DBS Bundle

Who Does DBS Bank Serve?

In the ever-evolving financial landscape, understanding the customer is key. For DBS Company, a leading Asian financial institution, knowing its customer demographics and target market is crucial for sustained success. This knowledge allows DBS to tailor its services and maintain a competitive edge in a dynamic industry. Dive in to discover the intricacies of DBS's customer base and market strategies.

From its roots in supporting Singapore's economic development, DBS has broadened its reach significantly. Today, DBS Bank caters to a diverse clientele, including individuals, SMEs, and large corporations, offering a wide array of services. To gain a deeper understanding, consider a comprehensive DBS SWOT Analysis. This exploration delves into the customer profile, market segmentation, and the evolving strategies DBS employs to meet the needs of its target market.

Who Are DBS’s Main Customers?

Understanding the DBS Bank's primary customer segments is crucial for grasping its market position and strategic focus. The company serves a diverse clientele, spanning both individual consumers (B2C) and businesses (B2B), catering to a wide array of financial needs. This comprehensive approach allows it to capture a significant share of the market.

In 2024, DBS served over 19 million customers, highlighting its extensive reach. This includes more than 18.4 million consumer banking and wealth management clients, alongside over 280,000 institutional banking customers. This broad customer base underscores its ability to provide services across various financial tiers and business sectors.

The bank employs sophisticated strategies to understand its customer base better. It utilizes artificial intelligence (AI) and machine learning to analyze over 15,000 customer data points. This data-driven approach allows DBS to offer personalized financial advisory services and tailor its offerings to specific segments.

DBS segments its customers into distinct groups based on wealth and service needs. For B2C operations, segments include 'DBS Account,' 'DBS Treasures,' and 'DBS Treasures Private Client.' This segmentation strategy enables the bank to customize its services and offerings to meet the specific requirements of each customer group.

The wealth management segment has experienced significant growth, with wealth management income rising to SGD 5.22 billion in 2024. Non-interest income in this segment climbed to SGD 2.60 billion, indicating the success of its strategies in attracting high-net-worth clients. This growth is partly fueled by clients diversifying investments in Asia.

In the B2B space, DBS focuses on SMEs and large corporations, providing services such as cash management and trade finance. The bank supports SMEs in their digital transformation, particularly in adopting Generative AI. The bank aims to reach out to 50,000 SMEs over the next two years to provide actionable insights and guidance.

DBS has expanded its footprint through strategic acquisitions, such as the integration of Citibank Taiwan's consumer banking business in 2024. This expansion boosted its wealth management reach in Taiwan, with income surging by 61%. The 'phygital' strategy helps DBS expand in regions like India and Indonesia.

DBS's target market includes a wide range of customers, from retail consumers to large corporations. The bank uses data analytics and AI to personalize services and tailor offerings to specific customer needs. Its market segmentation strategies are designed to maximize customer engagement and revenue generation.

- Consumer Banking and Wealth Management: Serving over 18.4 million customers.

- Institutional Banking: Catering to over 280,000 businesses.

- SME Support: Actively assisting SMEs with digital transformation, including Generative AI adoption.

- Geographic Expansion: Leveraging acquisitions and 'phygital' strategies to grow in key markets.

