MPT Bundle

How has Medical Properties Trust (MPT) navigated the healthcare real estate landscape?

Medical Properties Trust (MPT) has carved a unique niche in the healthcare sector, becoming a global leader in hospital real estate. Founded in 2003, MPT's journey from a Birmingham, Alabama startup to a major player with a presence across multiple continents is a compelling story of strategic growth. Understanding the MPT SWOT Analysis can provide further insights.

This evolution, marked by significant property acquisitions and a focus on long-term net leases, has positioned MPT as a key provider of capital to hospital operators. Despite recent financial headwinds, MPT's resilience and adaptability in the face of challenges, including tenant bankruptcies, underscore its strategic prowess in the dynamic healthcare real estate market. The company's ability to maintain a diversified portfolio and navigate market complexities highlights its enduring appeal.

What is the MPT Founding Story?

The story of Medical Properties Trust, Inc. (MPT) began on August 27, 2003, in Birmingham, Alabama. Edward K. Aldag, Jr., along with Emmett E. McLean and R. Steven Hamner, founded the company. Aldag's background in real estate, finance, and healthcare shaped his vision for MPT.

The founders identified a need in the healthcare sector: hospitals often needed capital for improvements. MPT aimed to address this by acquiring hospital facilities and leasing them back. This model allowed hospitals to free up capital for upgrades and technology.

The company's initial focus was as a self-advised real estate investment trust (REIT) specializing in net-leased hospital facilities. The timing was right, as healthcare costs were rising, and hospitals sought to optimize their finances. This positioned MPT as a unique solution for capital-intensive healthcare providers.

MPT's founding in 2003 marked the beginning of its journey in healthcare real estate. The company's initial public offering (IPO) in 2005 was a key milestone.

- Founded: August 27, 2003, in Birmingham, Alabama.

- Founders: Edward K. Aldag, Jr., Emmett E. McLean, and R. Steven Hamner.

- Initial Public Offering (IPO): July 7, 2005, raising approximately $200 million.

- Pre-IPO Funding: $233 million through a private 144A offering in 2004.

- Business Model: Focused on acquiring and leasing hospital facilities.

The initial capital for MPT came from a private 144A offering in 2004, which provided $233 million. The IPO in July 2005 raised around $200 million, fueling the company's early acquisitions. The management team's expertise in real estate and healthcare operations was crucial for success. The Mission, Vision & Core Values of MPT reflect the company's ongoing commitment.

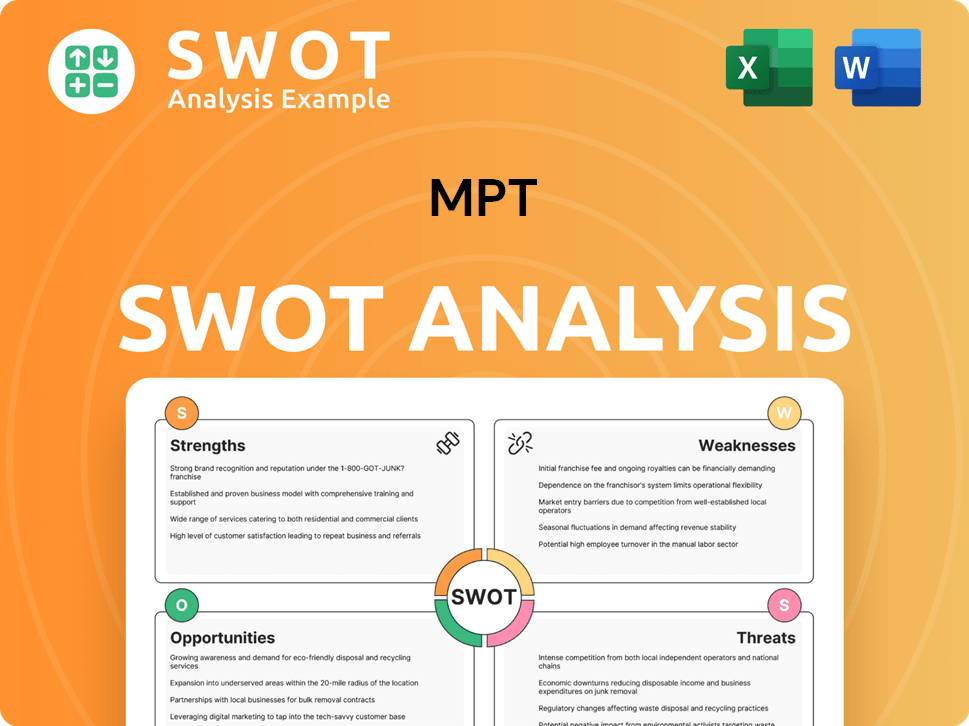

MPT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of MPT?

