Root Bundle

Can Root Company Thrive in the Cutthroat Insurance Arena?

The insurance industry is undergoing a massive transformation, and Root, Inc. is at the forefront of this revolution. Founded in 2015, Root aimed to disrupt the auto insurance market with its innovative telematics-based approach. But how does Root stack up against its rivals?

This analysis dives deep into the Root SWOT Analysis, providing a comprehensive Root Company competitive landscape, evaluating Root Insurance competitors, and offering a thorough Root Insurance market analysis. We'll explore Root's unique advantages, dissect its business model, and assess its financial performance within the dynamic insurance industry. Understanding the competitive dynamics, including direct-to-consumer insurance and telematics insurance, is crucial for evaluating Root's future outlook and growth potential in 2024 and beyond.

Where Does Root’ Stand in the Current Market?

Root, Inc. operates within the competitive insurtech sector, primarily focusing on auto insurance. Its core function revolves around offering auto insurance policies, with its primary differentiator being the use of a mobile app and telematics data for personalized rate generation. The company has established itself as a notable player among technology-first insurers, leveraging technology to assess driving behavior and offer customized insurance rates.

The value proposition of Root centers on providing potentially lower premiums to safe drivers, leveraging telematics to assess driving habits. This approach aims to offer more competitive rates, appealing to tech-savvy individuals comfortable with mobile applications. The company's business model is designed to be direct-to-consumer, streamlining the insurance process through its digital platform.

Root's geographic presence spans various U.S. states, continually expanding its operational footprint. The company's target customer base generally includes tech-savvy individuals seeking potentially lower premiums based on their driving habits. Root's focus on telematics-driven underwriting reinforces its position as a leader in this niche within auto insurance. Root's market position is as a significant disruptor in the digital insurance space.

While specific market share figures for Root can fluctuate, the company has established itself as a notable player in the insurtech segment. Root's primary product line is auto insurance, with its core differentiator being the use of a mobile app and telematics data. Its scale, while smaller than established insurance giants, positions it as a significant disruptor in the digital insurance space.

Root's competitive advantages include its telematics-driven underwriting, which allows for personalized rate generation. The company's direct-to-consumer approach and mobile-first platform enhance customer experience. Root Insurance's focus on technology and data analytics strengthens its market position. The company aims to offer more competitive rates to safe drivers.

Root primarily targets tech-savvy individuals comfortable with mobile applications. These customers are often seeking potentially lower premiums based on their driving habits. The company's customer segment is generally characterized by a preference for digital interactions. Root's business model analysis reveals a focus on attracting and retaining customers through its user-friendly app and competitive pricing.

Root's financial health is often assessed through metrics like policy-in-force growth and loss ratios, which indicate its operational performance. The company continues to invest in its technology platform and data analytics capabilities. The Revenue Streams & Business Model of Root are largely dependent on premium income and the effectiveness of its telematics-based pricing. Financial performance is subject to the volatility of a growth-oriented insurtech firm.

Root operates within the dynamic auto insurance market, competing with both traditional insurers and other insurtech companies. The company's approach to telematics insurance and direct-to-consumer insurance has positioned it as a disruptor. Root's competitive landscape includes established players and emerging insurtech firms, all vying for market share and customer acquisition.

- Root's market analysis reveals a focus on technology and data analytics.

- The company's geographic reach and availability are expanding across the U.S.

- Root's business model analysis highlights its direct-to-consumer approach.

- The company's future outlook and growth potential are tied to its ability to innovate and scale.

