MPT Bundle

Can Medical Properties Trust (MPT) Maintain Its Growth Trajectory?

Medical Properties Trust (MPT) has revolutionized healthcare real estate since its inception in 2003, becoming a major player in the global market. Its unique financing model has allowed it to amass a vast portfolio of hospital properties across multiple continents. But what does the future hold for this healthcare REIT?

This analysis provides a comprehensive look at MPT's strategic initiatives and financial planning, essential for understanding its MPT SWOT Analysis. We will explore MPT's growth strategy, dissecting its expansion plans, innovative approaches, and the challenges it faces. Understanding MPT's future prospects is crucial for investors, analysts, and anyone interested in the evolving landscape of healthcare real estate.

How Is MPT Expanding Its Reach?

The company's growth strategy centers on strategic acquisitions and diversification to expand its portfolio. This approach focuses on acquiring net-leased hospital facilities. The goal is to broaden its tenant base and reduce the impact of regional economic fluctuations.

Geographic and property type diversification are key elements of the company's expansion. It aims to spread risk and access various revenue streams. This includes exploring new international markets with strong healthcare demand and stable regulatory environments. The company also focuses on various hospital property types.

The company actively seeks to expand its presence in the healthcare real estate sector. This includes a focus on acquiring properties and engaging in sale-leaseback transactions. These transactions help hospital operators convert real estate into working capital. The company's disciplined underwriting approach ensures that new properties align with its long-term financial goals.

The company is expanding its global footprint to include new markets. It focuses on areas with strong healthcare demand and stable regulations. This diversification helps reduce risk and provides access to diverse revenue streams. The company has a significant presence in the United States, Europe, Australia, and South America.

The company diversifies its property types within the hospital sector. This includes acute care hospitals, long-term acute care hospitals, inpatient rehabilitation hospitals, and behavioral health facilities. This strategy allows the company to cater to a wider range of healthcare needs. It also capitalizes on various growth segments within the industry.

The company engages in sale-leaseback transactions as a core part of its business model. These transactions enable hospital operators to convert their real estate into working capital. This approach supports the company's expansion by providing capital for acquisitions and growth.

The company targets significant acquisition volumes to expand its asset base and strengthen its market leadership. A disciplined approach to underwriting potential acquisitions ensures that new properties align with long-term financial objectives. This strategy supports the company's Mission, Vision & Core Values of MPT.

The company's strategic plan includes geographic expansion and property type diversification to enhance its portfolio. The focus is on acquiring net-leased hospital facilities and engaging in sale-leaseback transactions. These initiatives are crucial for the company's growth and market position.

- Acquiring net-leased hospital facilities in new and existing markets.

- Diversifying property types within the hospital sector.

- Engaging in sale-leaseback transactions to support hospital operators.

- Maintaining a disciplined approach to underwriting acquisitions.

