Fawry Bundle

Who Does Fawry Serve? Unveiling Fawry's Customer Base

In Egypt's dynamic digital payment landscape, understanding Fawry SWOT Analysis is crucial. Fawry's journey from a bill payment facilitator to a comprehensive fintech platform exemplifies the power of knowing its customers. This exploration dives deep into Fawry's customer demographics and target market, revealing how it has adapted to meet evolving needs.

From its inception targeting the unbanked, Fawry's Fawry company has broadened its reach significantly. This shift reflects a strategic evolution to cater to a diverse demographic, including banked individuals, SMEs, and large corporations. Analyzing Fawry target market segmentation is essential for understanding its success and future growth potential. This analysis will cover Fawry users, Demographic data, and Target audience analysis, offering insights into who uses Fawry services the most and their spending habits.

Who Are Fawry’s Main Customers?

Understanding the customer demographics and target market is crucial for any business, and for the Egyptian payment solutions provider, it's no different. The company serves a diverse customer base, segmented into both consumers (B2C) and businesses (B2B), reflecting the broad scope of its services. This segmentation allows for targeted marketing and service improvements.

The B2C segment includes a wide range of individuals, from young adults to working professionals, all of whom are potential Fawry users. The company's services cater to different income levels and educational backgrounds, ensuring accessibility for a broad audience. Families also use the platform for various household needs.

For businesses, the company focuses on small and medium-sized enterprises (SMEs), large corporations, and government entities. SMEs benefit from the platform's efficiency in cash collection and payments, while larger organizations use it for mass disbursements. This dual approach allows the company to maintain a strong position in the market.

The B2C segment includes a broad age range, with a significant portion being young adults and working professionals. Income levels vary, with services accessible to both lower and higher-income individuals. Education and occupation also vary, from blue-collar workers to white-collar professionals.

The B2B segment includes SMEs, large corporations, and government entities. SMEs use the platform for cash collection and payments. Large corporations and government bodies use it for mass bill collection and disbursement. This segment is a growing part of the company's revenue.

The company has expanded its target segments beyond the unbanked to include the banked population and businesses. This shift is driven by new product launches and market research. The increasing penetration of smartphones and e-commerce in Egypt also contributes to this expansion.

The company's 2024 financial reports indicate continued growth in both consumer and business transactions. E-commerce payment volumes have seen a notable increase. This demonstrates the company's strong position and the effectiveness of its strategies.

A thorough target audience analysis reveals that the company's services are used by a wide demographic, from those with limited access to traditional banking to those seeking convenience. The company's customer demographics Egypt show a diverse user base.

- Fawry customer age range spans from young adults to older individuals, reflecting the broad appeal of digital financial services.

- Fawry user location analysis indicates a widespread presence across Egypt, with a strong focus on urban and suburban areas.

- Fawry service usage by gender is relatively balanced, with both men and women utilizing the platform for various transactions.

- Fawry customer income levels vary, providing services for both lower and higher-income individuals.

To understand the company's approach, consider reading about the Marketing Strategy of Fawry. This article provides insights into how the company targets and engages its diverse customer base.

