DBS Bundle

What Drives DBS: Mission, Vision, and Values?

Understanding a company's core principles is key to assessing its long-term potential. DBS, a prominent player in Asian finance, provides a compelling case study in how mission, vision, and values shape its trajectory. This exploration delves into the heart of DBS's strategic framework.

DBS Group's commitment to these principles is evident in its operations, influencing its DBS SWOT Analysis and overall DBS strategy. Examining the DBS mission, DBS vision, and DBS core values illuminates how DBS Singapore has cultivated a strong corporate culture and a forward-thinking approach to banking. Discover the key principles that guide DBS and its aspirations for the future of banking.

Key Takeaways

- DBS's core principles underpin its success in Asia's evolving financial sector.

- Focus on digital banking, joyful experiences, and strong values drives DBS's performance.

- Alignment with mission, vision, and values is key for future growth and impact.

- DBS demonstrates how purpose-driven strategies build trust and contribute to society.

Mission: What is DBS Mission Statement?

DBS's mission is 'to be the best bank for a better world.'

Let's delve into the core of DBS Group's purpose. Understanding the DBS Mission is crucial for investors, analysts, and anyone seeking to grasp the bank's strategic direction. This mission statement is not merely a slogan; it's a guiding principle that shapes DBS’s operations and its interactions with stakeholders. It reflects a commitment to innovation, customer-centricity, and sustainable practices.

The mission emphasizes being the 'bank of choice for a digital generation.' This directly targets the evolving needs of modern customers. DBS focuses on delivering seamless and joyful banking experiences.

DBS has made significant investments in digital transformation. This includes leveraging AI and machine learning to enhance customer experience and operational efficiency. This is a key component of their DBS Strategy.

The mission statement highlights the creation of long-term value for customers, employees, and stakeholders. This broad focus underscores DBS’s commitment to sustainable growth. This is a key aspect of their overall DBS Group approach.

DBS focuses on delivering innovative financial solutions. This includes a wide array of products and services designed to meet the diverse needs of its customers. This is a core element of the DBS Singapore operations.

DBS emphasizes providing personalized solutions based on understanding customer needs. This approach ensures that customers receive tailored services that meet their specific financial goals. This is part of their commitment to customer service.

DBS integrates sustainability into its mission. This includes initiatives to promote environmental and social responsibility. This is a key aspect of their commitment to building a better world.

The mission statement of DBS is a dynamic framework. It is designed to adapt to the changing financial landscape. DBS's commitment to technology and customer-centricity is evident in its investments. For example, DBS reported a record net profit of S$8.19 billion in 2023, a 23% increase year-on-year, reflecting the success of its strategic initiatives. Their digital transformation efforts have led to increased efficiency and improved customer satisfaction. Furthermore, DBS's focus on sustainability is reflected in its green financing initiatives and commitment to reducing its carbon footprint. Understanding the DBS Vision and how it aligns with these initiatives is key. To learn more about how DBS approaches its market, consider reading about the Marketing Strategy of DBS.

