LendLease Bundle

How Does Lendlease Thrive in the Global Market?

Lendlease, a global powerhouse in property and infrastructure, shapes skylines and communities worldwide. From urban regeneration to large-scale construction, understanding the LendLease SWOT Analysis is key to grasping its strategic positioning. Its integrated approach, encompassing development, construction, and investment, offers a comprehensive suite of services.

This exploration into Lendlease's operations will uncover how this industry leader generates revenue and maintains its competitive advantage. We'll delve into its core operations, examining its diverse Lendlease projects and strategic moves within the dynamic global property market. Whether you're interested in Lendlease investment opportunities or the company's sustainability initiatives, this analysis provides valuable insights into its financial performance and future trajectory.

What Are the Key Operations Driving LendLease’s Success?

The core of the Lendlease business revolves around an integrated model that encompasses development, construction, and investment management. This approach allows the company to serve a diverse range of clients, including governments, corporations, and private individuals. Their primary offerings include large-scale urban regeneration projects, master-planned communities, and commercial and residential property development.

Operationally, Lendlease manages complex projects from inception to completion, including long-term asset management. This involves intricate processes such as land acquisition, urban planning, architectural design, and construction management. Sustainability is a key focus, with ESG considerations integrated throughout the project lifecycle. The company often partners with local governments and landowners to execute large-scale projects.

The value proposition of Lendlease lies in its integrated business model, which provides greater control over project quality, timelines, and costs. This 'end-to-end' capability differentiates it from competitors. This approach leads to comprehensive project solutions and often results in higher-quality, more sustainable outcomes for clients. To learn more about the company's structure, consider reading about Owners & Shareholders of LendLease.

Lendlease is involved in numerous Lendlease projects globally. These range from large-scale urban regeneration to commercial developments. Recent projects include the development of mixed-use precincts and infrastructure projects. The company's project portfolio is diverse, reflecting its global presence.

The Lendlease services encompass a wide array of offerings. These include development, construction, and investment management. The company also provides property and asset management services. Their integrated approach ensures clients receive comprehensive support throughout the project lifecycle.

Lendlease investment activities are a crucial part of its business model. They manage investment funds and offer investment opportunities in real estate. The company's investment strategy focuses on long-term value creation. They aim to deliver sustainable returns for investors.

The Lendlease business model is based on an integrated approach. This allows for control over all aspects of a project. This model enhances efficiency and reduces risks. The company's end-to-end capabilities set it apart from competitors.

The operational success of Lendlease hinges on several key factors. These include effective project management, sustainable practices, and strategic partnerships. The company's global presence and diverse project portfolio contribute to its operational strength.

- Land acquisition and urban planning are critical early stages.

- Construction management ensures projects are completed on time and within budget.

- Sustainable development practices are integrated throughout the lifecycle.

- Strategic partnerships with governments and landowners are common.

LendLease SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does LendLease Make Money?

Understanding the revenue streams and monetization strategies of Lendlease is crucial for grasping its business model. The company generates revenue through three main segments: Development, Construction, and Investments. Each segment contributes differently to the overall financial performance, reflecting the diverse nature of

The primary goal of

The financial performance of

The Development segment focuses on urban regeneration, communities, and commercial and residential projects. Revenue comes from the sale of developed properties and land. For the first half of the 2024 financial year, this segment generated A$1.9 billion in revenue.

The Construction segment provides construction services for various projects, including commercial, residential, and infrastructure. Revenue is typically generated on a fee-for-service basis. In the first half of FY24, this segment reported A$4.3 billion in revenue.

The Investments segment earns revenue through management fees, performance fees, and co-investments in property and infrastructure funds. This segment recorded A$154 million in revenue in the first half of FY24.

Lendlease partners with institutional investors for large-scale urban development projects. They also use pre-sales and long-term lease agreements to de-risk projects. The company focuses on growing its funds under management (FUM).

As of December 31, 2023, Lendlease's FUM stood at A$47.9 billion. This was a slight decrease from A$48.5 billion as of June 30, 2023, due to divestments and revaluations. The company is also exploring divestments of non-core assets.