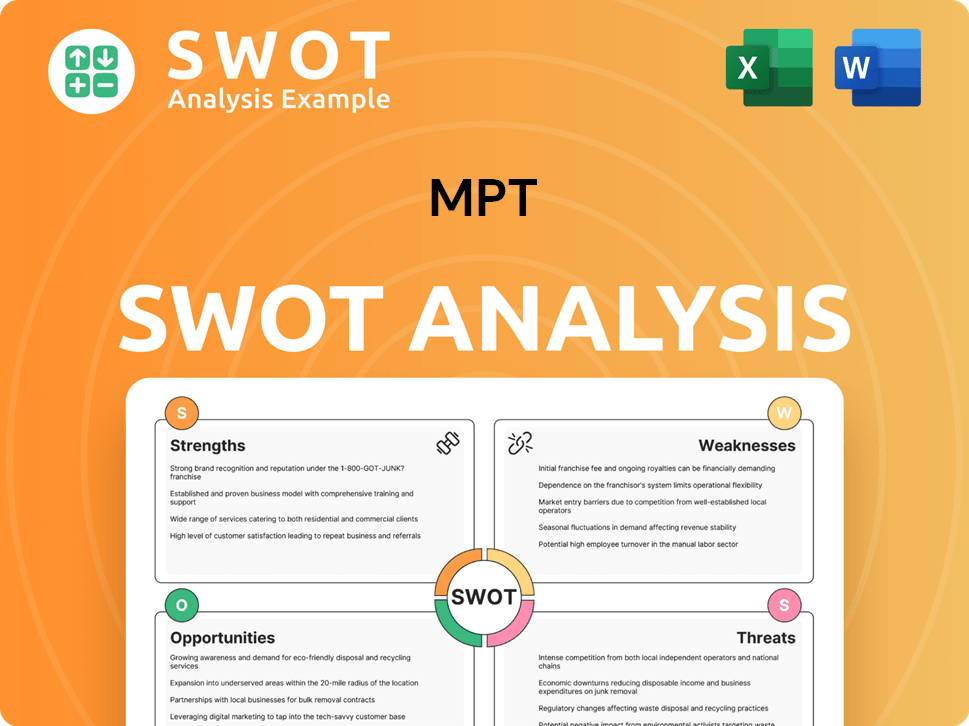

MPT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does MPT Invest in Innovation?

The company's innovation and technology strategy centers on enhancing operational efficiency and improving its value proposition for hospital operators. This approach involves leveraging data-driven insights and technology adoption to optimize asset management and tenant relations. The focus is on supporting the healthcare sector's evolution through strategic investments.

The company's strategy includes investing in advanced property management systems to streamline operations, improve reporting, and provide detailed data on portfolio performance. Digital transformation enables more effective asset management, tenant relations, and risk assessment. It also uses data analytics to identify emerging trends in healthcare delivery and real estate, informing acquisition strategies.

While the company doesn't directly engage in medical technology R&D, it indirectly supports innovation within the healthcare sector. This support comes through providing the capital infrastructure that allows hospital operators to invest in cutting-edge medical equipment, advanced treatment modalities, and digital health initiatives. This indirect support reinforces the long-term viability of the company's real estate assets.

The company uses data analytics to identify high-growth areas and property types within the healthcare sector. This includes analyzing healthcare demographics, patient needs, and regulatory changes. This proactive approach allows for strategic market entry decisions.

Investments in advanced property management systems streamline operations and improve reporting. These systems provide granular data on portfolio performance. This digital transformation enhances asset management, tenant relations, and risk assessment.

The company is committed to sustainability initiatives, such as energy-efficient building upgrades and green certifications. These efforts enhance asset value and align with global environmental, social, and governance (ESG) standards. This demonstrates a forward-thinking approach.

The company provides capital infrastructure that allows hospital operators to invest in cutting-edge medical equipment. This indirect support contributes to the overall advancement of healthcare. This approach reinforces the long-term viability of the company's real estate assets.

The primary focus is on optimizing operational efficiency through data-driven insights and technology adoption. This includes streamlining operations and improving reporting. This approach enhances the value proposition for hospital operators.

The company's commitment to sustainability initiatives helps enhance asset value. This includes energy-efficient building upgrades and green certifications. These efforts align with ESG standards.

The company's technology strategy is multifaceted, focusing on both internal efficiencies and external support for the healthcare sector. This involves leveraging data analytics, implementing advanced property management systems, and supporting healthcare providers' technological advancements.

- Data Analytics: The company utilizes data analytics to identify emerging trends in healthcare delivery and real estate. This informs acquisition strategies and market entry decisions, ensuring alignment with high-growth areas and property types.

- Property Management Systems: Investments in advanced property management systems streamline operations, improve reporting, and provide detailed data on portfolio performance. This digital transformation enables more effective asset management, tenant relations, and risk assessment.

- Sustainability Initiatives: The company is committed to sustainability through energy-efficient building upgrades and green certifications. These initiatives enhance asset value and align with global ESG standards.

- Indirect Support for Healthcare Innovation: By providing the capital infrastructure for hospital operators, the company indirectly supports investments in cutting-edge medical equipment, advanced treatment modalities, and digital health initiatives. This contributes to the overall advancement of healthcare.

