MPT Bundle

Decoding Medical Properties Trust: What Drives Its Strategy?

Understanding a company's mission, vision, and core values is crucial for investors and stakeholders. These elements provide a roadmap for success, especially in the dynamic healthcare real estate sector. Let's delve into the foundational principles that guide Medical Properties Trust (MPT).

Medical Properties Trust (MPT) is a significant player in the healthcare real estate market, so grasping its MPT SWOT Analysis is vital. Exploring the MPT mission, MPT vision, and MPT core values offers insights into its strategic goals and commitment to the healthcare industry. This exploration will help you understand How does MPT define its mission and how it aligns its MPT core values and principles with its long-term objectives, including its potential role in places like MPT Myanmar.

Key Takeaways

- MPT's mission, vision, and values are fundamental to its strategic direction and market differentiation.

- The company's focus on healthcare providers and global hospital capital distinguishes its approach.

- Core values like integrity and long-term value creation guide MPT's operations and investment decisions.

- Alignment with these principles is crucial for navigating industry challenges and seizing growth.

- MPT's purpose extends beyond financial returns, contributing to healthcare system stability.

Mission: What is MPT Mission Statement?

MPT's mission is 'to be the leading capital partner to healthcare providers, enabling them to deliver exceptional patient care by providing innovative real estate solutions and fostering long-term relationships.'

Delving into the core of Medical Properties Trust (MPT), understanding its mission statement offers crucial insight into its operational focus and strategic direction. This mission statement, as inferred, encapsulates the essence of MPT's business model and its commitment to the healthcare sector.

The MPT mission places healthcare providers, specifically hospital operators, at the forefront. This customer-centric approach is a cornerstone of MPT's operations, guiding its investment decisions and relationship management strategies. This focus helps define Brief History of MPT and its future.

MPT's primary function is to provide capital through real estate investments. This is achieved mainly through acquiring and developing net-leased hospital facilities. As of the latest reports, MPT's portfolio includes approximately 440 properties with a combined value of around $20 billion, showcasing its significant role in the healthcare real estate market.

While the MPT mission is focused, its scope is global. MPT's portfolio is spread across the United States, Europe, and other international markets. This diversification helps mitigate risks and provides opportunities for growth. The company's international presence is a key element of its long-term strategy.

A unique value proposition within the MPT mission is its role in enabling healthcare providers to improve patient care. By providing capital and real estate solutions, MPT allows providers to focus on their core mission. This is a critical element of MPT's strategic goals.

The MPT mission emphasizes the provision of innovative real estate solutions. This could include sale-leaseback transactions, which allow operators to unlock the value of their real estate assets. This is a key component of how MPT aligns its core values with its mission.

Building long-term relationships with tenants is another key aspect of the MPT mission. This approach goes beyond simply being a landlord, focusing on providing ongoing support. This commitment to long-term relationships is crucial for sustained success.

The MPT mission, therefore, is not just a statement of intent but a guiding principle that shapes its business practices and strategic decisions. Understanding the MPT mission is fundamental for anyone seeking to analyze the company's performance, investment potential, or its role within the healthcare real estate landscape. The MPT mission is a driving force behind the company's commitment to its vision.