The early growth and expansion of the company, now known as Medical Properties Trust, was marked by rapid portfolio and geographical expansion. Following its establishment, the company quickly acquired properties and strategically diversified its holdings. This phase was crucial in establishing its presence and setting the stage for its future growth as a global leader in hospital real estate.

In 2004, the company acquired its initial six properties from Vibra Healthcare, establishing a presence across six U.S. states. A significant milestone was the Initial Public Offering (IPO) on July 7, 2005, which saw the company listed on the New York Stock Exchange at $10.50 per share. The IPO raised approximately $125.7 million in net proceeds, or $200 million in total, providing capital for further acquisitions. This early capital injection was vital for fueling the company's expansion strategy.

By 2008, the company's investments had increased by nearly 75% to over $1.3 billion, with annual revenue exceeding $100 million. The company demonstrated resilience during the financial crisis, restarting its acquisition program in 2010 with over $200 million in new investments. This period highlighted the company's ability to navigate economic challenges and continue its growth trajectory.

A key strategic shift occurred in 2013 with the first international acquisition in Germany, marking the beginning of significant geographic diversification beyond the United States. This was followed by expansion into the U.K. in 2014 with the acquisition of Circle Bath Hospital. These moves reduced dependency on the domestic market and broadened the company's global footprint. Learn more about the Revenue Streams & Business Model of MPT.

Major acquisitions continued, including a $900 million transaction for Capella Healthcare in 2015, encompassing seven hospitals, and the acquisition of eight acute care hospitals in northern Italy for approximately $100 million. In 2016, the company made a significant investment of $1.25 billion in Steward Health Care System, substantially scaling its portfolio. By August 2019, the company expanded its U.K. footprint by acquiring eight hospitals operated by Ramsay Health Care and 16 hospitals operated by Prospect Medical Holdings. As of March 31, 2025, total assets reached approximately $14.9 billion.

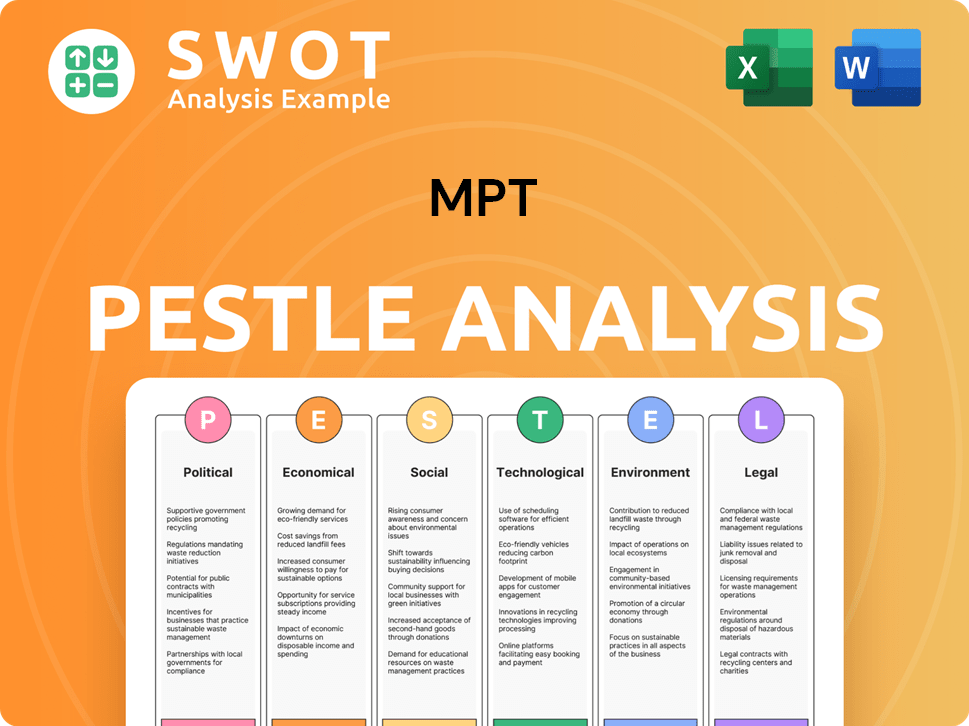

MPT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in MPT history?

The MPT company has a rich history marked by significant milestones. From its inception, the company has expanded its operations and adapted to the evolving telecommunications landscape in Myanmar. The MPT history is characterized by strategic partnerships and technological advancements, shaping its role in the nation's telecom sector.

| Year | Milestone |

|---|---|

| 2003 | Foundation of the company, marking the beginning of MPT's journey in Myanmar's telecom sector. |

| 2005 | Launch of the first mobile network, establishing MPT as a key player in the Myanmar telecom market. |

| 2014 | Strategic partnership with KDDI, enhancing technological capabilities and service offerings. |

| 2016 | Expansion of 4G LTE network, improving data services and coverage across Myanmar. |

| 2020 | Continued network expansion and service enhancements, solidifying MPT's market position. |

MPT's innovations have been pivotal in shaping the telecommunications landscape. The company has consistently introduced new technologies and services to meet the growing demands of its customers. These innovations have not only improved connectivity but also contributed to Myanmar's economic development.

