Root Bundle

How Does Root Company Revolutionize Car Insurance?

Root, Inc. is shaking up the insurance world, especially in the auto sector. They're using tech to change how car insurance works and how customers interact with it. This innovative approach, centered around a mobile app and data-driven risk assessment, has positioned Root as a challenger to the established players.

Want to know how Root SWOT Analysis helps this innovative insurance company? This article will break down Root's core operations, showing you how it generates revenue and its strategic moves. We'll explore its competitive advantages, and its future in the ever-changing insurance market, giving you a complete picture of Root Insurance and how it works.

What Are the Key Operations Driving Root’s Success?

The core operations of the Root Company, also known as Root Insurance, center on its mobile application and telematics technology. This technology is fundamental to their value proposition: offering fair and personalized auto insurance rates. Root Insurance leverages data collected from policyholders' smartphones to assess driving behavior, aiming to provide more accurate and tailored rates than traditional insurers.

Root Insurance uses a data-driven approach to benefit safe drivers with potentially lower premiums. This operational model involves continuous technology development for its mobile platform, advanced data analytics for risk assessment, and a streamlined digital claims process. The company's supply chain is primarily digital, focusing on software and data infrastructure, with sales mainly direct-to-consumer through its app and website.

Customer service is also integrated within the app, providing a self-service model alongside digital support. This unique operational strategy allows Root to leverage behavioral data at scale, offering personalized pricing. This contrasts with conventional insurers' use of actuarial tables and broad risk pools. The result is potentially lower premiums for safe drivers and a convenient, app-based insurance experience.

Root Insurance uses a mobile app to collect driving data. This data, gathered through smartphone sensors, includes metrics like braking, acceleration, and mileage. The app is central to how Root assesses individual driving risk, offering personalized insurance rates.

Root Insurance analyzes driving data using sophisticated algorithms. This allows the company to assess individual driving risk, which helps in offering customized insurance rates. This approach aims to offer more accurate pricing compared to traditional methods.

Root Insurance offers several customer benefits. Safe drivers may receive lower premiums due to the personalized risk assessment. The app provides a convenient, app-based insurance experience.

The operational processes include continuous technology development and data analytics. Root Insurance focuses on a streamlined digital claims process. Sales are primarily direct-to-consumer through the mobile app and website.

Root Insurance distinguishes itself through its innovative approach to car insurance. The company uses telematics to assess driving behavior. This allows for personalized pricing and potentially lower premiums for safe drivers. Learn more about the company's performance by reading Owners & Shareholders of Root.

- Mobile app-based experience.

- Data-driven risk assessment.

- Personalized insurance rates.

- Potential for lower premiums.

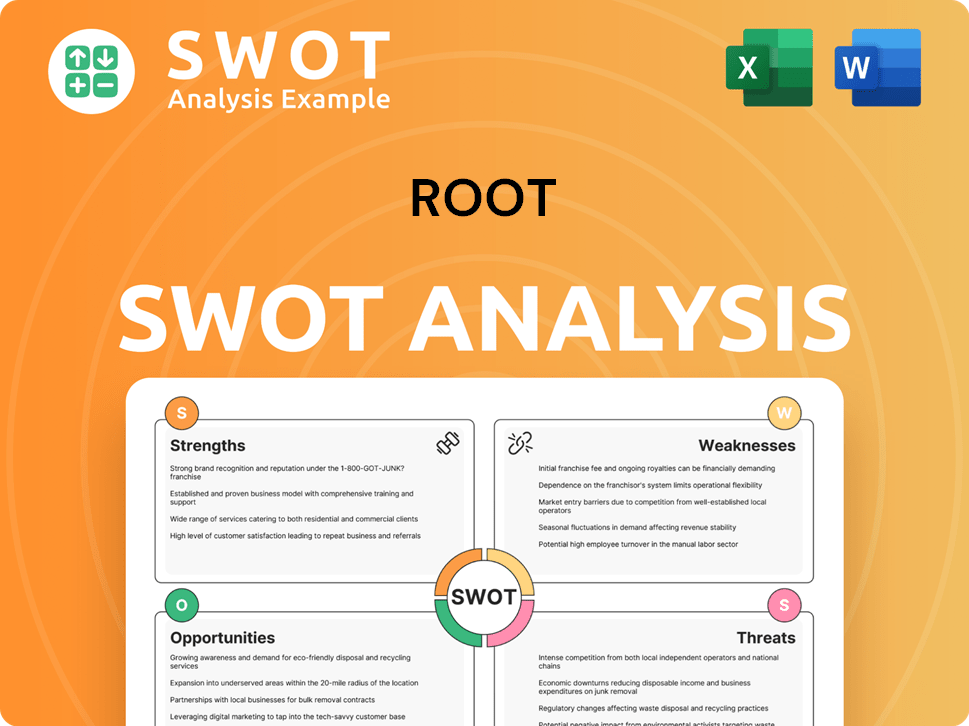

Root SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Root Make Money?

