MPT Bundle

Who are MPT's Key Customers?

In the dynamic world of healthcare real estate, understanding the customer is key to success. For Medical Properties Trust (MPT) Company, a deep dive into its customer demographics and target market reveals the core of its strategic approach. This analysis is critical for investors, analysts, and anyone seeking to understand MPT's position in the market.

MPT's success hinges on its ability to identify and serve the specific needs of its customer base within the healthcare sector. This exploration delves into the specifics of MPT's MPT SWOT Analysis, examining its market segmentation, customer profile, and the strategies it employs to acquire and retain its ideal customers. Understanding MPT's customer demographics, including age, gender, location, and income levels, provides valuable insights into its market share and competitive positioning.

Who Are MPT’s Main Customers?

Analyzing the MPT Company's customer base involves understanding its primary customer segments. The MPT Company, a real estate investment trust (REIT), primarily focuses on the healthcare sector. Its target market is mainly composed of businesses within this industry.

The core customer base for MPT Company consists of hospital operators. This includes established healthcare systems, individual hospitals, and physician groups. These entities own and operate various healthcare facilities, such as acute care hospitals, long-term acute care hospitals, inpatient rehabilitation centers, and behavioral health facilities.

While MPT Company doesn't segment its customers by age, gender, or income in the traditional sense, it analyzes its customer base based on the size and financial health of the operating entity, the type of hospital facility, and the geographic reach of their operations. The company targets operators seeking capital for strategic initiatives, making financial stability and growth potential key characteristics of its ideal customers.

MPT Company's market segmentation strategy focuses on identifying and catering to specific types of hospital operators. This approach allows for targeted investment and management of its real estate portfolio. The company adapts to shifts in the healthcare industry, such as consolidation among hospital systems and the growing demand for specialized care facilities.

The customer profile of MPT Company includes financially stable hospital operators with a proven track record. These operators often seek capital for strategic initiatives, such as facility expansions or upgrades. Understanding the customer profile helps MPT Company make informed investment decisions and maintain a strong portfolio.

While MPT Company doesn't focus on traditional customer demographics like age or income, it analyzes its customers based on the size and financial health of the operating entity. This approach helps the company assess the creditworthiness and long-term viability of its tenants. The company's focus is on operators seeking capital for strategic initiatives, making financial stability and growth potential key characteristics of its target customers.

MPT Company's target market is the healthcare sector, specifically hospital operators. The company focuses on established healthcare systems, individual hospitals, and physician groups. The company strategically expands its portfolio to include a greater proportion of behavioral health facilities. For more details, you can read about Revenue Streams & Business Model of MPT.

MPT Company targets hospital operators with specific characteristics to ensure successful investments and long-term partnerships. These characteristics are crucial for the company's financial stability and growth.

- Financial Stability: The ability to demonstrate consistent revenue and profitability.

- Growth Potential: The capacity for expansion and strategic initiatives.

- Operational Expertise: Proven experience in managing healthcare facilities.

- Strategic Alignment: Compatibility with MPT Company's investment goals.