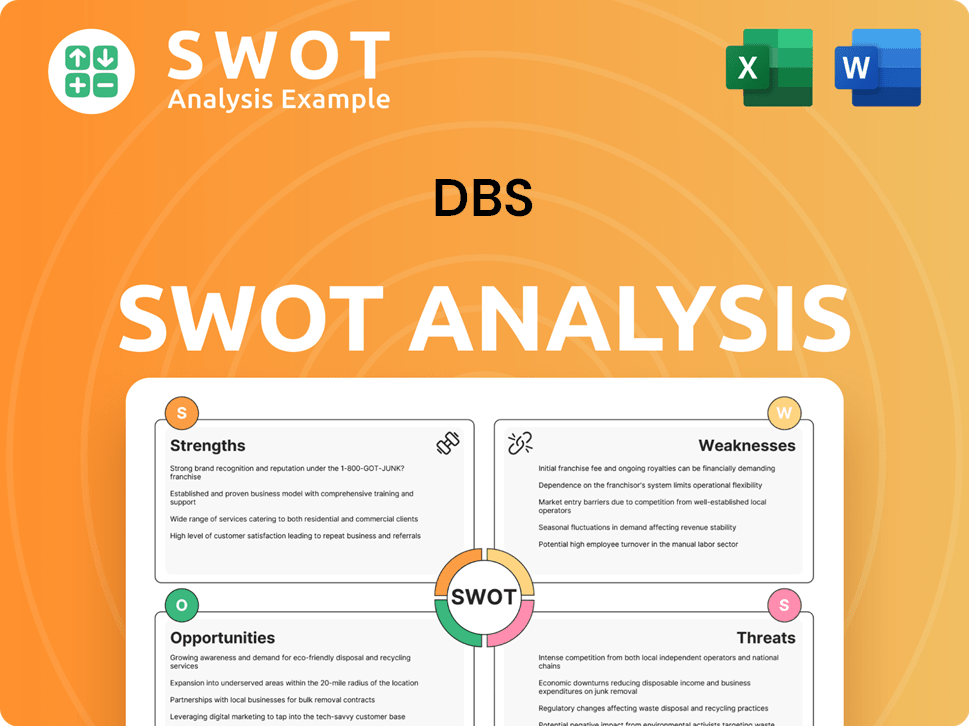

DBS SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do DBS’s Customers Want?

Understanding customer needs and preferences is at the core of the strategy of the [Company Name]. This customer-centric approach enables the bank to deliver tailored services, leveraging advanced technologies to meet the evolving expectations of its diverse customer base. The bank's focus on personalization and digital accessibility reflects a deep understanding of modern customer behavior.

The bank uses cutting-edge technologies, including AI and data analytics, to provide hyper-personalized experiences to its customers. This approach is designed to meet the growing demand for tailored services. This customer-centric approach is crucial for maintaining customer loyalty and driving positive outcomes.

Purchasing behaviors and decision-making criteria are increasingly influenced by convenience, digital accessibility, and personalized insights. The bank's mobile wallet, PayLah!, hit a record 41.6 million logins a month in 2024. The bank's digibank app goes beyond traditional banking, offering integrated travel services, enhancing customer loyalty.

The bank uses AI and machine learning algorithms to analyze vast amounts of customer data, generating personalized recommendations. These 'nudges' guide customers in their financial decisions, leading to significant improvements in savings, investments, and insurance coverage. This approach is crucial for maintaining customer loyalty and driving positive outcomes. The bank's focus on personalization and digital accessibility reflects a deep understanding of modern customer behavior.

- Over 100 AI and machine learning algorithms analyze 15,000 customer data points.

- Customers who engaged with AI-powered nudges saved two times more, invested five times more, and were nearly three times more insured than non-users in 2024.

- The bank's AI and machine learning initiatives delivered over SGD 750 million of economic value in 2024.

The bank prioritizes digital accessibility and convenience to meet the needs of its target market. The mobile wallet, PayLah!, and digibank app offer seamless and purpose-driven platforms. These platforms provide integrated services, such as travel bookings, and reward programs to enhance customer engagement and reduce platform switching. This approach is crucial for maintaining customer loyalty and driving positive outcomes.

- PayLah! handled over 60% of all scan-to-pay transactions in hawker centers in Singapore in 2024.

- The digibank app integrates travel services like flights, buses, and hotel bookings.

- Customers can earn and redeem reward points within the app.

The bank actively addresses common customer pain points and unmet needs through strategic initiatives. This includes implementing self-managed security features to combat rising scam incidents and developing tools for managing finances. The bank has developed new features to allow customers to easily lock their savings or file a card fraud dispute. For SMEs, AI-powered algorithmic models are used to identify potential credit risks, helping businesses manage their finances more effectively.

- Over 1.5 million customers in Singapore leveraged self-managed security tools in 2024.

- AI-powered models identify potential credit risks for SMEs.

Feedback and market trends are crucial in shaping product development and service tailoring. The bank's 'Managing through Journeys' (MtJ) framework uses data-driven experimentation and rapid iteration. This agile approach ensures that the bank remains responsive to customer needs and market changes. The bank's commitment to digital innovation and customer-centricity is a key competitive advantage. For more insights, explore the Competitors Landscape of DBS.

