Root Bundle

How Did Root Company Disrupt the Insurance Industry?

Founded in 2015, Root, Inc. burst onto the scene with a bold mission: to overhaul the auto insurance sector. They aimed to personalize insurance rates based on driving behavior, a stark contrast to traditional methods. This Root SWOT Analysis highlights their innovative approach and strategic positioning.

The Root Company history is a fascinating tale of technological innovation and market disruption. From its Root Company origins in Columbus, Ohio, the company quickly gained traction, fueled by its unique business model and commitment to data-driven insights. Understanding the Root Company timeline is crucial to appreciating its evolution from a startup to a significant player in the insurtech space. The company's journey showcases key milestones and significant historical events that have shaped its current standing.

What is the Root Founding Story?

The Marketing Strategy of Root began in March 2015, with Alex Timm and Dan Manges establishing the company in Columbus, Ohio. Their goal was to transform the insurance sector. They wanted to use technology and data to fix the issues in old insurance models.

The Root Company history is rooted in a desire to modernize insurance. Timm and Manges saw a chance to use telematics and machine learning. This would allow them to create a more customized and affordable insurance plan for customers. This approach marked a significant shift from traditional methods.

The Root Company background includes a business model centered on auto insurance. The company offered this through a mobile app. The app tracked a customer's driving behavior during a 'test drive'. This data was used to determine a personalized premium. The goal was to give lower rates to safe drivers. This focus on good drivers helped maintain competitive premiums.

The company's journey involved significant funding rounds and strategic developments.

- The company raised a total of $540 million across multiple funding rounds.

- The Series E round, completed in August 2019, brought in $360 million.

- Root focused on using data to assess risk and set premiums.

- The company aimed to offer lower rates to safe drivers.

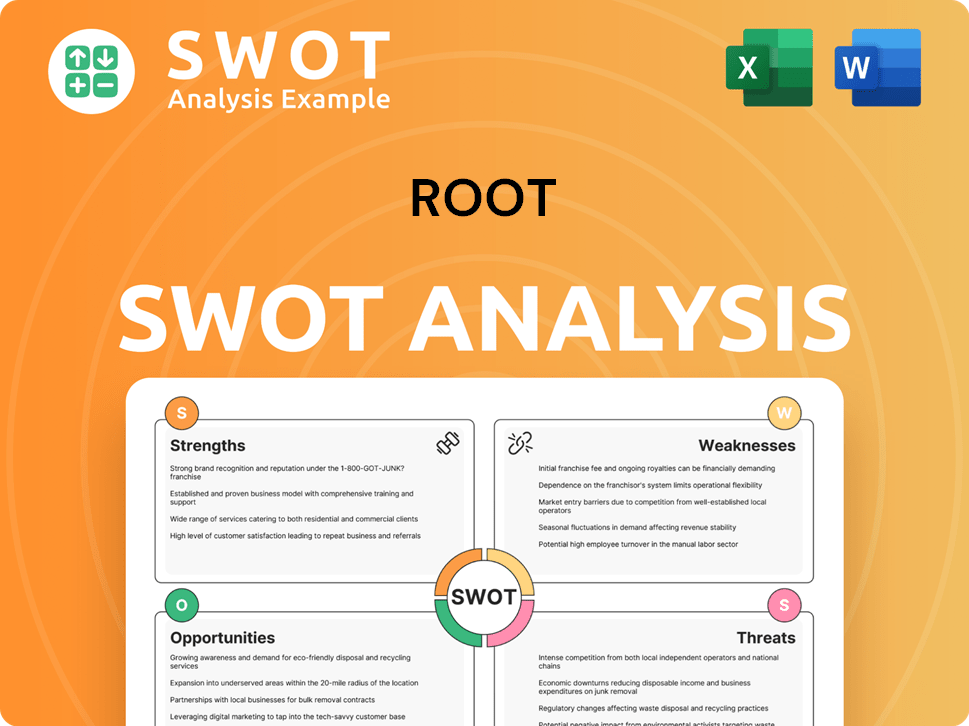

Root SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Root?

The early growth of the [Company Name] was marked by the development of its app-based telematics model. This innovative approach allowed the company to gather extensive driving data, which was crucial for refining its pricing strategies. The company quickly expanded its reach and offerings, achieving significant milestones in a short period. This period set the stage for its future growth and impact on the insurance industry. Check out Revenue Streams & Business Model of Root for more information.

The company's mobile application has been downloaded nearly 15 million times. This app allows users to get a policy and file claims. The company has collected over 30 billion miles of driving data, which it uses to improve its pricing models.

In 2017, the company offered a discount to Tesla owners using Autosteer, a first in the insurance industry. This move showed the company's focus on technology and data-driven insights. This was a key step in the company's evolution.

By 2018, the company became the first insurtech startup outside healthcare to reach a valuation over $1 billion. This milestone highlighted the company's rapid growth and market success. The company's valuation reflected its innovative approach to insurance.