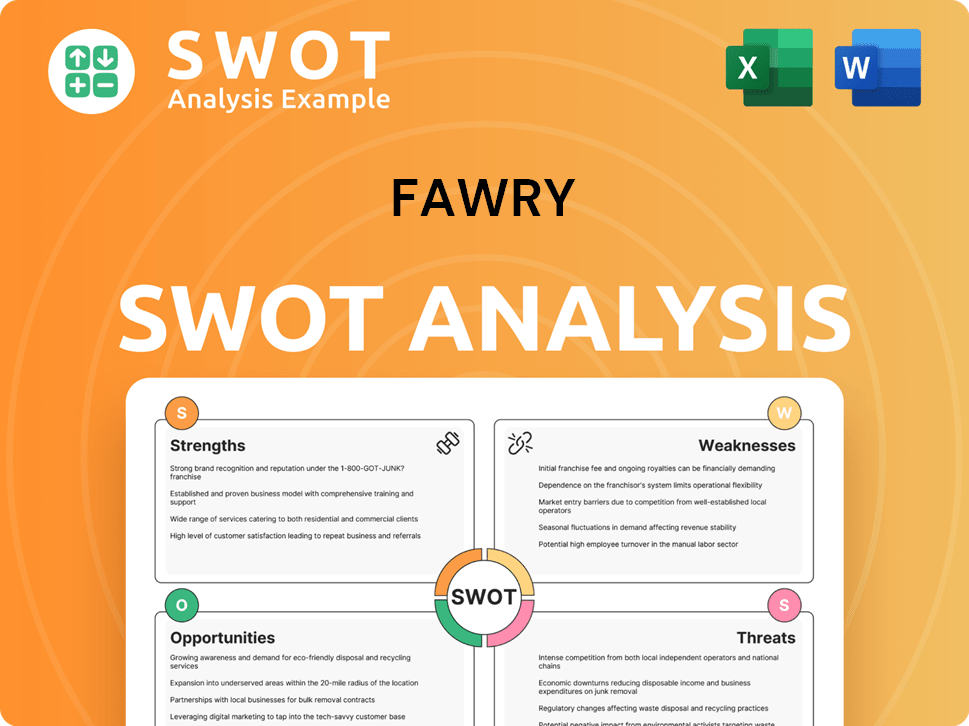

Fawry SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Fawry’s Customers Want?

Understanding the needs and preferences of customers is crucial for the success of any financial service provider. For the company, this involves a deep dive into what drives their users, what they value, and how the company can best meet their expectations. The company's approach is centered on providing convenient, accessible, secure, and efficient financial transaction solutions.

The primary drivers for customers include the ease of paying bills, recharging mobile credit, and making online purchases, especially for those without traditional banking access. The company caters to the psychological need for financial control and the practical need for seamless transactions, enabling participation in the digital economy. This focus helps to build customer loyalty and drive continuous service improvement.

The key needs, motivations, and preferences of the company's customers revolve around convenience, accessibility, security, and efficiency in financial transactions. For consumers, the primary drivers are the ease of paying bills (utilities, telecom, internet), recharging mobile credit, and making online purchases without needing a bank account or credit card. Purchasing behaviors often involve frequent, smaller transactions for daily needs. Decision-making criteria include the proximity of the company agents, the user-friendliness of the mobile app, and the reliability of the service. Loyalty factors are tied to consistent service quality, competitive fees, and the breadth of services offered.

The company addresses common pain points such as the time-consuming nature of traditional bill payments and the lack of access to financial services in remote areas. They also focus on security concerns associated with carrying large amounts of cash. The company continually updates its mobile application based on user experience feedback to ensure intuitive navigation and enhanced functionality, aiming to provide a frictionless payment experience.

- The company has tailored its marketing to highlight the time-saving aspects of its services.

- Features like QR code payments and card acceptance at its POS terminals cater to evolving preferences.

- The company's success is significantly influenced by customer feedback and market trends, such as the increasing demand for digital wallets and contactless payments.

- The company's services are designed to be accessible to a wide range of users, including those without traditional banking access.

The company's customer base is diverse, with a significant portion of users residing in Egypt. The company’s ability to understand and adapt to the needs of its customers is crucial for its continued growth. For a deeper dive into the company’s strategic initiatives and growth, you can read about the Growth Strategy of Fawry.