MPT pioneered mobile services in Myanmar, offering voice and SMS capabilities to a wide customer base. This early introduction of mobile technology transformed communication in the country.

The rollout of the 4G LTE network significantly improved data speeds and coverage, enabling faster internet access for users. This advancement supported the growth of digital services.

MPT has continually improved its customer service, offering various channels for support and assistance. These improvements have enhanced customer satisfaction and loyalty.

Collaborations with international companies like KDDI have brought in expertise and resources, boosting service quality. These partnerships have been crucial for technological and market expansion.

MPT has consistently expanded its network coverage, reaching more areas and customers across Myanmar. This has enhanced accessibility to telecom services.

The company has expanded its service offerings to include data packages, value-added services, and digital solutions. This diversification has catered to a wider range of customer needs.

Despite its achievements, MPT has faced challenges in the competitive Myanmar telecom market. These challenges include managing infrastructure, adapting to regulatory changes, and competing with other telecom providers. Understanding these challenges is critical for assessing MPT's future prospects. For more information on MPT's target market, see Target Market of MPT.

Increased competition from other telecom operators has put pressure on MPT to maintain market share. This competition requires continuous innovation and competitive pricing strategies.

Changes in regulations and policies can impact MPT's operations and strategies, requiring adaptability. Navigating these changes is essential for compliance and market stability.

Maintaining and upgrading telecom infrastructure across Myanmar presents logistical and financial challenges. Efficient infrastructure management is crucial for service quality.

Economic instability and fluctuations can affect MPT's financial performance and investment plans. Adapting to economic conditions is vital for sustainable growth.

Keeping pace with rapid technological advancements requires continuous investment in new technologies. This ensures MPT remains competitive in the market.

Attracting and retaining customers in a competitive environment requires effective marketing and customer service strategies. This is vital for long-term success.

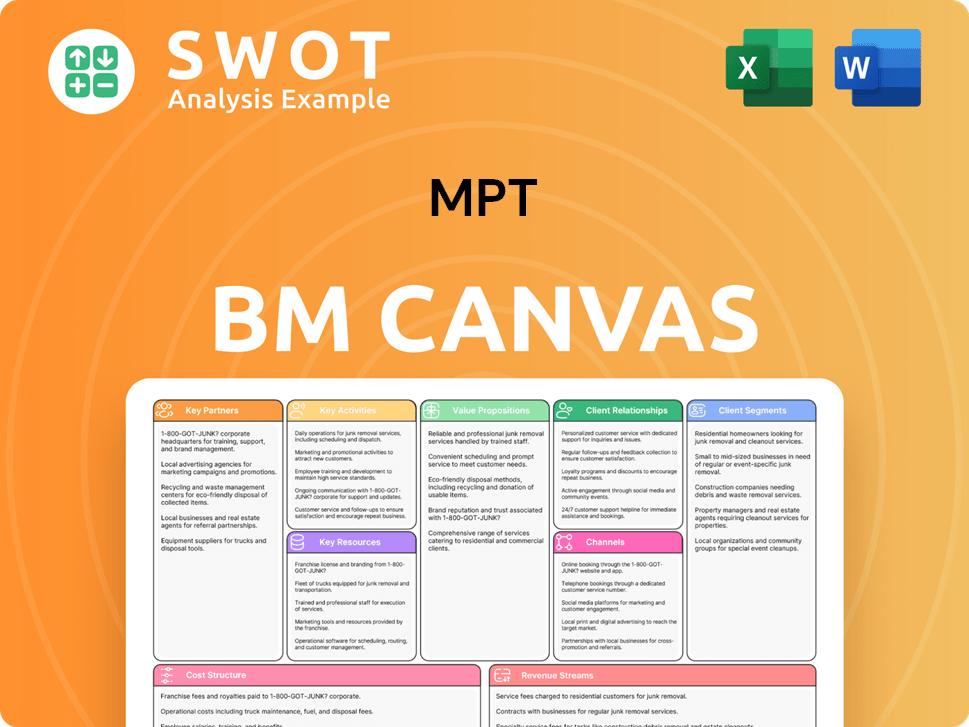

MPT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for MPT?

