a significant presence in the financial services industry.

CNO Financial Group's history is defined by strategic acquisitions that fueled its growth. These moves expanded its footprint in the insurance market. Understanding these early steps is crucial for grasping the company's evolution. For more insights, you can explore the Marketing Strategy of CNO Financial Group.

- 1979: Founded as Security National of Indiana Corp. by Stephen Hilbert.

- 1982: Commenced insurance operations.

- 1983: Acquired Consolidated National Life Insurance Co.

- 1985: Became a public company.

- 1986: Acquired Lincoln Income Life Insurance Company and Bankers National Life Insurance Company.

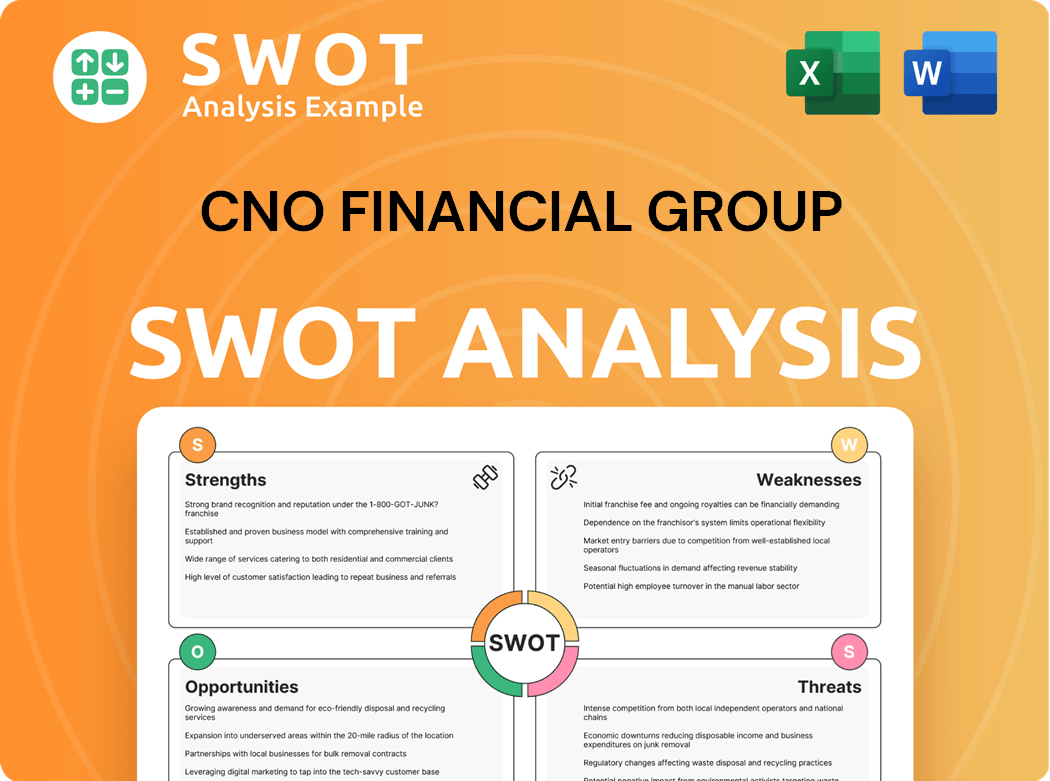

CNO Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CNO Financial Group’s Ownership Changed Over Time?

The journey of CNO Financial Group, initially known as Conseco, Inc., began its public journey in 1985. A pivotal moment in its ownership narrative was the Chapter 11 reorganization in 2002. The company emerged from this in 2003 and later rebranded its holding company to CNO Financial Group on May 11, 2010. As of June 13, 2025, the market capitalization of CNO Financial Group stands at approximately $3.66 billion.