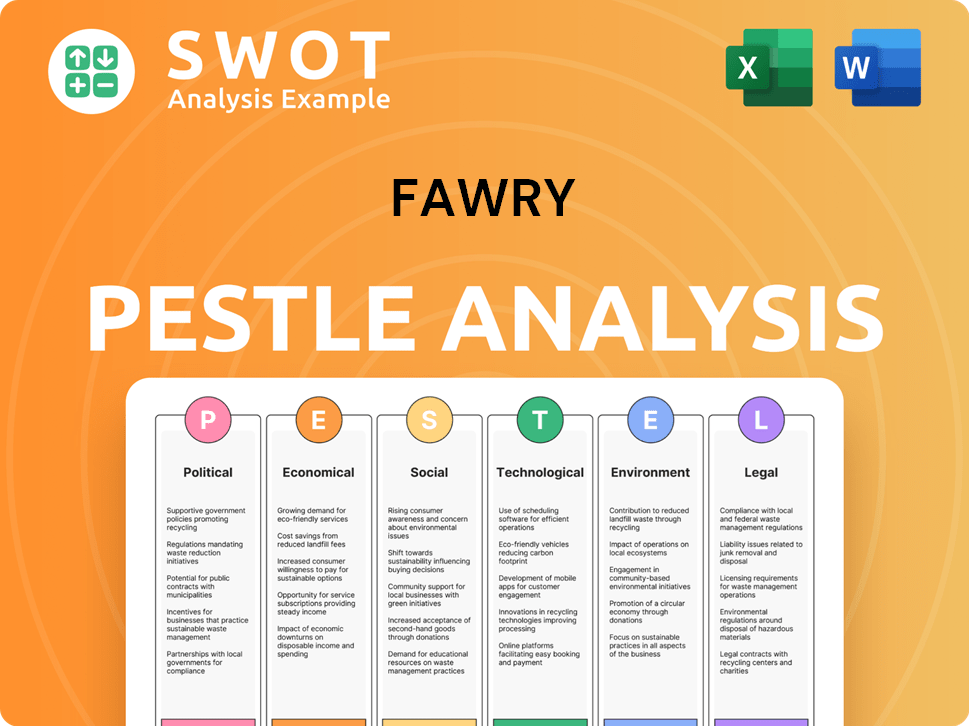

Fawry PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Fawry operate?

The primary geographical market for the company is Egypt, where it holds a leading position in the electronic payment network sector. Its strong brand recognition and market share are evident across major Egyptian governorates, including Cairo, Alexandria, and Giza. This focus allows the company to tailor its services to the specific needs of each region, ensuring broad accessibility and relevance.

The company's extensive network of over 270,000 retail agents, as of late 2024, plays a crucial role in ensuring accessibility, especially in areas with limited traditional banking infrastructure. This widespread physical presence, combined with its digital platforms, allows the company to cater to a diverse customer base across the country. The company's strategic focus remains on deepening its penetration and expanding its service offerings within its home market.

Geographic distribution of sales and growth continues to show robust performance across all Egyptian regions. The company localizes its marketing campaigns by using regional dialects and cultural references to resonate with specific communities. This approach helps in effectively targeting the diverse Customer demographics and preferences across Egypt, ensuring high user engagement and satisfaction.

The company's widespread network of agents and digital platforms ensures high market penetration across various regions in Egypt. This extensive reach allows the company to serve a diverse Fawry target market, from urban centers to rural areas.

Differences in customer demographics, preferences, and buying power across regions are addressed through localized marketing efforts and tailored service offerings. For example, in more rural areas, the agent network is critical for basic bill payments.

In urban centers, the mobile app and online payment options for e-commerce and more advanced financial services are more heavily utilized. The company's strategy balances its physical agent network with digital platforms to cater to varied customer needs.

While the company's core operations remain in Egypt, it has explored potential expansion opportunities within the MENA region. However, the primary focus remains on deepening its penetration and expanding service offerings within its home market.

The company's services are widely used across Egypt, with significant presence in key areas. Understanding the geographic distribution is crucial for analyzing the Fawry company's market strategy and growth potential.

- Cairo: High concentration of users due to the large population and high e-commerce activity.

- Alexandria: Significant user base with a mix of urban and semi-urban demographics.

- Giza: Growing market with increasing adoption of digital payment solutions.

- Other Urban and Semi-Urban Areas: Consistent growth driven by expanding digital infrastructure.