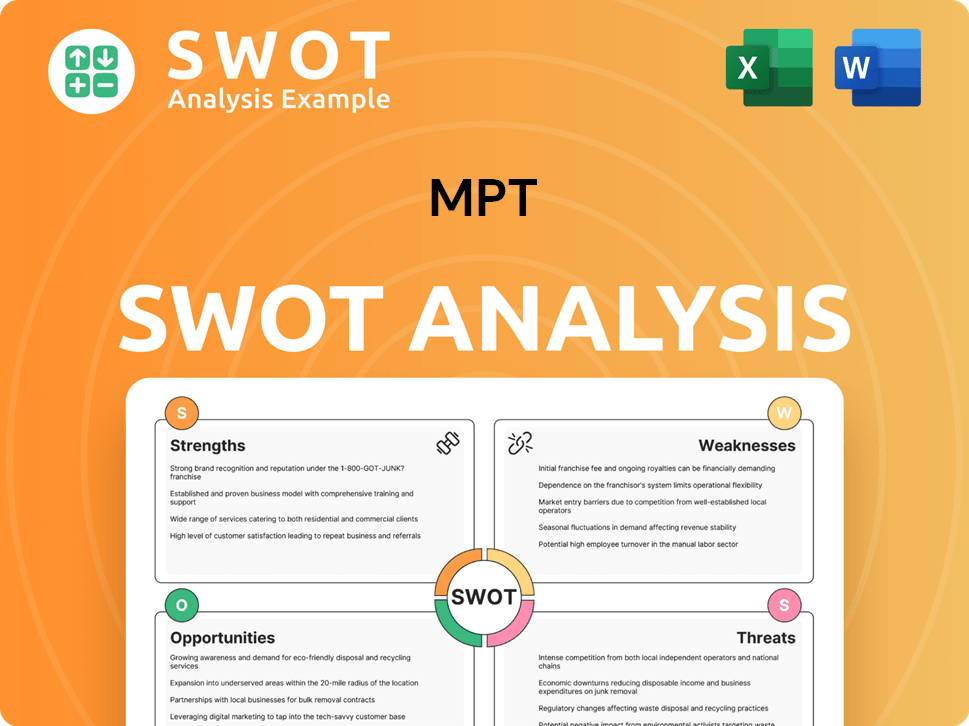

MPT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do MPT’s Customers Want?

Understanding the customer needs and preferences is crucial for the success of any business, and for the [Company Name], this involves a deep dive into the financial and operational goals of hospital operators. The primary focus is on providing solutions that enable these operators to optimize their capital structure and enhance their operational efficiency.

The key drivers for [Company Name]'s customers revolve around financial flexibility, strategic capital allocation, and establishing long-term partnerships. Hospital operators seek to unlock the value of their real estate assets, gaining access to capital for improvements, debt refinancing, or expansion projects. Their purchasing behavior is primarily driven by the need for liquidity and the desire to optimize their balance sheets.

Decision-making criteria often include the terms of the lease agreement, [Company Name]'s financial stability, and its reputation as a reliable real estate partner. Product/service usage patterns involve long-term net leases, where tenants handle most property-related costs, aligning with their preference for operational control while freeing up capital. This aligns with the broader trends in the healthcare real estate sector, where operators are increasingly focused on core healthcare services.

Hospital operators need access to capital for various purposes, including operational improvements, debt refinancing, and expansion projects. Sale-leaseback transactions provide a way to unlock the value of real estate assets and free up capital.

Operators aim to optimize their balance sheets by converting illiquid real estate into working capital. This allows them to focus on their core healthcare services and strategic initiatives.

Building reliable relationships is essential. Operators look for a partner with financial stability and a proven track record in healthcare real estate.

The terms of the lease agreement are a critical factor. Operators seek favorable terms that provide operational control while freeing up capital. Net leases are common, where tenants handle most property-related costs.

Operators rely on the financial strength of the real estate partner. A stable partner ensures long-term reliability and the ability to meet obligations.

A strong reputation as a reliable real estate partner is highly valued. This includes expertise in healthcare real estate, responsiveness, and a commitment to long-term relationships.

The psychological drivers for choosing [Company Name] include a desire for financial security and the ability to invest in core healthcare services without the burden of real estate ownership. Practical drivers include the efficiency of a sale-leaseback transaction and the ability to leverage [Company Name]'s expertise in healthcare real estate. [Company Name] addresses common pain points such as capital constraints for hospital expansions or upgrades and the need for a predictable, long-term real estate solution. Feedback from operators and market trends, such as the increasing cost of healthcare delivery and the need for modern facilities, have influenced [Company Name]'s focus on acquiring and developing state-of-the-art hospital properties. [Company Name] tailors its offerings by structuring flexible lease terms and providing capital solutions that align with the specific financial goals and operational needs of each hospital operator, demonstrating a deep understanding of the unique demands within the healthcare real estate sector.

Understanding the specific needs of hospital operators is crucial for [Company Name]'s success. These needs drive their decision-making process and influence their long-term partnerships.

- Financial Flexibility: Access to capital is a primary need, allowing operators to invest in core services and improve operations.

- Strategic Capital Allocation: Operators seek to optimize their balance sheets by converting real estate into working capital.

- Long-Term Partnerships: Building trust and reliability through a stable, experienced partner is essential.

- Favorable Lease Terms: Flexible lease agreements that provide operational control while freeing up capital are preferred.

- Expertise in Healthcare Real Estate: Operators value partners with deep knowledge of the healthcare sector.

- Predictable Solutions: Consistent, reliable real estate solutions that support long-term operational goals.

