MPT Bundle

Who Really Owns Medical Properties Trust?

Understanding the MPT SWOT Analysis is just the beginning; the true power lies in knowing who steers the ship. Diving into MPT's ownership unveils its strategic roadmap, governance structure, and the forces shaping its future. Discover the key players and their influence on this healthcare real estate giant.

This exploration into MPT ownership will provide a comprehensive view of the company's structure. From its inception in Birmingham, Alabama, to its current status as a global leader, the MPT company has evolved significantly. Understanding the ownership structure, including major shareholders and historical shifts, is crucial for anyone seeking to understand the MPT ownership and its impact on the company's trajectory. This analysis will cover key aspects, answering questions like "Who owns MPT?" and "What is the ownership structure of MPT?"

Who Founded MPT?

The story of the MPT company begins in August 2003, with Edward K. Aldag, Jr. at the helm as founder. He took on the roles of Chairman, President, and CEO. The early days saw the joining of Emmett E. McLean and R. Steven Hamner, solidifying the founding team.

These founders played active roles in the company's management for many years. Emmett E. McLean, who served as Executive Vice President, Chief Operating Officer, and Secretary, retired in September 2023, after more than two decades of service. R. Steven Hamner has been the Executive Vice President and Chief Financial Officer since September 2003.

The initial ownership structure and specific equity splits aren't publicly detailed. However, the founders, including Aldag, Jr., William G. McKenzie, McLean, and Hamner, personally invested in the early stages. This funding was crucial for building a portfolio of potential acquisitions and preparing for the company's initial funding rounds.

A private placement of common stock in April 2004 was a key early funding event. It generated approximately $233.5 million in net proceeds for the company.

The Initial Public Offering (IPO) on July 7, 2005, marked a significant milestone. The company was listed on the New York Stock Exchange (NYSE) at $10.50 per share.

The IPO successfully raised about $125.7 million in net proceeds for the company. This amount was after deducting underwriting discounts and offering expenses.

These funds from the IPO played a crucial role in financing the company's initial property acquisitions. This helped MPT grow its portfolio.

Edward K. Aldag, Jr. served as the Chairman, President, and CEO. Emmett E. McLean was the Executive Vice President, Chief Operating Officer, and Secretary. R. Steven Hamner held the position of Executive Vice President and Chief Financial Officer.

The founders' personal investment was essential to kickstart the company. It allowed them to build a pipeline of potential acquisitions.

Understanding the MPT history provides a deeper insight into the company's evolution. The initial funding rounds and the IPO were pivotal for MPT's early growth. The founders' commitment and strategic financial decisions set the stage for the company's future expansion and success. As of the latest filings, the company continues to operate with Edward K. Aldag, Jr. at the helm, demonstrating the enduring influence of the founding team.

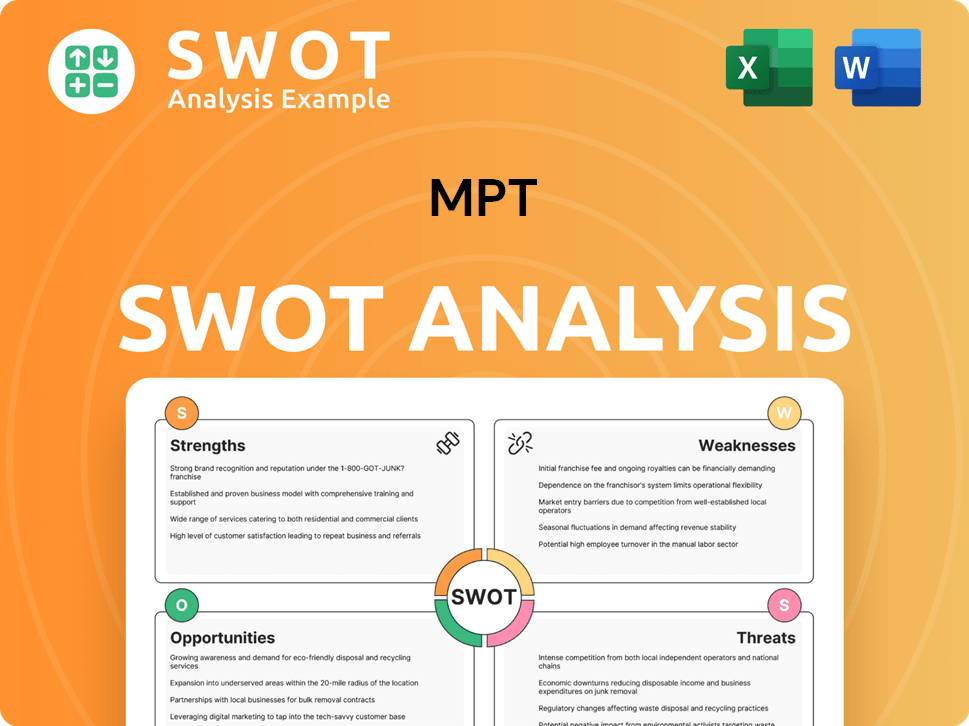

MPT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has MPT’s Ownership Changed Over Time?

