LendLease Bundle

Who Does Lendlease Serve?

In the ever-evolving landscape of real estate and infrastructure, understanding the Lendlease SWOT Analysis is crucial. The demand for build-to-rent properties and master-planned communities is reshaping the industry, highlighting the importance of adapting to shifting customer needs. Lendlease, a global property and infrastructure group, has a rich history of evolving its strategies to meet these changing demands.

This exploration delves into the intricacies of the Lendlease target market and customer demographics, providing critical insights for investors and business strategists. We'll examine the Lendlease company's approach to market segmentation, analyzing its customer profile analysis, and uncovering the characteristics of its target audience. By understanding Lendlease's market share by demographic and geographic target markets, we can better evaluate its real estate investment and property development strategies.

Who Are LendLease’s Main Customers?

Understanding the primary customer segments of the Lendlease company is crucial for assessing its market position and strategic direction. Lendlease operates across various sectors, including Investments, Development, and Construction, which influences its diverse customer base. This segmentation strategy allows Lendlease to cater to both individual consumers (B2C) and other businesses (B2B), reflecting a multifaceted approach to market engagement.

The company's customer demographics vary depending on the specific business area. In the residential sector, Lendlease targets individuals and families seeking homes in master-planned communities and build-to-rent properties. On the B2B side, Lendlease serves governments, businesses, and institutional investors. This broad approach to market segmentation helps Lendlease capture a wide range of opportunities within the real estate investment and property development industries.

Lendlease's target market is dynamic, adapting to changing market conditions and strategic priorities. The company's shift towards its Australian operations and international Investments platform, as announced in May 2024, indicates a focus on capital-light, high-margin businesses. This strategic pivot is expected to increase the contribution from investment management, which is projected to account for approximately 50% of group mid-cycle EBITDA.

For residential developments, Lendlease targets families and first-home buyers. Build-to-rent properties attract renters seeking high-quality, professionally managed homes. Student accommodation is another area of focus, as seen in projects like the Queen Victoria Market Precinct Plan in Melbourne.

Lendlease's B2B clients include institutional investors like pension funds and sovereign wealth funds. Governments are partners for urban regeneration and infrastructure projects. Businesses collaborate on commercial and life sciences developments. The company's investment management services provide access to quality property assets.

Lendlease is prioritizing its Australian operations and its international Investments platform. This shift is expected to increase the contribution from investment management. Exiting international construction businesses simplifies the portfolio and focuses on higher-margin activities.

- Focus on capital-light, high-margin businesses.

- Investment management is expected to contribute approximately 50% of group mid-cycle EBITDA.

- Streamlining operations by exiting international construction.

LendLease SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do LendLease’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of the Lendlease company. Their customer base is diverse, encompassing residential buyers, institutional investors, governments, and businesses, each with unique motivations and requirements. This understanding allows Lendlease to tailor its offerings, ensuring it meets and exceeds customer expectations across various market segments.

For residential customers, particularly in master-planned communities, the desire for a strong sense of community and access to amenities is paramount. In the B2B sector, institutional investors prioritize the quality of property assets and environmental, social, and governance (ESG) factors. Governments and businesses seek integrated real estate solutions, from the initial concept to ongoing management, highlighting the importance of comprehensive service offerings.

Lendlease addresses common pain points by continually evolving its customer experience and incorporating feedback into product development. By focusing on sustainability and future-ready infrastructure, the company aims to meet the evolving needs of its diverse customer base, thereby enhancing customer satisfaction and loyalty.

Residential customers prioritize community living, access to amenities like open spaces and recreational facilities, and convenient commercial or retail centers. These factors are particularly important for families and first-home buyers. The focus is on creating vibrant, livable communities.

In urban centers, build-to-rent customers seek professionally managed, high-quality rental products and services. This segment values convenience, quality, and a hassle-free living experience.

Institutional investors demand high-quality property assets and a strong focus on environmental, social, and governance (ESG) factors. ESG considerations are integral to their investment decisions and management strategies.

Governments and businesses require integrated real estate solutions, from concept and planning to design, delivery, and ongoing management. They seek partners capable of delivering projects to an exceptional standard within required timeframes.

Lendlease's commitment to sustainability, including Net Zero Carbon by 2025 and Absolute Zero Carbon by 2040, aligns with the preferences of responsible investors and supports long-term value creation.

Lendlease continually evolves its customer experience and incorporates customer feedback into product development. This includes tracking customer satisfaction and advocacy at regional and business unit levels.

Lendlease tailors its offerings to meet specific customer needs. For example, the focus on sustainable infrastructure in UK urban regeneration projects aims to deliver over 25,000 homes and over nine million square feet of commercial space. The Queen Victoria Market Precinct Plan focuses on all-electric buildings and carbon-neutral operations.

