DBS Bundle

Who Really Owns DBS Bank?

Unraveling the DBS SWOT Analysis, a cornerstone of Southeast Asia's financial landscape, requires understanding its ownership structure. Knowing "Who owns DBS" is key to grasping its strategic direction and its impact on the global market. From its origins to its present status, DBS's ownership story reveals much about its evolution.

Understanding the DBS ownership structure is vital, especially considering its significant influence in Singapore and the broader Asian market. This exploration will reveal the major investors in DBS, including the role of DBS shareholders and the influence of key stakeholders. This dive into DBS's history and ownership will provide valuable insights into this financial powerhouse, including whether DBS is a publicly traded company and details on DBS Bank parent company.

Who Founded DBS?

The establishment of DBS, officially incorporated on July 16, 1968, marked a pivotal moment in Singapore's financial landscape. It was a strategic move by the Singapore government to foster industrial and manufacturing growth by enabling private sector participation in financing projects. The initial capitalization of the bank was set at S$100 million, signaling a significant investment in the nation's economic future.

The early ownership structure of DBS reflected a collaborative effort between the government and various financial institutions. This approach aimed to create a robust financial ecosystem capable of supporting Singapore's ambitious development plans. The involvement of commercial banks, insurance companies, and other financial entities underscored a shared commitment to the country's economic advancement.

The inaugural leadership of DBS was entrusted to Hon Sui Sen, who transitioned from his role as chairman of the Economic Development Board (EDB). His appointment, along with the composition of the first board of directors, highlighted the strategic importance of the bank. The early days of DBS were also supported by technical assistance from the German credit bank Kreditanstalt für Wiederaufbau (KfW), which aided in establishing operational and organizational frameworks.

DBS began with an initial capital of S$100 million, a substantial investment by the Singapore government. This financial backing was crucial for the bank's establishment and early operations.

The Singapore government held a significant stake in DBS, with an initial investment of S$48.6 million. This demonstrated the government's commitment to the bank's success and its role in national development.

Commercial banks contributed S$25.9 million, and insurance companies and other financial institutions invested S$7.6 million. This diverse shareholder base supported the bank's operations.

Hon Sui Sen, formerly of the EDB, was appointed as the first Chairman and President. Ang Kong Hua also played a key role in setting up the Corporate Finance Division.

Technical assistance from KfW helped in the early operational and organizational phases. This international collaboration was crucial for the bank's initial setup.

Other companies and the public held S$17.9 million of shares, showing broad-based support for the bank. This initial public participation was a key aspect of DBS's early ownership.

The initial ownership structure of DBS Bank, as detailed in Brief History of DBS, set the stage for its future. In its first year, the Singapore government held a significant portion of the shares, with commercial banks and other financial institutions also contributing. This structure facilitated the bank's early operations and its mission to support Singapore's industrialization. The early involvement of the EDB staff and the technical assistance from KfW were instrumental in establishing the bank's operational framework. This early foundation was critical for DBS's subsequent growth and its evolution into a leading financial institution. The initial share distribution among various stakeholders, including the government, commercial banks, and the public, highlights the collaborative approach to building a robust financial infrastructure in Singapore.

