Fawry Bundle

Can Fawry Continue its Fintech Dominance?

Fawry, the Egyptian fintech giant, has revolutionized digital payments and financial inclusion since 2008. From its humble beginnings digitizing bill payments, Fawry has become a cornerstone of Egypt's digital economy. This Fawry SWOT Analysis provides an in-depth look at the company's strengths, weaknesses, opportunities, and threats.

This exploration of Fawry's growth strategy examines its ambitious expansion plans, innovative technology, and financial outlook, while also considering potential risks. Understanding Fawry's business model explained and its strategic acquisitions is crucial for assessing its future prospects in the competitive Egyptian fintech landscape. We will delve into Fawry's market share in Egypt and the impact on financial inclusion, providing a comprehensive Fawry company analysis.

How Is Fawry Expanding Its Reach?

Fawry's Fawry growth strategy hinges significantly on ambitious expansion initiatives. These initiatives target both new market segments and enhancements to existing service offerings within its current operational footprint. A primary focus involves deepening its penetration within Egypt's rapidly growing digital economy. This is achieved by broadening its network of retail agents and diversifying its service portfolio. This strategic approach aims to solidify its position in the Egyptian fintech landscape.

The company is actively expanding its merchant acquiring services, enabling businesses to seamlessly accept digital payments. This includes supporting various payment methods, from card payments to QR code-based transactions. Beyond its core payment services, Fawry is strategically venturing into new verticals. The company has been actively promoting its 'Fawry Plus' branches, which offer a broader array of financial services.

These services include banking services in partnership with financial institutions, microfinance, and insurance. This move aims to capture a larger share of the financial services market and cater to a more diverse customer base. Furthermore, Fawry is exploring opportunities in the burgeoning e-commerce sector, providing integrated payment solutions for online merchants and consumers. The company has also indicated plans for potential international expansion in the long term, though specific timelines remain under wraps. These initiatives are driven by the need to access new customer segments, diversify revenue streams beyond traditional bill payments, and maintain a competitive edge in a rapidly evolving market.

Fawry is expanding its merchant network to increase its reach and transaction volume. This involves adding more points of sale and integrating with a wider range of businesses. This expansion is crucial for capturing a larger share of the digital payments Egypt market.

The company is diversifying its service offerings to include more financial services. This includes expanding its 'Fawry Plus' branches to offer a broader range of financial products. This diversification aims to increase revenue streams and customer engagement.

Fawry is focusing on integrating its payment solutions with e-commerce platforms. This allows online merchants to easily accept payments through Fawry's gateway. This strategic move aims to tap into the growing e-commerce market in Egypt.

While specific details are still emerging, Fawry is exploring international expansion opportunities. This could involve entering new markets in Africa or other regions. This expansion will help diversify its revenue base and increase its global footprint.

Fawry's expansion strategies are designed to drive growth and maintain its competitive advantage. These strategies include expanding its merchant network, diversifying its service offerings, and integrating with e-commerce platforms. These initiatives are crucial for achieving sustained growth in the Fawry future prospects.

- Expanding the agent network to increase the points of sale.

- Launching new financial services through 'Fawry Plus' branches.

- Partnering with e-commerce platforms for payment integration.

- Exploring international expansion opportunities.

To understand the competitive landscape, it's helpful to review the Competitors Landscape of Fawry. The company's expansion initiatives are critical for sustaining its growth trajectory and solidifying its position in the market. These initiatives are designed to address the evolving needs of its customer base and capitalize on emerging opportunities within the digital economy. By focusing on these areas, Fawry aims to enhance its market share and revenue streams.