The ownership structure of Medical Properties Trust (MPT) has evolved significantly since its initial public offering (IPO) on July 7, 2005. It is structured as a publicly traded Real Estate Investment Trust (REIT), with ownership distributed among numerous shareholders. As of June 12, 2025, the share price was $4.49 per share. The company's market capitalization stood at $2.72 billion as of May 29, 2025.

Key events impacting the MPT ownership structure include major transactions such as the investment in Steward Health Care properties, which began in 2016. This scaled the portfolio but also increased tenant concentration risk. In March 2022, MPT sold a 50% stake in eight Massachusetts hospitals leased to Steward Health Care System to Macquarie Infrastructure Partners V for $1.7 billion, resulting in a 47% gain on the sale of real estate for MPT. More recently, in September 2024, MPT reached a global settlement with Steward Health Care System, its secured lenders, and the Unsecured Creditors Committee, restoring MPT's control over its real estate and facilitating the transition of operations to new operators at 15 hospitals. This transition is expected to generate approximately $160 million in annualized cash rental payments upon stabilization in the fourth quarter of 2026.

| Stakeholder | Percentage of Shares (May 2025) | Shares Held (May 2025) |

|---|---|---|

| Institutional Investors | 60.46% | Not specified |

| Mutual Funds | 49.02% | Not specified |

| Insiders | 2.01% | Not specified |

Major stakeholders in MPT primarily include large institutional investors and individual retail investors. As of May 2025, institutional investors held 60.46% of the shares, while mutual funds held 49.02%. Insiders held 2.01% of the company's shares as of May 2025. Key institutional owners include BlackRock, Inc., holding 13.74% or 82,518,934 shares, and Vanguard Group Inc, holding 12.82% or 76,949,277 shares. For more insights into the company's growth strategy, consider reading Growth Strategy of MPT.

MPT is a publicly traded REIT with a diverse shareholder base, primarily consisting of institutional and retail investors. Key institutional investors hold significant stakes in the company.

- Institutional investors hold the majority of shares.

- The ownership structure has been shaped by significant transactions.

- The company is navigating changes in its tenant relationships.

- The recent settlement with Steward Health Care System is a key development.

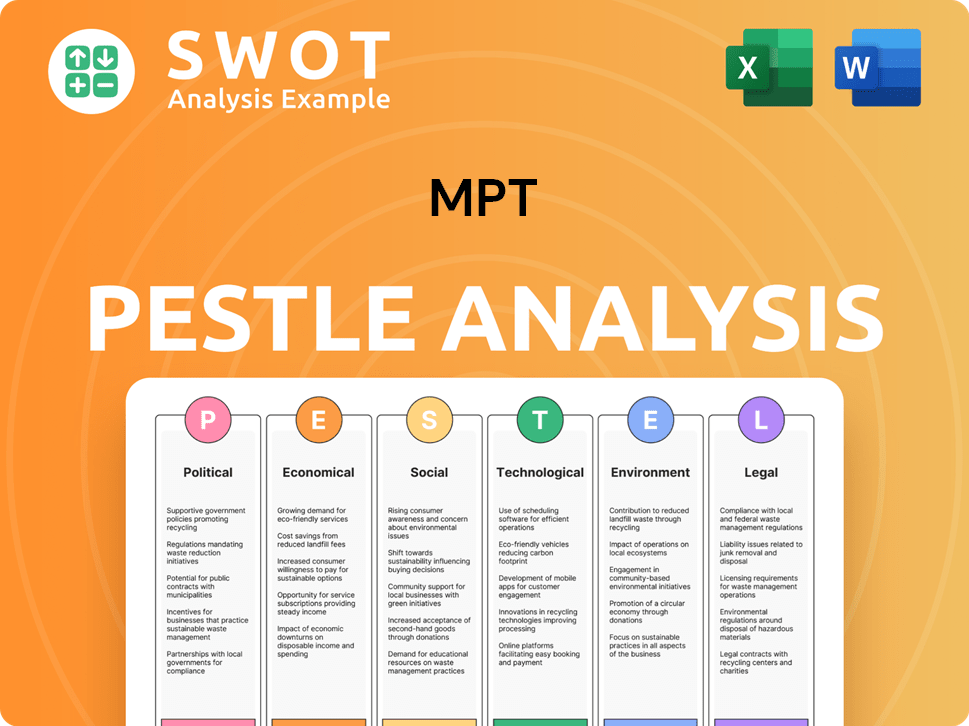

MPT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on MPT’s Board?