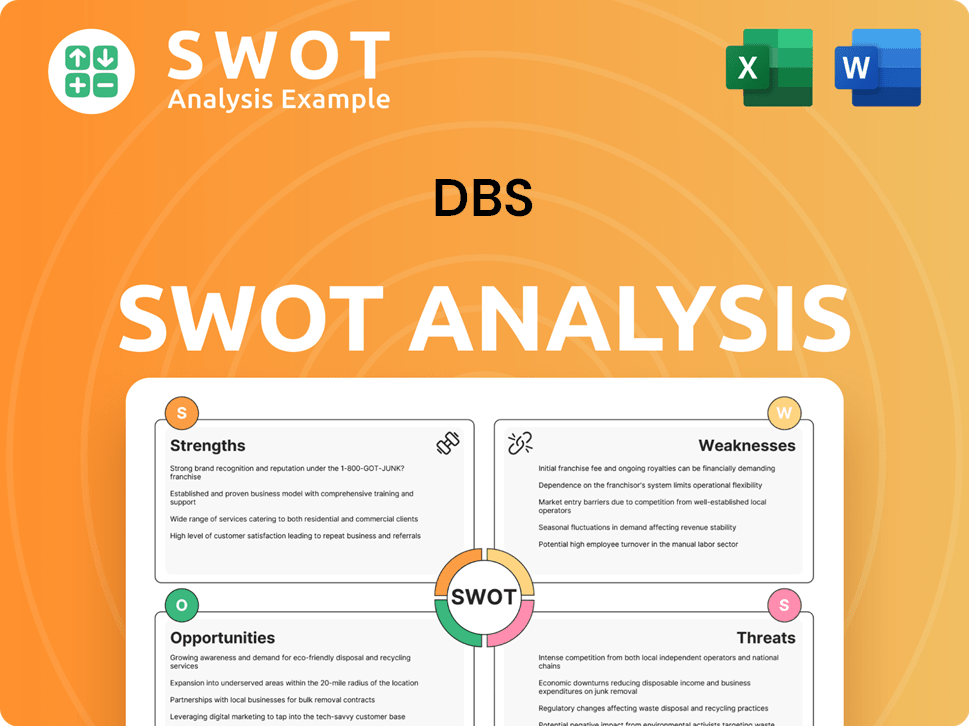

DBS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has DBS’s Ownership Changed Over Time?

The evolution of DBS ownership has been marked by key shifts. Initially, DBS became a publicly listed entity on the Singapore Exchange (SGX: D05) following its initial public offering (IPO). A significant change occurred on September 5, 2003, when the Singapore government consolidated its holdings. The government's direct 2.1% stake and MND Holding's 13.9% stake were transferred to Maju Holdings, a Temasek Holdings subsidiary, streamlining government interests without altering the effective stake.

This strategic move consolidated government influence under Temasek, setting the stage for the current ownership structure. The DBS history includes these pivotal moments that shaped its shareholder composition and influence.

| Date | Event | Impact |

|---|---|---|

| September 5, 2003 | Transfer of government stakes to Maju Holdings | Consolidated government holdings under Temasek. |

| February 10, 2023 | Shareholder data update | Provided a snapshot of major institutional and individual shareholders. |

| November 20, 2023 | Individual Investor Shareholding | Showcased the significant role of individual investors. |

As of March 31, 2023, Temasek Holdings (Private) Ltd, a wholly-owned subsidiary of the Ministry of Finance, is the largest shareholder, controlling 29% of DBS shares. As of February 10, 2023, Maju Holdings Pte Ltd held 17.83% of shares. Other major DBS shareholders include Citibank Nominees Singapore Pte Ltd (19.68%), DBSN Services Pte Ltd (11.83%), RAFFLES NOMINEES (PTE) LIMITED (8.94%), and HSBC (Singapore) Nominees Pte Ltd (8.73%). Individual investors collectively hold a substantial 44% stake as of November 20, 2023, making them the largest shareholder group. Private equity firms hold 29%. The top 25 shareholders collectively control less than half of the company's shares, indicating widely disseminated ownership. More information about the company's growth can be found in the Growth Strategy of DBS.

Temasek Holdings is the primary controlling shareholder of DBS Bank.

- Individual investors hold the largest single block of shares.

- Institutional investors, including Temasek and various nominees, hold significant stakes.

- The ownership structure reflects a mix of government, institutional, and individual investor influence.

- The shareholding is widely distributed, with no single entity dominating beyond Temasek.

