Root Bundle

Who Drives Root Company's Success?

The insurance industry is undergoing a significant transformation, and Root Company is at the forefront of this change. But who exactly are the people embracing this new approach to auto insurance? Understanding the Root SWOT Analysis, customer demographics, and target market is crucial for grasping Root's strategic positioning and future growth potential.

This exploration delves into the specifics of Root Company's customer base, providing a detailed market analysis to reveal the characteristics of its ideal customer profile. We'll examine customer segmentation strategies, customer psychographics, and the factors influencing buying behavior to understand how Root Company tailors its customer value proposition and meets its target market's needs and wants. This comprehensive analysis will shed light on Root Company's customer age range, income levels, location data, and interests and preferences.

Who Are Root’s Main Customers?

The primary customer segments for the auto insurance market are consumers (B2C). The company focuses on individuals who are comfortable using mobile technology and sharing data for personalized rates. While specific demographic data isn't publicly available, the telematics-driven model attracts those who value transparency and potentially lower premiums based on their driving habits.

This often includes younger, tech-savvy drivers or those with excellent driving records who may feel penalized by traditional insurance models. The mobile-first approach suggests a target audience comfortable with managing their insurance via an app. The company has expanded its offerings to include renters and homeowners insurance, broadening its customer base beyond just auto insurance holders.

As of late 2023, the company reported a significant decrease in policies in force, indicating a shift in target segments or a more refined focus on profitable policyholders. This suggests a strategic move towards higher-quality customers who align with their profitability goals, potentially refining their target demographic to those with better driving scores and higher retention potential. Understanding the Brief History of Root can provide additional context.

The company's customer base is primarily composed of individuals who are comfortable with mobile technology. The company's business model attracts those who value transparency and potentially lower premiums based on their driving habits. This often includes younger, tech-savvy drivers.

The target market includes individuals who are comfortable managing their insurance through a mobile app. The company's focus is on customers with good driving records. The company is expanding its customer base to include renters and homeowners.

The company's customer segmentation strategy targets specific groups within the auto insurance market. The ideal customer profile includes tech-savvy drivers who value transparency and potentially lower premiums. The company's market analysis indicates a focus on profitable policyholders with good driving scores.

- Tech-Proficient Drivers: Those comfortable with mobile apps and data sharing.

- Value-Conscious Consumers: Individuals seeking lower premiums based on driving behavior.

- Good Driving Record Holders: Customers who feel penalized by traditional insurance models.

- Renters and Homeowners: Expanding customer base beyond auto insurance.

