MPT Bundle

How Does MPT Company Shape Healthcare Real Estate?

Medical Properties Trust (MPT) is a key player in healthcare real estate, focusing on hospital facility ownership and financing. In a constantly evolving healthcare landscape, MPT’s model of acquiring and developing net-leased hospital facilities makes it a crucial partner for hospital operators. This innovative approach allows healthcare providers to free up capital for operational improvements and patient care.

Delving into MPT's operations is crucial for anyone seeking to understand the dynamics of healthcare finance and real estate investment. This examination will explore the core mechanisms driving MPT's profitability and strategic framework. For those interested in a deeper dive, consider exploring the MPT SWOT Analysis to gain further insights into the company's strengths, weaknesses, opportunities, and threats.

What Are the Key Operations Driving MPT’s Success?

The core operations of the company center on acquiring, developing, and leasing hospital facilities, primarily through long-term net leases. This approach allows the company to provide financing solutions for hospital operators, enabling them to unlock the value of their real estate assets. Its focus is on a diverse range of hospital operators, including acute care hospitals, rehabilitation hospitals, and behavioral health facilities across various geographic markets.

The company's value proposition lies in its ability to provide a specialized financing model tailored to the healthcare industry. This model helps hospital operators convert real estate into working capital, which can be used for strategic initiatives such as facility upgrades, technology investments, or debt reduction. This focus on a specific niche within the real estate market allows for a deep understanding of the unique needs of hospital operators.

The operational process typically begins with identifying and acquiring hospital properties, often through sale-leaseback transactions. In these transactions, the company purchases a hospital's real estate and leases it back to the original operator. This allows hospital operators to convert illiquid real estate assets into working capital.

Extensive due diligence is conducted on potential acquisitions, evaluating the financial health of the hospital operator and the long-term viability of the local healthcare market. Properties are leased under net lease agreements, where tenant hospital operators are responsible for most operating expenses. This reduces ongoing operational costs and risks for the company.

The supply chain involves sourcing attractive hospital properties and securing long-term lease agreements with reputable operators. Partnerships with various healthcare systems and providers contribute to a stable tenant base. The distribution network is the geographic spread of owned properties, including facilities in multiple countries. The company's specialized focus on hospital real estate differentiates it from generalist REITs.

The company's unique financing model directly benefits hospital operators by enhancing their liquidity. This creates a compelling customer benefit and strong market differentiation. As of late 2024, the company's portfolio includes properties in several countries, diversifying its investments. For more information, you can check out the Owners & Shareholders of MPT.

- Specialized focus on hospital real estate.

- Long-term net lease agreements.

- Geographic diversification.

- Provides financing solutions for hospital operators.

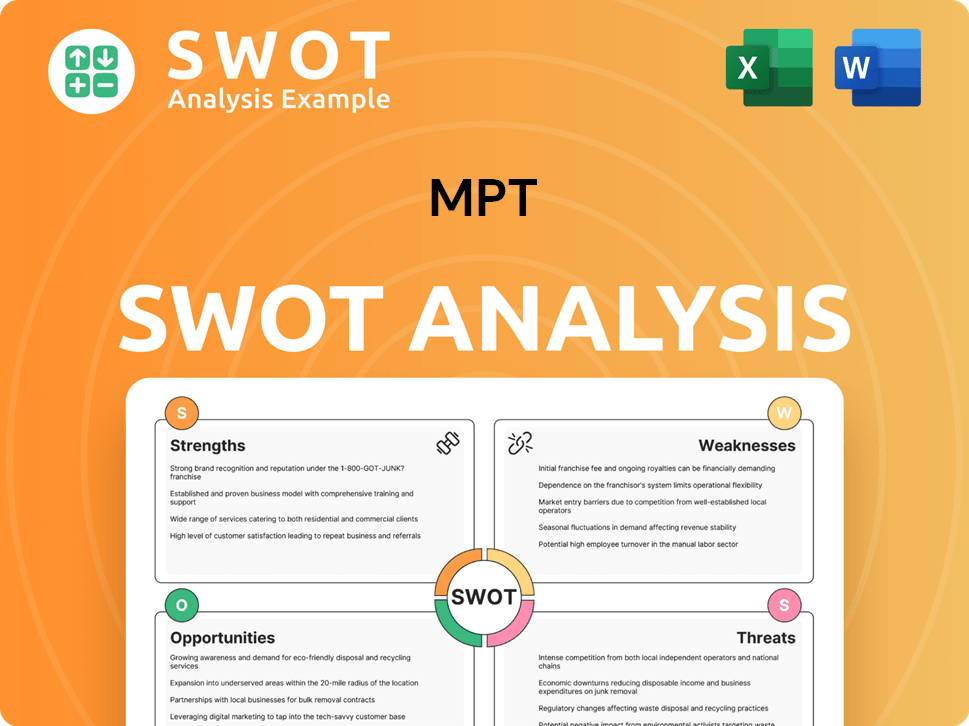

MPT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does MPT Make Money?