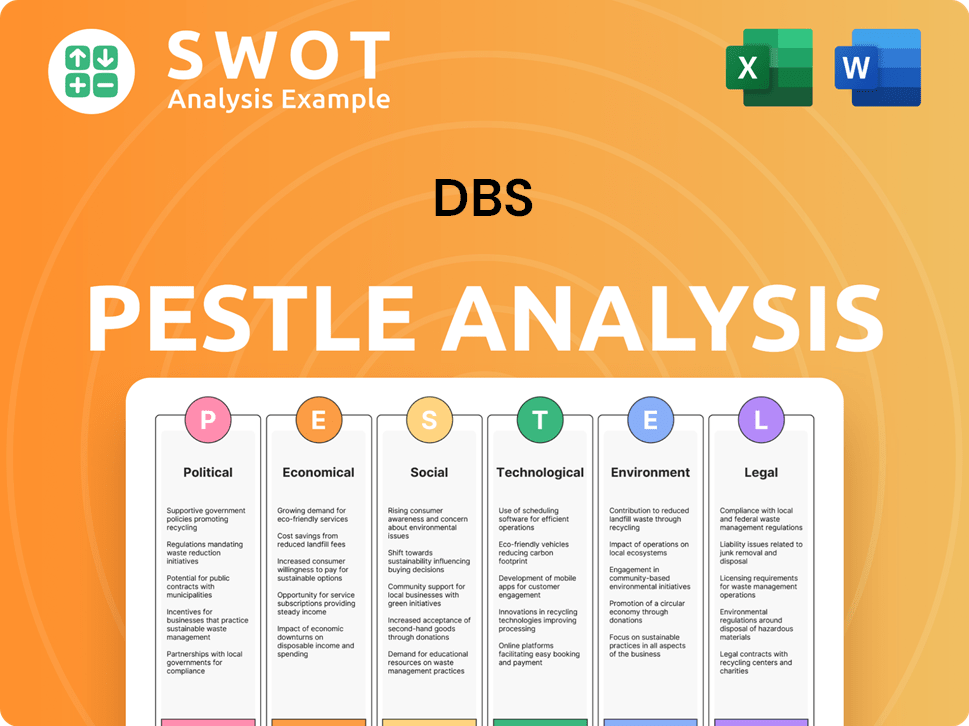

DBS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on DBS’s Board?

The Board of Directors of DBS Group Holdings Ltd is responsible for overseeing the company's strategic direction and governance. As of February 7, 2025, the board is composed of several key figures. Mr. Peter Seah serves as Chairman, ensuring the board's effectiveness in its supervisory role. Mr. Olivier Lim holds the position of Lead Independent Director, promoting independent oversight. Mr. Piyush Gupta is the Chief Executive Officer, responsible for the day-to-day operations and execution of the company's strategy. Other directors include Dr. Bonghan Cho, Mr. Chng Kai Fong, Mr. David Ho Hing-Yuen, Ms. Punita Lal, Ms. Judy Lee, Mr. Anthony Lim, and Mr. Tham Sai Choy. Peter Seah Lim Huat serves as the Non-executive Chairman, and Olivier Lim Tse Ghow is the Lead Independent Director.

The board's composition reflects a commitment to diverse expertise and independent oversight, which is crucial for maintaining stakeholder trust and ensuring robust corporate governance. This structure is designed to provide a balance of perspectives and experiences, which is essential for effective decision-making and strategic planning. The presence of both executive and non-executive directors helps ensure that the board can provide both operational expertise and independent oversight.

| Director | Position | Date of Appointment |

|---|---|---|

| Peter Seah | Chairman | May 1, 2010 |

| Olivier Lim | Lead Independent Director | January 1, 2020 |

| Piyush Gupta | Chief Executive Officer | November 9, 2009 |

| Dr. Bonghan Cho | Independent Director | April 25, 2018 |

| Chng Kai Fong | Independent Director | April 26, 2023 |

| David Ho Hing-Yuen | Independent Director | April 25, 2017 |

| Punita Lal | Independent Director | April 26, 2023 |

| Judy Lee | Independent Director | April 28, 2022 |

| Anthony Lim | Independent Director | April 27, 2021 |

| Tham Sai Choy | Independent Director | April 26, 2023 |

The voting structure at DBS generally follows a one-share-one-vote principle for ordinary shares, which is a standard practice in publicly traded companies. The company's adherence to the Code of Corporate Governance 2018 underscores its commitment to strong corporate governance. This code emphasizes a clear division of responsibilities between the board leadership and management, ensuring no single individual has excessive power. Furthermore, the Code sets a shareholding threshold of 5% for determining a director's independence, aligning with the definition of 'substantial shareholders' under the Securities and Futures Act. For more insights, you can explore the Competitors Landscape of DBS.