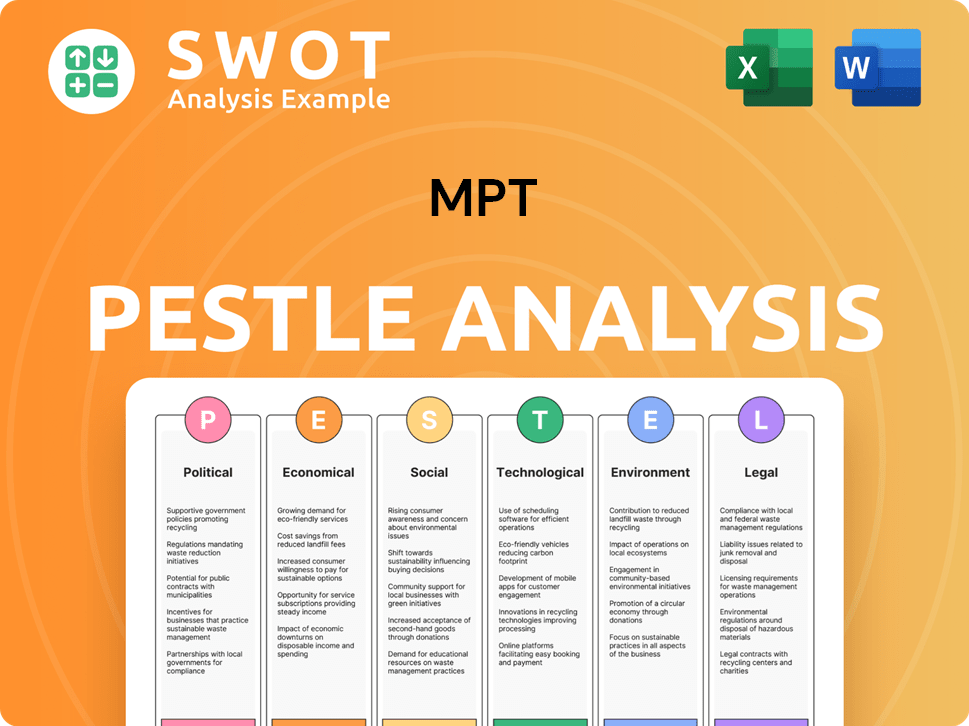

MPT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does MPT operate?

Medical Properties Trust (MPT) has a broad geographical market presence, focusing on key markets in the United States and several international regions. In the U.S., MPT has a strong presence across various states, with a diversified portfolio spanning numerous cities and metropolitan areas. MPT's strategy involves careful consideration of differences in customer demographics and buying power across these regions.

Internationally, the company has strategically expanded into markets such as the United Kingdom, Germany, Australia, and Spain. MPT's strongest market share and brand recognition are typically found in regions with robust healthcare infrastructure and a high concentration of hospital facilities. This international expansion is a key part of MPT's growth strategy, allowing it to diversify its portfolio and reduce its reliance on any single market.

The company's approach involves adapting to the specific regulatory environments and healthcare delivery models of each country. For example, in Europe, more centralized healthcare systems may present different acquisition dynamics compared to the fragmented U.S. market. This includes working with local operators and adhering to regional real estate and healthcare regulations. MPT's geographic distribution of sales and growth is directly tied to the performance of its hospital tenants in these diverse regions, emphasizing its global strategy in healthcare real estate. You can learn more about the company's history by reading Brief History of MPT.

MPT's market segmentation strategy involves dividing its customer base into distinct groups based on geographic location. This allows for tailored approaches to meet the specific needs of each market segment. This is crucial for effective customer acquisition and retention strategies.

The customer profile for MPT includes hospital operators and healthcare providers. These entities are the primary tenants of MPT's real estate portfolio. Understanding their needs and financial stability is key to MPT's success.

Analyzing MPT's customer base involves understanding the demographics of the patients served by its tenants. This includes age, gender, income levels, and location. This data helps MPT assess the long-term viability of its investments.

MPT's target market is primarily composed of hospital operators and healthcare providers in developed countries. The company focuses on regions with stable healthcare economies and strong regulatory frameworks. This targeted approach helps MPT maintain a competitive edge.