The ownership structure of CNO Financial Group is primarily shaped by institutional investors. As of March 31, 2025, the company has a substantial number of institutional owners, totaling 759, who collectively hold 126,288,469 shares. This ownership landscape underscores the significance of institutional influence in shaping the company's strategic direction.

| Shareholder | Shares Held (as of March 31, 2025) | Percentage of Ownership |

|---|---|---|

| BlackRock, Inc. | 13,283,350 | 13.17% |

| Vanguard Group Inc. | 12,610,130 | 12.5% |

| State Street Corp. | 4,619,220 | 4.579% |

The major shareholders of CNO Financial Group include BlackRock, Inc., Vanguard Group Inc., and State Street Corp. These institutional investors collectively hold a significant portion of the company's shares, influencing its strategic direction. The high level of institutional ownership, which remained largely unchanged at 92.23% in May 2025, emphasizes the importance of long-term value creation and sound governance. For more details on the company's background, you can read Brief History of CNO Financial Group.

CNO Financial Group's ownership is dominated by institutional investors, with significant holdings by BlackRock, Vanguard, and State Street. This structure emphasizes long-term value creation and stable governance. The company's history includes a Chapter 11 reorganization, which reshaped its ownership landscape.

- Institutional investors hold a substantial majority of shares.

- Major shareholders include BlackRock and Vanguard.

- The company's history includes a significant restructuring.

- The ownership structure influences the company's strategy.

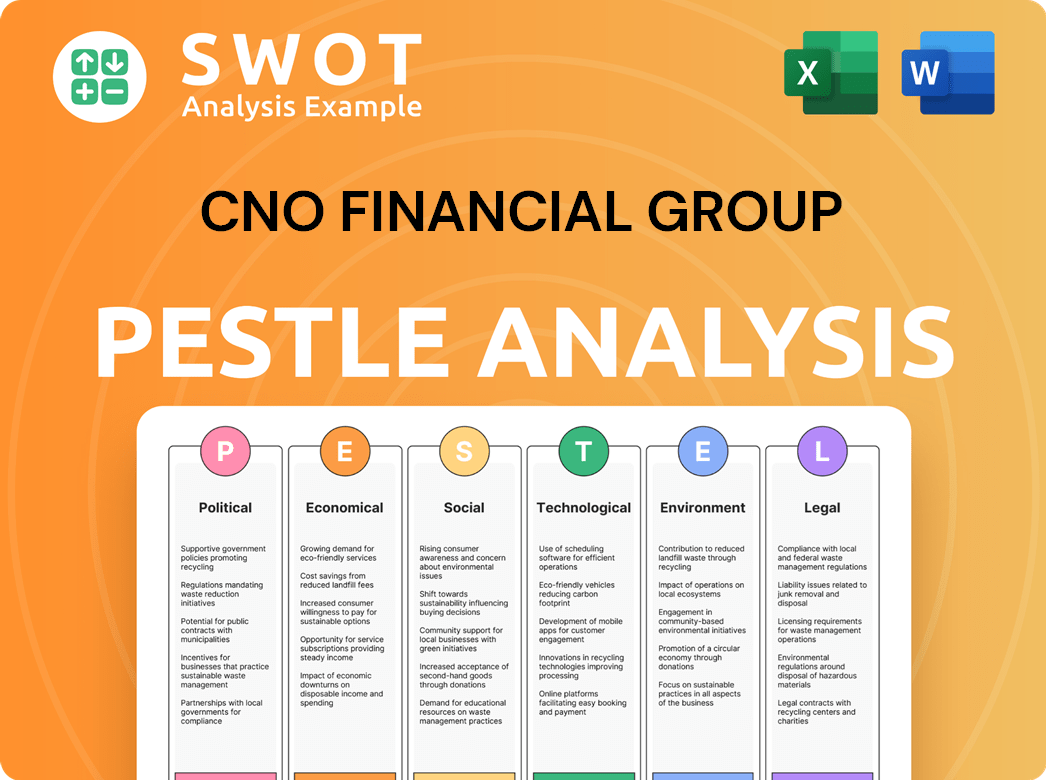

CNO Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CNO Financial Group’s Board?

