MPT Bundle

How Does Medical Properties Trust Thrive in the Healthcare REIT Arena?

Medical Properties Trust (MPT) has established itself as a leading player in healthcare real estate, but how does it actually attract and retain clients? This article unveils MPT's unique approach to sales and marketing, exploring the strategies behind its global expansion and sustained growth. We'll analyze the tactics that have allowed MPT to become a 'pure-play' hospital investment strategy and a global force.

From its inception, MPT's MPT SWOT Analysis has been crucial in defining its market position. This analysis will dissect MPT's sales and marketing plan, examining its customer acquisition strategy and brand awareness campaigns. We'll also explore the company's digital marketing strategy and how it navigates challenges, including the competitive landscape, to maintain its market share.

How Does MPT Reach Its Customers?

The primary sales channels for the company are direct and relationship-driven, focusing on acquiring hospital real estate and leasing it back to operators under long-term triple-net leases. This strategy emphasizes direct engagement with healthcare operators, which is crucial for repeat business and deal flow. Professionals like Luke Savage, Vice President and Head of Global Acquisitions, directly engage with hospital owners and operators, showcasing a hands-on approach to sales.

The company's sales strategy has evolved, particularly through international expansion to diversify its portfolio and mitigate risks. As of March 31, 2025, the company's portfolio spans nine countries. The company utilizes its Investor Relations website as a key channel for disclosing information, including press releases and SEC filings, which is vital for stakeholder communication.

Strategic partnerships and exclusive distribution deals are central to the company's growth. The company's model is built on forming strategic partnerships with leading healthcare providers to acquire and develop properties. For example, the company engaged in a partnership with Macquarie Asset Management for eight Massachusetts hospitals and has recently transitioned operations of 17 former Steward hospitals to five new operators, diversifying its rent roll and enhancing tenant quality. These strategic asset sales and re-tenanting efforts, such as the sale of five Utah hospitals to a joint venture with an institutional asset manager in April 2024, generating approximately $1.1 billion in total proceeds, demonstrate how strategic partnerships contribute significantly to growth and market share by providing capital for debt reduction and future investments.

The company's sales strategy relies heavily on direct engagement with healthcare operators. This approach is supported by a dedicated team, including professionals like Luke Savage, who focus on building and maintaining relationships with hospital owners and operators. The emphasis is on long-term partnerships and repeat business.

The company has expanded internationally to diversify its portfolio and reduce risk. As of March 31, 2025, the company's portfolio includes properties in nine countries. This strategic move is aimed at mitigating tenant concentration risks and expanding market reach.

The company uses its Investor Relations website as a key channel for communication and transparency. This includes disclosing material nonpublic information, press releases, and SEC filings. This digital presence supports stakeholder engagement and provides crucial updates.

The company's growth is driven by strategic partnerships with leading healthcare providers. Asset sales and re-tenanting efforts, such as the sale of five Utah hospitals in April 2024, generated approximately $1.1 billion in proceeds. These partnerships provide capital for debt reduction and future investments.

The company's sales channels focus on direct engagement, international expansion, and strategic partnerships. These channels are supported by a strong digital presence and a commitment to transparency. For a comprehensive understanding of the competitive environment, consider exploring the Competitors Landscape of MPT.

- Direct Sales: Building and maintaining relationships with hospital operators.

- Global Diversification: Expanding into international markets to reduce risk.

- Digital Communication: Utilizing the Investor Relations website for transparency.

- Strategic Partnerships: Collaborating with healthcare providers for growth.