By the end of 2024, the company's policies in force grew by 21% to 414,862. This growth indicates the company's ability to attract and retain customers. The expansion into new states further fueled this growth.

The partnership channel, including embedded partners and independent agents, has seen significant growth. New writings more than doubled year-over-year in Q1 2025. This channel accounted for 33% of new writings in Q1 2025.

Key partnerships in Q1 2025 included collaborations with Hyundai Capital America and Experian. These partnerships allowed for embedded insurance purchasing at the point of sale. These partnerships expanded the company's reach.

The company's strategic shifts emphasized disciplined underwriting, driven by technology and algorithms. This approach moved away from solely focusing on market share. This strategy improved the company's financial performance.

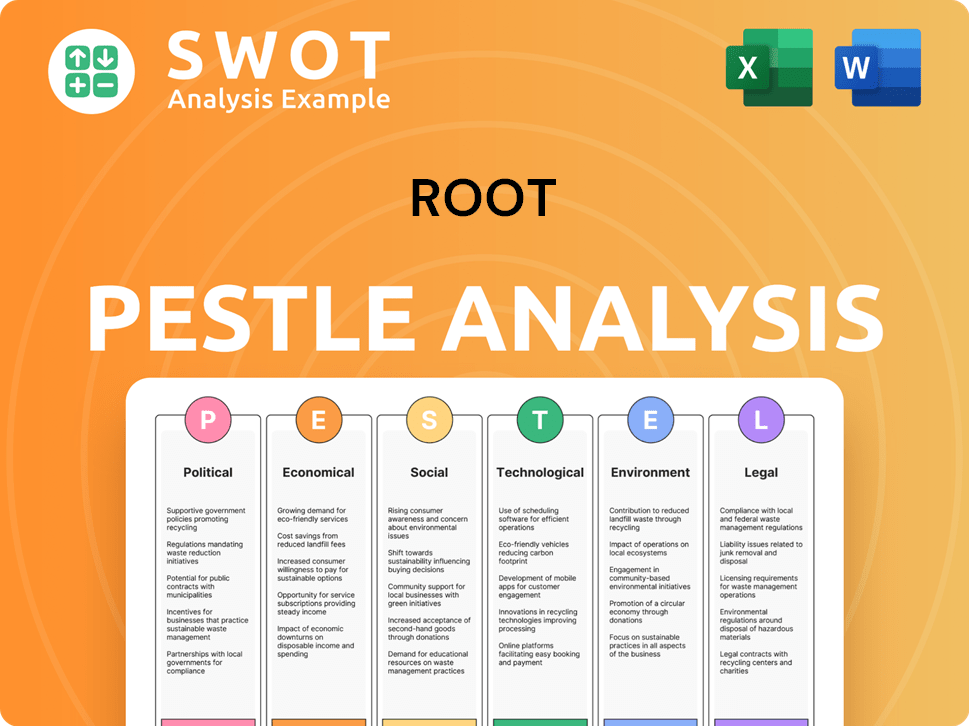

Root PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Root history?

The Root Company history includes several significant milestones, from its initial public offering to achieving profitability. These achievements highlight the company's evolution and its impact on the industry.

| Year | Milestone |

|---|---|

| 2020 | Initial Public Offering (IPO) raised $724.4 million, the largest IPO in Ohio's history. |

| 2024 | Achieved quarterly net income profitability for the first time in Q3, reporting approximately $23 million in net income. |

| 2024 | Reported a net income of $22.1 million in Q4, leading to the company's first profitable full year in 2024, with a net income of $31 million. |

| 2025 | Continued profitability in Q1, reporting a net income of $18.2 million. |

| 2025 | Improved gross combined ratio to 95.6 in Q1 from 102 a year prior, demonstrating enhanced operational efficiency. |

Innovations have been central to the

Root uses a unique pricing model, now in its sixth version, to assess risk and determine premiums. This model is expected to enhance predictive power by 7%, improving accuracy.

Advanced machine learning techniques are employed in claims processing to improve efficiency and accuracy. This technology helps in quickly assessing and resolving claims.

Despite its successes,

The company faces challenges from macroeconomic factors, which can impact financial performance. These uncertainties require strategic adjustments.

Root operates in a competitive market with established players and other insurtech companies. This requires constant innovation and strategic adaptation.

The company must continually adapt to changing consumer preferences and regulatory environments. Compliance and adaptation are ongoing priorities.

Root focuses on disciplined underwriting to manage risk and optimize unit economics. This involves careful assessment of policies.

The company has worked on reducing reinsurance costs and interest expenses. Interest expenses were cut by approximately 50% on a run rate basis in 2024.

