LendLease Bundle

Can Lendlease Rebuild and Thrive?

Lendlease, a global force in construction and real estate, is at a pivotal moment. Founded in 1958, the company's ambitious vision to shape cities worldwide has led to a massive $121 billion development pipeline. However, recent financial headwinds have forced a strategic pivot, making this a critical juncture for the company's future.

This LendLease SWOT Analysis will examine the company's revamped 'refocused strategy' announced in May 2024. We'll explore how Lendlease, a leading construction company, plans to navigate challenges, including reported losses and debt, by focusing on its core Australian business and international investment management. Understanding Lendlease's growth strategy and future prospects requires a deep dive into its expansion plans, financial outlook, and the risks it faces within the competitive real estate development market.

How Is LendLease Expanding Its Reach?

The current expansion initiatives of Lendlease represent a significant strategic shift. The company is moving away from its previous global focus on construction and development. Instead, it is prioritizing its Australian operations and international investment management business.

This strategic pivot, announced in May 2024, involves exiting overseas development and construction businesses. These include regions like the United States and the United Kingdom. The goal is to sell over AUD $2.8 billion in assets by the end of fiscal year 2025. This restructuring aims to simplify the company's structure and reduce its risk profile.

The company's strategy focuses on simplifying its structure and reducing its risk profile. This allows Lendlease to free up capital. This capital will be used primarily for debt reduction. Some of it may be reinvested to expand its project pipeline within Australia. For more insights, you can read about the Brief History of LendLease.

Lendlease is selling assets to streamline its operations. This includes exiting overseas development and construction businesses. The company is targeting the sale of over AUD $2.8 billion in assets by the end of fiscal year 2025.

The capital released from asset sales will be primarily directed towards debt reduction. Some funds may be reinvested in the Australian project pipeline. As of May 2025, Lendlease has already completed or announced $2.5 billion in capital recycling initiatives.

Lendlease is pursuing partnerships and joint ventures. This includes late-stage negotiations with The Crown Estate for a UK residential development joint venture. This partnership could create up to $24 billion of new investment product.

Despite the global pipeline reduction, Lendlease still has a sizable development work-in-process in Australia. This pipeline is valued at AUD $8 billion. This is expected to drive growth for its investment management platform.

Lendlease's expansion strategies involve significant asset sales and strategic partnerships. The company is focusing on debt reduction and reinvestment in the Australian market. This strategic shift aims to streamline operations and maximize value.

- Exiting overseas development and construction.

- Targeting AUD $2.8 billion in asset sales by FY25.

- Focusing on Australian operations and investment management.

- Pursuing partnerships like the Crown Estate joint venture.

LendLease SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LendLease Invest in Innovation?

The Lendlease growth strategy is significantly shaped by its commitment to innovation and technology. This approach is central to the company's goal of driving sustained growth. By focusing on digital transformation, Lendlease aims to streamline operations and enhance its competitive edge within the real estate development and construction sectors.

Lendlease's strategic use of technology is evident in initiatives like Lendlease Digital and Lendlease Podium. These platforms are designed to simplify complex processes in the built environment. The company also recognizes the importance of emerging technologies such as robotics, artificial intelligence (AI), and biotechnology, which are poised to revolutionize the industry.

A key element of Lendlease's innovation strategy involves digital twins, which are virtual representations of physical assets. Lendlease collaborates with technology leaders like Microsoft and Dell to establish global standards for this technology. The application of digital twins is already underway across its portfolio, contributing to operational efficiency and providing valuable insights.

Lendlease uses digital twins to improve operational efficiency and gain insights into its projects. This technology allows for better decision-making and more effective project management.

Digital twins are used to model complex systems, helping to enable more sustainable construction practices. This supports Lendlease's ambitious sustainability targets.

Lendlease partners with industry leaders like Microsoft and Dell to advance digital twin technology. This collaboration helps establish industry standards and drive innovation.

The implementation of digital twins contributes to significant operational improvements. This leads to better resource allocation and reduced costs across projects.

Lendlease has set ambitious sustainability targets, including net-zero carbon emissions for Scope 1 and 2 by 2025 and absolute zero across Scope 1, 2, and 3 emissions by 2040.

Lendlease aims to create $250 million of social value by 2025 through shared value partnerships funded by the Lendlease Foundation.