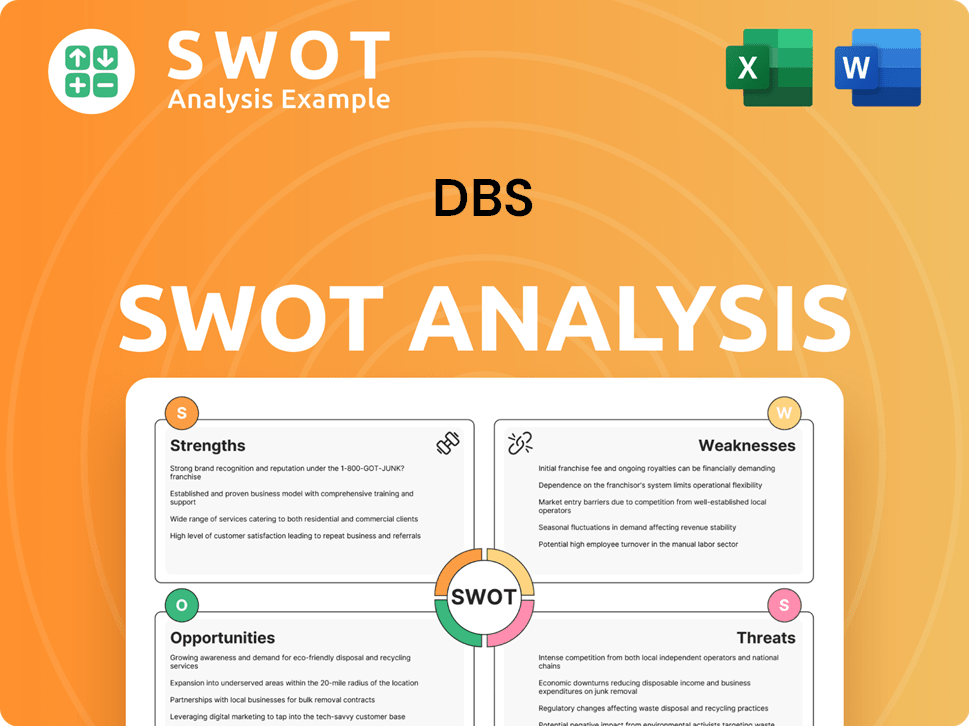

DBS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is DBS Vision Statement?

DBS's vision is 'Making banking joyful.'

DBS's vision statement is a bold declaration, aiming to redefine the banking experience. The core of the DBS Vision is to be the 'bank of choice for a digital generation'. This forward-looking statement encapsulates DBS's commitment to leading digital banking innovation and transforming the industry. The DBS Group's strategy is deeply rooted in this vision, guiding its investments and initiatives.

DBS envisions a future where banking is seamless and personalized. This involves leveraging cutting-edge technology to create intuitive and user-friendly digital platforms. The bank is actively investing in technologies such as AI, cloud computing, and cybersecurity to achieve this vision.

DBS aims to empower individuals, businesses, and communities to thrive. This is achieved by providing them with the financial tools and resources they need. The DBS Vision extends beyond just financial transactions, focusing on creating positive societal impact.

The bank's vision includes disrupting the traditional banking model through digital solutions. DBS is constantly seeking innovative ways to improve its services and stay ahead of the curve. This includes exploring new technologies and business models.

Given DBS's current trajectory and market position, the vision is both realistic and aspirational. DBS Singapore has consistently been recognized as a leading digital bank. This recognition validates their strategic direction and ongoing efforts.

DBS is actively investing in AI, cloud computing, and cybersecurity to realize its vision. These investments are crucial for enhancing customer experience, improving operational efficiency, and ensuring data security. These investments are part of the DBS Strategy.

DBS's vision for the future of banking is one where technology plays a central role in delivering exceptional customer experiences. This includes personalized financial solutions, seamless transactions, and proactive customer service. To understand how DBS has evolved to this point, consider a brief history of DBS.

The DBS Vision is not just a statement; it is a commitment to continuous improvement and innovation. The DBS Mission and DBS Core Values are closely aligned with this vision, providing the framework for achieving its goals. DBS Group's dedication to digital transformation and customer-centricity positions it well to lead the banking industry into the future. As of Q1 2024, DBS reported a 15% increase in digital banking transactions year-over-year, demonstrating the impact of its vision and strategic investments.