As of April 8, 2025, the Board of Directors of Medical Properties Trust (MPT) consisted of 11 members. All directors were nominated for election at the Annual Meeting. The company operates with a single-class board structure, where stockholders vote on the entire board annually. MPT adheres to a majority vote standard and a director resignation policy for uncontested director elections.

Key leadership includes Edward K. Aldag, Jr. as Chairman, President, and CEO, along with R. Steven Hamner as Executive Vice President and CFO. Other directors include Caterina A. Mozingo, Emily W. Murphy, Elizabeth N. Pitman, D. Paul Sparks, Jr., Michael G. Stewart, C. Reynolds Thompson, III, and G. Steven Dawson. Rosa Hooper serves as Executive Vice President, Chief Accounting Officer, Controller, and Treasurer.

| Director | Title | |

|---|---|---|

| Edward K. Aldag, Jr. | Chairman, President, and Chief Executive Officer | |

| R. Steven Hamner | Executive Vice President and Chief Financial Officer | |

| Caterina A. Mozingo | Director | |

| Emily W. Murphy | Director | |

| Elizabeth N. Pitman | Director | |

| D. Paul Sparks, Jr. | Director | |

| Michael G. Stewart | Director | |

| C. Reynolds Thompson, III | Director | |

| G. Steven Dawson | Director | |

| Rosa Hooper | Executive Vice President, Chief Accounting Officer, Controller, and Treasurer |

The voting structure for MPT is straightforward: one share equals one vote. As of the record date of March 27, 2025, there were 350,996,169 shares of common stock outstanding and eligible to vote. There are no indications of special voting rights or other mechanisms that would grant outsized control to specific individuals or entities. For more insights into MPT's business model, consider reading about the Revenue Streams & Business Model of MPT.

Understanding MPT ownership is key for investors. The company's structure ensures that all shareholders have equal voting power, reflecting a standard one-share-one-vote system.

- MPT is a publicly traded company.

- Shareholders vote on the entire board annually.

- The company has a single-class board structure.

- There are no special voting rights.

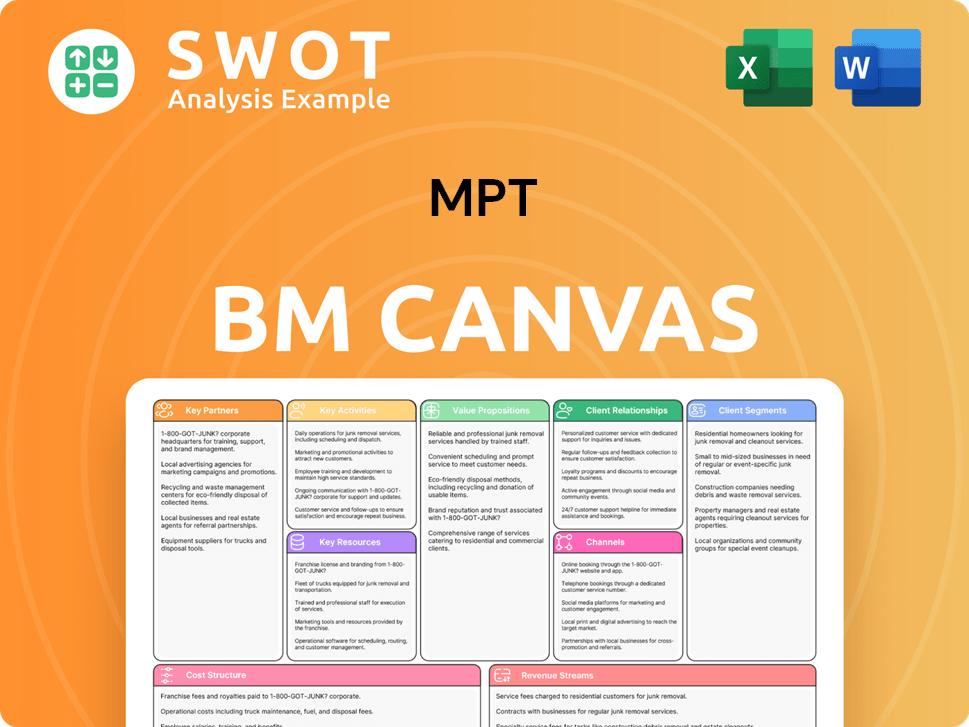

MPT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped MPT’s Ownership Landscape?

Over the past few years, the ownership profile of Medical Properties Trust (MPT) has seen significant shifts, largely driven by efforts to address financial challenges and deleverage. In February 2025, MPT completed approximately $5.5 billion in asset monetization transactions, including a $2.5 billion senior secured notes offering. This offering, which was oversubscribed, highlights investor confidence in MPT's real estate portfolio. The company's strategic moves, including a global settlement agreement with Steward Health Care in September 2024, have reshaped its operational control and financial outlook.