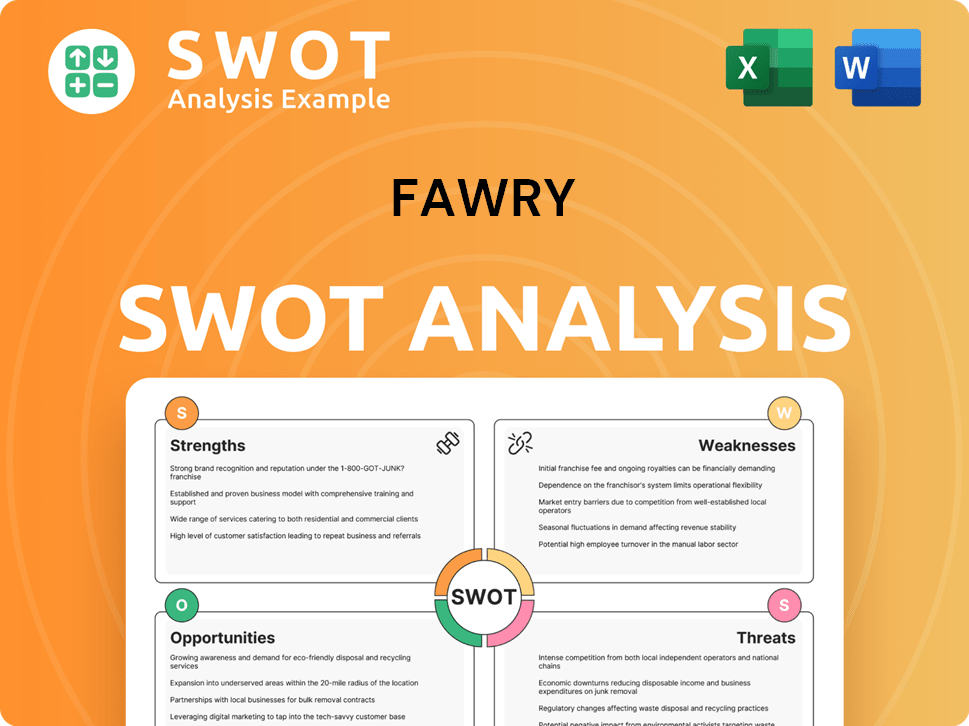

Fawry SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Fawry Invest in Innovation?

The sustained growth of the company is deeply intertwined with its innovation and technology strategy. This strategy focuses on digital transformation, automation, and the adoption of cutting-edge technologies to maintain a competitive edge in the rapidly evolving digital payments landscape. The company consistently invests in research and development to enhance its existing platforms and introduce new value-added services, ensuring it meets the dynamic needs of its customer base.

A core element of the company's strategy involves leveraging data analytics and artificial intelligence (AI). This enables the company to personalize customer experiences, optimize transaction processes, and strengthen fraud detection capabilities. By focusing on AI, the company aims to offer more tailored financial products and services, thereby enhancing customer engagement and loyalty within the Egyptian fintech market.

The company's commitment to innovation is further demonstrated through continuous upgrades to its mobile applications and online platforms. This ensures a seamless and user-friendly experience across all touchpoints. Furthermore, the company actively seeks collaborations with external innovators, including fintech startups and technology providers, to integrate new functionalities and expand its technological capabilities. For insights into the company's business model, you can explore Revenue Streams & Business Model of Fawry.

The company prioritizes digital transformation across all its operations. This involves migrating traditional processes to digital platforms to improve efficiency and customer experience. Digital transformation is key to the company's growth strategy in the competitive Egyptian fintech sector.

Automation plays a crucial role in streamlining operations and reducing costs. The company utilizes automation technologies to handle repetitive tasks, allowing employees to focus on more strategic activities. This focus on automation supports the company's long-term goals.

The company leverages AI and data analytics to personalize customer experiences and enhance security. AI-driven fraud detection systems are critical in protecting transactions. These technologies help the company to maintain a competitive edge.

Continuous upgrades to mobile applications and online platforms ensure a seamless user experience. The company focuses on user-friendly interfaces and features to boost customer engagement. These efforts are vital for digital payments Egypt.

The company has been at the forefront of introducing new payment technologies, such as QR code payments and contactless transactions. These innovations align with global trends in digital payments. This helps to attract a broader customer base.

The company actively explores collaborations with fintech startups and technology providers. These partnerships help to integrate new functionalities and expand technological capabilities. Strategic alliances are crucial for future prospects.

The company's technology strategy is multifaceted, focusing on several key initiatives to drive growth and maintain its market position. These initiatives are designed to improve customer experience, enhance security, and expand service offerings. The company's technology infrastructure supports its business model.

- AI-Powered Personalization: Implementing AI to tailor financial products and services to individual customer needs.

