LendLease Bundle

Who's Challenging Lendlease in Today's Market?

Lendlease, a global powerhouse in property and infrastructure, faces a dynamic and competitive arena. Understanding the LendLease SWOT Analysis is crucial to grasping its position. This exploration delves into the complex web of Lendlease competitors, offering a detailed Lendlease market analysis to uncover its strengths and vulnerabilities.

From its origins, Lendlease has navigated the global property landscape, but the construction industry is constantly evolving. Analyzing the Lendlease competitive landscape reveals key rivals and how Lendlease's market share analysis stacks up. This analysis will also explore Lendlease's global presence and market positioning, providing insights into its strategic approach and the challenges it faces.

Where Does LendLease’ Stand in the Current Market?

Lendlease holds a significant position in the global property and infrastructure sectors. It operates in urban regeneration, master-planned communities, and integrated property solutions. The company's primary activities include development (residential, commercial, retail), construction, and investment management, offering a broad revenue base. Lendlease's market analysis reveals a focus on sustainable urban development and placemaking, which aligns with evolving market demands.

Geographically, Lendlease has a strong presence in Australia, where it originated. It also has a significant footprint in Asia (e.g., Singapore, Malaysia), Europe (e.g., UK, Italy), and the Americas (e.g., USA). Lendlease serves a diverse customer base, including government agencies, corporate clients, institutional investors, and individual purchasers of residential properties. The company's strategic shift towards sustainable urban development and placemaking has helped it maintain a competitive edge.

Financially, Lendlease reported a statutory profit after tax of A$105 million for the half-year ended 31 December 2023. This financial health, along with its substantial asset base, positions it as a resilient force in the industry. The company often demonstrates greater scale and stability compared to many smaller, regional players. To understand more about its financial structure, you can explore the Revenue Streams & Business Model of LendLease.

Lendlease is consistently ranked among the top property developers and contractors in Australia. While specific global market share figures for 2024-2025 are not readily available, the company's strong presence in key markets indicates a significant market position. The company's focus on urban regeneration and master-planned communities contributes to its competitive advantages.

Lendlease has a strong presence in Australia and has established a significant footprint in Asia, Europe, and the Americas. This global presence allows Lendlease to diversify its revenue streams and mitigate risks associated with regional economic fluctuations. The company's international operations are crucial for its overall market positioning.

Lendlease serves a diverse customer base, including government agencies, corporate clients, institutional investors, and individual purchasers. Its integrated property solutions, encompassing development, construction, and investment management, cater to a wide range of needs. This diversified service offering strengthens its competitive landscape.

Lendlease reported a statutory profit after tax of A$105 million for the half-year ended 31 December 2023. This financial performance, coupled with its substantial asset base, positions it as a resilient player in the industry. The company's financial stability is a key factor in its long-term success.

Lendlease's competitive advantages include its integrated business model, strong brand reputation, and focus on sustainable development. Its diverse portfolio of projects and its global presence contribute to its resilience. The company's ability to adapt to local market dynamics is also a key factor.

- Integrated Business Model: Combining development, construction, and investment management.

- Strong Brand Reputation: Recognized for quality and innovation in the construction industry.

- Global Presence: Diversified operations across multiple continents.

- Sustainable Development Focus: Commitment to environmentally friendly practices.

LendLease SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging LendLease?

The Lendlease competitive landscape is shaped by a complex interplay of direct and indirect competitors across its development, construction, and investment management segments. Understanding these competitive dynamics is crucial for assessing Lendlease's market position and strategic challenges. The company faces competition from large multinational firms, specialized players, and emerging entities, all vying for market share in a global property market.

Direct competitors include established names in construction and real estate development, while indirect competition comes from niche players and investment funds. Furthermore, the rise of technology and sustainable building practices adds another layer of complexity to the competitive environment. The competitive battles often involve bidding for major projects and adapting to changing market demands.

The construction industry is highly competitive, with firms constantly striving for efficiency, innovation, and strong client relationships. Lendlease's ability to navigate this landscape depends on its strategic initiatives and its capacity to differentiate itself from its rivals.

Key direct competitors include large multinational construction and real estate firms. These firms often compete directly with Lendlease for major projects. They leverage their capabilities in engineering and project delivery.

A significant player in infrastructure and building projects across Australia. John Holland's strong engineering capabilities often make it a direct competitor for major public and private sector contracts. It's known for its expertise in large-scale projects.