- Market Segmentation: Lendlease utilizes market segmentation to understand and cater to different customer demographics and preferences.

- Customer Acquisition: The company employs various strategies to attract customers, including showcasing high-quality amenities and community-focused developments.

- Customer Retention: By focusing on customer satisfaction and advocacy, Lendlease aims to build long-term relationships and foster customer loyalty.

- Geographic Focus: Lendlease's projects are strategically located in key urban centers and master-planned communities, targeting specific demographic groups.

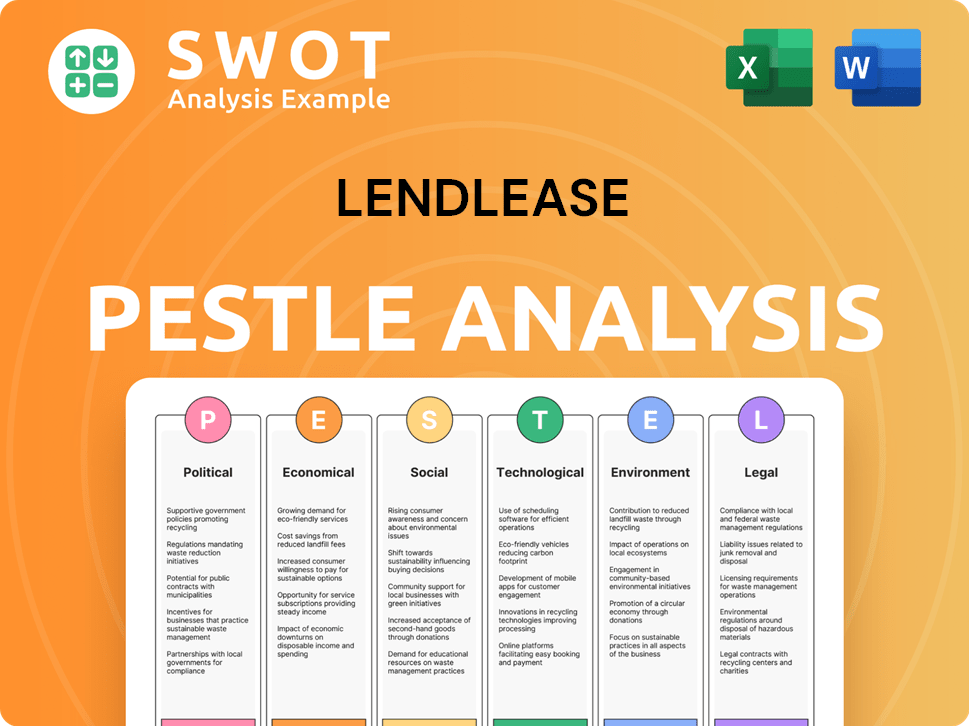

LendLease PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does LendLease operate?

The geographical market presence of Lendlease, an international property and infrastructure group, is a key element of its business strategy. The company operates across Australia, Asia, Europe, and the Americas, but recent strategic shifts indicate a renewed focus on its Australian operations and international Investments platform. This focus is partly driven by plans to exit international construction activities, as announced in May 2024.

In Australia, Lendlease maintains a market-leading integrated real estate business, leveraging its Investments, Development, and Construction capabilities. The company's operations are concentrated in major cities such as Sydney, Melbourne, Brisbane, and Perth. This focus allows Lendlease to create and manage mixed-use precincts, as well as civic and social infrastructure, serving a diverse Customer demographics.

The company's strategy includes significant projects in the UK, particularly through a joint venture with The Crown Estate. This partnership focuses on major regeneration sites in London and Birmingham. Lendlease's Investment Management platform continues to span Europe, Australia, the Americas, and Asia, investing on behalf of institutional clients, demonstrating its broad geographical reach and commitment to Real estate investment.

Lendlease has a robust Australian development pipeline, with a secured pipeline of $13 billion and actively competing on an additional $13 billion of new development projects from a current target market of $40 billion for projects from FY24 onwards. Key projects include urban regeneration (mixed-use) with an end value of $8 billion, residential projects totaling $7 billion, and commercial developments.

Lendlease has entered a 50/50 joint venture with The Crown Estate to offload six of its UK development projects, with an end value exceeding £20 billion. This partnership aims to deliver over 25,000 homes and more than nine million square feet of commercial, life sciences, and office space across London and Birmingham.

Lendlease's Investment Management platform spans Europe, Australia, the Americas, and Asia, investing on behalf of institutional clients. As of December 2024, Lendlease's gearing was 27%, above its target of 5-15%, but is expected to be within range by fiscal 2026, partly due to asset divestments and the completion of major developments.