As of March 31, 2025, MPT's total assets were approximately $14.9 billion, with a portfolio encompassing 393 properties. For the first quarter ended March 31, 2025, MPT reported a net loss of ($0.20) per share and Normalized Funds from Operations (NFFO) of $0.14 per share. For the full year 2024, MPT reported a net loss of ($4.02) per share and NFFO of $0.80 per share. These figures reflect the ongoing adjustments within the company's financial structure.

| Metric | Value | Date |

|---|---|---|

| Total Assets | $14.9 billion | March 31, 2025 |

| Properties in Portfolio | 393 | March 31, 2025 |

| Q1 2025 Net Loss per Share | ($0.20) | March 31, 2025 |

| Q1 2025 NFFO per Share | $0.14 | March 31, 2025 |

| 2024 Net Loss per Share | ($4.02) | December 31, 2024 |

| 2024 NFFO per Share | $0.80 | December 31, 2024 |

Industry trends show a continued dominance of institutional ownership in REITs like MPT. As of May 2025, institutional investors held 60.46% of MPT's shares, with mutual funds owning 49.02%. Insider holdings decreased to 2.01% in May 2025. MPT's focus on operator diversification and its European portfolio's performance underscore its strategic approach. For a deeper dive into the company's growth trajectory, you can read about the Growth Strategy of MPT.

Institutional investors hold the majority of MPT shares. Mutual funds are a significant part of the ownership structure. Insider ownership represents a smaller percentage of the total shares.

MPT reported a net loss per share for both Q1 2025 and the full year 2024. The company's NFFO per share was positive in both periods. Asset monetization and debt management are key strategic focuses.

MPT is focused on operator diversification and portfolio growth. The company is committed to accessing capital for accretive growth. European portfolio continues to perform well.

Institutional ownership remains a key component of MPT's shareholder base. The company is actively managing its financial position. MPT's strategic direction is influenced by market conditions.

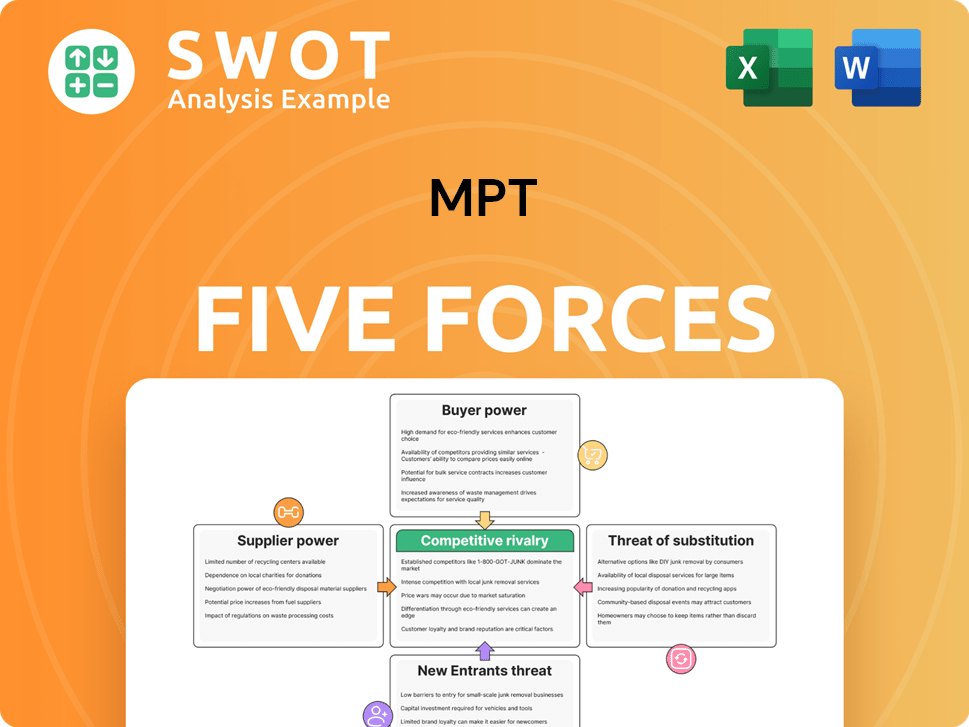

MPT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of MPT Company?

- What is Competitive Landscape of MPT Company?

- What is Growth Strategy and Future Prospects of MPT Company?

- How Does MPT Company Work?

- What is Sales and Marketing Strategy of MPT Company?

- What is Brief History of MPT Company?

- What is Customer Demographics and Target Market of MPT Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.