The primary revenue stream for Medical Properties Trust (MPT) is derived from rental income generated by its long-term net leases with hospital operators. This model allows MPT to focus on property ownership and leasing while transferring operational responsibilities to its tenants. As of the financial year ending December 31, 2024, MPT's total revenue was approximately $1.32 billion, with the majority stemming from these rental agreements.

The net lease structure is a key monetization strategy for MPT, as it shifts the burden of property operating expenses to the tenants. This approach maximizes MPT's net operating income from its properties, providing a stable and predictable cash flow. MPT's strategy also includes strategic acquisitions and developments, which, once operational, contribute to its rental income base.

Beyond rental income, MPT employs various financing and investment strategies. These include mortgage loans to operators, which generate additional interest income. The company's focus on long-term leases, often spanning 10-20 years with renewal options, ensures consistent revenue streams. MPT's portfolio expansion through strategic acquisitions directly correlates to growth in rental revenue, with ongoing management of its portfolio, including dispositions and new investments, reshaping its revenue profile.

MPT's financial success is heavily reliant on its ability to generate consistent revenue through its long-term net lease agreements with hospital operators. The company's strategy is further enhanced by its geographic diversification and strategic acquisitions, which contribute to its overall revenue growth. For more insights into the competitive landscape, consider the Competitors Landscape of MPT.

- Rental Income: The primary source of revenue comes from long-term net leases with hospital operators.

- Financing and Investments: Generating income through mortgage loans and other investment structures.

- Strategic Acquisitions: Expanding the property portfolio to increase rental income.

- Geographic Diversification: Expanding into international markets to mitigate risks and diversify revenue streams.

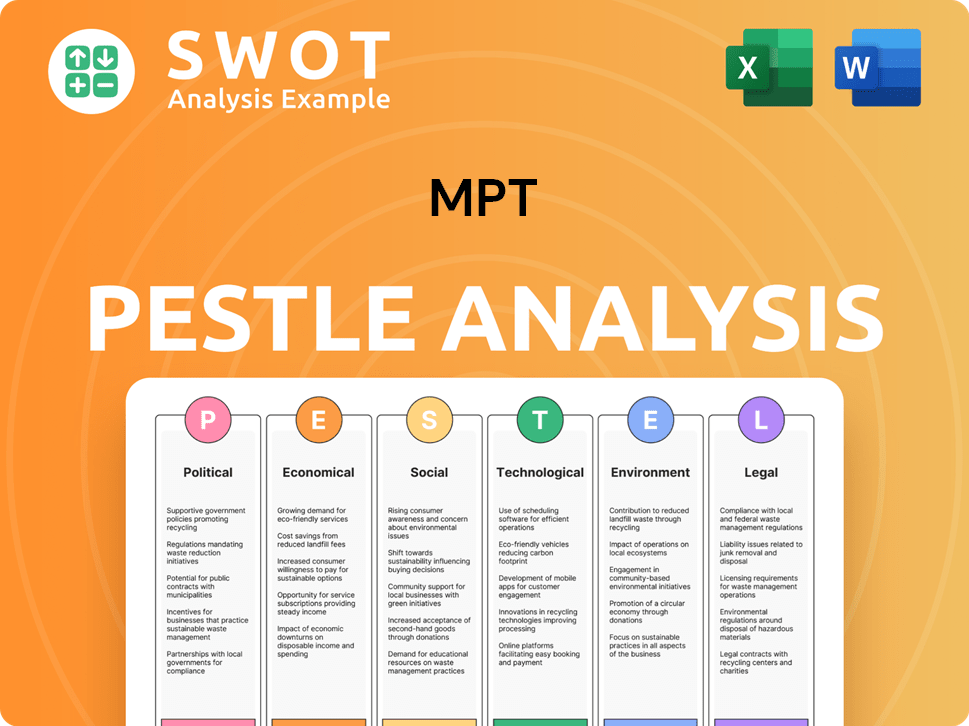

MPT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped MPT’s Business Model?

The journey of Medical Properties Trust (MPT company) has been marked by significant milestones and strategic decisions that have shaped its trajectory in the healthcare real estate sector. From its inception, MPT has focused on a specialized niche, which has allowed it to build a strong portfolio and establish a distinct market position. The company’s approach to acquisitions and its financial strategies have been crucial in its growth and ability to navigate the complexities of the healthcare industry.