DBS's governance structure is designed to ensure accountability and transparency.

- One-share-one-vote principle for ordinary shares.

- Adherence to the Code of Corporate Governance 2018.

- Shareholding threshold of 5% for director independence.

- Nine-year tenure limit for independent directors.

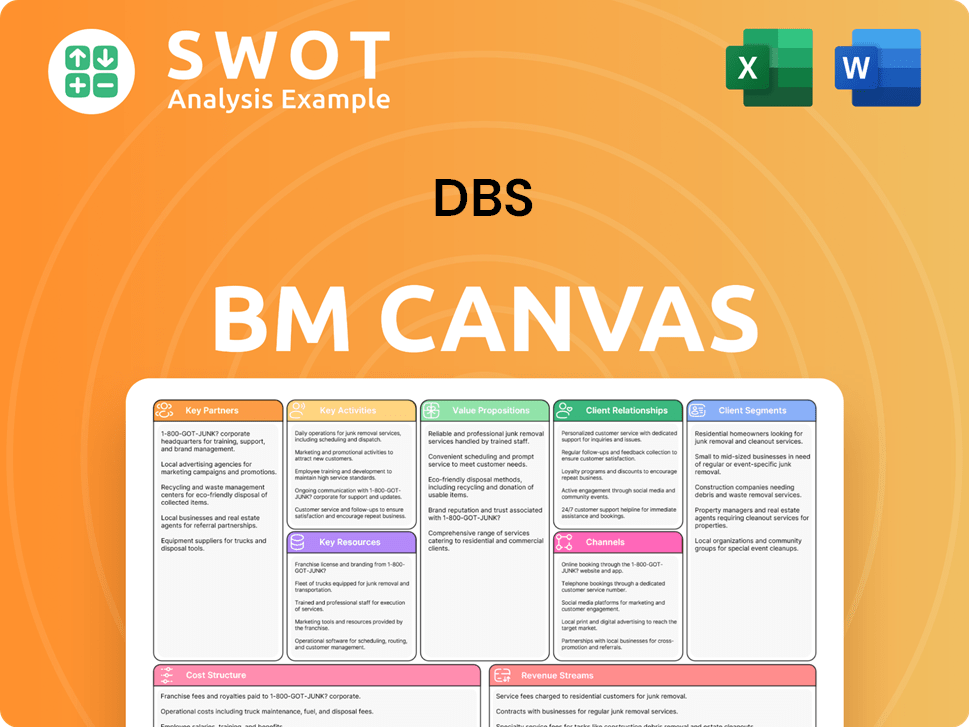

DBS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped DBS’s Ownership Landscape?

Over the past few years, significant shifts have occurred in the ownership profile and strategic direction of DBS Bank. In May 2024, DBS became the first Singapore-listed company to surpass S$100 billion in market capitalization, which further increased to S$124 billion by the end of the year. This performance led to total shareholder returns of 51% for 2024, with a 44% share price gain and a 7% dividend return. These returns were the highest in DBS's history, excluding periods of crisis recovery. This demonstrates strong investor confidence in DBS Singapore and its future prospects.