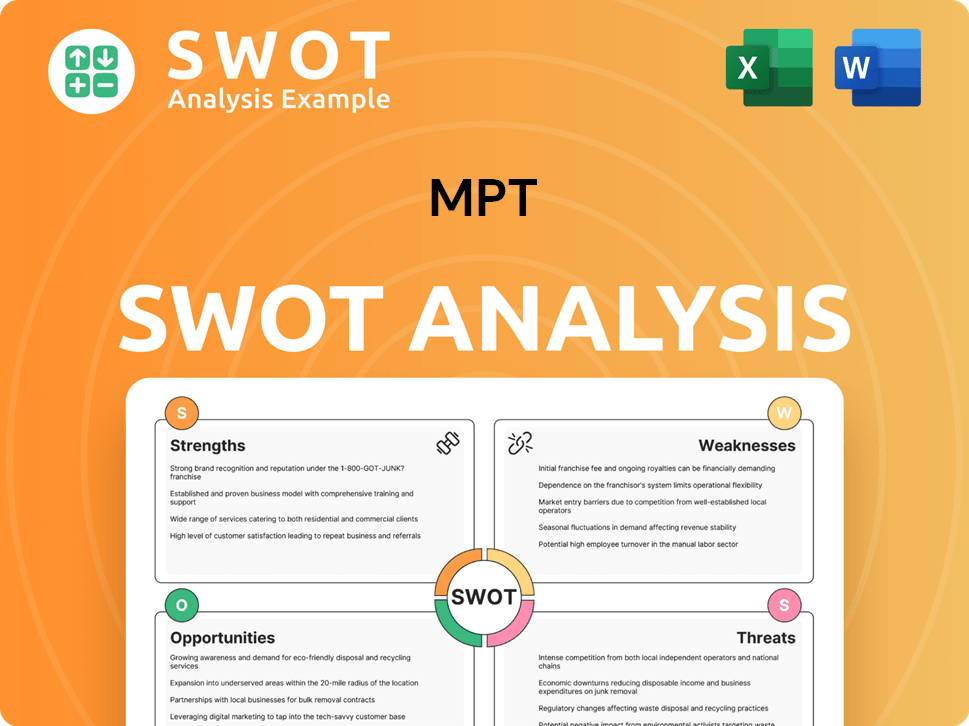

MPT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Vision: What is MPT Vision Statement?

MPT's vision is 'to be the premier global source of capital for hospitals, facilitating the sustainable delivery of high-quality healthcare across diverse international markets.'

Delving into the Owners & Shareholders of MPT, understanding the company's vision is crucial for investors and stakeholders alike. The MPT vision statement provides a clear roadmap for the company's future, outlining its aspirations and strategic direction. This vision is not merely a statement; it's a commitment to leading the healthcare real estate market globally.

The MPT vision is distinctly future-focused. It projects a future where MPT is the leading provider of capital for hospitals worldwide. This forward-thinking approach is essential for long-term growth and sustainability in the dynamic healthcare sector.

The vision explicitly targets market leadership, aiming to be the 'premier global source of capital.' This ambitious goal underscores MPT's intent to dominate the international market for hospital real estate financing and investment.

The vision's international scope is evident in its focus on 'diverse international markets.' This highlights MPT's commitment to expanding its footprint and impact across various global healthcare landscapes. This is crucial for understanding MPT's strategic goals.

While aspirational, the vision is grounded in reality. MPT's current position as a significant global owner of hospital real estate, with a portfolio of 393 facilities and approximately 39,000 licensed beds across nine countries as of March 31, 2025, provides a solid foundation for achieving this vision.

The emphasis on 'sustainable delivery of high-quality healthcare' aligns with the growing importance of sustainability in the healthcare sector. This focus positions MPT to capitalize on the increasing demand for environmentally and socially responsible investments. Addressing MPT Myanmar and other markets is key.

Despite challenges, such as tenant issues, MPT's proactive measures, including re-tenanting properties, demonstrate a commitment to stabilizing its portfolio and pursuing its long-term vision. This approach is vital for understanding the MPT company profile.

The MPT mission is supported by its vision, guiding the company's actions and decisions. The MPT core values further reinforce this commitment, ensuring that the company operates with integrity and a focus on long-term value creation. Understanding these elements is crucial for anyone seeking to analyze or invest in MPT. For instance, examples of MPT's core values in action can be seen in their sustainable healthcare initiatives.