The primary revenue stream for the Root Company is generated through insurance premiums. As a car insurance provider, Root Insurance collects these premiums from policyholders in exchange for auto insurance coverage. The company's financial health is heavily reliant on the premiums it collects.

The monetization strategy of Root car insurance centers on its unique underwriting model. This model uses telematics data to assess driving behavior, aiming to attract and retain lower-risk drivers. This approach allows for personalized pricing, adjusting premiums based on driving habits.

In the first quarter of 2024, Root reported gross written premiums of $177.3 million, reflecting a 20% year-over-year increase. This growth highlights the importance of premium collection in the company's financial performance.

The core of Root's financial strategy revolves around attracting and retaining low-risk drivers through telematics. This approach allows for more accurate risk assessment and sustainable revenue generation. The company focuses on optimizing customer acquisition costs and improving its combined ratio to enhance overall profitability. Learn more about the Marketing Strategy of Root.

- Premium-Based Revenue: The main source of income is auto insurance premiums.

- Telematics-Driven Underwriting: Uses driving data to personalize pricing and attract safer drivers.

- Dynamic Pricing: Premiums are adjusted based on ongoing driving behavior.

- Focus on Efficiency: The company aims to improve customer acquisition and combined ratios.

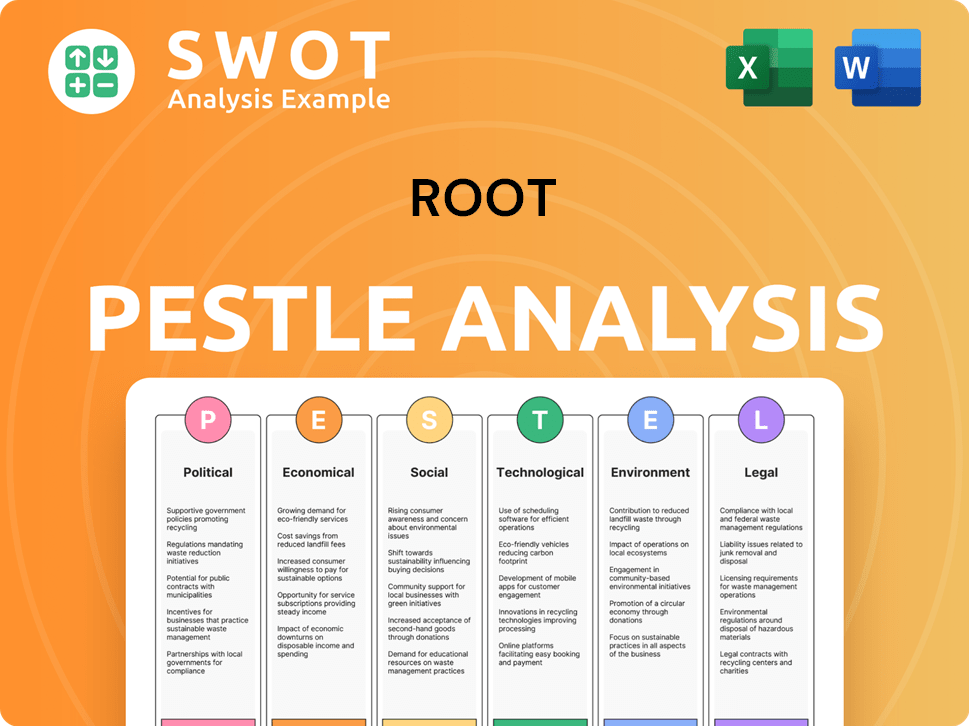

Root PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Root’s Business Model?

The journey of the Root Company, now known as Root Insurance, has been marked by significant milestones and strategic shifts aimed at reshaping the car insurance market. A key early achievement was the successful implementation of its telematics-driven underwriting model. This innovative approach allowed Root to differentiate itself from established insurance providers. The company's expansion across the United States has also been a crucial strategic move, broadening its customer base and market reach.

Root has navigated challenges, including intense competition from both traditional insurers and insurtech startups, alongside regulatory hurdles inherent in the insurance industry. The company has responded by continually refining its technology, improving its data analytics capabilities, and streamlining its customer experience. Root's evolution reflects a commitment to adapting and innovating within a dynamic market.

