Fawry Bundle

Who Really Owns Fawry?

Unraveling the ownership of Fawry, Egypt's leading electronic payment network, is crucial for understanding its future. From its inception in 2009, Fawry has transformed how Egyptians handle financial transactions. But who controls this fintech giant, and how has its ownership evolved since its IPO?

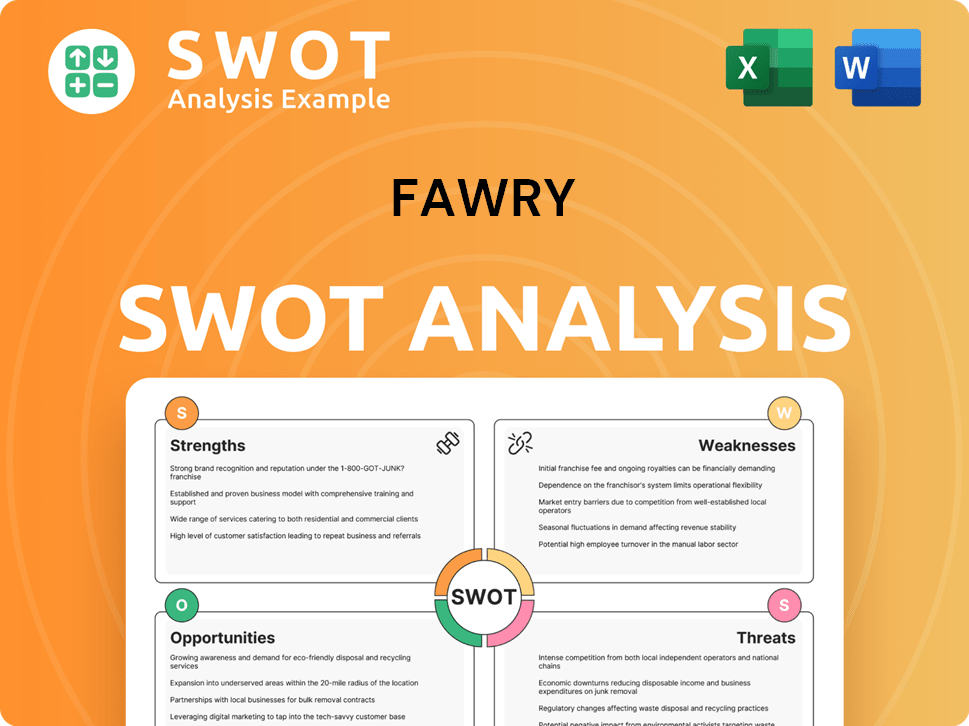

Understanding the Fawry SWOT Analysis is a good start to understand the company. The shift from private to public ownership in August 2019 marked a pivotal moment for Fawry company, altering its governance and exposing it to public scrutiny. This exploration will delve into the Fawry ownership structure, examining the influence of key investors, the role of Fawry shareholders, and the impact of these changes on the company's strategic direction. Discover the individuals and entities that shape the future of Fawry Egypt.

Who Founded Fawry?

The story of Fawry, a leading digital payment solutions provider in Egypt, began with a dedicated founding team. While the exact initial ownership breakdown isn't always public for private companies, the founders collectively drove the company's vision. Ashraf Sabry, as CEO, played a pivotal role in shaping Fawry's strategy and growth.

Early ownership likely involved a significant stake held by the founders, alongside investments from angel investors or venture capital firms. These early backers provided crucial capital for development and expansion, setting the stage for Fawry's future success in the Egyptian market.

Fawry's early stages saw a mix of local and regional investors. For example, Helios Investment Partners, a private equity firm focused on Africa, was an early investor, indicating confidence in Fawry's long-term potential. The Egyptian-American Enterprise Fund (EAEF) also provided early support. These investments were essential for scaling operations, expanding the agent network, and developing the technology infrastructure.

The initial ownership structure of Fawry involved the founders and early investors who believed in the potential of digital payments in Egypt. The early investments were crucial for scaling operations and expanding the agent network. Agreements like vesting schedules and share transfer clauses were likely in place to protect the interests of all parties.

- Ashraf Sabry: CEO and key figure in shaping Fawry's strategic direction.

- Helios Investment Partners: A significant early investor.

- Egyptian-American Enterprise Fund (EAEF): Provided early financial support.

- Early investors played a vital role in Fawry's growth.