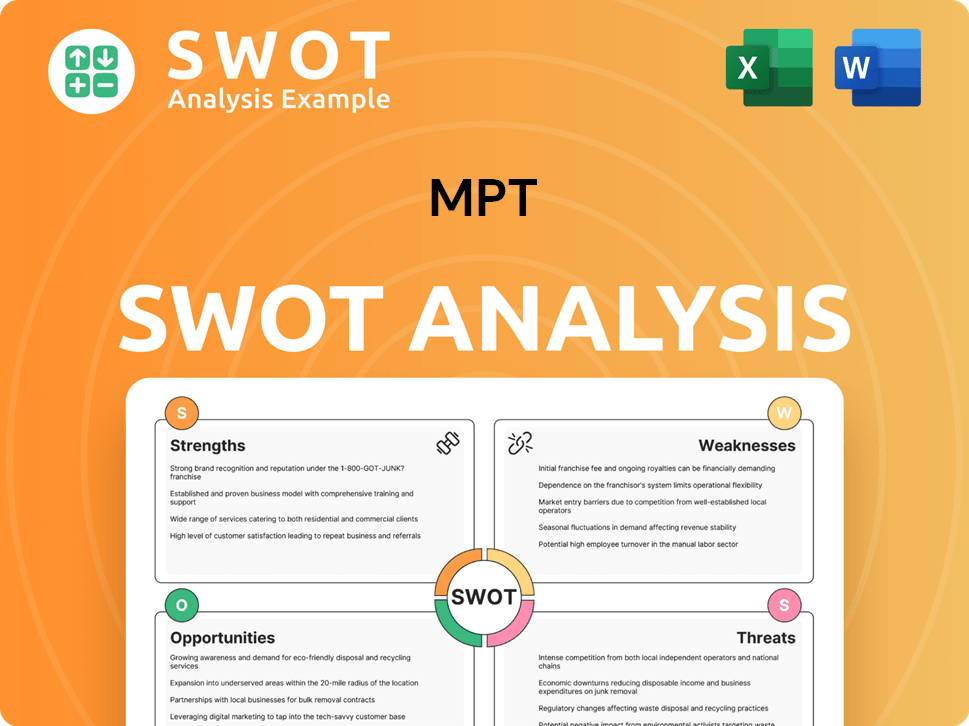

MPT SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does MPT Use?

The marketing tactics of MPT are primarily business-to-business (B2B) focused, emphasizing its value as a capital partner to hospital operators and a sound investment for shareholders. Given its unique Real Estate Investment Trust (REIT) structure, the company's marketing strategy deviates from traditional consumer-facing approaches.

Instead, MPT's marketing mix is heavily reliant on direct communication, investor relations, and thought leadership within the healthcare and real estate finance sectors. This strategy is designed to attract and retain investors while also demonstrating value to potential hospital operator partners.

Digital strategies are centered on a robust Investor Relations website, which serves as a central hub for financial results, press releases, SEC filings, and webcast replays of earnings calls. This transparency is crucial for attracting and retaining investors. MPT also uses its website to host video messages from its CEO, Edward K. Aldag, Jr., which describe the company's business model, value creation levers, and capital allocation priorities, effectively acting as content marketing aimed at shareholders and potential investors.

MPT's Investor Relations website is a critical tool for disseminating financial information and communicating with investors. Video messages from the CEO provide insights into the company's strategy.

The company focuses on direct communication and engagement with investors to maintain transparency and build trust. Regular financial reporting, such as the Q1 2025 results, is a key component.

Participation in industry conferences and engagement with financial news outlets help raise MPT's profile. This helps reach the target audience of institutional and individual investors.

Consistent reporting of financial performance, such as the Q1 2025 net loss of ($0.20) per share and normalized FFO of $0.14 per share, highlights financial health. Strategic initiatives, like the $2.5 billion senior secured notes offering in early 2025, act as key marketing messages.

MPT's rigorous underwriting process for hospital acquisitions informs its investment decisions and operator selection. Extensive research and analysis of operators' financial stability is performed.

The marketing mix emphasizes financial transparency and strategic capital recycling. This is especially important in response to market challenges and efforts to reduce debt and improve liquidity.

MPT's marketing strategy focuses on transparency and strategic capital allocation, with a strong emphasis on investor relations and industry engagement. The company's approach is supported by data-driven analysis and a focus on financial health.

