Root Bundle

Can Root Company Revolutionize Auto Insurance?

Root, Inc. burst onto the scene with a bold vision: to disrupt the auto insurance industry through technology and data. Founded in 2015, Root promised fairer rates based on individual driving behavior, a stark contrast to traditional methods. This innovative approach, emphasizing a mobile-first experience, aimed to capture a segment of the market.

This exploration delves into the Root SWOT Analysis and its strategic roadmap for future growth, examining how the company plans to expand its reach and solidify its market standing. Understanding Root's growth strategy and future prospects is crucial for investors and strategists alike. We'll analyze Root Company's business development plans, its strategic planning, and its company expansion initiatives to assess its long-term potential.

How Is Root Expanding Its Reach?

The Root company's growth strategy centers on expanding its customer base and increasing market penetration. This is primarily achieved through a data-driven approach, leveraging telematics to attract drivers who are overpaying for insurance. Their focus is on optimizing the current market presence and improving unit economics in existing territories.

Root's expansion strategy is not just geographical but also product-centric, all within its core auto insurance offering. This includes continuously refining its algorithms and mobile app experience to enhance customer acquisition and retention. The company is exploring partnerships to drive customer referrals and integrate its technology into broader ecosystems.

The company's pursuit of these initiatives is driven by the need to achieve profitability and scale in a highly competitive insurance market. They aim to differentiate themselves by offering a truly personalized and transparent insurance experience. The company's historical expansion has been state-by-state, gradually increasing its operational footprint across the U.S.

Root's expansion has historically been state-by-state, gradually increasing its operational footprint across the U.S. The company focuses on optimizing its current market presence. While specific details on new geographical market entries for 2024-2025 are not broadly publicized, the strategy remains focused on organic growth and improved customer lifetime value.

Root continuously refines its algorithms and mobile app experience to enhance customer acquisition and retention. This includes exploring partnerships that could drive customer referrals or integrate Root's technology into broader ecosystems. The aim is to offer a personalized and transparent insurance experience.

The Root company employs a multifaceted growth strategy to enhance its market position. This includes leveraging telematics, focusing on customer acquisition, and improving customer lifetime value. These strategies are designed to achieve profitability and scale in the competitive insurance market.

- Data-Driven Underwriting: Utilizing telematics to accurately assess risk and offer competitive pricing.

- Customer Acquisition: Refining algorithms and mobile app experience to attract and retain customers.

- Strategic Partnerships: Exploring collaborations to drive customer referrals and integrate technology.

- Operational Efficiency: Focusing on organic growth and improving unit economics in existing territories.