The founders' vision of creating a widespread electronic payment network was closely linked to how Fawry's ownership was structured, ensuring alignment on strategic goals and market dominance. The company's journey reflects the importance of early investors in fostering growth within the digital payment sector in Egypt. As of 2024, Fawry continues to be a major player in the Egyptian market, with a growing network of agents and a wide range of services. In 2024, Fawry reported a revenue of EGP 3.8 billion, a 40.8% increase year-over-year, demonstrating its continued growth and market presence. The company's success is a testament to the vision of its founders and the support of its early investors.

Fawry SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Fawry’s Ownership Changed Over Time?

The Brief History of Fawry reveals that the company's ownership structure has significantly evolved, especially with its Initial Public Offering (IPO) on the Egyptian Exchange (EGX) in August 2019. This IPO was a crucial turning point, shifting from private to public ownership and broadening its shareholder base. At the time of the IPO, Fawry raised EGP 1.64 billion (around $98 million), which positioned it as a major player on the EGX. The IPO attracted strong interest from both institutional and retail investors, leading to oversubscription of its shares.

Following the IPO, the major shareholders of the Fawry company included a mix of institutional investors, private equity firms that retained stakes, and public shareholders. Alpha Oryx Limited, a subsidiary of the UAE's Chimera Investments, acquired a significant stake, reaching 26.04% in early 2024. This reflects a trend of strategic investments from regional players in key Egyptian companies. Other significant institutional investors often include mutual funds, index funds, and investment companies that hold substantial portions of Fawry's publicly traded shares. For instance, in 2024, NBE (National Bank of Egypt) accounted for 7.8% of Fawry's shares, while Banque Misr held 6.4%. Helios Investment Partners, an early investor, also maintained a notable stake post-IPO, demonstrating their continued belief in the company's growth trajectory. This shift in Fawry ownership has enabled the company to fund its expansion and maintain its technological edge in the fintech sector.

| Shareholder | Stake in 2024 | Notes |

|---|---|---|

| Alpha Oryx Limited (Chimera Investments) | 26.04% | Significant strategic investment |

| NBE (National Bank of Egypt) | 7.8% | Institutional investor |

| Banque Misr | 6.4% | Institutional investor |

The changes in major shareholding have influenced company strategy and governance. New large shareholders often bring their perspectives and exert influence through board representation, impacting the direction of the Fawry Egypt.

The IPO in 2019 marked a significant shift in Fawry's ownership structure, transforming it into a publicly traded company.

- Major shareholders include institutional investors, private equity firms, and public shareholders.

- Strategic investments, like that of Alpha Oryx Limited, highlight regional interest.

- Changes in ownership influence company strategy and governance.

- The company is a publicly traded entity.

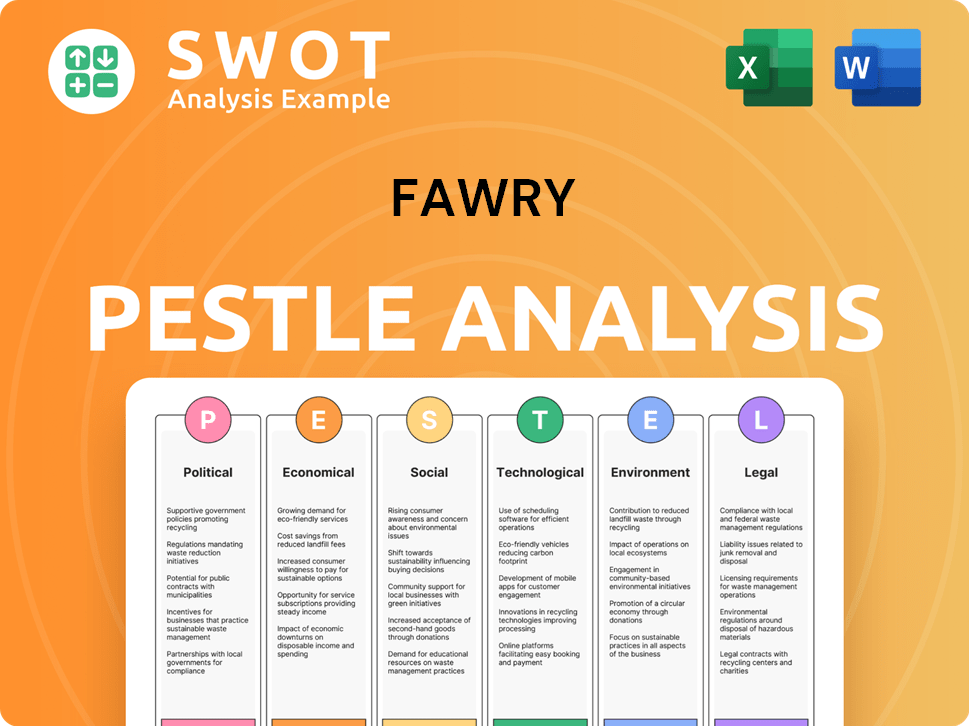

Fawry PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Fawry’s Board?