Root's competitive advantages primarily stem from its technological leadership in telematics and behavioral underwriting. Its ability to leverage smartphone data to assess risk more granularly provides a distinct edge in pricing and customer segmentation. This technology-first approach also enables a more efficient and digital customer journey, from quoting and policy issuance to claims processing. Furthermore, its brand strength as an innovative insurtech company helps attract tech-savvy consumers. Root continues to adapt to new trends and competitive threats by focusing on improving its profitability and unit economics. The company has emphasized reducing its customer acquisition costs and improving its combined ratio, reflecting a strategic pivot towards sustainable growth and financial discipline in a challenging market environment.

Root's initial success was the implementation of its telematics-driven underwriting model. This model allowed for more personalized pricing. Expansion across the U.S. broadened its customer base and market reach.

Continuous refinement of technology and data analytics. Streamlining the customer experience to improve efficiency. Focus on reducing customer acquisition costs and improving the combined ratio.

Technological leadership in telematics and behavioral underwriting. Ability to use smartphone data for granular risk assessment. Efficient and digital customer journey, from quoting to claims.

Facing competition from traditional insurers and insurtechs. Regulatory hurdles within the insurance industry. Adapting by improving profitability and unit economics.

Root Insurance leverages telematics to offer car insurance. They use a mobile app to assess driving behavior. This data-driven approach helps in providing personalized insurance rates.

- Root uses smartphone sensors to monitor driving habits.

- The app tracks factors like braking, speed, and phone usage.

- Good drivers often get lower premiums based on their driving scores.

- This model allows Root to offer competitive rates.

For more insights, you can read a Brief History of Root. As of late 2024, Root continues to focus on improving its financial performance. The company's strategy includes optimizing customer acquisition costs and enhancing its combined ratio to ensure sustainable growth. The insurtech sector remains competitive, with Root Insurance working to maintain its position through innovation and customer-focused services.

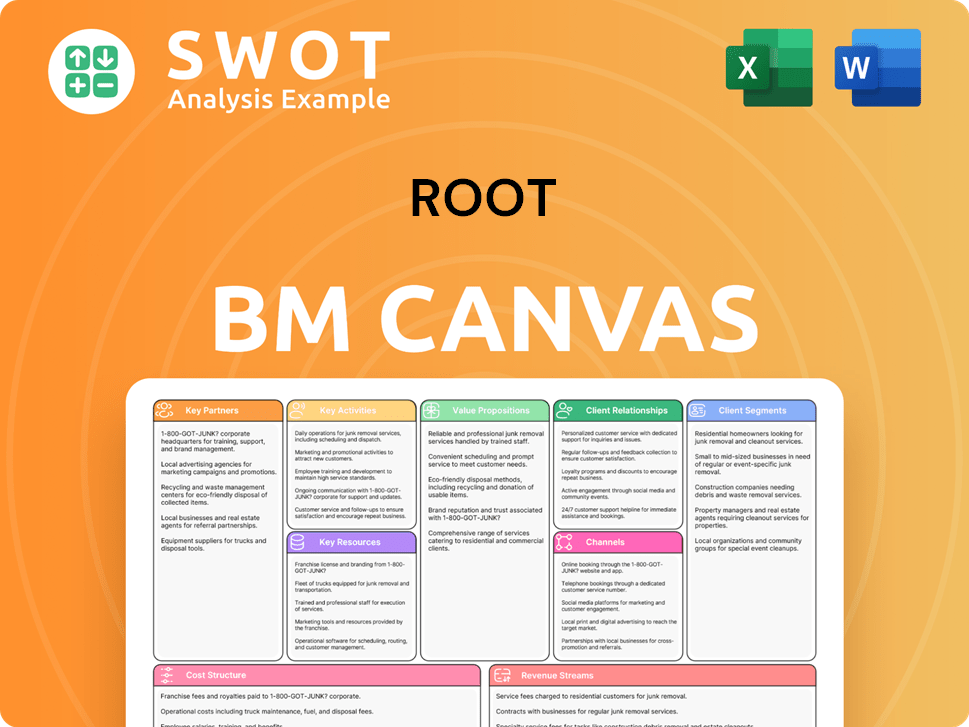

Root Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Root Positioning Itself for Continued Success?

Root car insurance, as a prominent player in the insurtech space, has carved out a specific niche in the competitive auto insurance market. It distinguishes itself by offering personalized rates based on driving behavior, leveraging a mobile app and telematics technology. While its market share is smaller compared to established insurance companies, Root's approach resonates with drivers seeking tailored and potentially cheaper insurance options.

