LendLease Bundle

How has Lendlease Shaped the Global Landscape?

Founded in Sydney in 1958, Lendlease, an Australian multinational, has a fascinating history. From its inception, the company aimed to integrate construction, development, and investment, a groundbreaking approach. This integrated model allowed Lendlease to undertake large-scale real estate projects, leaving a lasting impact on cities worldwide.

The LendLease SWOT Analysis provides a deeper dive into the company's strategic position. Lendlease's journey, from its origins in Australia to its current strategic pivot, is a testament to its adaptability. Understanding the Lendlease history and Lendlease company evolution reveals its commitment to innovation and sustainability, making it a key player in the construction and real estate industries. Explore the Lendlease timeline to understand its significant projects and Lendlease Australia roots.

What is the LendLease Founding Story?

The story of the Lendlease company begins in Australia in April 1958. It was founded by Dick Dusseldorp, a Dutch immigrant with a vision for the future of construction and development. This early history laid the groundwork for what would become a global leader in the industry.

Dusseldorp's journey started in 1950 when he was sent to Australia to assess its development potential. Recognizing significant growth opportunities, he established Civil & Civic Contractors in 1951. This initial venture focused on supplying prefabricated houses.

Dusseldorp identified a gap in the market, particularly the need for professionals to finance building projects. This led to the creation of Lend Lease Corporation Limited, designed to raise funds for Civil & Civic's projects. The company's integrated approach, combining construction, development, and investment, set it apart from the beginning.

Lendlease was established in April 1958 in Sydney, Australia. The company's initial focus was on financing construction projects.

- Dick Dusseldorp, the founder, saw the potential for growth in Australia.

- Civil & Civic, the construction arm, was integral to Lendlease's early success.

- The initial share issue aimed to finance a seven-story building for professional consulting rooms.

- Lendlease's business model combined construction, development, and investment.

The initial capital for Lendlease was raised through an IPO on the Australian stock exchange. Civil & Civic held a 40% stake in the newly formed company. The funds were specifically earmarked for the construction of a seven-story building. This marked the beginning of Lendlease's journey in the construction and property development industry.

Lendlease's integrated model allowed it to acquire sites, plan developments, and construct buildings in collaboration with Civil & Civic. In 1961, Lendlease acquired Civil & Civic, further solidifying its integrated approach. Dusseldorp pioneered a 'triple bottom line' view of business, prioritizing environmental and social outcomes alongside financial results. This approach, which is still relevant today, helped shape the company's core values.

Lendlease's early projects and acquisitions, like the purchase of Civil & Civic, were key to its growth. The company's innovative approach to finance and development set it apart. This early focus on an integrated model, combined with a commitment to social responsibility, helped establish Lendlease's legacy in the construction industry. To learn more about the competitive landscape, read about the Competitors Landscape of LendLease.

LendLease SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of LendLease?

The early growth of the company, now known as Lendlease, was marked by strategic moves in acquisitions and geographical expansion. Following its establishment in 1958 and initial public offering (IPO) on the Australian Securities Exchange (ASX) in 1962, the company quickly integrated its construction capabilities. This shift enabled the company to evolve from a financing entity to an active developer and manager of real estate assets, setting the stage for its global expansion.

In 1961, the company acquired Civil & Civic, integrating its construction arm, which was a pivotal move. This acquisition was a significant step in the company's early years, allowing it to expand its services beyond just financing projects. The integration of Civil & Civic provided the company with the necessary capabilities to actively develop and manage real estate assets, which was a key factor in its growth.

The company's operations expanded internationally, with its first venture into the United States in 1971. This was followed by expansion into Singapore in 1973. These early international moves were crucial for establishing a global presence. The expansion into these markets laid the groundwork for future international projects and growth, showcasing the company's ambition.

A major diversification occurred in the 1980s when the company entered financial services. In 1982, it acquired a 50% interest in MLC, later making it a wholly-owned subsidiary by 1985. The financial services division became a significant contributor to the company's profits. This diversification strategy proved to be very successful, with the financial services division contributing nearly half of the company's after-tax profit by 1991.

Further expansion continued in the late 1990s and early 2000s. In 1999, the company formed Actus Lendlease and acquired Bovis Construction. The company also acquired Amresco's commercial mortgage business in 2000 and Delfin in 2001. These acquisitions broadened the company's market reach and product categories. The company's entrepreneurial culture and ability to act quickly on new opportunities were key to its success.

The company's early strategic moves, including acquisitions and international expansion, laid the foundation for its growth. The diversification into financial services and further acquisitions in the late 1990s and early 2000s, such as Bovis Construction, Amresco, and Delfin, broadened its market reach. These strategic actions, combined with an entrepreneurial culture, have shaped the company's evolution, as highlighted in the Marketing Strategy of Lendlease.

