Icahn Enterprises Bundle

How Did Carl Icahn Build Icahn Enterprises?

Delve into the captivating Icahn Enterprises SWOT Analysis and uncover the story of a financial titan. From its inception, Icahn Enterprises, under the leadership of Carl Icahn, has been a force in the world of activist investing. This investment company's journey is a masterclass in strategic maneuvering and value creation, offering valuable lessons for investors and business strategists alike. Explore the

The

What is the Icahn Enterprises Founding Story?

The story of Icahn Enterprises began in 1987, founded by the well-known financier, Carl C. Icahn. This marked a significant step in Icahn's career, building upon his reputation as a prominent figure in the world of finance and corporate takeovers during the 1980s. The formation of the company was a strategic move to capitalize on undervalued assets and reshape them for enhanced value.

Initially, the company operated as American Real Estate Partners, focusing on real estate investments. This venture was a natural extension of Icahn's investment philosophy, which involved identifying underperforming assets, acquiring a substantial stake, and implementing strategies to maximize their value. This approach was consistent with his previous activities in publicly traded companies.

The company's initial business model centered on acquiring real estate properties, often with the intention of restructuring or selling them for profit. This aligned with Icahn's broader strategy of activist investing, applying similar principles to real estate assets as he did to publicly traded companies. Initial funding likely came from Icahn's existing capital and investor networks, given his established presence in the financial world. The transition to Icahn Enterprises L.P. later broadened the scope beyond solely real estate, signifying a diversification into various industries.

The founding of Icahn Enterprises by Carl Icahn in 1987 marked a pivotal moment in the corporate history.

- The company's initial focus was on real estate investments, operating under the name American Real Estate Partners.

- The business model was centered around acquiring undervalued properties and implementing strategies for profit.

- The foundation of Icahn Enterprises was built on Icahn's established investment strategy of identifying and enhancing the value of underperforming assets.

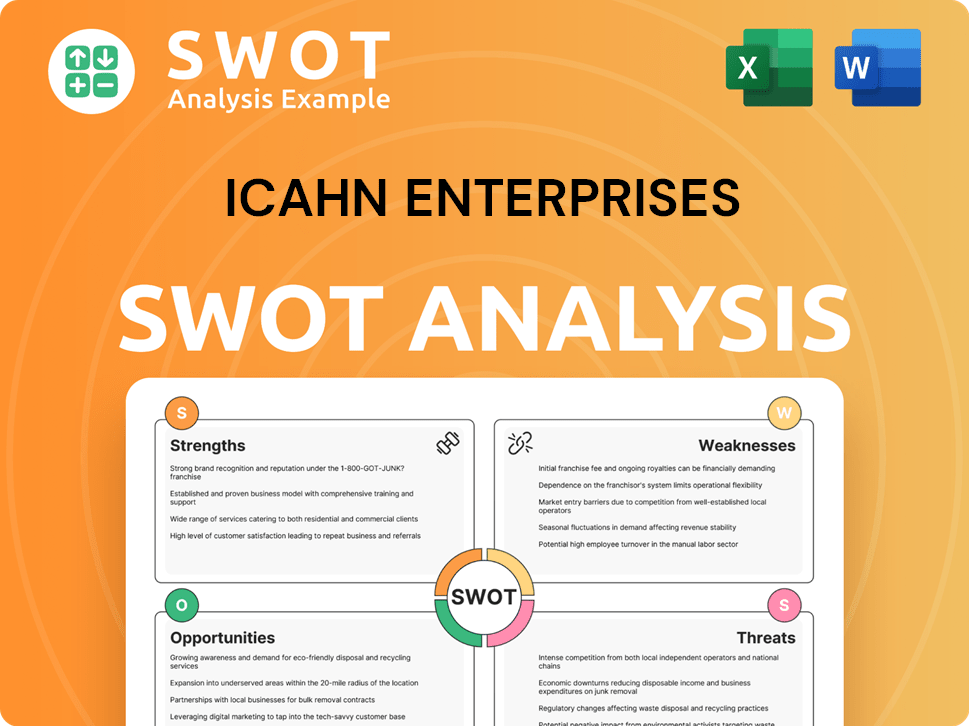

Icahn Enterprises SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Icahn Enterprises?

The early growth of Icahn Enterprises (formerly American Real Estate Partners) centered on building its real estate holdings. This initial phase saw the acquisition of various properties, with Carl Icahn applying his value-investing approach to the real estate market. As the company evolved, it expanded beyond real estate, diversifying into other sectors through strategic investments and acquisitions. This expansion was driven by Carl Icahn's strategy of identifying undervalued companies across different industries. The company's journey is a significant part of Icahn Enterprises history.