Lendlease's commitment to sustainability is closely linked with its technological advancements. The company's sustainability goals include achieving net-zero carbon emissions for Scope 1 and 2 by 2025 and absolute zero emissions across Scope 1, 2, and 3 by 2040. To reach these targets, Lendlease is focusing on reducing Scope 3 emissions by encouraging its suppliers to adopt low-carbon practices. Their Australian commercial office funds under management are already certified as carbon neutral. Furthermore, Lendlease aims to create $250 million of social value by 2025 through shared value partnerships.

Lendlease's innovation strategy encompasses several key initiatives designed to enhance its operational efficiency and sustainability efforts. These initiatives are critical to achieving its long-term growth objectives.

- Digital Twins: Implementing digital twins for enhanced project management and operational insights.

- AI and Robotics: Exploring the integration of AI and robotics to improve construction processes and reduce costs.

- Sustainable Construction Practices: Using technology to model complex systems and enable more sustainable construction methods.

- Collaboration: Forming partnerships with tech giants like Microsoft and Dell to develop industry standards.

- ESG Integration: Aligning technological advancements with its ESG strategy to drive environmental, social, and economic outcomes.

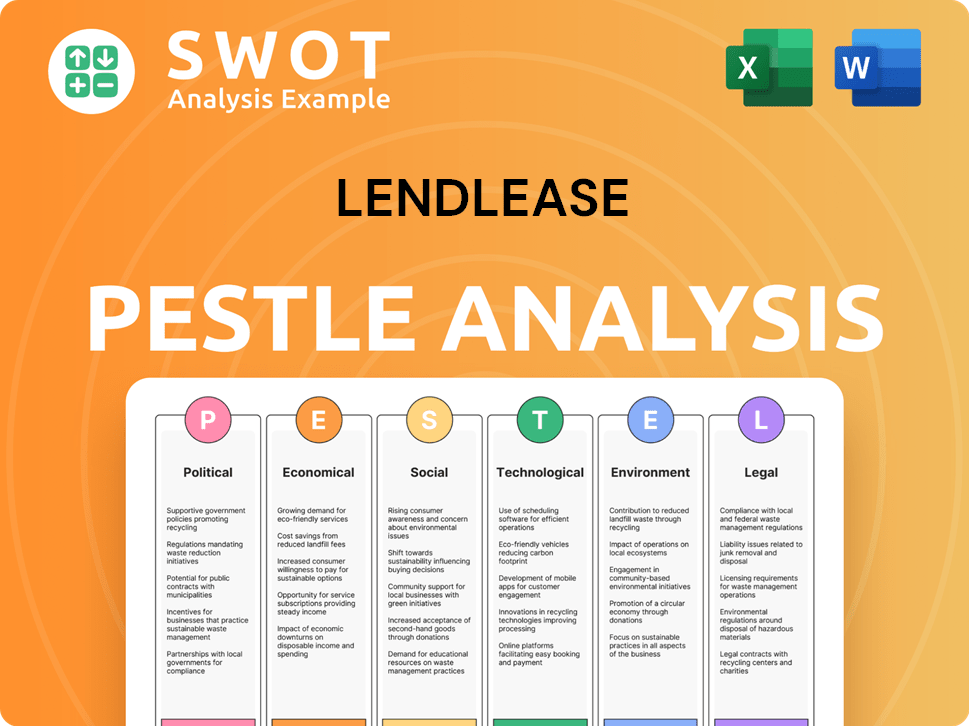

LendLease PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is LendLease’s Growth Forecast?

The financial outlook for Lendlease is significantly influenced by its strategic shift aimed at improving its financial performance and strengthening its balance sheet. The company's focus on capital recycling and investment management is central to its future growth. This strategic realignment is expected to drive profitability and enhance shareholder value.

For the first half of fiscal year 2025, ending December 31, 2024, Lendlease reported a statutory profit of AUD 48 million (approximately USD 30.46 million). This marks a substantial improvement from the statutory loss of AUD 136 million recorded in the same period a year earlier. Operating Profit after Tax (OPAT) for the first half of FY25 was AUD 122 million, an increase of AUD 133 million.

Lendlease's strategic plan includes a focus on capital recycling, with a target of releasing AUD 4.5 billion in capital. As of May 2025, the company has already completed or announced AUD 2.5 billion in capital recycling initiatives. This capital is primarily directed towards debt reduction and returning capital to securityholders, including an initial AUD 500 million on-market buyback. These initiatives are key to the company's financial restructuring and future growth.

Lendlease is actively recycling capital to strengthen its financial position. The company aims to release AUD 4.5 billion through capital recycling, with AUD 2.8 billion anticipated by the end of FY25. This strategy includes initiatives like asset sales and strategic partnerships to optimize its capital structure.