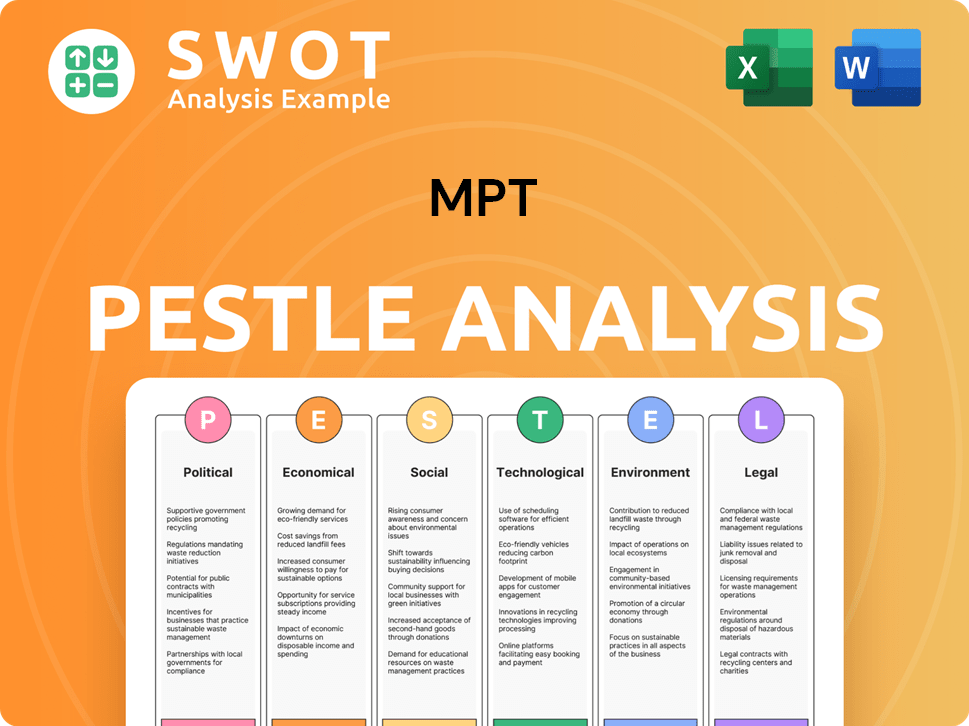

MPT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Values: What is MPT Core Values Statement?

Understanding the core values of Medical Properties Trust (MPT) is crucial to grasping its operational philosophy and strategic direction. These values shape MPT's approach to investments, partnerships, and its role within the healthcare real estate sector, ultimately influencing its long-term success.

Integrity is paramount for MPT, demonstrated through transparent financial practices and ethical conduct. As a publicly traded REIT, MPT adheres to strict SEC regulations, ensuring regular and detailed financial disclosures. This commitment builds trust with stakeholders, including hospital operators, fostering strong, lasting partnerships.

MPT prioritizes sustainable, long-term investments in healthcare facilities, reflecting its commitment to long-term value creation. The company’s strategy centers on acquiring properties with long-term net leases, which provide stable and predictable cash flows. This focus on the enduring need for hospital infrastructure underscores this core value.

MPT emphasizes collaboration with hospital operators, fostering mutual success through a partnership-driven approach. This involves working closely with operators to understand their specific needs and providing tailored support, going beyond a simple landlord-tenant relationship. This collaborative model is key to MPT's operational strategy.

Financial discipline is a cornerstone of MPT's operations, encompassing prudent capital allocation and rigorous risk management. This is evident in its meticulous underwriting process for acquisitions and its efforts to maintain a robust balance sheet. Recent financial actions, such as the $2.5 billion senior secured notes offering in February 2025, demonstrate this commitment to financial stability.

These MPT core values distinguish the company by highlighting its specialized focus on healthcare real estate and its emphasis on collaborative, long-term partnerships. Understanding these values provides a foundation for assessing MPT's strategic direction and its commitment to supporting the essential function of healthcare. Now, let's explore how MPT's mission and vision influence its strategic decisions.

How Mission & Vision Influence MPT Business?

MPT's mission and vision are not merely aspirational statements; they are the cornerstones that shape its strategic direction and operational decisions. These guiding principles directly influence how MPT allocates capital, manages its portfolio, and navigates the complexities of the healthcare real estate market.

The MPT mission to be a leading capital partner and the MPT vision of being a premier global source of capital for hospitals profoundly impact its investment strategy. This focus is evident in their acquisition of net-leased hospital facilities worldwide.

- Acquisition and Development: MPT prioritizes acquiring and developing net-leased hospital facilities, aligning with its vision to be a premier capital source.

