DBS Bundle

How Does DBS Dominate the Banking Arena?

DBS Group Holdings, a financial powerhouse born in Singapore, has consistently redefined success in the banking sector. With a remarkable 2024 net profit and a market capitalization exceeding SGD 100 billion, DBS stands as a testament to strategic foresight and robust performance. But how does DBS maintain its leading position in an ever-evolving global market?

To truly understand DBS's dominance, a deep dive into its DBS SWOT Analysis is essential, alongside a thorough DBS competitive landscape analysis. This includes identifying its key DBS competitors and assessing its market share within the Singapore banking sector and beyond. This detailed look at DBS's strengths and weaknesses, alongside its rivals, reveals the strategic initiatives that fuel its continued success in the banking industry.

Where Does DBS’ Stand in the Current Market?

DBS Bank holds a strong market position, recognized as a leading bank in Asia. Its core operations encompass consumer banking, wealth management, institutional banking, and treasury and markets services. This diverse range of services caters to individuals, SMEs, and large corporations across multiple markets.

The bank's value proposition lies in its comprehensive financial solutions and digital-first approach. DBS differentiates itself by offering a wide array of online and mobile banking services. This digital emphasis allows DBS to reach a larger customer base and provide convenient banking solutions.

Geographically, DBS operates across 19 markets, with a strategic focus on Greater China, Southeast Asia, and South Asia. In its home market of Singapore, DBS holds approximately a 25% share in deposits. This significant market share reflects its extensive branch network and strong customer base. For a deeper understanding of their strategic approach, consider reading about the Growth Strategy of DBS.

DBS has a dominant presence in Singapore, holding a substantial market share. The bank's extensive branch network and digital platforms contribute to its strong market position. This includes a significant share of deposits and a broad customer base.

DBS offers a comprehensive suite of financial products and services. These include consumer banking, wealth management, institutional banking, and treasury and markets services. This diversified portfolio caters to a wide range of customer segments.

DBS operates in 19 markets, with a strategic focus on key regions. These regions include Greater China, Southeast Asia, and South Asia. This geographic diversification supports its growth strategy and reduces reliance on any single market.

DBS has embraced a digital-first approach to differentiate itself. This includes a wide range of online and mobile banking services. This digital focus enhances customer convenience and expands its reach.

In 2024, DBS delivered a record total income of SGD 22.3 billion, a 10% year-on-year improvement, and a net profit of SGD 11.4 billion, an 11% climb from the previous year. Its return on equity stood at 18.0% in 2024, among the highest for developed market banks. The bank's asset quality remains healthy, with a non-performing loan (NPL) ratio of 1.1% as of December 31, 2024.

- DBS's market capitalization reached SGD 124 billion by the end of 2024.

- Wealth management income rose by 18% to SGD 5.22 billion in 2024.

- The successful integration of Citibank Taiwan's consumer banking business contributed to a 61% surge in income from Taiwan.

- These figures highlight DBS's strong financial health and its ability to maintain a competitive edge in the banking industry.

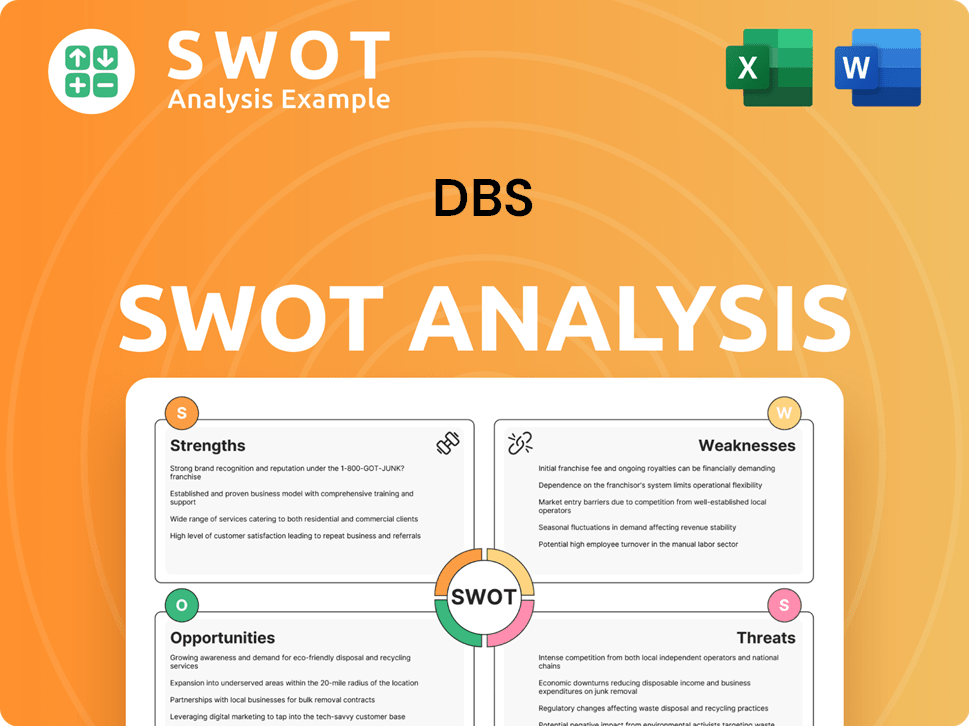

DBS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging DBS?

