CNO Financial Group Bundle

How Does CNO Financial Group Thrive in the Financial World?

CNO Financial Group (CNO) is a major player in the financial services sector, focusing on the needs of middle-income Americans. With a diverse portfolio of life and health insurance, annuities, and other financial products, CNO helps millions secure their financial futures. But how does this CNO Financial Group SWOT Analysis help the company?

This deep dive into CNO Financial explores its operational framework, revenue streams, and strategic positioning. Understanding how CNO Financial Group, an insurance company, functions is key for investors seeking to evaluate its potential and for customers looking to understand the value of its offerings. We will explore the work process of CNO and how it generates value in a competitive market, looking at its products and services.

What Are the Key Operations Driving CNO Financial Group’s Success?

CNO Financial Group (CNO) focuses on providing insurance and financial solutions tailored to the middle-income American market. The company delivers its services through brands like Bankers Life, Colonial Penn, Optavise, and Washington National. CNO's primary goal is to protect its customers' health, income, and retirement needs.

The company's operations are designed to reach customers through multiple channels. CNO uses a network of exclusive agents, independent partner agents, and direct marketing to engage with customers. This multi-channel approach includes telephone, virtual interactions, online platforms, and face-to-face meetings.

In 2020, CNO realigned its operating model into two divisions: Consumer and Worksite. The Consumer Division serves individual consumers with a broad portfolio of insurance and financial solutions. The Worksite Division focuses on providing voluntary benefit life and health insurance products, benefits administration technology, and services to employers.

CNO utilizes a multi-channel distribution strategy. This includes a network of approximately 4,900 exclusive agents and over 5,500 independent partner agents. CNO also uses direct marketing channels to reach customers.

CNO interacts with customers through various methods. These include telephone, virtual interactions, online platforms, and in-person meetings. This approach allows CNO to provide comprehensive services.

In 2020, CNO restructured its operating model. This led to the creation of the Consumer and Worksite divisions. This change helped streamline operations and focus on specific market segments.

CNO combines virtual connections with its in-person agent force. This hybrid model supports sales, service, and customer experience. This approach differentiates CNO in the market.

CNO's performance is reflected in its ability to meet customer needs and manage its finances effectively. The company's focus on disciplined expense and capital management supports its strong financial foundation. For more insights into the competitive landscape, consider exploring the Competitors Landscape of CNO Financial Group.

- In 2024, CNO paid approximately $2.1 billion in claims to policyholders.

- The company processed 607,000 new applications in 2024.

- CNO's financial strength is supported by disciplined expense and capital management.

- The company continues to adapt its strategies to meet market demands.

