Fawry Bundle

How Did Fawry Revolutionize Payments in Egypt?

Imagine a world where paying bills and managing finances is as simple as a tap on your phone. That's the reality Fawry SWOT Analysis helped create in Egypt. This Egyptian fintech company, born from a need for efficient transactions, has fundamentally reshaped how millions manage their money.

From its humble beginnings in 2008, Fawry's history showcases an impressive growth trajectory, quickly becoming a leading force in online payment solutions. This brief overview of Fawry details its journey from a startup to a financial powerhouse, highlighting key milestones and its significant impact on digital payments and financial inclusion within Egypt and beyond. Understanding the Fawry company background provides crucial insights into the future of the Egyptian fintech landscape.

What is the Fawry Founding Story?

The story of Fawry, a leading Egyptian fintech company, began in 2008. Founded by Ashraf Sabry, the company emerged to revolutionize the way Egyptians handled bill payments and other financial transactions. This marked the start of a significant shift in the country's financial landscape.

Ashraf Sabry, with his background in technology and industry consulting, identified a critical need in the market. He saw the inefficiencies and inconveniences of traditional payment methods. This insight led to the conceptualization of Fawry's core idea in 2007, focusing on electronic bill payment solutions.

Fawry's early days were defined by a clear vision: to create a comprehensive electronic payment network. This network would facilitate seamless transactions between consumers and businesses. The initial focus was on electronic bill payment services, which allowed users to pay utilities and telecommunications bills.

Ashraf Sabry's vision led to the founding of Fawry in 2008, addressing inefficiencies in traditional payment methods.

- The initial product was electronic bill payment services.

- The company invested in technology, including Cisco and IBM platforms, and established an ISO-certified data center.

- Early investors included Ideavelopers, Raya Holding, Arab African International Bank, HSBC, Alexbank, and the International Finance Corporation (IFC).

- These investments were crucial for technology development and network expansion.

The company invested heavily in building its technology infrastructure. They based their solutions and network design on platforms from Cisco and IBM. They also established an ISO-certified data center to ensure security and reliability. Early funding came from various sources, including Ideavelopers. Other early investors included Raya Holding, Arab African International Bank, HSBC, Alexbank, and the International Finance Corporation (IFC). These investments were vital for developing Fawry's technology and expanding its network of payment outlets.

For a deeper dive into the company's impact and evolution, you can explore a detailed overview of Fawry's journey.