In the first half of FY24, the Development segment had an adjusted EBITDA of A$103 million. The Construction segment reported an adjusted EBITDA of A$74 million. The Investments segment recorded an adjusted EBITDA of A$97 million.

Lendlease's revenue streams are diversified across Development, Construction, and Investments. The company uses strategic partnerships and funding structures to manage risk and secure funding. Growing FUM is a key strategy for recurring revenue.

- The Development segment's revenue is driven by property sales.

- Construction services generate revenue on a fee-for-service basis.

- The Investments segment earns from management and performance fees.

- Partnerships with institutional investors are a key strategy.

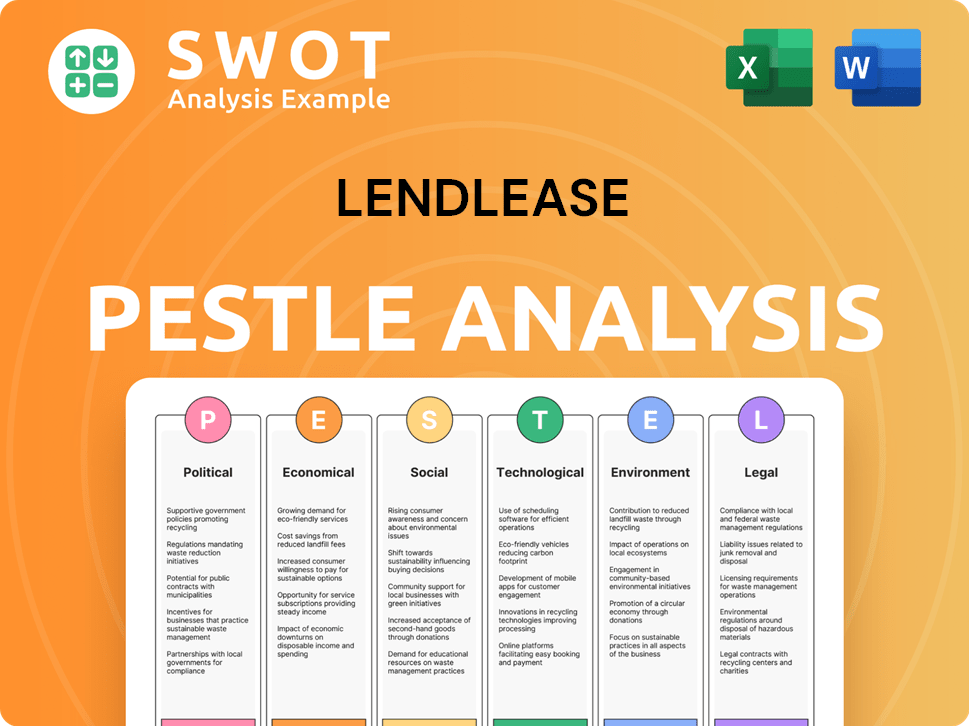

LendLease PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped LendLease’s Business Model?

Navigating significant milestones and strategic shifts, the company has shaped its operational and financial performance. A recent strategic move is the focus on its 'Next Chapter' strategy. This aims to simplify the business, improve capital efficiency, and drive returns. This includes divesting non-core assets and streamlining operations.

The company's strategic pivot is a response to challenging market conditions. It aims to enhance shareholder value by concentrating on its core strengths in urban regeneration, communities, and investment management. The company has reported a statutory loss after tax of A$136 million for the half-year ended December 31, 2023, primarily due to challenging market conditions and revaluations.

Despite these headwinds, the company's competitive advantages lie in its integrated business model. This offers end-to-end capabilities from development to construction and investment management, providing a unique value proposition. Its strong brand reputation, particularly in delivering complex and sustainable urban projects, also provides a significant competitive edge. For further insights, explore the Brief History of LendLease.

Over the years, the company has achieved several key milestones. These include the successful completion of large-scale urban regeneration projects. Another milestone is the expansion of its global presence, establishing itself as a key player in international markets. The company's evolution reflects its adaptability and strategic vision.

Recent strategic moves involve a shift towards core competencies. This includes divesting from non-core businesses to streamline operations and improve capital efficiency. The company is also focusing on urban regeneration, communities, and investment management. This strategic realignment aims to enhance shareholder value.

