DBS Bundle

Can DBS Continue Its Ascent in the Global Banking Arena?

DBS Group Holdings, a titan in Asian finance, has consistently demonstrated the power of a forward-thinking DBS SWOT Analysis. From its roots in Singapore to its current status as a global leader, DBS's journey is a masterclass in strategic growth. This exploration dives into the core of DBS's approach, examining its past successes and future ambitions.

This detailed DBS company analysis will dissect the bank's robust DBS growth strategy, evaluating its DBS future prospects within the dynamic financial landscape. We'll analyze its impressive DBS financial performance, market position, and business model, providing crucial insights for investors and strategists alike. Understanding DBS's expansion plans, its digital transformation journey, and its sustainability initiatives is key to grasping its long-term growth potential and competitive edge.

How Is DBS Expanding Its Reach?

The following outlines the expansion initiatives of a leading financial institution, focusing on its strategic moves to enhance its market presence and diversify revenue streams. This analysis delves into the geographical expansion, wealth management growth, and strategic partnerships that are key components of their growth strategy. The aim is to provide a comprehensive overview of the company's current strategies and future prospects.

The company's approach involves a multi-faceted strategy, combining organic growth with strategic acquisitions and partnerships. These initiatives are designed to capitalize on emerging market opportunities and technological advancements in the financial sector. The analysis will highlight specific examples and data points to illustrate the effectiveness of these expansion efforts.

For a deeper understanding of the company's foundational principles, consider exploring the Mission, Vision & Core Values of DBS.

The company has a strong presence in 19 markets, with a primary focus on Greater China, Southeast Asia, and South Asia. This includes deepening its footprint in key growth markets such as China, India, Indonesia, and Taiwan. The company is also exploring potential acquisitions in new markets to strengthen its regional presence.

The company is focused on growing its wealth management franchise. In 2024, wealth management income increased by 18% to S$5.22 billion, with non-interest income rising by 45% to S$2.60 billion. The bank aims for double-digit growth in wealth management fee-based income for 2025.

The company engages in strategic partnerships to promote trade flows and expand its market reach. An example is the US$500 million facility with IFC launched in April 2024, aimed at supporting trade in emerging markets. The company also leverages technology and partnerships to participate in the growing open banking market.

The company actively participates in the open banking market, which was valued at USD 26.16 billion in 2023 and is projected to grow by 23.6% annually from 2024 to 2030. This includes leveraging technological capabilities and partnerships to enhance its digital offerings and customer experience.

The company's expansion strategy focuses on geographical diversification, wealth management growth, and strategic partnerships. These initiatives are supported by technological advancements and a focus on customer-centric solutions. The goal is to achieve sustainable long-term growth and enhance shareholder value.

- Geographical Expansion: Deepening presence in key markets such as China, India, Indonesia, and Taiwan.

- Wealth Management: Targeting double-digit growth in fee-based income for 2025.

- Strategic Partnerships: Collaborating with organizations like IFC to support trade and expand market reach.

- Digital Transformation: Leveraging open banking and fintech to enhance customer experience.

DBS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does DBS Invest in Innovation?

DBS's approach to innovation and technology is central to its DBS growth strategy, focusing on digital transformation to maintain a competitive edge in the financial sector. This strategy has led to significant recognition, including being named the 'World's Best Digital Bank' by Euromoney and the 'Most Innovative in Digital Banking' by The Banker. The bank's investments in research and development and in-house development are key drivers of its technological advancements.

The bank's commitment to innovation is evident in its strategic use of AI, cloud computing, and cybersecurity. These technologies are not just add-ons; they are core components of DBS's operational and customer service strategies. This approach supports its DBS future prospects by enhancing efficiency, improving customer experiences, and enabling the bank to adapt quickly to market changes.

DBS's technology strategy is designed to create impactful solutions for its 19 million customers by leveraging technology, new ways of working, and deep ecosystem partnerships. The bank's focus on digital transformation is a key element of its DBS company analysis, driving its financial performance and market position.

DBS has deployed over 1,500 AI models across more than 370 use cases. These models are designed to improve decision-making and automate risk management. The anticipated economic impact of these AI initiatives is expected to exceed S$1 billion by 2025.

Cloud computing powers 90% of DBS's applications and workloads. This shift to the cloud has enabled greater scalability and agility. The transition supports the bank's ability to quickly deploy and upgrade applications.

Blockchain technology is being integrated into digital asset transactions and trade finance. This integration aims to improve efficiency and security. The use of blockchain supports DBS's efforts to streamline financial processes.