Prominent in the Australian residential and mixed-use development space. They challenge Lendlease in creating master-planned communities and urban regeneration projects. They leverage extensive land banks and established market presence.

With a global reach, it competes on large-scale commercial and residential building projects. Multiplex often emphasizes efficient project delivery and strong client relationships. It has a strong reputation in the construction industry.

Indirect competitors include specialized firms and investment funds. These entities focus on niche markets or directly manage real estate assets. They bypass traditional development models.

New and emerging players are a disruptive threat. They leverage advanced construction technologies or sustainable building practices. They offer innovative solutions and more cost-effective approaches.

The Lendlease competitive landscape is also influenced by mergers, alliances, and technological advancements. These factors shape the strategies and market positioning of all players. High-profile 'battles' often manifest in competitive bidding for major projects.

- Mergers and Alliances: Increasing collaboration between technology firms and traditional construction companies to integrate smart building solutions.

- Technological Advancements: Use of Building Information Modeling (BIM) and other technologies to improve project efficiency and reduce costs.

- Sustainability: Growing emphasis on sustainable building practices and green certifications, influencing project design and material selection.

- Market Volatility: Economic fluctuations and interest rate changes impacting project financing and investment decisions.

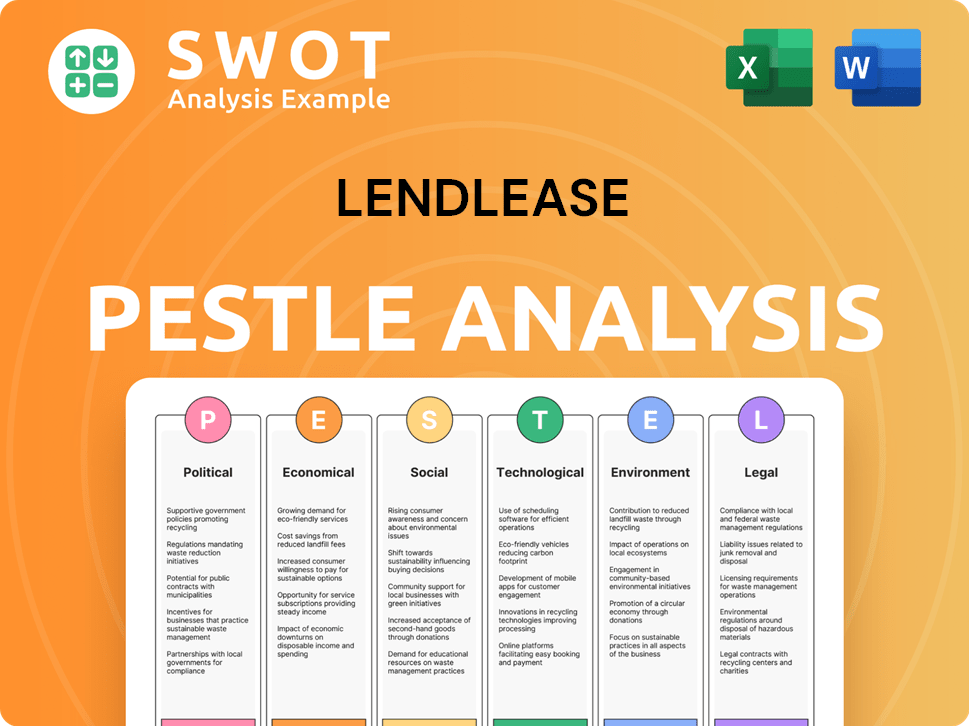

LendLease PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives LendLease a Competitive Edge Over Its Rivals?

Understanding the Lendlease competitive landscape requires a deep dive into its core strengths. The company's integrated model, encompassing development, construction, and investment management, sets it apart. This structure allows for greater control and efficiency throughout the project lifecycle, from inception to completion and beyond.

Lendlease's strong brand equity, built over more than six decades, is a significant asset in the construction industry. This reputation fosters strong relationships with clients, investors, and government bodies. The company's commitment to sustainability and innovation further strengthens its position.

The company's expertise in urban regeneration and placemaking is another key advantage. Lendlease transforms underutilized areas into vibrant communities. This capability, combined with its deep understanding of urban planning, community engagement, and sustainable design principles, allows it to undertake projects that are not merely structures but integrated urban environments.