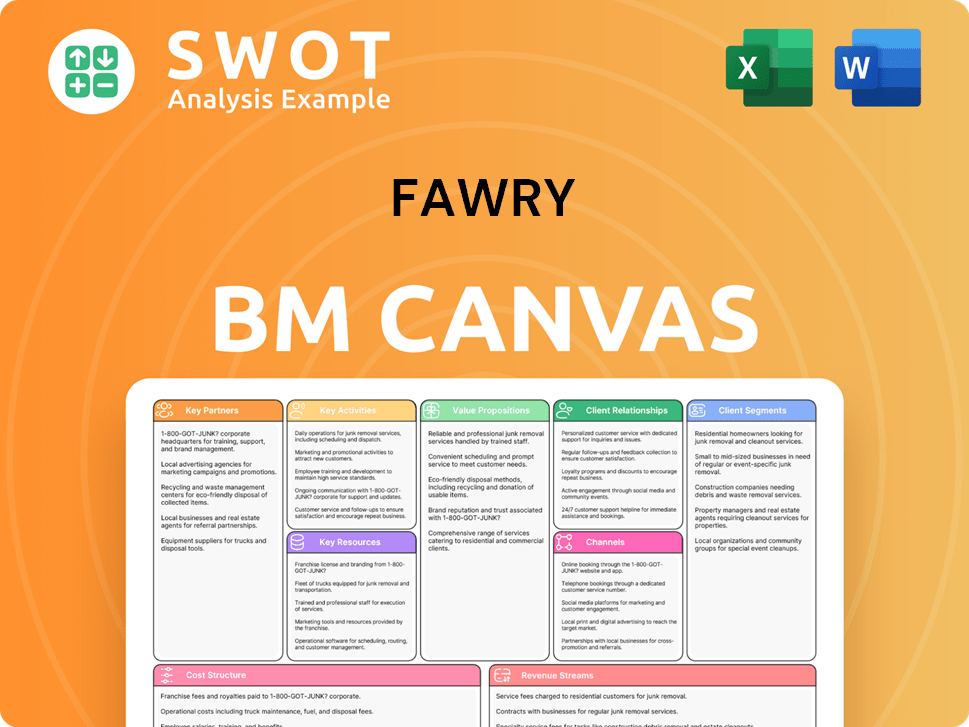

Fawry Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Fawry Win & Keep Customers?

The customer acquisition and retention strategies of are multifaceted, focusing on both attracting new users and maintaining the loyalty of existing customers. The company employs a blend of traditional and digital marketing, strategic partnerships, and robust customer service to achieve its goals. These strategies are continuously refined to adapt to the evolving digital landscape and changing customer behaviors, ensuring sustained growth and market leadership.

Customer acquisition is primarily driven by extensive digital advertising campaigns on social media platforms like Facebook, Instagram, and YouTube, and search engines. These campaigns target specific demographic segments with tailored messages. Traditional media, such as television commercials and outdoor billboards, are also used to reach a broader audience, especially in areas with lower digital penetration. Strategic partnerships with banks, mobile network operators, and e-commerce platforms are also crucial for expanding its reach and integrating its payment solutions into existing ecosystems.

Retention efforts center on fostering customer loyalty through personalized experiences and efficient service. The mobile app offers personalized recommendations based on a user's transaction history, encouraging repeat usage. After-sales service is crucial, with dedicated customer support channels to address queries and resolve issues promptly, enhancing customer satisfaction. The use of customer data and CRM systems is paramount in targeting campaigns effectively, allowing the company to segment its customer base and deliver relevant promotions and service updates.

Digital advertising is a cornerstone of the acquisition strategy, with campaigns on platforms like Facebook, Instagram, and YouTube. These campaigns are designed to reach specific Fawry target market segments with tailored messaging. This approach ensures that the advertising is relevant and effective in attracting new Fawry users.

The retail agent network serves as a direct point of acquisition. Agents assist customers with their first transactions, providing education about the services. This face-to-face interaction helps overcome barriers to adoption, particularly for those less familiar with digital payment methods.

Partnerships with banks, mobile network operators, and e-commerce platforms play a crucial role in expanding the reach. Integration into existing ecosystems makes the payment solutions easily accessible to a wider audience. These partnerships are essential for growth.

The mobile app offers personalized recommendations based on user transaction history. This feature encourages repeat usage by providing relevant services and promotions. Personalization enhances the user experience and fosters loyalty.