- Investor Relations: The Investor Relations website is central to the strategy.

- Financial Reporting: Consistent reporting of financial performance, such as the Q1 2025 net loss of ($0.20) per share and normalized FFO of $0.14 per share.

- Industry Engagement: Participation in industry conferences and engagement with financial news outlets.

- Data-Driven Underwriting: Rigorous analysis of potential acquisitions.

- Strategic Capital Recycling: Emphasis on financial transparency.

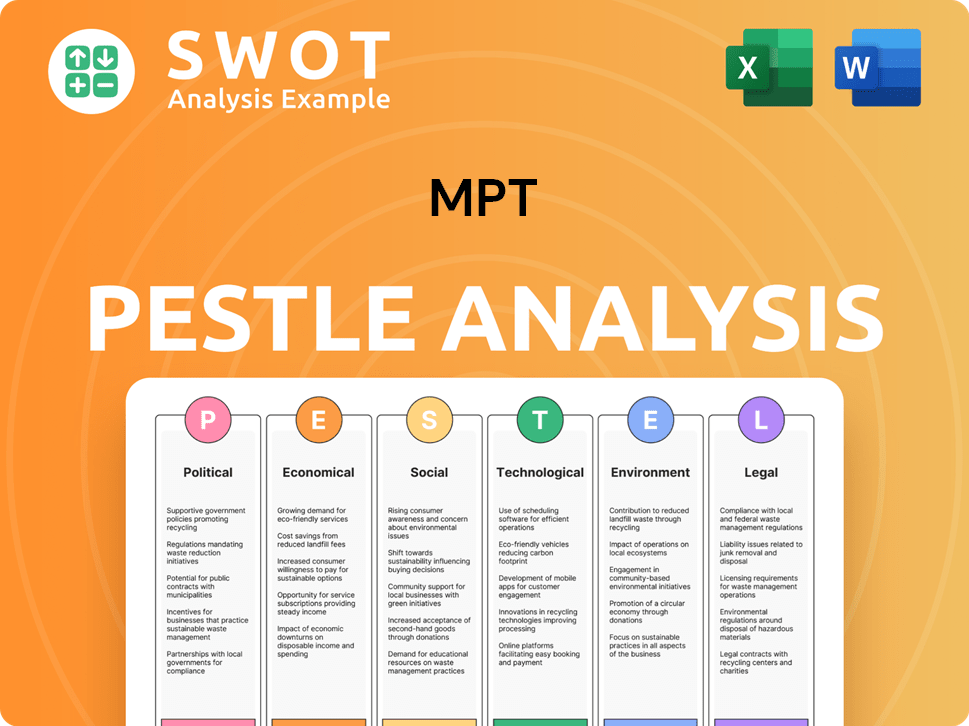

MPT PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is MPT Positioned in the Market?

The company strategically positions itself as a 'pure-play' specialist in hospital investments, distinguishing itself as a leading capital source for hospitals globally. This positioning emphasizes a deep understanding of the healthcare sector and a commitment to long-term relationships with hospital operators. The core message focuses on providing capital to hospitals for facility upgrades, technology improvements, and strategic growth, thereby enhancing patient care.

This differentiation is achieved through its exclusive focus on hospital real estate, setting it apart from REITs that diversify across various property types. The company's brand identity, primarily communicated through its corporate website and investor communications, projects a professional, authoritative, and reliable image.

The brand's appeal to its target audience is rooted in the value it provides: offering up to 100% of a hospital's real estate value as capital, improving operators' financial positions by converting non-liquid assets into cash, and providing potential tax benefits through lease payments. This strategy has helped the company secure significant capital, as demonstrated by its successful fundraising efforts.

The company's exclusive focus on hospital real estate differentiates it from diversified REITs. This specialization allows for a deeper understanding of the healthcare industry and its unique needs. This targeted approach is key to the company's success in the market.