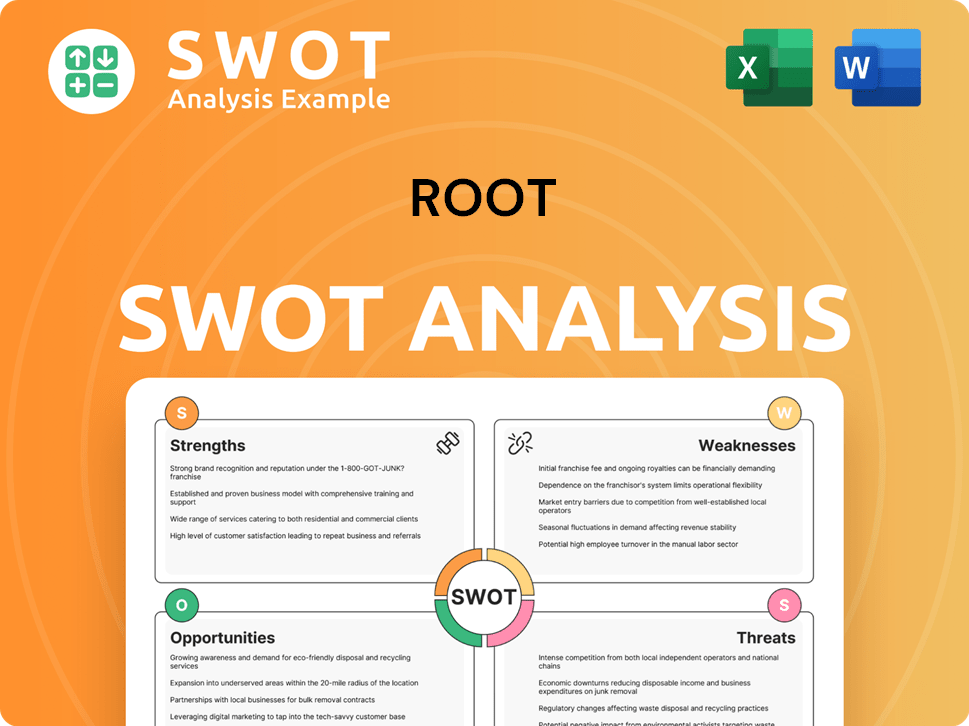

Root SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Root?

The Root Company competitive landscape in the auto insurance sector is shaped by a mix of direct and indirect competitors. Understanding these players is crucial for assessing Root's position and strategies. The market is dynamic, with shifts in market share and the emergence of new technologies constantly reshaping the competitive environment. This analysis provides a detailed look at the key competitors influencing Root's performance.

Root faces both insurtech rivals and established insurance giants. Direct competitors focus on technology-driven insurance models, while indirect competitors leverage brand recognition and extensive resources. The competitive pressures include pricing strategies, technological innovation, and customer acquisition efforts. This analysis helps to clarify the competitive dynamics and the strategies employed by Root's rivals.

The auto insurance market is highly competitive, with significant players vying for market share. The competitive landscape includes direct and indirect competitors, each employing different strategies to attract and retain customers. The following sections detail the key competitors and their impact on Root's position in the market.

Direct competitors of Root are primarily other insurtech companies. These companies utilize technology and digital platforms for underwriting and distribution. They often compete on user experience, app features, and innovative pricing models.

Lemonade has expanded into auto insurance, directly competing with Root. They offer a technology-driven approach with a focus on user-friendly interfaces and digital claims processing. Lemonade's strategy involves leveraging AI and data analytics for personalized pricing.

Metromile, now part of Lemonade, previously focused on pay-per-mile insurance models. This approach targeted drivers who drive less frequently, offering a potentially more cost-effective option. The acquisition by Lemonade has altered the competitive dynamics.

Indirect competitors include traditional, established insurance carriers. These companies have significant brand recognition, extensive agent networks, and substantial financial resources. They compete through comprehensive coverage options and marketing campaigns.

State Farm is a major player with a vast customer base and a strong brand reputation. They offer a wide range of insurance products and have a large network of agents. State Farm is a significant competitor due to its market share and financial strength.

GEICO is known for its direct-to-consumer approach and aggressive marketing. They offer competitive pricing and a streamlined online experience. GEICO's strong brand recognition and advertising efforts make them a formidable competitor.

Progressive is another major competitor, known for its usage-based insurance programs and innovative pricing models. They leverage technology to assess risk and offer personalized rates. Progressive's focus on technology and customer experience makes them a key player.

Allstate has a strong presence in the insurance market, offering a variety of coverage options. They have a large customer base and a well-established brand. Allstate competes through comprehensive coverage and a focus on customer service.

The competitive landscape is continually evolving, with mergers, acquisitions, and new entrants impacting the market. The shift towards telematics insurance and digital platforms is a key trend. Understanding these dynamics is crucial for assessing Root's position and future prospects. For example, the Marketing Strategy of Root highlights how they are adapting to these changes.