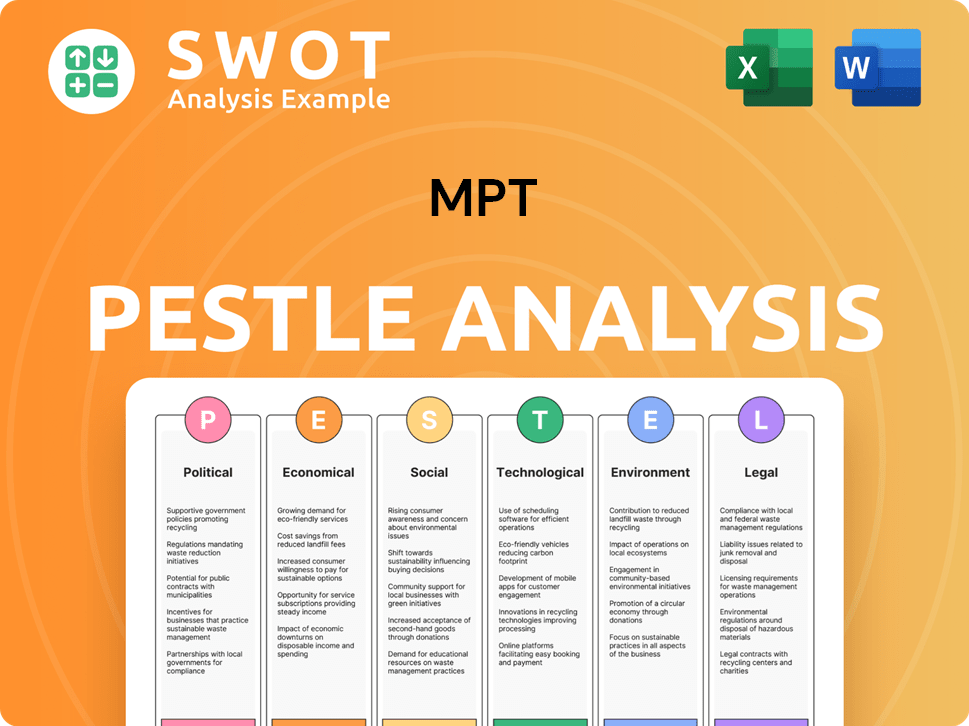

MPT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is MPT’s Growth Forecast?

The financial outlook for Medical Properties Trust (MPT) is supported by its stable, long-term net leases and a disciplined approach to capital allocation. The company aims for consistent revenue growth, driven by increasing lease payments and strategic portfolio expansion. MPT's ability to secure long-term leases with creditworthy hospital operators is crucial to its financial stability and predictable cash flows, which is a key aspect of its MPT growth strategy.

For the first quarter of 2024, MPT reported a normalized funds from operations (FFO) of $0.24 per diluted share. This performance sets a baseline for the year, with the company focusing on optimizing its portfolio and managing its debt to maintain financial health. The company's financial ambitions are centered on generating attractive risk-adjusted returns for its shareholders, supported by its diversified portfolio and the essential nature of healthcare services. The company's financial performance is closely monitored by analysts, with a consensus around its ability to generate stable income through its specialized real estate model.

MPT's financial strategy includes managing its debt maturity profile and exploring various capital-raising avenues to fund future acquisitions and reduce leverage. As of March 31, 2024, MPT reported total assets of approximately $18.3 billion. These financial strategies are critical to understanding the MPT future prospects, particularly in the context of its long-term growth plans. The company's focus on financial stability and strategic growth is a key factor in its overall success.

MPT's financial health is reflected in key metrics such as FFO and total assets. The company's ability to maintain strong occupancy rates and secure long-term leases is crucial for its financial stability. These metrics are essential for evaluating the MPT company's performance and future potential.