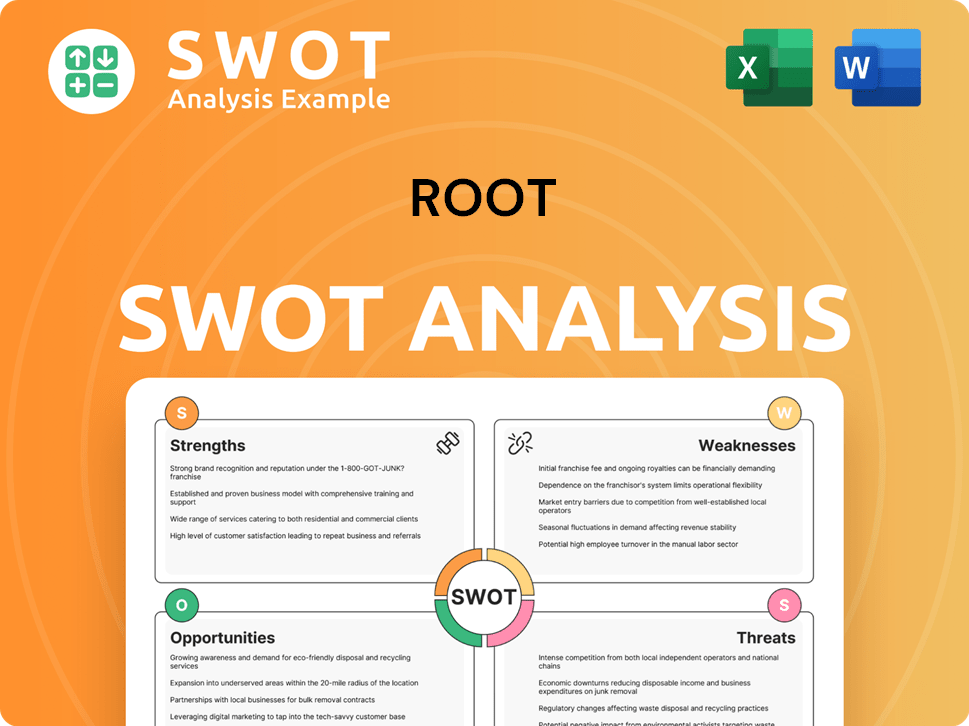

Root SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Root’s Customers Want?

Understanding the customer needs and preferences is crucial for any business, and for the Root Company, this involves a deep dive into what drives their customers. The customer base of Root, a company focused on data-driven insurance, is primarily seeking fairness and transparency in pricing. They often feel underserved by traditional insurance models, which is a key driver for their interest in Root.

The purchasing behavior of Root's customers is heavily influenced by the promise of personalized rates based on actual driving behavior. This addresses a significant pain point associated with generic pricing models. Customers are also motivated by the potential for cost savings and the convenience of managing their insurance through a mobile application. This combination of factors shapes their expectations and preferences.

Decision-making criteria for Root customers often include the ease of obtaining a quote, the perceived fairness of the premium, and the simplicity of the claims process. The mobile app is the primary interface for policy management, telematics data collection, and communication, influencing product usage patterns. Loyalty is tied to competitive pricing and a seamless customer experience, highlighting the importance of ongoing value delivery.

Customers are drawn to Root due to the promise of fair and transparent insurance pricing, which is a significant departure from traditional insurers. This addresses a key pain point for many customers.

The appeal of personalized rates based on actual driving behavior is a major factor in customer purchasing decisions. This data-driven approach resonates with those seeking a more tailored insurance experience.

Customers are motivated by the potential for cost savings and the convenience of managing their insurance through a mobile application. This dual benefit is a key driver of customer satisfaction.

Ease of obtaining a quote, the perceived fairness of the premium, and the simplicity of the claims process are critical decision-making factors. The mobile app streamlines these processes.

Product usage revolves around the mobile app, which serves as the primary interface for policy management, telematics data, and communication. This app-centric approach is central to the customer experience.

Loyalty is tied to continued competitive pricing and a seamless customer experience. Maintaining these aspects is vital for customer retention and satisfaction.

Root aims to address unmet needs by providing a modern, data-driven alternative to traditional insurance, appealing to individuals who value efficiency and personalized service. Feedback and market trends have influenced Root's product development, leading to refinements in their telematics scoring model and the expansion into other insurance lines like renters and homeowners. For example, Root has tailored its marketing to highlight the direct correlation between good driving and lower premiums, appealing to aspirational drivers who seek to be rewarded for their safe habits. Further insights into the Revenue Streams & Business Model of Root can provide additional context for understanding their customer-centric approach.

Understanding the customer needs and preferences of the Root Company is essential for effective market analysis and customer segmentation. The ideal customer profile is someone who values data-driven insights and personalized service.

- Customer Demographics: Root's target market often includes younger, tech-savvy drivers aged between 25-45 years old. This demographic is comfortable with mobile technology and values transparency.

- Customer Psychographics: Customers are typically interested in cost savings and are motivated by the potential to lower their insurance premiums through safe driving habits. They are also attracted to the convenience of managing their insurance via a mobile app.

- Customer Buying Behavior: The ease of obtaining a quote, the fairness of the premium, and the simplicity of the claims process are critical factors influencing buying behavior. The mobile app plays a central role in policy management and communication.