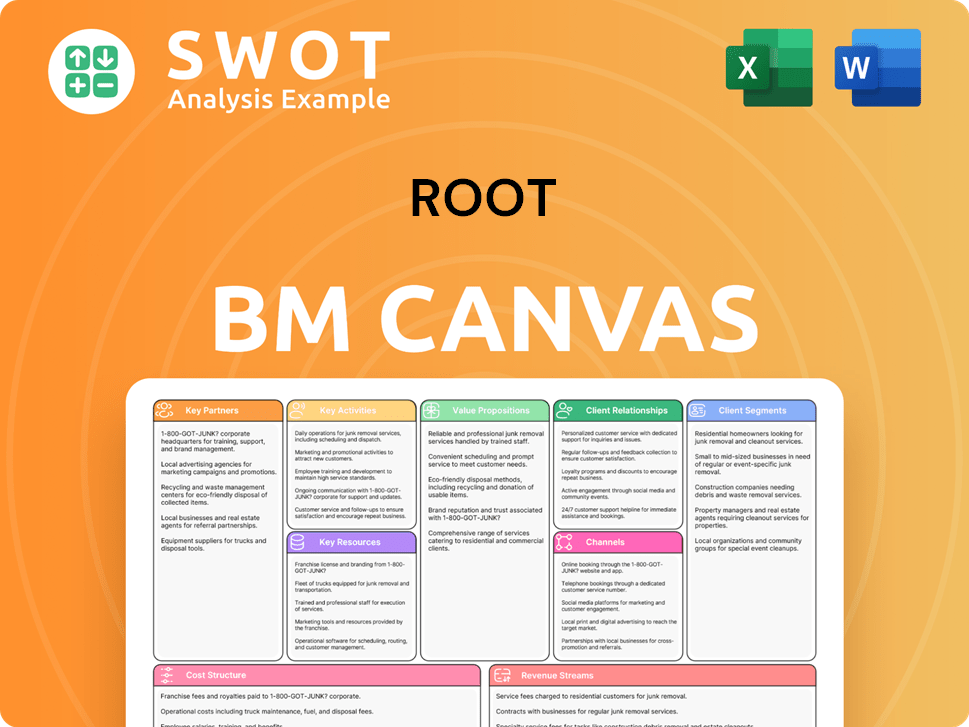

Root Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Root?

The Root Company history began in March 2015 when Alex Timm and Dan Manges founded the company in Columbus, Ohio. The Root Company background includes pioneering efforts in the insurtech space. Over the years, the Root Company evolution has been marked by significant milestones, including its IPO and the achievement of profitability.

| Year | Key Event |

|---|---|

| March 2015 | Root, Inc. was founded by Alex Timm and Dan Manges in Columbus, Ohio. |

| 2017 | Root began offering discounts to Tesla owners using Autosteer mode, a first in the industry. |

| 2018 | Root achieved 'unicorn' status, becoming the first insurtech startup outside healthcare to do so. |

| August 20, 2019 | Root announced a Series E funding round of $360 million on a $3.6 billion valuation. |

| October 27, 2020 | Root had its Initial Public Offering (IPO), raising $724.4 million, Ohio's largest IPO. |

| August 11, 2021 | Root partnered with Carvana to develop personalized auto insurance programs. |

| January 2024 | Root's stock price surged to an all-time high since the start of Q4 2024 earnings season. |

| October 30, 2024 | Root reported its first-ever quarterly net income profit in Q3 2024, reaching approximately $23 million. |

| December 17, 2024 | Root expanded its operations into Minnesota, bringing its coverage to 35 states and over 77% of the US population. |

| February 26, 2025 | Root announced its Q4 and full-year 2024 financial results, reporting a net income of $22 million for Q4 and $31 million for the full year, marking its first profitable year. |

| April 2, 2025 | Root partnered with Hyundai Capital America. |

| April 30, 2025 | Root partnered with Experian to expand its auto insurance portfolio. |

| May 7, 2025 | Root reported Q1 2025 results with a net income of $18 million, gross premiums written up 24% year-over-year to $411 million, and policies-in-force reaching approximately 454,000. |

Root plans to increase its partnership channel mix throughout 2025, expanding into new states like Massachusetts, New Jersey, Washington, and Michigan. They are also developing a product for the independent agency channel.

The company anticipates higher loss ratios in Q2 and Q3 due to storm seasons. Despite this, Root focuses on long-term growth, emphasizing lifetime unit economics and ongoing expansion.

Analyst predictions for Root's stock in 2025 suggest an average price of $155.93, with a high of $208.42 and a low of $103.44. These forecasts reflect the company's growth trajectory.

Root's leadership aims to become the largest and most profitable company in the industry, staying true to its founding vision of using technology and data to offer fair and efficient insurance. Read more about the company's journey in this detailed article about the Root Company history.

Root Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Root Company?

- What is Growth Strategy and Future Prospects of Root Company?

- How Does Root Company Work?

- What is Sales and Marketing Strategy of Root Company?

- What is Brief History of Root Company?

- Who Owns Root Company?

- What is Customer Demographics and Target Market of Root Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.