Investment management is set to become Lendlease's core business. The company anticipates investment management to contribute approximately 50% of group mid-cycle EBITDA. Funds under management are projected to grow at a CAGR of around 4% over the next five years, reaching over AUD 58 billion.

Lendlease is targeting a significant reduction in its gearing ratio. The company aims to lower its gearing ratio (net debt over total tangible assets) from 27% as of December 2024 to a revised target range of 5%-15% by the end of fiscal year 2026. This will improve its financial flexibility.

The development segment's contribution to group earnings is expected to shift. It is projected to contribute only one-third of group earnings in the future. This shift reflects the company's strategic focus on investment management and capital recycling.

Despite anticipated impairments and charges of up to AUD 1.475 billion in FY24 related to exiting international operations, Lendlease maintained its FY24 guidance of a 7% return on group equity, equating to approximately AUD 450 million in operating profit after tax. This demonstrates the company's resilience and strategic focus. For more insights, you can explore the Competitors Landscape of LendLease.

- Statutory profit of AUD 48 million (approximately USD 30.46 million) for H1 FY25.

- Operating Profit after Tax (OPAT) for H1 FY25 was AUD 122 million.

- Target to reduce gearing ratio to 5%-15% by the end of FY26.

- Investment management to contribute approximately 50% of group mid-cycle EBITDA.

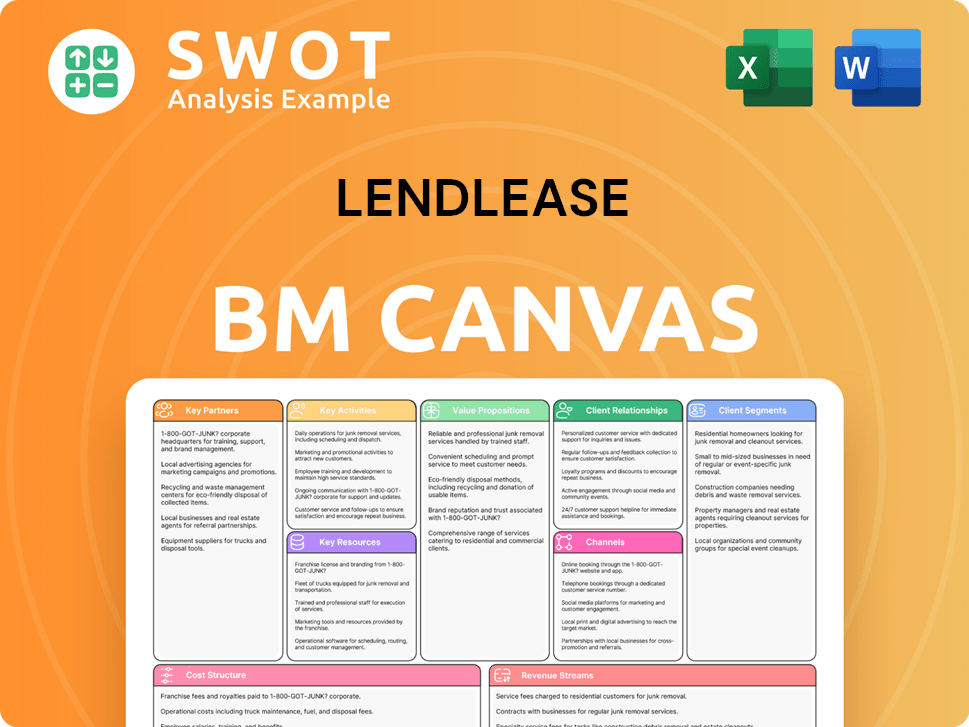

LendLease Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow LendLease’s Growth?

The strategic shift of the company, while aimed at mitigating past challenges, still faces several potential risks and obstacles. Market competition, especially in investment management, could squeeze fees. The construction division, despite generating substantial revenue, operates on thin margins, making it vulnerable to unexpected cost blowouts.

Exposure to property development and construction makes the company sensitive to interest rate fluctuations, property prices, demand, and overall economic activity. Regulatory changes and geopolitical uncertainties in international markets could also present challenges during the divestment process. The company is actively embracing digital transformation and technologies like digital twins, but successful integration requires significant investment and careful management.

Internal resource constraints, particularly during organizational restructuring and headcount reduction, could pose challenges. The company's risk management framework emphasizes debt reduction and capital returns.