The MPT company has a dynamic history, marked by strategic acquisitions and financial milestones. Founded in 2003, the company quickly expanded its portfolio, completing its Initial Public Offering (IPO) in 2005. International expansion began in 2013, followed by significant investments and acquisitions in the UK and the U.S. Notably, the company addressed debt maturities through 2026 with a recent private offering in February 2025. By March 2025, the total assets were approximately $14.9 billion, with a portfolio of 393 properties.

| Year | Key Event |

|---|---|

| 2003 | Founded in Birmingham, Alabama. |

| 2004 | Acquired its first six properties. |

| 2005 | Completed its Initial Public Offering (IPO). |

| 2008 | Investments grew to over $1.3 billion, and annual revenue exceeded $100 million. |

| 2012 | Acquired a 16-property portfolio from Ernest Health for $300 million. |

| 2013 | Made its first international acquisition in Germany. |

| 2016 | Invested $1.25 billion in Steward Health Care System. |

| 2019 | Acquired eight UK hospitals from Ramsay Health Care and 16 hospitals from Prospect Medical Holdings. |

| 2020 | Purchased 30 acute care hospitals in the UK for nearly £1.5 billion. |

| 2021 | Acquired 35 UK mental health facilities for £800 million. |

| 2022 | Sold a 50% stake in eight Massachusetts hospitals for $1.7 billion. |

| 2023-2024 | Reported net losses totaling $1.4 billion. |

| 2025 | Completed a private offering of over $2.5 billion in senior secured notes. |

MPT is focused on enhancing shareholder value by stabilizing and growing cash flows. The company is working to stabilize its financial standing following recent losses. This includes managing existing assets and seeking new opportunities for revenue generation.

Expected increases in cash rents from former Steward facilities, projected to rise from $4 million to $23 million by Q4 2025. The company anticipates achieving over $1 billion in annualized cash rent once new tenants are fully operational.

MPT is exploring asset repositioning opportunities to enhance revenue streams. With improved operator diversification and debt maturities addressed through 2026, the company is positioned to pursue shareholder value initiatives in 2025.

The healthcare industry's recovery and demographic trends are expected to support MPT's long-term prospects. This aligns with its founding vision of providing essential capital solutions to the healthcare sector.

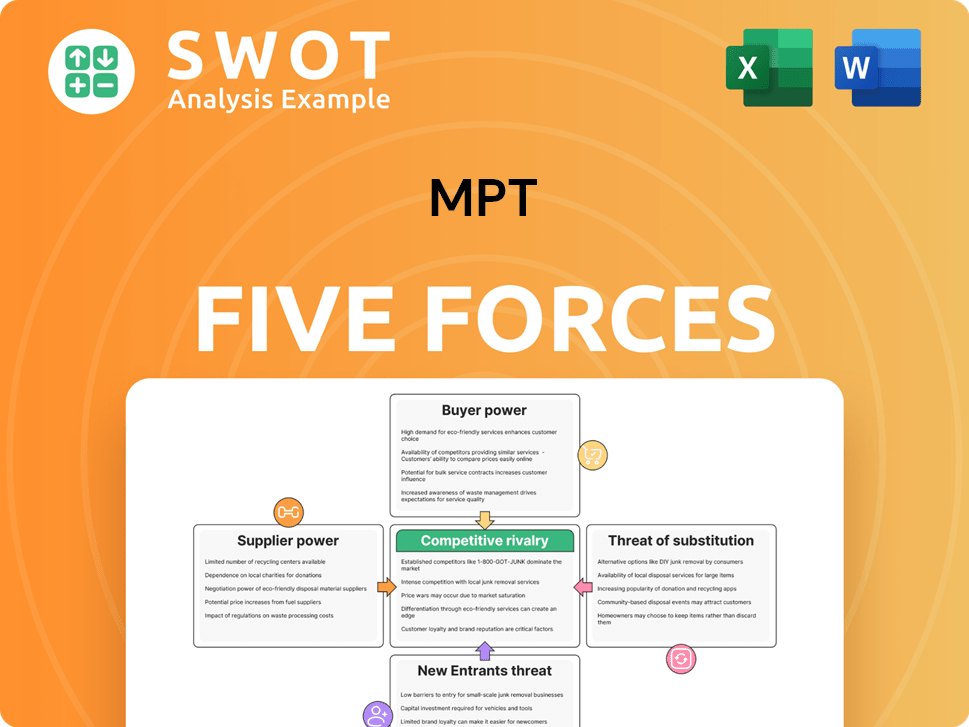

MPT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of MPT Company?

- What is Growth Strategy and Future Prospects of MPT Company?

- How Does MPT Company Work?

- What is Sales and Marketing Strategy of MPT Company?

- What is Brief History of MPT Company?

- Who Owns MPT Company?

- What is Customer Demographics and Target Market of MPT Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.