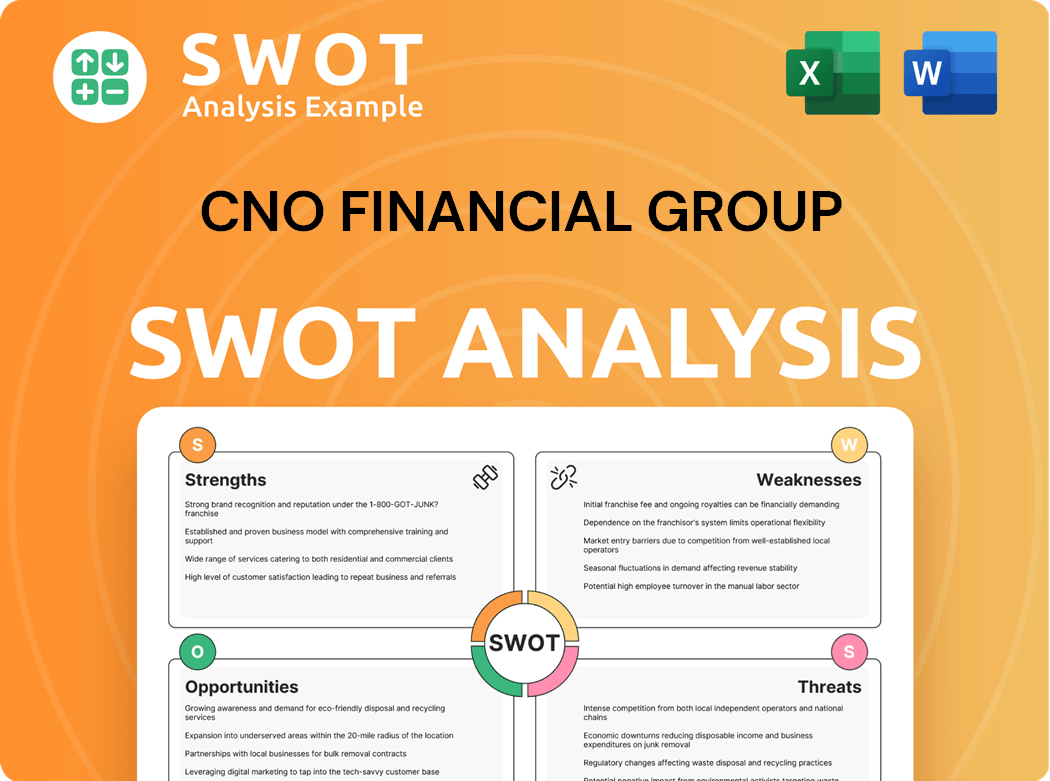

CNO Financial Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CNO Financial Group Make Money?

CNO Financial Group, a prominent insurance company and financial services provider, generates revenue primarily through its diverse insurance product lines and strategic investment activities. The company structures its financial reporting around consolidated product line segments, including annuity, health, and life insurance, alongside investment and fee income segments. This approach allows for a clear view of the financial performance across its various business areas.

As of the trailing twelve months ended March 31, 2025, CNO Financial Group reported a revenue of $4.3 billion. In 2024, the company's total revenue was $4.44 billion, reflecting an increase from $4.14 billion in 2023. For the first quarter of 2025, revenue reached $1,004.1 million, demonstrating consistent financial performance.

The revenue streams of CNO Financial are diversified, with key contributions from insurance policy income, investment income, and fee income. These streams are pivotal in driving the company's overall financial health and growth. The company's work process involves a strategic focus on these core areas to maintain and enhance profitability.

CNO Financial Group's monetization strategies are centered around its insurance products and investment portfolio. The company leverages tiered pricing and cross-selling to maximize revenue generation. A detailed look at the revenue streams includes:

- Insurance Policy Income: This is a significant revenue source, primarily from annuity, health, and life insurance products. In 2024, total new annualized premiums (NAP) increased by 7%, with the Worksite Division's NAP up 16% and the Consumer Division's NAP up 5%. Annuity collected premiums saw a record 13% increase in 2024. For Q1 2025, annuity collected premiums were up 12%. Medicare Supplement NAP was up 24% in Q1 2025.

- Investment Income: CNO Financial's investment portfolio contributes substantially to its earnings. In 2024, new money rates exceeded 6% in all four quarters. Net investment income remained strong in Q1 2025, with a 6% increase in net investment income allocated to products.

- Fee Income Business: This segment also adds to the overall revenue, contributing to the financial services offered by CNO.

The company's focus on the middle-income market provides a broad customer base and consistent premium generation. The ongoing strength in underwriting margins and net investment income are key drivers of profitability. To learn more about the company's strategic growth, read the Growth Strategy of CNO Financial Group.