Lendlease's integrated model allows for seamless project execution. This model provides greater control over project quality, cost, and timelines. This contrasts with competitors who may specialize in only one aspect.

The company's reputation signals reliability, quality, and a track record of delivering complex, large-scale projects globally. This fosters strong relationships with clients, investors, and government bodies. This is a key factor in the Lendlease market analysis.

Lendlease aims for Net Zero Carbon in Scope 1 and 2 emissions by 2025 and Scope 3 by 2040. This commitment drives innovation in sustainable building materials, energy efficiency, and waste reduction. This focus resonates with environmentally conscious clients and investors.

Lendlease transforms derelict or underutilized areas into vibrant communities. This is underpinned by its deep understanding of urban planning, community engagement, and sustainable design principles. This is a key differentiator in the real estate development sector.

Lendlease's competitive advantages are multifaceted and include its integrated business model, strong brand equity, and commitment to sustainability. These advantages provide a significant head start, making them relatively sustainable in the near to medium term. However, the company faces threats from imitation as competitors increasingly adopt integrated models and sustainability targets.

- Integrated Model: Control over project quality, cost, and timelines.

- Brand Equity: Reliability and a track record of delivering complex projects.

- Sustainability: Net Zero Carbon targets and innovation in sustainable building.

- Urban Regeneration: Expertise in transforming underutilized areas.

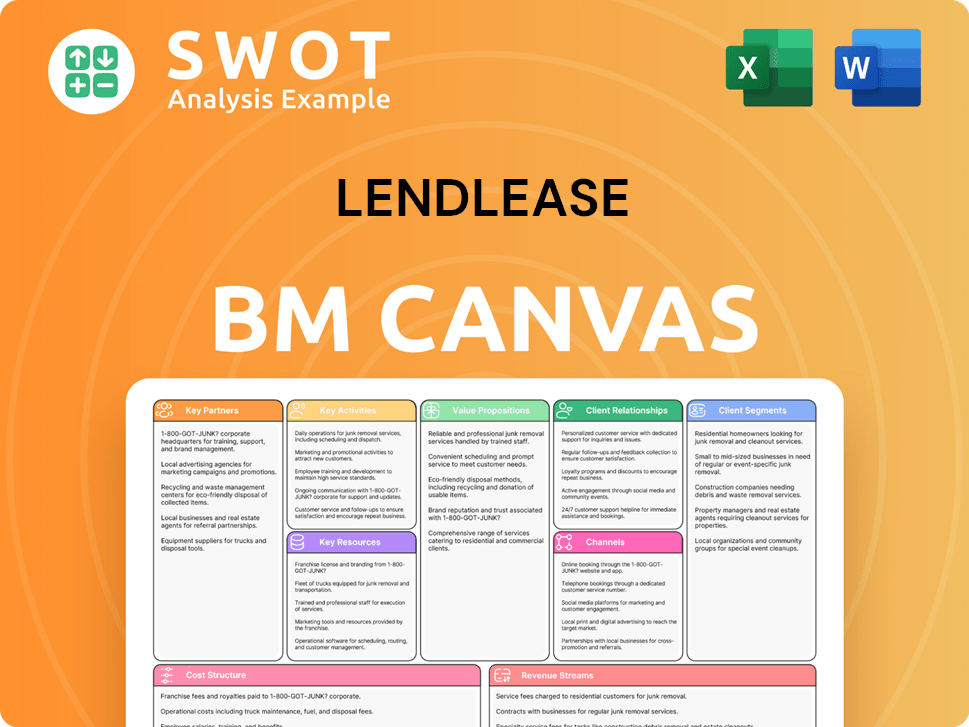

LendLease Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping LendLease’s Competitive Landscape?

The property and infrastructure sector is currently undergoing significant transformation, creating both challenges and opportunities for companies like Lendlease. Technological advancements, regulatory changes, and shifting consumer preferences are reshaping the industry. Understanding the Lendlease competitive landscape requires a close look at these trends and how they impact the company's strategic positioning.

The industry faces pressures from economic shifts, including inflation and rising interest rates, alongside geopolitical instability and supply chain disruptions. These factors can affect project viability and profitability, making it crucial for Lendlease to adapt. This analysis aims to provide insights into the company's future outlook, potential risks, and growth opportunities.