- Market Share Shifts: Competition often leads to shifts in market share as companies vie for customers through pricing, product offerings, and marketing.

- Advertising Spend: Increased advertising spend in specific regions is a common strategy as both insurtechs and incumbents try to gain market share.

- Mergers and Acquisitions: Acquisitions, such as Lemonade's purchase of Metromile, consolidate market power and alter the competitive landscape.

- New Entrants: New players, particularly those focused on niche markets or leveraging advanced AI, pose a continuous challenge to Root's position.

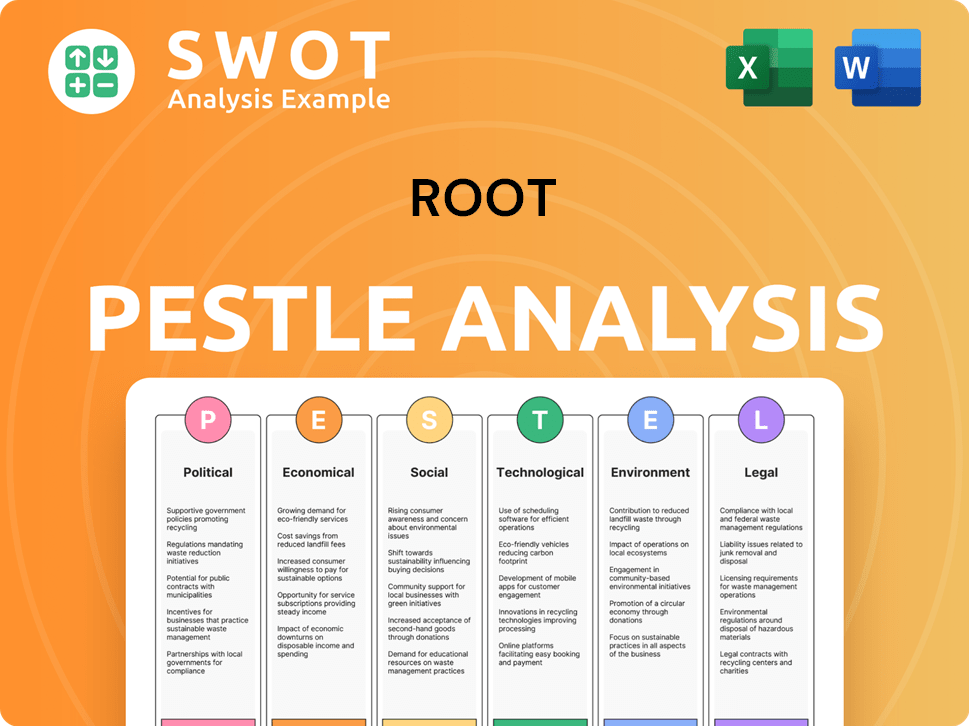

Root PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Root a Competitive Edge Over Its Rivals?

The competitive landscape for auto insurance is dynamic, and understanding the strengths of each player is crucial. This analysis focuses on the competitive advantages of Root, a company that has carved out a niche in the insurance market. Root's approach centers on technology and data to offer a different value proposition to consumers. This chapter explores the core elements that position Root in the market and how it aims to maintain its competitive edge.

Root's strategy emphasizes a direct-to-consumer model, leveraging technology to streamline the insurance process. This approach allows for operational efficiencies and a focus on customer experience. The company's ability to analyze driving behavior through telematics is a key differentiator, enabling personalized pricing and potentially attracting a specific segment of drivers. For a deeper dive into the company's growth trajectory, consider examining the Growth Strategy of Root.

Root's competitive advantages are multifaceted, stemming from its innovative use of technology and data-driven strategies. These strengths are critical in a market where traditional insurers are also investing in digital capabilities and customer experience improvements. Continuous innovation and adaptation are essential for Root to maintain its position.

Root's primary competitive advantage lies in its use of telematics. This technology allows for a more accurate assessment of driving behavior, leading to personalized pricing. Root collects data on driving habits to offer rates that reflect individual risk profiles. This approach can be particularly appealing to safe drivers.

Root offers a mobile-first platform, providing a seamless digital customer experience. The entire insurance process, from quoting to claims, is managed through a smartphone app. This ease of use caters to a digitally native customer base, offering convenience that traditional insurers often lack. Root has invested heavily in its app's user interface and functionality.