- Over 60% of the bank's revenue is delivered through the MtJ program.

- The bank's AI and machine learning initiatives delivered over SGD 750 million of economic value in 2024, more than double the previous year.

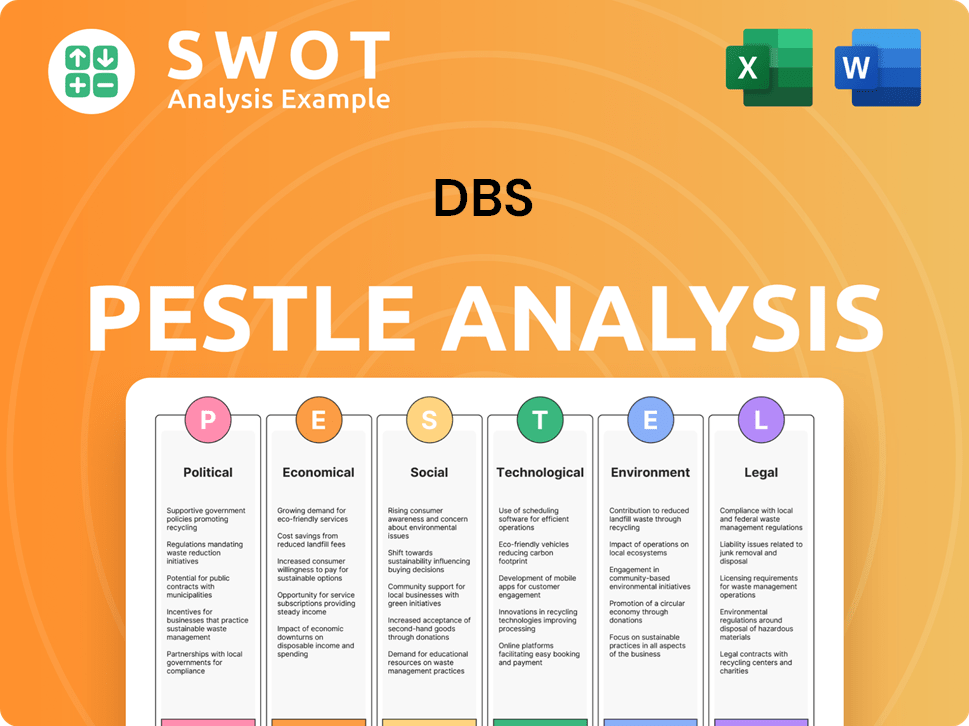

DBS PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does DBS operate?

DBS Group Holdings Ltd. has a strong geographical presence, mainly in Asia. Headquartered in Singapore, the bank operates in 19 markets, concentrating on Greater China, Southeast Asia, and South Asia. This strategic focus highlights the importance of understanding its customer demographics and effectively targeting its target market.

The bank's footprint in Asia is a key strength, given the region's growing financial needs. Major markets include Singapore, Hong Kong, China, Taiwan, India, Indonesia, and Malaysia. DBS has been expanding its presence, particularly in India and Taiwan, demonstrating a commitment to growth in key areas.

In 2024, DBS saw substantial growth in several markets. Income from India increased by 25%, while income from Taiwan surged by 61% following the acquisition of Citibank Taiwan's consumer banking business. The bank is also exploring expansion opportunities in Malaysia, including the Johor-Singapore Special Economic Zone (JS-SEZ).

DBS has a significant presence in key Asian markets such as Singapore, Hong Kong, China, and India. These markets are crucial for its growth strategy. The bank continues to invest in these regions to capitalize on financial opportunities.

DBS is actively expanding, especially in India and Taiwan. It is also exploring new opportunities in Malaysia, including the Johor-Singapore Special Economic Zone. These expansion efforts are key to reaching a broader target market.

DBS's geographic diversification helps to reduce risk and capture growth opportunities across different markets. This strategy allows it to serve a diverse customer profile. The bank adapts its services to meet local needs.

DBS employs a 'phygital' strategy, combining digital capabilities with a physical presence. This approach is particularly important in markets like India and Indonesia. This strategy enhances accessibility for its customer demographics.