- Global Expansion: The company's growth from a few hospitals to hundreds across multiple countries exemplifies its mission-driven expansion. As of March 31, 2025, MPT had investments in 393 facilities across nine countries.

- Financial Performance: The company's total assets have grown significantly, from $8.8 billion at year-end 2018 to approximately $14.9 billion at March 31, 2025, demonstrating the effectiveness of its mission-aligned investment strategies.

MPT's mission and vision guide its approach to partnerships and acquisitions. They prioritize relationships with high-caliber operators, ensuring the long-term success of their investments.

The company's response to industry challenges, such as tenant financial difficulties, is shaped by its mission and core values. This includes strategic asset sales and re-tenanting efforts.

In 2024, MPT completed approximately $5.5 billion of asset monetization transactions, demonstrating its proactive approach to maintaining financial health and adapting to market conditions. This aligns with its commitment to protecting investments and ensuring continued healthcare delivery.

MPT's weighted average lease and loan maturity of 16.8 years as of Q1 2025 underscores its commitment to long-term investments. This strategic focus is a direct result of its mission and vision.

Edward K. Aldag, Jr., Chairman, President, and CEO, emphasizes the importance of their strategy in creating long-term value through profitable investments in hospital real estate. His insights highlight how the team's expertise and passion for the hospital landscape are crucial for success.

The alignment between MPT's mission, vision, and strategic actions is evident in its financial performance and operational decisions. This ensures that the company remains focused on its core objectives.

The influence of the MPT mission and MPT vision on the company's strategic decisions is undeniable, driving its investment choices, operational strategies, and overall financial performance. Understanding how MPT’s core values translate into action is crucial for appreciating its long-term growth potential. For a deeper dive into MPT's strategic approach, consider reading about the Marketing Strategy of MPT. Next, we will explore the MPT core values and how these principles are continuously refined to support the company's mission and vision.

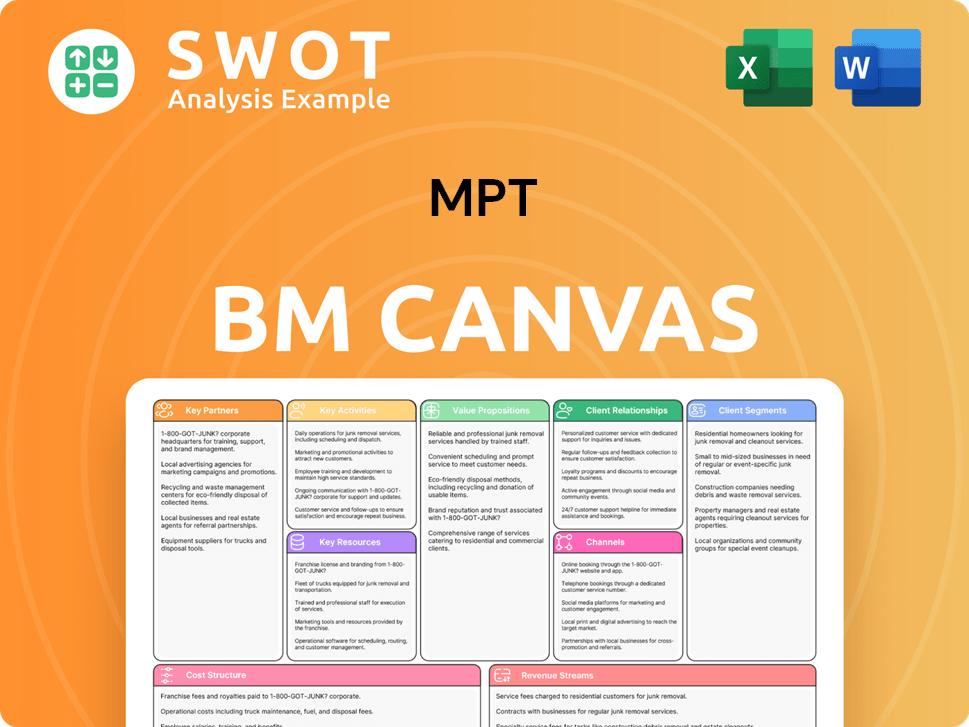

MPT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Mission & Vision Improvements?