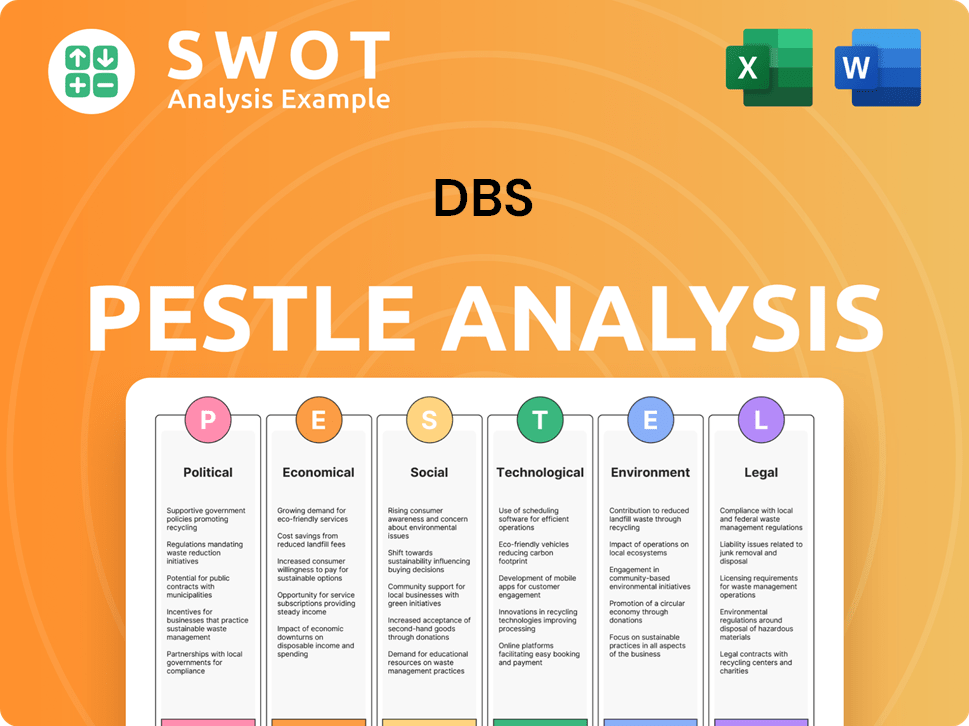

DBS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is DBS Core Values Statement?

Understanding the core values of DBS (Development Bank of Singapore) is crucial to grasping its operational philosophy and its impact on the financial landscape. These values, collectively known as PRIDE!, shape DBS's culture, guide its strategic decisions, and define its interactions with customers and stakeholders.

DBS is committed to making a positive impact beyond financial returns. This is evident in initiatives like the DBS Foundation, which supports vulnerable communities. Furthermore, DBS's sustainable financing commitments reached S$89 billion by the end of 2024, showcasing its dedication to environmental and social responsibility.

DBS emphasizes building strong, lasting relationships with its customers and stakeholders. This value is reflected in its customer-centric approach, focusing on understanding individual needs and providing personalized solutions. This also extends to its partnerships and collaborations, fostering a network of trust and mutual benefit.

Innovation is at the heart of DBS's identity, driving its digital transformation. This value is demonstrated through the development of digital-first solutions and the integration of emerging technologies like AI and blockchain. DBS fosters a culture of experimentation and encourages a start-up mindset to stay ahead in the competitive market.

DBS values making informed and timely decisions, supported by data and analytics. This approach enables the company to respond quickly to market changes and opportunities. The use of data-driven insights is integral to DBS's strategies and operations, ensuring agility and effectiveness.

These core values of DBS, encompassing Purpose-driven, Relationship-led, Innovative, Decisive, and Everything Fun!, collectively define the essence of DBS Group. They are a testament to DBS's commitment to excellence, customer satisfaction, and social responsibility. To further understand how DBS leverages these values to achieve its strategic goals, you may want to explore the Growth Strategy of DBS. Next, let's delve into how the DBS Mission and Vision influence the company's strategic decisions.

How Mission & Vision Influence DBS Business?

DBS's mission, vision, and core values are not just aspirational statements; they are the guiding principles that shape the bank's strategic decisions and drive its operational focus. These foundational elements influence every aspect of DBS Group's operations, from technological investments to sustainability initiatives and customer service approaches.

DBS's mission to be a bank for the digital generation is clearly reflected in its significant investments in artificial intelligence (AI) and machine learning. This commitment is a direct translation of their vision to make banking joyful through seamless experiences. This strategic focus has yielded substantial returns, with AI contributing S$750 million in value in 2024, and a target exceeding S$1 billion by 2025.

- Investment in AI and machine learning aligns with the mission and vision.

- AI contributed S$750 million in value in 2024.

- Target is to generate over S$1 billion in value from AI by 2025.

DBS's purpose-driven values are evident in its expansion of sustainable financing commitments. This aligns with their aim to be the 'best bank for a better world'. By the end of 2024, sustainable financing reached S$89 billion, marking a 27% increase compared to the previous year, demonstrating a strong commitment to ESG principles.

The acquisition of Citi Consumer Taiwan further illustrates the bank's strategic vision for regional expansion and strengthening its wealth management presence. This move aligns with the DBS Strategy of growth and diversification. This strategic decision supports the mission and vision of DBS Group.