- Enhanced Security: Investing in advanced fraud detection systems and secure payment gateways to protect transactions.

- Mobile Payment Solutions: Continuously updating mobile applications to provide a seamless and user-friendly experience.

- Strategic Partnerships: Collaborating with fintech startups and technology providers to integrate new functionalities.

- Data Analytics: Utilizing data analytics to optimize transaction processes and improve operational efficiency.

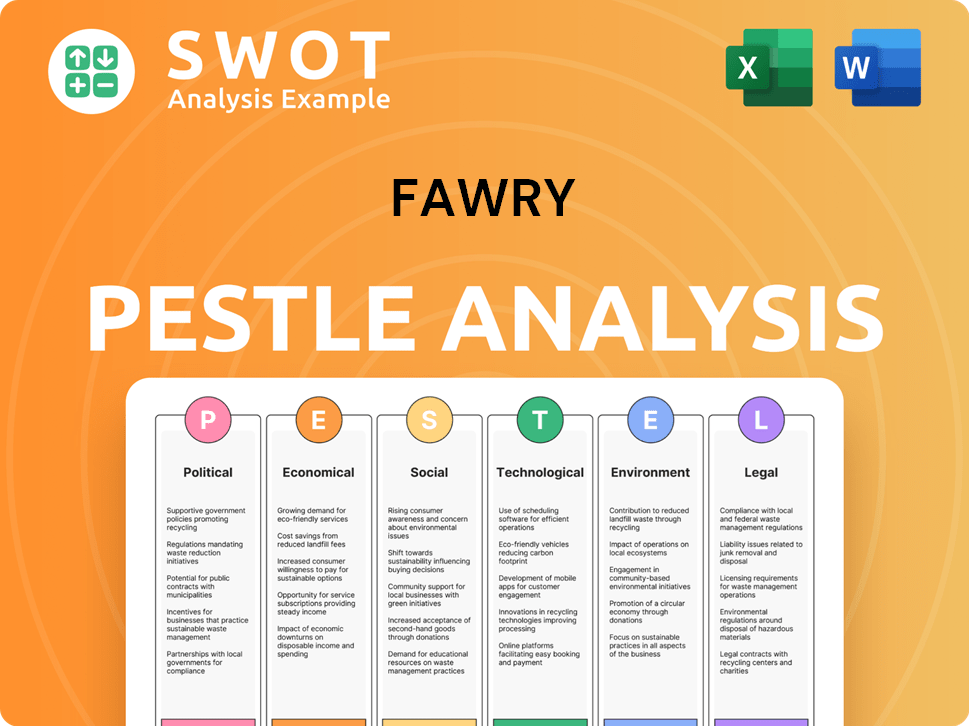

Fawry PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Fawry’s Growth Forecast?

The financial outlook for Fawry remains strong, supported by its leading position in the market and the expansion of its service offerings. A thorough Fawry company analysis reveals consistent growth, driven by the increasing adoption of digital payment solutions in Egypt. This growth is further fueled by strategic initiatives and a robust business model.

In Q1 2024, Fawry demonstrated significant financial performance. The company's revenue reached EGP 1.05 billion, marking a substantial year-over-year increase of 47.9%. This impressive growth underscores the effectiveness of Fawry's growth strategy and its ability to capitalize on the expanding digital payments market. The company's focus on innovation and customer-centric solutions has positioned it well for future prospects.

The company's net profit after tax also saw a substantial rise, reaching EGP 152.9 million in Q1 2024, a 169.5% increase compared to the same period in the previous year. This strong performance is attributed to the growth in its payment services, particularly within the banking and FawryPlus channels, and the increasing adoption of its digital payment solutions. For more insights into the company's origins, you can explore the Brief History of Fawry.

Fawry's revenue for Q1 2024 was EGP 1.05 billion, a 47.9% increase year-over-year. This growth reflects the increasing demand for Fawry's services and its effective market penetration. This strong revenue performance is a key indicator of Fawry's financial health and its ability to generate sustainable returns.

Net profit after tax in Q1 2024 reached EGP 152.9 million, a remarkable 169.5% increase compared to the same period last year. This significant profit growth highlights the company's operational efficiency and its ability to scale its business model. This also underlines the success of Fawry's strategic initiatives.