While MPT's current mission and vision provide a foundation, strategic refinements can enhance their alignment with evolving market dynamics and stakeholder expectations. These improvements aim to strengthen MPT’s position in the market and foster long-term growth.

Explicitly incorporating environmental, social, and governance (ESG) principles into MPT's mission and vision would demonstrate a stronger commitment to sustainability and social responsibility. This could attract socially conscious investors and partners, potentially leading to more favorable financing terms and enhanced brand reputation. For instance, companies with strong ESG ratings often experience lower cost of capital; recent data shows a 10-20% reduction in borrowing costs for companies with high ESG scores.

Refining the mission and vision to address the impact of emerging technologies in healthcare delivery is crucial. This would position MPT as a forward-thinking partner, attracting innovative healthcare operators and aligning with the rapid advancements in areas like telehealth and remote patient monitoring, which are projected to grow significantly in the coming years. The global telehealth market is expected to reach $636.3 billion by 2028, according to a report by Grand View Research.

Adapting the mission and vision to reflect the shift towards outpatient care and changing consumer preferences is essential for long-term resilience. This could involve emphasizing the provision of modern, accessible healthcare facilities that cater to the evolving needs of patients. The outpatient healthcare market is experiencing substantial growth, with a projected value of $1.7 trillion by 2027, according to a report by MarketsandMarkets.

To improve stakeholder understanding and guide strategic decision-making, MPT should consider refining its mission, vision, and core values to be more clear and specific. This could involve providing concrete examples of how MPT will achieve its goals, which will help to align internal efforts and communicate the company's purpose more effectively. For a deeper dive into MPT's financial structure, consider reading Revenue Streams & Business Model of MPT.

How Does MPT Implement Corporate Strategy?

Implementing a company's mission, vision, and core values is crucial for translating strategic intent into tangible actions and outcomes. This section examines how MPT, a real estate investment trust (REIT) specializing in healthcare facilities, brings its stated principles to life through its business practices.

MPT's mission, What is the mission of MPT company, to be a capital partner enabling exceptional patient care, is directly reflected in its acquisition and development process. They focus on identifying and partnering with hospital operators who require capital for growth and operational improvements. This approach ensures that their investments align with their mission and contribute to the provision of essential healthcare services.

- Strategic Partnerships: MPT actively seeks out partnerships with established hospital operators, providing them with the financial resources needed for expansion, facility upgrades, and technological advancements.

- Due Diligence: Before any investment, MPT conducts rigorous due diligence to assess the financial viability of the operator, the quality of care provided, and the long-term sustainability of the healthcare facility.

- Capital Allocation: MPT strategically allocates capital to projects and operators that align with its mission and vision. This includes investments in both existing facilities and new developments.

- Portfolio Diversification: MPT maintains a diversified portfolio of healthcare properties across various geographic locations and healthcare service lines to mitigate risk and ensure long-term stability.

Leadership plays a vital role in reinforcing MPT's mission and vision. CEO Edward K. Aldag, Jr. consistently emphasizes the company's core strategy and the importance of its relationships with operators. This consistent messaging helps align employees, investors, and other stakeholders with the company's goals.

MPT's commitment to transparency is evident through its regular SEC filings, investor presentations, and earnings calls. This open communication demonstrates the company's adherence to its stated principles and provides stakeholders with the information needed to assess its performance and strategy.

MPT's response to challenges, such as the issues with tenant Steward Health Care, showcases its commitment to its core values. Actions taken to regain control of properties and re-tenant them with new operators demonstrate financial discipline and commitment to healthcare.

MPT's focus on environmental sustainability, as detailed in its Corporate Responsibility Report, demonstrates its commitment to its values. While the majority of their leases are triple-net, MPT engages in dialogue with tenants on sustainability matters. This proactive approach aligns with MPT's long-term vision for Myanmar and the broader trend towards responsible investing.