The DBS competitive landscape is shaped by a diverse group of financial institutions vying for market share in the banking sector. This analysis examines the key players challenging DBS and the strategies they employ. Understanding the competitive dynamics is crucial for assessing DBS's position and future prospects.

DBS market analysis reveals a complex interplay of traditional banking giants, regional powerhouses, and disruptive fintech companies. The bank's ability to navigate this environment will be critical for its continued success. This chapter provides a detailed look at DBS's main rivals and the competitive pressures it faces.

In Southeast Asia, DBS faces strong competition from OCBC Bank and United Overseas Bank (UOB). These banks offer a wide range of services and have established regional presences.

Globally, DBS competes with major international banks like Citibank, Standard Chartered, and HSBC. These banks provide a broad spectrum of banking and financial services.

Fintech companies and digital banks are also disrupting the market. These include Grab Financial Services, SeaMoney, and others, challenging traditional banking models.

DBS, OCBC, and UOB are the top three banks in Singapore. In Q3 2024, DBS outperformed its rivals in net profit growth, with a surge of 16.7%.

DBS is actively expanding its wealth management reach, as seen with the successful integration of Citibank Taiwan's consumer banking business in 2024.

DBS focuses on innovation and technology to maintain its competitive edge. For more insights, see Marketing Strategy of DBS.

The DBS competitors employ varied strategies to gain market share. Understanding these approaches is essential for a comprehensive DBS competitive analysis.

- OCBC and UOB: Focus on comprehensive banking services and regional expansion.

- Citibank: Leverages its global presence and corporate banking expertise.

- Standard Chartered: Emphasizes its strong foothold in Asia, Africa, and the Middle East.

- HSBC: Offers a broad range of financial services across multiple markets.

- Fintech Companies: Disrupt the market through innovation and specialized services.

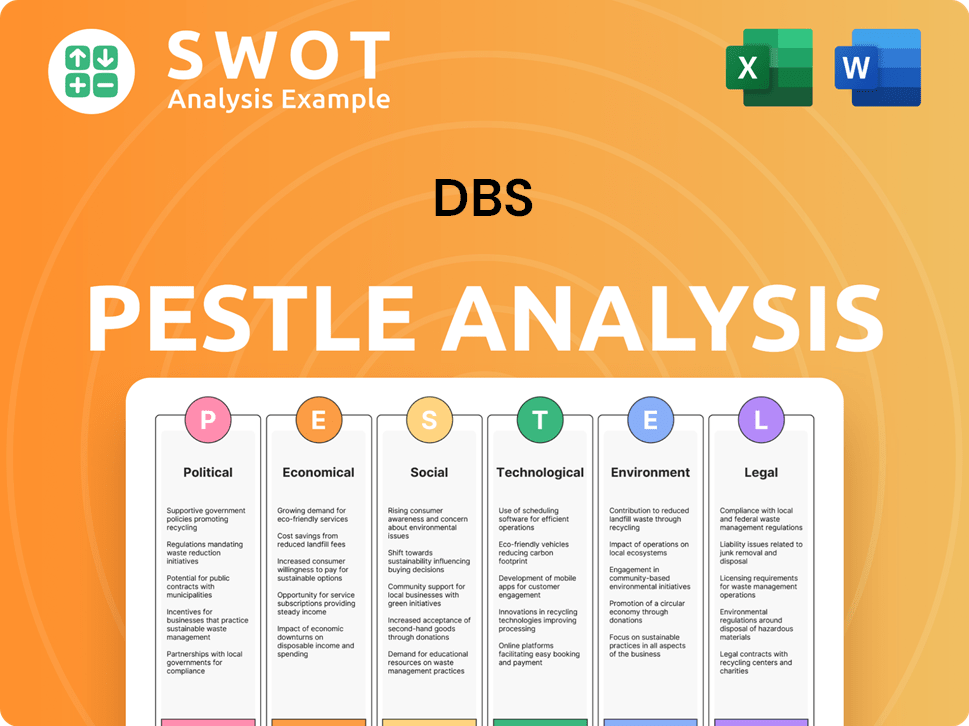

DBS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives DBS a Competitive Edge Over Its Rivals?