The company's competitive edge is its integrated business model, offering end-to-end capabilities. Its strong brand reputation, especially in sustainable urban projects, sets it apart. Furthermore, its global presence and long-standing relationships with governments and investors contribute to its sustained business model.

The company reported a statutory loss after tax of A$136 million for the half-year ended December 31, 2023. This was primarily due to challenging market conditions and revaluations. Despite these challenges, the company continues to focus on optimizing its capital allocation and prioritizing projects with strong risk-adjusted returns.

The company is adapting to market dynamics by focusing on its core competencies and optimizing capital allocation. This includes prioritizing projects with strong risk-adjusted returns. The company's strategic focus aims to navigate evolving market conditions and competitive threats. The company's long-term success depends on its ability to adapt and innovate.

- Focus on core competencies: Urban regeneration, communities, and investment management.

- Divestment of non-core assets: Streamlining operations and improving capital efficiency.

- Optimizing capital allocation: Prioritizing projects with strong risk-adjusted returns.

- Adapting to market dynamics: Navigating challenges such as rising interest rates and inflationary pressures.

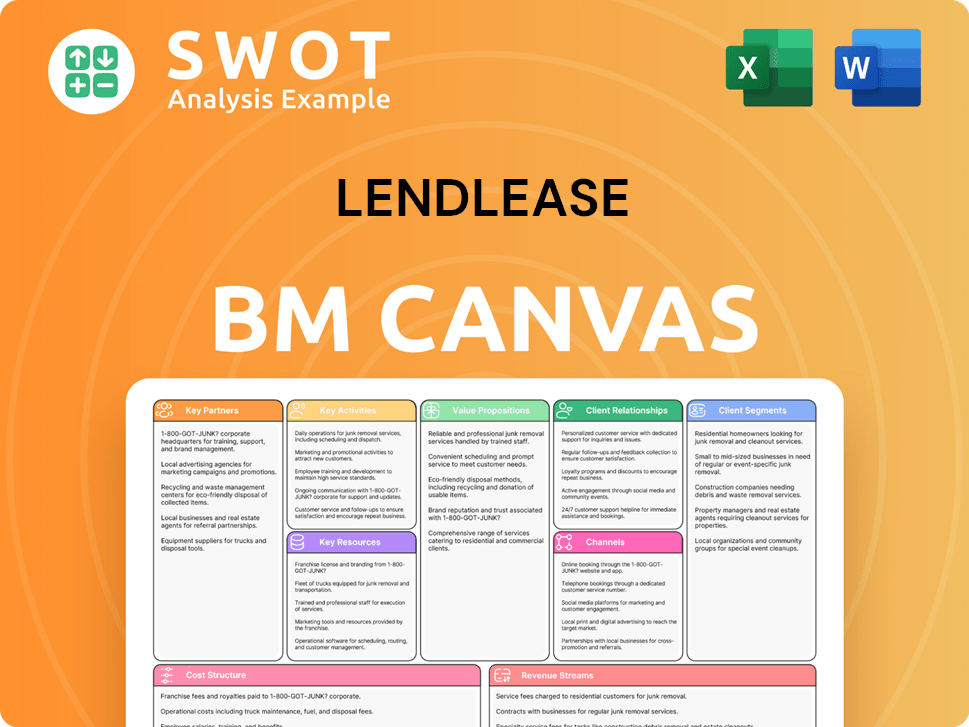

LendLease Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is LendLease Positioning Itself for Continued Success?

Lendlease maintains a significant presence in the global property and infrastructure sectors, competing with other large developers, contractors, and investment managers. Its integrated business model and focus on urban regeneration and sustainable development provide differentiation. The company has a substantial market share in specific segments, particularly in Australia and key international markets, where it has a long-standing presence. Customer loyalty is often built on its track record of delivering complex projects and its commitment to sustainability.

Key risks include macroeconomic volatility, like interest rate fluctuations and inflation, which impact construction costs and property values. Regulatory changes in planning, environmental, and building codes also pose challenges. New competitors leveraging disruptive technologies could impact its market position. Shifts in consumer preferences towards more flexible living or working arrangements could also influence demand for certain developments. The company's future outlook is shaped by its ongoing 'Next Chapter' strategy, which aims to simplify the business and improve returns.