Root has cultivated a brand image as a modern, fair, and transparent insurer. This image fosters customer loyalty, particularly among those seeking alternatives to traditional insurance companies. The company's focus on transparency in pricing and claims processes builds trust with its customers. Root's marketing efforts emphasize these aspects of its brand.

Root benefits from the network effect of data collection. As more drivers use its app, the dataset grows, leading to more accurate risk assessments and pricing models. This creates a virtuous cycle, where more data improves the quality of the product. The ability to analyze a large volume of driving data is a significant advantage.

Root's competitive advantages are centered on technology, data analysis, and customer experience. These elements work together to create a unique value proposition in the auto insurance market. The company's strategy is designed to attract and retain customers through personalized pricing and a user-friendly platform.

- Telematics Technology: Enables personalized pricing based on driving behavior.

- Mobile-First Platform: Provides a seamless digital customer experience.

- Data-Driven Approach: Enhances risk assessment and pricing accuracy.

- Brand and Customer Loyalty: Fosters trust through transparency.

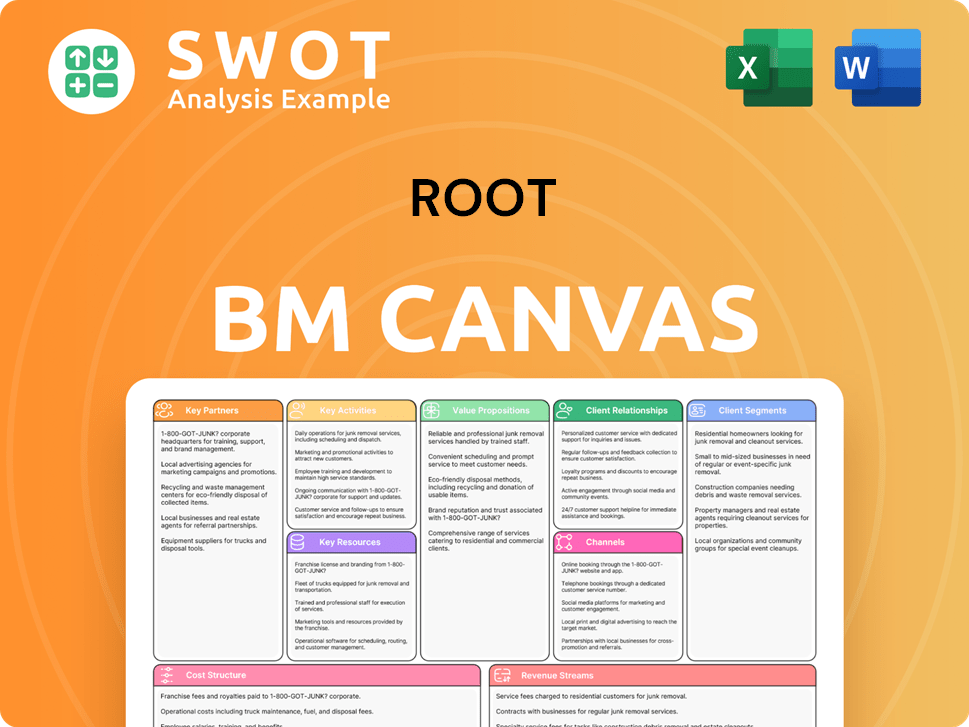

Root Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Root’s Competitive Landscape?

The competitive landscape for Root Company is shaped by the dynamic shifts within the insurance industry. Root, a direct-to-consumer (DTC) insurer, faces a mix of opportunities and challenges as it navigates the evolving demands of the market. This analysis delves into the industry trends, potential future challenges, and growth prospects that will influence Root's trajectory.

Understanding the Root Insurance market analysis is crucial, especially considering the company's focus on telematics and data-driven risk assessment. Key factors include the rise of digital insurance, the integration of AI, and the increasing importance of customer experience. The company's success hinges on its ability to adapt to these changes while differentiating itself from both established players and new entrants.

The insurance sector is experiencing rapid technological advancements. AI and machine learning are being used to improve risk assessment and personalize customer interactions. Data privacy regulations and the adoption of telematics are reshaping how insurers operate. Consumer preferences are leaning towards digital and on-demand services, aligning with Root's business model.