A key development was the transformation from a real estate investment vehicle into a multi-industry holding company. This involved significant capital raises to fund new ventures. The company's expansion included entry into new markets, such as energy and automotive. These moves often involved acquiring distressed or underperforming companies. This strategic shift is a crucial part of the corporate history of the company.

Acquisitions were typically followed by operational restructuring and strategic guidance from Icahn and his team. The goal was to improve profitability and unlock shareholder value. This period also included the company's shift in identity to Icahn Enterprises L.P., reflecting its broader investment mandate. The company's acquisitions are a key part of its business timeline.

The company's strategic shifts were always underpinned by Carl Icahn's activist investing philosophy. This involved challenging existing management and advocating for changes to enhance shareholder returns. The company's approach to acquisitions and restructuring is a key aspect of its strategy. If you want to know more about the investment company landscape, you can check out the Competitors Landscape of Icahn Enterprises.

The company's entry into various sectors, such as automotive and energy, has significantly impacted its financial performance. For example, in 2024, the automotive segment showed notable growth due to strategic acquisitions. The company's ability to identify and restructure underperforming companies has been a key driver of its success. Its diverse portfolio is a core part of its strategy.

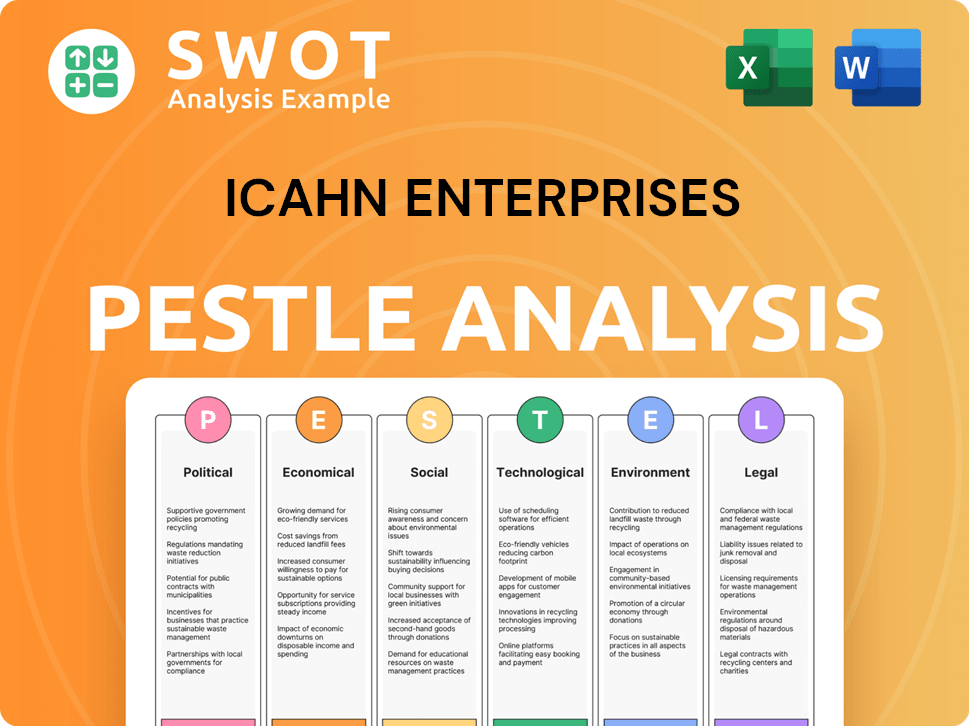

Icahn Enterprises PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Icahn Enterprises history?

The Icahn Enterprises history is marked by significant achievements and strategic shifts. Icahn Enterprises, under the leadership of Carl Icahn, has navigated various market cycles, consistently adapting its investment strategies to maximize returns and influence corporate decisions. The company's journey reflects a deep understanding of financial markets and a commitment to shareholder value, making it a notable player in the corporate world.

| Year | Milestone |

|---|---|

| 1980s | Carl Icahn gains prominence through corporate takeovers and restructurings, establishing his reputation as an activist investor. |

| 1987 | Icahn leads the restructuring of Trans World Airlines (TWA), a significant early deal. |

| 1990s | Icahn expands his investment activities across diverse sectors, including energy, automotive, and real estate. |

| 2000s | Icahn Enterprises goes public, providing a platform for further investment and expansion. |

| 2010s | Icahn Enterprises engages in high-profile battles with companies like Herbalife and Apple, shaping corporate governance. |

| 2020s | The company continues to manage a diverse portfolio, adapting to changing market conditions and regulatory environments. |

Icahn Enterprises has innovated primarily through its consistent application of activist investing. This strategy involves acquiring significant stakes in publicly traded companies to advocate for changes that enhance shareholder value, such as restructuring, asset sales, or changes in management. This approach, pioneered by Carl Icahn, has become a hallmark of the company's operations, driving numerous successful outcomes.