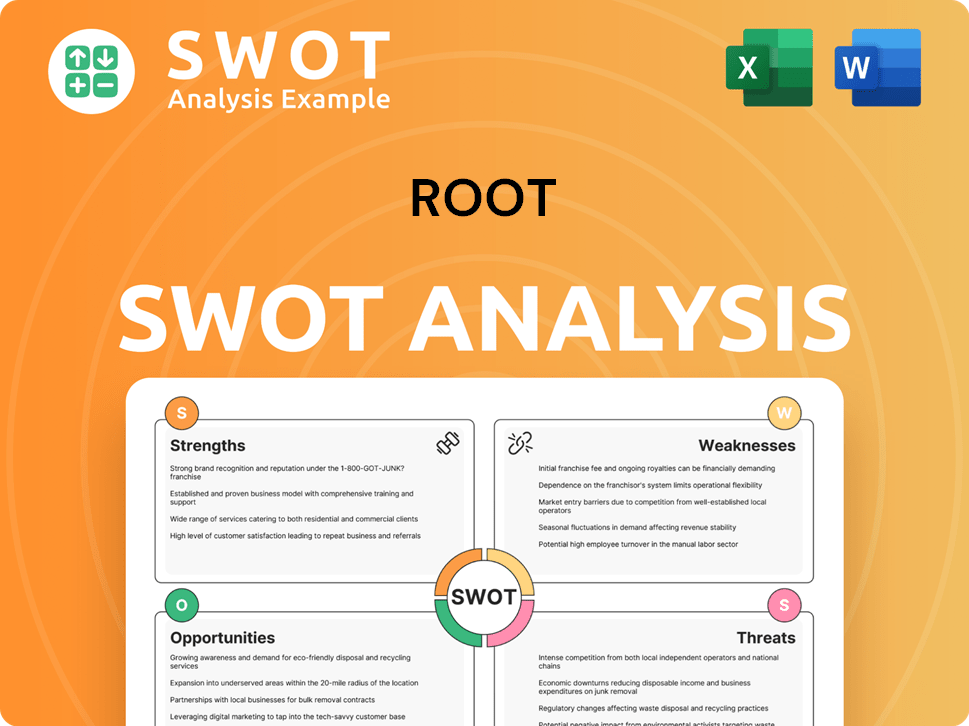

Root SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Root Invest in Innovation?

The innovation and technology strategy of the Root Company is central to its growth, deeply integrated into its telematics-driven insurance model. This approach allows the company to offer personalized insurance rates, a significant departure from traditional underwriting. Root's commitment to digital transformation is evident in its mobile-first platform, which streamlines the entire insurance process from quoting to claims.

Root heavily invests in research and development to refine its proprietary algorithms. These algorithms analyze driving behavior data collected through its mobile app. Continuous enhancements in data analytics and machine learning improve risk assessment accuracy and operational efficiency. Root's focus on leveraging technology to create a fairer and more efficient insurance experience remains a core tenet of its strategy, positioning it as a leader in insurtech innovation.

Root continuously updates its app and underwriting models, demonstrating its ongoing commitment to technological advancement. These technological capabilities directly contribute to growth objectives by enabling more precise pricing, attracting safer drivers, and reducing claims costs. The company's ability to adapt and innovate is crucial for its long-term success in the competitive insurance market.

Root utilizes advanced data analytics and machine learning to assess driving behavior and risk. This allows for more accurate pricing and personalized insurance offerings.

The company's mobile-first platform streamlines the entire insurance process, from quoting to claims management. This enhances user experience and operational efficiency.

Root invests heavily in research and development to refine its proprietary algorithms. These algorithms are key to its telematics-driven insurance model.

Root regularly updates its app and underwriting models to stay at the forefront of technological advancements. This ensures the company remains competitive and efficient.

The company's technological capabilities provide a competitive edge in the insurance market. This helps in attracting safer drivers and reducing claims costs.

Root's technology-driven approach aims to create a fairer and more efficient insurance experience for its customers. This focus enhances customer satisfaction and loyalty.

Root's growth strategy depends heavily on its innovation and technology initiatives. The company's focus on data-driven insights and a user-friendly mobile platform sets it apart in the insurtech space.

- Data-Driven Underwriting: Root uses telematics to assess driving behavior, offering personalized insurance rates.

- Mobile-First Approach: The company's platform simplifies the insurance process through its mobile app.

- Continuous Improvement: Root regularly updates its algorithms and app to enhance accuracy and efficiency.

- Focus on Customer Experience: The company aims to provide a fairer and more efficient insurance experience.