DBS's robust financial performance in 2024, with a record net profit of S$11.4 billion and an impressive return on equity of 18.0%, serves as a measurable indicator of the effectiveness of aligning its mission, vision, and values with its actions. These results showcase how DBS Singapore's strategic alignment directly contributes to its financial success.

The DBS mission, vision, and core values shape day-to-day operations by emphasizing customer-centricity and fostering innovation across all processes. This approach ensures that every initiative and service offered by DBS is aligned with its commitment to providing superior customer experiences and driving positive change.

The DBS vision statement impact on employees is significant, as it fosters a culture of purpose and encourages employees to embody the bank's core values in their daily work. This alignment helps create a cohesive and motivated workforce, driving the bank's success. Understanding the core values of DBS and their meaning is crucial for both employees and stakeholders.

The strategic decisions made by DBS, from technological investments to sustainable financing, are all underpinned by its mission, vision, and core values. For a deeper understanding of how DBS operates, including its revenue streams and business model, you can explore the insights provided in this article: Revenue Streams & Business Model of DBS.

In conclusion, the DBS mission, vision, and core values are not just words; they are the foundation upon which DBS Group builds its strategy and measures its success. They drive a customer-centric, innovative, and sustainable approach to banking, ensuring that DBS remains a leader in the financial industry. Now, let's explore the Core Improvements to the Company's Mission and Vision in the next chapter.

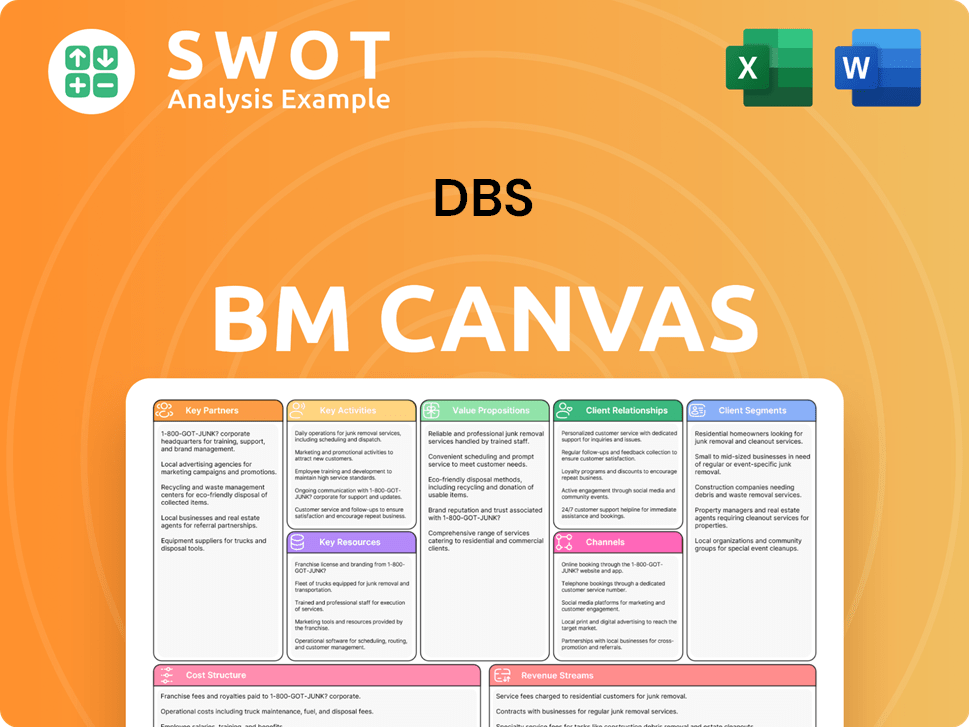

DBS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While DBS has a strong foundation in its mission, vision, and core values, continuous improvement is essential in today's dynamic environment. This section explores potential refinements to further strengthen DBS's position and align it with evolving societal expectations and industry best practices.

Evolving the DBS vision to explicitly include a commitment to fostering a more equitable and inclusive financial future for all segments of society would be beneficial. This could involve specific goals related to financial inclusion, accessibility, and addressing disparities in access to financial services. This aligns with the growing importance of Environmental, Social, and Governance (ESG) factors, which are increasingly influencing investment decisions; in 2024, ESG assets under management are projected to reach $50 trillion globally, representing over a third of total assets.

