DBS Bundle

How Did DBS Transform Singapore's Financial Landscape?

Founded in 1968, DBS, initially the Development Bank of Singapore, emerged as a cornerstone of Singapore's industrialization. From its inception, the DBS SWOT Analysis reveals the strategic vision that propelled it from a development financier to a leading financial services group. Its establishment was a pivotal moment, driven by the Singaporean government's foresight to fuel economic growth.

This article delves into the brief history of DBS, charting its evolution from a government-backed initiative to a digitally-driven financial institution. Explore the early years of DBS Bank and understand its pivotal role in Singapore banking, tracing its key milestones and expansion history. Discover how DBS Group became a leading financial institution, impacting millions across diverse markets and contributing significantly to Singapore's development.

What is the DBS Founding Story?

The story of the DBS company, or the Development Bank of Singapore, began on July 16, 1968. It was a pivotal moment, driven by the Singaporean government's vision to propel the nation's industrialization forward. The creation of DBS marked a strategic shift in how Singapore approached economic development, laying the groundwork for its transformation into a global financial hub.

The primary goal of establishing DBS was to take over the industrial financing responsibilities from the Economic Development Board (EDB). The EDB, established in 1961, had already played a crucial role in attracting foreign investment and fostering industrial growth. However, the government recognized the need for a dedicated financial institution to support long-term industrial expansion. This led to the birth of the Development Bank of Singapore Limited.

The initial business model of DBS centered on providing long-term loans to manufacturing and industrial enterprises. This was a critical need in the rapidly developing post-colonial economy of Singapore. The cultural and economic context of the time, characterized by a strong push for self-sufficiency and economic diversification, significantly influenced the company's creation. This focus helped shape DBS into the financial powerhouse it is today. For more insights into the bank's strategic approach, you can explore the Target Market of DBS.

DBS was founded in 1968 by the Singaporean government to support industrialization.

- Its initial focus was on providing long-term loans to manufacturing and industrial businesses.

- The creation of DBS was influenced by Singapore's drive for self-sufficiency and economic diversification.

- The bank's early years were crucial in shaping Singapore's economic landscape.

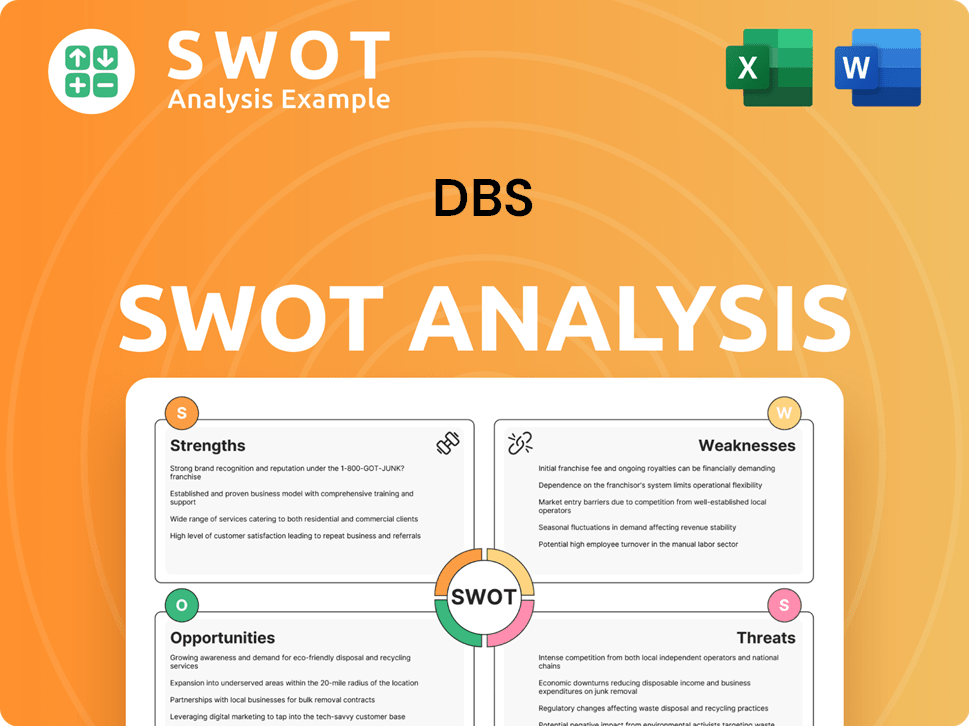

DBS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of DBS?