Technological advancements, such as Building Information Modeling (BIM) and smart building technologies, are driving efficiency. Sustainability and urban planning regulations are becoming more stringent. Consumer demand is shifting towards sustainable and community-focused developments.

Inflationary pressures on construction costs and rising interest rates impact project viability. Geopolitical instability and supply chain disruptions add complexity to project execution. Increased regulatory burdens and aggressive new competitors pose risks.

Growth potential exists in emerging markets, especially in Asia. Product innovations, such as advanced sustainable materials, offer differentiation. Strategic partnerships with tech providers can expand capabilities.

Greater emphasis on technology adoption and continued leadership in sustainable urban development are critical. Strategic divestments or acquisitions will be essential. Lendlease must maintain resilience in a dynamic global market.

To navigate the Lendlease competitive landscape effectively, the company must address several key areas. This includes adapting to technological advancements, managing economic pressures, and capitalizing on global growth opportunities. For example, the use of BIM can reduce project costs by up to 10%, as reported by industry analysts in 2024.

- Technology Adoption: Investing in digital transformation and upskilling the workforce is crucial. This includes adopting BIM, modular construction, and smart building technologies to improve efficiency and reduce costs.

- Sustainability Leadership: Maintaining a strong focus on sustainable development and meeting evolving regulatory standards is essential. This helps in attracting environmentally conscious investors and clients.

- Strategic Partnerships: Forming alliances with technology providers and specialized firms can expand capabilities and market reach. This can lead to more innovative project outcomes.

- Market Expansion: Exploring growth opportunities in emerging markets, particularly in Asia, where urbanization is driving demand. This will help diversify the company's revenue streams.

- Risk Management: Implementing robust risk management strategies to mitigate the impact of economic shifts and geopolitical instability. This includes managing construction costs and supply chain disruptions.

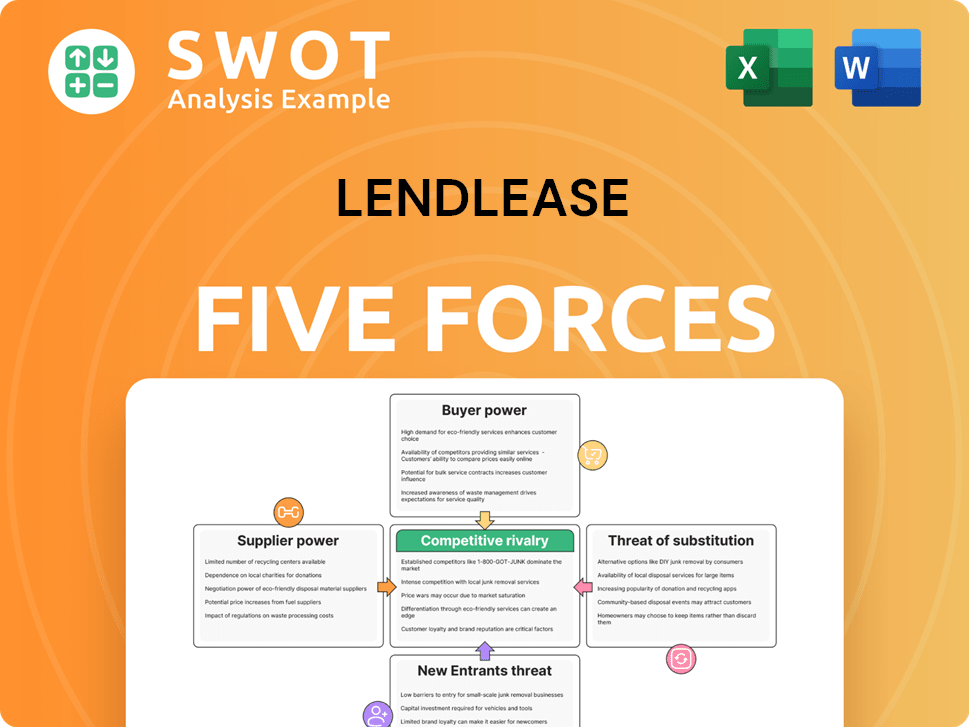

LendLease Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LendLease Company?

- What is Growth Strategy and Future Prospects of LendLease Company?

- How Does LendLease Company Work?

- What is Sales and Marketing Strategy of LendLease Company?

- What is Brief History of LendLease Company?

- Who Owns LendLease Company?

- What is Customer Demographics and Target Market of LendLease Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.