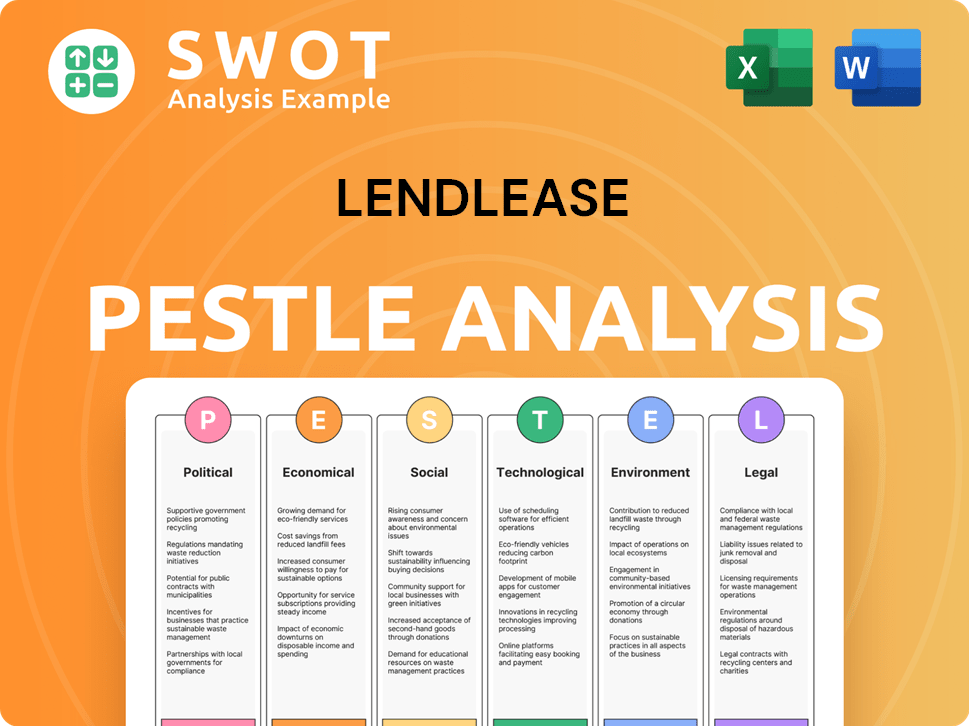

LendLease PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in LendLease history?

The history of the Lendlease company is marked by significant milestones, innovations, and challenges that have shaped its evolution from its origins to its current status as a global property and construction group. The Lendlease timeline reflects a journey of growth, adaptation, and a commitment to sustainable practices.

| Year | Milestone |

|---|---|

| 1958 | The company was founded, pioneering an integrated business model combining construction, development, and investment. |

| 1963 | Introduced superannuation for Australian employees, preceding industry standards. |

| Various Years | Received recognition for architectural excellence, including the Sulman prize for buildings such as the Academy of Science in Canberra. |

| 2022 | The Singapore portfolio achieved net-zero carbon (Scope 1 and 2) in August 2022, ahead of its 2025 goal. |

| 2024 | Announced a strategic pivot to exit international construction markets and reorganize its business to focus on Australian work. |

Lendlease has consistently pursued innovations to enhance its operations and sustainability efforts. A key aspect has been its integrated business model, which was groundbreaking at its inception. The company also pioneered the use of ground glass pozzolan and piloted rechargeable electric construction equipment.

Combining construction, development, and investment under one roof was a pioneering approach. This model allowed for greater control and efficiency across various projects.

The introduction of superannuation for Australian employees in 1963, long before it became standard, demonstrated a commitment to employee welfare. This initiative set an early precedent for corporate social responsibility.

Winning the Sulman prize for buildings like the Academy of Science in Canberra highlighted the company's commitment to high-quality design and construction. This recognition enhanced its reputation.

Pioneering the use of ground glass pozzolan and piloting rechargeable electric construction equipment are examples of its commitment to reducing its environmental impact. These innovations are part of a broader sustainability strategy.

Setting ambitious targets, such as achieving net-zero carbon emissions (Scope 1 and 2) by 2025 and absolute zero carbon (including Scope 3) by 2040, demonstrates a long-term commitment to sustainability. The Singapore portfolio achieving net-zero carbon (Scope 1 and 2) in August 2022, ahead of its 2025 goal, is a significant achievement.

Championing fully electric buildings and sustainable steel usage are part of its efforts to reduce its carbon footprint. This includes the adoption of eco-friendly materials.