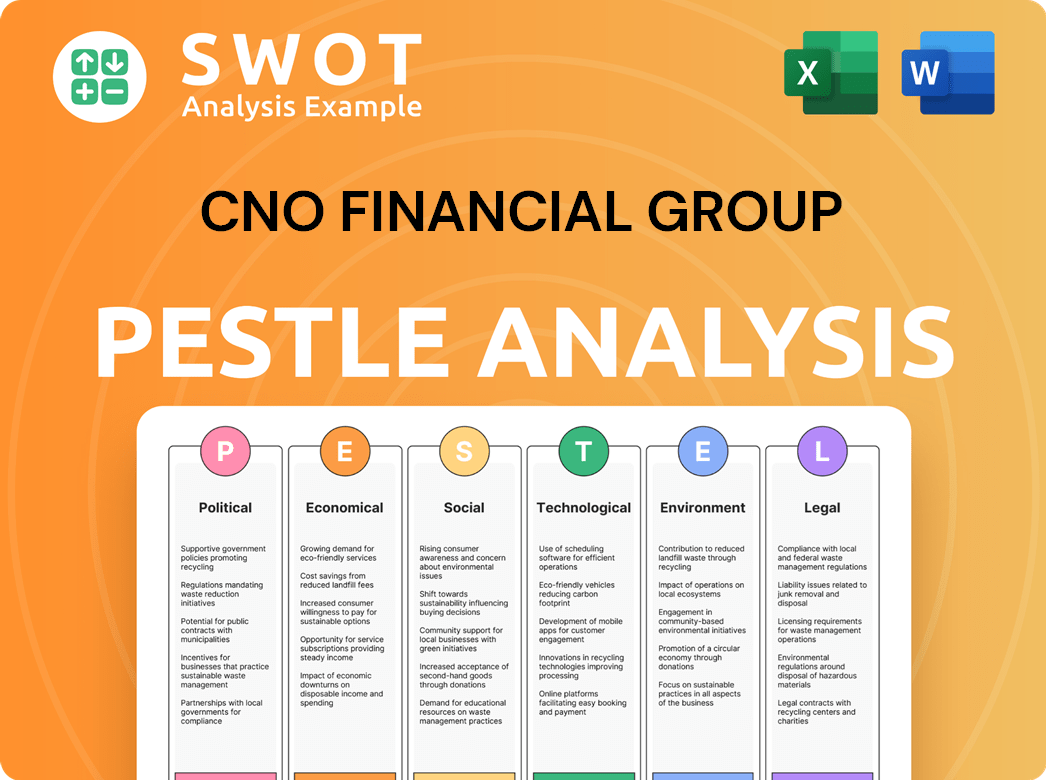

CNO Financial Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped CNO Financial Group’s Business Model?

CNO Financial Group has strategically evolved, focusing on operational enhancements and financial performance. A critical move in 2020 involved reorganizing its business units into Consumer and Worksite Divisions. This restructuring aimed to align with evolving consumer behaviors, laying the groundwork for continuous growth.

The company has consistently achieved significant milestones. In 2024, CNO delivered one of its strongest operating performances, marked by substantial earnings growth and an improved return on equity (ROE). This included record sales in both its Consumer and Worksite Divisions. Furthermore, the first quarter of 2025 saw operating earnings per share, excluding significant items, increase by 42%.

CNO's competitive advantages are multifaceted, stemming from its integrated distribution model and strong brand presence. The company's disciplined financial management further strengthens its position in the market. For more insights into the company's structure, consider reading about Owners & Shareholders of CNO Financial Group.

In 2024, the Worksite Division achieved record full-year insurance sales, up 16%. The Consumer Division saw a 5% increase in net annualized premium (NAP). The fourth quarter of 2024 marked the 11th consecutive quarter of insurance sales growth.

The realignment of business units into Consumer and Worksite Divisions in 2020 was a pivotal strategic move. This restructuring was designed to adapt to evolving consumer behaviors. CNO continuously adapts to new trends and technology shifts to enhance its work process.

CNO's integrated distribution model, combining a nationwide agent force with direct-to-consumer (D2C) channels, is a significant advantage. The scale of its agent force is difficult for new entrants to replicate. Brand strength and disciplined expense management contribute to its market standing.

The company maintains a strong capital position, with a consolidated statutory risk-based capital ratio of its U.S. based insurance subsidiaries estimated at 379% at March 31, 2025. CNO also actively returns capital to shareholders, with $349 million returned in 2024, a 50% increase from 2023.

CNO leverages technology to improve its operations. Its Medicare health insurance technology platform, Myhealthpolicy.com, processed almost 90% of all Medicare Advantage policies sold during the annual enrollment period.

- Accelerated underwriting on simplified life products delivered a nearly 80% instant decision rate on submitted policies.

- CNO continues to invest in technology to enhance customer experience.

- These technological advancements support the company's growth and efficiency.

- The company is focused on innovation to maintain its competitive edge in the financial services sector.