DBS recognizes the importance of adapting to different customer demographics, preferences, and buying power across its markets. The bank uses a 'phygital' strategy, blending digital and physical presence, which is essential in markets like India and Indonesia, where customers still prefer visiting branches. With 500 branches in India and 50 in Indonesia, DBS has seen growth in Current and Savings Account (CASA) operations. The bank's ability to understand and serve its diverse customer base is critical to its success. For more insights, you can explore the Growth Strategy of DBS.

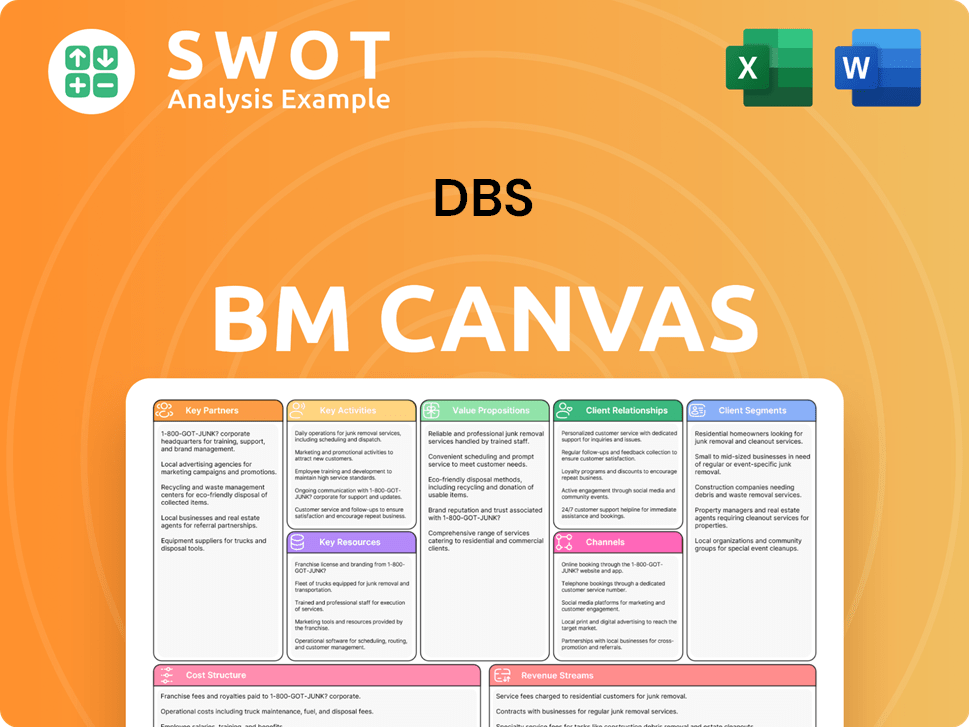

DBS Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does DBS Win & Keep Customers?

The [Company Name] (DBS) employs a multifaceted approach to customer acquisition and retention, heavily leveraging digital innovation, personalized experiences, and strategic partnerships. This strategy is designed to attract and retain a diverse customer base, focusing on both tech-savvy individuals and those who prefer traditional banking methods. The bank's success is reflected in its financial performance and customer engagement metrics.

A key element of DBS's strategy is its digital-first approach, coupled with a 'phygital' strategy. This dual approach allows the bank to cater to a broad spectrum of customers, ensuring that both those who prefer digital channels and those who value physical interactions are well-served. The bank's focus on customer needs and preferences is central to its acquisition and retention efforts.

DBS's marketing channels are primarily digital, with the bank recognized as a leader in digital banking. The digibank mobile app is central to this strategy, offering a range of services beyond traditional banking. This approach enhances customer loyalty and retention by creating a purpose-driven platform. The bank also uses AI-powered nudges to guide financial decisions.

DBS's digital-first approach includes the digibank mobile app, which integrates services like flight, bus, and hotel bookings. This creates a purpose-driven platform that enhances customer loyalty. The bank's focus on digital channels is a key part of its customer acquisition and retention strategies.

DBS leverages AI-powered nudges, sending over 1.2 billion personalized nudges to more than 13 million customers across the region in 2024. These nudges guide financial decisions and promote product adoption. This hyper-personalization is made possible through the bank's internal data-as-a-service ADA Platform.

DBS partners with government agencies, such as the 'Spark GenAI' program launched in late 2024 to drive generative AI adoption among Singaporean SMEs. This program aims to reach 50,000 SMEs over the next two years. These partnerships help expand the bank's reach and services.