Despite its achievements, Lendlease has faced significant challenges, including the impact of the COVID-19 pandemic and rising material costs. The company reported a first-half loss of $264 million in February 2022, leading to restructuring and job cuts. The company is now focused on a strategic pivot to streamline operations and improve financial performance.

The global pandemic caused enforced site closures and impaired revenues. This resulted in financial losses and operational disruptions.

A first-half loss of $264 million in February 2022 led to approximately 360 job cuts and $160 million in savings. This restructuring aimed to address financial challenges.

Soaring material costs and ballooning project expenses have put pressure on profitability. These issues necessitated strategic adjustments.

The decision to exit international construction markets and focus on Australian work is a key strategic shift. This pivot aims to reduce risk and improve financial performance.

The complex nature of divesting international businesses presents a challenge. This process requires careful planning and execution.

Addressing high construction costs and project productivity issues is crucial. The goal is to restore profitability and deliver sustainable returns. The company aims for an investment-led model and is targeting $70 billion in funds under management by FY26.

For more insights into the company's strategic direction, you can read about the Growth Strategy of Lendlease.

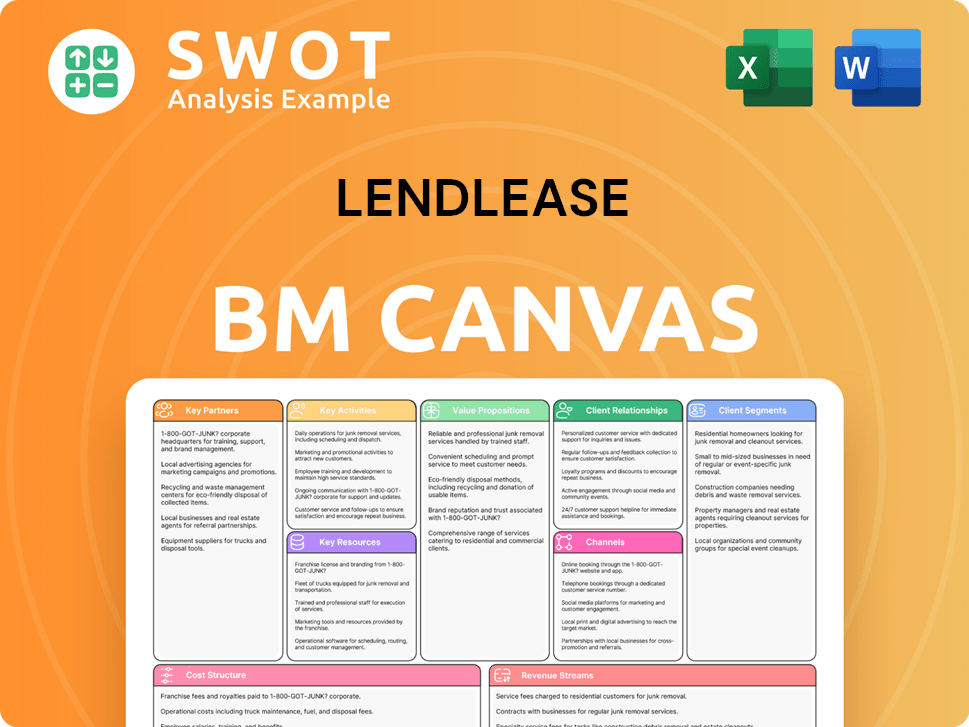

LendLease Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for LendLease?

The Lendlease history began in Australia, evolving from its founding in 1951 to become a global property and construction company. The company's journey is marked by strategic acquisitions, expansions, and significant projects, reflecting its adaptability and long-term vision within the real estate sector. The Lendlease company has navigated through various market cycles, continually reshaping its business model to stay competitive.

| Year | Key Event |

|---|---|

| 1951 | Civil & Civic Contractors is formed in Australia by two Dutch firms, marking the company's initial entry into the construction industry. |

| 1958 | Dick Dusseldorp establishes Lend Lease Corporation Limited in Sydney to finance Civil & Civic projects, setting the stage for future growth. |

| 1961 | Lendlease acquires Civil & Civic, consolidating its operations and expanding its capabilities. |

| 1962 | Lendlease is first listed on the ASX, providing access to capital and enhancing its market presence. |

| 1971 | Operations expand to the United States, signaling the beginning of its global presence. |

| 1973 | Operations expand to Singapore, further extending its international footprint. |

| 1982 | Lendlease acquires 50% of MLC, moving into financial services and diversifying its business. |

| 1985 | MLC becomes a wholly owned Lendlease subsidiary, fully integrating financial services into its portfolio. |

| 1999 | Lendlease acquires Bovis Construction, forming Bovis Lend Lease, strengthening its construction capabilities. |