The company anticipates $1.7 billion in contracted cash inflows from capital recycling and One Sydney Harbour apartment settlements in the second half of FY25, with $1.3 billion already received post balance date. This capital recycling strategy supports its focus on core markets and investments.

Lendlease's target market includes a range of segments, from individual investors to institutional clients. The company's Market segmentation strategy focuses on identifying and serving specific customer needs within its key geographical areas. Understanding the Marketing Strategy of LendLease is crucial for grasping how the company approaches its target audience.

- Institutional Investors: High-net-worth individuals and organizations looking for Real estate investment opportunities.

- Residential Buyers: Individuals and families seeking apartments and homes in urban developments.

- Commercial Tenants: Businesses looking for office spaces and retail locations in Lendlease's mixed-use projects.

- Government and Public Sector: Entities involved in civic and social infrastructure projects.

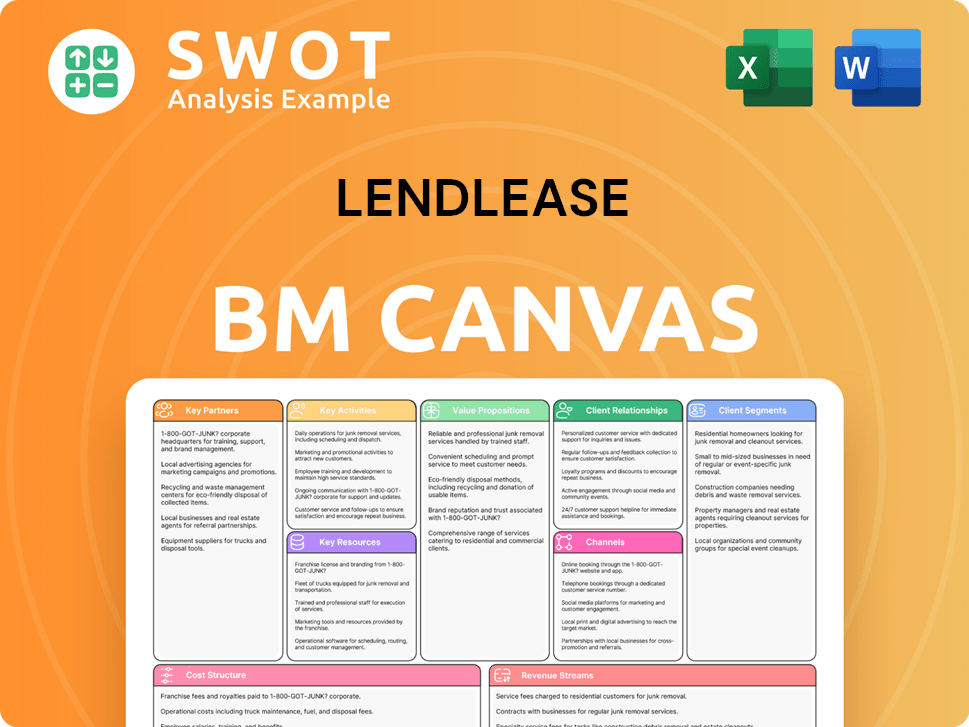

LendLease Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does LendLease Win & Keep Customers?

The company employs a multi-faceted approach to attract and retain customers, integrating marketing channels, sales tactics, and a strong emphasis on customer experience. Their core strategy revolves around an integrated business model of Investments, Development, and Construction, providing end-to-end capability in real estate. This approach is key to understanding the Lendlease target market and tailoring strategies to meet their needs.

For customer acquisition, the company capitalizes on its reputation and track record, particularly in large-scale urban regeneration projects. In residential developments, they compete with other major developers by offering high-quality amenities and community features. The investment management sector benefits from a global platform managing approximately A$49.6 billion in property assets for institutional investors, a significant driver for acquiring new clients. Understanding the customer demographics is crucial for these diverse segments.

Customer retention is a key focus, with an emphasis on understanding customers and responding to market changes. Continuous improvement, based on customer insights and market research, is embedded to consistently measure customer satisfaction. Customer feedback is tracked at regional and business unit levels, reported to the Global Leadership Team and the Board, with action plans developed to drive continuous improvement. This feedback also informs product development and innovation.

The company uses its strong reputation, especially in urban regeneration, to attract new clients. This reputation acts as a powerful testament to their capabilities. This strategy helps in securing government and business clients, showcasing their expertise in large-scale projects.

In residential developments, the company focuses on offering high-quality amenities, education, parks, and town centers. This approach aims to attract families and first-home buyers. They compete directly with other large developers by providing comprehensive community features.