Understanding the DBS competitive landscape requires a deep dive into its strengths and how it differentiates itself in the banking industry analysis. DBS Group Holdings has consistently demonstrated a commitment to innovation and customer-centric strategies, setting it apart from its DBS competitors. This focus has allowed it to maintain a strong position within the Singapore banking sector and beyond.

DBS market analysis reveals a bank that has successfully integrated technology and customer service to create a sustainable competitive edge. Its strategic moves in digital transformation and global expansion have solidified its standing. This analysis offers insights into how DBS navigates the challenges and opportunities within a dynamic financial environment.

The bank's ability to adapt and innovate has been key to its success, allowing it to maintain a leading position in the market. For more information on DBS's customer focus, you can read about the Target Market of DBS.

DBS competitive landscape is significantly shaped by its digital prowess. The bank has been recognized as the 'World's Best Digital Bank' by Euromoney and 'Most Innovative in Digital Banking' by The Banker. In 2024, DBS was ranked No. 1 globally for AI Leadership, showcasing its advanced capabilities.

DBS prioritizes customer satisfaction through 24/7 support, personalized financial planning, and user-friendly digital platforms. This approach has cultivated a loyal customer base, making it a preferred choice for many. The emphasis on customer experience is a key differentiator in the competitive market.

DBS's financial health provides a solid foundation for its competitive edge. In 2024, it reported a record-high net profit of SGD 11.4 billion and a return on equity of 18.0%. This financial stability enables DBS to invest in new technologies and expand operations.

With a presence in 19 markets across Asia, DBS has a significant global footprint. Income from India grew by 25% and from Taiwan by 61% in 2024 following the Citi Consumer Taiwan acquisition. This network enables DBS to serve a diverse customer base and expand its market reach.

DBS's robust risk management framework, including real-time AI fraud detection, effectively identifies and mitigates risks. This disciplined approach contributes to its healthy asset quality, with a non-performing loan ratio of 1.1% in 2024. This focus has earned it the 'Safest Bank in Asia' award by Global Finance for 16 consecutive years from 2009 to 2024.

- Continuous investment in technology and innovation.

- Strong organizational culture fostering innovation.

- Adaptation to changing banking landscape.

- Strategic partnerships and product development.

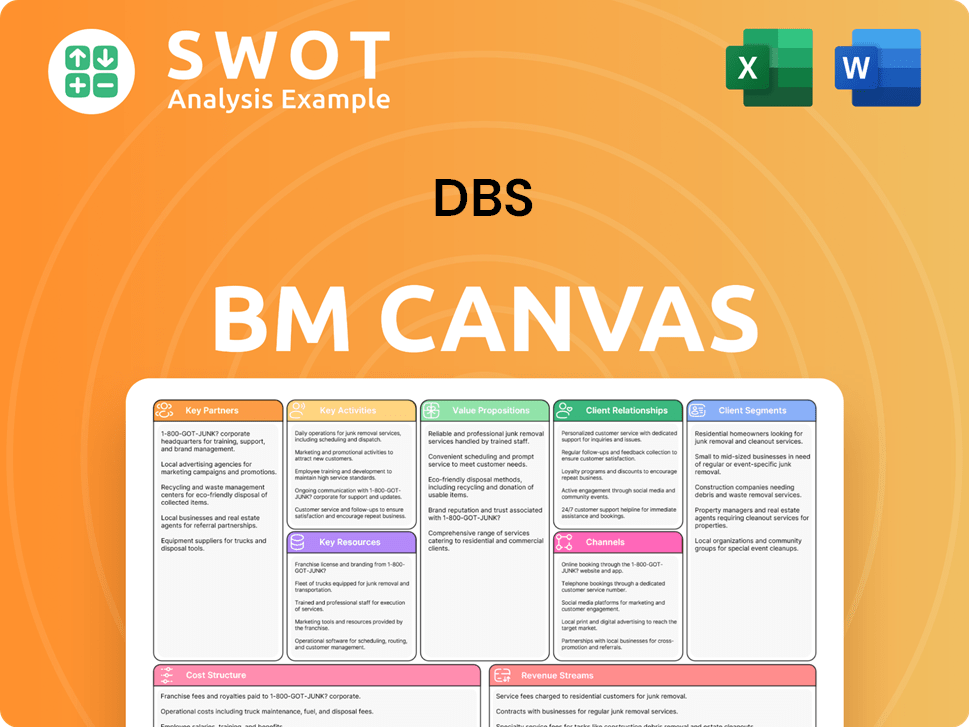

DBS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping DBS’s Competitive Landscape?

The Growth Strategy of DBS is heavily influenced by the evolving banking industry, marked by rapid technological advancements, shifting regulatory frameworks, and changing consumer expectations. A thorough DBS market analysis reveals that the bank operates within a dynamic environment, necessitating continuous adaptation and innovation to maintain its competitive edge. This includes navigating the rise of fintech companies, managing cybersecurity threats, and ensuring compliance with stringent regulations.