The total payment transactions processed through Fawry's network reached EGP 109.8 billion in Q1 2024, a 40.5% increase year-over-year. This demonstrates the increasing reliance on Fawry's platform for various financial transactions. This growth in transaction volume is a testament to the company's expanding customer base.

Fawry continues to maintain healthy profit margins, reflecting efficient operations and a scalable business model. These margins are a key factor in Fawry's ability to invest in future growth and expansion. The company's focus on cost management contributes to its strong profitability.

Fawry's financial performance in Q1 2024 underscores its robust growth and market leadership. The company's ability to sustain high growth rates in both revenue and profit demonstrates its strong position in the Egyptian fintech market.

- Revenue: EGP 1.05 billion, up 47.9% year-over-year

- Net Profit: EGP 152.9 million, up 169.5% year-over-year

- Transaction Volume: EGP 109.8 billion, up 40.5% year-over-year

- Strong profit margins

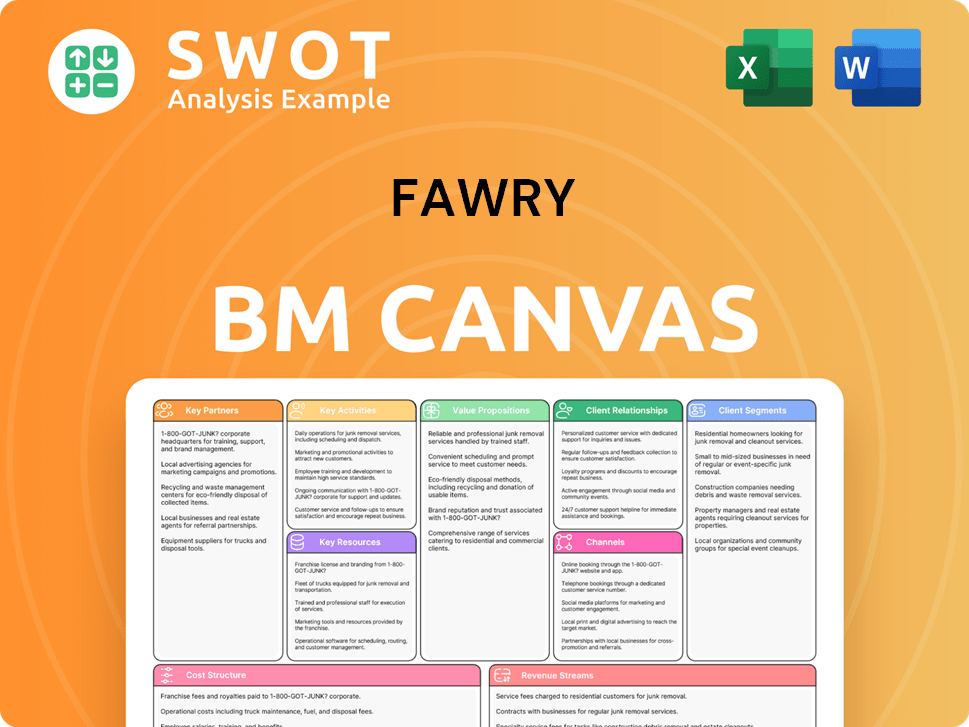

Fawry Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Fawry’s Growth?

Analyzing the potential risks and obstacles is crucial for understanding the Fawry growth strategy and its Fawry future prospects. While the company has shown impressive growth, several challenges could impact its trajectory in the Egyptian fintech market. These challenges range from competitive pressures to regulatory changes and operational hurdles.

The digital payment landscape in Egypt is becoming increasingly crowded, intensifying competition and potentially affecting profitability. Moreover, the need for continuous innovation is paramount to maintain a competitive edge. Navigating these complexities requires a proactive approach to risk management and strategic planning.

Understanding these risks is essential for a comprehensive Fawry company analysis. The ability to adapt and mitigate these challenges will be critical for sustained success in the dynamic Egyptian market.

The Fawry competitive landscape analysis includes new fintech players and traditional banks entering the digital payments Egypt space. This increased competition could lead to pricing pressures, impacting revenue margins. Continuous innovation is essential to retain market share and attract new customers.