Lendlease's industry position is characterized by its integrated business model spanning development, construction, and investment. It competes with global players, maintaining a strong presence in Australia and key international markets. Its focus on urban regeneration and sustainable development differentiates it from competitors. The company's focus on Growth Strategy of LendLease has helped it stay competitive.

Lendlease faces risks from macroeconomic factors such as interest rate fluctuations and inflation, impacting construction costs and property values. Regulatory changes and new competitors pose additional challenges. Shifts in consumer preferences also influence demand. The company's financial performance is sensitive to these external factors.

The future outlook for Lendlease is shaped by its 'Next Chapter' strategy, focusing on core businesses and divesting non-core assets. The company aims to enhance capital efficiency and drive sustainable growth. Leadership emphasizes disciplined capital allocation. The company will continue to leverage its integrated model and focus on urban regeneration.

The Lendlease business model integrates development, construction, and investment activities. This integrated approach allows for greater control over projects and the ability to capture value across the entire project lifecycle. The company's focus on urban regeneration and sustainable development is a key differentiator. This model has helped in its global presence.

Lendlease is focusing on its core businesses of Development, Construction, and Investments. The company is divesting non-core assets to streamline operations. It is committed to enhancing capital efficiency and driving sustainable growth through disciplined capital allocation and strategic partnerships.

- Focus on core businesses: Development, Construction, and Investments.

- Divestment of non-core assets to streamline operations.

- Enhancing capital efficiency and driving sustainable growth.

- Disciplined capital allocation and strategic partnerships.

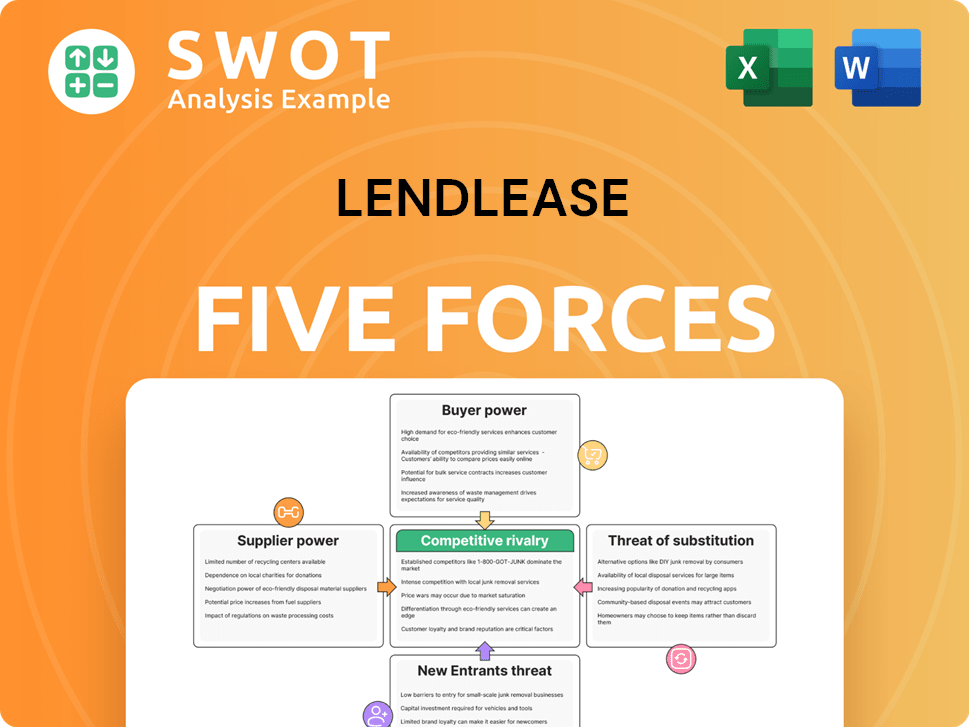

LendLease Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of LendLease Company?

- What is Competitive Landscape of LendLease Company?

- What is Growth Strategy and Future Prospects of LendLease Company?

- What is Sales and Marketing Strategy of LendLease Company?

- What is Brief History of LendLease Company?

- Who Owns LendLease Company?

- What is Customer Demographics and Target Market of LendLease Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.