The Board of Directors at Fawry, a key player in Egypt's digital payment landscape, oversees the company's strategic direction, reflecting the interests of its diverse ownership. The board's composition typically includes representatives from major shareholders, independent directors, and executive management. Major shareholders often have nominees on the board to protect their investments and influence strategic decisions. Understanding the composition of the board is crucial for anyone analyzing Fawry's governance and strategic priorities. For more insights, you can explore the Growth Strategy of Fawry.

The board's structure ensures a balance of perspectives, with independent directors providing oversight and executive management contributing operational expertise. This blend is designed to foster transparency and accountability to the shareholders. The board's role is pivotal in navigating the company's growth and maintaining its competitive edge in the rapidly evolving fintech sector. The specifics of the board's composition and any changes are usually detailed in Fawry's annual reports and shareholder communications.

| Board Member | Role | Notes |

|---|---|---|

| Ashraf Sabry | CEO | Oversees day-to-day operations and strategic initiatives. |

| Ahmed Al-Shazly | Chairman | Leads the board and guides overall strategy. |

| Tarek Assaad | Board Member | Brings extensive experience in finance and investments. |

Fawry's voting structure generally follows a one-share-one-vote principle, which is common for publicly traded companies. This means that each share of common stock grants its holder one vote in shareholder meetings. This structure ensures that voting power is directly proportional to ownership stake, promoting fairness and transparency in decision-making. There is no publicly available information suggesting the existence of dual-class shares or other complex voting arrangements that would grant outsized control to specific individuals or entities beyond their equity ownership. This approach is designed to promote accountability to its broad base of shareholders.

Fawry's governance structure emphasizes transparency and shareholder rights, with a board of directors overseeing strategic direction. The company's voting structure is based on a one-share-one-vote system, ensuring that voting power aligns with ownership stakes.

- Board composition includes representatives from major shareholders, independent directors, and executive management.

- Voting rights are proportional to share ownership, promoting fairness.

- Annual reports and shareholder communications provide details on board composition and changes.

- The board plays a key role in overseeing the company's growth and maintaining its competitive edge.

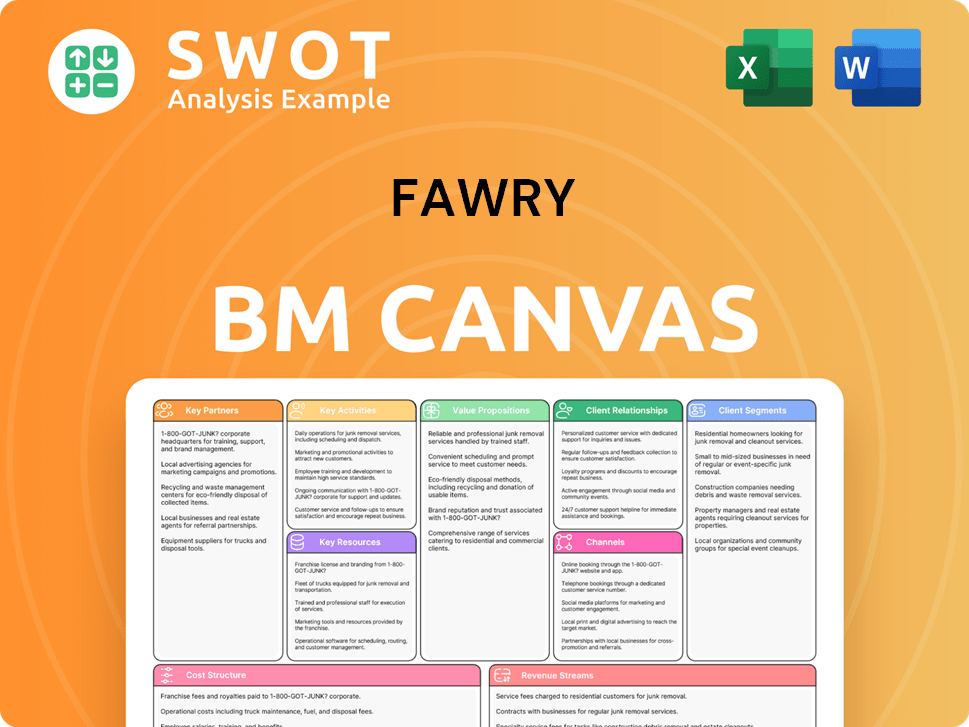

Fawry Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Fawry’s Ownership Landscape?