MPT actively manages its debt maturity profile and explores capital-raising options to fund acquisitions and reduce leverage. These strategies are vital for maintaining financial flexibility and supporting long-term growth. Effective capital allocation is a key component of MPT's financial strategy.

The company aims for consistent revenue growth through escalating lease payments and strategic portfolio expansion. These initiatives support the company's long-term financial goals and enhance shareholder value. This approach is critical for sustained growth.

The company's guidance for full-year 2024 normalized FFO is projected to be in the range of $0.62 to $0.72 per diluted share. This projection reflects ongoing efforts to optimize its portfolio and manage its debt. This guidance provides a clear view of the company's financial expectations.

MPT's financial performance is closely monitored by analysts, with a consensus around its ability to generate stable income. The company's focus on generating attractive risk-adjusted returns for its shareholders is supported by its diversified portfolio and the essential nature of healthcare services. For more insights into the company's strategic approach, consider reading about the Marketing Strategy of MPT.

- $0.24 normalized FFO per diluted share for Q1 2024.

- Total assets of approximately $18.3 billion as of March 31, 2024.

- Full-year 2024 normalized FFO projected between $0.62 and $0.72 per diluted share.

- Focus on managing debt maturity and exploring capital-raising options.

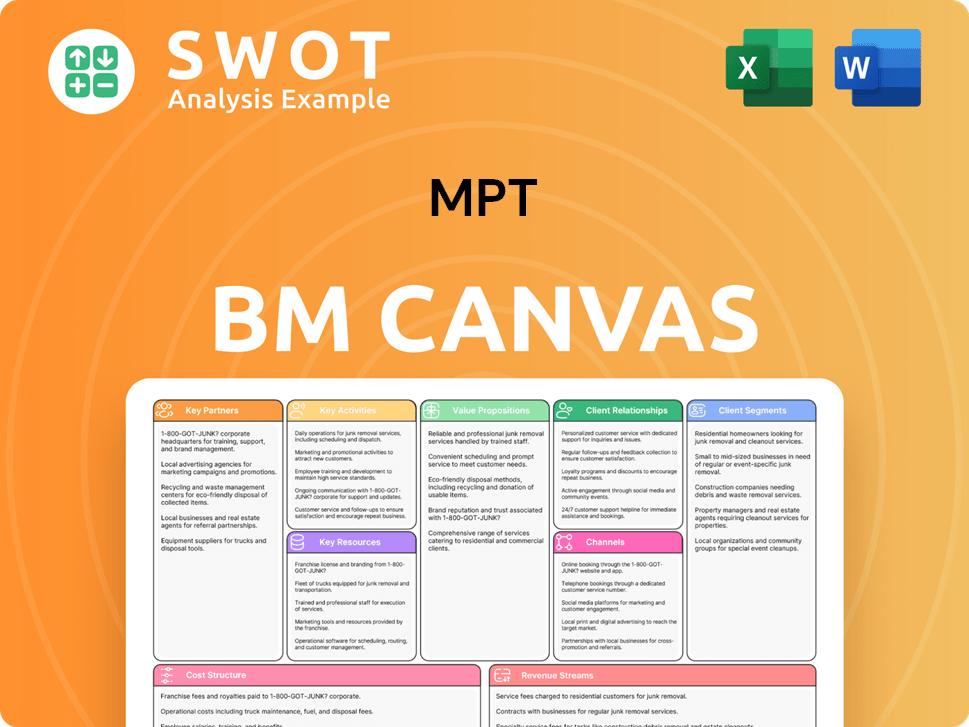

MPT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow MPT’s Growth?

The company faces several potential risks and obstacles that could affect its growth. These challenges range from market competition and regulatory changes to supply chain issues and technological disruptions. The company's ability to navigate these risks is crucial for its long-term success and maintaining its position in the healthcare real estate market.

Market competition from other healthcare REITs and private equity firms is a constant challenge, potentially increasing acquisition costs and lowering yields. Regulatory shifts in the healthcare industry, such as changes in reimbursement policies or licensing requirements, could negatively impact the financial health of the company's tenants, affecting their ability to meet lease obligations. Therefore, a proactive approach to risk management is essential.