The company offers capital solutions to hospitals, including providing up to 100% of a hospital's real estate value. This helps hospitals fund facility improvements, technology upgrades, and growth strategies. This approach enables better patient care.

The company maintains brand consistency across all investor touchpoints, including press releases and earnings calls. This consistent messaging reinforces its strategic priorities of debt reduction, portfolio optimization, and shareholder value creation. This helps build trust with investors.

The company proactively addresses challenges by resolving issues with key tenants and optimizing its portfolio. This includes strategic asset sales and re-tenanting initiatives. This demonstrates adaptability and commitment.

The company's brand positioning focuses on its specialization in hospital real estate and its ability to provide capital solutions. This strategy is reinforced through consistent messaging and proactive problem-solving. The company's approach allows it to stand out in the market.

- Exclusive focus on hospital real estate.

- Offering up to 100% of a hospital's real estate value.

- Consistent messaging across all investor communications.

- Proactive approach to resolving issues and optimizing the portfolio.

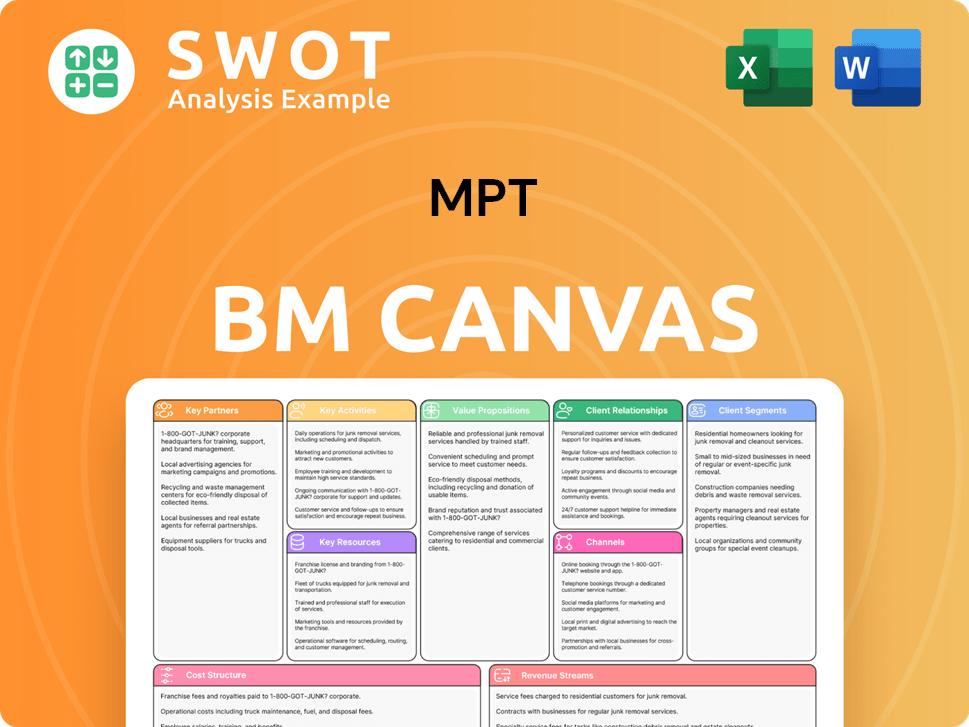

MPT Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are MPT’s Most Notable Campaigns?

The strategies of the company, particularly its 'campaigns,' are more about strategic financial and operational initiatives. These are communicated to the market to reinforce the company’s business model and financial health. These initiatives are primarily communicated through official press releases, SEC filings, investor presentations, and earnings calls. These serve as the main channels for reaching investors and the broader financial community.

A key focus has been on strengthening the balance sheet, lowering the cost of capital, and expediting debt reduction. This involves proactive asset monetizations and capital recycling. The success of these 'campaigns' is measured by key financial metrics such as debt reduction, increased liquidity, and improved tenant diversification. The market's positive response to these efforts indicates the effectiveness of these strategic communications.