The early years of the Development Bank of Singapore (DBS) were pivotal in shaping its identity and role in Singapore's economy. DBS history began by focusing on financing Singapore's industrialization, providing crucial long-term loans. This support was vital for the growth of key industries, laying the foundation for what would become a leading financial institution history.

DBS played a crucial role in financing Singapore's industrialization during its early phases. The bank offered long-term loans to support infrastructure projects and manufacturing facilities. This support was essential for the growth of key industries in Singapore, contributing significantly to the nation's economic development. In its initial years, DBS focused heavily on these types of loans to foster industrial growth.

By the 1970s, DBS expanded its services beyond industrial financing, entering commercial banking. This move allowed DBS to serve a broader client base, including offering consumer banking services. The expansion of its branch network within Singapore was a key strategy to reach more customers. This diversification marked a significant step in DBS's evolution, broadening its financial offerings.

A major milestone in DBS history was its public listing on the Singapore Exchange in 1976. This event provided DBS with access to capital markets, supporting its growth and expansion. The IPO was a significant step in DBS's development, enhancing its visibility and financial strength. This strategic move helped DBS to further establish itself within the Singapore banking sector.

The 1990s were marked by significant regional expansion for DBS. The bank established a presence in key Asian markets, including Hong Kong, India, Indonesia, and Thailand. This expansion was often achieved through strategic acquisitions. For example, the acquisition of POSB (Post Office Savings Bank) in 1998 significantly expanded DBS's retail customer base. This period saw DBS evolve from a domestic development bank to a regional financial institution.

The acquisition of POSB in 1998 was a landmark event, significantly expanding DBS's retail customer base and solidifying its position in Singapore's consumer banking sector. This period saw DBS evolve from a domestic development bank to a regional financial institution, adapting to changing market dynamics and increasing competition. For more insights, you can explore the Marketing Strategy of DBS.

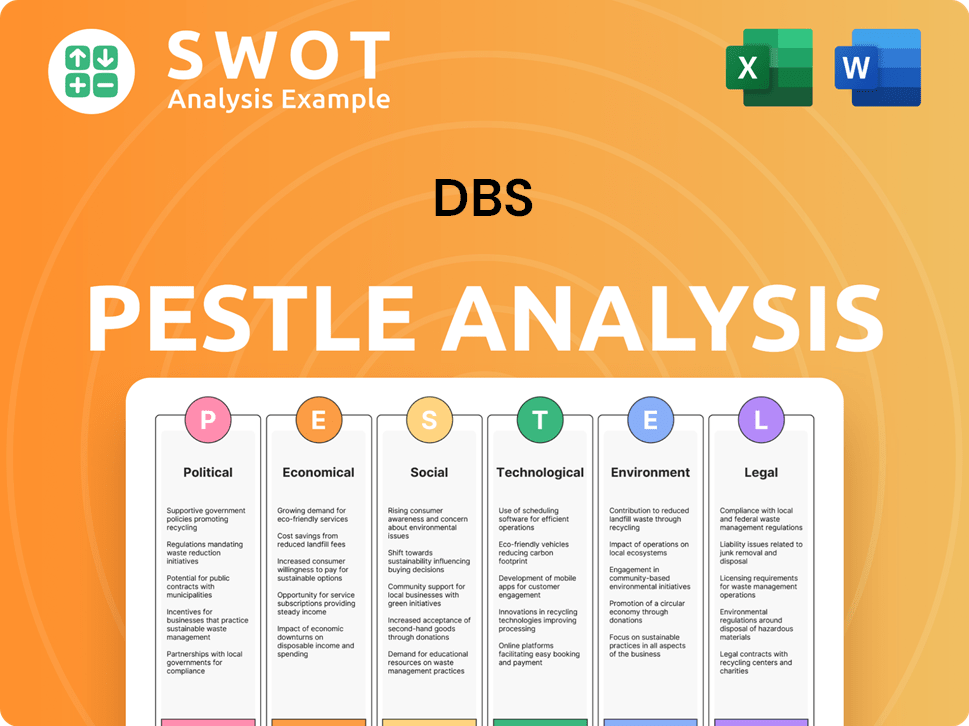

DBS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in DBS history?