In early 2024, a significant shift in the ownership structure of the company occurred. Alpha Oryx Limited, a subsidiary of Chimera Investments based in the UAE, acquired a substantial stake, reaching 26.04%. This investment highlights the increasing trend of cross-border investments in the MENA region, particularly within the fintech sector. This influx of capital often supports strategic partnerships and market expansion.

Another evolving aspect of the company's ownership is the growing presence of institutional investors within the Egyptian market. As the company continues to demonstrate strong market leadership and financial performance, it attracts investment from both domestic and international institutional funds. This may lead to a gradual shift in the ownership, with founder or early-investor shares potentially diluted as the company's market capitalization increases. The fintech sector is experiencing consolidation and increased competition, which could influence future ownership changes through potential mergers or alliances. For more insights, you can explore the Competitors Landscape of Fawry.

The company's focus on digital transformation and financial inclusion in Egypt remains a key strategic objective. Any future changes in ownership or leadership will be communicated through official company disclosures, reflecting its commitment to transparency as a publicly listed entity. The company's continuous expansion of services and market reach indicates a dynamic ownership landscape.

The ownership of the company has seen significant changes, especially with the recent acquisition by Alpha Oryx Limited. Institutional investors also play a major role. These shifts reflect the company's growth and the dynamic nature of the fintech sector.

Increased cross-border investments, particularly from the UAE, are notable. The growing presence of institutional investors is another key trend. These factors are shaping the future of the company's ownership structure.

The company's commitment to digital transformation and financial inclusion continues. Any changes in ownership will be transparently communicated. The company's expansion strategy will likely influence future ownership dynamics.

The acquisition by Alpha Oryx Limited is a recent and significant development. The company's performance attracts further investment. These moves highlight the company's growth trajectory.

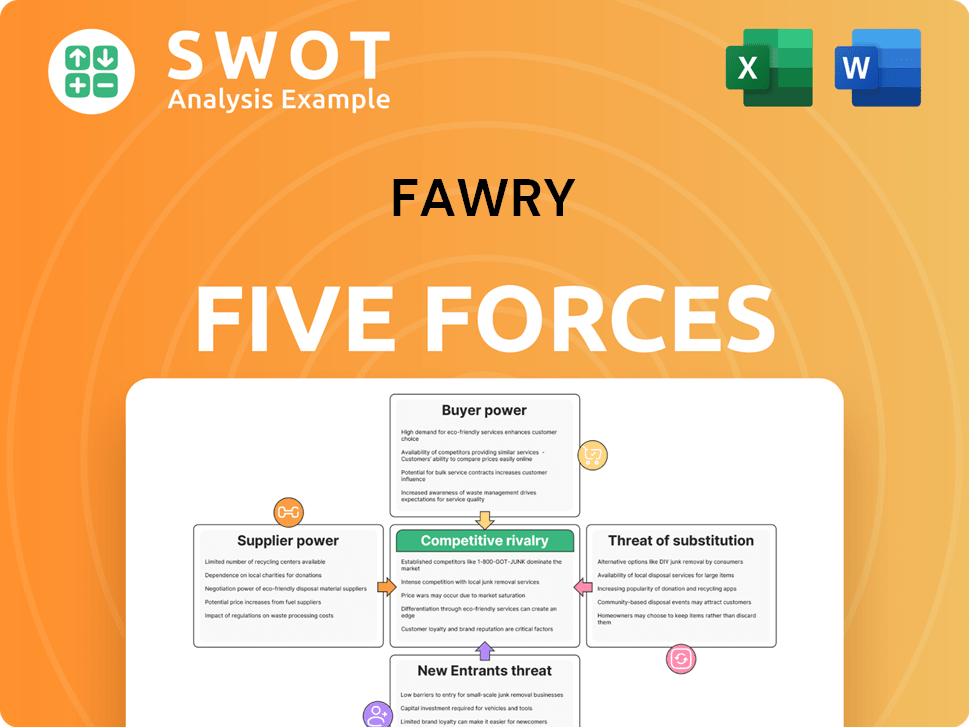

Fawry Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Fawry Company?

- What is Competitive Landscape of Fawry Company?

- What is Growth Strategy and Future Prospects of Fawry Company?

- How Does Fawry Company Work?

- What is Sales and Marketing Strategy of Fawry Company?

- What is Brief History of Fawry Company?

- What is Customer Demographics and Target Market of Fawry Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.