DBS uses its internal data-as-a-service ADA Platform, which houses over 5.3 petabytes of data, enabling hyper-personalization of customer interactions. The bank has transformed over 240 experimental AI initiatives into more than 20 practical use cases. This data-driven approach enhances customer experiences.

DBS's sales tactics focus on specific customer segments and their unique needs. For wealth management, over half of new-to-wealth customers are acquired digitally, with forecasts to reach 65% by 2026. The bank also provides tailored solutions for SMEs, including unsecured working capital loans and sustainability financing. These strategies help in reaching the target market. The Revenue Streams & Business Model of DBS provides more insights into their customer-centric approach.

More than half of new-to-wealth customers are acquired digitally, with forecasts to reach 65% by 2026. This digital focus allows DBS to reach a younger, tech-savvy demographic. This strategy is key to their customer acquisition efforts.

DBS provides tailored solutions for SMEs, including unsecured working capital loans and sustainability financing. These offerings support digitalization and upskilling efforts. This targeted approach helps attract and retain SME clients.

DBS sent over 1.2 billion personalized nudges to more than 13 million customers across the region in 2024. These nudges drove a 40% increase in digital product adoption rates. This personalized approach enhances customer engagement.

The Gen AI-enabled Customer Service Officer (CSO) Assistant is being rolled out to 500 customer service staff. This system helps manage over 250,000 monthly customer queries and reduces average handling time by up to 20%. This improves operational efficiency.

In 2024, over 1.5 million customers in Singapore used DBS's self-managed security features to protect themselves from scammers. The bank has seen a 17% increase in funds saved from scams through AI in risk management. These initiatives build customer trust.

DBS's record financial performance in 2024 included a 10.6% growth in total income and an 11% increase in net profit. These results reflect the effectiveness of their customer acquisition and retention strategies. This growth indicates strong customer loyalty.

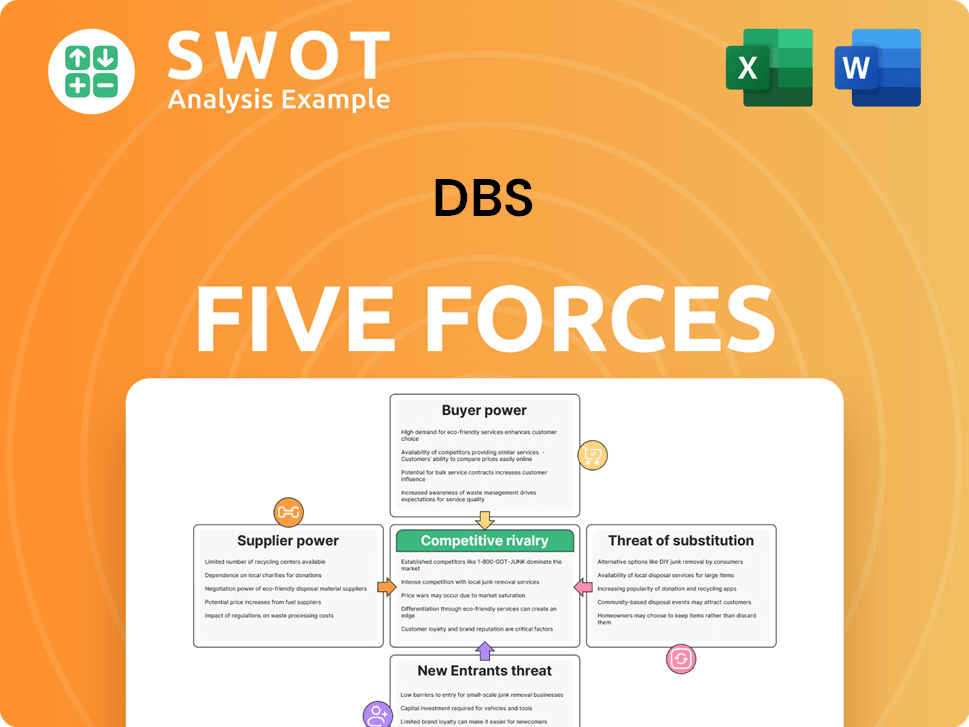

DBS Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.