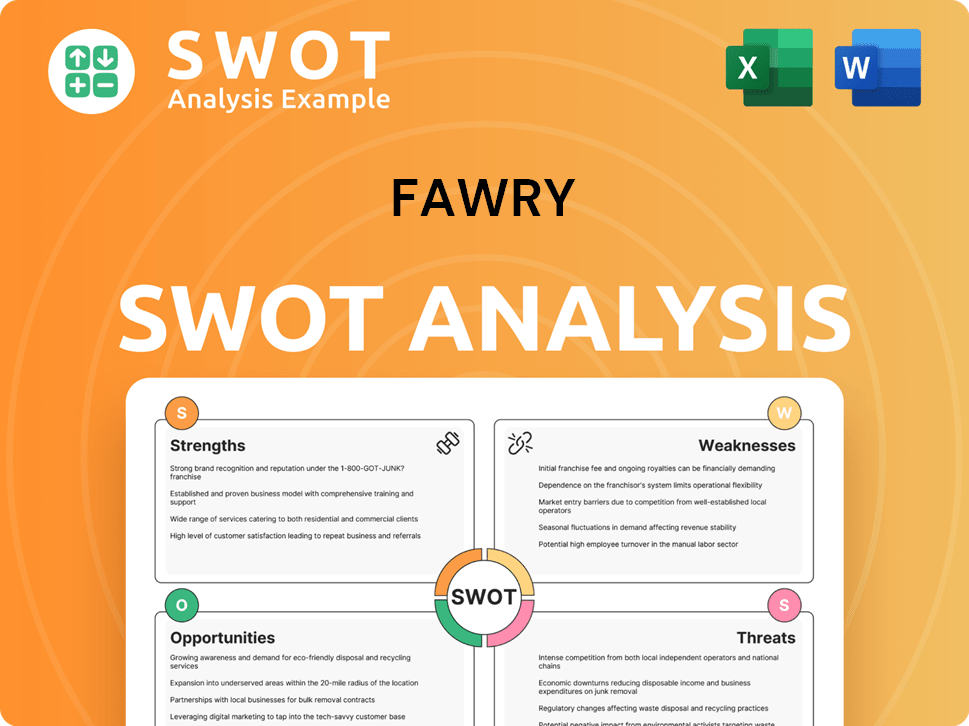

Fawry SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Fawry?

The early growth and expansion of the company, a key player in the Egyptian fintech sector, were marked by strategic deployments and rapid customer acquisition. Initially, the company focused on facilitating bill payments through traditional banking channels, which quickly became a core service. This early focus set the stage for the company's rapid expansion and diversification within the digital payments landscape. The company's history is a testament to its adaptability and its impact on Egypt's financial ecosystem.

The company officially launched in March 2010, introducing its services with 5,000 Points of Sale (POS) terminals across two Egyptian cities. This initial rollout focused on enabling bank payments, establishing a foundation for quick and efficient bill transactions. Within six months, the company had already attracted 400,000 customers and processed half a million transactions.

The company experienced rapid growth by broadening its payment outlets and diversifying its services. These included mobile phone top-ups, online payments, and digital wallets, significantly expanding its market reach. By 2015, the company had formed partnerships with leading banks, enhancing its offerings and solidifying its position within the Egyptian digital payments market. The company's early days were marked by a strategic expansion.

In 2024, the company demonstrated robust financial performance. Revenues reached EGP 5.51 billion, a 68.4% year-on-year increase, with net profit soaring by 124.6% to EGP 1.61 billion. The total throughput value jumped 72.9% to EGP 601.7 billion (approximately $13.3 billion), supported by a 12.4% expansion in its retail network to 372,400 POS terminals. The number of transactions processed increased by 20% to 1.93 billion during 2024. This growth trajectory highlights the company's strong market position.

In the first quarter of 2025, the company's total throughput value reached EGP 188.5 billion, a 62.2% increase from 1Q 2024, and it completed 484.8 million transactions, up 9.8% year-on-year. Its retail network further expanded by 11.1% year-on-year to 396,000 POS terminals in 1Q 2025. Strategic shifts included diversifying business segments, with Banking Services contributing 46.9% to the overall revenue increase in 2024. For more insights, explore the Target Market of Fawry.