A pivotal move for MPT was its initial public offering (IPO) in 2005, which provided the necessary capital to pursue its mission of investing in hospital real estate. This initial funding allowed MPT to begin acquiring properties and establish its presence in the market. Over the years, MPT has expanded its portfolio through strategic acquisitions, both domestically and internationally. This growth strategy has been a key driver of its financial performance and market capitalization.

MPT's strategic moves have included diversification into international markets, particularly in Europe. This expansion has helped to mitigate geographic concentration risks and tap into new healthcare markets. The company's focus on sale-leaseback transactions has also been a core part of its business model, providing hospitals with capital while allowing MPT to secure long-term leases. These transactions have been a significant part of MPT’s growth strategy.

MPT's IPO in 2005 provided the initial capital for its real estate investments. The company has consistently expanded its portfolio through strategic acquisitions. International expansion, particularly in Europe, has been a key strategic move.

MPT has focused on sale-leaseback transactions, providing capital solutions for hospitals. Expansion into European markets has diversified its portfolio and reduced geographic risk. These moves have helped MPT adapt to changing market dynamics.

Its specialized focus on hospital real estate gives MPT a distinct advantage. The long-term net lease model provides stable cash flow. MPT offers unique financing solutions that are hard for traditional lenders to replicate.

Managing tenant relationships, especially during financial distress, is a key challenge. Regulatory hurdles and healthcare policy changes require adaptability. MPT must navigate these challenges to maintain portfolio value.

MPT's competitive advantages include its specialized focus, which allows for deeper market insights and specialized underwriting capabilities. The long-term net lease model provides a stable and predictable cash flow. The company's ability to offer unique financing solutions to hospital operators creates a strong competitive moat, which is difficult for traditional lenders to replicate. However, MPT faces challenges such as managing tenant relationships, especially during periods of financial distress for some hospital operators, and navigating regulatory hurdles and changes in healthcare policy. The company has faced scrutiny and challenges related to tenant exposures, requiring active management and restructuring efforts to protect its investments. For more insights, read about the Growth Strategy of MPT.

- Specialized Focus: Provides deeper market insights.

- Long-Term Net Lease Model: Offers stable cash flow.

- Unique Financing Solutions: Creates a strong competitive moat.

- Tenant Relationships: Requires active management.

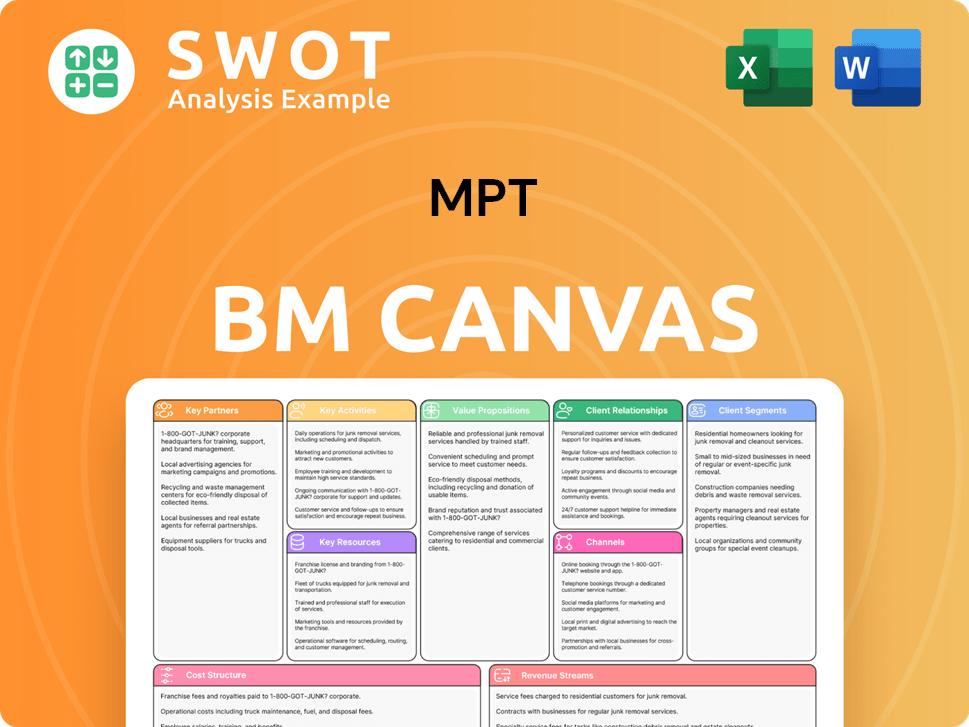

MPT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is MPT Positioning Itself for Continued Success?