Integrating a statement on leveraging technology for broader social good, beyond just banking services, could further enhance DBS's impact. This could involve partnerships with other organizations to address societal challenges, such as promoting financial literacy or supporting sustainable development initiatives. The global fintech market is expected to reach $324 billion by 2026, highlighting the potential for technology to drive positive social change.

Considering the integration of explicit commitments to DE&I within the DBS mission or vision statements, rather than solely as a value, could enhance its corporate identity. This would signal a deeper commitment to creating a diverse and inclusive workplace and serving a diverse customer base. For instance, companies with strong DE&I initiatives often see a 15-20% increase in employee satisfaction and retention rates, according to recent studies.

While the DBS vision mentions empowering communities, a more explicit link to addressing specific societal challenges beyond financial inclusion and sustainability could be considered. This could involve identifying specific areas where DBS can make a tangible difference, such as supporting education, healthcare, or environmental conservation. This would further distinguish DBS's Mission, Vision & Core Values of DBS and its commitment to social responsibility.

How Does DBS Implement Corporate Strategy?

DBS Group's commitment to its mission, vision, and core values is demonstrated through tangible actions and strategic initiatives. This implementation is crucial for ensuring that the company's stated principles translate into real-world impact and sustainable success.

The 'Gandalf' digital transformation program at DBS exemplifies the practical application of its vision, particularly the goal of making banking joyful. This initiative involves reimagining customer journeys and reshaping internal culture to enhance the overall banking experience.

- Reimagining Customer Journeys: Focus on user-friendly digital interfaces, streamlined processes, and personalized services.

- Reshaping Internal Culture: Promoting innovation, agility, and a customer-centric mindset among employees.

- Impact: Increased customer satisfaction scores and efficiency gains, reflecting the success of this vision-driven approach.

- DBS Strategy: By leveraging technology, DBS aims to provide seamless and delightful banking experiences, aligning with its vision for the future of banking.

Leadership plays a pivotal role in reinforcing DBS's mission, vision, and core values. The leadership team actively integrates these principles into key people programs, such as recruitment and performance appraisals, to ensure alignment across the organization.

DBS communicates its commitments and progress to stakeholders through various channels. These include annual reports, sustainability reports, and public statements, providing transparency and accountability.

DBS demonstrates its 'Purpose-driven' value through extensive employee volunteering. In 2024, DBS employees volunteered over 270,000 hours, focusing on areas like elderly care, education, and environmental sustainability, showcasing the company's commitment to social responsibility.

The introduction of digital ID verification and automation in customer service reflects DBS's 'Innovative' and customer-centric approach. These technological advancements enhance efficiency and improve the overall customer experience, aligning with the DBS vision for the future of banking.

DBS showcases its commitment to sustainability and community impact through formal programs. The ESG Ready Programme for SMEs and the DBS Foundation's initiatives are prime examples of how DBS integrates its purpose-driven approach into its business strategy.

- ESG Ready Programme for SMEs: Supports small and medium-sized enterprises in adopting sustainable practices.

- DBS Foundation: Funds social enterprises and community projects, promoting financial inclusion and social impact.

- Impact: These initiatives contribute to DBS's ESG goals and enhance its reputation as a responsible corporate citizen.

- DBS Mission: These programs directly support the DBS mission by fostering a positive impact on society and the environment.

DBS's financial performance is closely linked to its strategic alignment with its mission, vision, and core values. By focusing on customer-centricity, innovation, and sustainability, DBS aims to achieve long-term value creation.

DBS continuously monitors its progress and adapts its strategies to ensure alignment with its mission, vision, and core values. This iterative approach allows DBS to respond effectively to changing market dynamics and stakeholder expectations.

The implementation of DBS's mission, vision, and core values has a significant impact on its corporate culture and employee engagement. Employees are more likely to be motivated and committed when they feel their work aligns with the company's principles.

Understanding how DBS implements its mission, vision, and core values provides valuable insights into its competitive positioning. To further analyze DBS's market position, consider exploring the Competitors Landscape of DBS.

DBS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of DBS Company?

- What is Competitive Landscape of DBS Company?

- What is Growth Strategy and Future Prospects of DBS Company?

- How Does DBS Company Work?

- What is Sales and Marketing Strategy of DBS Company?

- Who Owns DBS Company?

- What is Customer Demographics and Target Market of DBS Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.