Changes in central bank policies or new regulations concerning digital payments Egypt could necessitate operational adjustments. Compliance costs and the need for swift adaptation to new rules pose a risk. Fawry's regulatory environment is constantly evolving, requiring proactive monitoring.

The agent network is crucial, and its availability and maintenance represent operational challenges. Disruptions in this network could impact service delivery and customer satisfaction. Fawry's technology infrastructure must support the agent network.

Rapid advancements in payment technologies could render existing systems obsolete. Fawry's mobile payment solutions and online payment gateway must evolve to stay ahead. The company needs to invest in R&D to remain competitive.

Attracting and retaining top talent in a competitive tech landscape can be challenging. Skill gaps could hinder innovation and expansion. Fawry's partnerships and collaborations can help mitigate this risk.

The Egyptian economy's volatility can impact consumer spending and business operations. Economic downturns could reduce transaction volumes and affect profitability. Fawry services are designed to be adaptable to economic shifts.

Fawry employs several strategies to mitigate these risks. Continuous market monitoring helps identify emerging trends and competitive threats. Active engagement with regulatory bodies ensures compliance and influences policy. A robust risk management framework includes diversification of Fawry services and strategic partnerships. For more information, you can read about Mission, Vision & Core Values of Fawry.

Fawry's experience in the dynamic Egyptian market has equipped it with resilience. The company has demonstrated an ability to adapt to past economic fluctuations and technological shifts. This positions Fawry to address emerging risks in its future trajectory. The company's ability to quickly adapt is one of its key strengths.

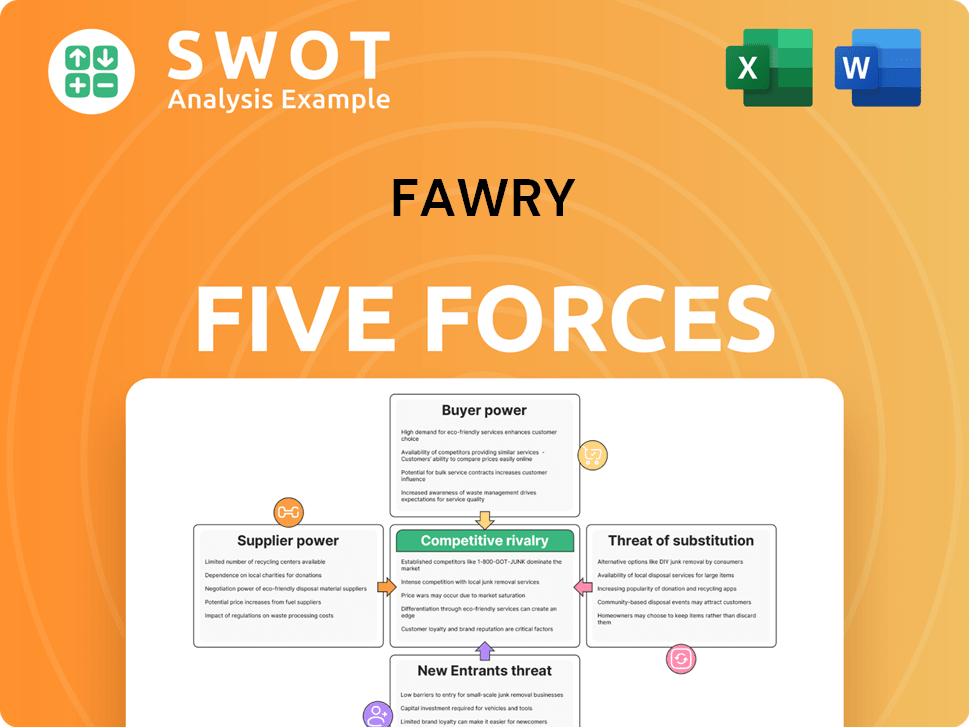

Fawry Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fawry Company?

- What is Competitive Landscape of Fawry Company?

- How Does Fawry Company Work?

- What is Sales and Marketing Strategy of Fawry Company?

- What is Brief History of Fawry Company?

- Who Owns Fawry Company?

- What is Customer Demographics and Target Market of Fawry Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.