MPT's geographic strategy is influenced by several factors. These include the stability of healthcare systems, regulatory environments, and economic conditions. The company continually assesses these factors to make informed investment decisions.

- Market Share: MPT's market share varies by region, with a strong presence in the U.S. and strategic growth in international markets.

- Acquisition Dynamics: The acquisition process differs across regions, with the U.S. market offering diverse opportunities and Europe presenting more centralized systems.

- Regulatory Compliance: MPT adheres to local real estate and healthcare regulations, ensuring compliance in each market.

- Tenant Performance: The performance of MPT's hospital tenants directly impacts the company's sales and growth in diverse regions.

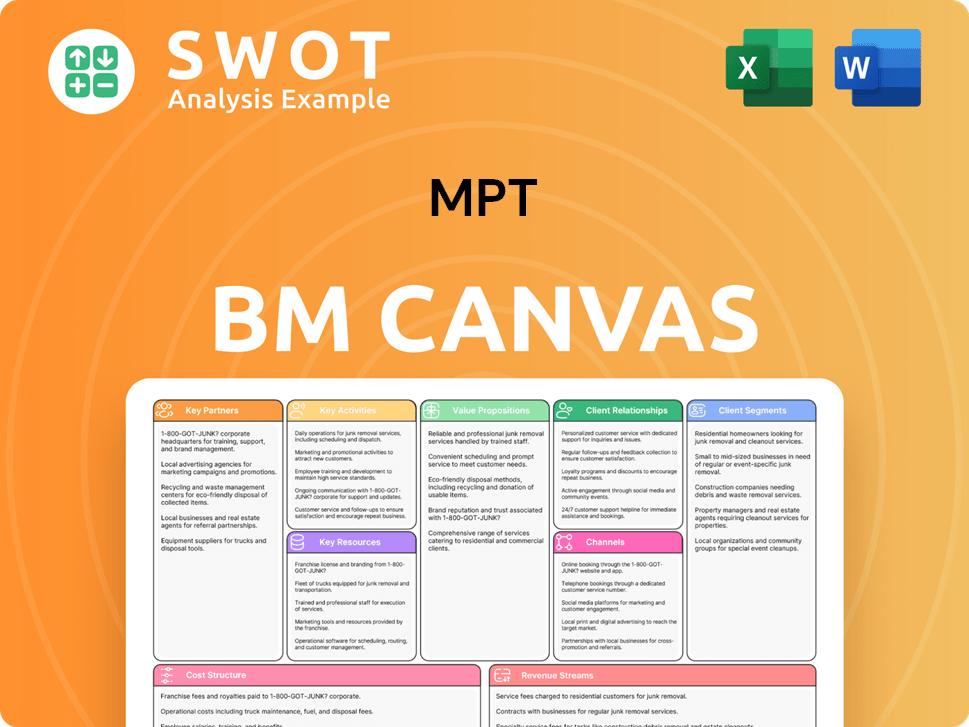

MPT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does MPT Win & Keep Customers?

When it comes to customer acquisition and retention, focusing on the specific needs of its clientele is crucial for the success of the Medical Properties Trust (MPT) Company. This approach is particularly important given its business-to-business (B2B) model, which concentrates on long-term relationships with hospital operators. The strategies involve targeted outreach and nurturing existing partnerships to ensure sustained growth and stability within the healthcare real estate market.

Acquisition strategies are centered on direct engagement with key decision-makers in the healthcare industry. This includes hospital operators, healthcare systems, and private equity firms. MPT leverages its reputation and expertise to offer tailored real estate solutions, such as sale-leaseback agreements, that meet the operational and financial needs of these organizations. The goal is to establish itself as a trusted partner, providing long-term capital and operational flexibility.

Retention efforts are highly focused on cultivating and maintaining strong relationships with existing tenants, which is essential for sustained success. This involves proactive asset management, ensuring tenant satisfaction, and demonstrating a commitment to their long-term success. The company’s approach includes providing personalized experiences through tailored lease agreements and responsive property management. Understanding the evolving needs of its tenants and identifying opportunities for additional investments or lease modifications are key components of its retention strategy. This approach helps to minimize churn rates and enhance the overall value of its portfolio.

MPT acquires customers through direct outreach to hospital operators and healthcare systems. The company leverages its reputation and expertise to offer tailored real estate solutions. Key channels include industry conferences and direct networking with healthcare executives.