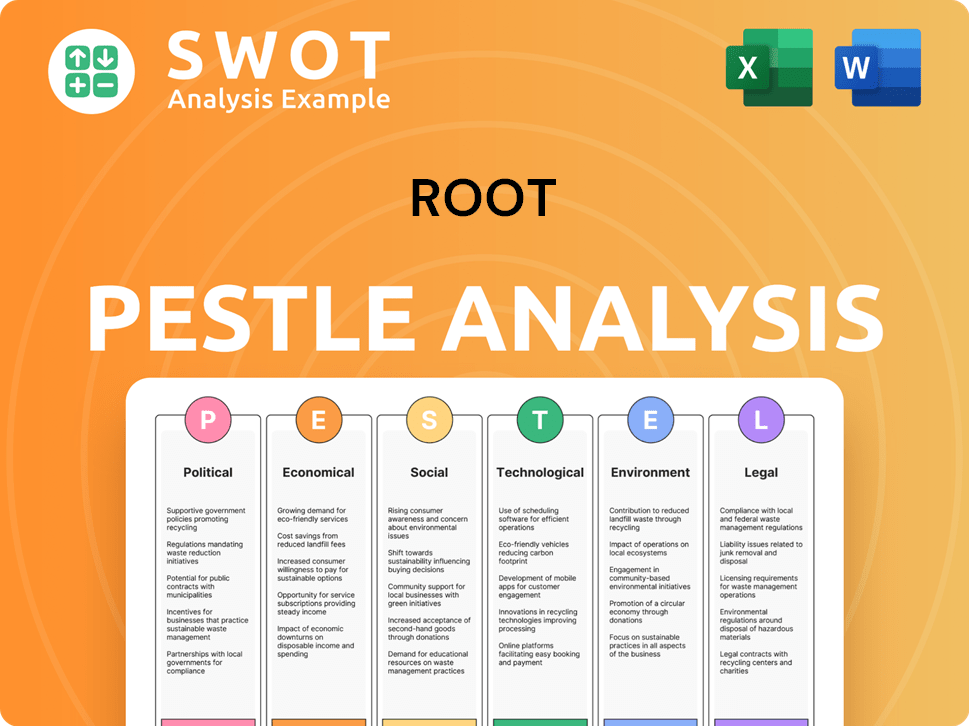

Root PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Root’s Growth Forecast?

The financial outlook for Root is centered on achieving profitability and sustainable growth, transitioning from its initial high-growth, high-loss phase. The company's strategic focus includes improving underwriting profitability and reducing operational expenses. This shift is crucial for long-term viability and investor confidence.

In the first quarter of 2024, Root reported a net loss of $25.1 million, a significant improvement compared to the $49.7 million loss in the same period last year. This improvement indicates progress in financial recovery efforts. Gross written premiums were $167.3 million in Q1 2024, slightly down from $178.6 million in Q1 2023.

Root's financial strategy involves optimizing capital allocation and potentially seeking further capital raises to support growth initiatives. The reduction in net loss and improvement in the combined ratio—which was 107.8% in Q1 2024, down from 124.6% in Q1 2023—suggests a positive trend towards financial stability. The ability to scale its customer base efficiently while maintaining underwriting discipline is key.

Root's financial performance is closely watched, with key metrics like net loss and combined ratio indicating progress. The company's strategic goals and objectives are focused on achieving profitability. The company is implementing strategic planning to drive business development.

Optimizing capital allocation is a key component of Root's financial strategy. Exploring further capital raises may be necessary to support company expansion and growth initiatives. The company's approach includes assessing Root company investment opportunities.

Maintaining underwriting discipline is crucial for improving profitability. Root is focused on leveraging its technology to achieve operational efficiency. This approach contributes to the Root company future market trends.

The financial narrative emphasizes cautious optimism, focusing on long-term profitability. This approach supports Root company strategic goals and objectives. The company's approach includes assessing Root company challenges and opportunities.

The combined ratio is a critical indicator of underwriting performance. The improvement in the combined ratio from 124.6% to 107.8% shows progress. This metric is essential for Root company financial projections.

Root is focused on leveraging technology for operational efficiency. The company's focus on improving underwriting profitability is a key initiative. This supports sustainable growth strategies.

The company is navigating the competitive landscape. Root's approach includes assessing industry outlook and market share analysis. The company's approach includes assessing Root company new product development.

Analyst forecasts highlight the importance of scaling the customer base efficiently. The company's financial projections are crucial for investors. The company's approach includes assessing Root company business model analysis.

The company's growth strategy is focused on achieving profitability and sustainable growth. Root is implementing expansion plans and strategies. The company's approach includes assessing Root company competitive landscape.

Root company investment opportunities are carefully evaluated. The company is focused on long-term growth potential. For more details, you can read this article about Root's business strategy.