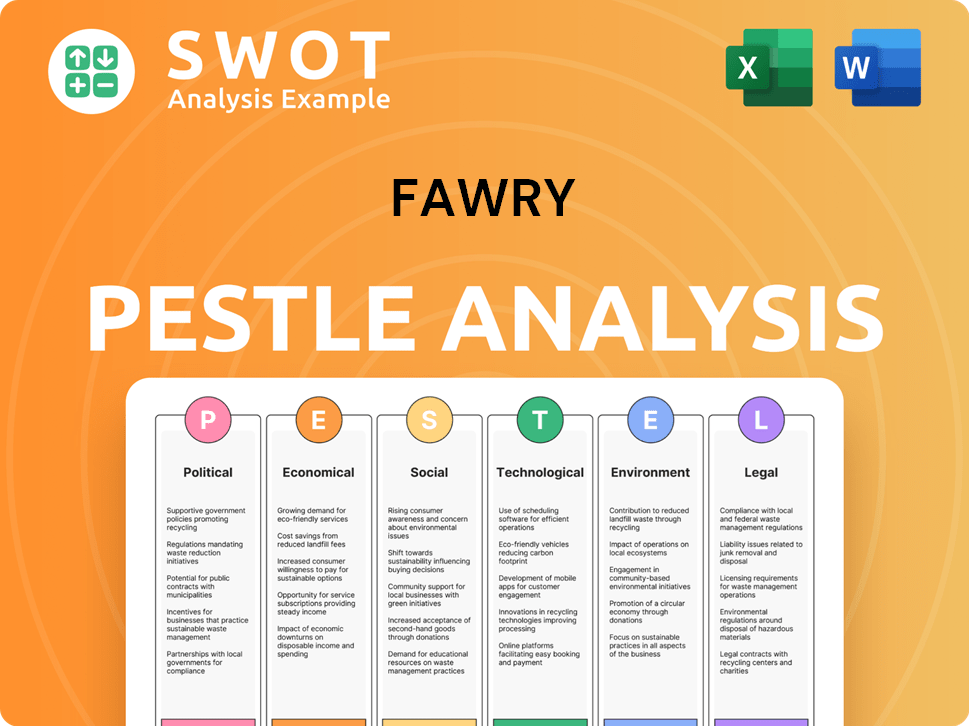

Fawry PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Fawry history?

The Fawry company has achieved several significant milestones, solidifying its position in the Egyptian fintech landscape. A key moment came in August 2020 when Fawry became Egypt's first tech company to reach unicorn status, with a valuation of $1 billion. This achievement followed its initial public offering (IPO) in July 2019 on the Egyptian Exchange (EGX), where shares surged by 31% on the first day.

| Year | Milestone |

|---|---|

| 2019 | Initial Public Offering (IPO) on the Egyptian Exchange (EGX), with shares increasing by 31% on the first day. |

| 2020 | Achieved unicorn status, becoming Egypt's first tech company with a $1 billion valuation. |

| 2024 | Launch of 'Your Health Fawry' medical insurance product, after issuing over 700,000 digital insurance policies. |

| 2024 | Launch of 'Alnota' Overdraft, Egypt's first BNPL digital solution for merchants, facilitating 750,000 transactions. |

| 2025 | Launch of 'Fawry Business' to provide integrated digital solutions for businesses of all sizes. |

Fawry has consistently introduced innovative solutions to enhance its digital payments ecosystem and expand its service offerings. The company has diversified its services beyond bill payments, integrating digital lending and insurance products into its platform.

In January 2024, Fawry launched embedded financial services, including digital lending and insurance, integrated into its existing payment platform, expanding user access to financial services.

In October 2024, Fawry launched its medical insurance product, 'Your Health Fawry,' after issuing over 700,000 digital insurance policies across various categories, marking a strategic push into the insurtech sector.

Launched in December 2024, 'Alnota' Overdraft, Egypt's first BNPL digital solution for merchants, facilitated 750,000 transactions with a total value of EGP 2 billion.

Developed in partnership with Banque Misr, the Fawry Corporate Card enhances payment solutions for businesses.

Tap N Pay, a Soft POS solution, enables merchants to accept payments via smartphones without additional hardware.

Achieved dual CPOC and MPOC certifications for its Soft POS solution in November 2024, the first in MENA and tenth globally to do so.

Despite its successes, Fawry has faced challenges, including competition from other electronic payment providers. However, the company has responded by consistently expanding its services and technological capabilities to maintain its market position.

Fawry faces competition from other electronic payment providers, requiring continuous innovation and service expansion.

Launched in February 2025, 'Fawry Business' aims to provide integrated digital solutions for businesses of all sizes, from SMEs to large enterprises.

Partnerships with Al-Futtaim Group (May 2024) and PayMe (March 2024) have been key to expanding its ecosystem and facilitating remittance services.

In February 2025, Fawry announced strategic investments worth EGP 80 million in three Egyptian technology companies—Dirac Systems, Virtual CFO, and Code Zone—to expand its 'Fawry Business' suite.

Fawry continues to expand its services and technological capabilities to meet market demands and competitive pressures.

Constant innovation in digital payments and financial services is crucial for Fawry's continued success.