As of October 1, 2024, the board of directors for CNO Financial Group consists of nine members. The board's composition includes Gary C. Bhojwani, who also serves as the Chief Executive Officer, along with other directors: Archie M. Brown, David B. Foss, Mary R. (Nina) Henderson, Adrianne B. Lee, Daniel R. Maurer (Board Chair), Chetlur S. Ragavan, Steven E. Shebik, and Jess Turner. The addition of Jess Turner, a senior technology executive from Mastercard, highlights the company's focus on digital transformation. This board structure reflects a blend of executive leadership and independent oversight, guiding the strategic direction of the CNO Financial Group.

The board's structure includes a mix of executives and independent directors, which is a common governance practice. The presence of a senior technology executive like Jess Turner suggests a strategic emphasis on digital initiatives within the company. This composition supports effective oversight and strategic decision-making, with a focus on both operational expertise and forward-looking technological advancements.

| Director | Position | Additional Information |

|---|---|---|

| Gary C. Bhojwani | Chief Executive Officer | Also serves as a director. |

| Daniel R. Maurer | Board Chair | Oversees board meetings and governance. |

| Jess Turner | Director | Appointed on October 1, 2024; Senior technology executive from Mastercard. |

| Archie M. Brown | Director | Independent director. |

| David B. Foss | Director | Independent director. |

| Mary R. (Nina) Henderson | Director | Independent director. |

| Adrianne B. Lee | Director | Independent director. |

| Chetlur S. Ragavan | Director | Independent director. |

| Steven E. Shebik | Director | Independent director. |

CNO Financial Group operates on a one-share-one-vote basis for its common stock, ensuring that each share has equal voting power. As of the 2024 annual meeting, there were 108,644,555 shares of common stock outstanding and entitled to vote. The company has taken steps to protect its net operating losses, with the adoption of an Amended and Restated Section 382 Shareholder Rights Plan in May 2024, followed by a Replacement NOL Protective Amendment in May 2025, which is a strategic move to preserve the value of tax assets. The 2025 annual meeting, held virtually on May 8, 2025, saw the election of nine directors and the approval of key governance documents.

CNO Financial Group uses a one-share-one-vote system, which is standard for many publicly traded companies. This structure ensures that all shareholders have voting rights proportional to their ownership. The company's focus on preserving its net operating losses through protective amendments indicates a proactive approach to financial management.

- One-share-one-vote voting structure.

- 108,644,555 shares of common stock outstanding as of 2024.

- Amended and Restated Section 382 Shareholder Rights Plan adopted in May 2024.

- Replacement NOL Protective Amendment approved in May 2025.