The company's focus on technology and data-driven underwriting sets it apart, but it also faces considerable challenges. The insurance company operates exclusively within the United States, and its long-term success hinges on its ability to manage risks, adapt to regulatory changes, and maintain a competitive edge in a rapidly evolving market.

Root Insurance operates as an insurtech, competing with both traditional insurers and other tech-focused companies. Its primary market is the United States. The company uses a mobile app and telematics to assess driving behavior and offer personalized rates, differentiating it from standard insurers. Root car insurance targets drivers looking for potentially lower premiums based on their driving habits.

Key risks include competition from established players and other insurtechs, as well as regulatory changes and technological disruptions. Data privacy concerns and evolving consumer preferences could also affect its telematics-driven model. Achieving profitability and scaling the business efficiently are crucial. These factors could impact the company's financial performance.

The future outlook for Root car insurance involves achieving underwriting profitability and positive operating cash flow. Strategic initiatives focus on improving unit economics, optimizing marketing spend, and enhancing product offerings. The company aims to refine its technology, improve risk selection, and potentially diversify its product portfolio. The company is focused on sustainable growth within a dynamic market.

In recent financial reports, Root has shown progress in reducing its operating losses. The company is working towards improving its combined ratio, a key metric in the insurance industry. Root is focused on achieving underwriting profitability and positive operating cash flow in the near term. The company's ability to manage its expenses and improve its risk selection will be critical for its financial health.

Root Insurance's strategic plans emphasize profitability and efficient scaling. The company is focused on enhancing its technology platform and refining its risk assessment models. They are also exploring opportunities to expand their product offerings and potentially enter new markets. The company is committed to maintaining a disciplined approach to growth.

- Improve unit economics through better pricing and cost management.

- Optimize marketing spend to acquire customers more efficiently.

- Enhance product offerings to meet evolving customer needs.

- Focus on underwriting profitability and positive cash flow.

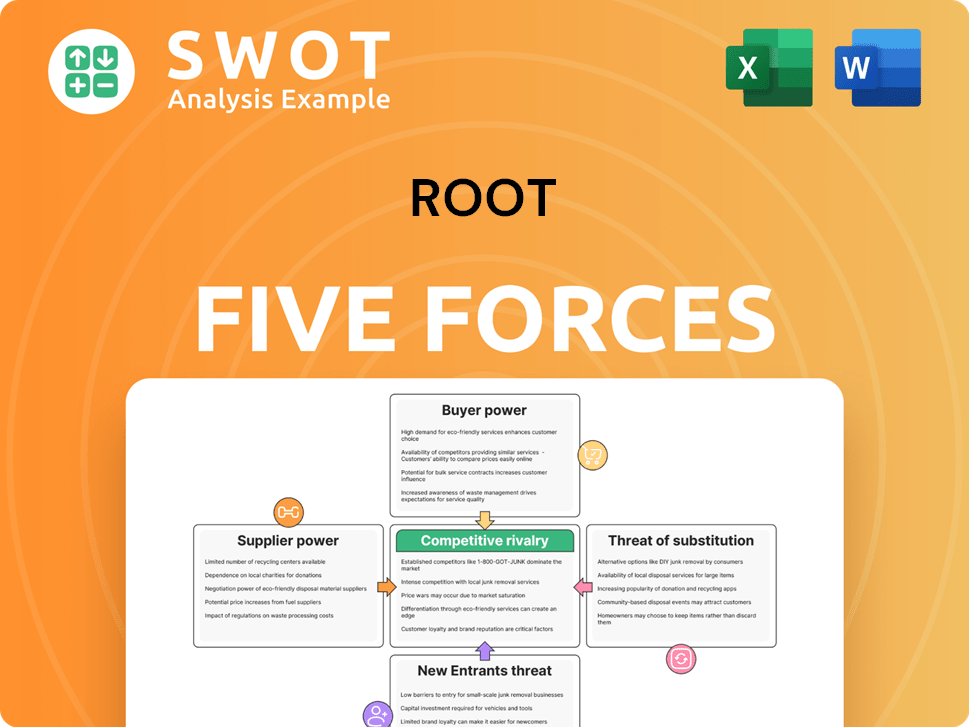

Root Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Root Company?

- What is Competitive Landscape of Root Company?

- What is Growth Strategy and Future Prospects of Root Company?

- What is Sales and Marketing Strategy of Root Company?

- What is Brief History of Root Company?

- Who Owns Root Company?

- What is Customer Demographics and Target Market of Root Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.