DBS Group Holdings faces both challenges and opportunities in the competitive landscape. Economic slowdowns, regulatory changes, and geopolitical uncertainties pose potential headwinds. However, strategic expansions, especially in high-growth markets like Asia, along with a focus on sustainable finance, offer significant avenues for growth. The bank's ability to leverage its digital capabilities and drive sustainable growth is crucial for its long-term success in the Singapore banking sector and beyond.

The banking industry is undergoing significant transformation, driven by digital innovation and evolving customer preferences. Digital transformation is a key trend, with banks investing heavily in technology to improve customer experience and operational efficiency. The global open banking market, valued at USD 26.16 billion in 2023, is projected to grow by 23.6% annually from 2024 to 2030.

The rise of fintech companies and digital banks intensifies competition, requiring continuous differentiation and innovation. Cybersecurity threats are a major concern, with potential for significant regulatory fines and reputational damage. Regulatory compliance is an ongoing challenge, with banks spending billions annually on adherence to strict standards.

Strategic expansion into high-growth markets, particularly in Asia, remains a key avenue for growth. DBS's commitment to sustainable finance positions it to attract eco-friendly customers and lead in ESG initiatives, with sustainable financing growing beyond SGD 89 billion. Product innovations like digital wallets and robo-advisory platforms, and strategic partnerships offer further growth potential.

DBS is adapting to the changing banking landscape through continued investment in technology and strategic regional expansion. The bank is leveraging its digital capabilities to enhance customer experience and streamline operations. The bank's strategy involves leveraging its digital capabilities to enhance customer experience, streamline operations, and drive sustainable growth, positioning it to remain resilient in a dynamic financial landscape.

DBS is focusing on several strategic initiatives to navigate the competitive market. These include digital transformation, strategic regional expansion, and a strong emphasis on sustainable finance. The bank is also exploring product innovations and partnerships to enhance its offerings and customer base.

- Leveraging AI and blockchain to improve decision-making and customer experience.

- Expanding into high-growth markets, such as its acquisition of Citibank Taiwan's consumer banking business.

- Focusing on sustainable finance and ESG initiatives.

- Developing digital wallets and robo-advisory platforms.

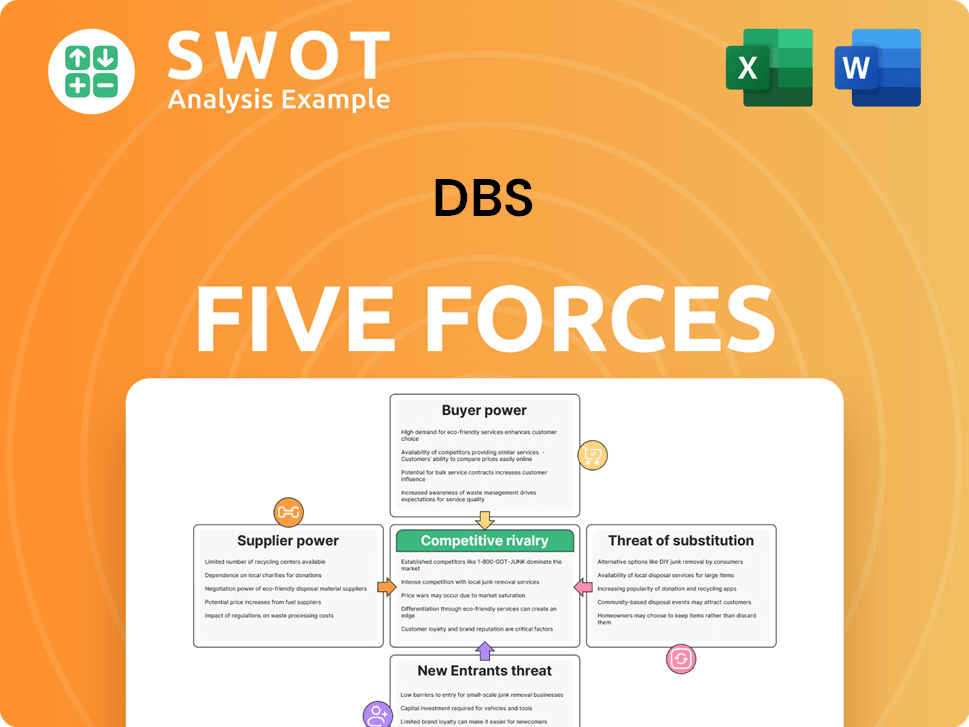

DBS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DBS Company?

- What is Growth Strategy and Future Prospects of DBS Company?

- How Does DBS Company Work?

- What is Sales and Marketing Strategy of DBS Company?

- What is Brief History of DBS Company?

- Who Owns DBS Company?

- What is Customer Demographics and Target Market of DBS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.