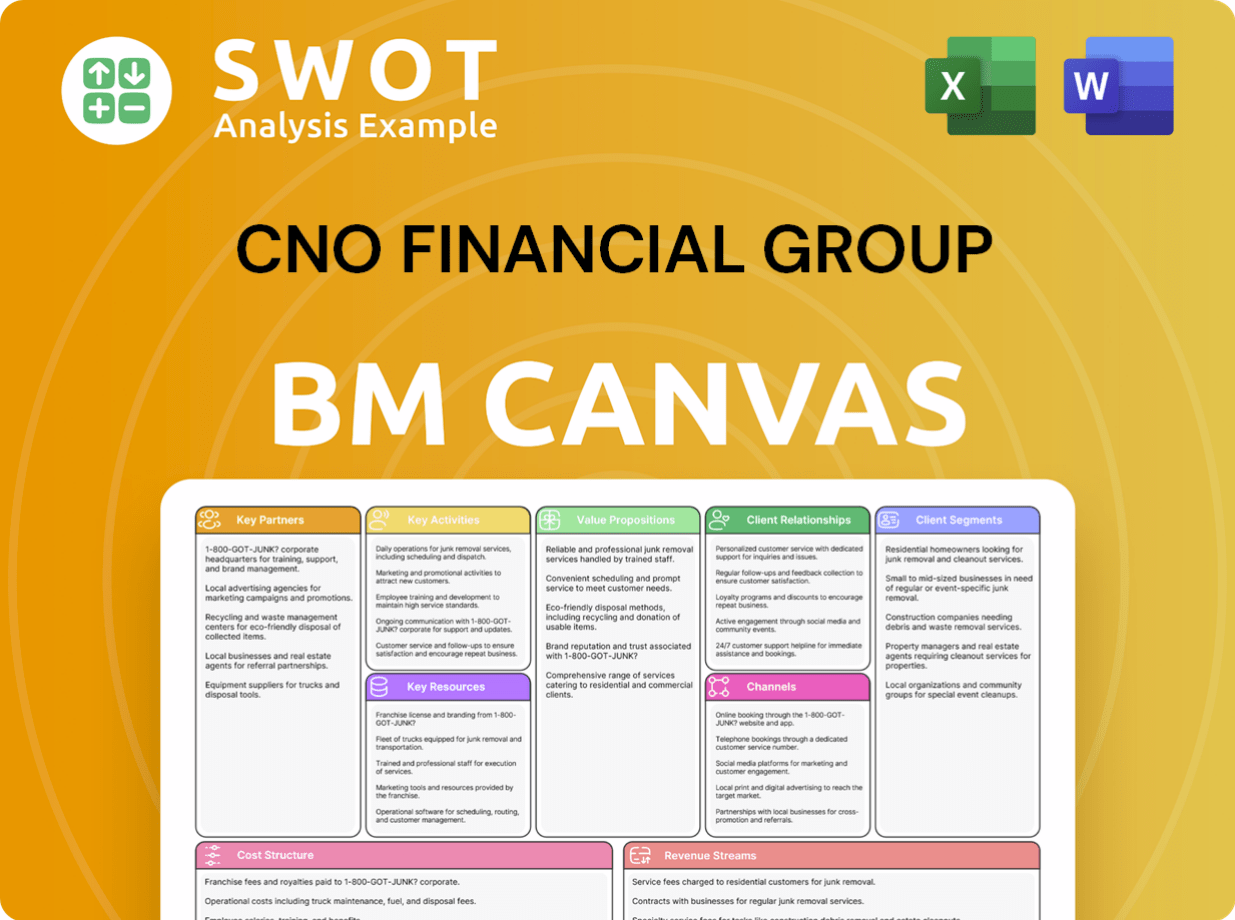

CNO Financial Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is CNO Financial Group Positioning Itself for Continued Success?

CNO Financial Group (CNO) holds a strong position in the U.S. insurance sector, particularly focusing on the middle-income market. The company's strategy of offering a diverse range of products, including annuities, life, and health insurance, through various distribution channels, contributes to its financial stability. As of March 31, 2025, CNO managed 3.2 million policies and had total assets of $37.4 billion.

Despite its strengths, CNO faces potential challenges. Risks include the impact of rising medical costs on profitability, competition in its core markets, and macroeconomic uncertainties. These factors could influence the company's performance in 2025.

CNO Financial Group is a significant player in the U.S. insurance market, specializing in serving middle-income consumers. Its diversified product portfolio and multiple distribution channels enhance its market position. The company's focus on this demographic allows it to tailor its products and services effectively.

Key risks for CNO include the impact of increased medical costs, which could affect profitability. Competition from new entrants and the commoditized nature of some products also pose challenges. Additionally, macroeconomic factors and potential recessionary pressures in 2025 could create uncertainties.

CNO is strategically positioned for sustained profitable growth. Management anticipates generating between $3.70 and $3.90 in operating earnings for 2025. Strategic initiatives and capital deployment are expected to drive continued success.

CNO aims to improve operating ROE by 50 basis points to 10.50%. The company repurchased $99.9 million of common stock in Q1 2025, demonstrating its commitment to shareholder value. The company is focused on its Consumer and Worksite Divisions.

CNO Financial Group is focusing on several strategic initiatives to drive future growth and profitability. These initiatives include expanding its Consumer and Worksite Divisions, driving sales and agent growth, and introducing new products. The company is also focused on maintaining strong underwriting margins and managing expenses.

- Focus on Consumer and Worksite Divisions.

- Driving sales and agent growth.

- Leveraging new products.

- Disciplined expense and capital management.

CNO Financial Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CNO Financial Group Company?

- What is Competitive Landscape of CNO Financial Group Company?

- What is Growth Strategy and Future Prospects of CNO Financial Group Company?

- What is Sales and Marketing Strategy of CNO Financial Group Company?

- What is Brief History of CNO Financial Group Company?

- Who Owns CNO Financial Group Company?

- What is Customer Demographics and Target Market of CNO Financial Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.