Leadership transitions also mark a key development in DBS ownership. CEO Piyush Gupta is scheduled to step down in March 2025, to be succeeded by Tan Su Shan, who was appointed Group Chief Operating Officer from April 1, 2025. Tan's extensive experience, including her previous role as Group Head of Institutional Banking, positions her well to lead the company. These changes reflect DBS Bank's commitment to adapting and evolving its leadership to meet future challenges and opportunities, ensuring continuity and strategic focus.

| Metric | Details | Year |

|---|---|---|

| Market Capitalization | Exceeded S$100 billion | May 2024 |

| Shareholder Returns | 51% total return | 2024 |

| Dividend per Share | Proposed final dividend of 60 cents | FY2024 |

In terms of capital management, DBS proposed a final dividend of 60 cents per share for FY2024, bringing the full-year ordinary dividend to S$2.22 per share, a 27% increase from the previous year. The bank also plans to introduce a 'Capital Return Dividend' of 15 cents per share per quarter for FY2025, with an indication that this will continue into the subsequent two years. Furthermore, the company's share purchase mandate, approved at the 2024 AGM, allowed for the purchase of up to 2% of issued ordinary shares and is proposed to be increased to 3% at the 2025 AGM. This reflects DBS Bank's commitment to enhancing shareholder value through consistent dividend payouts and strategic share repurchases, which are key aspects of DBS ownership.

DBS has strategically increased its stake in key Asian markets, including raising its stake in Shenzhen Rural Commercial Bank (SRCB) and DBS Securities China.

The successful integration of Citigroup's consumer banking business in Taiwan has made DBS the largest foreign bank by assets there.

Following the amalgamation of Lakshmi Vilas Bank, DBS has established a robust full-service platform in India.

These moves showcase DBS Bank's commitment to strategic growth and expansion, reflecting its adaptability and vision for long-term success, as highlighted in the Growth Strategy of DBS.

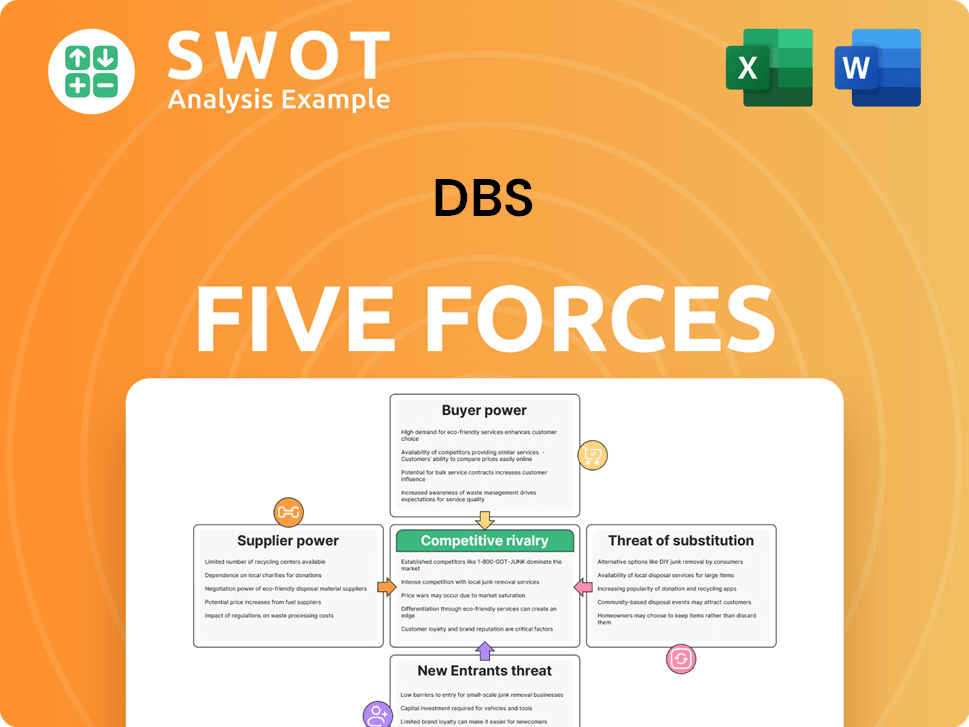

DBS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DBS Company?

- What is Competitive Landscape of DBS Company?

- What is Growth Strategy and Future Prospects of DBS Company?

- How Does DBS Company Work?

- What is Sales and Marketing Strategy of DBS Company?

- What is Brief History of DBS Company?

- What is Customer Demographics and Target Market of DBS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.