The DBS history is marked by significant milestones, reflecting its growth and adaptation within the Singapore banking sector and beyond. From its inception, the Development Bank of Singapore (DBS) has played a crucial role in Singapore's economic development, evolving into a leading financial institution. The journey of the DBS company is characterized by strategic decisions and responses to both local and global financial landscapes.

| Year | Milestone |

|---|---|

| 1968 | DBS was established by the Singapore government to provide financing for industrial development. |

| 1998 | DBS acquired POSB (The Post Office Savings Bank), expanding its retail banking presence significantly. |

| 2000s | DBS expanded its regional presence, acquiring banks and expanding operations in various Asian countries. |

| 2021 | DBS was named 'World's Best Bank' by Euromoney, highlighting its digital transformation and financial performance. |

| 2024 | DBS was again recognized as 'World's Best Bank' by Euromoney, underscoring its continued leadership and innovation in the industry. |

Innovations have been central to the DBS Group's strategy, particularly in digital banking. The bank has consistently invested in technology to enhance customer experience and operational efficiency, leading to significant advancements in its service offerings.

DBS has launched various digital platforms, including mobile banking apps and online portals, providing customers with convenient access to financial services.

DBS has implemented AI-powered tools to offer personalized financial advice and investment recommendations to its customers.

The bank has expanded its ecosystem partnerships to integrate financial services into various platforms, enhancing customer convenience and reach.

DBS leverages data analytics to offer personalized financial solutions and improve customer service, enhancing its competitive edge.

DBS integrates environmental, social, and governance (ESG) considerations into its lending and investment frameworks to promote sustainable practices.

DBS has enhanced its mobile banking app, offering a wide range of services, including account management, payments, and investment options, to provide customers with a seamless banking experience.

The DBS company has faced various challenges, including navigating financial crises and adapting to increasing competition. These challenges have driven the bank to continually innovate and refine its strategies.

The Asian Financial Crisis in the late 1990s and the Global Financial Crisis in 2008 required strategic restructuring and enhanced risk management to ensure stability.

Competition from both traditional banks and fintech companies has driven DBS to continually innovate and adapt its business model.

Adapting to evolving regulatory landscapes and compliance requirements has been a constant challenge for DBS, necessitating continuous adjustments to its operations.

Economic downturns and fluctuations in global markets have impacted DBS, requiring strategic pivots to maintain profitability and manage risks effectively.

The rapid pace of technological advancements and the emergence of new digital platforms have necessitated continuous investment and adaptation to stay competitive.

Geopolitical events and uncertainties have posed challenges to DBS's international operations, requiring careful risk management and strategic planning.