Retention focuses on building strong relationships with existing tenants. This involves proactive asset management and ensuring tenant satisfaction. MPT aims to provide personalized experiences and identify opportunities for additional investments.

MPT's sales tactics emphasize the long-term capital benefits of its net-lease structure. The company highlights the operational flexibility that its financing model provides. Presentations focus on the advantages of its real estate solutions.

Customer data and relationship management are crucial for understanding tenant needs. MPT identifies opportunities for additional investments or lease modifications. The company aims to act as a trusted partner for its tenants.

MPT uses industry conferences to connect with potential clients. Direct networking with healthcare executives is a core strategy. Targeted financial presentations highlight the benefits of MPT's financing model.

MPT prioritizes long-term lease agreements with financially sound operators. This strategy minimizes churn rates within its portfolio. The focus is on securing stable and predictable cash flows.

MPT offers tailored lease agreements to meet specific tenant needs. Responsive property management ensures tenant satisfaction. The company focuses on fostering strong, enduring relationships.

Successful retention initiatives often involve collaborative efforts. MPT supports tenant expansions and addresses operational challenges. These efforts reinforce MPT's role as a trusted partner.

Customer data and relationship management are critical. This helps in understanding the evolving needs of tenants. Identifying opportunities for additional investments is part of the process.

MPT focuses on fostering strong, enduring relationships with its existing tenants. Proactive asset management is a key component of this strategy. Tenant satisfaction is a priority for the company.

MPT's customer acquisition and retention strategies are essential for its success in the healthcare real estate market. These strategies are carefully designed to build and maintain strong relationships with hospital operators and healthcare systems. By focusing on long-term partnerships and understanding the unique needs of its tenants, MPT aims to ensure sustained growth and stability. For a deeper dive into the Marketing Strategy of MPT, consider the details of customer acquisition and retention efforts.

- Direct outreach to hospital operators.

- Emphasis on long-term capital benefits.

- Proactive asset management and tenant satisfaction.

- Tailored lease agreements and responsive property management.

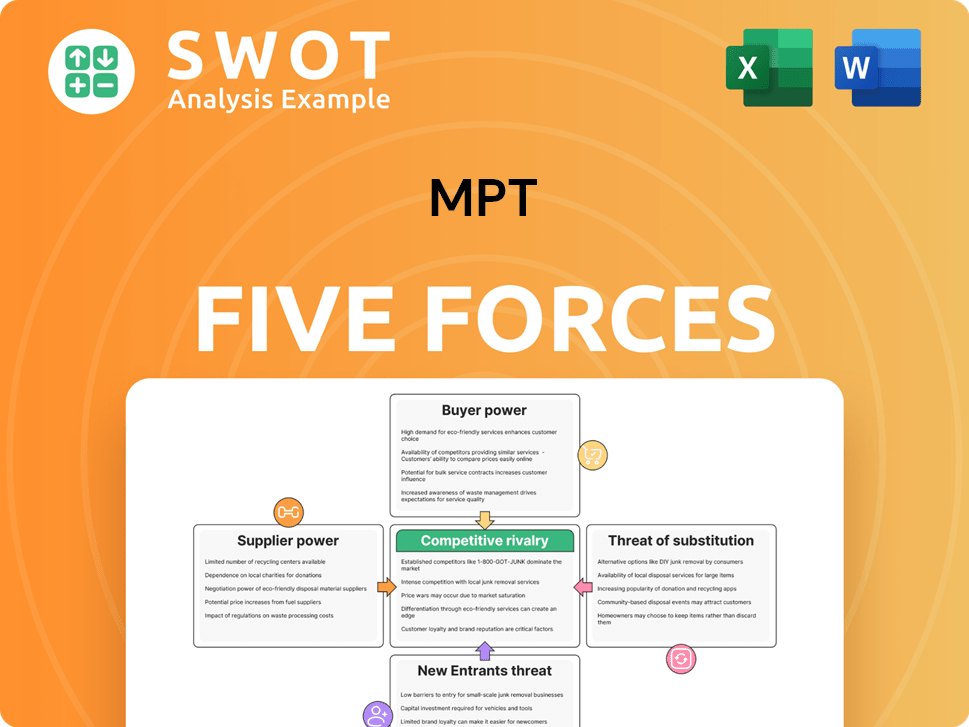

MPT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.