Dedicated customer support channels are in place to address queries and resolve issues promptly. Efficient customer service is vital for maintaining customer satisfaction and building trust. This helps to reduce churn and increase customer lifetime value.

Customer data and CRM systems are used to segment the customer base and deliver relevant promotions and service updates. This approach allows the company to target its marketing efforts more effectively. Data-driven strategies improve campaign performance.

The company's customer acquisition strategy includes a focus on ease of use and security to attract new customers. Retention strategies emphasize expanding service offerings to meet evolving customer needs, such as adding new billers or digital services. The evolution of these strategies has seen a greater emphasis on digital channels and data-driven marketing, leading to improved customer lifetime value and reduced churn rates. For a deeper dive into the company's growth trajectory, you can explore the Growth Strategy of Fawry.

Effective acquisition campaigns highlight the ease and security of transactions. These campaigns often focus on the convenience and reliability of the service to attract new users. Successful acquisition strategies are crucial for expanding the Fawry customer demographics.

- Targeted Digital Advertising: Utilizes social media and search engines to reach specific Fawry target market segments.

- Retail Agent Network: Provides direct customer interaction and assistance with initial transactions.

- Strategic Partnerships: Collaborates with banks, mobile operators, and e-commerce platforms for wider reach.

- Traditional Media: Leverages television and billboards to reach a broader audience, especially in areas with lower digital penetration.

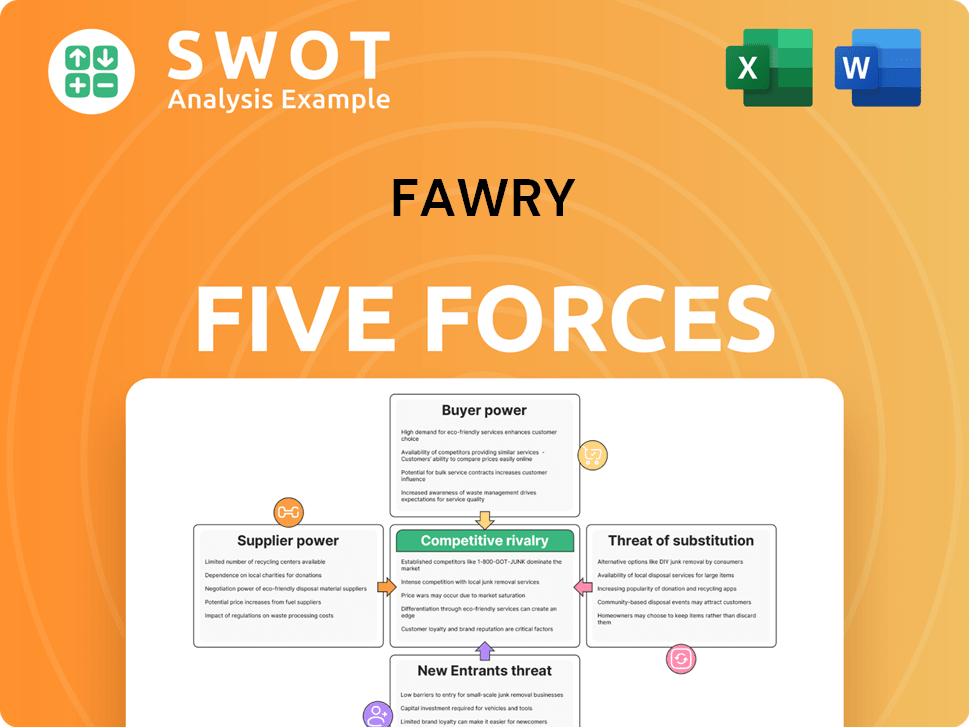

Fawry Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fawry Company?

- What is Competitive Landscape of Fawry Company?

- What is Growth Strategy and Future Prospects of Fawry Company?

- How Does Fawry Company Work?

- What is Sales and Marketing Strategy of Fawry Company?

- What is Brief History of Fawry Company?

- Who Owns Fawry Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.