Increased competition from insurtech startups and traditional insurers could compress margins. Declining demand for telematics-only insurance if competitors offer superior hybrid models poses a risk. Stricter regulations could limit data usage, and aggressive new competitors with advanced technologies could emerge. Economic factors like inflation also impact the industry.

Expansion into new geographic markets and the introduction of innovative products beyond auto insurance offer growth potential. Strategic partnerships with auto manufacturers and tech companies can create new distribution channels. The continued growth of usage-based insurance and digital services provides a solid foundation for customer base expansion.

Root is likely to focus on refining underwriting models, enhancing customer experience, and exploring new product lines. Diversifying distribution channels and adapting to the evolving regulatory landscape are also critical. The company must balance innovation with financial discipline to maintain its competitive edge.

The Root Insurance competitive landscape is intense, with companies like Progressive and other direct insurance companies vying for market share. Root's success depends on its ability to leverage technology, manage risk effectively, and provide a superior customer experience. For a deeper dive into the financial aspects, you can explore the insights provided for Owners & Shareholders of Root.

Root's strategy must address several key areas to ensure long-term success. This includes technological innovation, regulatory compliance, and customer acquisition.

- Technological Innovation: Continuous investment in telematics, AI, and machine learning.

- Regulatory Compliance: Adapting to evolving data privacy and usage regulations.

- Customer Experience: Providing personalized, digital-first services.

- Market Expansion: Exploring new geographic markets and product offerings.

- Strategic Partnerships: Collaborating with other companies to broaden reach.

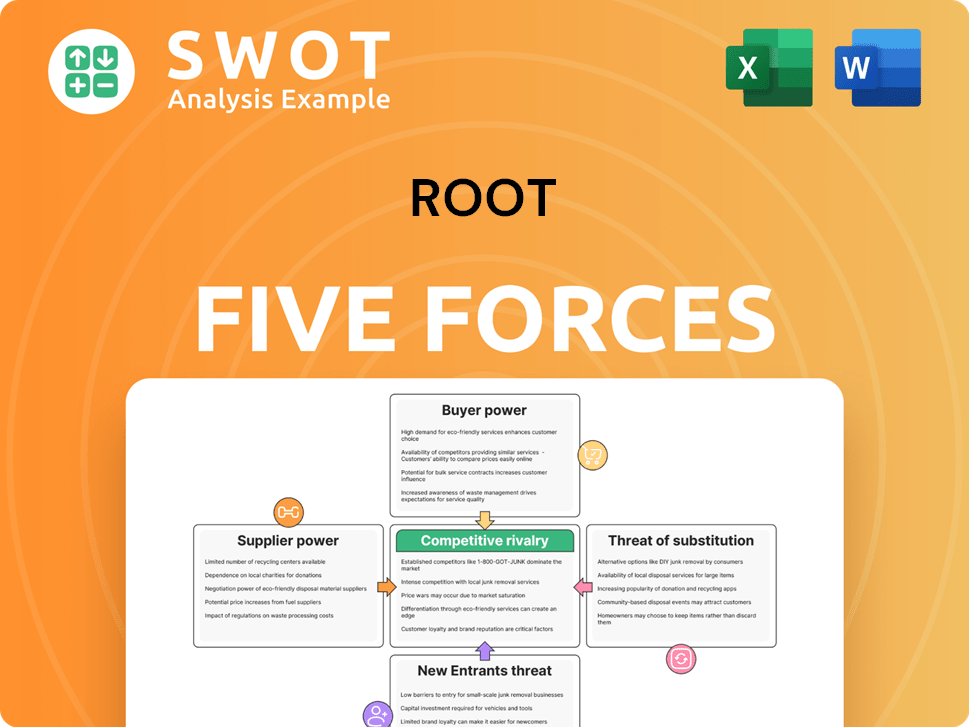

Root Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Root Company?

- What is Growth Strategy and Future Prospects of Root Company?

- How Does Root Company Work?

- What is Sales and Marketing Strategy of Root Company?

- What is Brief History of Root Company?

- Who Owns Root Company?

- What is Customer Demographics and Target Market of Root Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.