Carl Icahn's core strategy of acquiring substantial stakes in companies to influence management decisions and drive shareholder value.

Implementing changes such as asset sales, cost-cutting measures, and operational improvements to boost profitability.

Investing across various sectors, including energy, automotive, real estate, and others, to mitigate risk and capitalize on opportunities.

Utilizing financial instruments and strategies to optimize capital structure and enhance returns.

Employing strategies to manage and mitigate the risks associated with investments in volatile markets.

The ability to adjust strategies and investments in response to changing market conditions and economic trends.

Icahn Enterprises has faced challenges, including legal battles and resistance from management teams. The aggressive nature of activist investing can lead to protracted disputes and the need to navigate complex regulatory environments. Underperforming investments and market downturns have also tested the company's resilience, requiring strategic adjustments to maintain financial stability. For more insights, you can read this article about Icahn Enterprises company profile.

Navigating lawsuits and regulatory scrutiny associated with activist campaigns and investment activities.

Adapting to economic downturns and market fluctuations that can impact the value of investments.

Overcoming resistance from entrenched management teams who may oppose activist interventions.

Managing and restructuring investments that do not meet performance expectations, requiring strategic divestitures or intensive efforts.

Addressing public and media scrutiny related to activist campaigns and corporate governance practices.

Managing debt levels and ensuring sufficient capital to pursue investment opportunities and withstand market pressures.

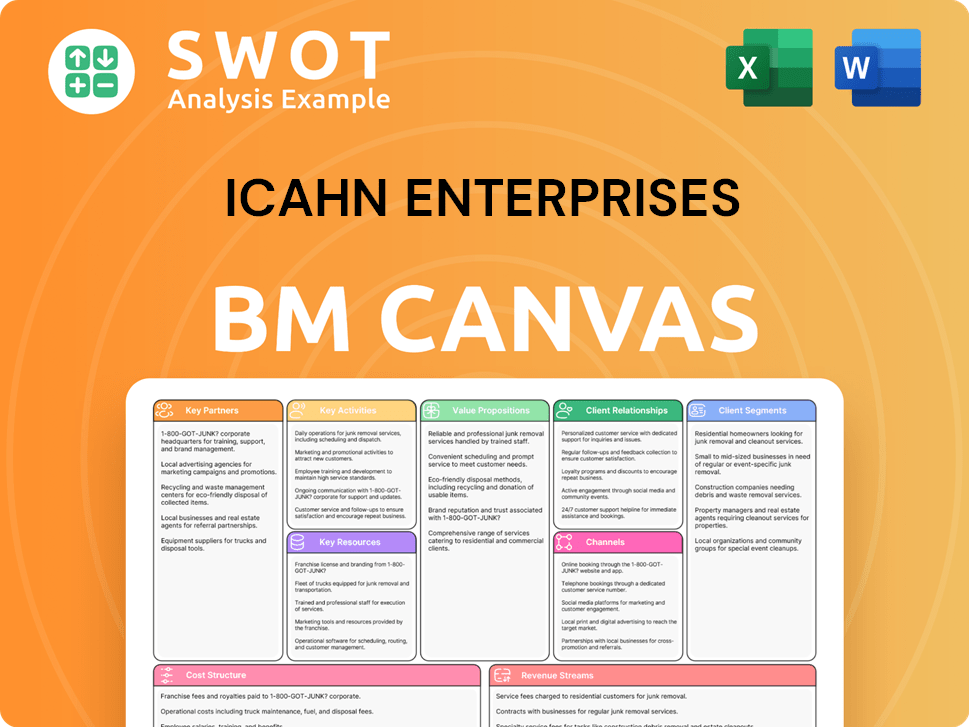

Icahn Enterprises Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Icahn Enterprises?