AI-powered financial nudges have contributed to a 40% increase in digital product adoption rates. This increase demonstrates the effectiveness of AI in enhancing customer engagement. The bank is focused on creating impactful solutions for its 19 million customers.

DBS has revamped its entire technology stack, moving from a monolithic structure to a cloud-based, open-source framework. This new framework supports APIs and microservices, allowing for seamless deployment and upgrading of applications. This modernization is key to the bank's ability to adapt to changing market demands.

DBS emphasizes deep ecosystem partnerships to enhance its innovative capabilities. These partnerships are critical for creating new solutions and expanding the bank's reach. The bank's focus on digital transformation also includes strategic partnerships.

DBS's technology and innovation strategy is designed to enhance its DBS financial performance and strengthen its DBS market position. The bank's investments in technology are crucial for its DBS business model, allowing it to offer innovative services and maintain a competitive advantage. For more insights into how DBS approaches its marketing efforts, explore the Marketing Strategy of DBS.

- The bank's digital transformation journey is significantly impacting its DBS growth strategy in Southeast Asia.

- DBS's focus on fintech and innovation directly influences its DBS future prospects in digital banking.

- The bank's technological advancements are key factors in its DBS company financial performance review.

- DBS's investment in technology is an integral part of its DBS investment strategy analysis.

DBS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is DBS’s Growth Forecast?

In 2024, the financial performance of the company showcased a strong upward trajectory. The company's total income rose by 10% year-on-year, reaching S$22.3 billion. Net profit also saw a significant increase, climbing 11% year-on-year to an all-time high of S$11.4 billion. This robust performance underscores the effectiveness of the company's strategies and its strong market position.

The company's return on equity (ROE) hit 18.0%, positioning it among the top performers in developed market banks. This high ROE reflects the company's ability to generate substantial profits from its shareholders' equity. The company's success is a testament to its robust business model and efficient operations.

Looking ahead, the company anticipates continued growth. For 2025, the company expects net interest income to remain slightly above 2024 levels, supported by loan growth. This will help offset the impact of lower interest rates. This positive outlook is a key indicator of the company's Owners & Shareholders of DBS and future prospects.

Total income grew by 10% year-on-year, reaching S$22.3 billion, demonstrating strong revenue generation. Net profit increased by 11% year-on-year, reaching S$11.4 billion, reflecting improved profitability. ROE reached 18.0%, highlighting efficient capital utilization and profitability.

Net interest income is expected to be slightly higher than 2024, supported by loan growth. Non-interest income from the commercial book is projected to grow in the high-single digits, driven by wealth management and treasury sales. Total income is expected to increase in the low single digits, indicating continued expansion.

Net profit for 2025 is expected to be below 2024 levels due to higher tax expenses from the 15% global minimum tax. Pretax profit is anticipated to remain around the record S$13.4 billion achieved in 2024, demonstrating resilience. This highlights the impact of regulatory changes on the company's financial results.

A final dividend of 60 cents per share for FY2024 is proposed, bringing the full-year ordinary dividend to S$2.22 per share, a 27% increase. A 'Capital Return Dividend' of 15 cents per share per quarter is planned for FY2025, expected to continue for three years. This shows a commitment to shareholder value.

Total income reached a new record of S$5.9 billion. Net profit decreased by 1.8% to S$2.9 billion due to the global minimum tax. This highlights the short-term impact of the tax and the company's overall strong performance.

- The company's strong financial performance in 2024 sets a solid foundation for future growth.

- The anticipated growth in net interest income and non-interest income indicates positive momentum.

- The commitment to capital returns and dividends enhances shareholder value.

- The impact of the global minimum tax is a factor to watch in the coming year.

DBS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow DBS’s Growth?

The path to future success for DBS faces several significant risks and obstacles. These challenges span macroeconomic uncertainties, technological disruptions, and evolving regulatory landscapes. Understanding these potential pitfalls is crucial for investors and stakeholders assessing the DBS company analysis and its long-term viability.

Macroeconomic and geopolitical factors, such as a slowdown in China's economy or escalating trade tensions, introduce considerable uncertainty. The banking sector also confronts the rapid evolution of technology, particularly the increasing impact of artificial intelligence (AI) and the persistent threat of cybersecurity breaches. While DBS has embraced digital transformation, this also brings forth its own set of challenges, including regulatory complexities and the need for continuous technological adaptation.

Regulatory changes, intense market competition, and potential declines in asset quality are also ongoing concerns that DBS must navigate. The bank's management actively assesses and prepares for these risks through stress testing, liquidity management, and robust credit assessment systems. DBS financial performance is also impacted by these risks.