- Market Analysis: Root's market analysis focuses on understanding the unmet needs of customers who feel overcharged by traditional insurers. This involves identifying the key pain points and tailoring the value proposition to address these needs.

- Customer Segmentation: Root segments its customer base by focusing on drivers who are willing to have their driving behavior monitored and are motivated by the potential for lower premiums. This segmentation strategy helps in targeting the ideal customer profile.

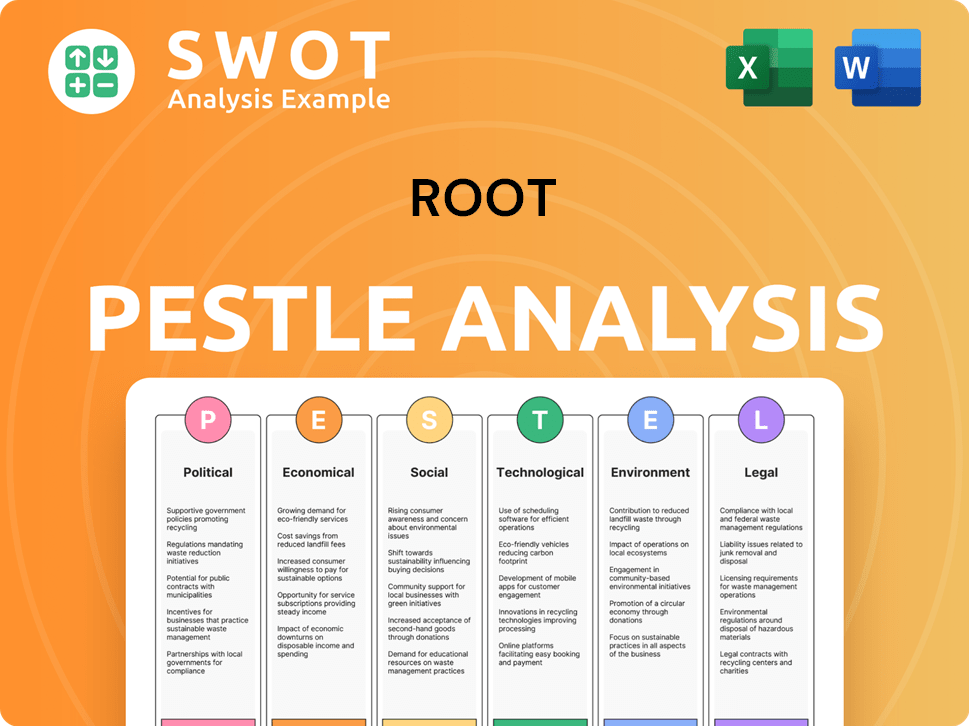

Root PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Root operate?

The geographical market presence of the [Company Name] is a crucial aspect of its business strategy, impacting its ability to reach its target market and achieve profitability. As of December 31, 2023, the company's auto insurance product was available in 34 states across the United States. This widespread availability indicates a significant national footprint, though market penetration varies by region.

The company's approach to geographical expansion and contraction is dynamic, reflecting its focus on sustainable growth and operational efficiency. Market analysis and customer segmentation play a key role in these decisions. The company strategically adjusts its presence based on regulatory environments, competitive landscapes, and the effectiveness of its data-driven pricing model in specific states.

The company's strategy involves localized marketing efforts and potentially tailored pricing strategies to address the varying customer demographics, preferences, and buying power across different regions. This approach is essential for effectively targeting the ideal customer profile and optimizing market share. This targeted approach is essential for effectively targeting the ideal customer profile and optimizing market share.

The company's auto insurance product was available in 34 states as of the end of 2023. This broad coverage suggests a national focus, but the company strategically adjusts its presence based on market conditions.

The company has withdrawn from certain markets to optimize operational efficiency and focus on profitability. This dynamic approach prioritizes sustainable growth over mere market expansion, influencing policy count adjustments.

Localized marketing and pricing strategies likely address differences in customer demographics, preferences, and buying power across regions. The core telematics-based pricing model remains consistent.