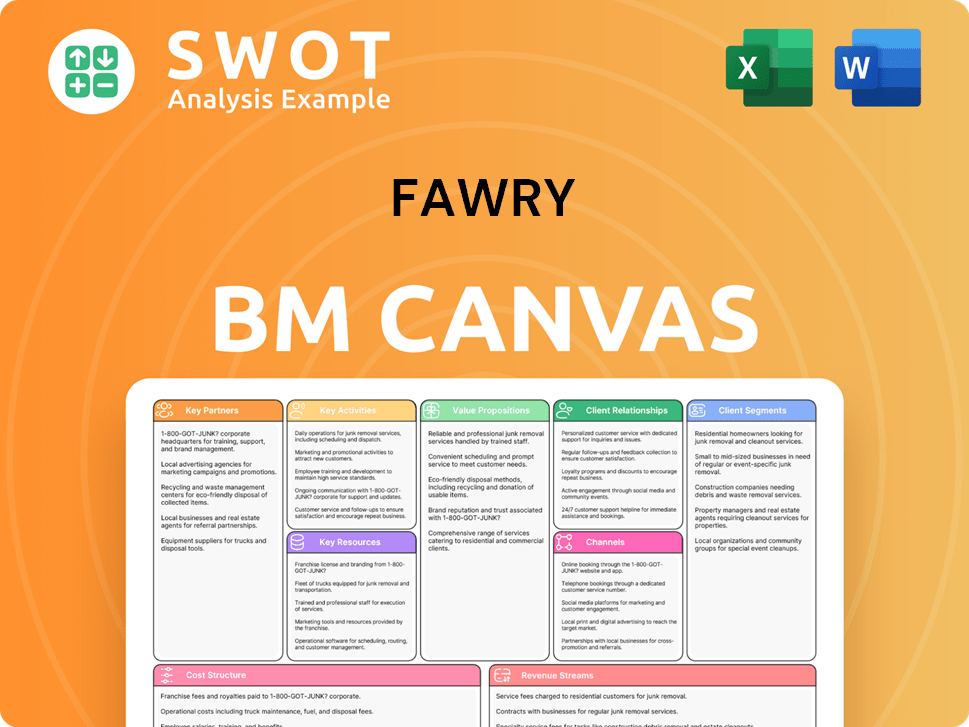

Fawry Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Fawry?

The Fawry company journey began with Ashraf Sabry's vision in 2007, leading to its official founding in 2008. Since then, Fawry has evolved from an electronic bill payment solution to a comprehensive digital payments platform. The company's expansion, significant partnerships, and strategic initiatives have solidified its position as a leading player in the Egyptian fintech landscape, driving financial inclusion and revolutionizing online payment methods.

| Year | Key Event |

|---|---|

| 2007 | Ashraf Sabry conceptualizes the idea for an electronic bill payment solution. |

| 2008 | Fawry is founded by Ashraf Sabry. |

| March 2010 | Fawry launches its electronic payment network with 5,000 Points of Sale (POS) in two Egyptian cities. |

| 2012 | Expansion of Fawry's services to include bill payments and mobile top-ups. |

| 2015 | Fawry partners with leading banks and financial institutions, broadening its service offerings. |

| 2018 | Fawry reaches over 20 million customers and processes billions of transactions annually. |

| July 2019 | Fawry goes public, listing on the Egyptian Exchange (EGX) with its IPO oversubscribed by 30.3 times. |

| August 2020 | Fawry achieves unicorn status, becoming Egypt's first tech company to reach a $1 billion valuation. |

| November 2022 | Fawry Microfinance launches its digital loan request and tracking mobile app, Tamweelak Fawry. |

| January 2024 | Fawry launches a suite of embedded financial services, including digital lending and insurance products. |

| March 2024 | Fawry Dahab partners with PayMe to enhance remittance services for Egyptian expatriates. |

| May 2024 | Fawry partners with Al-Futtaim Group to enhance electronic payment solutions. |

| August 2024 | Fawry announces plans to operate in Saudi Arabia by the end of 2024. |

| October 2024 | Fawry launches its 'Your Health Fawry' medical insurance product. |

| November 2024 | Fawry achieves dual CPOC and MPOC certifications for its Soft POS solution. |

| December 2024 | Fawry MSME launches 'Alnota' Overdraft, a BNPL solution for merchants, which has facilitated EGP 2 billion in transactions. |

| February 2025 | Fawry announces strategic investments in three Egyptian tech companies and launches 'Fawry Business' suite. |

| May 2025 | Fawry reports Q1 2025 revenues of EGP 1.794 billion, up 65.1% year-on-year, and net profit of EGP 605.4 million, up 97.1% year-on-year. Fawry also partners with CTM360 to strengthen digital risk protection and Microsoft to drive digital transformation for Egyptian SMEs. |