Slowing economic growth in key markets and geopolitical instability can significantly affect the bank's operations. Escalations in global trade disputes and military conflicts introduce uncertainties that could impact DBS's international business and overall financial stability. These risks require careful monitoring and strategic responses to mitigate potential adverse effects.

The rapid advancement of technology, especially in areas like AI, presents both opportunities and risks. While digital transformation is a key part of the DBS growth strategy, it also increases the vulnerability to cybersecurity threats and requires continuous investment in technology and talent. The financial sector is constantly under threat from cyberattacks.

Changes in financial regulations, such as the implementation of the global minimum tax, can increase costs and impact profitability. Ensuring compliance with evolving regulatory requirements across multiple jurisdictions adds complexity and expense. Adapting to these changes is essential for maintaining operational efficiency and avoiding penalties.

Intense competition from both traditional banks and fintech companies puts pressure on margins and market share. Monitoring and maintaining asset quality, as well as the DBS market position, is critical, although the non-performing loan ratio remained stable at 1.1% in 2024. A deterioration in asset quality could lead to increased credit losses and reduced profitability.

A global or regional economic slowdown could lead to reduced demand for financial services and increased credit risk. Reduced business activity and consumer spending can impact loan performance and overall revenue. Proactive management of these risks is essential to maintaining financial health during economic downturns.

Operational risks, including fraud, system failures, and internal control weaknesses, can lead to financial losses and reputational damage. The bank must maintain robust operational controls and continuously invest in risk management systems to prevent and mitigate these risks. Strengthening cybersecurity measures is a top priority.

DBS employs several strategies to manage and mitigate these risks. These include rigorous stress testing to assess the bank's resilience under various economic scenarios, robust liquidity management to ensure adequate funding, and strong credit assessment systems to manage credit risk. The bank also focuses on diversifying its revenue streams, as seen in the strong growth of wealth management and treasury customer sales. For more insights, read about Revenue Streams & Business Model of DBS.

DBS's proactive approach to risk management is further demonstrated by its focus on integrating risk management into decision-making at all levels and strengthening cybersecurity measures. This integrated approach helps the bank identify and address potential risks promptly. Regular reviews and updates to risk management frameworks are essential to adapt to the evolving threat landscape.

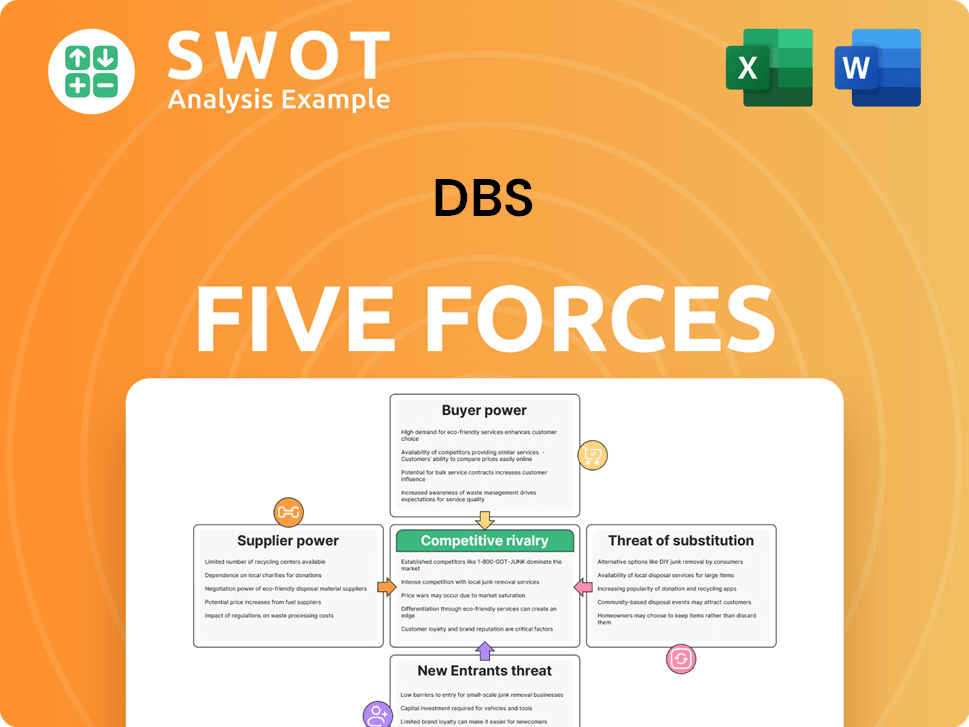

DBS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.