Another critical initiative involves the resolution and re-tenanting efforts related to Steward Health Care. The objective is to regain control over its real estate assets from Steward and transition operations to new, financially stronger operators, thereby diversifying its tenant base.

Initiated in late 2023, this strategy aimed to significantly strengthen the company's balance sheet and position it for long-term shareholder value creation. This included a focus on asset monetizations and capital recycling. In February 2025, the company announced the completion of approximately $5.5 billion of asset monetization transactions.

The company completed approximately $5.5 billion of asset monetization transactions. This included a $2.5 billion senior secured notes offering that addresses all debt maturities through 2026. Further validating its lease underwriting, the company sold its interests in five Utah hospitals in April 2024, generating approximately $1.1 billion in total proceeds.

This 'campaign' focused on regaining control of real estate assets and transitioning operations to new, financially stable operators. As of November 2024, operations of 17 former Steward hospitals were transitioned to five new operators. Cash rent payments from these new tenants were expected to commence in Q1 2025.

The company's combined cash and line of credit availability was $1.4 billion as of February 2025. Market response to these efforts was positive, with the company's stock rallying 35.8% in February 2024. The market's positive response indicates the effectiveness of these strategic communications.

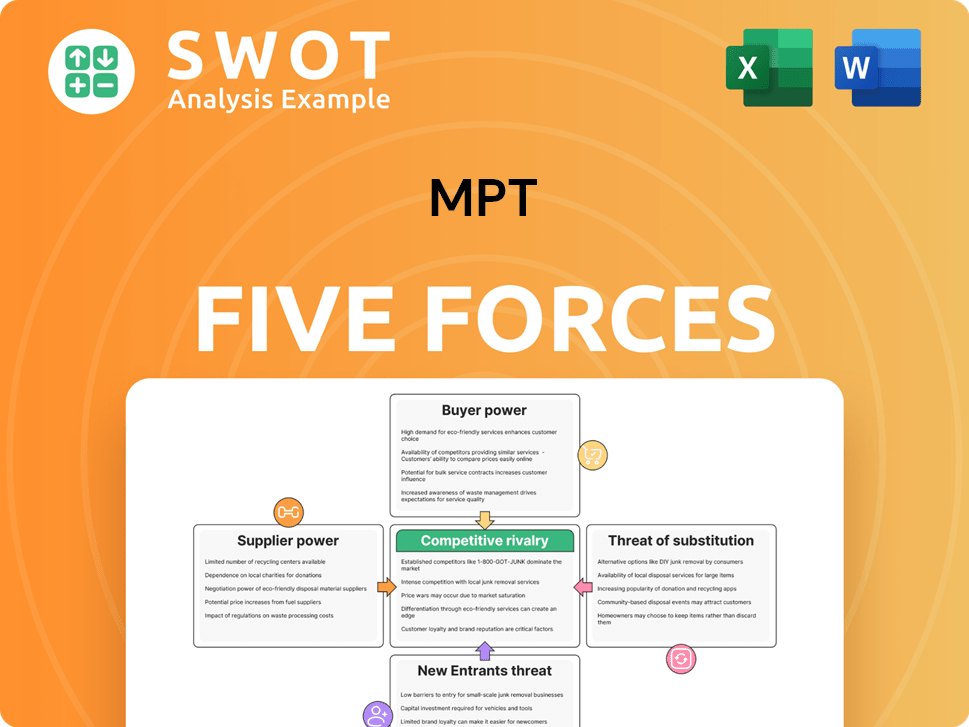

MPT Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of MPT Company?

- What is Competitive Landscape of MPT Company?

- What is Growth Strategy and Future Prospects of MPT Company?

- How Does MPT Company Work?

- What is Brief History of MPT Company?

- Who Owns MPT Company?

- What is Customer Demographics and Target Market of MPT Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.