To measure the effectiveness of its implementation, MPT tracks several key metrics. These include occupancy rates, rent collection rates, same-store net operating income (NOI) growth, and the number of new acquisitions. These metrics provide insights into the company's financial performance and its ability to achieve its strategic goals.

- Occupancy Rate: High occupancy rates indicate strong demand for MPT's properties and the effectiveness of its tenant relationships.

- Rent Collection Rate: Consistent rent collection is crucial for maintaining financial stability and generating returns for investors.

- Same-Store NOI Growth: This metric measures the organic growth of the portfolio, excluding the impact of new acquisitions.

- Acquisition Volume: The number and quality of new acquisitions reflect MPT's ability to execute its growth strategy.

MPT faces challenges in implementing its mission and vision, including managing tenant relationships, navigating regulatory changes, and adapting to evolving healthcare trends. However, these challenges also present opportunities for growth and innovation. For example, MPT can leverage its expertise to identify and invest in emerging healthcare sectors, such as outpatient facilities and behavioral health centers. Furthermore, understanding the Competitors Landscape of MPT can help the company to refine its strategies.

- Tenant Risk: MPT's financial performance is directly tied to the success of its tenants. Managing tenant risk is crucial for maintaining a stable portfolio.

- Regulatory Changes: The healthcare industry is subject to constant regulatory changes. MPT must adapt to these changes to ensure compliance and maintain its competitive advantage.

- Market Trends: Shifts in healthcare delivery models and patient preferences can impact MPT's business. The company must stay ahead of these trends to remain relevant.

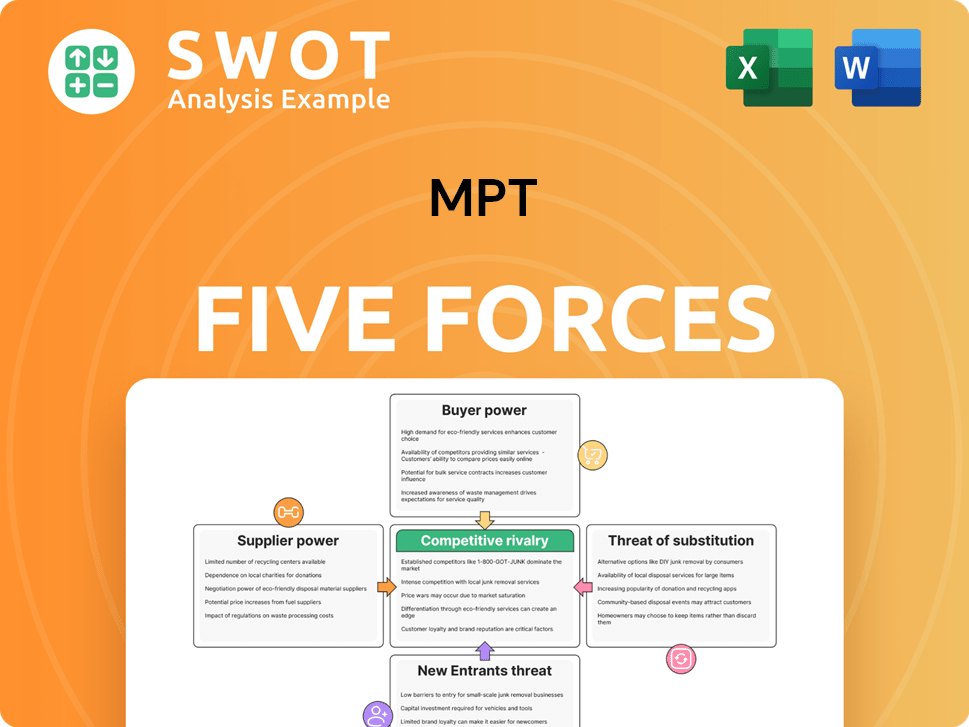

MPT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of MPT Company?

- What is Competitive Landscape of MPT Company?

- What is Growth Strategy and Future Prospects of MPT Company?

- How Does MPT Company Work?

- What is Sales and Marketing Strategy of MPT Company?

- Who Owns MPT Company?

- What is Customer Demographics and Target Market of MPT Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.