Internal operational risks, such as managing a large and diverse global portfolio, also require robust oversight. The company must address currency fluctuations, political instability in international markets, and tenant-specific challenges. The company mitigates these risks through careful tenant selection, geographic diversification, and active portfolio management.

Increased competition from other healthcare REITs and private equity firms can drive up acquisition costs. This could compress yields, making it harder to find profitable investment opportunities. The company must remain competitive to secure favorable deals and maintain its growth trajectory within the healthcare real estate sector.

Changes in healthcare regulations, such as shifts in reimbursement policies, can significantly impact the financial stability of the company's tenants. These changes could affect their ability to meet lease obligations. The company needs to monitor regulatory developments closely and adapt its strategies accordingly.

Supply chain issues, although not directly impacting the company's real estate, can affect the operational efficiency of its hospital tenants. This could indirectly pose a risk to lease payments. The company needs to understand and prepare for potential disruptions affecting its tenants.

Technological advancements, such as the rise of telehealth, could alter the demand for traditional hospital facilities. This requires the company to develop adaptive strategies. The company must stay ahead of these changes to ensure its properties remain relevant and profitable.

Managing a vast and globally diversified portfolio demands robust operational oversight. This includes addressing currency fluctuations and political instability. The company must have strong risk management frameworks in place to protect its investments and ensure consistent returns. As discussed in Owners & Shareholders of MPT, understanding these challenges is vital for long-term success.

Tenant bankruptcies or operational difficulties can directly impact lease payments and property stability. The company's proactive asset management is critical for working with tenants. This helps ensure continued lease payments and property stability, protecting the company's financial performance.

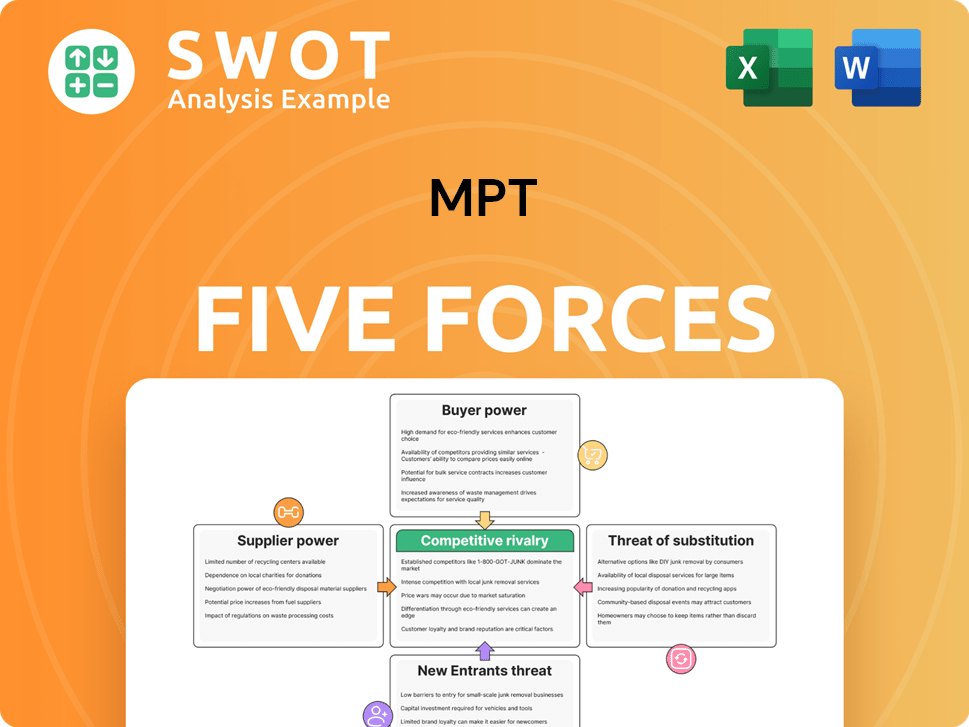

MPT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.