Fawry plans to invest over EGP 1 billion in 2025 in information security, software development, and foreign market expansion. This investment underscores its commitment to technological advancement and global growth. The company's expansion into Saudi Arabia by the end of 2024 demonstrates its ambition to become a regional fintech leader.

The company is exploring opportunities in remittances, targeting transactions outside the official sector. They also plan to launch investment funds in 2025, building on their existing investment services, which include a daily investment fund that has grown to EGP 1.3 billion. This strategic move aims to diversify its financial offerings.

Fawry's CEO, Ashraf Sabry, envisions building an integrated financial ecosystem, with explorations into digital banking. This vision reflects the company's commitment to offering a comprehensive suite of financial services. The company is focused on enhancing financial inclusion and providing seamless payment solutions.

Fawry continues to focus on its founding vision of democratizing financial services for Egypt's underserved and unbanked market segments. The company's future plans include expanding its services and partnerships. Fawry aims to play a key role in the future of digital payments and financial inclusion in Egypt and beyond.

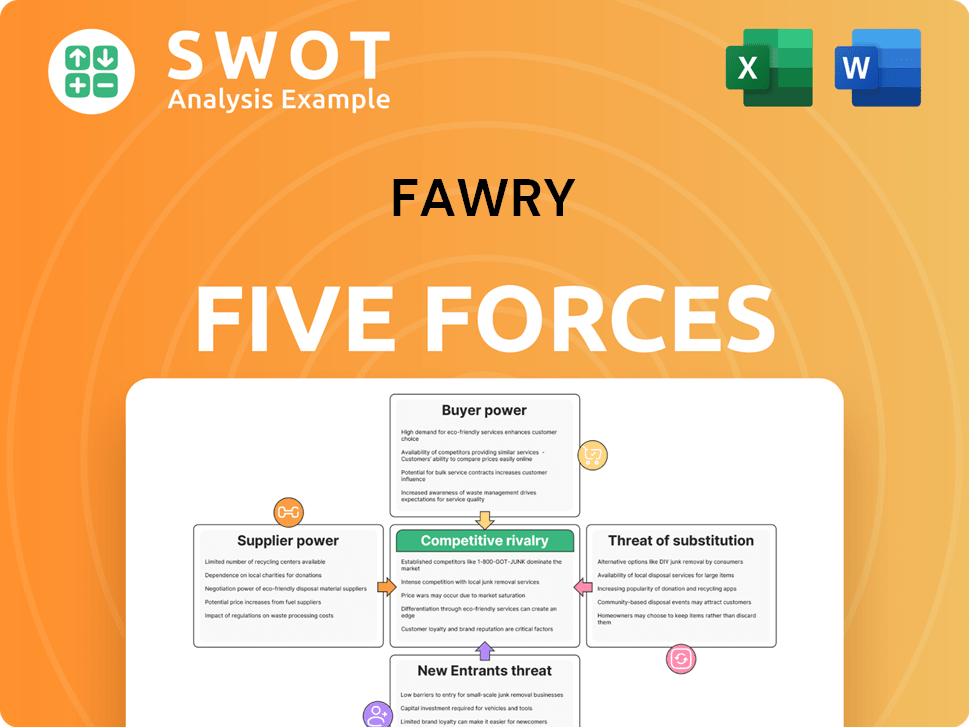

Fawry Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Fawry Company?

- What is Growth Strategy and Future Prospects of Fawry Company?

- How Does Fawry Company Work?

- What is Sales and Marketing Strategy of Fawry Company?

- What is Brief History of Fawry Company?

- Who Owns Fawry Company?

- What is Customer Demographics and Target Market of Fawry Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.