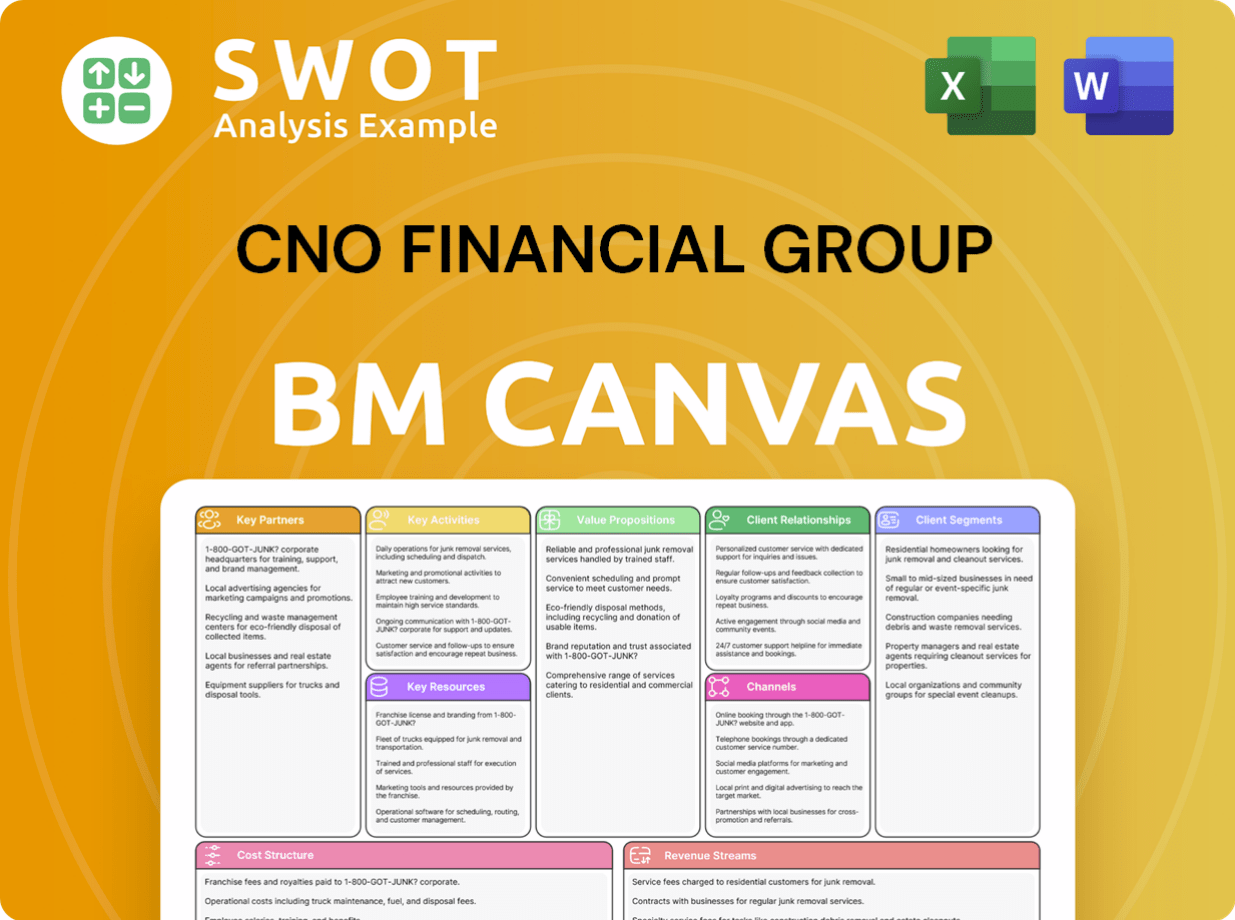

CNO Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CNO Financial Group’s Ownership Landscape?

Over the past few years, CNO Financial Group has consistently focused on returning value to its shareholders. In 2024, the company distributed $349.3 million to shareholders. During the fourth quarter of 2024, CNO repurchased $91.6 million of its common stock, acquiring 2.5 million shares at an average price of $36.96 per share. As of December 31, 2024, the company had 101.6 million shares outstanding. Furthermore, in February 2025, the Board of Directors authorized an additional $500 million for share repurchases, bringing the total repurchase capacity to approximately $740.3 million. CNO also declared a quarterly cash dividend of $0.16 per share, payable on March 24, 2025.

The ownership structure of CNO Financial Group reflects industry trends, particularly an increase in institutional ownership. As of March 31, 2025, institutional investors held approximately 92.41% of the company's shares. Insider holdings saw a slight increase from 1.41% to 1.43% in May 2025, while mutual fund holdings increased from 88.59% to 88.98% in April 2025, and remained unchanged at 91.74% in May 2025. This strong institutional presence suggests a focus on long-term stability and value creation for this insurance company.