Medical Properties Trust (MPT) holds a significant position in the healthcare real estate investment trust (REIT) sector, focusing primarily on hospital facilities. MPT's global footprint, spanning North America, Europe, and Australia, strengthens its market standing compared to more regionally focused competitors. The company's long-term lease agreements and strategic partnerships with hospital operators reflect customer loyalty.

Despite its strong market position, MPT faces several risks, including tenant concentration and economic downturns. Rising interest rates, inflation, and regulatory changes in healthcare can also impact MPT's operations. Technological advancements in healthcare necessitate that MPT's facilities remain adaptable to evolving medical practices.

MPT is a leading player in the hospital-focused REIT niche, competing with other healthcare REITs. Its global presence, including properties across North America, Europe, and Australia, sets it apart. Customer loyalty is evident through long-term lease agreements and partnerships with hospital operators.

Key risks include tenant concentration and economic factors like rising interest rates and inflation. Regulatory changes in healthcare and technological disruptions pose additional challenges. Past issues with certain tenants highlight the impact of tenant concentration risk.

MPT's strategic focus is on portfolio optimization, debt reduction, and disciplined capital allocation. The company is actively involved in asset sales and joint ventures to reduce leverage. Leadership emphasizes strengthening the balance sheet and enhancing shareholder value through a stable dividend.

MPT plans to continue acquiring high-quality hospital properties and leveraging sale-leaseback transactions. The company aims to be a preferred real estate capital partner globally. This strategy capitalizes on the ongoing need for modern healthcare infrastructure and the financial flexibility it provides.

In late 2024 and early 2025, MPT focused on asset sales and joint ventures to reduce debt. Leadership is committed to a stable and growing dividend. The company's strategy supports its role as a real estate capital partner for global hospital operators.

- MPT's focus is on portfolio optimization and debt reduction.

- The company is actively involved in asset sales and joint ventures.

- Leadership is committed to enhancing shareholder value.

- MPT aims to be a preferred capital partner for hospital operators globally.

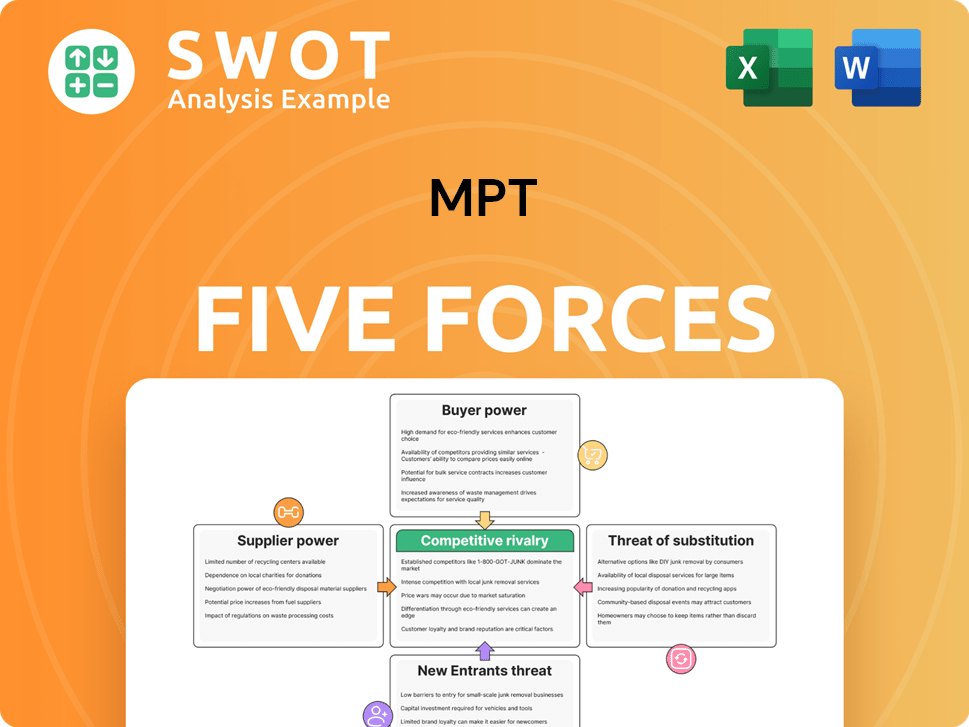

MPT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of MPT Company?

- What is Competitive Landscape of MPT Company?

- What is Growth Strategy and Future Prospects of MPT Company?

- What is Sales and Marketing Strategy of MPT Company?

- What is Brief History of MPT Company?

- Who Owns MPT Company?

- What is Customer Demographics and Target Market of MPT Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.