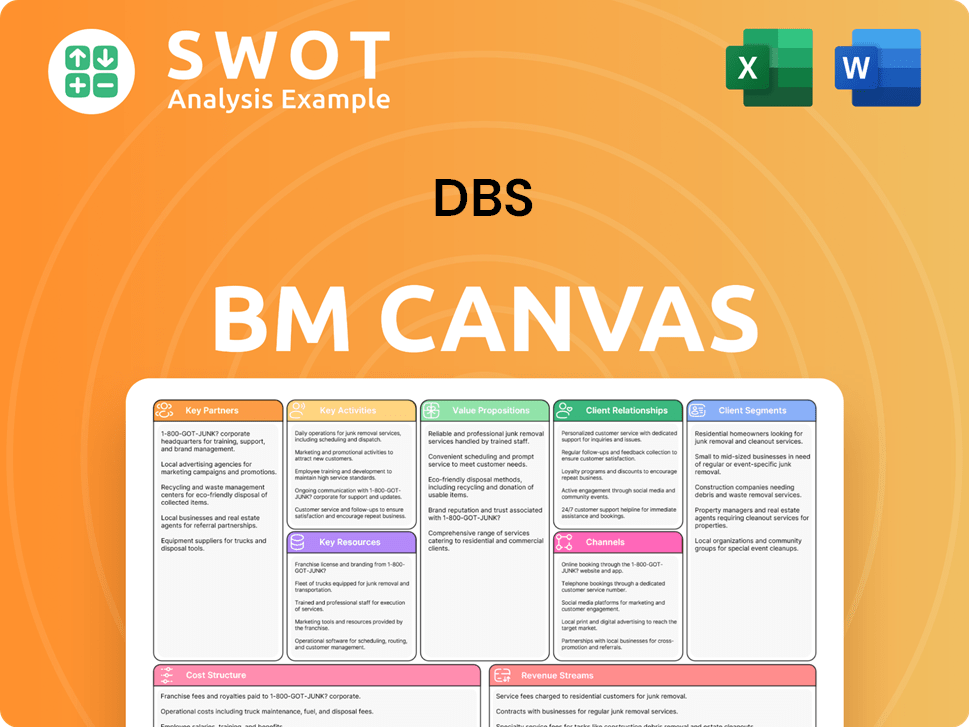

DBS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for DBS?

The DBS history is marked by significant milestones, reflecting its growth from a development bank to a leading financial institution in Asia. This journey began in 1968 with the establishment of the Development Bank of Singapore Limited, followed by its public listing on the Singapore Exchange in 1976. Key acquisitions, such as POSB in 1998, expanded its reach, and a rebranding to DBS Bank Ltd. in 2003 signaled its evolution. Digital innovation became a focus with the launch of digibank in 2017, and the bank has consistently garnered accolades, including multiple 'World's Best Bank' awards from Euromoney, most recently in 2021, and the 'Best Bank in the World' award from Global Finance in 2024.

| Year | Key Event |

|---|---|

| 1968 | The Development Bank of Singapore Limited is established, marking the beginning of DBS's journey. |

| 1976 | DBS is publicly listed on the Singapore Exchange, a significant step in its growth. |

| 1998 | Acquisition of POSB expands DBS's retail banking presence significantly. |

| 2003 | DBS rebrands to DBS Bank Ltd., reflecting its evolution. |

| 2009 | Introduces DBS Treasures Private Client, enhancing its wealth management offerings. |

| 2014 | Recognized as the 'Safest Bank in Asia' by Global Finance. |

| 2017 | Launches digibank by DBS in India and Indonesia, a mobile-only bank. |

| 2019 | Named 'World's Best Bank' by Euromoney. |

| 2021 | DBS recognized as 'World's Best Bank' by Euromoney for a second time. |

| 2022 | Announced plans to expand its digital asset ecosystem. |

| 2023 | Continues to enhance its digital platforms and expand its regional footprint, particularly in wealth management and SME banking. |

| 2024 | DBS receives the 'Best Bank in the World' award from Global Finance for the sixth consecutive year, affirming its leadership in digital innovation and sustainable finance. |

DBS is set to enhance its digital banking capabilities, leveraging technology to expand in key Asian markets. This includes further investment in AI and data analytics to personalize customer experiences and improve operational efficiency. The bank aims to maintain its position as a leader in digital innovation, building on its existing digital platforms.

The bank plans to deepen its presence in wealth management, targeting affluent and high-net-worth individuals. Simultaneously, it will strengthen its SME banking franchise, providing tailored financial solutions for small and medium-sized enterprises. These initiatives are part of its strategy to drive sustainable growth.

DBS is committed to sustainability, aiming to be a leader in sustainable finance. The bank will support the transition to a low-carbon economy through various initiatives. This commitment aligns with global trends and regulatory pressures, and it is expected to be a key driver of its future strategy.

Analyst predictions suggest continued growth for DBS, driven by its strong digital strategy and expanding regional footprint. The bank's ability to adapt to changing market conditions and its focus on innovation are key factors supporting this positive outlook. Its commitment to sustainability is also expected to enhance its long-term performance.

DBS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of DBS Company?

- What is Growth Strategy and Future Prospects of DBS Company?

- How Does DBS Company Work?

- What is Sales and Marketing Strategy of DBS Company?

- What is Brief History of DBS Company?

- Who Owns DBS Company?

- What is Customer Demographics and Target Market of DBS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.