CNO Financial Group has a history of engaging in mergers and acquisitions, such as the 1998 acquisition of Colonial Penn. The company's 2024 10-K report highlights strategic initiatives aimed at enhancing its market position through distribution channels and product offerings. The company anticipates operating earnings per diluted share for 2025 to be in the range of $3.70 to $3.90.

| Ownership Category | March 31, 2025 | May 2025 |

|---|---|---|

| Institutional Investors | 92.41% | - |

| Insider Holdings | 1.41% | 1.43% |

| Mutual Fund Holdings | 88.59% (April 2025) | 91.74% |

The company's stock is publicly traded. Investors can buy CNO Financial Group stock through various brokerage platforms.

Bankers Life is a subsidiary of CNO Financial Group. Therefore, CNO Financial Group owns Bankers Life insurance company.

Major shareholders primarily consist of institutional investors. The exact names and percentages can be found in the company's SEC filings.

CNO Financial Group's headquarters is located in Carmel, Indiana.

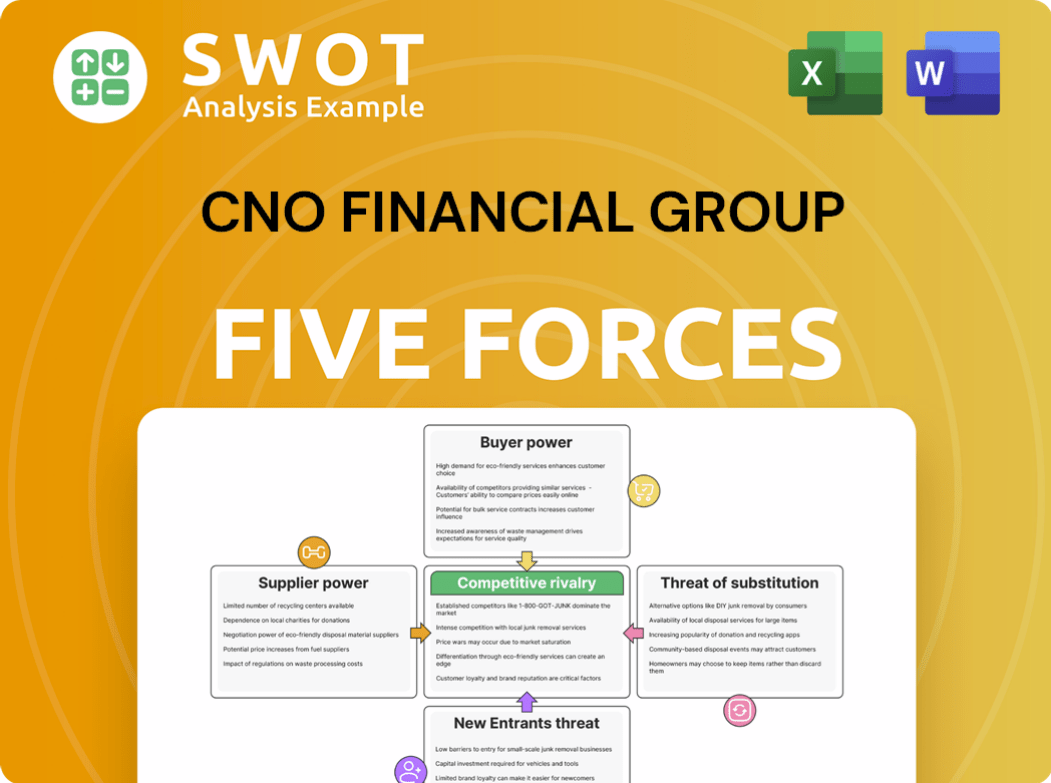

CNO Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CNO Financial Group Company?

- What is Competitive Landscape of CNO Financial Group Company?

- What is Growth Strategy and Future Prospects of CNO Financial Group Company?

- How Does CNO Financial Group Company Work?

- What is Sales and Marketing Strategy of CNO Financial Group Company?

- What is Brief History of CNO Financial Group Company?

- What is Customer Demographics and Target Market of CNO Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.