The Icahn Enterprises history is marked by strategic shifts and significant investments, reflecting its evolution from real estate to a diversified investment firm. Founded by Carl Icahn, the company's journey includes pivotal moments such as its initial focus on real estate, subsequent diversification into various industries, and the adoption of an activist investment strategy. The company has navigated market changes while adapting its approach to maintain its vision of enhancing value through active involvement and strategic direction.

| Year | Key Event |

|---|---|

| 1987 | Carl Icahn establishes American Real Estate Partners, focusing on real estate investments. |

| Early 2000s | The company begins diversifying its portfolio beyond real estate, venturing into various industries. |

| 2007 | American Real Estate Partners officially rebrands as Icahn Enterprises L.P., reflecting its expanded investment mandate. |

| 2010s | Icahn Enterprises continues its activist investing strategy, taking significant stakes in major corporations across different sectors. |

| 2020s | The company continues to manage its diverse portfolio, adapting to evolving market conditions and maintaining its activist stance in select investments. |

| March 22, 2024 | Icahn Enterprises L.P. reported a net loss of $283 million, or $0.75 per depositary unit, for the full year 2023. |

| May 10, 2024 | Icahn Enterprises L.P. announced a net loss of $174 million, or $0.46 per depositary unit, for the first quarter ended March 31, 2024. |

Icahn Enterprises is expected to continue its opportunistic investment strategy, seeking undervalued companies and pushing for operational and strategic changes. The firm's future is influenced by global economic trends, regulatory changes, and the availability of attractive investment opportunities. Carl Icahn's long-term strategic initiatives continue to center on identifying situations where his activist approach can yield significant returns.

The firm's investment strategy focuses on identifying undervalued companies and implementing changes to increase shareholder value. This approach often involves taking significant stakes in companies and advocating for strategic and operational improvements. Analyst predictions often focus on the performance of the company's diverse holdings and the impact of its investment activities on the broader market.

Global economic trends and regulatory changes significantly impact the company's investment decisions. Changes in corporate governance regulations and the overall economic climate can affect the types of investments that are pursued and the strategies employed. The availability of attractive investment opportunities also plays a crucial role in shaping the firm's future trajectory.

The company's financial performance reflects its diverse holdings and investment activities. In 2023, Icahn Enterprises reported a net loss of $283 million. For Q1 2024, the company reported a net loss of $174 million. These figures highlight the impact of market conditions and the performance of its investments on its overall financial health.

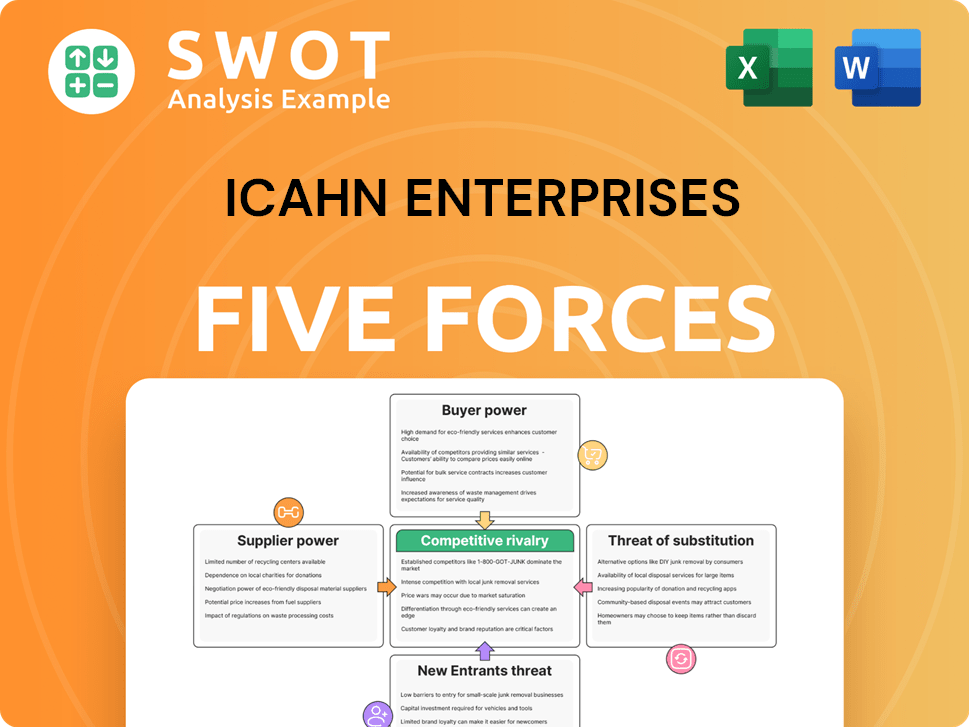

Icahn Enterprises Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Icahn Enterprises Company?

- What is Growth Strategy and Future Prospects of Icahn Enterprises Company?

- How Does Icahn Enterprises Company Work?

- What is Sales and Marketing Strategy of Icahn Enterprises Company?

- What is Brief History of Icahn Enterprises Company?

- Who Owns Icahn Enterprises Company?

- What is Customer Demographics and Target Market of Icahn Enterprises Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.