Expansion and contraction strategies are often influenced by regulatory environments and the competitive landscape within specific states. This highlights the importance of market analysis.

The company's geographical strategy is shaped by several key factors. Understanding these elements is crucial for anyone seeking to understand the company's market approach. Here's a breakdown:

- Data-Driven Approach: The company focuses on states where its data-driven approach to insurance pricing can be most effective.

- Profitability: The company prioritizes profitable growth, leading to strategic withdrawals from underperforming markets.

- Market Dynamics: Regulatory environments and competitive landscapes significantly influence expansion and contraction decisions.

- Customer Segmentation: Localized marketing and pricing strategies are employed to address regional differences in customer demographics.

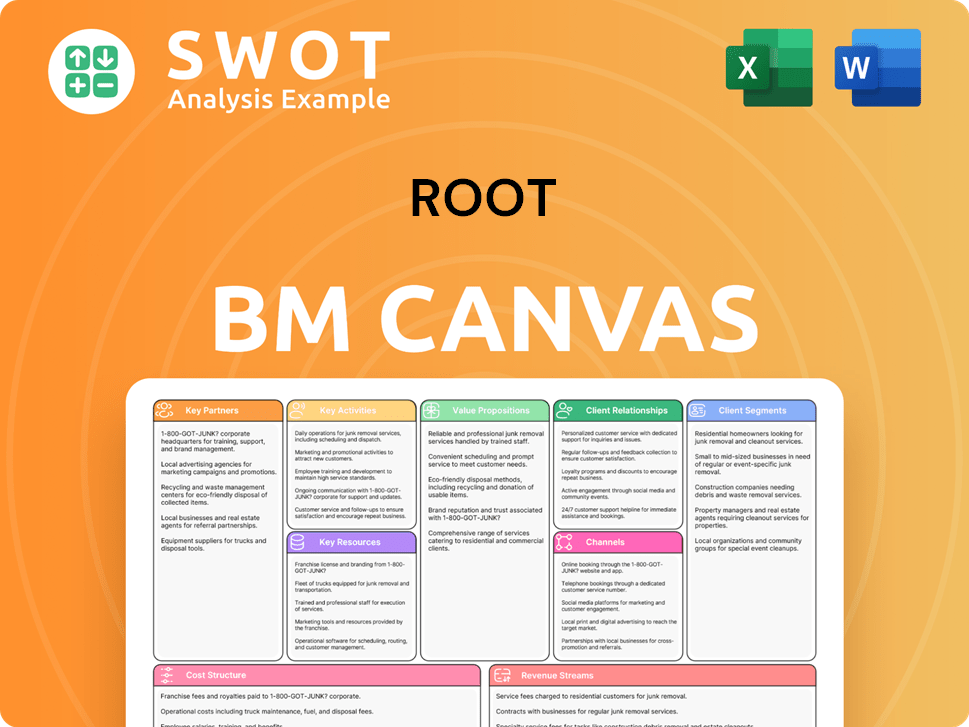

Root Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Root Win & Keep Customers?

Customer acquisition and retention strategies are crucial for the success of any insurance company. The approach of the company involves a multi-faceted strategy, primarily focusing on digital channels and its unique telematics-driven model. This strategy is designed to attract and retain customers in a competitive market. Understanding the customer demographics and target market is essential for tailoring these strategies effectively.

The company leverages digital advertising and social media campaigns to reach its target audience. The ease of obtaining quotes and policies through its mobile app is a key sales tactic. Furthermore, the company has invested in improving customer experience, which is critical for retention. The company's telematics data plays a significant role in targeting campaigns and personalizing messaging based on driving scores and potential savings.

The company has shifted its focus towards profitability over rapid growth, impacting customer acquisition volume but aiming to improve customer lifetime value and reduce churn. This strategic shift is evident in efforts to reduce cash burn and enhance operational efficiency. A deeper dive into the specifics of the Marketing Strategy of Root provides additional insights into these approaches.