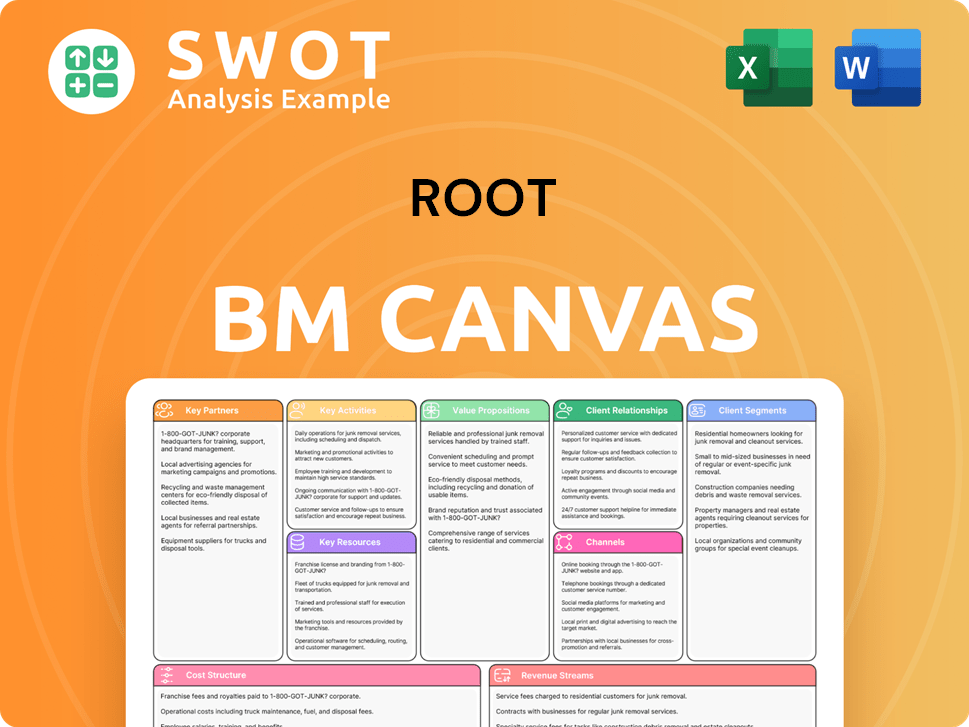

Root Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Root’s Growth?

The Root company faces several potential risks and obstacles as it pursues its growth strategy. These challenges span market competition, regulatory hurdles, technological disruptions, and internal resource constraints. Understanding and proactively addressing these risks is crucial for the company's long-term success and its future prospects.

Market competition represents a significant hurdle. The insurance sector is crowded, with both established players and innovative insurtech startups vying for market share. Regulatory changes across different states can also impact operations and profitability. Furthermore, technological advancements and shifts in consumer preferences pose both opportunities and threats, requiring continuous adaptation and innovation.

Internal resource limitations, especially in attracting and retaining top talent, could impede growth. The company's ability to navigate these challenges, maintain financial health, and capitalize on emerging opportunities will determine its trajectory.

The insurance market is highly competitive, with numerous established companies and insurtech startups. This competition can lead to pricing pressures and challenges in acquiring and retaining customers. Root must continually innovate and differentiate itself to maintain a competitive edge.

Changes in insurance regulations across different states can affect Root's operational flexibility and profitability. Compliance costs and the need to adapt to varying state-specific requirements pose ongoing challenges. The company needs to stay informed and adapt to changing regulations.

While technology is a source of competitive advantage, rapid advancements can also create disruption. New telematics or underwriting models could emerge, potentially challenging Root's existing technologies. Root needs to invest in research and development to stay ahead of the curve.

Attracting and retaining skilled talent, particularly in the technology sector, can be challenging. Limited resources can hinder the company's ability to execute its growth strategy effectively. Addressing these constraints is crucial for sustained expansion.

Shifts in consumer preferences regarding data collection and privacy could impact Root. Increased scrutiny of AI-driven underwriting models could also affect the company's approach. Root must navigate these concerns to maintain customer trust and comply with evolving privacy standards.

Root's financial performance, including its ability to reduce net losses, is critical. The company's ability to demonstrate improved financial results is essential for attracting investment and ensuring long-term viability. Focusing on operational efficiency and cost management is key.

Effective strategic planning is crucial for navigating these risks. Root must continuously assess the competitive landscape, regulatory environment, and technological advancements. This includes developing contingency plans and adapting quickly to changing market dynamics. Strong strategic planning supports successful business development and company expansion.

Robust risk management practices are essential. This involves rigorous data analysis, proactive monitoring of potential threats, and the implementation of mitigation strategies. The company's ability to manage risk effectively directly impacts its financial projections and long-term growth potential.

Root Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Root Company?

- What is Competitive Landscape of Root Company?

- How Does Root Company Work?

- What is Sales and Marketing Strategy of Root Company?

- What is Brief History of Root Company?

- Who Owns Root Company?

- What is Customer Demographics and Target Market of Root Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.