The investment management sector benefits from the company's global platform and expertise. Managing approximately A$49.6 billion in property assets globally for institutional investors is a key acquisition driver. This positions the company as a trusted partner for large-scale investments.

The company focuses on understanding its customers and responding to market changes. They design and deliver innovative, customer-driven solutions. This approach ensures that they meet the evolving needs of their clients.

The company also utilizes loyalty programs and personalized experiences, particularly in its retail property management. The 'Lendlease Plus' program offers members opportunities to earn points ('Plus$') and redeem vouchers. Promotions like 'Wheels of Happiness' (November 2024 - February 2025) offer chances to win substantial rewards. These initiatives aim to enhance customer loyalty and engagement within their managed retail spaces. Sustainability efforts, with targets like Net Zero Carbon by 2025, also contribute to attracting and retaining customers who prioritize environmentally and socially responsible developments. To gain more insights, it's helpful to review the Competitors Landscape of LendLease.

The 'Lendlease Plus' program offers members opportunities to earn points ('Plus$') and redeem vouchers. Promotions like 'Wheels of Happiness' (November 2024 - February 2025) offer chances to win substantial rewards. These initiatives aim to enhance customer loyalty.

The company's focus on sustainability, with targets like Net Zero Carbon by 2025, attracts customers. Environmentally and socially responsible developments are a key focus. This helps to retain customers who prioritize these values.

A process of continuous improvement is embedded to measure customer satisfaction. Customer feedback is tracked and reported to the Global Leadership Team and the Board. This drives continuous improvement in the customer experience.

Customer feedback is tracked at regional and business unit levels. This feedback is regularly reported to the Global Leadership Team and the Board. Action plans are developed to drive continuous improvement.

Customer feedback provides insights for product development and innovation opportunities. This helps the company to create better products and services. They aim to meet the evolving needs of their clients.

Market research is used to understand customer needs and market changes. This helps the company to design and deliver innovative solutions. They consistently measure customer satisfaction and advocacy.

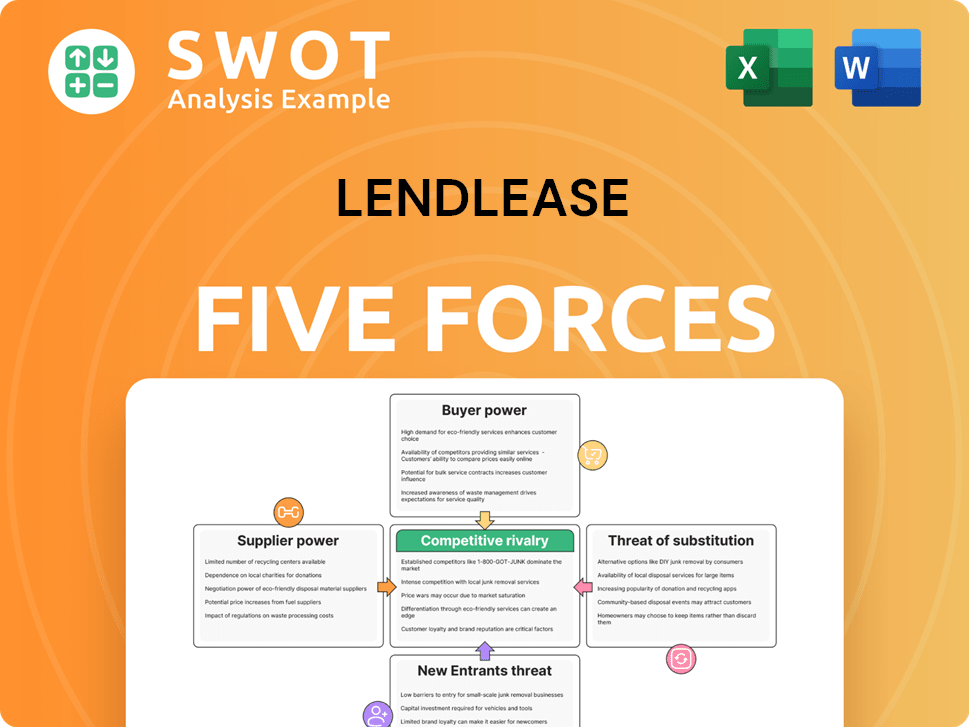

LendLease Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LendLease Company?

- What is Competitive Landscape of LendLease Company?

- What is Growth Strategy and Future Prospects of LendLease Company?

- How Does LendLease Company Work?

- What is Sales and Marketing Strategy of LendLease Company?

- What is Brief History of LendLease Company?

- Who Owns LendLease Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.