The company heavily relies on digital channels for customer acquisition. This includes digital advertising and social media campaigns. These efforts are aimed at reaching tech-savvy consumers who are comfortable with mobile applications.

The company's telematics-driven model is a core component of its customer acquisition and retention strategy. Telematics data allows for personalized messaging based on driving behavior. This data is used to offer customized rates and highlight potential savings.

A key sales tactic is the ease of obtaining quotes and policies through the mobile app. This streamlined process is designed to attract customers seeking convenience. The app often highlights potential savings based on driving behavior.

The company has invested in improving customer experience, which is crucial for retention. This includes streamlining processes and offering responsive customer service. The goal is to reduce churn and increase customer satisfaction.

The company has shifted its focus towards profitability, which has impacted customer acquisition volume but is intended to improve customer lifetime value and reduce churn rate. This strategic shift is evident in efforts to reduce cash burn and enhance operational efficiency. The company's combined ratio in Q4 2023 was 120.3%, indicating a need for improved profitability through better underwriting and potentially better customer retention.

- Focus on Customer Lifetime Value (CLTV): The company aims to increase the overall value derived from each customer over time.

- Churn Reduction: Efforts are being made to minimize the rate at which customers discontinue their policies.

- Operational Efficiency: Streamlining operations to reduce costs and improve overall financial performance.

- Underwriting Improvements: Enhancing the process of assessing risk to better manage profitability.

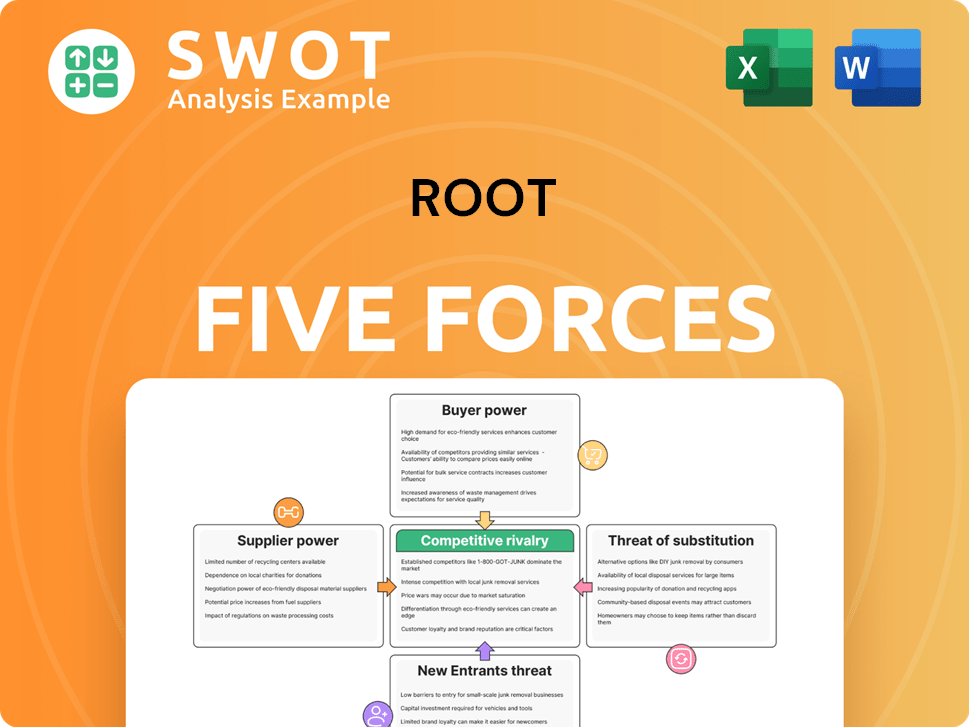

Root Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Root Company?

- What is Competitive Landscape of Root Company?

- What is Growth Strategy and Future Prospects of Root Company?

- How Does Root Company Work?

- What is Sales and Marketing Strategy of Root Company?

- What is Brief History of Root Company?

- Who Owns Root Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.