Intense competition in the investment management sector could lead to fee compression, affecting profitability. The company faces a competitive landscape with numerous players vying for market share. Understanding the Revenue Streams & Business Model of LendLease is crucial for assessing its ability to navigate these challenges.

The construction division operates on thin margins, making it susceptible to cost overruns. Unexpected expenses can significantly erode returns, impacting the company's financial performance. The company must carefully manage project costs to maintain profitability.

The company is highly sensitive to fluctuations in interest rates, property prices, and overall economic activity. Changes in these factors can significantly impact the demand for property development and construction projects. Economic downturns can negatively affect the company's project pipeline.

Regulatory changes and geopolitical uncertainties in international markets can present challenges during the divestment process. Compliance with new regulations and navigating political risks can be complex and time-consuming. The company must carefully manage its international operations to mitigate these risks.

Successful integration of digital transformation and technologies like digital twins requires significant investment. The widespread adoption of these innovations across complex projects demands careful management and strategic planning. The company must stay ahead of the curve in adopting new technologies.

Internal resource constraints, especially during restructuring and headcount reduction, can hinder efficient operations. The company's ability to execute its strategic plans depends on its capacity to manage its workforce effectively. The company aims to reduce headcount by another 35% by fiscal 2025 end.

The company aims to achieve AUD 125 million in annualized pre-tax savings within 12 months through streamlining operations and cost reduction initiatives. Its risk management framework emphasizes debt reduction and capital returns, with a goal to lower gearing to 5%-15% by FY26. The company's financial targets are crucial for its long-term growth strategy.

A recent legal obstacle, such as the NSW Supreme Court ruling in April 2025, highlights the importance of precise execution. The company lost the right to purchase over 200 hectares of future development land due to failing to meet a critical contractual deadline related to rezoning. This underscores the need for rigorous project management.

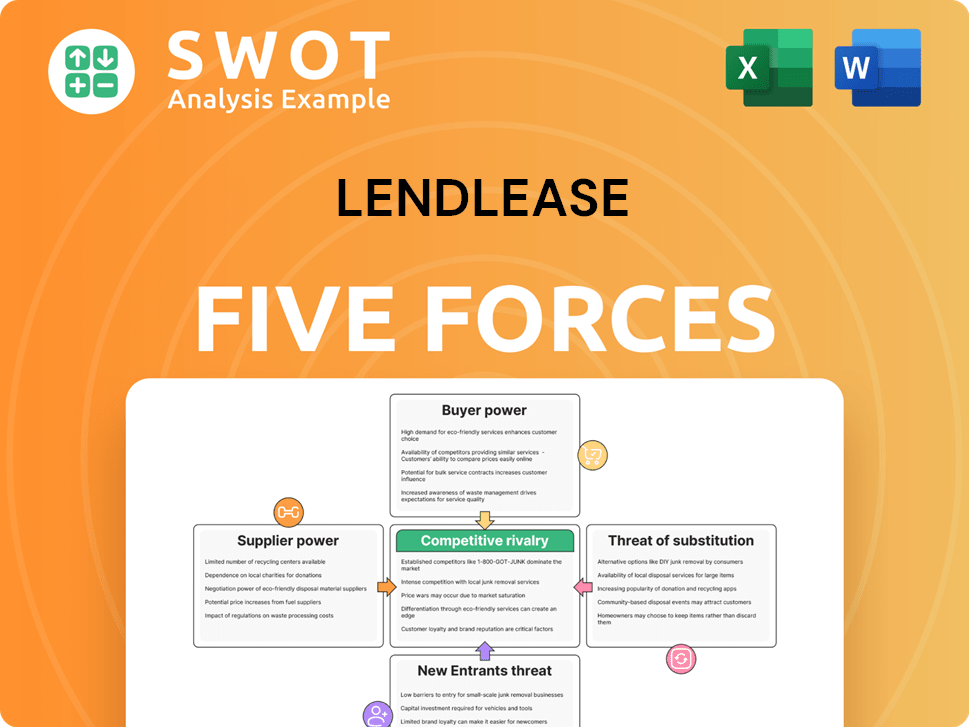

LendLease Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LendLease Company?

- What is Competitive Landscape of LendLease Company?

- How Does LendLease Company Work?

- What is Sales and Marketing Strategy of LendLease Company?

- What is Brief History of LendLease Company?

- Who Owns LendLease Company?

- What is Customer Demographics and Target Market of LendLease Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.