| 2000 | MLC is sold to National Australia Bank for $4.56 billion, restructuring its financial services division. |

| 2009 | Lendlease is selected to develop Barangaroo in Sydney, a landmark project. |

| 2015 | The company rebrands to use 'Lendlease' as a single word, modernizing its brand identity. |

| 2020 | Lendlease Digital, a new digital technology business, launches, embracing technological advancements. |

| 2021 | Tony Lombardo takes over as Group CEO, leading the company's strategic initiatives. |

| 2022 | Lendlease reports a first-half loss of $264 million due to restructuring and COVID-19 impacts, reflecting challenges faced. |

| 2024 (May) | Lendlease announces a strategic pivot to exit international property development and sell overseas construction divisions, focusing on Australia. |

| 2025 (Jan 1) | Lendlease announces the sale of its UK construction business to Atlas Holdings for £35 million, with completion targeted before the end of June 2025. |

| 2025 (Feb 19) | Lendlease reports a statutory profit of AU$48 million for the first half of fiscal year 2025, ending December 31, 2024, a return to profit after several years of losses. |

The company is undergoing a strategic pivot, focusing on the Australian market and higher-margin operations. This shift involves exiting international property development and selling overseas construction divisions. The goal is to streamline operations and reduce risk, enhancing net margins.

Lendlease aims to achieve $125 million in cost savings by the end of FY25. The company plans to sell over AUD 2.8 billion in assets and expects its gearing ratio to be within 5%-15% by fiscal 2026. Net debt repayment and growing funds under management are key priorities.

Lendlease is committed to achieving net-zero carbon emissions (Scopes 1 and 2) by 2025 and absolute zero carbon (all scopes) by 2040. This commitment aligns with global sustainability trends and enhances the company's long-term value proposition.

Analysts anticipate a decrease in revenue of 8.1% annually over the next three years. However, profit margins are expected to increase from -14.7% to 5.7% in three years. The focus on core markets and higher-margin operations should improve the company's financial performance.

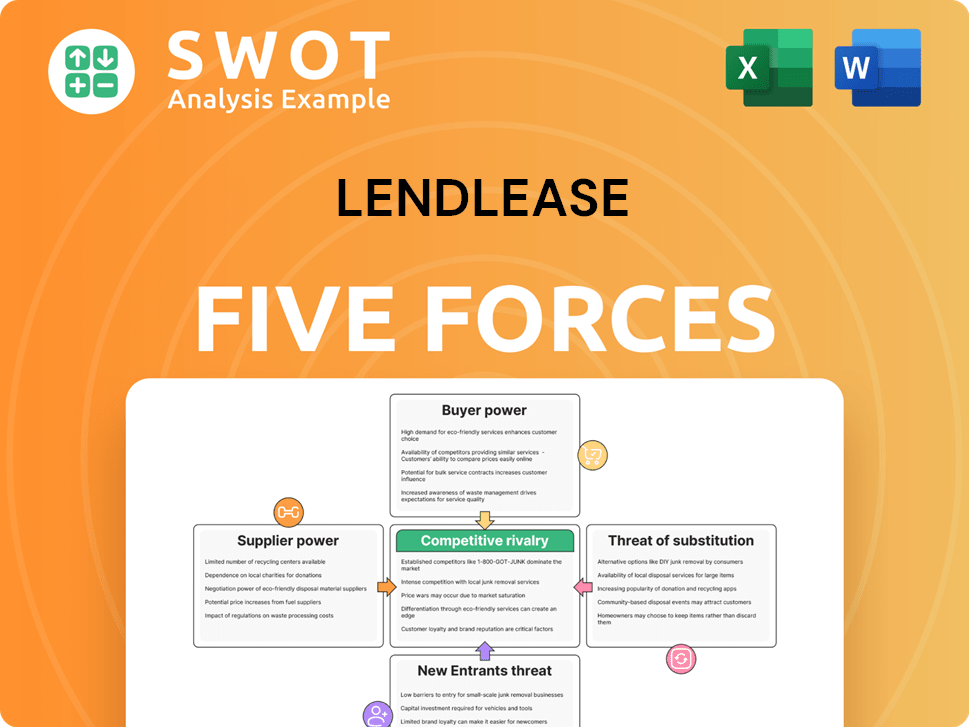

LendLease Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of LendLease Company?

- What is Growth Strategy and Future Prospects of LendLease Company?

- How Does LendLease Company Work?

- What is Sales and Marketing Strategy of LendLease Company?

- What is Brief History of LendLease Company?

- Who Owns LendLease Company?

- What is Customer Demographics and Target Market of LendLease Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.